There are a few different models that businesses can choose from when it comes to payment processing. One of the most popular models is the recurring payments model. This type of payment processing allows customers to pay for goods or services regularly.

Recurring payments have many advantages for both businesses and consumers alike, but they also come with a few downsides. In this article, we’ll discuss the pros and cons of recurring payments so that you can decide if this payment processing method is right for your business.

Table of Contents

ToggleWhat is Recurring Payment?

To recap, recurring payments are a type of payment processing in which customers pay for goods or services on a regular basis (e.g., monthly, quarterly, semi-annually, or annually). In some cases, businesses will give their customers the option to choose how often they’d like to make a payment.

For example, if you’re paying for an annual subscription to a software service, you may have the option to pay monthly, every six months, or annually.

Advantages of Recurring Payments

There are several advantages of recurring payments for businesses. Below are just some of them:

Better Predictability

Recurring payments can help businesses predict and forecast their future revenue more accurately. This is because businesses will have a good idea of how much money they’ll be bringing in each month or year, making it easier to budget and plan for the future.

For example, suppose you are running a business that generates $1 million in sales per year, with 60% of that coming from recurring billing. Instead of starting from zero, you will start each year knowing that you will make a guaranteed $600 thousand at the very least.

Increased Customer Lifetime Value

Customers on recurring payment plans tend to have a higher lifetime value than those who are not. This is because customers who are paying regularly are more likely to be engaged with your product or service and less likely to churn. At the same time, most customers also like the convenience of not having to worry about their bill.

In other words, recurring payments can help you to increase customer loyalty and retention. Recurring billing also builds long-term relationships with their customers and makes a sale regularly.

Improved Cash Flow

Recurring payments can also improve your business’s cash flow. Since your business is receiving payments regularly, you are guaranteed to have money flowing to your bank account every month. At the same time, you won’t have to worry about sporadic customers paying irregularly since you’re billing and collecting payment from them automatically.

With recurring billing, you can ensure that you have the money you need to cover expenses and grow your business. You don’t have to wait for customers to make a payment. Instead, you can charge them automatically and get paid on a regular basis.

Higher Business Valuation

Embracing a recurring revenue model can also help to increase your business’s valuation. This is because businesses with recurring revenue are more predictable and have a more stable cash flow. As a result, they tend to be worth more than businesses without recurring revenue.

Businesses that utilize recurring billing will experience stability and are less prone to insolvency. In addition, this level of steadiness is more appealing to potential investors, which can help increase your business’s valuation even more.

More Data

When you have recurring payments, you also can collect more data. This data can be used to improve your product or services, as well as your marketing and sales strategies.

You can use this data to track customer behavior, understand what they’re looking for, and figure out how to keep them happy. In other words, recurring payments can help you to gather valuable insights that you can use to grow your business.

Reduces Cost of Sales

Using a recurring revenue model will also decrease the long-term cost of sales. When you acquire a transaction with recurring billing, you’re not getting a single one-off purchase. Instead, you’re acquiring a customer that will (in theory) pay you month after month, year after year.

The cost of acquiring this customer is amortized over the lifetime of the customer, making it a lot cheaper in the long run. In fact, some businesses have reported that their customer acquisition costs decreased by 90% after switching to a recurring revenue model.

Disadvantages of Recurring Payments

While there are many advantages of recurring payments, there are also a few disadvantages that businesses should be aware of.

More Difficult to Set Up

One downside of recurring payments is that they can be more difficult to set up. You need to have a system in place to automatically charge customers regularly.

Setting up this system can be complicated and time-consuming if you’re not careful. In addition, you’ll need to make sure that your system is secure and compliant with industry regulations.

May Turn Off Some Customers

Another downside of recurring payments is that they may turn off some customers. Some people prefer to pay for things on a one-time basis.

They may not be comfortable with the idea of having their credit card charged automatically every month. As a result, they may not want to do business with you. Existing customers might also churn if you promptly switch to a recurring billing model.

Possible Technical Issues

Another potential downside of recurring payments is that there may be technical issues. But, again, this is because you’re relying on technology to automatically charge customers on a regular basis.

If your system isn’t set up properly, you may end up overcharging or undercharging customers. In addition, your system may have difficulty processing payments regularly.

Can Be Difficult to Change Plans

Finally, it’s important to note that it can be difficult to change plans once you’ve set up a recurring payments system. You’ll need to update your system and notify all of your customers of the change.

Changing your payment plan can be complicated and time-consuming if you’re not careful. In addition, it may turn off some customers who are comfortable with the old plan.

Why Use ReliaBills?

If you’re looking to incorporate recurring payments into your business model, ReliaBills is the perfect solution. ReliaBills invoicing and recurring billing software makes it easy to set up and manage recurring payments.

With ReliaBills, you can set up your payment process and automate it completely with ease. In addition, our recurring billing system offers the following perks:

- Automated Invoice Creation: with ReliaBills, you can generate, import, and send your invoices automatically. This feature saves time and ensures that your customers have the most up-to-date information.

- Flexible Payment Scheduling: with our recurring billing software, you have the flexibility to schedule payments however you’d like. You can set up weekly, monthly, or annual payments with ease.

- Automated Variable Payments: enroll your customers in AutoPay and automate variable payments with ease. With our recurring billing system, you can rest assured that your customers’ payments will be processed automatically and on time.

- Invoices Designed for Recurring Payments: our recurring billing system generates invoices designed for subscription-based businesses. Your customers will always know exactly what they’re being charged for and when.

- Failed Payment Mitigation: if a payment fails, our system will automatically retry the payment for you. This takes the guesswork out of failed payments and ensures that your customers’ payments always go through.

At just $24.95 per month, subscribing to ReliaBills PLUS will give you access to our recurring billing tools and features. If you’re ready to give ReliaBills a try, you can jump straight to creating your account.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

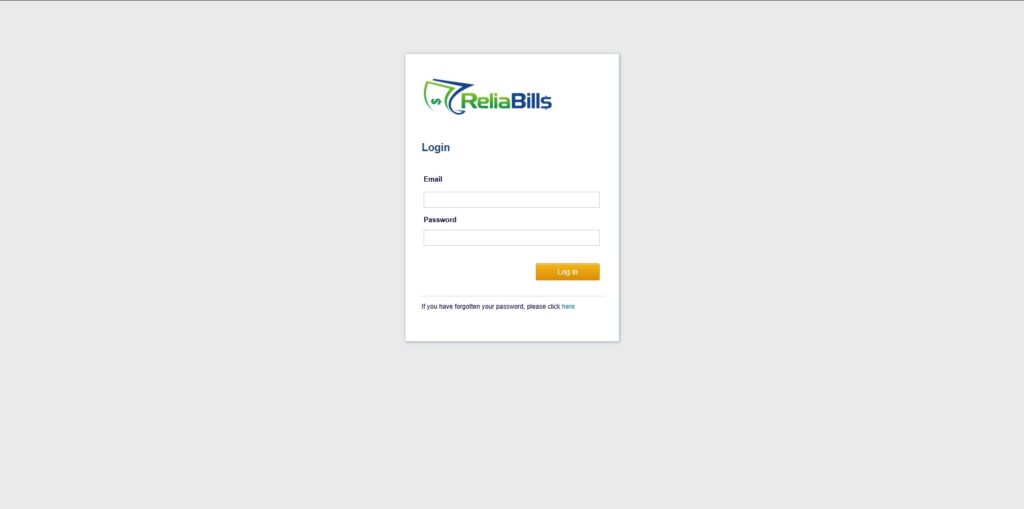

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

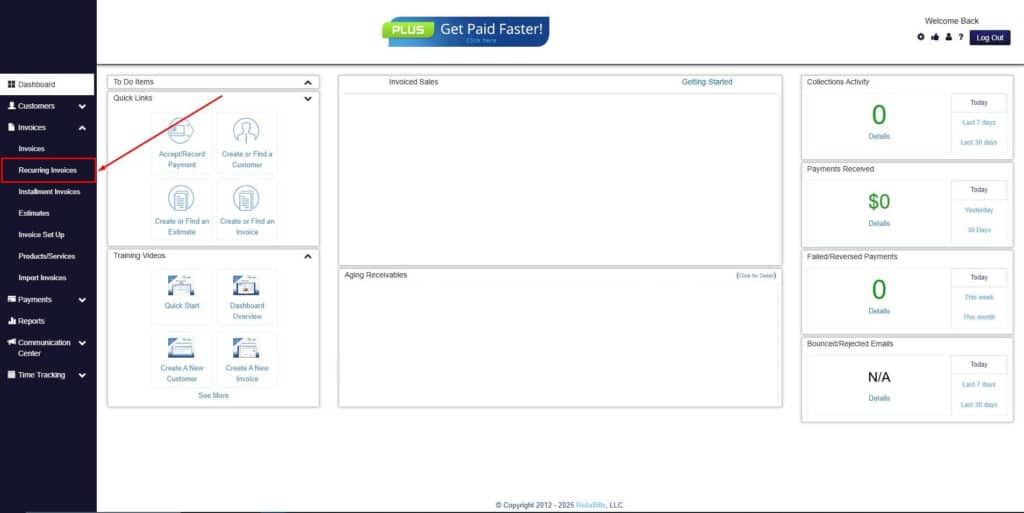

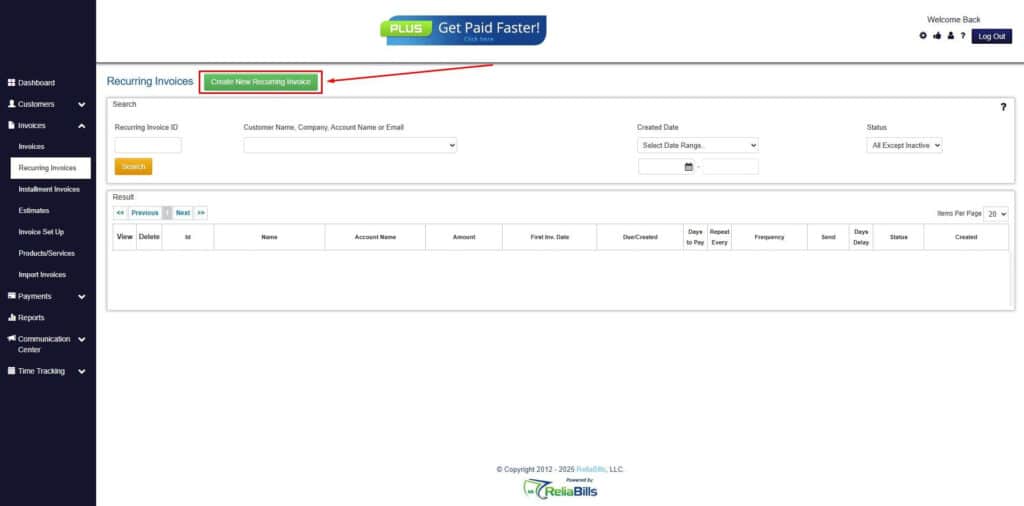

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

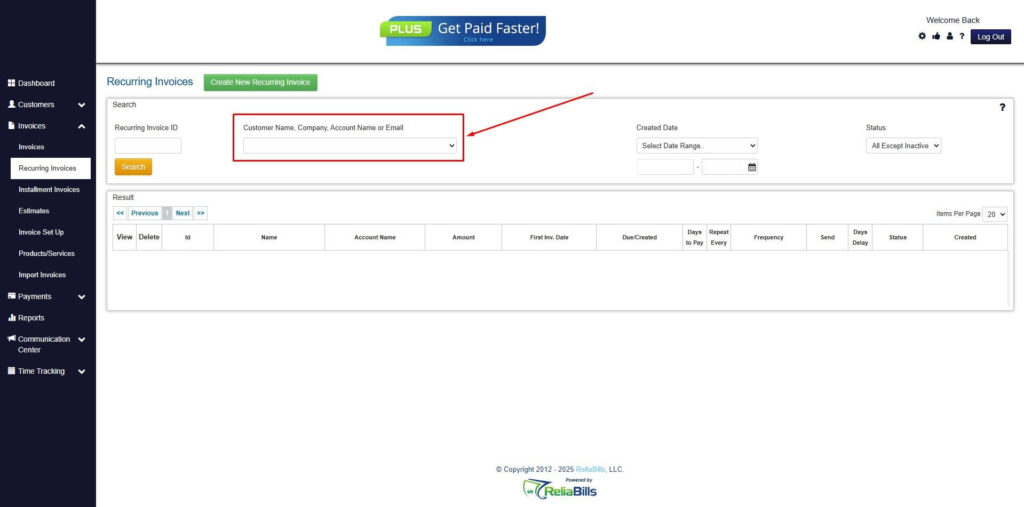

Step 3: Go to the Customers tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

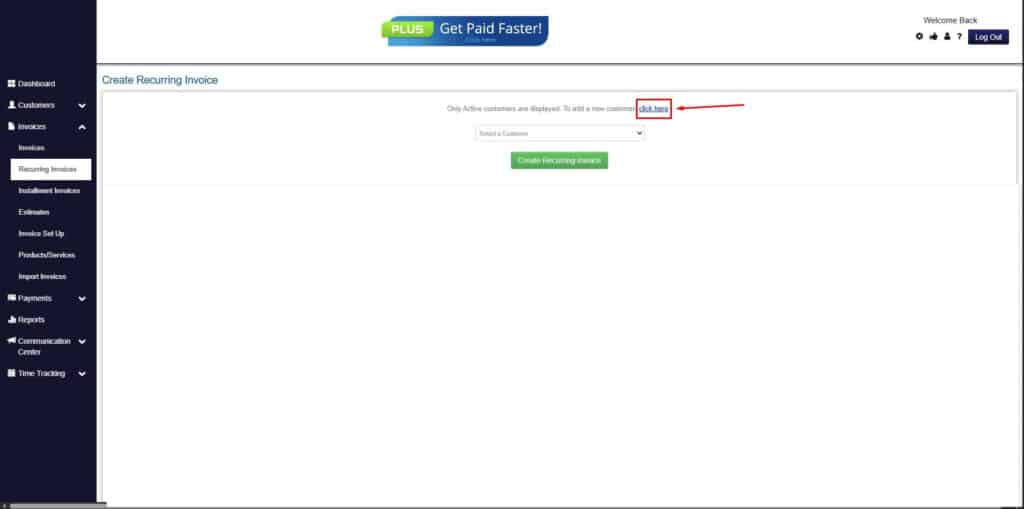

Step 5: Click on the “Click here” button

- Click on the “Click here” button to proceed with the recurring invoice creation.

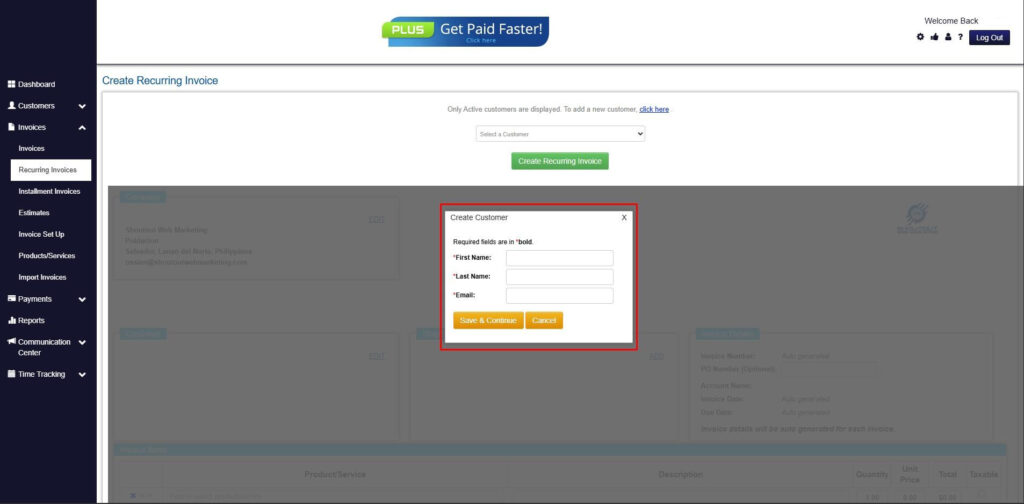

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

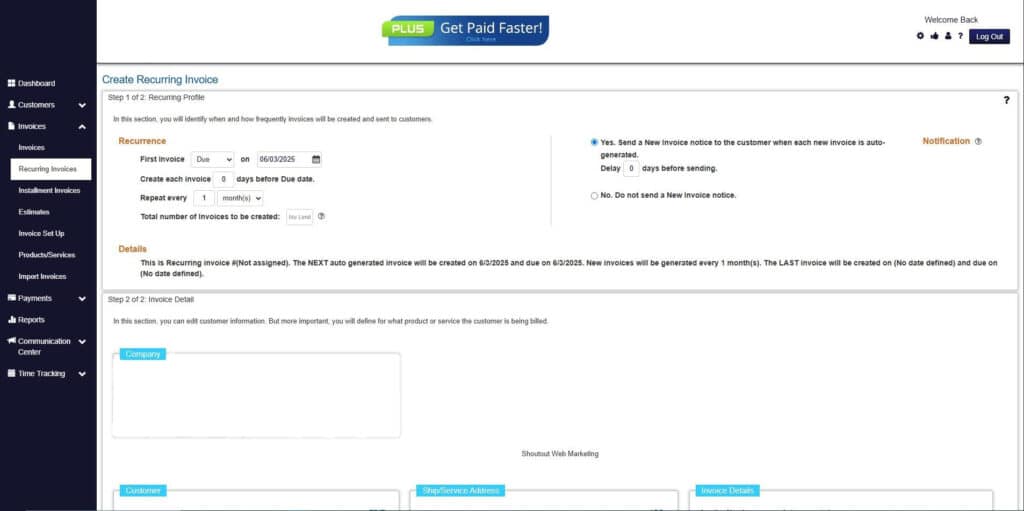

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

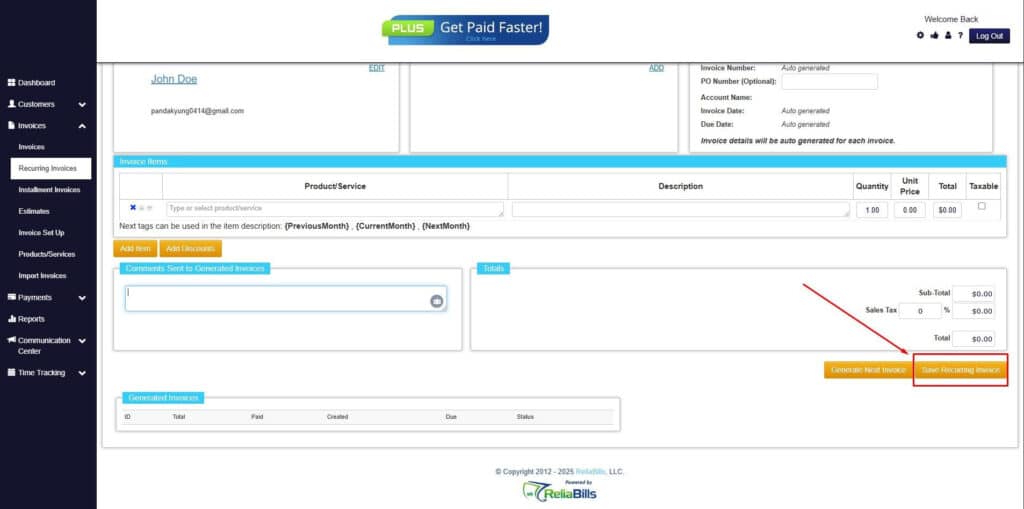

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

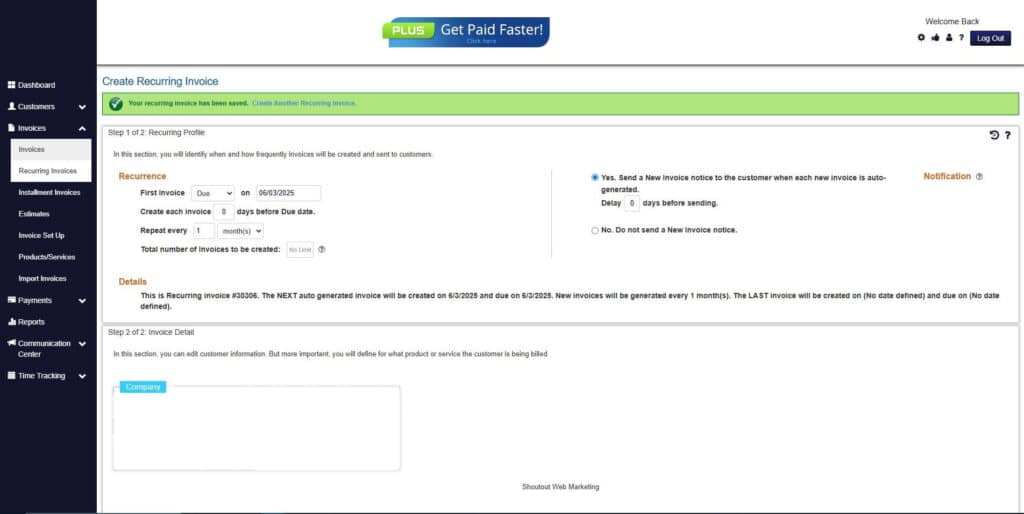

Step 9: Recurring Invoice Created

Your Recurring Invoice has been created.

Wrapping Up

All things considered, recurring payments have both pros and cons. Therefore, it’s important to carefully weigh the upsides and downsides before deciding if this payment processing method is right for you. While there are many advantages to recurring payments, businesses should know the potential disadvantages before making the switch.