Freelancers manage every part of their business, from finding clients to completing projects and ensuring they get paid. Two documents play a huge role in protecting their work. These are the contract and the invoice. Understanding the difference between an invoice vs contract is essential because each one serves a unique purpose in your workflow. Together, they help set clear expectations, reduce confusion, and support timely payments.

Table of Contents

ToggleWhy Freelancers Need Both Contracts and Invoices

Freelancers rely on contracts to define project terms before work starts. Meanwhile, invoices request payment after services are delivered. When both are used correctly, they help prevent disputes, strengthen relationships with clients, and create a more professional business structure. A contract outlines the agreement, while an invoice records the transaction. Knowing how each document works gives freelancers confidence and control over their business operations.

What Is a Contract?

A contract is a formal agreement between you and your client. It defines the work you will do, how much you will charge, deadlines, and expectations from both sides. It is one of the most important documents in freelancing.

Purpose of a Contract

A contract protects both the freelancer and the client. It sets the scope of work, deliverables, and timelines. It also establishes payment terms so both sides know what to expect.

Key Elements of a Freelance Contract

A strong contract usually includes:

- Client and freelancer details

- Scope of work

- Deliverables

- Deadlines and milestones

- Payment terms

- Revision or change policies

- Termination guidelines

When to Use a Contract

You should use a contract before starting any paid work. Even small or recurring projects should have documented agreements to avoid misunderstandings.

What Is an Invoice?

An invoice is a request for payment issued after a service has been completed or after a milestone is reached. It is a financial document that records what the client owes you.

Purpose of an Invoice

Invoices provide clarity and help clients process payments. They show the amount due, the service provided, and the payment deadline.

Key Components of an Invoice

A complete invoice typically includes:

- Invoice number

- Freelancer and client details

- Description of services

- Service date

- Total amount due

- Payment due date

- Payment options

When to Issue an Invoice

You normally issue an invoice once the work is done or according to agreed milestones in the contract.

Invoice vs. Contract: What’s the Difference?

Understanding the difference between invoice vs contract helps freelancers manage their workflow more effectively.

Legal Status

A contract is legally binding. An invoice is not legally binding by itself but can support an agreement for payment.

Timing in the Project Cycle

Contracts are created before work begins. Invoices are sent after work is completed.

Information Included

Contracts describe responsibilities and expectations. Invoices list completed services and payment details.

How They Protect Freelancers

Contracts protect your time, scope, and terms. Invoices protect your payment by creating a clear record of what is owed and when it should be paid.

Common Misconceptions

Some freelancers think a contract alone guarantees payment. Others believe invoices can replace contracts. In reality, you need both to operate professionally.

Why Freelancers Need Both

Using both an invoice and a contract gives freelancers full protection and better financial management.

Ensuring Clear Expectations

A contract ensures the client understands the work you will provide. An invoice ensures the client understands when and how much to pay.

Protecting Payments and Work Scope

Contracts reduce scope creep and secure your terms. Invoices help you track payments and maintain financial records.

Preventing Disputes

When clients have both documents, disagreements are less likely because everything is written and documented.

How to Create a Contract as a Freelancer

Creating a professional contract helps build trust and sets you up for a smooth project.

Must-Have Clauses

Make sure your contract includes payment schedules, deadlines, scope, and ownership rights for any created work.

Best Practices

- Keep your contract clear and easy to understand

- Include examples if needed

- Review regularly to update outdated sections

Common Mistakes to Avoid

- Using vague wording

- Forgetting revision limits

- Skipping termination clauses

How to Create an Invoice as a Freelancer

Your invoice should look professional and be easy for clients to process.

Required Information

Include client details, service descriptions, total amounts, payment due dates, and your preferred payment methods.

Invoice Types

Freelancers can use different invoice formats such as:

- Standard invoices

- Progress invoices

- Recurring invoices

- Final invoices

Tips for Getting Paid Faster

- Send invoices immediately after completing work

- Offer multiple payment options

- Use automated payment reminders

How ReliaBills Can Help Freelancers

ReliaBills gives freelancers an easier way to manage invoicing by reducing repetitive tasks and helping ensure payments come in on time. Instead of creating invoices manually for every project cycle, you can automate your billing so important details are handled for you. This is especially useful for freelancers with long-term clients or retainer agreements who need a consistent and dependable system.

The platform’s recurring billing feature is one of its biggest advantages. You can set up invoices to be sent automatically on a weekly, monthly, or custom schedule, which removes the stress of remembering due dates or sending reminders. This creates smoother cash flow and helps prevent the delays that often happen when busy clients forget to pay. ReliaBills can also send automated reminders and accept multiple payment methods, making the process faster for clients.

By relying on automation and recurring billing, freelancers can save time, reduce administrative work, and build more predictable income. It supports better client relationships, ensures steady revenue for ongoing projects, and keeps your workflow organized without extra effort. For freelancers who want to stay professional while focusing more on their craft, ReliaBills offers a simple and effective solution.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

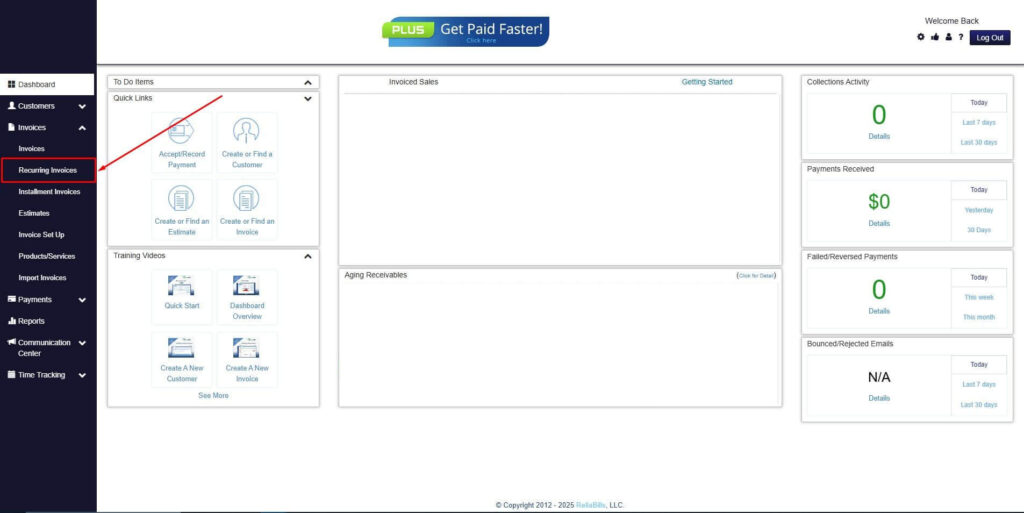

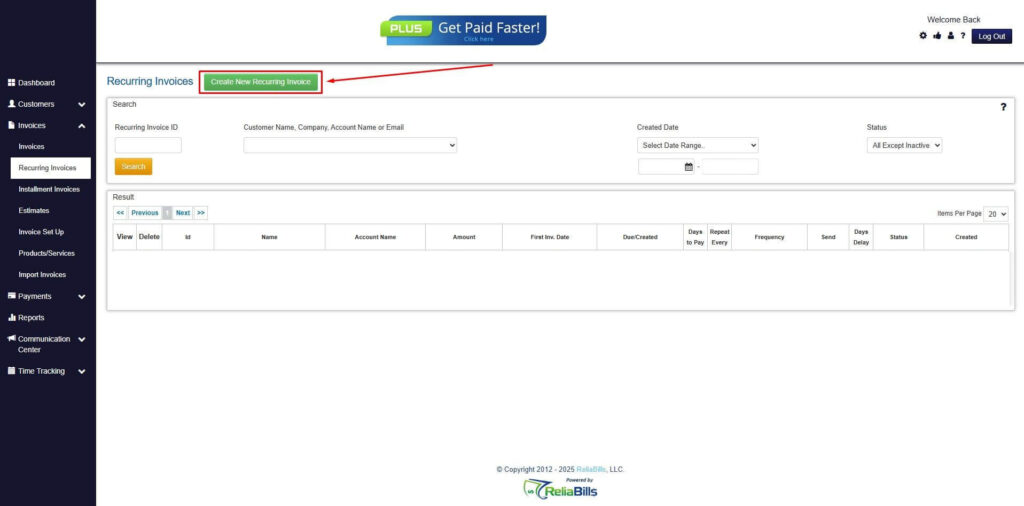

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

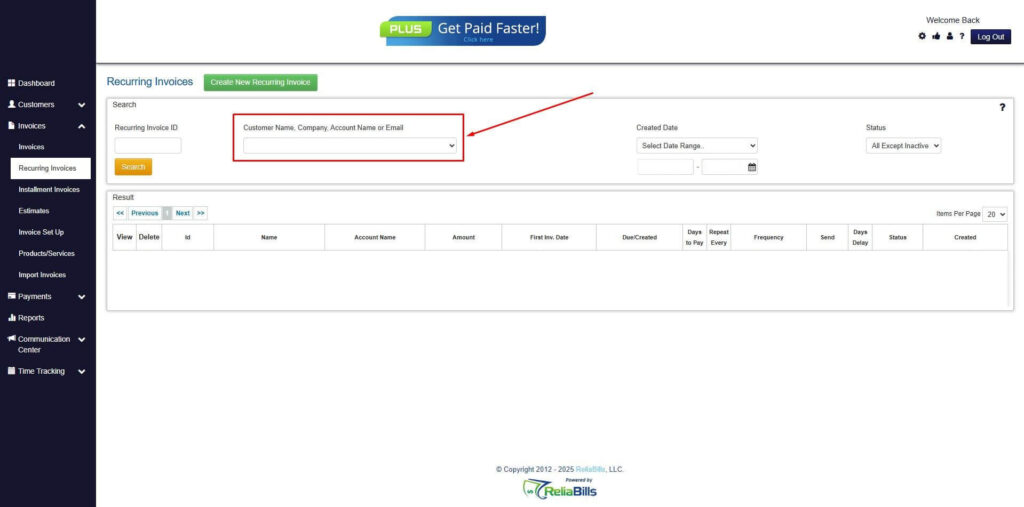

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

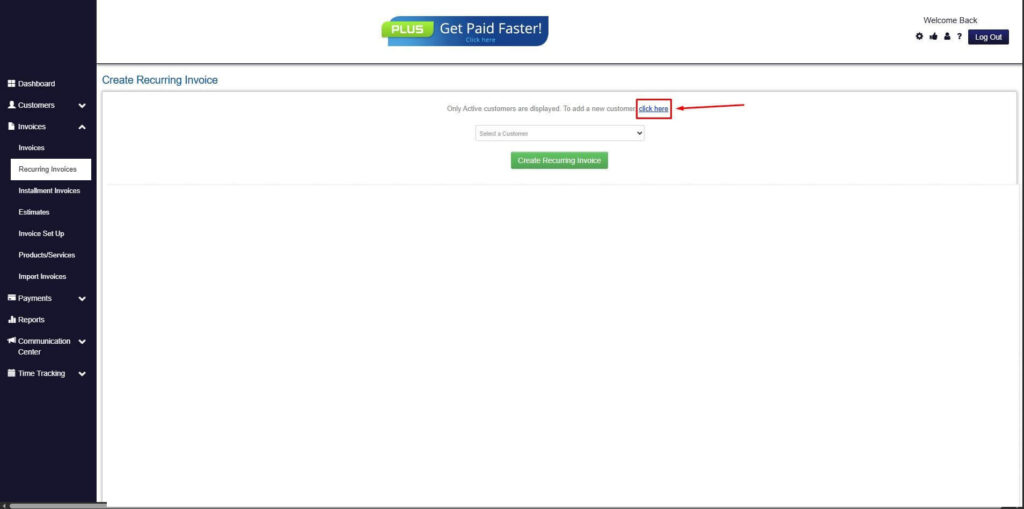

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

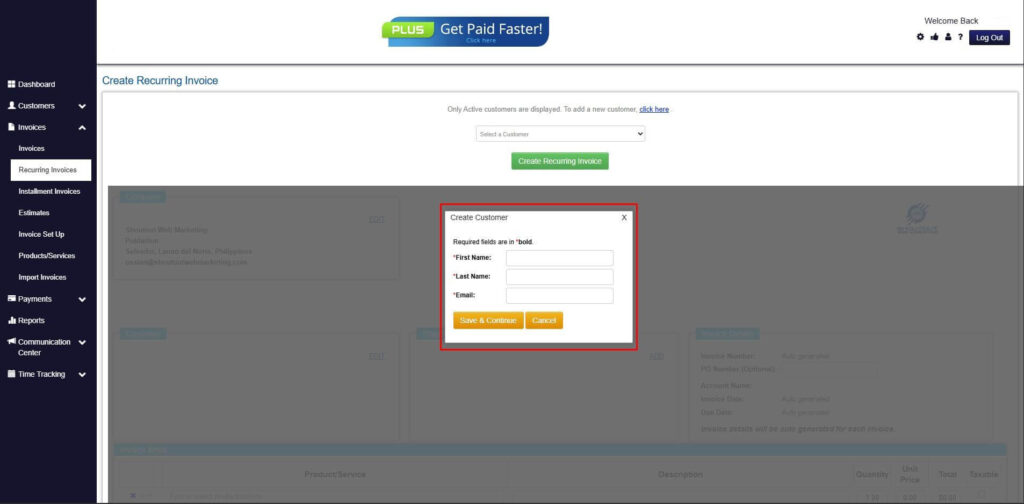

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

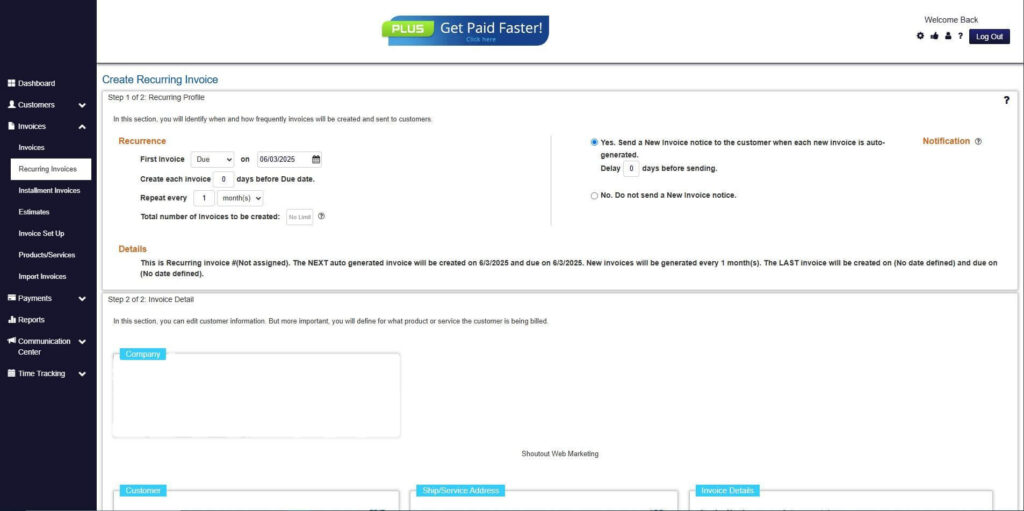

Step 7: Fill in the Create Recurring Invoice Form

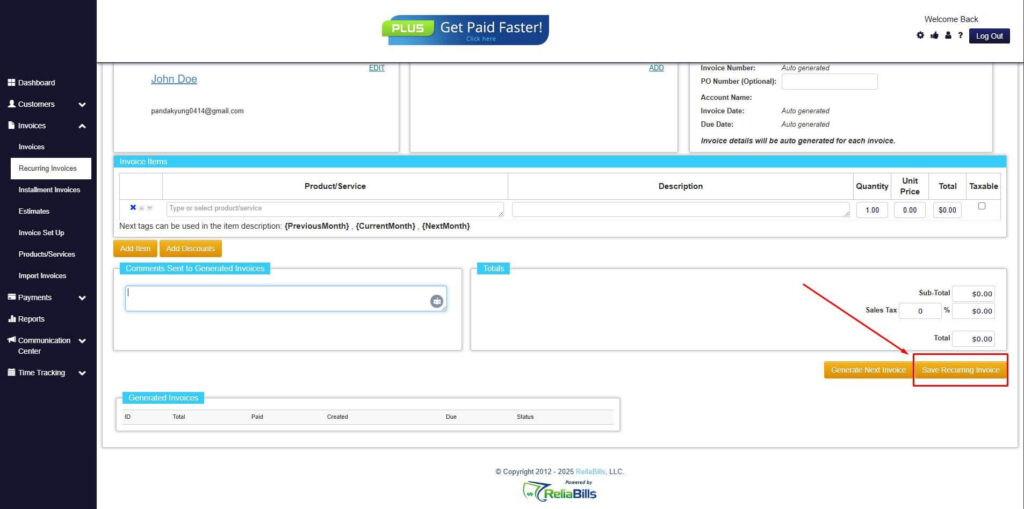

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

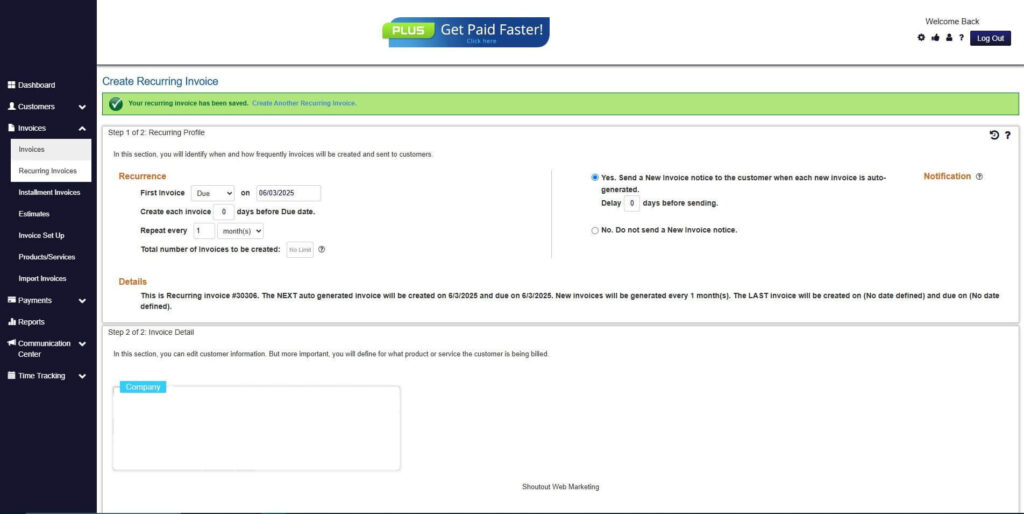

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Do I need both a contract and an invoice?

Yes, a contract defines the work and terms, while an invoice requests payment.

2. Can an invoice replace a contract?

No. An invoice alone cannot protect your project scope or payment terms.

3. What if a client refuses to sign a contract?

Consider it a red flag. You can explain that contracts protect both parties.

Conclusion

Understanding invoice vs contract helps freelancers stay organized, protect their work, and maintain healthy client relationships. With clear agreements and professional invoices, you improve your chances of getting paid on time and delivering a smooth experience for your clients. Adding tools like ReliaBills can further automate the process and make your freelance business more efficient.