Nonprofits and donation-driven organizations rely heavily on clear and accurate records. Every contribution, whether big or small, deserves proper documentation. An invoice for donation plays an important role in helping donors keep track of their giving while ensuring the organization stays organized and compliant. For charities, having well-prepared invoices also builds trust and reassures supporters that their donations are used responsibly.

Many smaller organizations overlook the value of sending donation invoices, but doing it the right way helps create transparency and strengthens relationships with donors.

Table of Contents

ToggleWhat Is a Donation or Charity Invoice?

A donation invoice is a document given to a donor to acknowledge that they contributed funds, goods, or services to a charitable organization. It works as both a confirmation and a record for future reference. Unlike a traditional invoice, it does not request payment. Instead, it provides clarity about what was donated, who gave it, and when the contribution occurred.

This type of invoice helps charities stay organized, protects them during audits, and provides donors with documentation they may need for personal tracking or tax reporting.

When Do You Need a Donation Invoice?

Donation invoices are used whenever an organization needs to formally record a contribution. Donors often request them for their own financial files or when preparing for tax season. Charities also use them internally to track contributions, especially during large campaigns or fundraising events.

You may also need one when a donor contributes physical items, offers free services, or commits to a recurring donation schedule. In all of these situations, the invoice helps both parties keep clear and consistent records.

Key Elements of a Donation and Charity Invoice

To create an accurate and reliable invoice for donation, make sure to include:

• Name, address, and contact details of the organization

• Donor’s name and contact details

• A clear description of what was donated

• The value of the donation

• The date of the donation and the date of issuance

• A unique invoice or reference number

• A short tax-related note if the donation is deductible

• A simple thank-you message to acknowledge the donor’s support

These elements help ensure the invoice is complete and useful for both sides.

How to Write an Invoice for Donations (Step-by-Step)

- Start with the organization’s name, logo, and contact information.

- Add the donor’s basic details.

- Assign an invoice number that follows your record-keeping system.

- Include the dates that apply to the donation.

- Describe the donation clearly. If it is an item, list its quantity and estimated value.

- Add a tax note if required in your region.

- Write a sincere thank-you line to recognize the donor’s generosity.

- Save or send the invoice digitally for easy tracking.

This simple process ensures the invoice is clean, complete, and professional.

Common Mistakes to Avoid

A few small errors can affect both clarity and credibility. Some common issues include:

• Not adding any tax-related explanation

• Missing invoice or reference numbers

• Vague descriptions of the donation

• Forgetting to include donor contact information

• Delays in sending the invoice

Keeping these points in mind helps maintain accuracy and donor confidence.

Sample Donation Invoice Template

Organization Name

Address

Email | Phone | Website

Donation Invoice

Invoice Number

Date of Issue

Donor Information

Name

Address

Donation Details

Description of donation

Type of contribution

Estimated value

Tax Information

A note on deductibility

Appreciation Message

A short thank-you to the donor

How ReliaBills Can Help Charities and Nonprofits

Managing donor records can be overwhelming, especially for organizations that receive frequent contributions. ReliaBills makes the entire process easier by offering a system that allows charities to create and send professional donation invoices without the usual manual tasks. It helps nonprofits keep clean and organized records while reducing time spent on paperwork.

One of the biggest advantages is the ability to automate donor receipts and acknowledgments. Instead of preparing each message manually, ReliaBills lets you set up templates and automatically send confirmation emails every time a donation is received. This is especially helpful for nonprofits with recurring donors who contribute monthly or yearly.

ReliaBills also supports recurring billing, which is ideal for supporters who prefer ongoing contributions. Once the donor’s schedule is set, the system manages the entire process, including sending reminders and generating digital receipts. This creates predictable support for the organization and gives donors an easy and consistent experience. With ready-made templates, automated workflows, and secure online payment options, ReliaBills helps nonprofits stay organized while focusing more time on their mission.

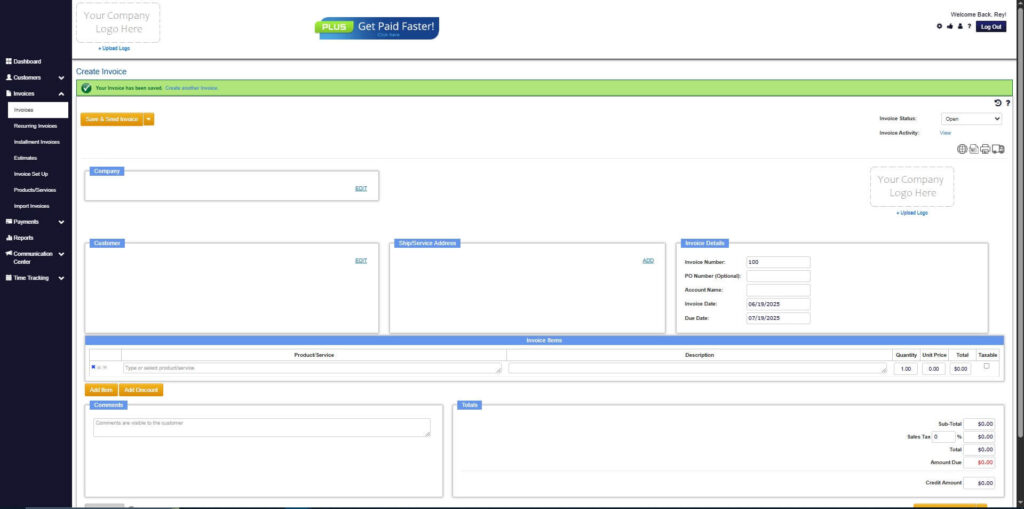

How to Create a New Invoice Using ReliaBills

Creating an invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

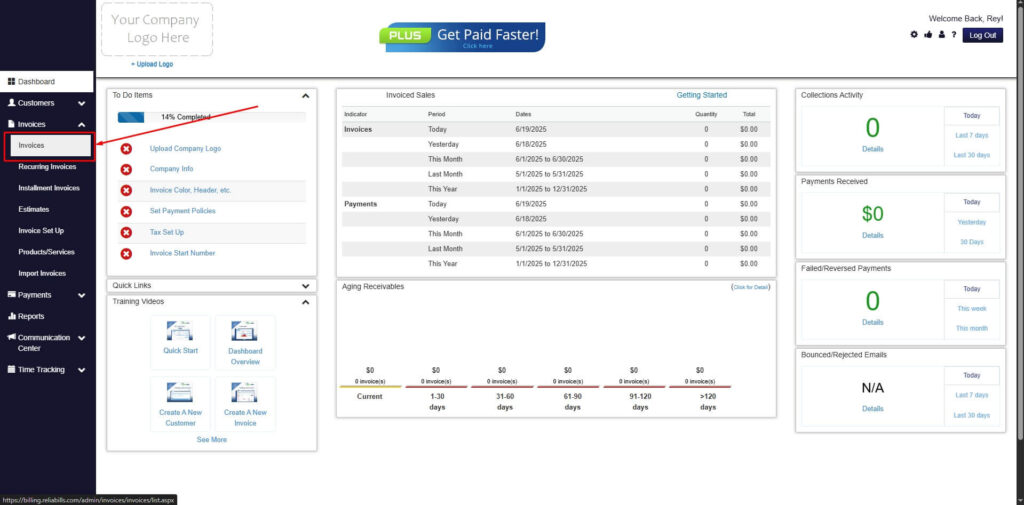

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

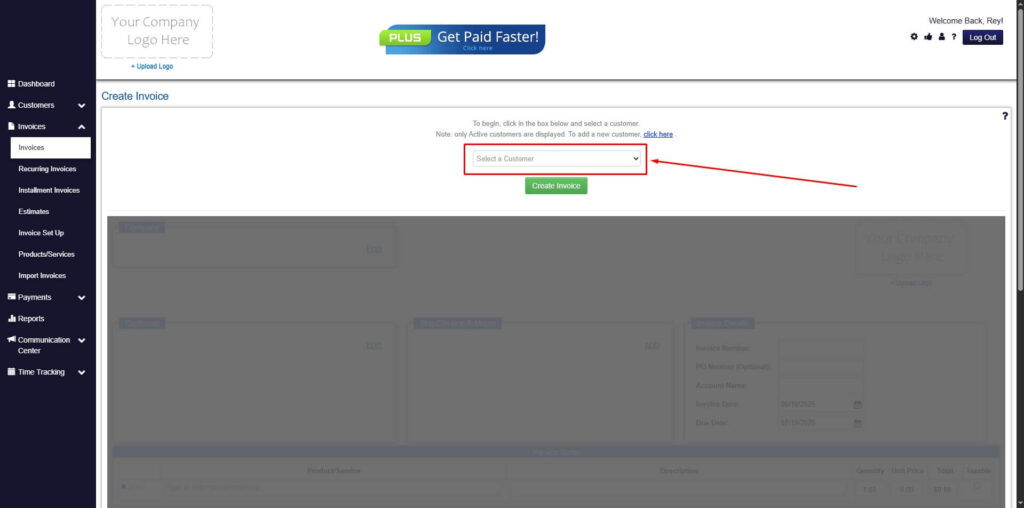

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

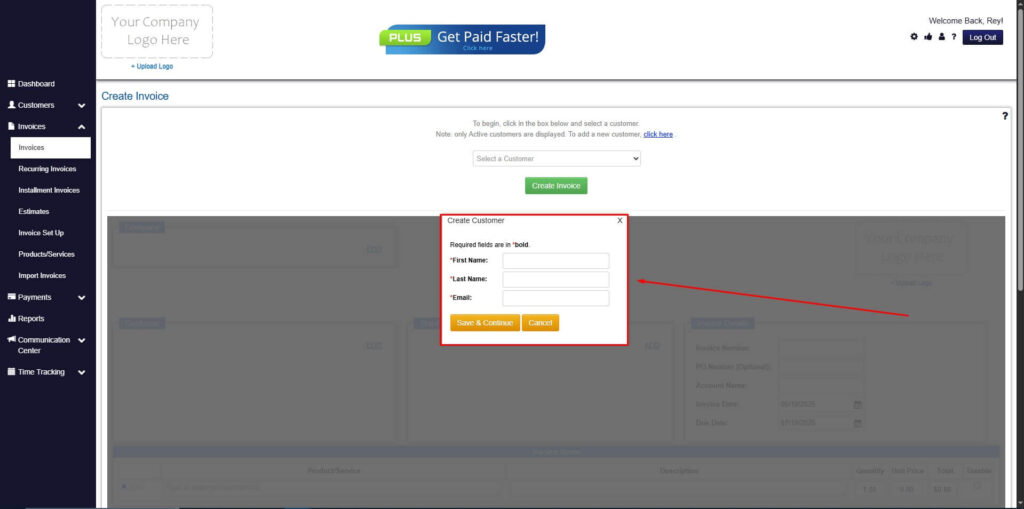

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

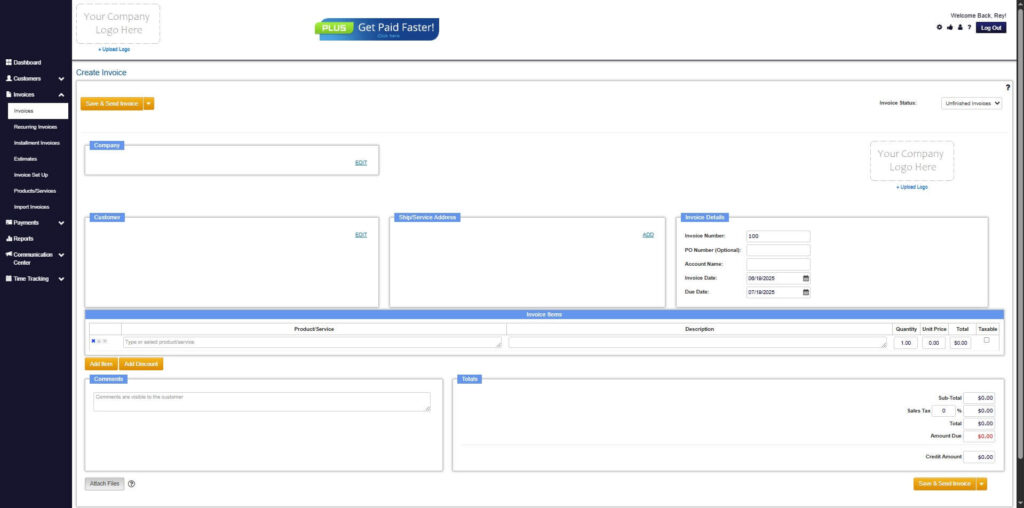

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

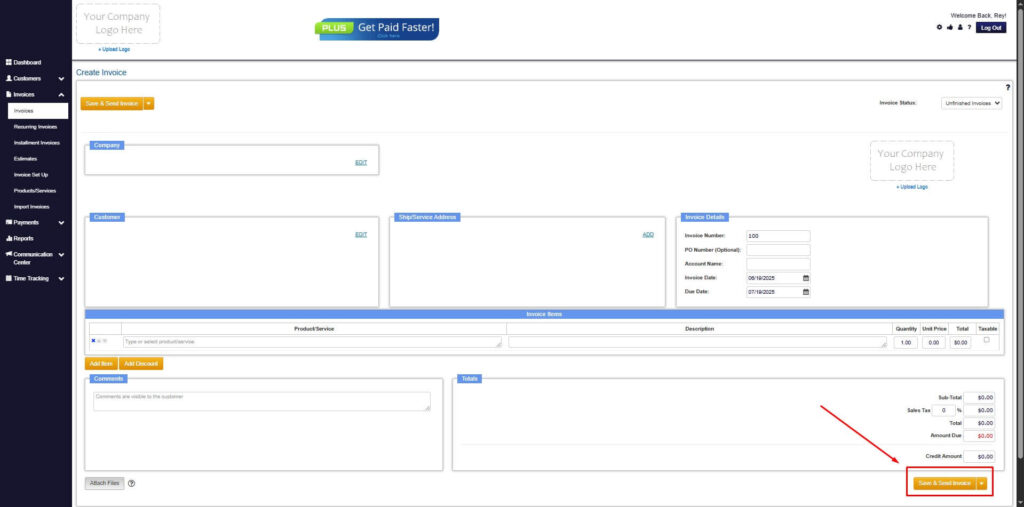

Step 7: Save Invoice

- After filling out the form, click “Save & Send Invoice” to continue.

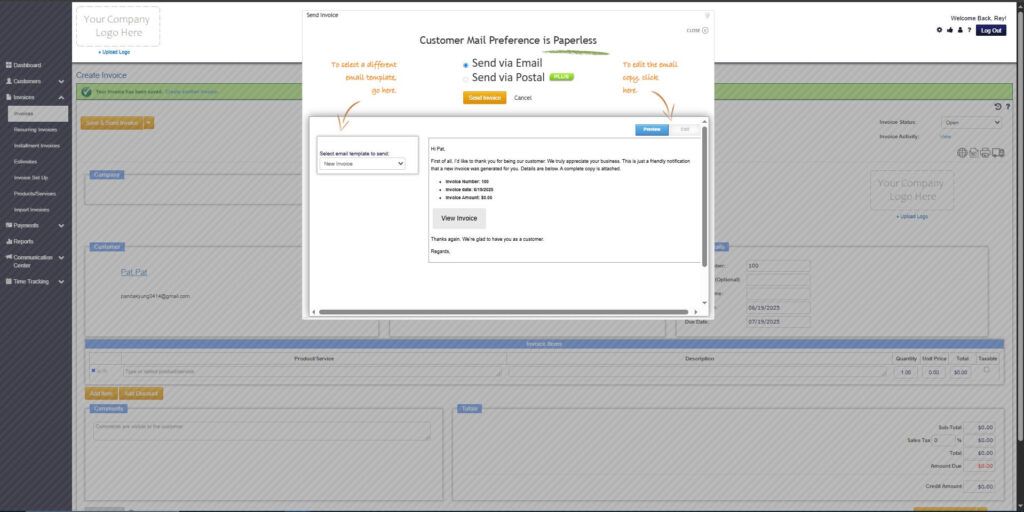

Step 8: Invoice Created

- Your Invoice has been created.

Frequently Asked Questions

1) Do donors need a donation invoice to claim a tax deduction?

Donors typically need a written acknowledgment—especially for donations above certain thresholds—to claim tax deductions. This document confirms the donation amount and whether any goods or services were provided in return.

2) What information must a donation invoice include?

A donation invoice should list the charity’s details, donor information, date, amount or item description, and a unique reference number. It must also clearly state whether the donation is tax-deductible and if any benefits were received.

3) How should noncash donations be documented?

Noncash donations must be described clearly, including item details and fair market value if known. High-value items may require additional forms, supporting documents, or appraisals.

4) When should a charity issue a donation invoice or receipt?

Receipts should be issued promptly after receiving the donation to ensure accurate donor records. They should be provided before the donor files taxes for the applicable year.

5) Are digital donation invoices and receipts acceptable?

Digital receipts are valid as long as they contain all required information and are stored properly. Many charities use email or PDF formats because they are faster, clearer, and easier to manage.

Conclusion

A clear and accurate invoice for donation helps charities stay organized and gives donors the records they need. It encourages trust, supports compliance, and strengthens relationships over time. With tools like ReliaBills, nonprofits can create professional invoices, automate receipts, and streamline donor management with very little effort.