Spend Less Time Creating Recurring Invoices and Billing Customers with Recurring Billing Software

Recurring Billing Software

5 “Must-Haves”

Growing businesses rely on our recurring billing software to help them automated invoice creation and get paid. To do it right, you need these FIVE things:

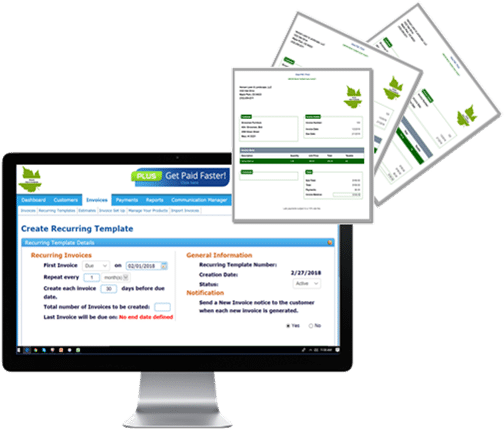

1. Automated Invoice

Creation

Save a TON of time by having your invoices automatically imported or generated and then automatically sent. You can even delay sending if edits are needed.

2. Automated Variable

Payments

Customers enrolled in Auto Pay can have their payments made by credit card or bank debit automatically. Even if the amount changes from month to month.

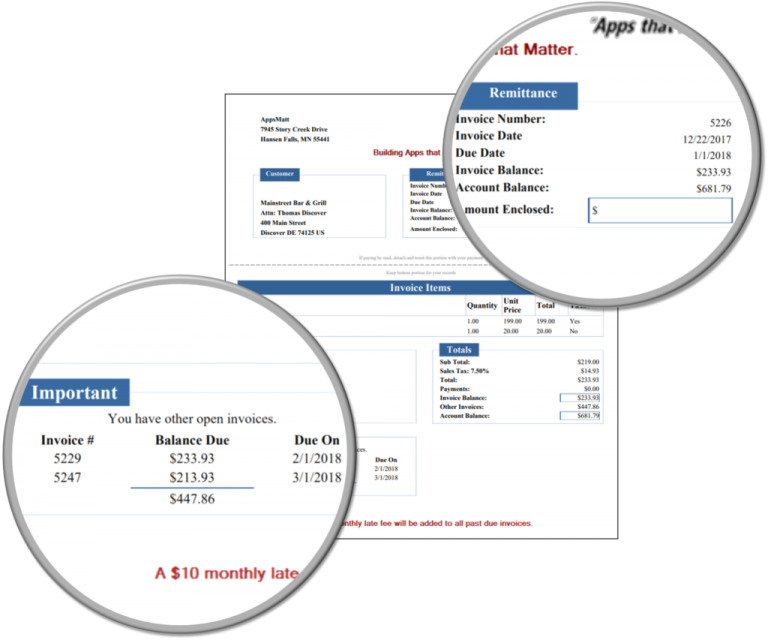

3. Invoices DESIGNED for

Recurring

Invoices can display the open invoice balance as well as the open account balance using our recurring billing software. Other open invoices are also listed.

4. Failed Payment Mitigation

Automated payments will fail (expired cards, insufficient funds, closed accounts, etc.). No worries. ReliaBills’ recurring billing software automatically notifies customers when their payment fails and even automatically re-attempts failed payments. Contact us if you’re having problems with automated payments.

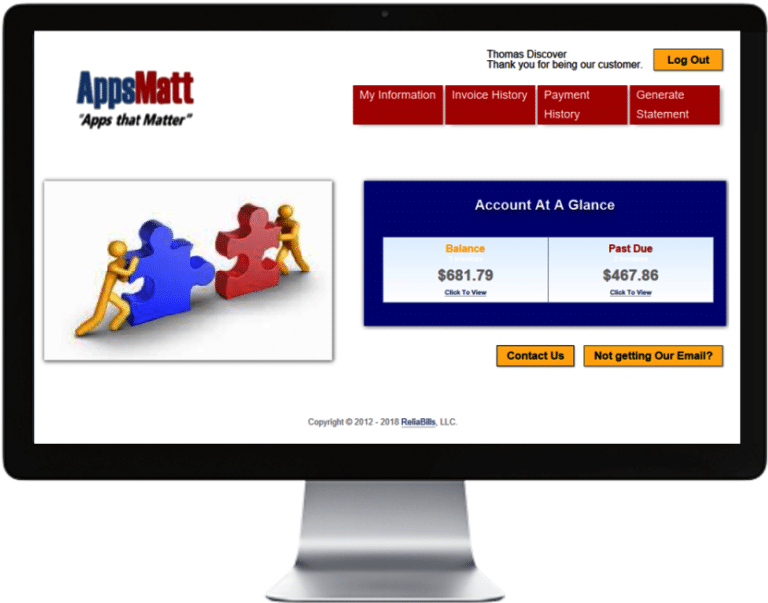

5. Customer Portal

Customers can securely save and store their information in our recurring billing software. Including payment information and set auto payments.

What You Need to Know About Recurring Billing

Do you have any idea what recurring billing is? If not, let’s keep it simple:

Recurring billing is an ongoing payment on a pre-defined basis for a product or service.

Why is it So Crucial to Your Business?

Reliable cash flow. Even though you will add and lose customers (known as “churn”), recurring billing gives you much more stable cash flow.

Improves Accounts Receivable. When payments are automated, you no longer have to wait for customers to make payments. Collection cost can also be reduced.

Subscription Billing vs. Recurring Billing

You may hear these terms used interchangeably. In fact, some might even say that they are the same thing. However, they are not. Both subscription billing and recurring billing need to process an electronic payment. So the basic building blocks of payment processing are required for both models are:

- Secure capture of payment information.

- Encryption or tokenization of payment information.

- Payment gateway connectivity.

- Online payment processing.

- Pay Card Industry Data security.

- Stored payment credentials.

- Dunning (collection of past due amounts).

- Failed payment management.

Subscription billing the more complicated version of recurring billing. The two models can also overlap. Let’s start with the latter:

What is Recurring Billing?

Recurring billing is the repetitive act of processing payment.

- Start with the basic building blocks as described earlier (tokenization, gateways, security, etc.)

- Now add a dollar amount to be billed; date to be billed; a frequency to be billed; and a customer to be billed. Sum that all together and you have recurring billing.

- Billing customers the same amount on a very regular billing cycle. Cable billing is an excellent example. As long as there are no extra or variable fees, you are generally being billed the same amount every month. You have a card or bank account on file, and payments are made automatically.

- Your rent or mortgage payment are other examples of recurring billing opportunities.

- A quarterly billing can also fall under recurring billing. However, the difference is that billing frequency is defined every three months instead of every month.

- The benefit to the customer is always ease of payment. They don’t have to remember a thing. Keep in mind that the easier you make it for the customer to pay, the more likely you are to get paid.

- The benefit of recurring billing to you is that you can save a ton of time and get paid automatically.

- Historically, recurring billing has been a popular billing option among businesses that need to bill for regular, consistent services (TV, phone, cleaning services, daycare, security systems, health club memberships, etc.).

- But today, there are no limits. The sustainable revenue of recurring billing is so desirable that this model appears in unexpected places. Who would have thought that you could pay for shaving every month? Thank you, Dollar Shave Club.

Now let’s add some complexity:

- Multiple pricing models. Offering tiered services (bronze, silver, gold platinum) is very common. It offers the customer choices of which recurring billing model they prefer.

- Variable billing. Have you noticed your phone bill? It’s also done monthly. However, the amount changes from month to month. This is called “variable” recurring billing. This type of billing takes place with a defined frequency. However, the amount needs to be updated via a data feed, API or import.

What is Subscription billing?

- Start with the basic building blocks as described earlier (tokenization, gateways, security, etc.)

- Like recurring billing, we need to add a dollar amount to be billed; date to be billed; a frequency to be billed; and a customer to be billed. However, subscriptions go way beyond this.

- Free trials. Your customers sign up for a 30-day plan where nothing is billed. However, at the end of that 30-day period, the customer is automatically “converted” to a paid monthly recurring billing. In this case, two different subscriptions are linked together. Same customer. However, the first is billed at $0 for a given period while the second starts once the first period ends and has an amount to be billed.

- Upgrades and downgrades are very common in subscription billing. They can be complicated as some subscriptions allow customers to voluntarily add features or services that change the billing amount. Customers can change packages based on their needs.

- Subscriptions can be involuntary and based on usage. Automatically changing price based on usage or users.

- Services with a large customer base require ongoing testing to optimize revenue and retention.

- Applying pro-ration can be complicated, especially when a customer upgrades or downgrades in the middle of a billing period.

- A key differentiator of subscription platforms is customer self-management. Any time the customer is allowed to make changes (other than simply updating their payment method), this method becomes complicated. Changes to billing frequency (weekly to monthly, etc.), billing date, or amount to be billed. A true subscription platform enables customers to make these changes with little or no involvement on your part.

- SaaS (software as a Service) platforms are frequent users of subscription billing.

So as you can see, the basic building blocks for both subscription and recurring billing are the same. The level of product and price complexity is what you should use to determine what billing model you should choose.

Advice: Be Sure to Do These 3 Things

- Automation. As your business grows, any tasks that you currently perform manually will become a drain on you and your customers. Billing, reminders, notifications, failed payment mitigation…all of these need to be 100% automated. Your operations should be on autopilot.

- DIY. When your customer base grows to thousands of customers, you cannot possibly manage all of the upgrades, downgrades, pricing changes, renewals, etc. When you get this big, you need a system that enables your customers to self manage.

- Transparency. Customers do not like surprises. If you want to retain customers, make sure that they know that they are in complete control…especially when it comes to their finances. Remind them when payments are due. Notify them when payments have been made. Provide a customer portal so that they can manage their information.

Advice: 3 Things NOT to Do

- Don’t over complicate. Having too many tiers and an insurmountable amount of options will confuse and suppress new sign-ups. So don’t overdo it.

- No Hidden agenda. When you offer a free product or service but ask for a credit card on file, we all know what’s coming.

- Ignore Churn. If your business solution to excessive customer cancellations is bringing in more new customers, … you’re doomed.

What is Churn, and Why Does it Matter?

If your company is spending time, resources and money to acquire new customers; yet business isn’t growing, that’s because customers are leaving as fast as new customers are acquired. This phenomenon is what we call a “churn.”

What is Churn?

Churn rate, also known as customer churn, revenue churn rate, or rate of attrition, is the percentage of customers who stop doing transactions with a particular business. It’s most commonly expressed as the rate of service subscribers discontinuing their subscription within a given period.

If you’re a business and you’re trying to grow your clientele, you need to get familiar in dealing with customer churn rates. Essentially, your company’s growth rate (measured by the percentage of new customers) must exceed its churn rate.

The calculation of churn tends to be used more in subscription billing than recurring billing. In a recurring billing model, individual pricing tends to be a little more consistent. So revenue can often be used as a measure of growth or decline. Because subscription pricing can be varied and dynamic, a more detailed and precise measure needs to be used to measure growth or decline.

What is Transparency and Why is It Important?

If you have ever seen a charge on your bank or credit card statement and wondered what it was, there is a problem. Some businesses rely on their customers, forgetting to cancel or not looking closely at their bank or credit card statements.

Transparency is all about making sure your customers always know when they will be billed and how much they will be billed and for what they are being billed. Customers are more satisfied when they see that they are in control. Tools to facilitate Transparency include pre-bill notifications, payment confirmations, customer self-service portals, and excellent customer service.

Recurring Billing Challenges

Failed payments. Eventually, every card on file will fail (expired, lost, stolen, insufficient funds, etc.). When a payment fails, you need to know why. The reason for the failure will determine what you do next. Always notify the customer when their auto payment fails. An immediate email will let them know that a payment was expected and that you are on top of your billing. You don’t need to tell them why (especially not in the email).

Failure mitigation. The card industry has very specific rules about re-attempting to process a failed payment. Automated re-submissions can be very successful. Sometimes you simply caught the customer at the end of a pay cycle. A resubmission just a few days later will resolve failures due to insufficient funds. But when a card is reported lost, stolen or simply expires, the customer needs to be notified that a new payment is needed.

Why Don’t Banks Like Recurring Billing and Subscriptions?

It’s not that banks don’t like recurring billing and subscriptions. Banks don’t like chargebacks. When a customer sees a charge on their statement that they don’t recognize, they call their bank or credit card company for more information. If they still don’t recognize the cost, they will ask the bank to reverse the payment.

Now, banks want to support their cardholders. However, they need to support the merchants as well. So banks will require the customer to contact the merchant and try to resolve the issue amongst themselves. If that doesn’t work, the customer may contact the bank again and begin the process of reversing the funds via a chargeback.

It is now up to the merchant to prove that a product or service was satisfactorily provided. If they can do that, they contact the customer’s bank and reverse the chargeback.

Without continuing further, you can see that banks HATE chargebacks. So how does this apply to recurring billing and subscriptions?

Have you heard the term “set it and forget it”? This is a common problem with recurring billing. Customers sign up for a service and then forget they have it or even stop using it. Unless the merchant is notified and cancellation requested, billing continues until realized by the consumer.

What to Look for in a Solution?

- Step 1. Understand your needs today. What are you trying to achieve? Are you trying to save time? Become more efficient? Grow? Make sure that the platform can easily support what you need right now.

- Step 2. Look forward. What is your wish list? Are you looking for more marketing (upsells, cross-sells) or more efficiency? Do you hope to have dozens of customers or hundreds or thousands? Now is the time to do a little business planning and shop for the solution that will get you there.

MAKE YOUR DECISION

Are you looking for recurring billing software or Subscription Management?

Subscription Management

Pros

- Rich in features (upgrades, downgrades, coupons, international, etc.)

- Enables creative marketing programs

- Ideal for Saas and enterprise-sized companies

Cons

- Can be very expensive

- May require detailed integration

- Requires staff to manage

Recurring Billing

Pros

- Requires a relatively simple solution

- Solutions are cost-effective

- Ideal for service businesses

Cons

- Limited functionality and flexibility

- If the business expands significantly, may require migration to a more complex solution.