If you have done accounting for your business, you might have heard about accounts payable and accounts receivable. In most cases, you might have also gone through the confusion of mistaking one for the other.

Accounts payable and accounts receivable are two types of accounts similar in how they are recorded. However, it’s essential to differentiate one from the other. You need to be able to tell the difference between accounts payable vs. accounts receivable. The reason is that one account receives assets while the other receives liabilities.

Mistaking one from the other can result in a lack of balance in your accounting equation that can potentially carry over your basic financial statements. That’s why you must acknowledge the importance of balancing your assets and liabilities and stockholders’ equity in accounting.

In this article, we’re going to do just that to help you understand the differences and significance of both accounts receivable and payable. This basic accounting equation can explain the significance of the balance:

Assets = Liabilities + Stockholder’s Equity

You can rearrange the equation to suit your preferences better.

Before we move further, let’s first define what accounts payable and accounts receivable are.

What is Accounts Payable?

Accounts payable involves the current liability account that keeps track of money that you owe to any third party. Third parties can be companies, banks, or even someone whom you owe money from. A common type of accounts payable is a mortgage accounts payable. When you decide to take out a mortgage, you will sign a contract that states you paying the loan back over a period of time (installments).

What is Accounts Receivable?

Receivable accounts are current asset accounts that keep track of the money that any third party owes you. As said earlier, these third parties can be other companies, banks, or even people who borrowed money from you. An example of an account receivable is an interest receivable that you get from making investments or putting cash into interest-bearing savings account from your bank.

How To Record Accounts Payable

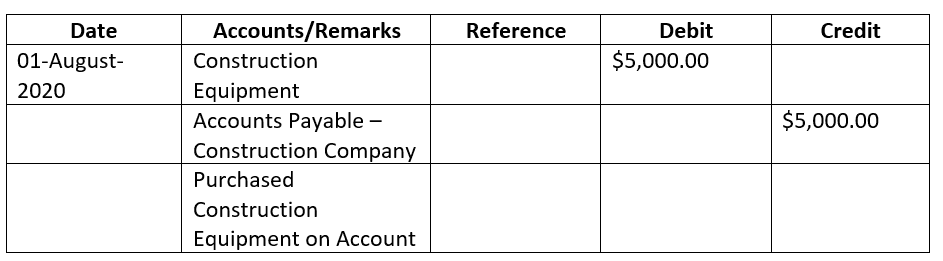

Many times, companies purchase items on account (not in cash). The term “on account,” should indicate a transaction where cash isn’t involved. To put it into perspective, here’s an example:

On August 1, 2020, Business A purchased $5,000 worth of construction equipment on account from Construction Company. It means that the asset account, which is a piece of construction equipment, increased and the liability account, which is the accounts payable, also increased by $5,000. If placed in a journal entry, this is what it would look like:

How To Record Accounts Receivable

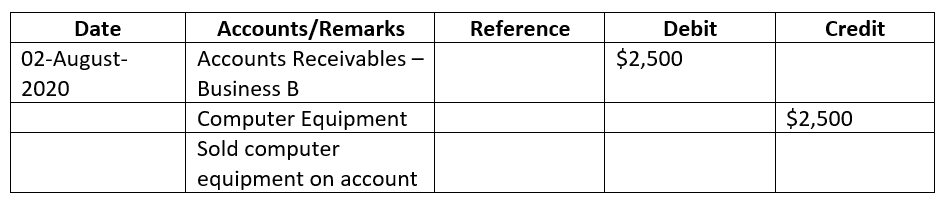

There are times when a company will offer goods or services on account. That means transactions are occurring where cash isn’t involved. However, this time, you’re on the receiving end. Here’s an example to help you visualize what it will look like:

On August 2, 2020, Computer Equipment Company sold $2,500 worth of computer equipment on account to Business B. In the transaction, the accounts receivables increased by $2,500, and the computer equipment account decreased by $2,500. Again, if placed in a journal or balance sheet, this is what it would look like:

Discounts

Another important aspect between accounts payable and receivable accounts is discounts. There will be instances when a company will attach discounts to accounts payable vs. accounts receivable. The discount will serve as an incentive for the borrower to pay back the amount earlier to receive the discount.

Discounts benefit both parties because the borrower will receive the discount while the company receives their cash repayment at an earlier period. As the company, you require cash for your operating activities. So, getting paid earlier is good since you can use the money for your business.

Notations for Discounts

For discounts to be effective, notations need to be used. Here are two commonly used notations that you should be aware of:

- x/10 or x/20, where “x” indicates any number between 1 and 4).

- n/30

The first notation is read as x percentage discount if the amount owed is paid back or received within 10 days. Some companies even give discounts if the current liability is paid before or received within 20 days. For example, a 5% discount that’s paid within 20 days would be 5/20.

The second notation is commonly used after the discount notation. That means the net amount within 30 days or the amount of days that you decide. To give you a clear view, here’s an example of accounts payable and accounts receivable from CFI.

How Does Recurring Billing Come Into Play?

Paying and receiving payments can be made easier with recurring billing. This payment processing strategy lets businesses charge their customers for their service or product. Billing cycle frequency will depend on what you’ve agreed upon from your client. However, it usually falls under weekly, bi-weekly, monthly, quarterly, or annually.

This process ensures that your customers or ‘subscribers’ are billing accurately and on time, accounting for proportion, global taxes, payment failures, and several other factors. Using recurring billing software, you can automate your billing process and make collecting recurring payments quicker and more convenient.

Some of the businesses that leverage from recurring billing include the following:

- Software as a Service (SaaS): online services such as Dropbox, Slack, Chargebee, Netflix, and more fall under this category.

- eCommerce: Amazon and subscription boxes like Barkbox and Birchbox are considered eCommerce that benefit from recurring billing.

- Entertainment: Netflix, Hulu, Amazon Prime, and even YouTube Premium use recurring billing to bill their subscribers regularly.

- Health & Fitness: 24-Hour Fitness, Practo, and other similar health and fitness service providers all use recurring billing to make their payment processing easier to manage.

- Publications: Online business newsletters, magazines, and newspapers now embrace modernization by offering a subscription basis to their content.

- E-Learning: Skillshare, Udemy, Shaw Academy, and other e-learning platforms make great use of recurring billing as the core of their billing system.

How Does Recurring Billing Work?

You might have reached this portion and wonder what recurring billing is and how it works specifically. Its process is quite simple:

Once a customer has subscribed to your product or service, a recurring billing software like ReliaBills will allow you to start processing recurring payments from them. To process payment securely, ReliaBills uses a safe and secure payment gateway system. Once the customer authorizes the transaction, it will push through the processing phase. It will then be routed to accounting and reporting for efficient and accurate revenue recognition.

Recurring billing platforms like ReliaBills help streamline the entire process by:

- Automating the entire recurring billing process, removing the possibility of manual errors.

- Managing complex billing situations like upgrades and downgrades, taxes, and other add-ons

- Removing any sign of developer dependency and giving you full control over your billing and invoicing needs.

How It Can Impact Accounts Payable/Receivable?

Recurring billing can make tracking and receiving payments relatively easy. Thanks to automation, you can receive payments from your valued customers (accounts payable) efficiently and effectively. You don’t have to manually send them an invoice since the system can do it for you.

In a similar fashion, recurring billing can also benefit the business in paying other businesses for their service. If you owe money to another business (accounts payable) for the product or service that they give you and they happen to have a recurring billing system in place, paying will be much easier and more convenient. Like your customers, all you need to do is enter your payment details once and you’ll be charged automatically, giving you some utmost satisfaction and peace of mind.

So whether you’re trying to track your accounts payable and accounts receivable, you can ensure that a recurring billing software like ReliaBills will help make your work easier by automating the entire process. From invoice creation to scheduling, you will be able to automate your entire billing process to ensure maximum efficiency, convenience, and peace of mind.

ReliaBills will help you get your recurring billing strategy started. All you need is to create a FREE account today and you’re all set. If you want more features, you can upgrade to ReliaBills PLUS for only $24.95 per month — cancel anytime you want! Discover what our unique system has in store for you.

Wrapping Up

So, there you have it! Accounts payable and accounts receivable are two different ends of the spectrum. However, it’s still essential for you to distinguish one from the other. Hopefully, this guide will show you just that. Use this article as a reference whenever you feel like you need to review your knowledge about these two terms. If you need a billing software that will take care of your accounts receivable, feel free to contact us.