Managing a large customer base with recurring payments can seem daunting whether you’re a fledgling startup or a seasoned multinational corporation. Enter the recurring payment processor—the unacknowledged face of subscription businesses.

With recurring payment processors, businesses can charge their customers on a predetermined schedule. By using this type of payment processing, you can say goodbye to the hassle of manual payment collection. So why is it important to understand this payment concept?

This article will discuss recurring payment processors and see how they can revolutionize the way you run your subscription business.

Table of Contents

ToggleWhat is Recurring Payment Processing?

Recurring payment processing, to put it simply, is an automated payment system that allows businesses to charge customers for products or services at regular intervals. The intervals can be customized according to the business model and customer agreement, ranging from weekly, monthly, quarterly, to annually.

This system is vital for subscription-based businesses, such as digital streaming services, fitness memberships, and software-as-a-service platforms. These companies can ensure a steady and predictable income stream by setting up recurring payments, significantly improving cash flow, and simplifying budget projections.

From a technological standpoint, a recurring payment processor integrates with a company’s billing system. It securely stores customer payment information and uses it to automatically charge customers when their subscription payment is due. This automation eliminates the need for manual invoicing and minimizes late or missed payments, vastly improving the efficiency of the business’s financial operations.

Recurring payment processors also come with the added benefits of providing robust security measures. They adhere to stringent data security standards to protect sensitive customer information, providing peace of mind to both businesses and customers.

How Do Recurring Payments Work?

Recurring payments work through a cyclical process which involves the following steps:

Step 1: Customer Authorization

The process begins when a customer agrees to the subscription terms and authorizes the business to charge their credit card or bank account on a recurring basis. This approval can be given through a web form, over the phone, or in person.

Step 2: Secure Storage of Customer Information

The data is securely stored in a database once the customer’s payment information and authorization are obtained. This is where the recurring payment processor comes in. It uses advanced encryption techniques to ensure the security of sensitive payment information.

Step 3: Payment Processing

When it’s time to charge the customer’s subscription fee, the stored payment information is used to process the transaction. This can occur on a weekly, monthly, quarterly, or annual basis, depending on the terms of the subscription.

Step 4: Transaction Confirmation

After the payment is processed, both the business and the customer receive a transaction confirmation. This can be delivered via email or text and is a digital receipt.

Step 5: Failed Payment Handling

If the payment fails due to an expired credit card, insufficient funds, or any other reason, the recurring payment processor can handle the situation in a few ways:

- Reattempt the transaction after a predetermined time.

- Send a notification to the customer to update their payment information.

- In some instances, pause or cancel the services until the payment issue is resolved.

Following this procedure, a recurring payment processor provides a seamless and efficient payment experience for businesses and their customers. It simplifies financial management, improves customer retention, and enables businesses to scale their services.

Key Benefits of Recurring Payment Processing

The implementation of a recurring payment processor in a business not only simplifies financial operations but also brings about a myriad of invaluable benefits such as minimized effort, error and fraud defense, and flexible payment terms and packages.

Minimized Effort

One of the most significant advantages of recurring payment processing is minimizing effort on the business’s and customer’s parts. For businesses, the automation of payments significantly reduces the time spent on manual invoicing, allowing resources to be diverted to other crucial areas. On the other hand, customers can enjoy a hassle-free payment experience without needing to remember and make payments manually, thus enhancing customer satisfaction and loyalty.

Error and Fraud Defense

With automated systems comes a lower chance of human error. Recurring payment processors reduce the likelihood of mistakes in invoicing and payment collection. Moreover, it offers robust security measures, adhering to stringent data security standards. This means sensitive information is encrypted and stored securely, making it much harder for fraudulent activities to occur. This high level of security protects the businesses and gives customers confidence in their transactions.

Flexible Payment Terms and Packages

Recurring payment processing allows businesses to offer flexible payment terms and packages, enabling them to cater to a more diverse customer base. Whether it’s weekly, monthly, or yearly subscriptions, customers have the freedom to choose a payment plan that best suits their needs and financial status, thereby making the business’s products or services more accessible. This flexibility can also lead to higher customer acquisition and retention rates, significantly benefiting the growth of the business.

Improved Cash Flow

Another significant advantage of using a recurring payment processor is the predictable cash flow it delivers. Subscription businesses are assured of a steady income stream at predetermined intervals, allowing for more accurate financial forecasting, budgeting, and planning. The result is a more financially stable and sustainable business model that can weather changes in market conditions.

Enhanced Customer Relationships

By offering a seamless, secure, and flexible payment experience, recurring payment processors also help foster stronger customer relationships. They eliminate common payment-related frustrations, leading to higher customer satisfaction. Moreover, the convenience of automatic payments can strengthen customer loyalty and increase retention rates, leading to long-term revenue growth for businesses.

Businesses That Need Recurring Payment Processing

As beneficial as recurring payment processing is, it shines the brightest in businesses where customers pay for products or services on a consistent basis. So if your business falls under the following categories, you should consider investing in a recurring payment processor:

- Subscription Boxes: Companies like Birchbox or Dollar Shave Club that send monthly curated boxes would benefit immensely from automatic recurring payments.

- Online Streaming Services: Entertainment platforms such as Netflix, Hulu, or Spotify, which charge monthly subscriptions for access to their content, are ideal candidates for recurring payment processing.

- Fitness and Health Clubs: Gyms, yoga studios, and wellness centers that have monthly membership fees can streamline their payment process with recurring payment processing.

- SaaS Companies: Software as a Service providers like Adobe or Microsoft that operate on a subscription-based model can significantly benefit from this payment method.

- Nonprofits and Charitable Organizations: These entities can use recurring payment processing to automate their donation collection process, making it easier for donors to contribute regularly.

- Online Publications: Newspapers or magazines with digital subscriptions, like The New York Times or The Atlantic, can use recurring payments to ensure uninterrupted access for their readers.

- Utility Companies: Providers of services like electricity, internet, or water can simplify their billing process through automated recurring payments.

- Educational Institutions: Schools and universities offering online courses can utilize it for handling course fee payments.

- Professional Service Providers: Lawyers, accountants, or consultants providing ongoing services can use this to invoice clients regularly.

- Digital Marketplaces: Platforms like Etsy or eBay, where vendors have the option to pay a regular fee for premium features, can use automated recurring payments to manage these transactions.

By adopting recurring payment processing, these businesses can streamline operations, improve customer experience, and drive revenue growth.

Switch To Recurring Payments with ReliaBills

Transitioning from manual payment processing to recurring payments is a significant change and requires careful consideration. To ensure smooth migration, businesses should opt for a reliable payment processing solution that can be quickly set up and integrated into their existing systems. That’s why you should give ReliaBills a try.

ReliaBills is a cloud-based invoicing and billing software designed to automate payment processes, reduce administrative overhead, and streamline payment processing duties. ReliaBills’ payment processing features include automated recurring billing, payment tracking, payment reminders, online payment processing, and much more!

It also provides valuable tools that help manage customer information, monitor payment records, and create proper billing and collection reports. As a result, invoice and billing management are simple and convenient. You also get access to active customer support, ready to assist you whenever you need help.

Get started with ReliaBills for free today! And if you want more features, you can upgrade your account to ReliaBills PLUS for only $24.95 monthly! Subscribing to ReliaBills PLUS will give you access to advanced features such as automatic payment recovery, SMS notifications, custom invoice creation, advanced reporting, and more!

With ReliaBills, you have an all-in-one solution to your invoicing and payment processing needs. Our convenient solutions will enable you to focus more on running and growing your business. Get started today!

How to Create a New Recurring Invoice Using ReliaBills

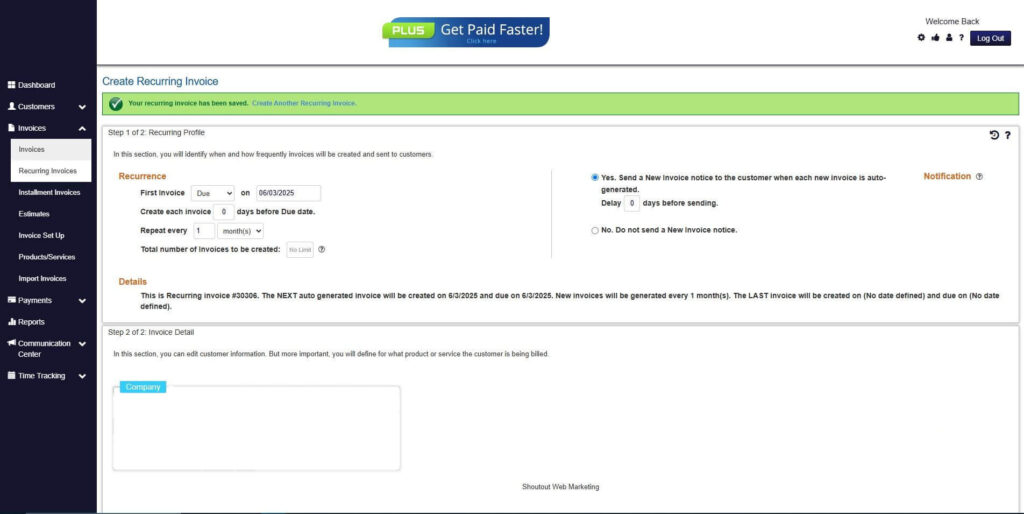

Creating a New Recurring Invoice using ReliaBills involves the following steps:

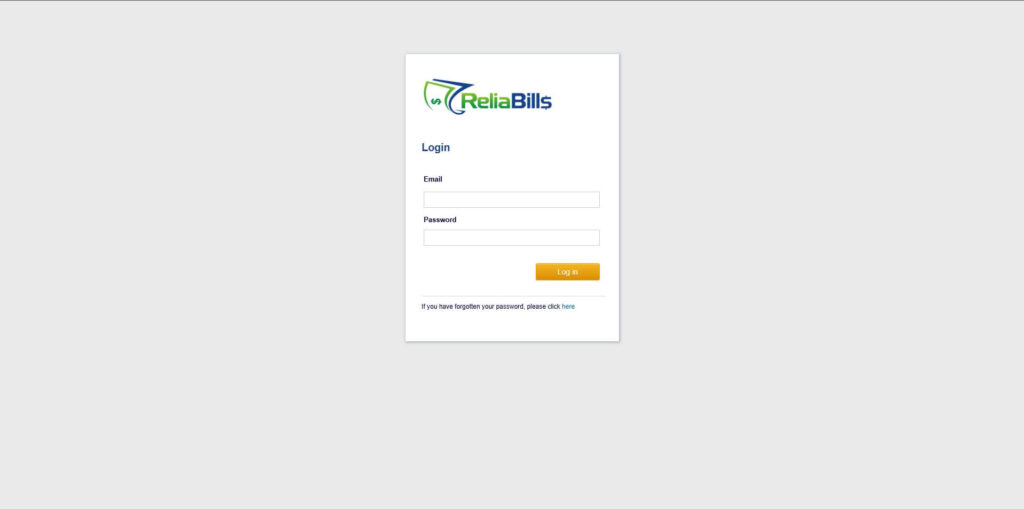

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

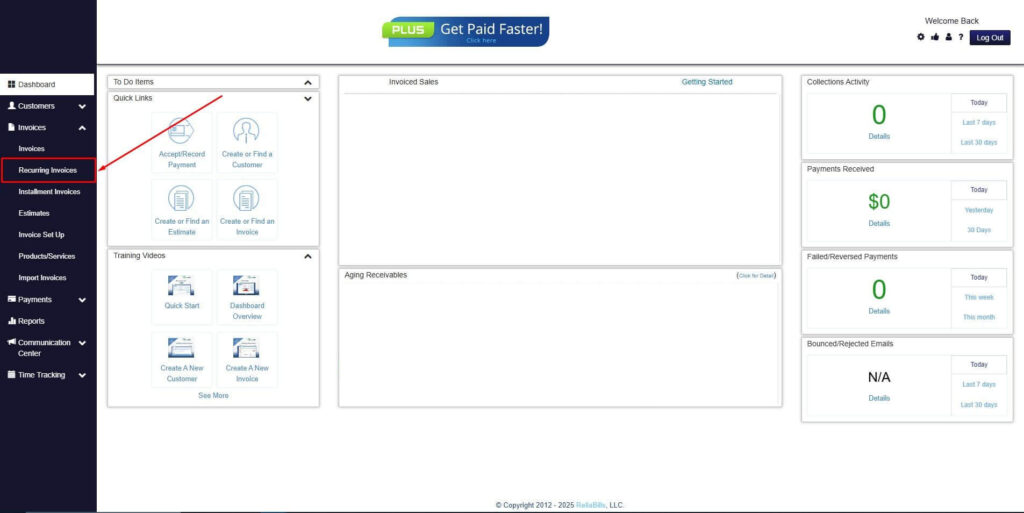

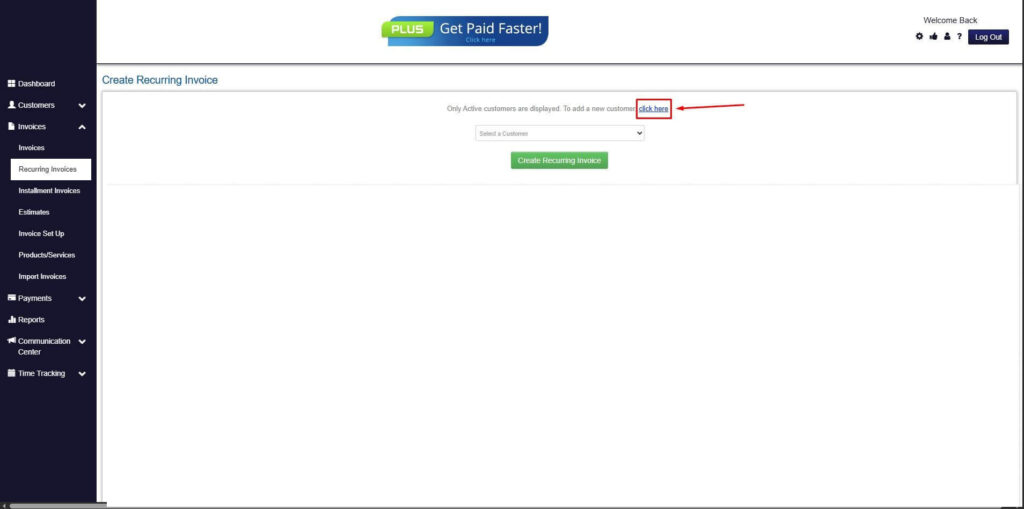

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

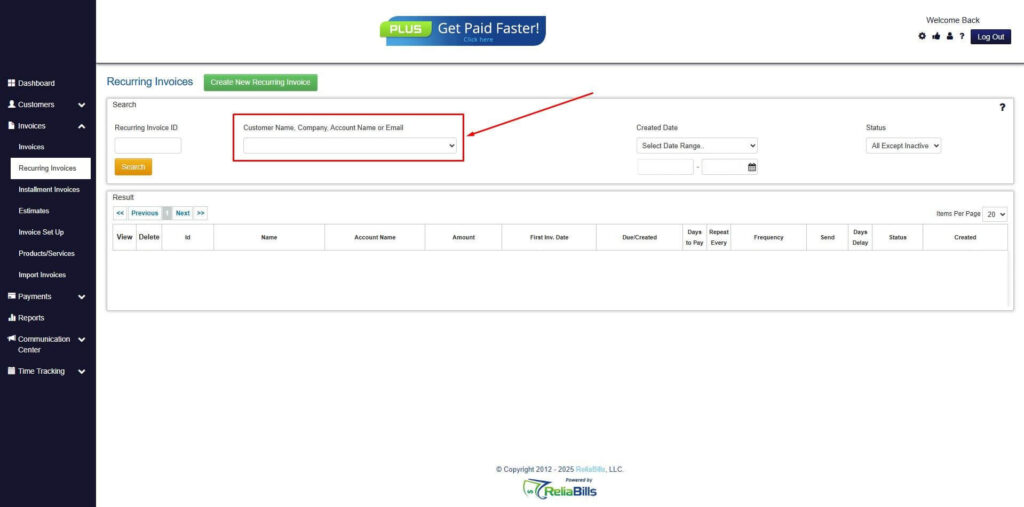

Step 3: Go to the Customers tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

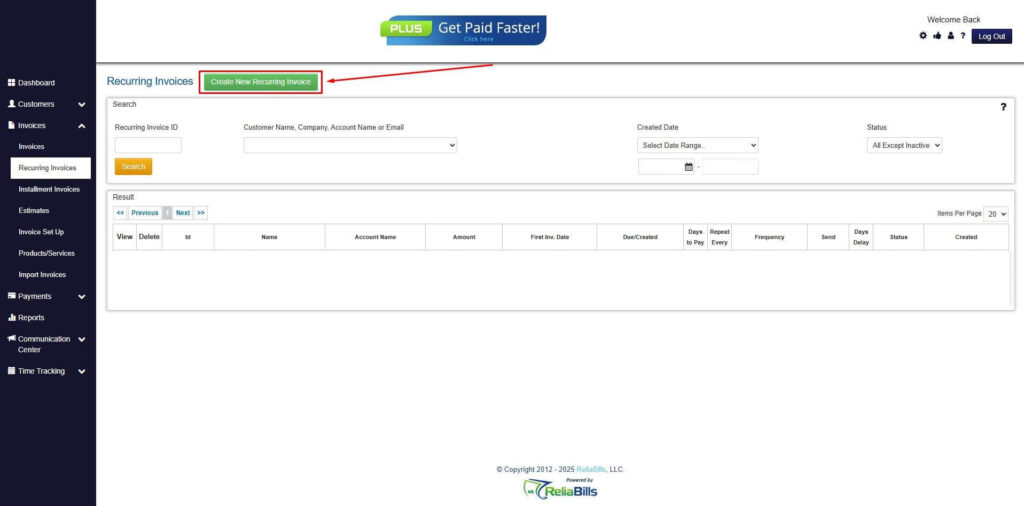

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” button

- Click on the “Click here” button to proceed with the recurring invoice creation.

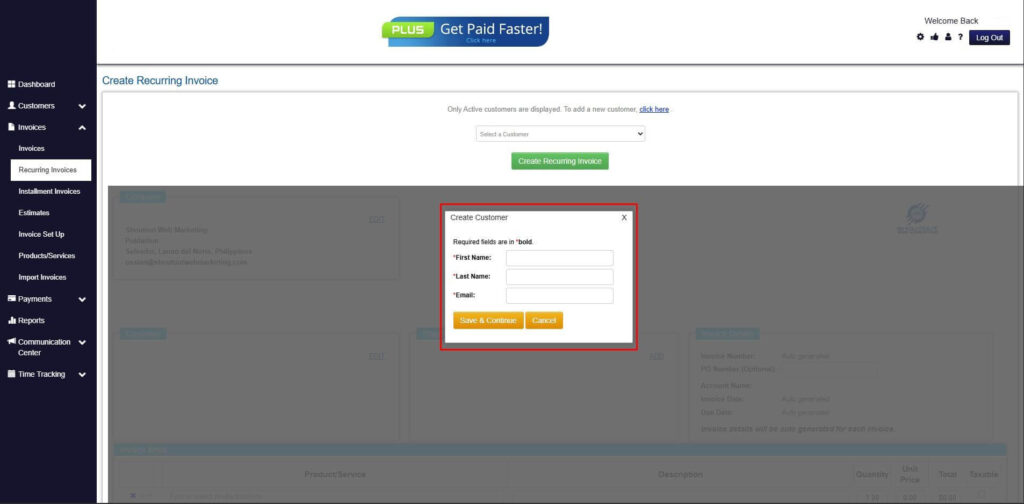

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

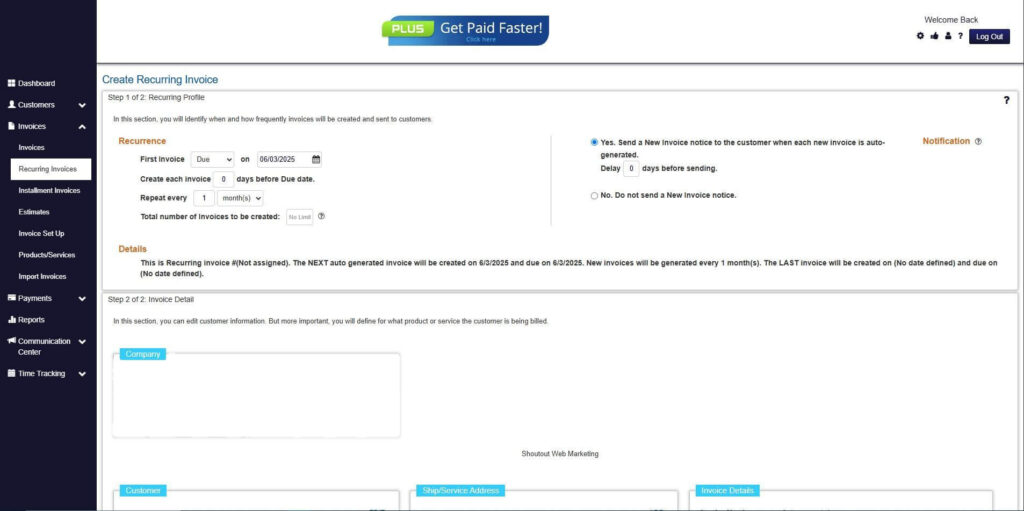

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

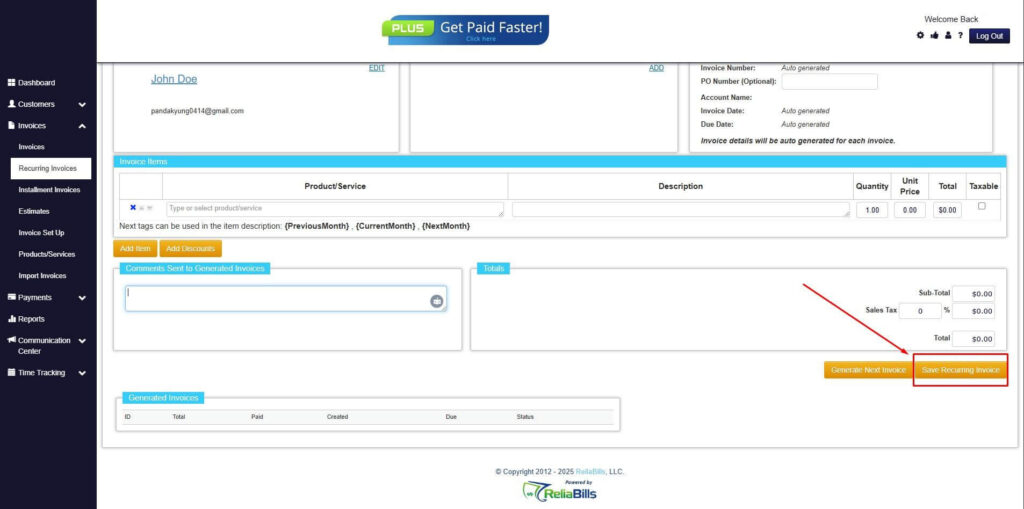

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Wrapping Up

Utilizing a recurring payment processor like ReliaBills can revolutionize how your business handles transactions. It offers numerous benefits that aid in developing better customer relationships with its efficient and user-friendly payment solutions. Shifting to recurring payment processing can prove to be a game-changer. And with ReliaBills, you get more than a payment processor—you get a comprehensive invoicing solution that caters to all your billing needs. Get started today!