Managing late payments is one of the toughest parts of running a business. Even if your invoicing process is clear, there will always be clients who miss deadlines. This is where a friendly overdue invoice letter becomes extremely useful. It helps you follow up politely, maintain good client relationships, and get paid without unnecessary tension.

A well-written follow-up letter reminds clients of what they owe, clarifies expectations, and helps prevent long delays. It also reinforces your professionalism and shows you take billing and payments seriously.

There are many reasons customers fail to pay on time. They may have missed the original invoice, forgotten the due date, misunderstood the terms, or experienced cash flow problems. Some clients may simply need a gentle reminder. A friendly overdue invoice letter helps resolve these situations quickly.

Table of Contents

ToggleWhat Is an Overdue Invoice Letter?

Definition and Purpose

An overdue invoice letter is a message sent to a client when payment has not been made by the due date. It serves as a clear reminder that the invoice is past due and outlines the amount owed, original terms, and any next steps.

Key Components of an Effective Reminder

A strong overdue invoice letter usually includes:

- The invoice number and due date

- The outstanding balance

- A polite but clear reminder that payment is late

- A call to action or deadline

- Payment instructions or a direct link to pay

- Contact information in case the client has questions

10 Tips on How to Write an Overdue Invoice Letter

1. Use a Clear and Professional Tone

Stay polite and respectful. A friendly tone makes clients more willing to respond and reduces tension. Direct communication often works best.

2. Include Essential Invoice Details

Always list the invoice number, original due date, services or products provided, and the total amount owed. This avoids confusion and speeds up the response.

3. Refer to Previous Communications

If you’ve already sent reminders or discussed the invoice, mention it briefly. This shows you have followed up professionally and keeps the message consistent.

4. Set a Firm but Polite Payment Deadline

Give a specific date when you expect the payment to be settled. This adds clarity and motivates clients to take action.

5. Provide Multiple Payment Options

Make it easy for clients to pay by offering several methods. This often increases the chances of faster payment.

6. Attach the Original Invoice for Reference

Including the invoice removes extra steps for the client and reduces excuses for further delays.

7. Personalize the Message for Better Engagement

Use the client’s name, refer to their company, or mention your working relationship. Personalized letters earn quicker responses.

8. Explain Any Late Fees (If Applicable)

If late fees apply, explain them calmly and clearly. This helps clients understand the cost of continued delays.

9. Offer Assistance if There Are Issues

Invite the client to reach out if they have concerns, questions, or billing errors. A friendly approach builds trust.

10. Keep the Message Concise

Long letters can overwhelm clients. Keep the message simple, direct, and easy to read.

When to Send an Overdue Invoice Letter

Most businesses follow a timeline to keep reminders clear and consistent. A common schedule is:

- First reminder: 1 to 3 days after the due date

- Second reminder: 7 to 14 days past due

- Final notice: 30 days or more past due

The goal is to stay polite in the early stages and become more firm only when needed.

Sample Overdue Invoice Letter Templates

Friendly Reminder

Hello [Client Name],

I hope you are doing well. I am reaching out regarding Invoice [Number], which was due on [Date]. The balance is [Amount]. I kindly ask you to review and complete the payment at your earliest convenience. Thank you.

Second Notice

Hello [Client Name],

This is a follow-up regarding Invoice [Number]. The invoice is still outstanding with a balance of [Amount]. Please let me know if there are any issues. Your prompt attention is appreciated.

Final Notice

Hello [Client Name],

This is the final reminder for Invoice [Number], which remains unpaid. The outstanding balance is [Amount]. Please arrange payment by [Date] to avoid additional fees. Contact me if you need assistance.

Common Mistakes to Avoid

Aggressive Language

Being harsh or confrontational can damage professional relationships. Stay firm but polite.

Missing Important Details

Forgetting to include invoice numbers, dates, or amounts can confuse clients and delay payments.

Failing to Set Expectations

Always provide a clear deadline and next steps. Unclear reminders often go ignored.

How ReliaBills Can Help You Automate Overdue Notices

Writing and sending overdue invoice letters manually can take up valuable time, especially if you handle many clients. ReliaBills makes this process easier by automating reminders, follow-ups, and overdue notices. Once your invoice is created, the system sends gentle reminders automatically when payments are late. You can schedule first, second, and final notices, all written in a friendly and professional tone.

ReliaBills also offers payment tracking, so you always know who has paid, who is late, and who needs another reminder. For clients with ongoing services, recurring billing ensures invoices are sent on schedule every month, reducing the chances of overdue payments. This automation helps you maintain positive client relationships while getting paid faster and more reliably.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

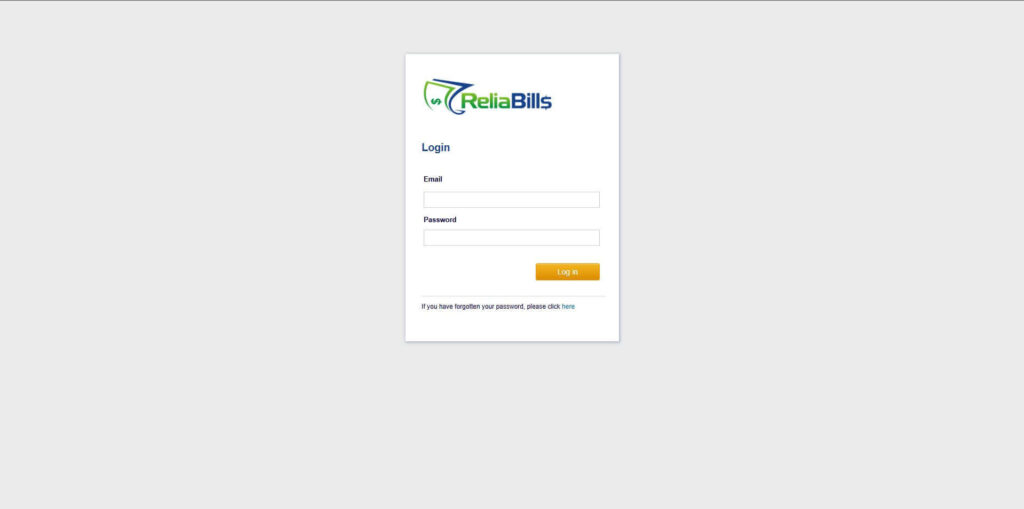

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

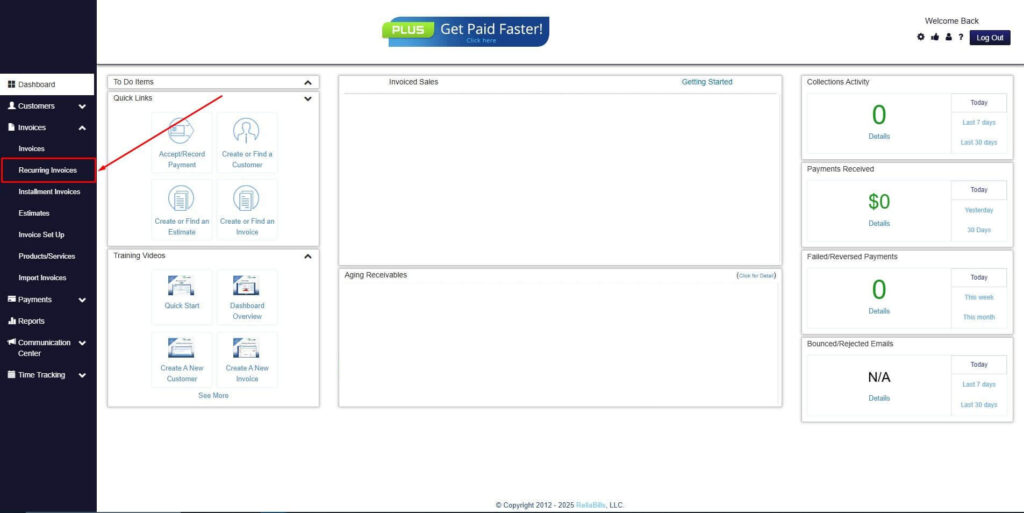

Step 2: Click on Recurring Invoices

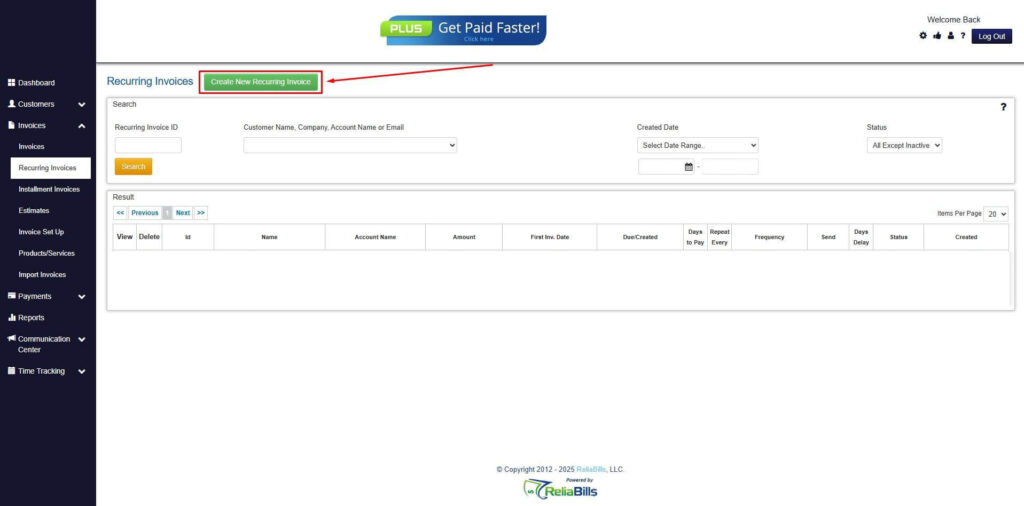

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

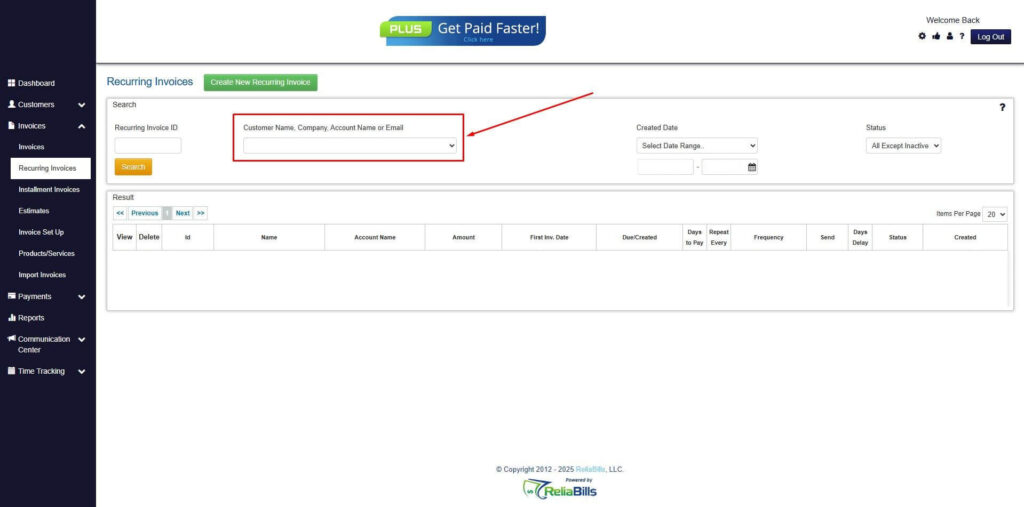

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

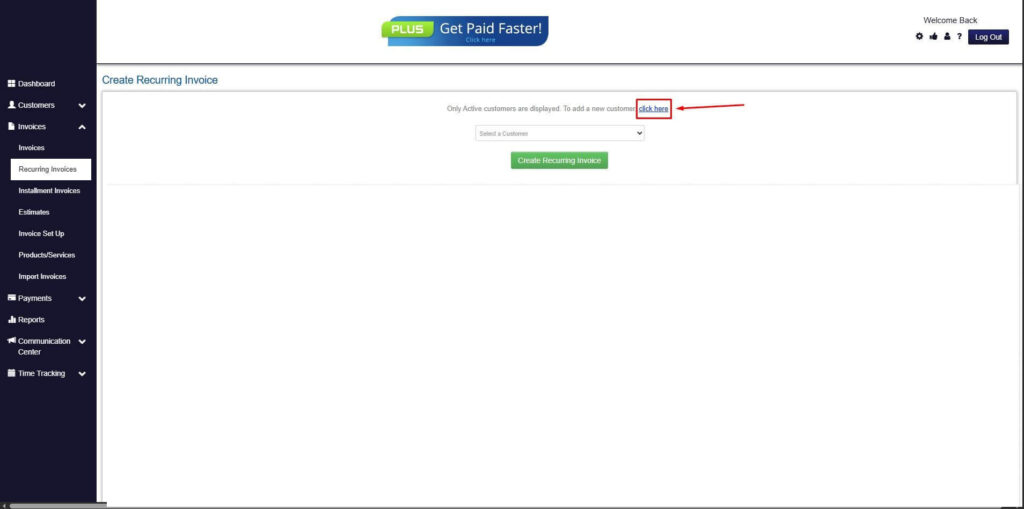

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

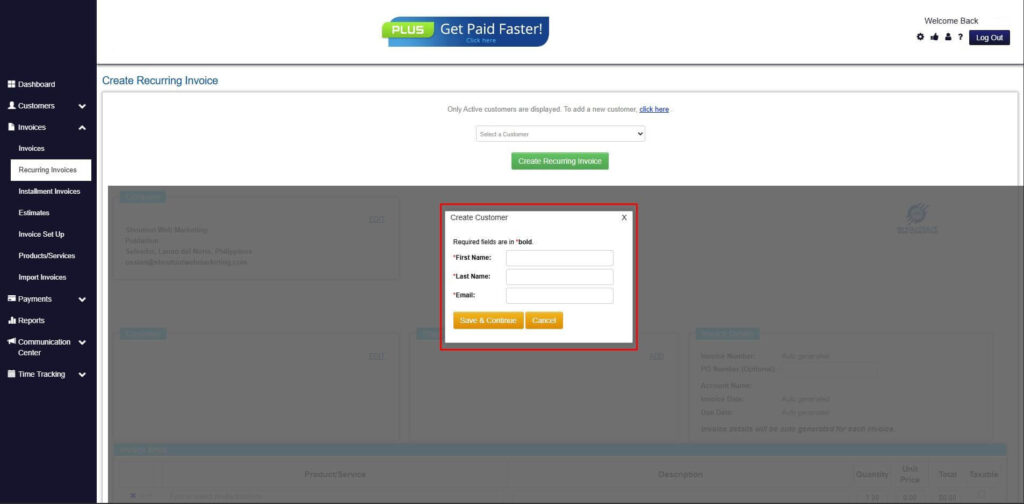

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

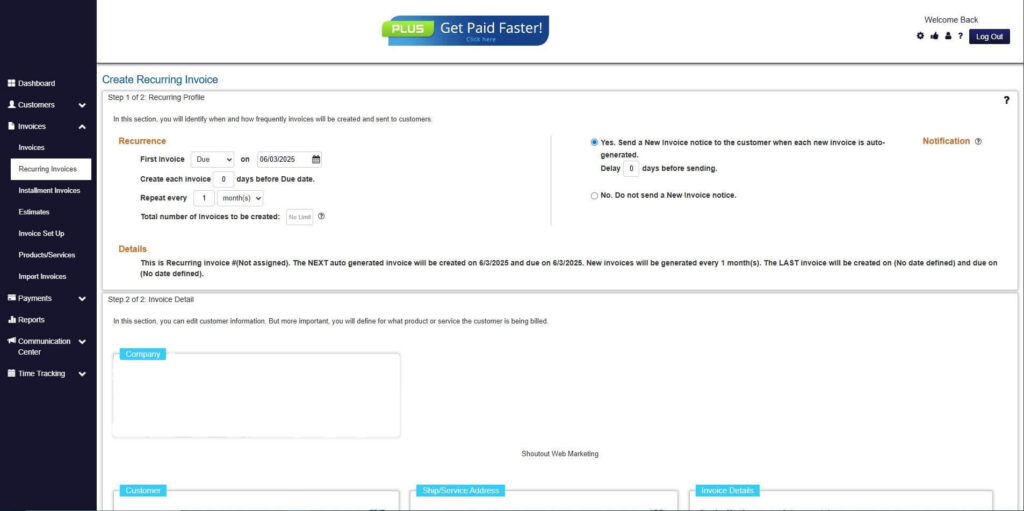

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

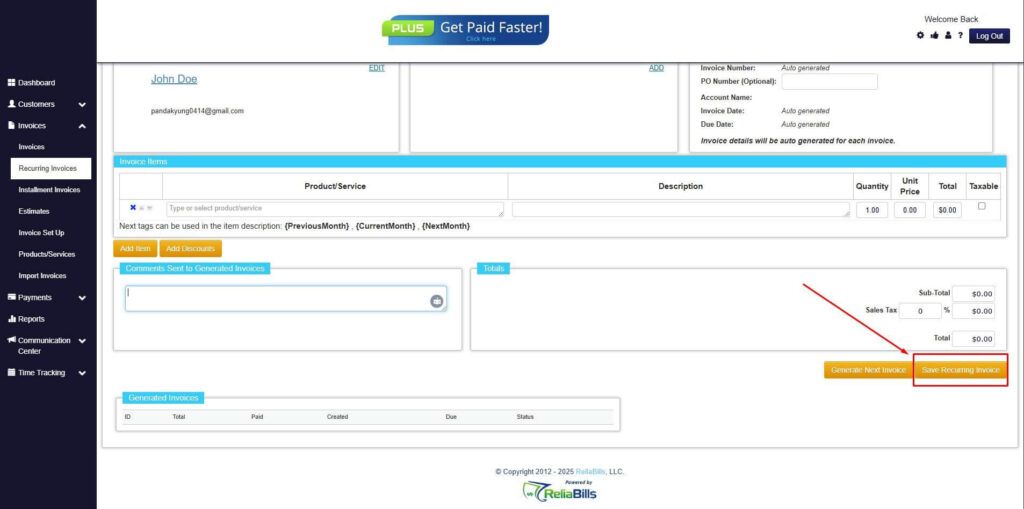

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

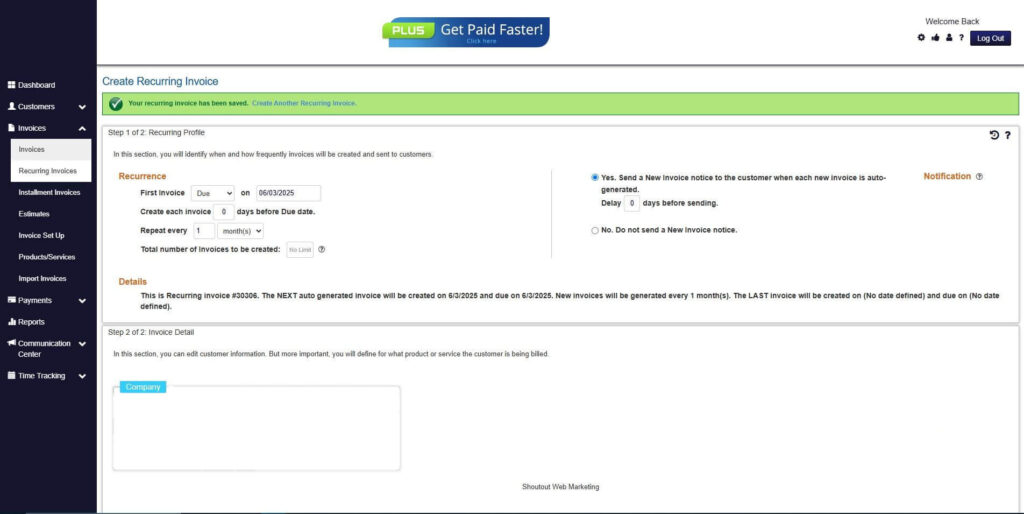

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How soon should I send an overdue invoice letter?

Within a few days after the due date is ideal.

2. Should I charge late fees?

It depends on your business policy. If you do, make sure the fees are clearly stated.

3. What tone works best?

A friendly overdue invoice letter often receives the fastest response.

4. Can I automate overdue reminders?

Yes. Tools like ReliaBills make it easy to automate reminders and track payments.

Conclusion

A friendly overdue invoice letter helps you get paid faster without creating tension with your clients. By being clear, professional, and proactive, you can resolve late payments while keeping relationships strong. With tools like ReliaBills, managing reminders and overdue notices becomes simple, efficient, and stress free.