There are two main ways to pay bills electronically in our fast-paced, electronic world: auto pay and bill pay. Both of these methods are easy and convenient, but you should be aware of a few subtle differences between auto pay and bill pay before deciding which one is right for you.

But what exactly are auto pay and bill pay? How exactly do they work, and what are the benefits and drawbacks of each? This article will look at auto pay and bill pay and discuss the better choice for you.

Table of Contents

ToggleWhat is Auto Pay?

Auto Pay, sometimes referred to as direct debit, is a payment method that allows you to set up recurring bill payments to be automatically withdrawn from your bank account or charged to your credit card on a preset schedule. This is often utilized for regular expenses such as utility bills, mortgage payments, or insurance premiums. Many service providers offer this option to customers, typically incentivizing it with perks such as discounts or waived convenience fees. From a financial management standpoint, Auto Pay ensures that payments are never forgotten or made late, thus avoiding late fees and potential hits to your credit score.

The way Auto Pay works is relatively straightforward. You authorize your biller to draw the funds for your bills directly from your account at specified monthly intervals. This is done by providing your billing details, which include your account number, bank routing number for checking accounts, or credit card number. The funds are automatically deducted from your account each billing cycle after the initial setup. It’s important to maintain sufficient funds in your account to prevent overdraft fees and to review your statements regularly to ensure the accuracy of the transactions. This proactive approach ensures that the Auto Pay process works seamlessly, providing you with a convenient means to manage your recurring expenses without manual intervention each month.

What is Online Bill Pay?

Online Bill Pay is a service offered by many banks and credit unions that allows customers to pay their bills through the institution’s online banking portal. Unlike Auto Pay, which automatically deducts payments, Online Bill Pay allows users to schedule payments on an as-needed basis. This method is particularly beneficial for bills that vary in amount, such as credit card bills or utility payments that aren’t consistent every month. Customers can set up one-time payments or recurring payments with the flexibility to change or cancel them before processing. This service often comes at no additional cost and enables the payer to keep all their bill payments consolidated in one platform, simplifying financial management.

To utilize Online Bill Pay, you typically need to log into your bank’s online platform and enroll in the service. Once enrolled, you can add payees by entering information such as the company name, your account number, and the payee’s address. For recurring bills, the user can specify the amount and the date on which the payment should be made each month. The bank will then either transfer the funds electronically to the payee or, if the payee does not accept electronic payments, print and mail a check to them directly. It’s crucial to set up payments a few days in advance of the due date to ensure they are processed in time and to confirm that funds are available to avoid potential overdraft fees.

What’s the Difference?

The primary difference between auto pay and online bill pay is the level of control and intervention required. With auto-pay, once you’re set up, the amount is automatically debited from your account on a regular schedule without any further action needed on your part, making it a “set it and forget it” solution. However, this can be a double-edged sword, requiring you to ensure that your account has enough funds to cover the payment at each interval. In contrast, online bill pay requires manual payment scheduling, providing greater flexibility and control. This method allows payers to review their bills before making payments, accommodate bills with variable amounts, and easily adjust or cancel payments as needed.

Another significant difference between the two payment methods is how the payments are processed. Auto pay transactions are generally processed through the Automated Clearing House (ACH) network, whereas online bill pay transactions may be processed electronically directly to the payee or through a mailed check if the payee does not accept electronic payments. Auto pay is more efficient for predictable, fixed expenses that you are obliged to pay regularly, whereas online bill pay is more suitable for variable expenses where one might want to maintain discretionary control over the payment schedule and amounts. It’s essential to recognize these distinctions and consider your financial management style and the nature of your bills when choosing between auto pay and online bill pay.

Why is Bill Pay Recommended at First?

When it comes to deciding between auto pay vs bill pay, it is recommended that you start with the latter. This is because, with bill pay, you are in control of when the payment is sent. This means that if there is ever an issue with your bank account or you need to dispute a charge, you can do so without worrying about the vendor charging your card. Since it’s a simple process, bill pay also gives you a greater awareness than auto pay. With bill pay, you get access to the following perks:

- Set up a payment as recurring or one-time.

- Select your preferred payment date.

- Start and stop recurring payments easily.

- Log in to a single website (your bank) and pay multiple vendors at once.

- Vendors don’t have access to your bank account.

- Since you’re more engaged with your bills, you are also more aware of how your bill fluctuates.

- You’re more likely to notice increases in your usage.

- You’re able to spot vendor errors.

When Does Auto Pay Make Sense?

Bill pay is the ideal option when you’re just getting into the habit of budgeting and managing your funds. However, auto pay will make more sense once you get the hang of things. Auto pay can be a complete time-saver, but it’s only recommended when you’re confident in your budgeting skills and have a good financial handle.

You’re authorizing the vendor to charge your card automatically on a schedule with auto pay. This means you need to ensure you have enough money to cover the charges, or you’ll be hit with overdraft fees. While auto pay might not be the best option for everyone, it can be helpful for those who are:

- Consistently meeting their monthly financial obligations.

- No longer want the hassle of manually paying bills each month.

- Tired of forgetting to make payments on time.

- Running a business of your own and need to make multiple payments each month.

- On a tight budget and can’t afford to miss a payment.

- Auto pay can also help you avoid late fees by ensuring your payments are always on time.

Why Recurring Billing is the Best for Business

If you’re running a business, recurring billing is the best way to offer payment to your customers. Recurring billing is auto pay in which customers are automatically charged on a set schedule. This can be weekly, monthly, or even yearly. Recurring billing is beneficial for businesses because it:

- Offers a predictable cash flow.

- Makes budgeting easier.

- Better customer retention rates

- Allows you to offer discounts for customers who commit to a long-term contract.

- Builds customer loyalty.

Businesses can offer customers a discount for committing to a long-term contract with recurring billing. This not only builds customer loyalty but also helps to retain customers.

Frequently Asked Questions (FAQs)

Q1: Can I use both Auto Pay and Bill Pay for the same account?

Yes, you can use both Auto Pay and Bill Pay for the same account based on your preferences. For example, you might prefer Auto Pay for fixed monthly expenses like a mortgage and use Bill Pay for variable expenses like utility bills.

Q2: What happens if my Auto Pay or Bill Pay fails due to insufficient funds?

If an Auto Pay or Bill Pay fails due to insufficient funds, your bank may charge you an overdraft fee. The payment might not be processed, which could also lead to late payment fees from the payee. It’s essential to always ensure you have enough funds in your account to cover the payment.

Q3: Do all banks offer Auto Pay and Bill Pay services?

Most banks offer Auto Pay and Bill Pay services, but features and availability vary. It’s best to check with your specific bank to understand their offerings. Inquire about any associated fees, and if they have any limits on the number of payments or payees, you can set up.

Q4: How secure is Auto Pay and Bill Pay?

Both Auto Pay and Bill Pay are typically very secure, using encrypted transfers and following banking regulations. However, as with any financial transaction, keeping track of payments and regularly checking your account for any unauthorized transactions is important. That’s why choosing a trusted and reputable bank for these services is essential.

Q5: Can I change or cancel an Auto Pay or Bill Pay once set up?

Yes, you can change or cancel an Auto Pay or Bill Pay any time before the transaction is processed. The procedure will vary by bank, so check with your bank for their specific process. That being said, it’s always important to double-check your payments before they are processed to avoid any issues.

Q6: Will using Auto Pay improve my credit score?

Using Auto Pay can indirectly improve your credit score by ensuring your bills are paid on time, which is a significant factor in credit scoring. Late payments negatively affect your credit score, so setting up Auto Pay for on-time payments can help maintain or improve your score. By doing so, you also decrease the risk of forgetting to pay a bill on time.

Take Advantage of Recurring Billing with ReliaBills

If you want your business to switch to recurring billing, ReliaBills can help you with that transition. ReliaBills is a cloud-based invoicing and billing software designed to automate payment processes, reduce administrative overhead, and streamline payment processing duties. ReliaBills’ payment processing features include automated recurring billing, payment tracking, payment reminders, online payment processing, and much more!

It also provides valuable tools that help manage customer information, monitor payment records, and create proper billing and collection reports. As a result, invoice and billing management are simple and convenient. You also get access to active customer support, ready to assist you whenever you need help.

Get started with ReliaBills for free today! And if you want more features, you can upgrade your account to ReliaBills PLUS for only $24.95 monthly! Subscribing to ReliaBills PLUS will give you access to advanced features such as automatic payment recovery, SMS notifications, custom invoice creation, advanced reporting, and more!

With ReliaBills, you have an all-in-one solution to your invoicing and payment processing needs. Our convenient solutions will enable you to focus more on running and growing your business. Get started today!

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

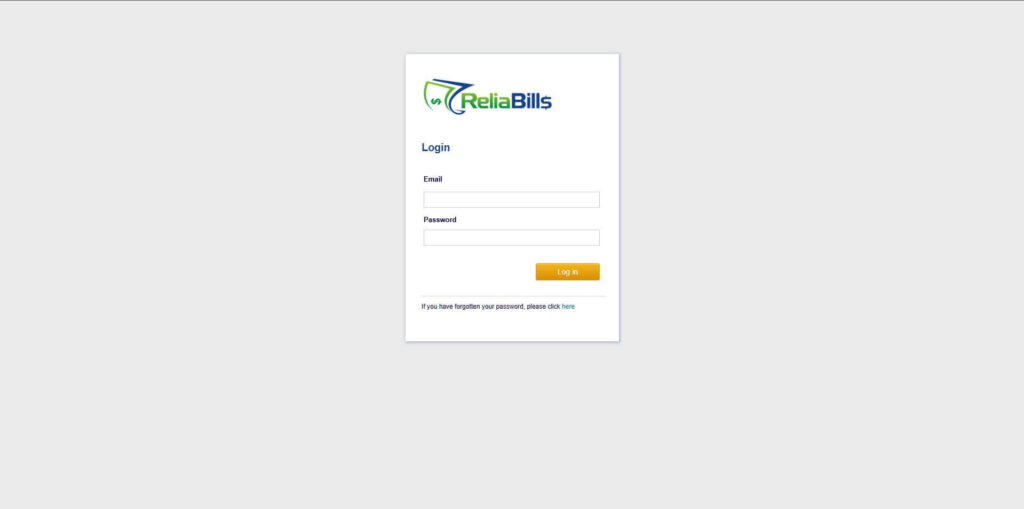

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

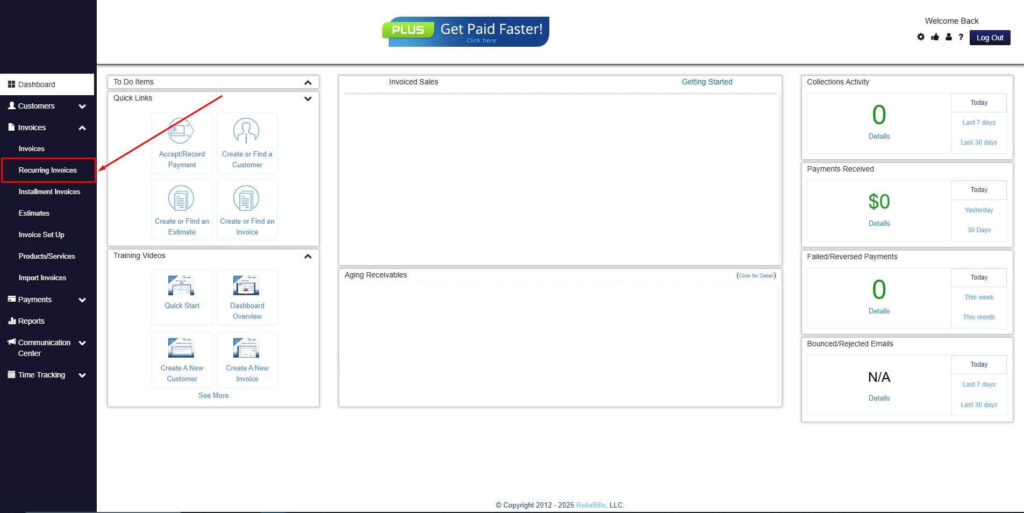

Step 2: Click on Recurring Invoices

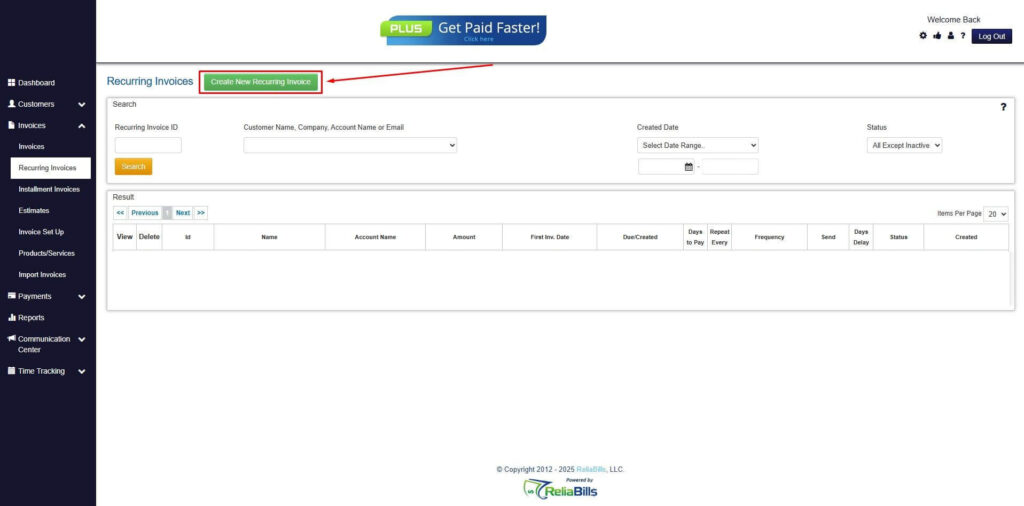

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

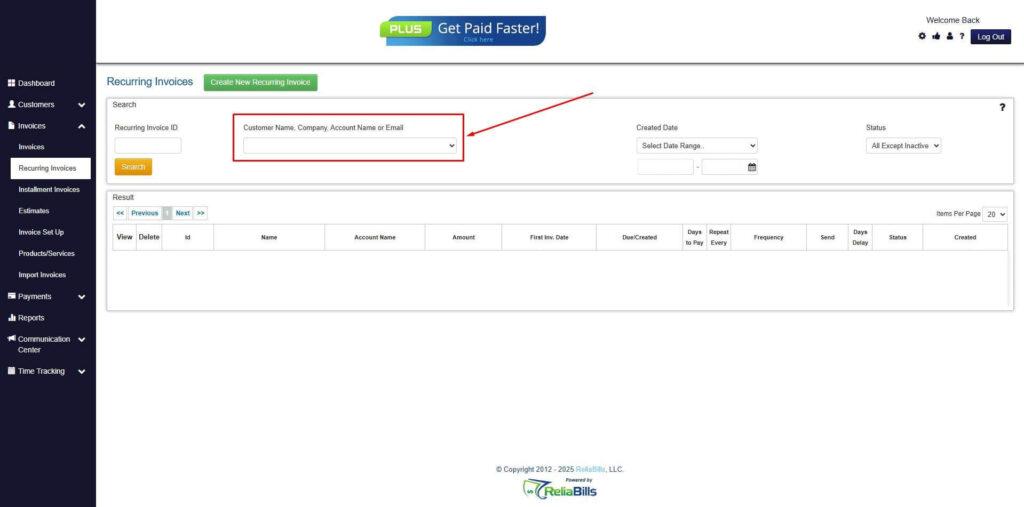

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

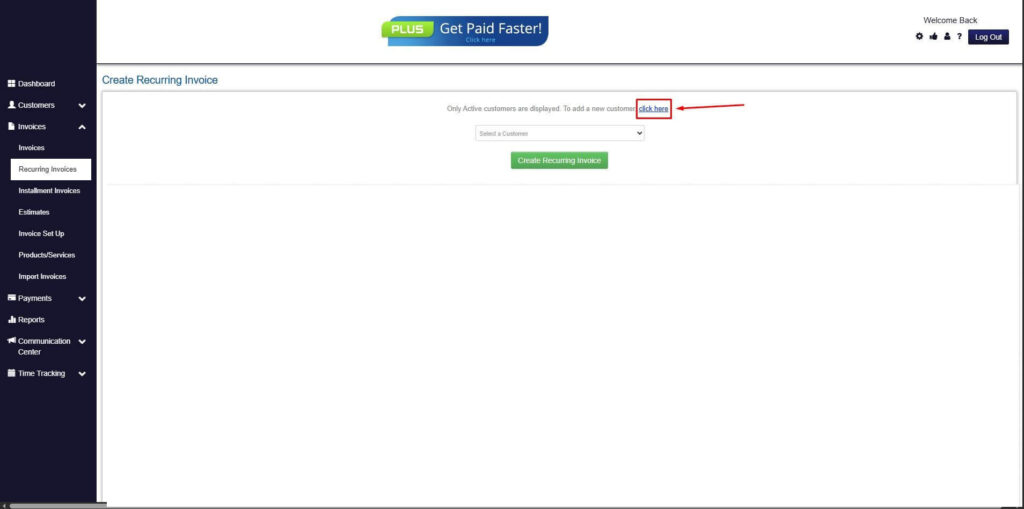

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

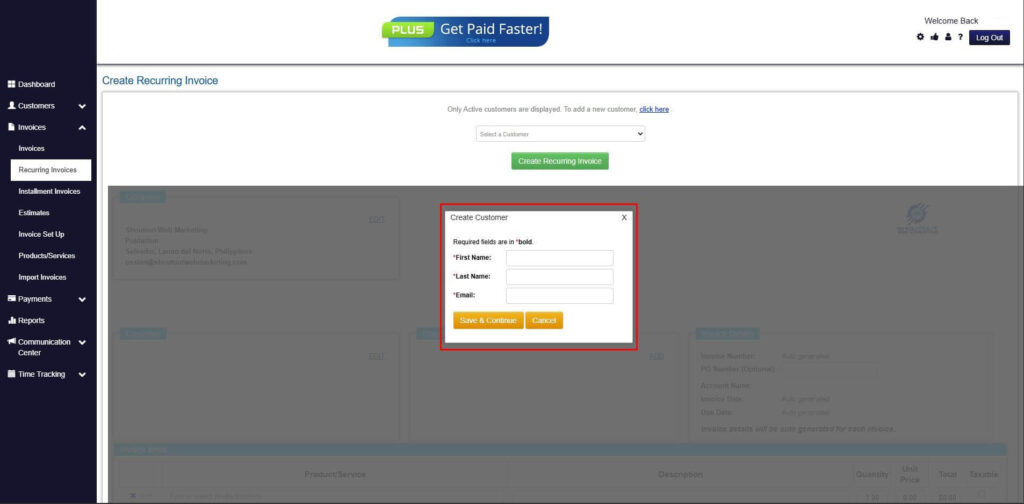

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

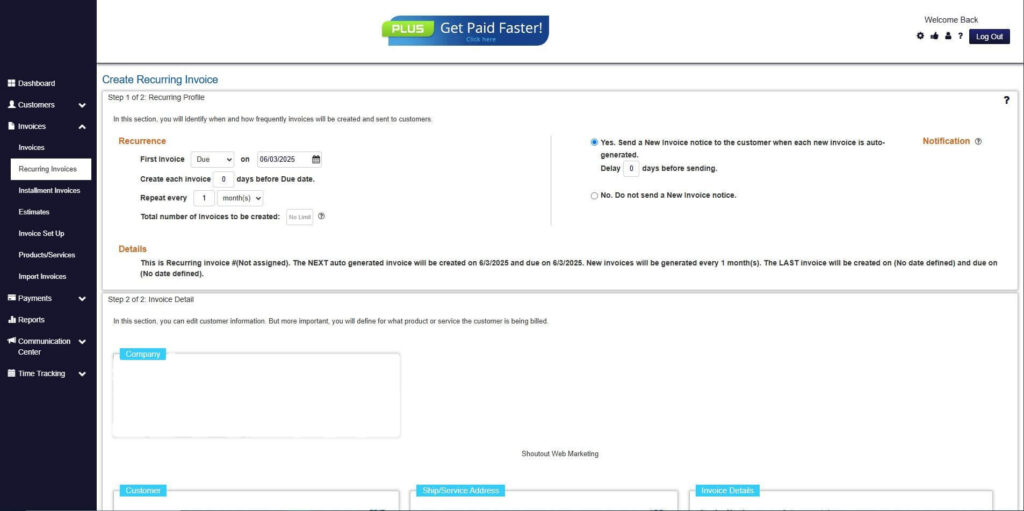

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

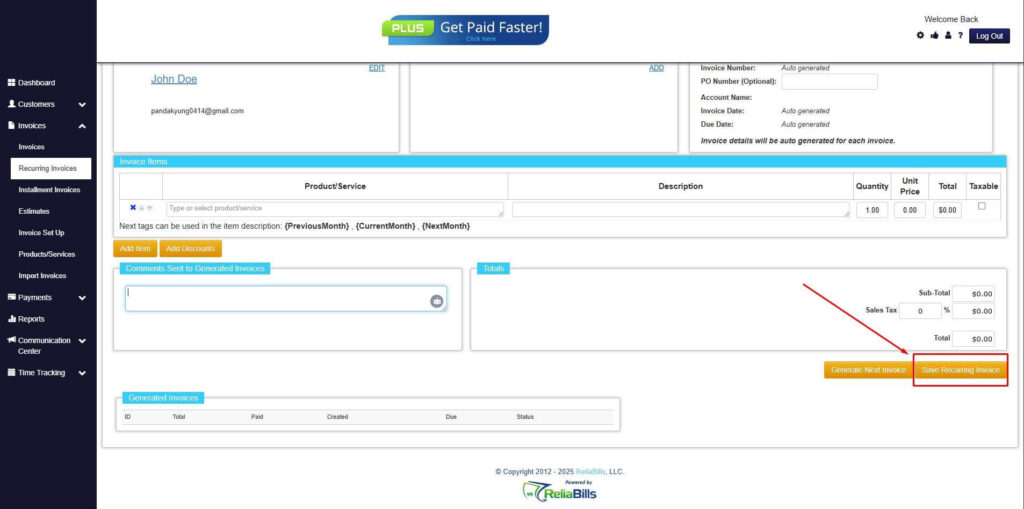

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

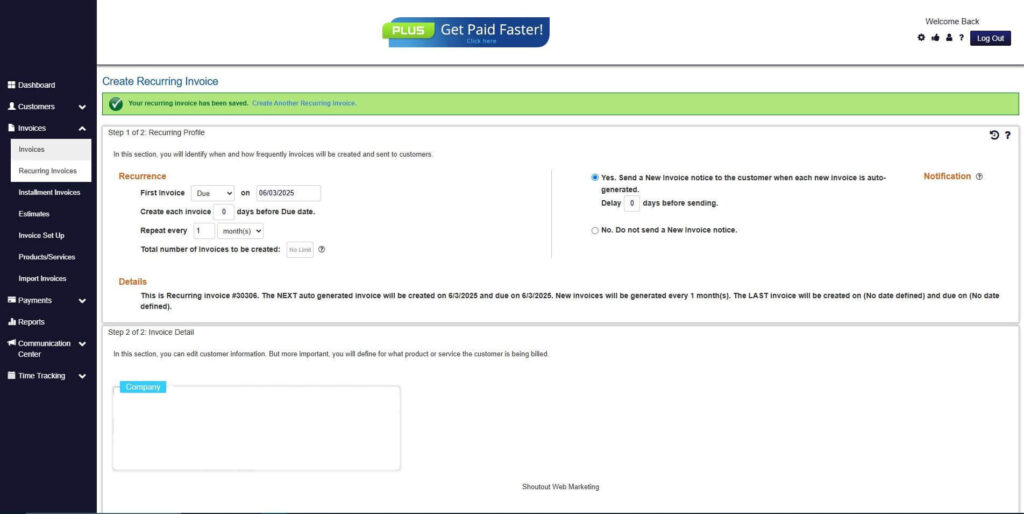

Step 9: Recurring Invoice Created

Your Recurring Invoice has been created.

Conclusion

Embracing auto pay and recurring billing systems offer undeniable advantages for individuals and business owners. A streamlined payment process saves time, augments financial management, enhances customer satisfaction, and contributes to a healthier cash flow. Whether you are an individual looking to simplify your monthly bill payments or a business seeking to garner customer loyalty and steady revenue, integrating automated billing solutions is a strategic move toward financial efficiency and reliability. By keeping abreast of the mechanisms, benefits, and security procedures associated with these payment methods, consumers can confidently leverage technology to their financial advantage.