When it comes to making recurring payments, there are a few different ways to go about it. Usually, people use a credit card or a debit card. However, did you know that a prepaid card can also be an option for recurring payments? There’s a lot of confusion about prepaid cards and whether or not people can use them for recurring payments. But just like with credit cards and debit cards, you can use a prepaid card for some recurring payments.

It’s a lesser-known fact but something you should keep in mind as you make your financial plans. This article will tackle the topic of using prepaid cards for recurring payments to have all the information you need before making your next purchase.

Table of Contents

ToggleIs it Possible to Pay Bills Using a Prepaid Debit Card?

Yes, it is indeed possible to pay bills using a prepaid debit card. Many service providers and billers allow you to set up automatic payments using prepaid cards like credit or debit cards. This includes utilities, streaming services, and other subscription-based services. However, the prepaid card must have sufficient funds to cover the transaction at the time of the billing cycle, as these cards do not offer a line of credit.

Prepaid cards are a convenient option for those looking to stick to a budget or who may not have a traditional bank account. They can be reloaded with funds as needed and used for bill payments while helping to avoid overdraft fees and interest charges. To facilitate smooth transactions, it’s essential to ensure that the prepaid card is from a network the biller accepts, typically Visa, MasterCard, Discover, or American Express.

Accessing and Using a Prepaid Debit Card

Accessing and using a prepaid debit card typically involves a straightforward process. First, you’ll need to purchase a card from a retailer or order one online from a financial service provider. Once you have the card, activating it is as simple as following the instructions provided, which often requires calling a phone number or visiting a website. You may have several options to add funds to your card:

- Direct deposit from your paycheck

- Transferring money from a bank account

- Loading cash at designated retail locations

Keep in mind there may be fees associated with loading funds on your card, so it’s essential to understand the fee structure. Using a prepaid card is similar to using a debit or credit card. You can make purchases at stores, online, or over the phone, wherever the card’s network (Visa, MasterCard, etc.) is accepted. Additionally, some prepaid cards allow you to withdraw cash at ATMs, though there may also be fees for this service.

It’s crucial to monitor your balance since transactions will be declined if you attempt to spend more than the amount on the card. Fortunately, many prepaid cards offer online tools to track spending, view your balance, and check transaction history, allowing you to manage your finances effectively.

Special Card Features

While prepaid cards offer convenience and budget control, they also come with unique features that make them increasingly attractive to consumers. Certain cards provide cashback rewards on purchases, a benefit usually associated with credit cards. Others may offer savings provisions, allowing users to set aside money while keeping it separate from their primary balance.

- Cashback Rewards: Some prepaid cards allow users to earn a percentage of their purchases back as cash rewards, which can be used for future transactions or added to the card’s balance.

- Savings Provisions: A savings feature may be included in a prepaid card, encouraging users to transfer funds into a designated savings area of the card, potentially even earning interest.

- Direct Deposit Services: Cardholders can have their paychecks or government benefits directly deposited onto their prepaid card, often resulting in faster access to funds than traditional bank deposits.

- Fraud Protection: Many prepaid cards come with limited fraud protection, which can provide a safety net in case the card is lost or stolen.

- Zero Liability: This is a policy that protects consumers from unauthorized transactions on their cards, akin to protections offered by credit cards.

- Mobile App Management: Card issuers often provide a dedicated mobile app where users can manage their accounts, review transactions, reload funds, and more.

- ATM Network Access: Prepaid cards may be part of an ATM network that allows users to withdraw cash without fees at specific locations.

- Customizable Cards: In some cases, consumers can personalize their prepaid cards with designs or images for a small fee.

- Travel Benefits: Certain prepaid cards may offer travel-related benefits similar to those with credit cards, such as no foreign transaction fees or travel insurance.

- Virtual Account Numbers: For added security during online transactions, some prepaid cards can generate temporary virtual card numbers to protect the actual card information.

Each of these features enhances the value and versatility of a prepaid card, making it an increasingly popular choice for managing personal finances. For more information on the specific features and benefits of a prepaid card, it’s best to consult with the card issuer or read through the terms and conditions carefully.

Things You Can’t Do with a Prepaid Card

While prepaid cards come with many advantages, there are limitations to their functionality that are important to consider before using them as your primary payment method. They lack some of the features and flexibilities traditional credit and debit cards offer. Understanding these limitations can help you avoid potential inconveniences and plan your finances accordingly.

- Cannot Improve Credit Score: Unlike credit cards, prepaid cards do not report to credit bureaus. Therefore, using them will not help you build or improve your credit score, which may limit your ability to access credit in the future.

- Inability to Borrow Funds: Prepaid cards are not linked to a line of credit or a bank account; hence, they cannot be used to borrow money or receive loans, making them unsuitable for situations requiring borrowing.

- Limited or No Overdraft Protection: Users cannot spend more than the balance on the card, as most prepaid cards do not offer overdraft protection services, potentially leading to declined transactions.

- Restrictions on Rental Services: Many car rental companies and hotels do not accept prepaid cards for reservations or may require a significant cash deposit if they do, restricting your options when traveling.

- No Bank Services: Prepaid cards typically do not offer additional bank services like writing checks, receiving interest on balances, or the full suite of services provided by banking institutions, limiting your financial management capabilities.

Frequently Asked Questions (FAQs)

Q1: What payments accept prepaid cards?

Prepaid cards are issued by major credit providers like Visa and MasterCard, which means they can be used virtually anywhere that debit cards are accepted. This encompasses a broad range of locations, from retail stores, restaurants, and gas stations to online marketplaces. The widespread acceptance of these network-branded prepaid cards ensures that cardholders can transact seamlessly in most situations, enjoying the convenience similar to those of traditional bank-issued debit cards.

Q2: Can I pay bills with a prepaid Visa?

Yes, prepaid Visa cards can typically be used to pay bills online or over the phone with companies that accept Visa debit card payments. Some billers may also offer the option to set up recurring payments using a prepaid card, similar to how one would with a traditional checking account. It’s important to check with your specific biller beforehand to ensure they accept prepaid cards as a payment method.

Q3: Is there a credit check for prepaid cards?

No, one of the primary advantages of using a prepaid card is that they do not require a credit check or impact your credit score. Prepaid cards are essentially pre-loaded with funds, so there is no need for a credit check or approval process like with traditional credit cards. This makes them an accessible option for individuals with no credit history or those looking to avoid potential credit inquiries.

Q4: Can you withdraw cash from a prepaid card?

Yes, most prepaid cards provide access to an ATM network where users can withdraw cash. However, it’s important to note that fees may apply for these transactions and vary depending on the card issuer and specific ATM location. Some prepaid cards also offer cashback options at participating retailers, allowing users to make purchases and receive cash back from their prepaid card at the same time.

Q5: Are there any fees associated with prepaid cards?

As with any financial product, it’s crucial to review the terms and conditions of a specific prepaid card to understand any potential fees that may apply. Some common fees associated with prepaid cards include activation fees, monthly maintenance fees, ATM withdrawal fees, foreign transaction fees, and reloading fees. Some card issuers may also charge fees for using certain services, such as adding additional funds to the card or requesting a paper statement. It’s important to compare different prepaid cards and their associated fees before choosing one that best fits your financial needs and habits.

Q6: Can I reload my prepaid card?

Yes, most prepaid cards offer the option to add additional funds or “reload” the card. This can typically be done online, through direct deposit, at participating retail store locations, or by transferring money from a bank account. Some prepaid cards may charge a fee for reloading funds, while others offer free options. It’s essential to check with your specific card issuer for their reload options and any potential fees. Overall, the flexibility to reload funds makes prepaid cards a convenient option for managing finances, especially for those who may not have access to traditional banking services.

Take Advantage of Recurring Billing with ReliaBills

If you’re a business owner and want to start offering card payments or recurring billing, using a platform that can offer both needs is important. ReliaBills is a great option as it offers invoicing and payment processing solutions, essential to any growing business.

ReliaBills is a cloud-based invoicing and billing software designed to automate payment processes, reduce administrative overhead, and streamline payment processing duties. Its payment processing features include automated recurring billing, payment tracking, payment reminders, online payment processing, and much more!

It also provides valuable tools that help manage customer information, monitor payment records, and create proper billing and collection reports. As a result, invoice and billing management are simple and convenient. You also get access to active customer support, ready to assist you whenever you need help.

Get started with ReliaBills for free today! And if you want more features, you can upgrade your account to ReliaBills PLUS for only $24.95 monthly! Subscribing to ReliaBills PLUS will give you access to advanced features such as automatic payment recovery, SMS notifications, custom invoice creation, advanced reporting, and more!

With ReliaBills, you have an all-in-one solution to your invoicing and payment processing needs. Our convenient solutions will enable you to focus more on running and growing your business. Get started today!

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

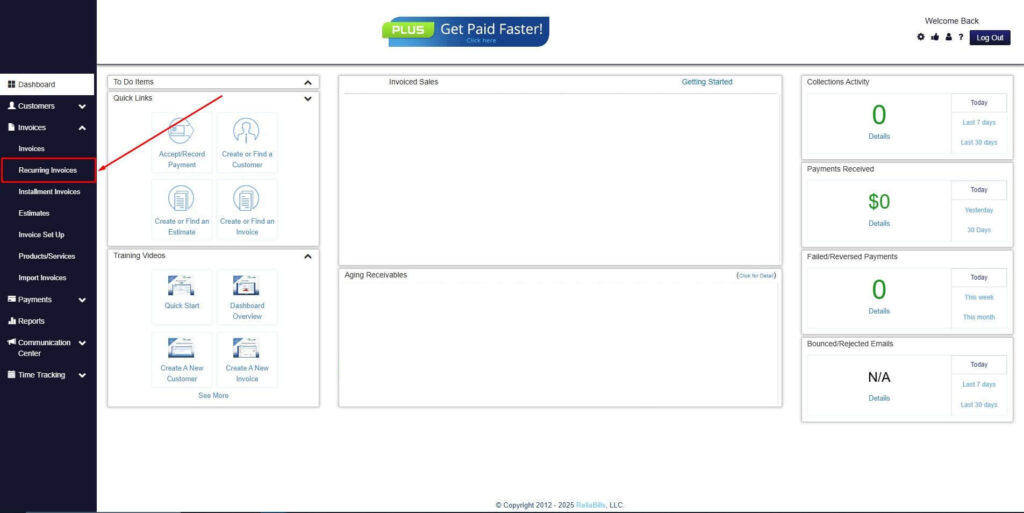

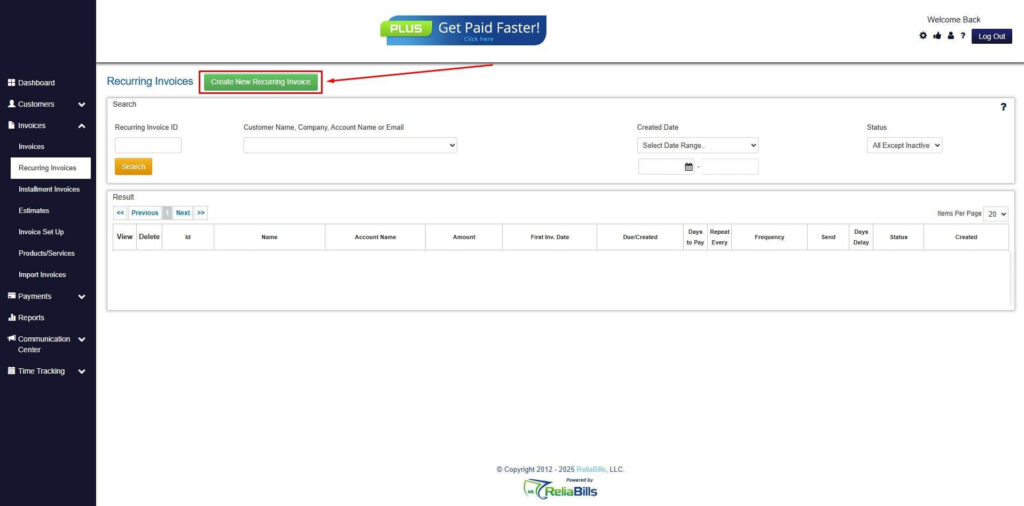

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

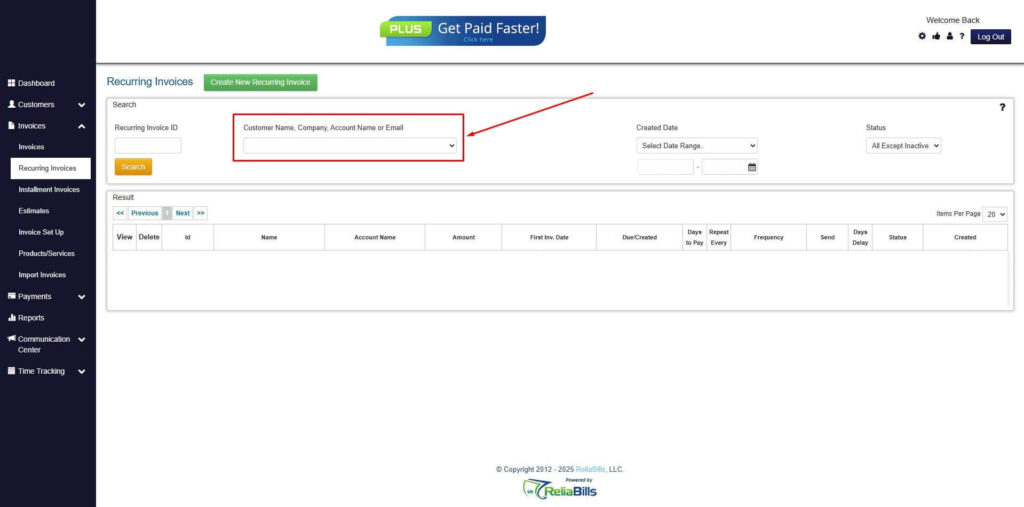

Step 3: Go to the Customers tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

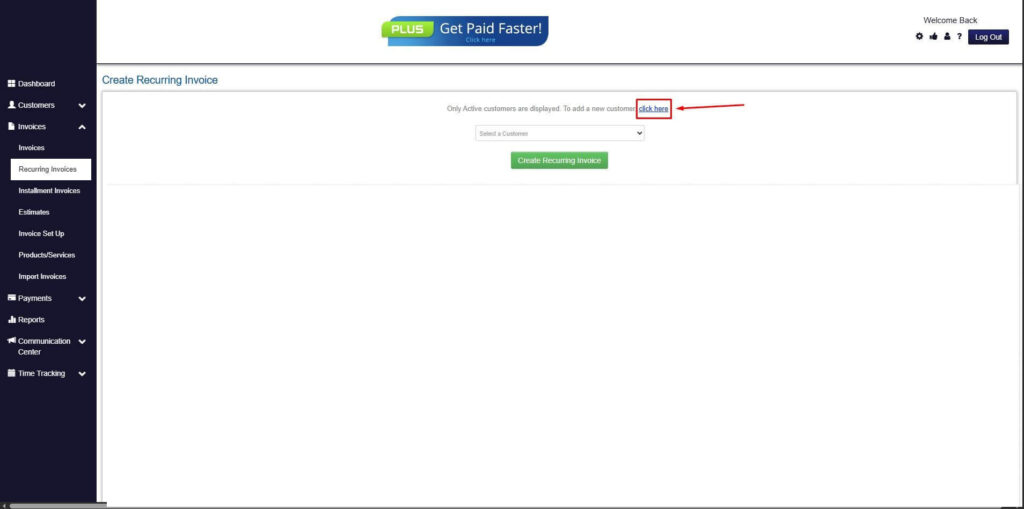

Step 5: Click on the “Click here” button

- Click on the “Click here” button to proceed with the recurring invoice creation.

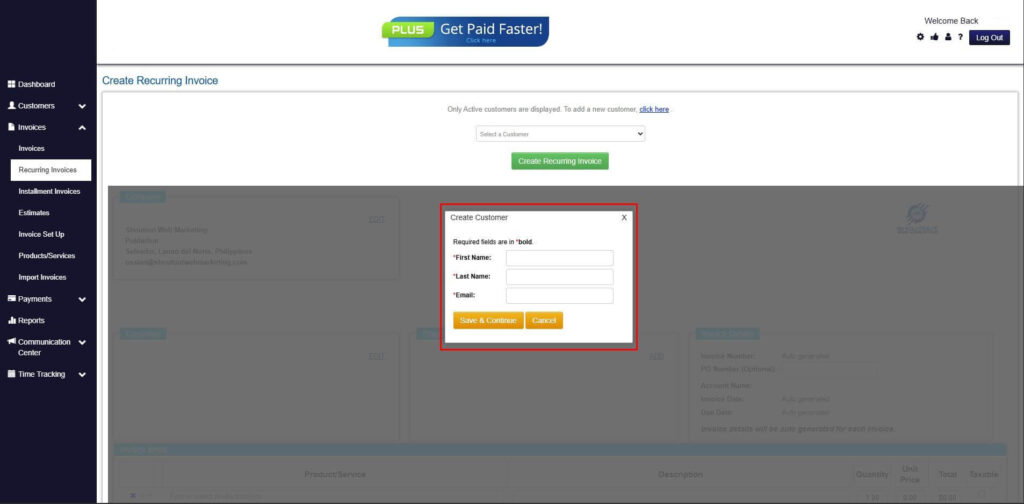

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

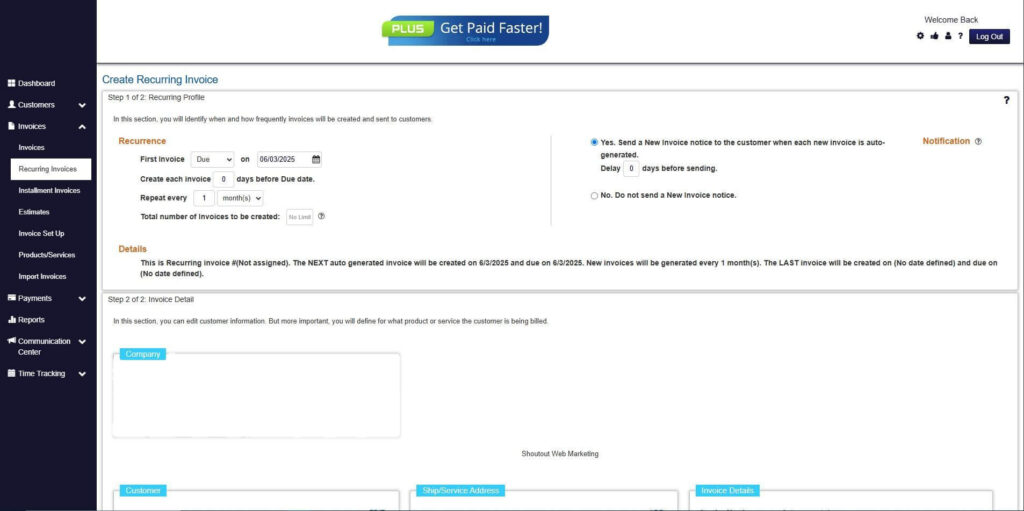

Step 7: Fill in the Create Recurring Invoice Form

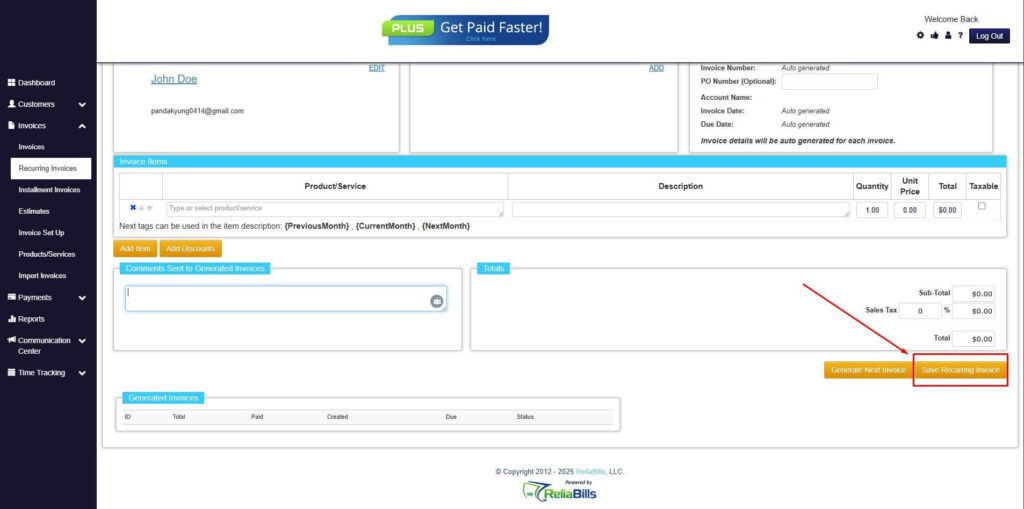

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

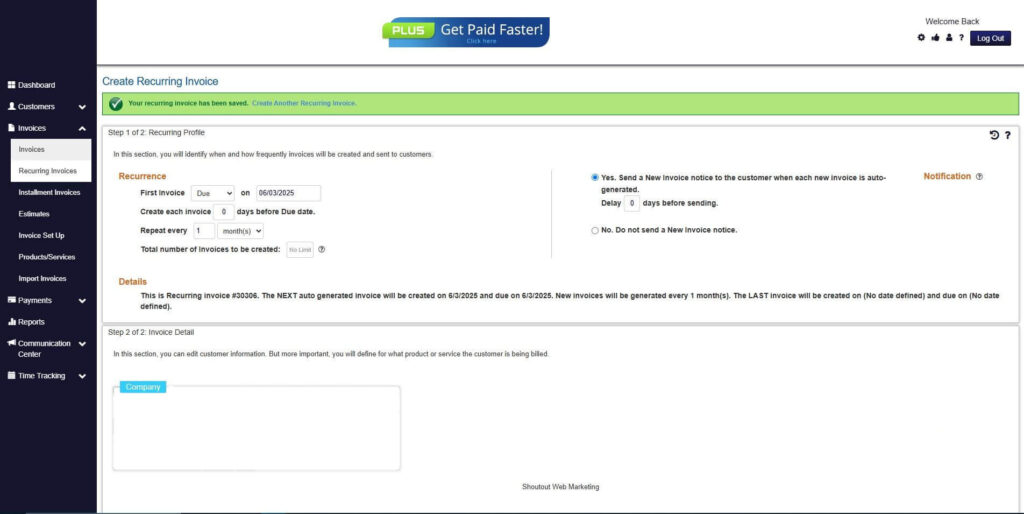

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Conclusion

Prepaid cards present a versatile and accessible financial tool for individuals seeking an alternative to traditional banking methods. Their ease of use, absence of credit checks, and wide acceptance make them an attractive option for a variety of transactions and financial management strategies. Whether for online shopping, controlling spending, or paying bills, prepaid cards offer the convenience and flexibility required in today’s fast-paced world.

Carefully considering the associated fees and reload options will ensure that you find the prepaid card that best suits your financial needs. As the financial landscape continues to evolve, the prominence of prepaid cards will likely grow, offering a practical solution for consumers to navigate their day-to-day finances confidently and efficiently.