Every business – big or small – needs regular cash flow to survive. By getting a steady income from clients, business owners can pay expenses such as employee salary and utility costs. That’s the reason why invoicing plays a vital role in every business operation. Without invoices and knowing what invoice payment terms is, your business won’t be able to compensate for the products sold or services rendered. Your business will take a considerable hit, financially, which will eventually result in bankruptcy.

However, while it may be the core of your business, keep in mind that your invoice will only be as good as your business’ payment terms and conditions. Without these provisions, you won’t have a stable flow of processing payments. Your terms and conditions cover a wide scale of your payment procedure. From your preferred payment method to incentives and penalties, everything will depend on the terms and conditions that you add to your business.

In addition, your payment terms will be used to help your business receive payments on a consistent and predictable schedule. When you have a fixed payment schedule, you can budget your expenses easily. You can also create financial forecasts so that you can prevent any potential issues with your cash flow in the future.

To put it simply, your business’s success will significantly depend on your invoice payment terms that you create. You can’t send out your invoices without one. So, make sure you have payment terms and conditions attached to your invoice.

The 10 Relevant Payment Terms & Conditions

To make sure your invoice terms and conditions complement well with your payment process, we’ve listed five of the most relevant payment terms and conditions. Make sure you have them included in you invoicing terms:

The Terms of Sale

Terms of Sale are the payment terms that both the buyer and seller have agreed on. Terms such as the invoice amount, delivery, mode of payment, payment are due, and the total cost are included. In other words, these are the essential components that make up an invoice.

It is the list of expectations between buyer and seller. That way, any disagreement or misunderstanding between both parties will be averted. Since both buyer and seller already know what to expect from the entire transaction, no issue will come between both parties. Payment is expected when it comes to doing business. So make sure you get paid the right way.

These are especially important in international trade as it covered shipping details, the person or firm responsible for international duties and taxes, and other factors. In addition, international invoices should ensure that their terms of sale are compliant with regulations set by the international chamber of commerce.

Advance Payment

As the term implies, advance payment, or payment in advance (PIA), is payment that’s settled ahead of schedule. It’s pretty common for some businesses to require advance payments for their goods or services.

A freelance graphic designer, for instance, will need a down payment before they can start a project. Advance payment will protect the seller against non-payments and cover any out-of-pocket expenses that may be needed to complete the project.

Immediate Payment

This term is associated with the “Payable on Receipt” or “Cash on Delivery (COD)” modes of payment. This payment term involves payment being due at the same time as the product or service is delivered. If the client doesn’t make the payment upon receiving the product or service, the seller will have full rights to reclaim the item for intellectual property.

Having an immediate payment in your invoice terms does hasten the payment process. However, it’s also unpopular for other clients due to fear of not having the cash to cover bills and other expenses.

Net 7, 10, 30, 60, 90

This term implies the net payment and the date on which they are due. It can be an invoice date net 30, invoice date net 60, invoice date net 10, and more. So, if it’s seven, the net payment is due in 7 days, and so on. For example, let’s use the most popular payment term, Net 30. That means if the invoice were dated September 27, then the payment would be expected before October 26.

Since this term can confuse both clients and accounts payable teams alike, experts suggest using a clearer term. For instance, you replace the word “Net” with “Days. To make it even clearer, you can add a sentence like “Please settle your account within 15 days.”

2/10 Net 30

Since “Net 30” is so popular, clients also have the options for “2/10 Net 30.”

This term basically implies that clients can get a 2% discount when they manage to pay within 10 days of a date Net 30 payment term. You can change the numbers depending on what you want or what suits you best. For instance, instead of a 2% discount, you can make it 5%. Instead of paying within 10 days, you make it 15 days instead.

When adding it to your invoice, make sure you make the words simpler. A simple phrase like “Pay within 10 days and get a two percent discount as compensation” will make the offer clearer and more enticing.

Line of Credit Pay

This term implies the option to give customers the chance to settle their bills over a period of time. The payment term can be on a monthly or quarterly basis. In other words, it will allow the customers to purchase a product or service on credit. This payment term is not suitable for smaller medium-sized businesses due to the risk involved.

In addition, it can potentially decrease your cash flow. That’s why it’s used more for larger and more established companies.

Quotes and Estimates

This payment term is the corresponding price for the goods and services offered. This figure is used when a client is trying to compare prices. Quotes and estimates aren’t the final invoice amount that you’re going to bill your client. However, it does comprise of several essential lines within your invoice, including the following:

- Price of products or services

- Itemized breakdown of how you came up with the price.

- Schedule for when the final goods or services will be delivered/rendered.

There are many invoicing platforms like ReliaBills that allow you to convert your quotes and estimates into an official invoice. All you need to do is enter the relevant details on the corresponding field.

Recurring Invoice

As explained in a previous article, recurring invoice implies ongoing services, such as web hosting, entertainment, financial automotive, and other services. These services are charged the same amount each month, which is similar to a subscription or membership.

Recurring invoicing guarantees consistent cash flow coming into your business. It also makes forecasting easier and will save you time from having to invoice your clients each month. Most of all, recurring invoicing eliminates the uncertainty of doing business and makes your business operations so much easier.

Interest Invoicing

Interest is what happens when a client fails to pay the invoice on time. Charging interest or added fees in the invoice is one of the most common solutions for this problem. Just remember that calculating the interest on late payments means you’re only charging for the number so days that the payment is past due.

For example, if you charge a 5% interest rate and the invoice for $2,000 is 30 days late, the calculation would look like this:

Divide 30 by 365. Multiply the result by .06. Finally, multiply that figure by 2,000. If you were able to follow, the interest charge for that particular scenario would be $8.22 for the 30-day period.

An invoice that contains an interest comes with the relevant interest charges and corresponding terms payment date to settle the payment. You can resend the invoice every month and adjust the calculation. That way, it will reflect the additional number of days that were past due. Late payments need to be compensated for your business to keep its operations going. Make sure you don’t skimp on imposing a strict rule when it comes to the due date.

Invoice Factoring

Finally, we have invoice factoring. If you’re in a situation where you’re in dire need of cash yet your client hasn’t paid your invoice, you can consider incorporating invoice factoring. This term is used when you hand over your invoice to an invoice factoring company. By doing so, you will receive up to 85% advance upfront payment in as fast as one day.

Keep in mind that invoice factoring companies will charge a fee. So make sure you read their terms and conditions first and see if it’s okay with you. Most invoice factoring companies charge a fare .5% fee per week. Some even allow your clients to continue making payments under your business name.

How to Set Up Your Payment Terms on ReliaBills

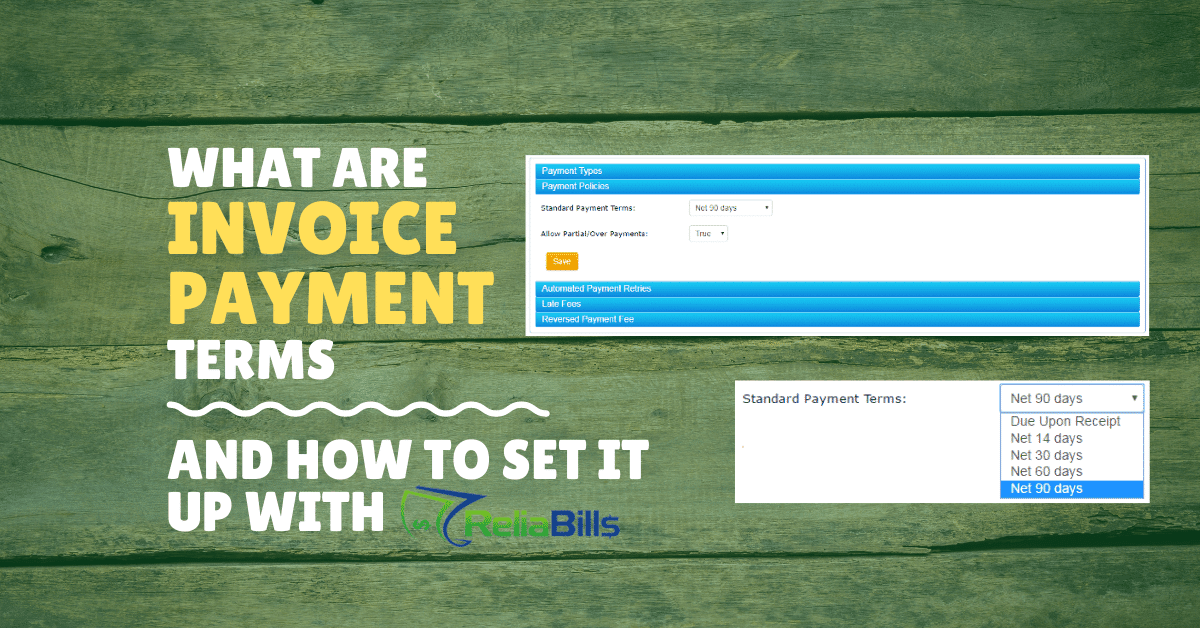

If you use ReliaBills as your invoicing platform, you’ll be happy to know that it has a plethora of features that you can use. One of them gives you the option to incorporate your payment terms on your invoice.

We have an article that covers this process comprehensively. But, just in case you want a shorter and more concise step-by-step process on how to do it, follow these set of instructions:

Payment Types

- Go to ‘Account Settings’> ‘Payment Processing.’

- In the ‘Payment Processing’ option, you will find the payment types and cards currently active on your account.

- Click the word “Active” on the right side of the page to access more details. Here, you can turn the payment method ON or OFF.

- In the case of credit cards, you can also select which type of cards you want to accept.

Payment Policies

Standard: Use the drop-down menu to select ‘standard invoice payment terms.’ If your payment terms are the same for all your invoices and customers, it will save you some time when creating invoices. You have the option to change the due date on any invoice. In addition, you also have the option to change your standard terms at any time.

Partial Payments: if your business requires partial payment, changing the setting from ‘True’ or ‘False.’ This setting will determine whether or not you will allow partial payment. ‘True’ is the default setting. If you don’t want to allow partial payment, you can always change it to ‘False.’

Automated Payment Retries

There are many reasons why a payment gets declined (closed account, insufficient funds, invalid account number, etc.) When a card failure is received, you and your client will be notified about it.

ReliaBills will automatically re-submit the payment according to the respective financial industry and card associations and regulations. However, keep in mind that it will be based on the type of payment and the type of decline you receive. In this option, you can change the attempt process based on your preference or needs.

Late Fees

To find late fees, follow this step:

- Go to ‘Settings’> ‘Payment Processing’> ‘Late Fees’

Late fees will help make sure you get paid. ReliaBills’ system will calculate late fees automatically and apply it to invoices that are way past due. However, keep in mind that the ‘Late Fees’ option is only available for ReliaBills PLUS accounts (valued at $24.95 per month).

Reverse Payment Fee

When a payment is reversed, ReliaBills will automate the invoice by re-opening it and a fee. The fee will then be labeled “Reverse Payment Fee,” along with a corresponding date. If the reverse payment is applied to multiple invoices, the fee will only be applied to one of the invoices.

Currency Options

For now, ReliaBills supports USD only. If you’re catering to international clients, you’ll need to use a third-party invoicing platform that offers other currencies for payment.

Improve Invoicing with Recurring Billing

Now that you know how to set up invoice payment terms on ReliaBills, the next thing you need to know is how to automate your entire billing process. While known as an invoicing system, ReliaBills boasts a formidable recurring billing feature as well.

Recurring Billing Helps Improve Cash Flow

One of the most important aspects that recurring billing brings is improved cash flow for businesses. Since you can automate your invoices and payments with ReliaBills, recurring billing helps you receive payments automatically. This level of efficiency will provide your business with a steady cash flow. Many business owners are switching to recurring billing because it is an easy way to achieve a better and more reliable income stream.

Recurring Billing Helps Retain Customers

Another great benefit of recurring billing is that your customers will be more likely to stay loyal to your company. Recurring billing is convenient for both you and your customers. It helps increase customer satisfaction rates over time since you’re providing them with the convenience of not having to think about their bill.

As mentioned earlier, recurring billing helps with the collection of payments regularly. This allows businesses to keep their cash flow steady while also improving their overall profitability. With an increase in customer acquisition and retention, your business will increase revenue since you can regularly collect payments from your customers.

In addition, ease of use and overall convenience are the two main benefits of recurring billing that help your business retain as many customers over time. Today’s business trend features customers getting used to paying for goods or services on a recurring basis. That means they are less likely to leave or switch companies.

Since it makes the payment process easier, recurring billing helps improve overall customer satisfaction rates. At the same time, you can retain more of your existing customers over time. So just by providing recurring billing services, you are gaining new customers while also retaining the current ones.

Recurring Billing Makes Invoicing and Payment Processes Easier

Traditional invoicing can be very time-consuming to produce for business owners. By using ReliaBills and its recurring billing software, you can automate the entire process of sending out recurring invoices. That way, it goes directly through your email or payment gateway system. This process indicates that recurring billing can help your business save time and money over the long run.

In addition, recurring billing helps make payment processes much easier for both you and your customers. With a recurring billing software like ReliaBills, recurring invoices are sent out automatically to ensure timely payments from all of your customers. This move saves you a lot of valuable time by not manually sending out recurring invoices every month.

Recurring billing is one of the best billing models that you can use today. With ReliaBills, you can improve your cash flow while also improving your overall profitability. In addition, recurring billing helps to keep customers loyal over time. So if you’re interested, get started today by creating a FREE account now. For pricing information, check this page.

Wrapping Up

Always keep in mind that your invoice is the heartbeat of your entire business operation. Without it, you won’t be able to request payment. Without cash flow, your business will crumble. But for payment to happen, there needs to be a set of terms and conditions to make sure both parties are in agreement. So, if you don’t have payment terms and conditions, make sure you make a difference by creating one today. That way, you will get paid the right way.