We often think of them as synonymous and interchangeable. But the fact is that Installment Invoices and Recurring Invoices are actually very different, and this article will prove just that.

If you do a quick surf on the internet, for example from Intercom, you’ll see that the search results will bring back different definitions for both installment invoices and recurring invoices. Incorporating both changes your entire business landscape, making it more diverse and versatile. Whether you’re accepting a subscription or membership, your users will appreciate the payment options that you offer them.

The nature of your business does not necessarily define which invoice method you use (although some businesses and merchants are more likely to opt for one way over another). Many companies may actually choose both. The method chosen is the one that best fits the particular situation as well as the product or service being invoiced.

First, it is important to understand that both recurring and installment invoices involve an extended financial relationship between merchant and customer. There is typically a written and mutually agreed-upon disclosure of terms. Invoices are sent over a period of time, and the customer makes payments. It sounds like they are very similar. But not when we look at the detail.

Table of Contents

ToggleTotal Balance

An installment payment plan will always involve a mutually-agreed-upon total balance due. Most people think of purchasing a car and then making regular payments. But it can also apply to other business transactions such as a landscape project or website creation. When a large sum is broken down into smaller invoices and spread over time, this type of payment is called an installment plan. Installments are necessary as it gives customers the option to make payments in segments instead of a hefty one-time fee.

The total dollar amount due may include finance fees or charges for the convenience of spreading the payment into segments that are paid over time. Whereas a recurring invoices payment method have no sense of a larger payment due. Invoices are documents sent on a regularly scheduled basis for services rendered.

Number of Invoices

An installment payment plan will always have a predefined, and mutually agreed upon, number of payment terms. The sum of these installment payments will equal the Total Payment. Recurring payments may also have a predefined number of payment terms (e.g., lawn care for six months). But most often, they are open-ended categories.

End Date

An installment payment plan will always identify an end date. This date indicates that the due date on which the payment needs to be settled. In contrast, recurring invoices may carry on as long as the service is active and continual. Your utility bills, for example, will continue until you move or vacate.

Invoice Amount

Each installment payment invoice is typically for the same, mutually agreed-upon sum of money. However, the first invoice may be larger if it includes a deposit or upfront payment. Or it can be smaller if it is for a partial month or pro-rated plan. The final invoice may also have a difference in the additional fees and other payment processes.

Recurring Invoices are wide open since they only reflect on the services rendered and each item’s corresponding payment total. Your phone bill, for example, may vary from month-to-month based on usage. And your monthly lawn care invoice may vary if depending on the additional service that your customer’s that you acquire.

Invoice Creation

You will need to generate recurring invoices one at a time for every service that you complete. In comparison, installment payments are pre-generated all at once. That way, the customer can see the remaining number of payments due, which will make a lot of difference.

Auto Payments

Ideally, both invoice methods benefit significantly if automated payments are enabled. However, due to the variability of invoice amounts, recurring payments benefit more from variable auto-billing. This means that the business has the authority to automatically charge customers for an amount that may vary from period to period.

Over Payments

Whether it’s card payments, bank account transfers, or online payments, getting paid for your service is important. When a recurring invoice encounters an overpayment, the amount will automatically convert into credit on the customer’s bank account. The reason is that you’ve yet to generate the next invoice. Once generated, the overpayment is automatically applied. In turn, the total amount will reflect the deduction from the invoice before you it is sent to the customers. For installment payment plans, an overpayment is an amount that will reflect in the LAST or FINAL invoice instead.

Why Choose ReliaBIlls?

Whether you choose installment or recurring invoices – or both – you need ReliaBills to incorporate these billing strategies into your business operations. Whether you’re planning to incorporate installment billing or recurring billing, you can subscribe to ReliaBills and get the most value out of anything you choose.

ReliaBills supports recurring billing, recurring payments, recurring subscriptions, and installment billing services that will help you maximize the payment plans that you can offer your customers. In addition, ReliaBills offers the following benefits:

- Ease of use – ReliaBills has an easy signup and get started process which takes minutes to complete.

- A simple monthly subscription plan for its premium version – upgrade to ReliaBills PLUS, available for only $24.95 per month; cancel any time you want!

- Transparent pricing with no hidden fees – ReliaBills only offers the free plan and ReliaBills PLUS with a $24.95 price tag.

- Accept credit cards and recurring ACH payments – ReliaBills will let you accept credit card payments, as well as ACH payments via its recurring billing feature.

- Pay your bills automatically – ReliaBills, in itself, also uses recurring billing. That means once you subscribe to ReliaBills PLUS, you will be charged automatically for the fee without having to make the payment yourself.

- The ultimate time-saver – Save time and save money by automating your recurring invoices and payment process.

Is Recurring Billing Right for Your Business?

Recurring billing is not specific to any one type of business. Whether you are a retailer, marketer, contractor, or freelancer, recurring billing can help streamline your invoicing and payment process with ease. However, recurring billing might not be the right choice for every industry out there because it works best when all parties involved understand its benefits and are willing to make the switch. In addition, while recurring billing can help improve your cash flow, it does not work for all business types due to its nature of lengthy payment terms and inflexible contracts.

Can You Incorporate Installment Billing?

You can incorporate recurring billing into your current billing strategy. However, many business owners are turning to installment billing to offer flexible payment terms that will work with their recurring bills. Installment billing allows you to offer custom-length contracts for customers who need more time or wish to pay in installments instead of all at once. This type of billing works best when recurring bills are included in the contract because it allows customers to pay their bills over time without worrying about forgetting or getting behind.

With ReliaBills, you can create payment plans for both these billing strategies. In addition, our system offers the convenience of both recurring billing and installment billing to ensure that your customers have all the payment options available.

How Do I Set Up Recurring Billing?

Setting up recurring billing is a simple and straightforward process. All you need to do is signup for a free account with ReliaBills, create an invoice and set it to ‘recurring,’ and you’re done! We make it easy for you by providing resources on how often recurring bills are due, creating recurring bills, and all the benefits of recurring billing.

Once you finish setting up your recurring invoices with ReliaBills, all you have left is adding your customers to AutoPay and letting our system do the rest of the hard work.

With ReliaBills, you can automate your payment process so that all of your recurring payments will be sent on a customized schedule while being collected from customers automatically. In this way, our recurring billing software makes it easier for you to automate recurring billing and payment processes.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

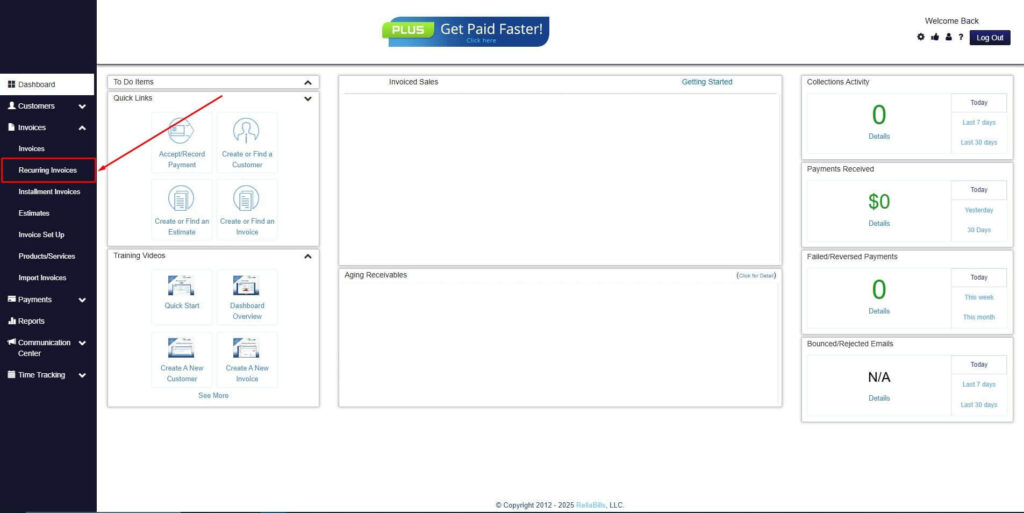

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

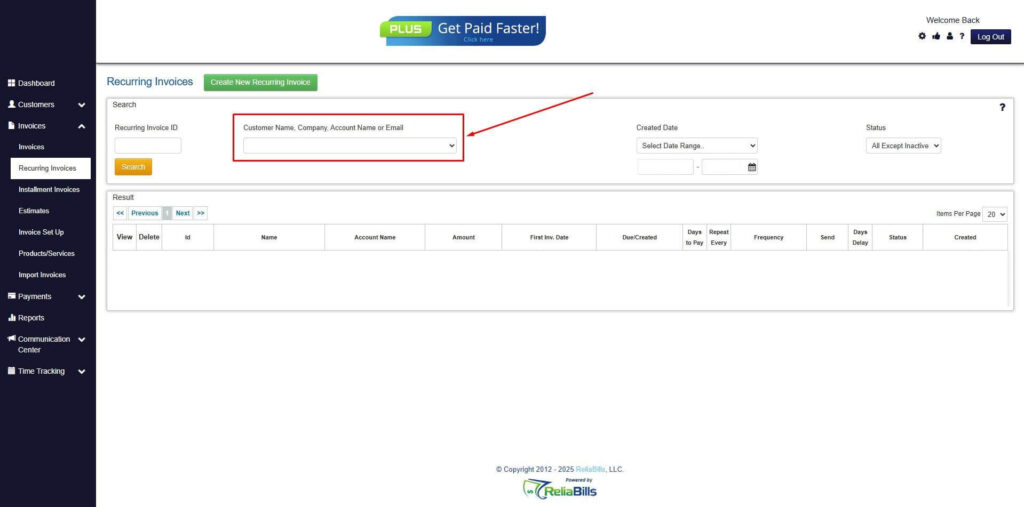

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

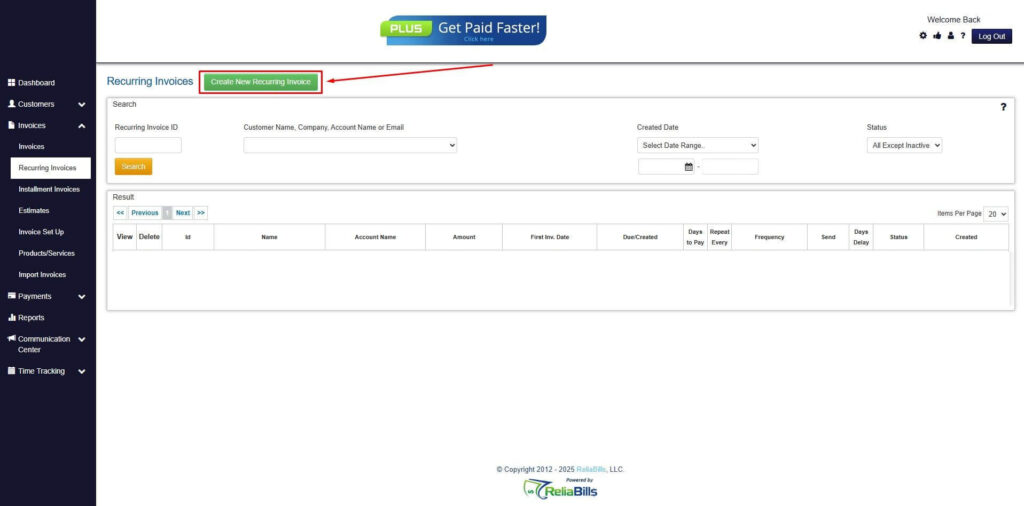

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

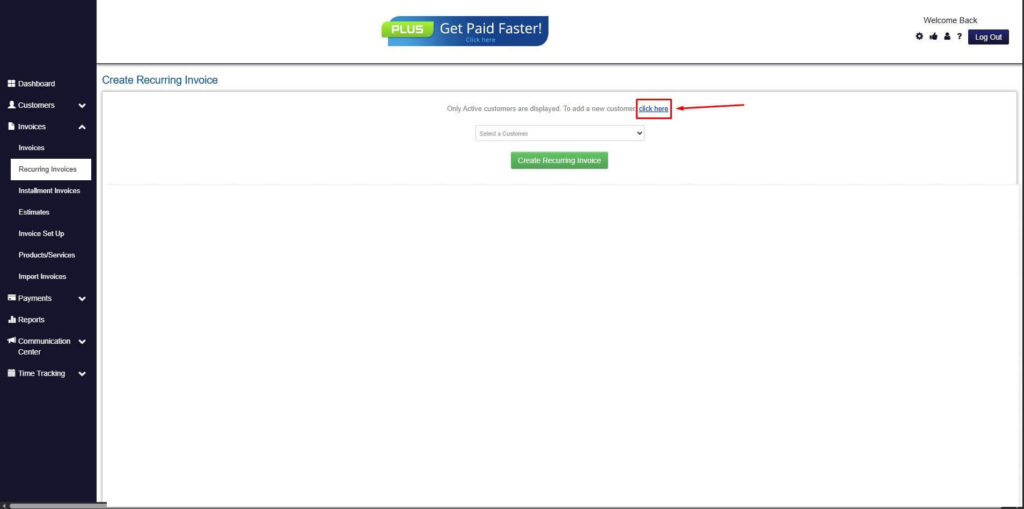

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

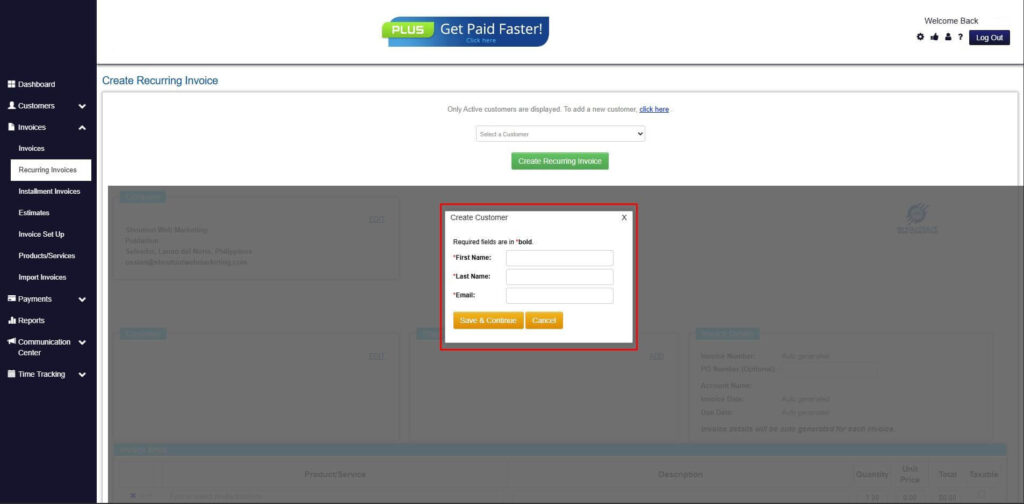

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

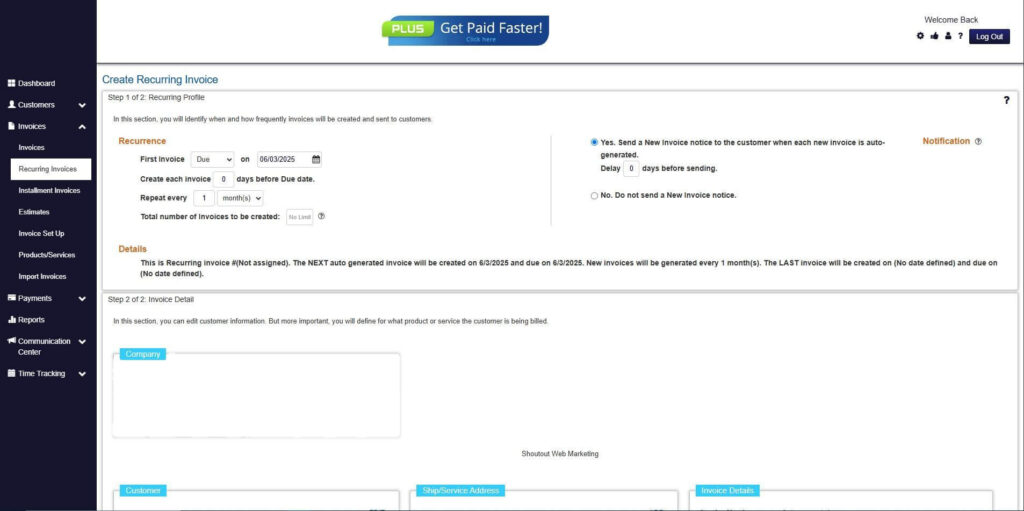

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

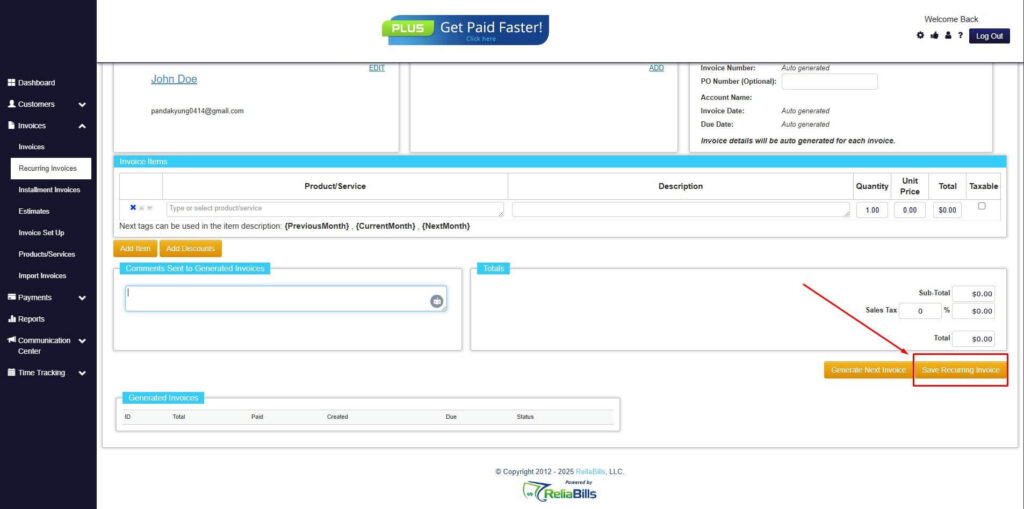

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

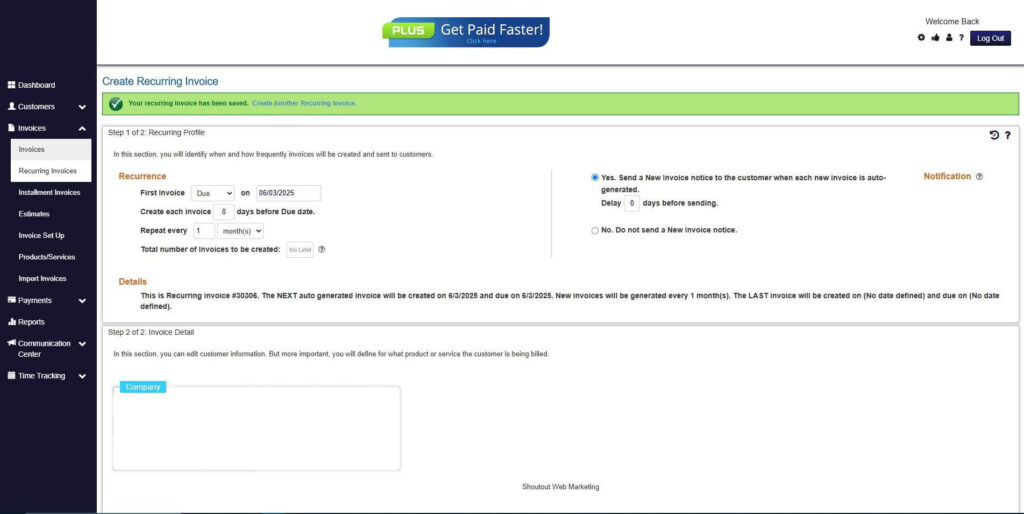

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Wrapping Up

Each of these payment plans will be relevant in different types of transactions. While they are not technically error-free, they do provide value to both merchants and customers. Most companies do not limit themselves to one method or the other. Instead, they use both depending on the circumstances and the product/service rendered.

ReliaBills technology supports the similarity and difference between both installment payments and Recurring invoices, billing, and payments.