When you’re processing payroll for your employees vs. yourself, choosing the appropriate business model is vital to reducing the amount of taxes you’ll have to pay. Determining when and how much to pay will help manage cash flow and profitability. This is why establishing a sound payroll system is essential. In this article, we’re going to talk about whether a self-employed payroll is right for you and your business.

What is Self-Employed Payroll, and How Does It Work?

As the name implies, self-employed payroll caters to individuals who have their very own business and work for themselves. If you are a sole proprietor, independent contractor, or if your business is unincorporated, you are considered self-employed. If your business falls under the aforementioned types, then you are eligible for a self-employed payroll.

Business owners that use self-employed payroll work in different ways. However, the ultimate process includes determining how to pay yourself and doing it. A self-employed payroll’s primary focus is to ensure that how you compensate yourself is both cost-efficient and legal.

Once you know how often you should distribute payments, you can now proceed to set up a fool-proof self-employed payroll system that involves paying calculations and transferring funds into your account. There are numerous ways to process a self-employed payroll. However, determining the ideal way will depend highly on the type of business that you run. Buckle up as the next sections will discuss the different types of business and how a self-employed payroll works in each respective variant.

Different Business Types for Self-Employed Payroll

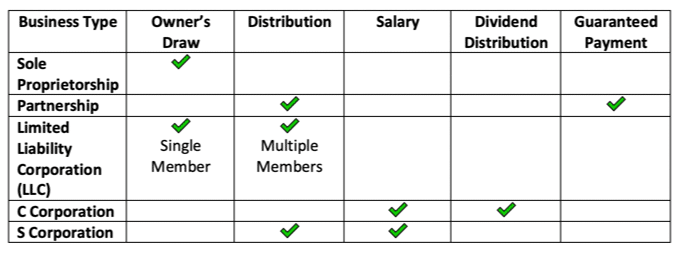

In a self-employed payroll business structure, the most common types are sole proprietorships (single owners), limited liability companies (LLCs), partnerships, C corporations (C-corp), and S corporations (S-corp). Continue reading to determine which one your business falls into and how a self-employed payroll can be used.

Common differences among these various business types include the number of owners, their income tax return, and of course, the way they raise money. If you’ve yet to choose your business type for a self-employed payroll, consider reviewing the options you have and making a decision before you start paying yourself. With that said, here’s a list of the most common business structure that we’ve just mentioned along with their corresponding attributes:

Sole Proprietorship

As we mentioned before, a sole proprietor business features a single owner. It requires little to no paperwork, and all the taxes are passed down to the owner’s personal income tax return. Due to the lack of personal liability protection, customers have the option to sue the owner in the event of an issue. Sole Proprietorship is best for freelance businesses like writers, photographers, virtual assistants, tutors, bookkeepers, consulting businesses, or small businesses with limited customers. It’s also ideal for self-employed payroll tax.

Partnerships

As the name implies, a partnership is a type of business that has two or more owners. This type of business is governed by a partnership agreement on how the owners will divide the profits and losses. In addition, all taxes are passed down to their personal tax return. Partnerships are best for family businesses like a family-owned moving company, certified public accountant firms, medical clinics, and even law firms. Of course, it’s also ideal for self-employed payroll.

C Corporation

A C-corp is commonly a large business that issues stock to raise money. It features a board of directors who governs and controls all company decisions. Owners are well-protected from personal liability. However, it’s quite costly to get started and even requires a lot of complicated paperwork. Earnings under a C corp are double-taxed when distributed to owners. C corps are also separate entities, which is not ideal for self-employed. This type of business is best for companies that need to raise capital to transition to a higher business stage. For a self-employed payroll to work for this business type, you’ll need to know more details about the board of directors and the agreement that you’ve all agreed upon in terms of the payment.

S Corporation

An S corp ranges from a small, medium to a large business that protects from personal liabilities. The business can be taxed as a sole proprietor or partnership, with all the profits passed down to each owners’ personal tax returns. This type of business is best for businesses that earn more than $40,000 in profits or any amount that’s enough to save money on taxes. A good example would be consulting companies. Due to this type of business’s versatility, a self-employed payroll tax is definitely doable without any compromises.

Limited Liabilities Companies (LLC)

An LLC provides owners with protection from liabilities in the event of a lawsuit. It’s ideal for any small business that has, at least, a few steady and consistent clients. You can utilize a self-employed payroll on this one without encountering any problems with your small business.

Payment Types for Business Payroll

There are different ways to utilize self-employed payroll and pay yourself. While they may all seem similar to you, the IRS treats them differently once tax-filing is in season. Depending on how you organize your business, you may be better off paying yourself an owner’s draw, dividend, a regular salary, distribution, or guaranteed payment. There are even instances of a mixture thereof. Before diving into determining each legal entity’s best payment, you need to understand the differences among the payment types and how a self-employed payroll works for each one.

Owners Draw Vs. Regular Salary

A draw is defined as money taken out of a business for personal use by the owner. Usually, this applies to sole proprietors or single-member LLCs. They can then write this expense off as a business-related expense. Unlike regular salary payments, a draw is not considered a payroll expense and isn’t subject to withholding taxes like Social Security and Medicare, or federal and employment tax.

Sole proprietorships are the only business that’s eligible to take owners’ draws. Partnerships operate the same way; however, since there are multiple owners, the withdrawals are called partnerships distribution – otherwise known as distributive shares. The most important factor to remember about draws is that they are not similar to salary payments. That means they cannot be dedicated as expenses to reduce your taxable income.

On the other hand, regular payments are for owners who classify themselves as employees—for instance, S-corps. If you opt for a regular salary, you will reduce your salary payout by any payroll deduction, such as payroll taxes like FICA and health insurance like Social Security and Medicare. Your business will then remit the withholdings along with employer payroll taxes on your wages to the appropriate employment tax agencies.

Distributions with Guaranteed Payments

Guaranteed payments are set up by partnerships to ensure the owners receive a minimum amount of business income for a particular period, regardless of how much income the business reports. Under a partnership agreement, each partnership member will identify how they will plan to split the company’s total profits and losses.

For example, 50/50; this is considered as a partnership distribution. S-corp owners, in particular, take distributions as well. That means a guaranteed payment is a specific amount that each partner must receive while partnership distributions are usually set percentages.

Here’s another example: there’s an agreement between Mike and Jude that includes a 50/50 net profit annual divide. This year, the business earned $60,000, which equates to $30,000 to each partner. This method is a partnership distribution. The agreement also includes a $35 guaranteed payment for Jude, who brings years of experience to the business – something that Mike doesn’t. The business would then recognize $5,000 – $35,000 and $30,000 distributions – as a guaranteed payment for that particular period.

Note that this guaranteed payment isn’t a salary, which means payroll taxes aren’t withheld. However, the business can write it off as a business expense, reducing overall taxable income. However, the owner with guaranteed payment will also be subject to self-employment payroll taxes.

On the contrary, a business isn’t able to write off a partnership distribution, which means taxable income will include all money paid to the owners. The owners will then pay taxes based on the gross profit.

Distribution Vs. Dividends as Self-Employed Payroll Tax Payment

Dividends are considered regular payments made to a C-corp’s shareholders out of profits that the business has earned during a particular period. Usually, these payments are compensated in cash, similar to distributions. However, it can also be distributed as additional shares of stock. They’re divided according to the total stock that a shareholder owns in proportion to the total outstanding stock. That means if you own 30% of the stock that’s available, you’ll receive 30% of declared dividends. In addition, taxes will also apply to dividends.

One feature that owners enjoy about paying themselves in dividends is that they can be taxed at a lower rate than a regular salary. This potentially saves them up to 20% in taxes. LLCs and partnerships don’t pay taxes on distributions, but the owners are subject to self-employment taxes when their earnings share is passed down to tax for self-employed. On the other hand, S-corps can issue tax-free non-dividend distributions to owners as long as they don’t exceed their company equity.

Payment Types by Business Structure

Now that you have a background on the different business types, the next thing you need to know is how you’re going to get paid by each one. The primary concern for many entrepreneurs when it comes to payroll is how much to pay for themselves. But before you determine the amount of income you distribute for yourself, it’s an excellent idea to spend some time contemplating what’s best for your business.

Your business structure – which could be one of the mentioned types – should establish the basis of all payroll decisions you make regarding paying yourself. You could potentially save thousands of dollars in taxes, as well as avoid IRS audits if you manage to set your business up in the right manner.

If you or the company accountant have already completed the necessary paperwork to determine your business structure, take some time to learn the different options and corresponding responsibilities you have in processing your payroll. Consider the table below:

Sole Proprietorship

If you choose a sole proprietorship business structure, you can pay yourself a draw as often and as much as you want. A sole proprietorship business owner’s draw will not affect taxes. Instead, it will merely reduce the company’s capital investment.

However, draws can be subject to a self-employment tax of around 15.3%, along with potential business income taxes. Self-employment taxes include Medicare and FICA taxes. Medicare is similar to FICA, which is paid half-and-half by the employer and employee – 7.65% each.

Partnerships

In a partnership, each partner is responsible for reporting the percentage or amount they’ve agreed upon. There are no employee or employer taxes; however, the earnings are subject to self-employment taxes.

C Corporation

The owners of a C-corp are not considered “self-employed.” Instead, the entire organization is an entity that’s legally recognized as separate from its owner. That means business income is subject to tax at the corporate level, and shareholder once dividends are distributed accordingly. An owner can opt to pay for his or her salary since business entities are allowed to have employees or plan to get dividend payments as approved by the board of directors.

S Corporation

With an S-corp, you can pay yourself a salary in dividends while lowering your tax rate. However, if you are performing substantial work for the company, you will be classified as an S-corp business employee. This action will help you avoid self-employment tax; however, payroll taxes self-employed will be withheld from your pay.

Suppose you are providing substantial work for the company. In that case, we’d advise you to speak with a tax advisor before deciding whether or not to classify yourself as an employee. If you opt not to be classified as an employee to avoid paying for payroll taxes, the IRS will automatically reclassify you after their recent audit and subject you to penalties and back taxes.

Limited Liability Companies (LLC)

Members of an LLC business are not classified as employees and do not receive a salary. For tax purposes, LLCs with a single owner is treated the same way as a sole proprietorship (owners draw). On the other hand, LLCs with multiple owners are treated like partnerships (distribution or guaranteed payments). However, you can opt to recognize your LLC business as either an S- or a C-corp for tax purposes to access more payment options.

How to Make Your Self-Employed Payroll More Efficient

If you want to succeed in any self-employed business you venture into, you need to automate your payment processing strategy. Receiving payment manually just won’t cut it. As your business grows, your customers will also increase. With numerous customers waiting for your invoice, you cannot do invoicing manually anymore. That’s why you should rely on a recurring payment system like ReliaBills to help you bill your customers.

Introducing ReliaBills

ReliaBills is invoicing, payment and automation software rolled into one convenient package. It’s your ultimate partner when it comes to sending and receiving payment. It offers a solid recurring billing system that doesn’t falter in any given situation. It provides some fantastic benefits that focus on helping you get paid quickly and on time.

ReliaBills enables merchants like you to charge their customers automatically for goods or services on a predetermined schedule. All you need is to create a free account, obtain your customer’s payment information and permission, and you’re all set.

Once you’ve created a recurring billing system through ReliaBills, you can now automatically make recurring charges to your customer’s account without the need for further permissions. This billing structure gives you control over the payment while giving your customers the convenience of not having to worry about paying you ever again. The system does it automatically so that you and your customers won’t have to do it manually.

Frequently Asked Questions

How to set up recurring payments on ReliaBills?

With ReliaBills, you can start billing your customers regularly for goods or services. To set up ReliaBills recurring payments, you must create a free ReliaBills account. Once you’ve registered, you will receive detailed instructions on the actual website on how to create invoices and set up recurring payment plans to start accepting online payments.

Can you cancel a recurring billing payment?

Yes! When you upgrade to ReliaBills PLUS, you will receive the following features:

- Snail mail

- Auto collection notifications

- SMS text messaging

- Chargeback recovery

- Automated failed payment recovery

- Store customer payment information (AutoPay)

- Virtual payment terminal

- Online customer AutoPay Auth Form

- Automated reversed payment fees

- Automated late fees

- QuickBooks online sync

You’ll get all of these features (and more) when you upgrade to ReliaBills Plus for only $24.95 per month. And since it’s billed every month, you can cancel any time you want! Since we’re billing on a monthly basis, you can cancel your subscription anytime without dealing with any hassle.

Similarly, your clients will also be given the option to cancel their subscription from your recurring billing anytime they want. That way, you are giving them a level of control that they will find convenient and useful.

Wrapping Up

So, as you can see, there are different ways that a self-employed payroll can be used for your business. It will all depend on what type of business you have and how you’re dealing with your taxes and other associated elements. Please use this article as a resource if you want to review self-employed payroll and how it affects your business. Keep in mind that a self-employed payroll works for different business types as long as you know what type of business you are running.

If you consider payroll automation, contact ReliaBills on how to set up one and we will guide you through the process.