When it comes to doing business the right way, managing cash flow proves to be one of the most crucial tasks. The key to achieving good cash flow is knowing and understanding your options of billing your customers and being aware of your revenue. One of the most well-known ways a business bill customers is advance payment or advance billing. This billing method is when you ask for payment even before providing a job or service.

You might think billing in arrears is the best option. But there are plenty of reasons why you should consider billing your customers in advance:

- Easier billing automation.

- On-hand cash before the job starts Ability to provide start-up capital if necessary.

- Lesser hassle on collections since payment is done upfront.

- Immediate credit is established for new clients.

- Up-to-date payments.

- Easier payment scheduling for recurring services.

While it may offer a ton of positive features, there are also some detractors to advance billing that you should be mindful of. If advance billing is a new approach for your business and customers, be wary of the following:

- There will be instances where you will need to issue a refund or credit if the job is completed under budget or is canceled prior to its completion.

- Additional charges will have to be issued for the next invoice – potentially extending billing for extra work.

- Some customers are skeptical when it comes to upfront billing; they want to see the progress first.

Table of Contents

ToggleUnderstanding Advance Payments

Just like billing in arrears, billing in advance is also a pretty simple billing concept. The payment done in advance involves the amount paid before a good or service is received. The balance owed, if any, is settled once service is rendered. This type of billing is in contrast to payment in arrears – also known as deferred payment. In this case, goods or services are delivered first then paid after completion. For instance, an employee at a company is paid at the end of the month for their monthly work. This billing process falls under deferred payment.

Payments in advance are tracked and recorded as assets for a company’s balance sheet. Whenever these assets are used, they are expended, tallied, and recorded on the ‘income statement’ for the period in which they are incurred.

Advance payments are available in two situations:

- It applies to a sum of money given before a contract due date agreed upon by both parties during negotiation.

- It may be necessary before the receipt of the requested goods or services.

Advance Payment Guarantees

An advance payment guarantee also serves as a form of insurance to your clients. It assures that, should your service fail to meet the agreed-upon obligation of goods or services, the advance payment amount will be refunded to the customer. This level of protection will allow your client to consider a contract void if you fail to perform. It also reaffirms the client’s rights to the initial funds paid.

How to Manage Advance Billing

The advance billing invoice allows you to take in payment from your client. Throughout the service, recognize the revenue by associating it with regular invoices. Doing so will enable your business to identify the income and expenses for the project within the same ledger period.

The advance billing format typically has two parts: AR and Accrual.

The AR section of the invoice serves as a regular invoice. That means it will reflect on your accounts receivable aging report. However, instead of crediting a revenue account, it will post to your designated arrears income accrual account.

The accrual part of your invoice will act as a credit memo. In this section, your regular invoices will be a debit for your deferred revenue account.

Under the accrual part or accounting, advanced revenues earned are a liability. If the business earns it within a year, they should refer to it as ‘current liability.’

Keep in mind that receiving and accounting for advance payment from a client will require careful attention to the manner in which entries enter your accounting records. This process usually involves qualifying the nature of the payment received before completing the posts to the general ledger.

Once the goods or services related to that particular payment are invoiced, the payment will reflect on your records appropriately. Some general steps to remember are the following:

- How you determine the type of advance payment;

- How you account for the advance payment; and

- How you report the advance payment.

Determining the Type of Advance Payment

Speaking of which, it’s essential to determine the type of advance payment you are receiving. The first thing you need to do is qualify the kind of advance payment. This process will depend on whether or not the goods or services have been delivered.

Earned revenue is payment for goods and services that are partially or completely delivered. However, it has yet to be invoiced.

Unearned Revenue is payment for goods and services that will be delivered and invoiced at a later date since you’ve yet to provide progress of work to the customer.

Once you’ve determined the type of advance payment, the next thing you need to do is create your deferred revenue account.

You might consider a customer’s deposit as a straight income. However, since you still owe the customer something, it’s actually a liability to your business.

The third and final thing you need to do is associate the advance payment it the correct customer account. If you’re doing business with a new client, you will need to create a customer account in the accounting records. The account should also post and mention details for both the earned or unearned revenue.

How to Create an Advance Billing Report

You can post the advance bill on either the income statement or the balance sheet. Keep in mind that it will depend on the type of payment.

- Unearned payment – the amount may be posted to the company’s balance sheet as ‘liability’ under the revenue line/unearned income line.

- Earned payment – the company’s income statement may post the amount once an invoice is sent to the customer.

After sending the invoice, you can proceed to complete the transactions in your accounting books. Doing so will move the unearned revenue from the balance sheet since it’s now a payment on a specific invoice and counted as part of the receivables for that particular period.

At the same time, earned income moves from an outstanding line item on the income statement that will then apply to the balance of the invoice.

Take Advantage of Recurring Billing

Whether or not you’re offering advanced billing or advanced payment for your business, you’ll need to make sure your payment processing is quick and efficient. That’s why you need to give recurring billing a try. Recurring billing offers several `for both merchants and customers.

Recurring billing helps increase sales and keep your cash flow at a consistent and reliable rate. In addition, recurring billing also encourages customers to buy more products or services since they know they will be charged in a timely manner.

How Does Recurring Billing Work?

Recurring billing works by using credit card information pieces known as “payment details” (e.g., credit card number, expiration date, and CVC). Using a recurring billing system will automatically charge the customer on a prearranged schedule for goods or services without further permission from customers. This means that recurring payments are completely automated!

Why Should You Consider Using Recurring Billing?

Recurring billing is a great way to increase customer satisfaction by making it easy to make recurring payments. This payment method can also help reduce administrative costs, processing fees, and credit card fraud. When you consider all of these benefits, combined with how quickly recurring billing systems are being adopted, recurring billing is a payment option that you should consider using.

Recurring billing is extremely convenient for customers since they don’t have to worry about remembering their payment dates or accidentally missing a payment — the charges will be automatically deducted from their account on a set schedule by merchants that automate recurring payments!

Why Get ReliaBills Automated Recurring Billing?

Automated recurring billing is excellent — but only when you’re using a great platform that offers a great recurring billing feature. ReliaBills is one of those providers, and we’re proud to offer automated recurring billing as part of our core products.

ReliaBills helps businesses reduce customer churn because it’s one less thing customers have to worry about. In addition, our recurring billing feature allows your business to increase its revenue since transactions are recurring and ongoing regularly. Finally, ReliaBills enables your business to quickly add charges for services if you choose to do so! So, if you’re looking for a reliable and feature-rich recurring billing solution, ReliaBills can help your business succeed! Click here to get started.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

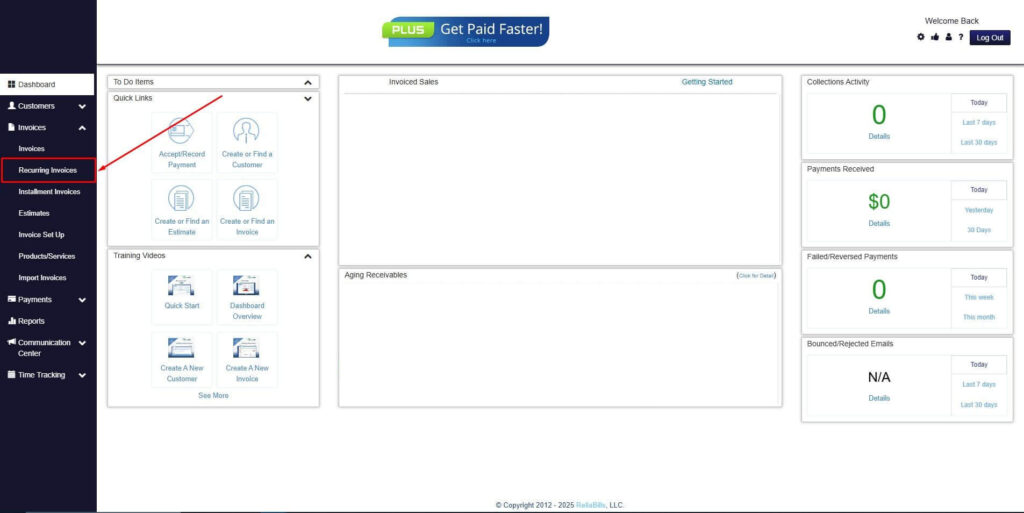

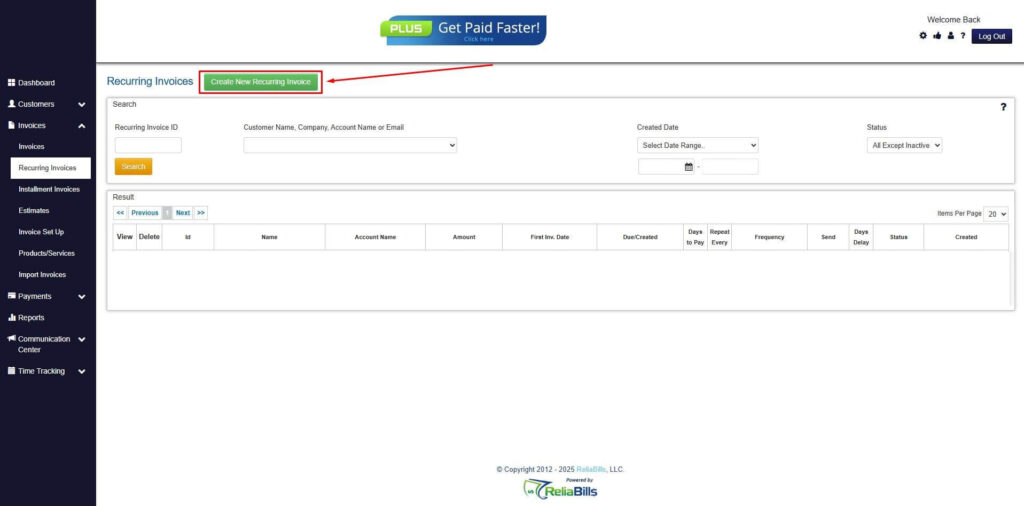

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

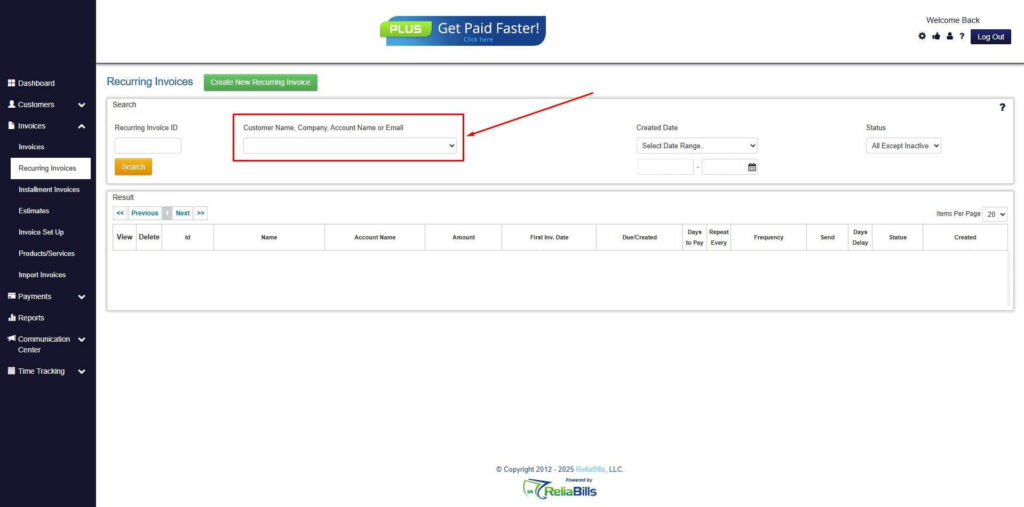

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

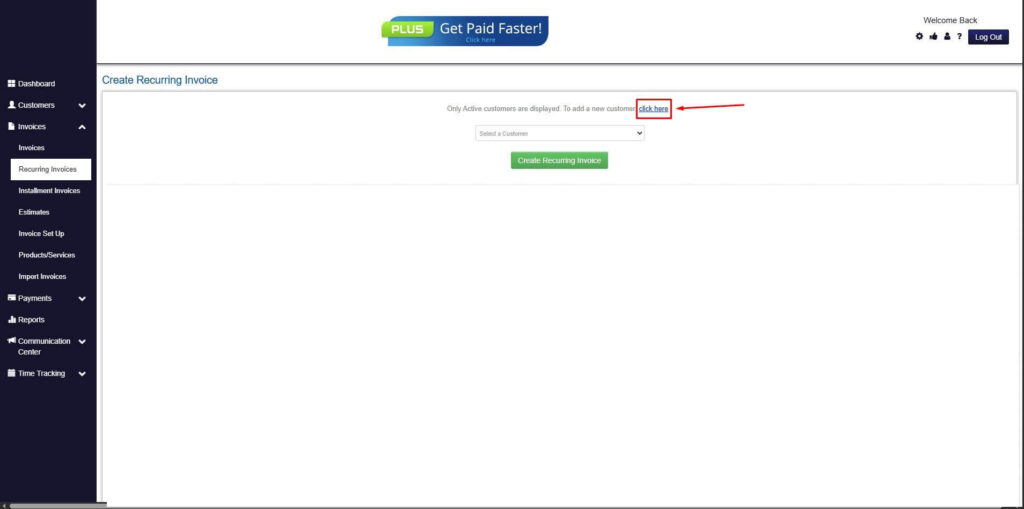

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

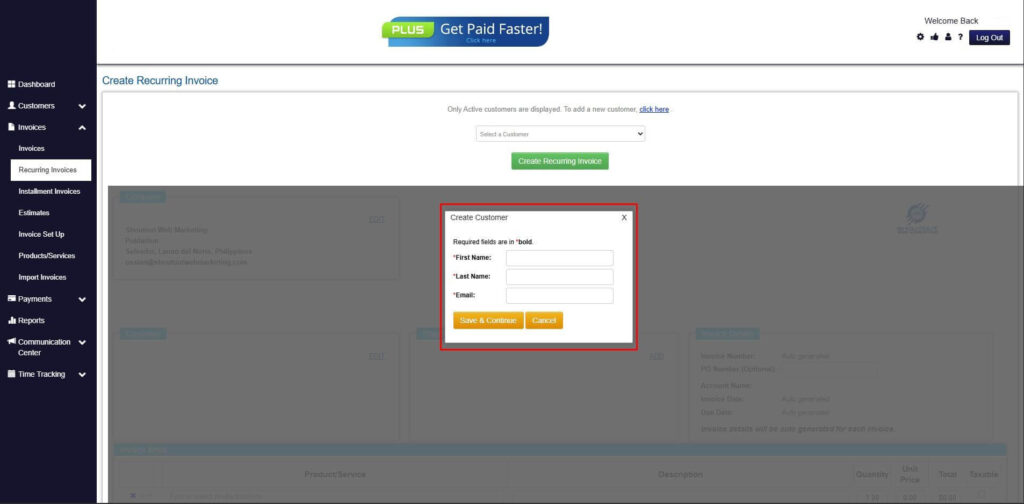

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

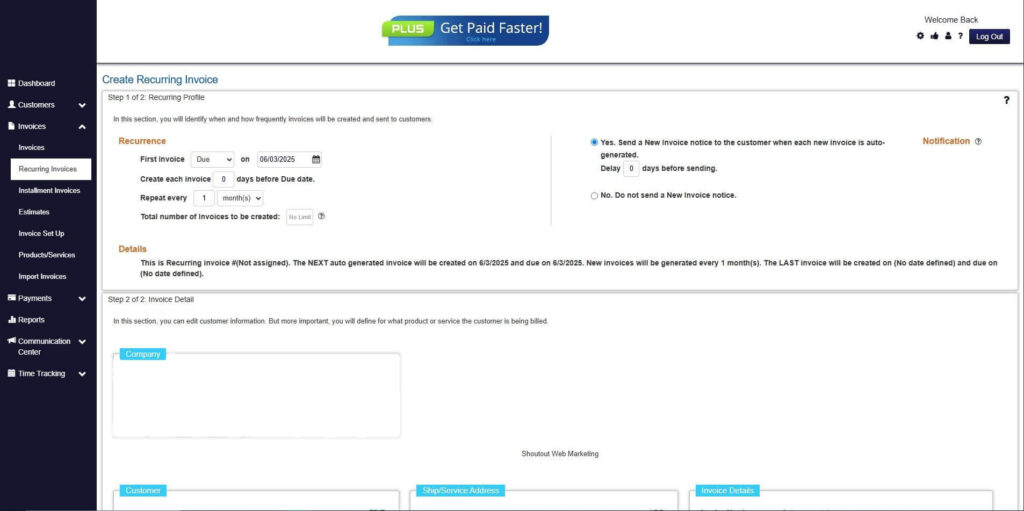

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

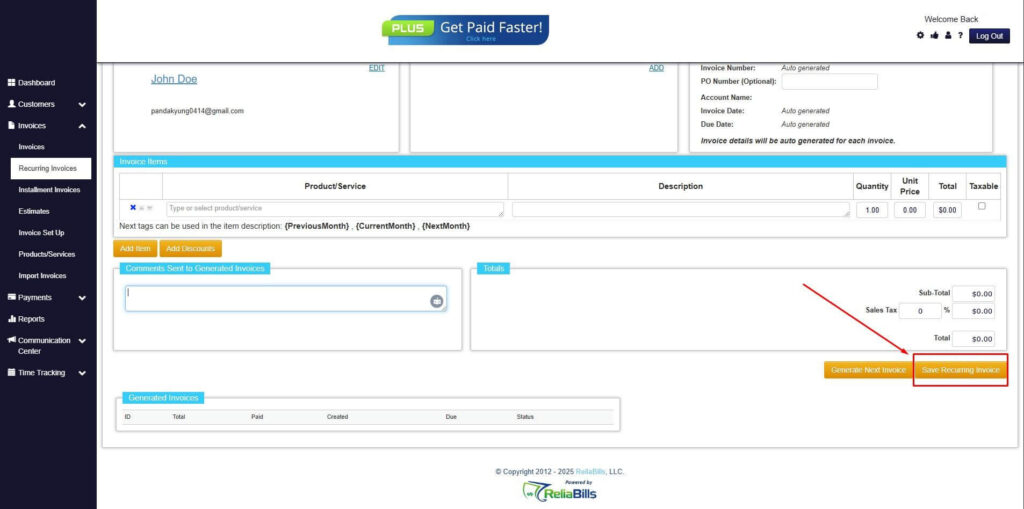

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

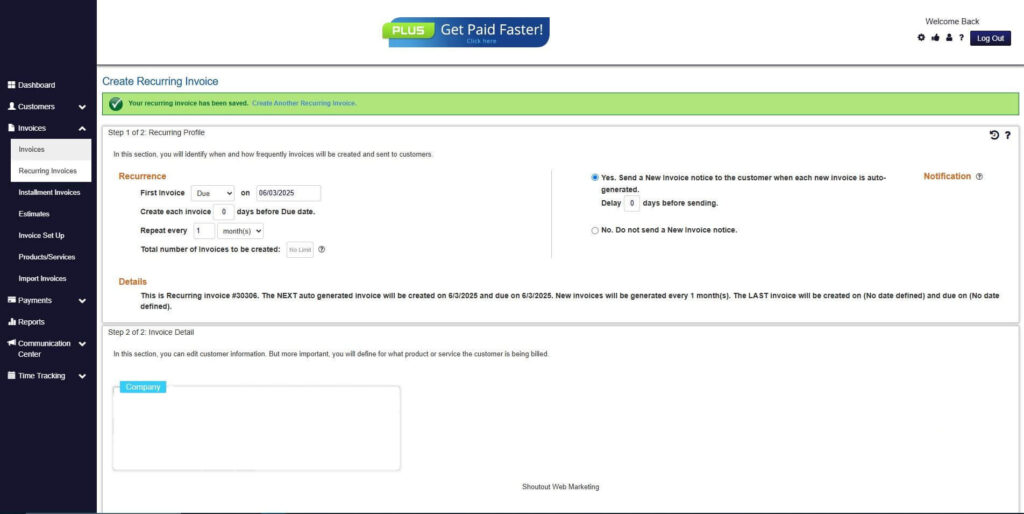

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Wrapping Up

Advance billing or advance payment is an excellent way to send and manage payments from customers, especially for recurring services. However, it does take some critical planning and attention to detail, especially on your accounts. That way, you can ensure that you are attributing correct and accurate numbers to your revenue. Advance billing also gives you better and more precise forecasting of cash flow, which means you have reliable information that you can use for your business.