We can all agree that the business world isn’t always smooth sailing. In fact, it has a lot of the opposite. For SaaS companies, the main problem lies in recurring billing issues. If you’re one of these companies that are struggling to manage their SaaS companies, then you’ve come to the right place. This article will discuss ten of the most common recurring billing issues and how to deal with them.

Table of Contents

Toggle1.) Customer Management

SaaS businesses that offer delivery usually have a large user base. That’s why they also need an effective way to manage their users by keeping a record of each customer who signs up for their services. A recurring billing system that offers sing-up categorization, trials, activations, upgrades, and downgrades will improve a company’s overall efficiency. So, if you fall under this type of SaaS business, go for a recurring billing solution that has everything you need to manage your customers.

2.) Flexible Billing Frequency

A business that features a recurring billing model will also need a solid subscription billing solution that lets them receive recurring payments at any frequency. At the same time, the flexibility to offer different price terms will also serve as a bonus. The recurring billing solution that you choose should be able to manage payments on different payment periods. Whether it’s monthly, quarterly, semi-annually, or yearly, the solution should be able to manage customer payments without any problem.

3.) Automatic Invoicing

With hundreds to thousands of potential customers that are likely to sign up for your services, invoicing can become a serious matter – as well as a headache. The situation will become more complex once you start offering different service tiers when customers sign up at different periods.

To solve this billing issue, look for a recurring billing solution that sends invoices automatically to your customers in different scenarios such as the following:

- When a customer purchases a subscription for the first time.

- During renewals.

- After the cancelation of the account.

Invoicing solutions such as ReliaBills proves to be a useful recurring billing solution. Not only does it let you create unique and professional-looking invoices, but it will also send your invoice and receives payment at a secure gateway. All of these basic features are available for FREE once you create an account.

4.) Safe and Secure Payment Systems

Speaking of a secure payment gateway, this also serves as a notable feature for any effective recurring billing solution. When doing online transactions, your customers should be confident that the mode of payment they choose will be handled securely. That’s why you should make sure that a secure connection is available between the customer’s browser and your company’s web server.

You will also need a billing solution that’s compliant with the payment card industry (PCI). It will not only ensure a legit transaction but will also guarantee the safety of your customers’ credit card information.

5.) Managing Discounts and Promos

Growing your company is also about getting new customers on board by making sure they upgrade their subscriptions. An effective recurring billing system will let you create, track, and manage discounts and promos for your services. Doing so will help you get new signups and subscription upgrades. In turn, your revenue will increase exponentially.

With an all-in-one recurring billing system in place, you can track the number of discounts that your customers redeemed. At the same time, you can also track new signups. All of these metrics will help you track your business’s overall performance by looking through the numbers.

6.) Setting Up Effective Pricing Plans

Every SaaS business will likely have different plans and strategies for its customers based on the features that they provide. Having different plans proves to be a relevant strategy since it makes your services better and more affordable.

In addition, it also opens to a broader range of users that feature diverse business needs. That means multiple levels of pricing plans will be inevitable. So, to manage the complexity, you will need an easy-to-use recurring billing system that will help make pricing changes with relative ease.

7.) Managing Errors and Failed Transactions

Failed transactions are a pretty common occurrence among SaaS businesses. What needs to be done is reducing the instances of them happening to a minimum. Spotting failed transactions, and finding a way to inform users will help save resources. At the same time, it will also make your operations more efficient.

With a large number of users subscribing to your services, it will be ineffective to go through these transactions manually.

It will become a waste of precious time and human capital resources that most small businesses use to grow and expand.

When there’s a recurring billing system in place, you can automate your failed transactions management strategy. You can also notify your customers automatically via automated emails. On the backend, you can track the number of invalid payments. All you need to do is get a billing system to do the hard work for you. That way, you can concentrate more on your core business.

8.) Multi-Language and Multi-Currency Support

If you’re catering to users from different parts of the world, multi-language and multi-currency support will be an absolute necessity. The majority of users are more comfortable when paying for services using their local currency. For instance, people in the United States are more familiar and comfortable paying under the dollar ($) currency. In Europe, it’s Euros (€). For Japan, it’s Yen (¥).

The billing software you choose should have options where your customers can choose and pay using the currency they prefer. At the same time, the system should also support multiple languages. That way, you can cater to users from different countries whose primary language isn’t English.

9.) Managing Customer Messaging for Billing & Errors

Reaching out to your customers for both billing and errors should also be a priority. Billing issues should be dealt with in a safe and secure manner. That way, your customers can ensure utmost confidentiality with their data, not landing in the wrong hands. That’s why the recurring billing solution you choose should have a built-in option to identify invalid or errors in user transactions. The system should also send a message automatically to the user. That way, you won’t have to do it manually and waste a lot of valuable time.

10.) Integration with Shopping Carts & Support for Main Payment Gateways

Finally, the recurring billing software you choose should support shopping cart integration to your company. At the same time, it should also support multiple payment gateways. Keep in mind that each of your customers has preferences that need consideration.

The recurring billing solution that you choose should support well-known payment gateways like Authorize.net, PayPal, TransferWise, among others. If you limit your payment gateway options, you’ll be locking out potential customers who prefer other payment methods.

Why Still Choose Recurring Billing

We’re almost at the end of this article. But before we wrap up, we want to address some of the readers who might ask, ‘why recurring billing?’ We want to educate as many people as about this fantastic billing model and why it’s surging in popularity as of late. This section will be dedicated to that.

What is Recurring Billing?

Recurring billing is a billing strategy that involves invoices sent and payments received on a recurring schedule. When you use recurring billing software, the entire process gets automated so that everything is done automatically without any intervention from your end whatsoever.

Recurring billing works by automatically sending out invoices to customers based on regular payment schedules between yourself and your customer. Then, once the invoice has been paid in full, recurring billing will release funds into your bank account immediately via direct deposit or ACH transfer (bank wire). This makes it easier for businesses to decide how they would like to receive their money instead of having other companies dictate when they should be receiving cash flow benefits such as this one!

Recurring Billing Software: How Does it Work?

The entire process works by sending out invoices automatically based on set regular payment schedules between you and your customer, so almost everything gets handled for you all on its own! Once an invoice has been paid with a recurring billing solution, funds will be released directly back to either yourself or over to one of our client’s bank accounts within the same day. This entire process is completely transparent and visible to you both because recurring billing software also provides a dashboard that will show all recurring transactions, payment statuses, failed payments, etc.

Benefits of Recurring Billing

Improves Cash Flow

When you use recurring billing, there is no waiting period from when a customer pays their invoice to when you receive funds into your bank account. Instead of having payments go through several different banks and financial institutions before making it to your business’s checking account, recurring billing software moves invoices paid by customers directly into your online banking system. They are then immediately available in your “pending transactions” section.

From there, recurring billing can either send out an ACH transfer or direct deposit payment directly back to the originating source (in this case, over to one of our clients’ accounts). This makes cash flow management much easier because all incoming revenue will be readily accessible without any delays.

Recurring billing also helps your cash flow by allowing recurring transactions that can be scheduled in advance. You can either choose to have recurring payments sent out monthly, quarterly, or even yearly, so you don’t have to worry about sending out invoices every time a customer needs an update on their account status.

Not only does this save you valuable hours of work each week when it comes to managing your business’s accounts payable department, but it allows for more flexible payment schedules and terms between businesses and clients as well which is always beneficial!

Builds Customer Loyalty and Retention

Another great benefit of using recurring billing software is the increase in loyalty from customers who enjoy having automated recurring bills rather than manually doing them themselves (or not at all). By simplifying the recurring billing process for your customers, you can also help to build their trust and confidence in doing business with your company. Not only does this make it easier for them, but recurring billing is a less stressful method of receiving payments because there are no confusing or convoluted payment terms that need to be adhered to.

Use ReliaBills for Recurring Billing

Recurring billing can be a powerful tool for businesses, but it often comes with a host of issues—missed payments, outdated customer information, billing errors, and time-consuming manual processes, to name a few. ReliaBills was built specifically to eliminate these challenges by automating the entire billing lifecycle. With features like smart invoicing, automated payment reminders, and branded customer portals, ReliaBills significantly reduces errors and streamlines communication. It turns what used to be a frustrating task into a simple, seamless process—allowing businesses to focus on growth instead of chasing payments.

Switching to ReliaBills’ recurring billing solution means tapping into a premium service that’s designed with small businesses in mind. For just $24.95/month, you get access to powerful tools that ensure timely payments, build stronger customer relationships, and maximize revenue. Our recurring pricing model not only saves time but also improves cash flow consistency and customer satisfaction. If you’re tired of handling the same recurring billing problems month after month, ReliaBills is the solution that finally gets it right—automated, affordable, and built for results.

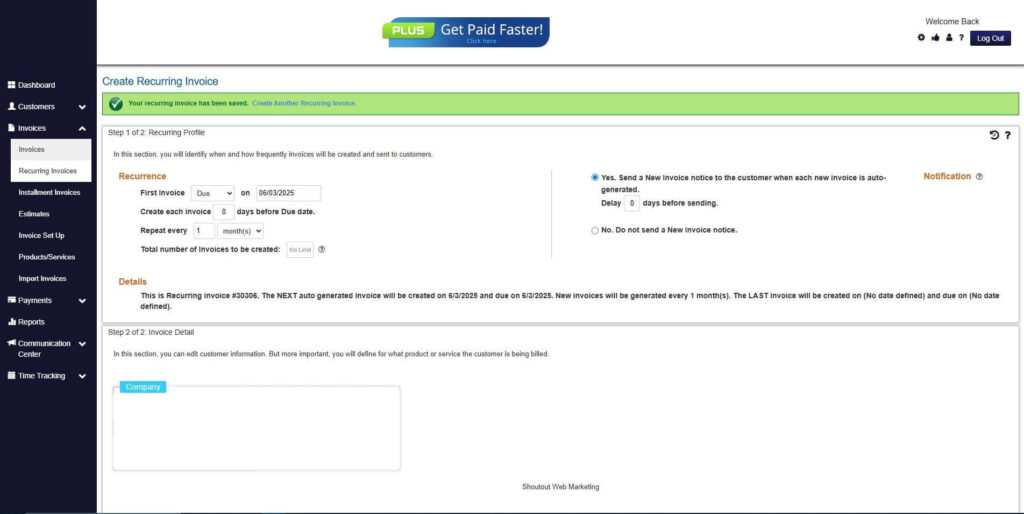

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

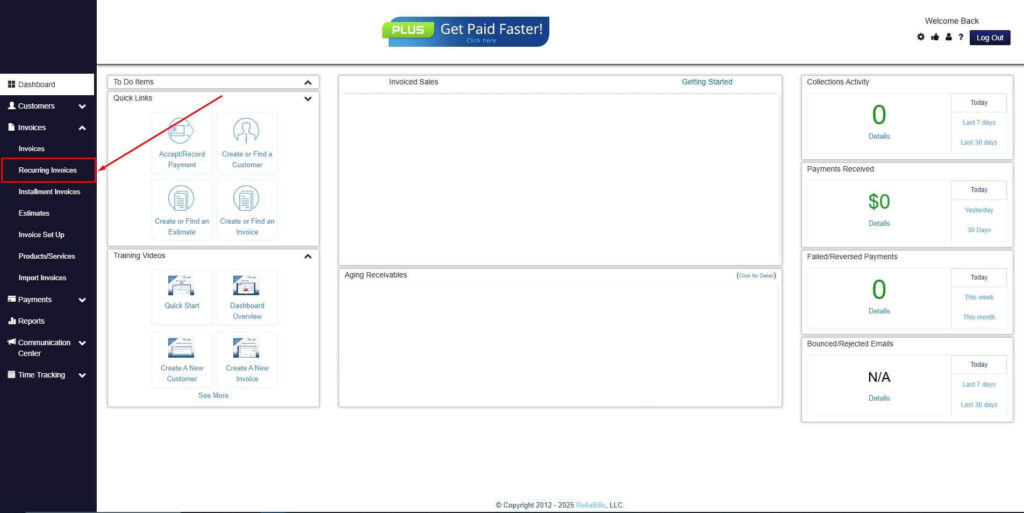

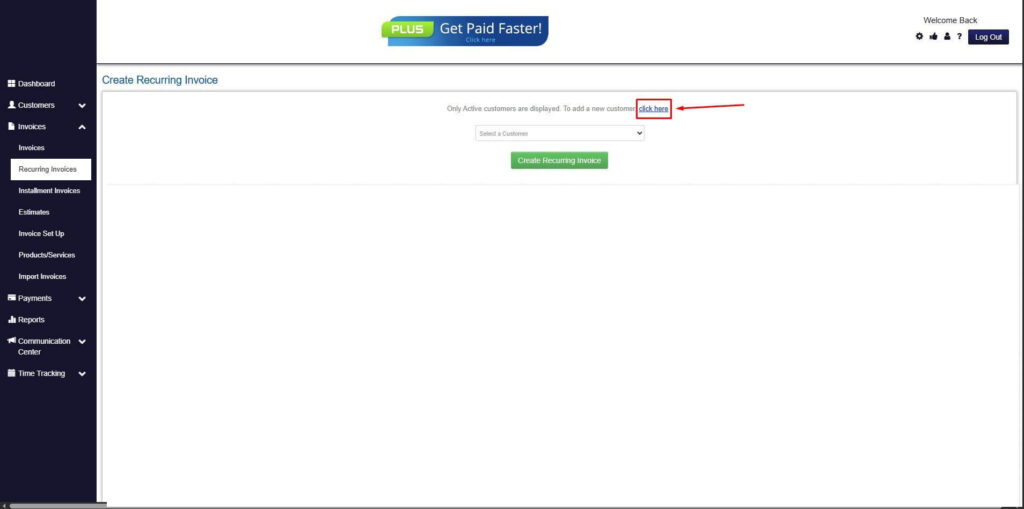

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

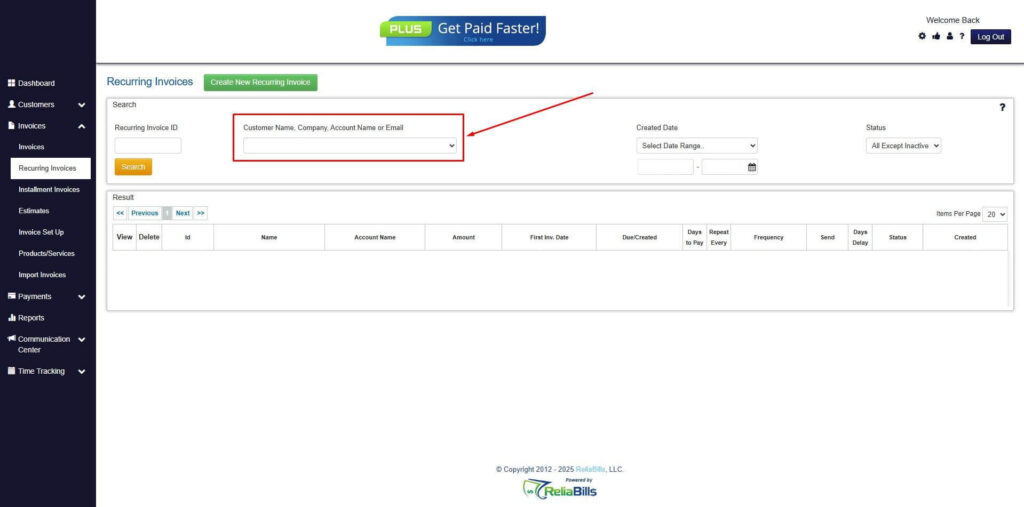

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

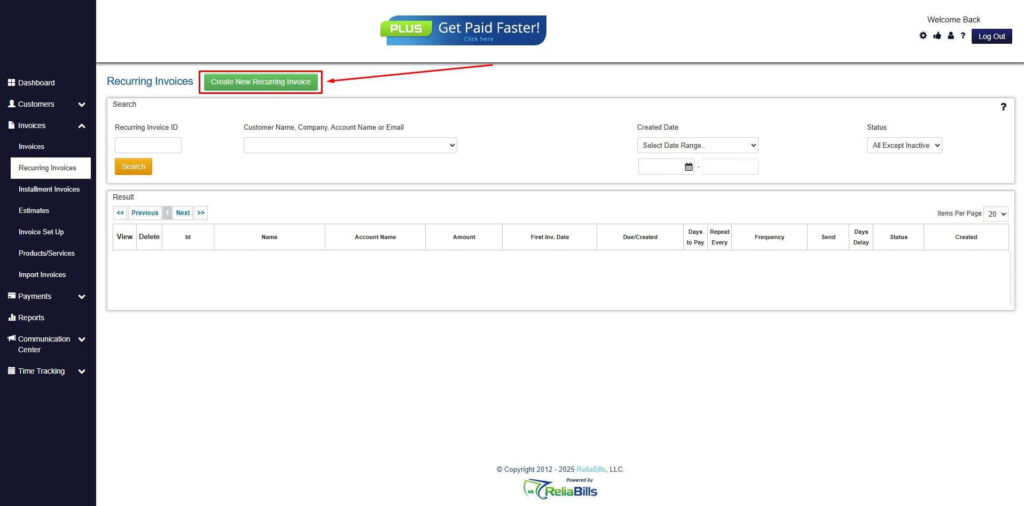

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

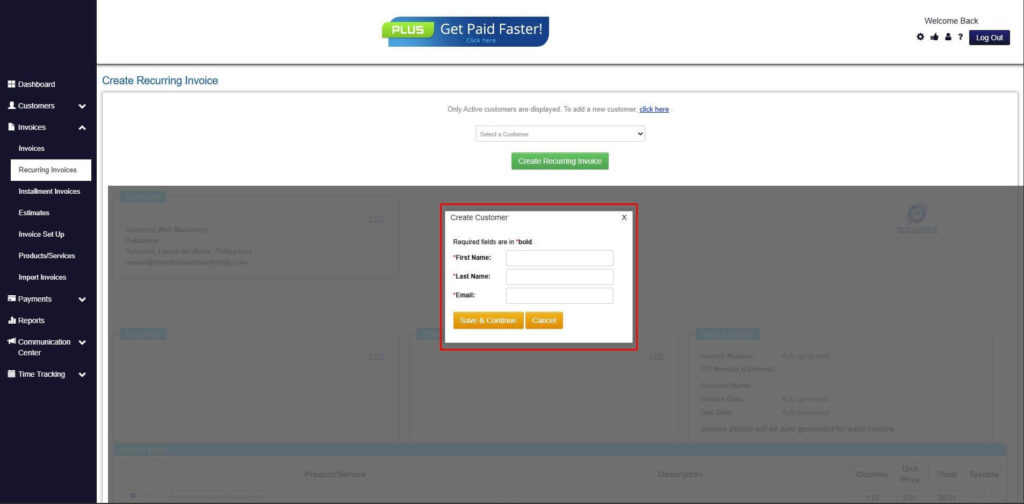

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

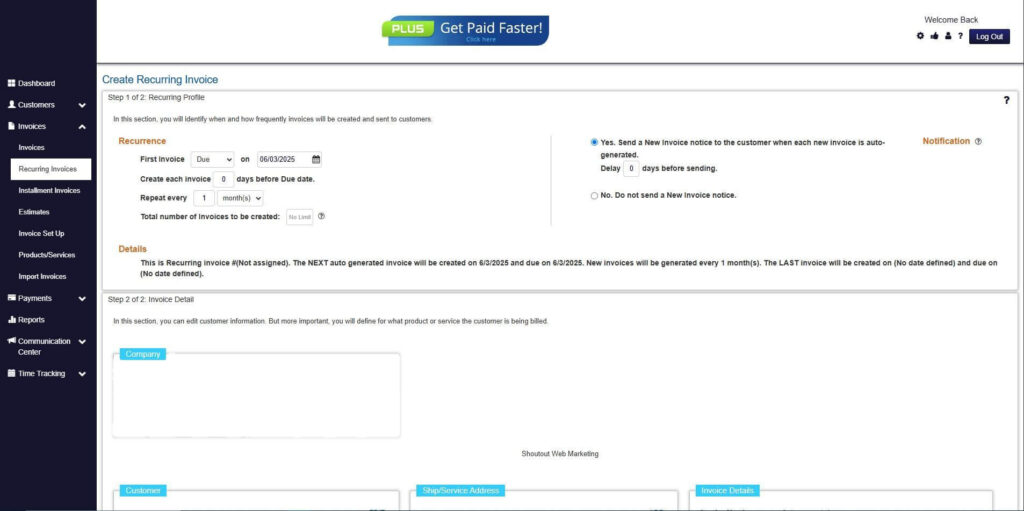

Step 7: Fill in the Create Recurring Invoice Form

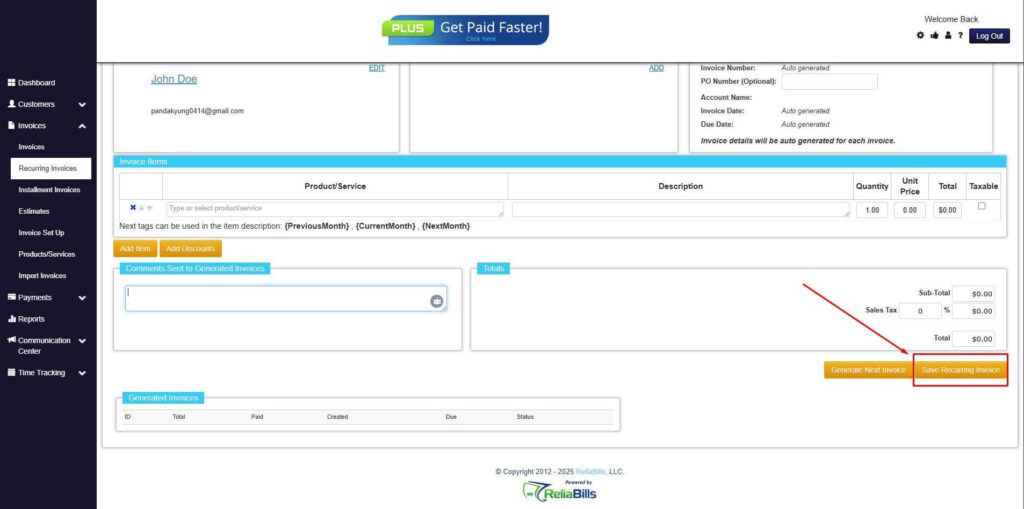

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

Your Recurring Invoice has been created.

Wrapping Up

To recap, the above list is some of the billing issues that many SaaS companies and start-ups have to consider when looking for a recurring billing solution. Keep in mind that if ignored, these billing problems will pose a threat to your company. So, make sure you safeguard and protect your business by acknowledging these problems and applying the solutions provided. Get started today by signing up for ReliaBills.