If you run a business or provide taxable goods and services, you’ve probably wondered what is a tax invoice and why it’s so important. A tax invoice is more than just a billing document. It plays a vital role in ensuring compliance with tax laws and maintaining accurate financial records.

In this comprehensive guide, you’ll learn what a tax invoice means, how it differs from a receipt, and why your business needs one. You’ll also see how ReliaBills can make tax invoicing easier, faster, and more accurate through automation.

Table of Contents

ToggleWhat Do You Mean by Tax Invoice?

To understand what is a tax invoice, think of it as a legal document that records the sale of taxable goods or services. It’s issued by a business that’s registered for VAT (Value Added Tax) or GST (Goods and Services Tax).

A tax invoice clearly shows the tax charged on each item or service, helping both the seller and buyer stay compliant with government tax regulations. It typically includes details such as:

- The seller’s and buyer’s names and addresses

- The seller’s tax registration number

- A description of goods or services provided

- The tax rate and amount charged

- The total price, including tax

A tax invoice ensures that both parties have a clear record of the transaction. For buyers, it’s also essential when claiming input tax credits on purchases made for business use.

Is Tax Invoice a Receipt?

A common question many business owners ask is whether a tax invoice is the same as a receipt. The answer is no. While both documents are part of the billing process, they serve different purposes.

A tax invoice is issued before payment as a request for payment from the buyer. It details the items sold, their prices, applicable taxes, and the total amount due. On the other hand, a receipt is issued after payment as proof that the customer has paid in full.

For example, if you run a cleaning service, you would issue a tax invoice after completing the service but before receiving payment. Once the customer pays, you then issue a receipt to confirm that the transaction is complete. Both documents are important for bookkeeping and tax reporting.

Why Is a Tax Invoice Necessary?

Now that you know what is a tax invoice, it’s important to understand why it’s necessary for every business that deals with taxable transactions.

First, a tax invoice ensures compliance with local and national tax regulations. It serves as proof that your business collects and reports taxes correctly. Without it, your business could face penalties or compliance issues.

Second, tax invoices create transparency in business transactions. By providing a detailed breakdown of costs, including tax amounts, you help customers understand exactly what they are paying for.

Third, a tax invoice is critical for claiming input tax credits. If your customers are registered businesses, they can use your tax invoice to recover the tax they paid on your goods or services.

Lastly, issuing professional tax invoices enhances your brand’s credibility. It shows that your business follows proper accounting practices, which builds trust with clients and partners.

Why Use ReliaBills for Your Invoicing Needs

While understanding what is a tax invoice is crucial, creating one manually can be time-consuming and error-prone. That’s where ReliaBills comes in.

ReliaBills is a complete invoicing and billing platform designed to automate and simplify your invoicing process. It automatically calculates taxes, applies the correct rates, and generates professional tax invoices that meet compliance requirements.

With ReliaBills, you can customize your invoices with your business branding, include all necessary tax details, and send them directly via email. The system tracks payments in real time and sends reminders to customers with unpaid balances.

Compared to manual methods like spreadsheets or handwritten forms, ReliaBills ensures consistency and accuracy across every invoice. This helps you save time, prevent costly errors, and maintain a polished professional image.

ReliaBills also offers recurring billing, which is perfect for businesses that issue tax invoices regularly to the same customers. Instead of creating invoices every billing cycle, ReliaBills automates the process, ensuring invoices are sent and payments are collected on time.

Improve Your Tax Invoicing With Recurring Billing Software

If your business frequently issues tax invoices, using recurring billing software can transform how you manage your billing process. Automation ensures that invoices are generated and sent automatically, taxes are calculated correctly, and payments are tracked efficiently.

Recurring billing software also helps maintain consistent cash flow and reduces administrative workload. For subscription-based businesses or long-term service contracts, this system minimizes human error and prevents missed payments.

The Benefits of Recurring Billing

Recurring billing offers significant benefits for businesses that need to issue invoices regularly. It ensures steady cash flow by automating billing and payment collection. It also reduces human error by automatically generating tax-compliant invoices and applying accurate tax rates.

Customers appreciate the convenience of recurring billing because they don’t need to remember to make payments each cycle. For your business, it saves time, lowers costs, and improves overall efficiency.

Is Your Business Fit for Recurring Tax Invoices?

If you’re still asking what is a tax invoice and whether you need recurring ones, consider your business model. Recurring tax invoices are ideal for companies that handle continuous services or repeat transactions. These include cleaning services, maintenance, digital marketing, and subscription-based industries.

Automating your tax invoicing ensures that payments are collected promptly and taxes are always applied correctly. It also helps maintain professional consistency in how you bill your customers.

Automate Your Tax Invoices With ReliaBills

ReliaBills simplifies your tax invoicing by automating every step of the process, from calculating taxes to sending invoices and tracking payments. All invoices are professional, accurate, and fully compliant with tax regulations.

When you upgrade to ReliaBills PLUS, you gain access to advanced tools such as automated reminders, detailed financial reporting, and secure online payment options. These features help you stay in control of your finances and reduce the time spent managing billing tasks.

By choosing ReliaBills, you can focus more on growing your business while ensuring that your invoicing system runs smoothly and efficiently.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

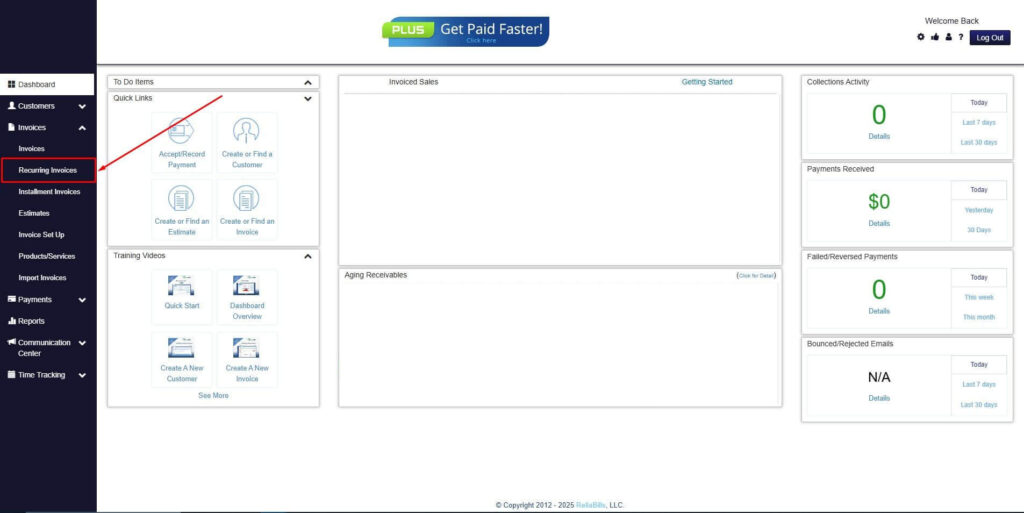

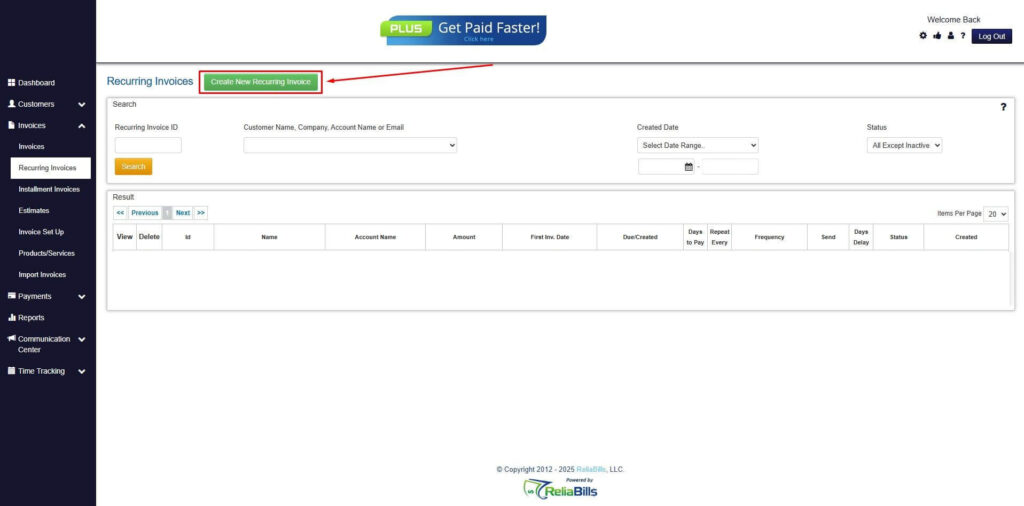

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

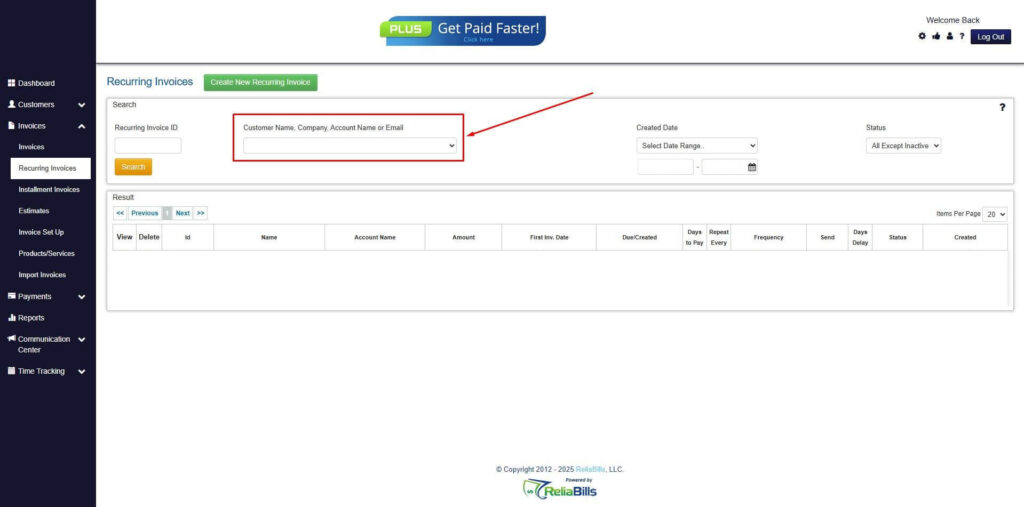

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

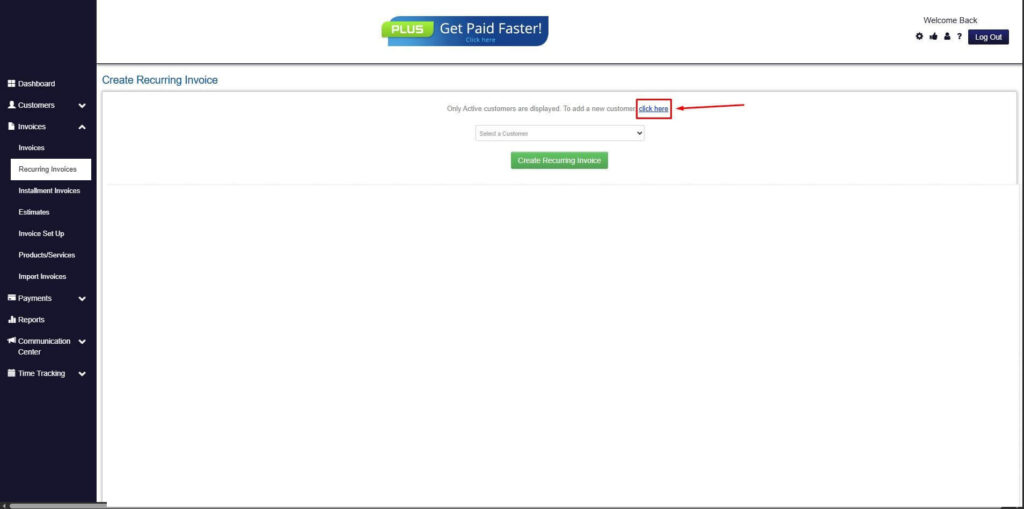

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

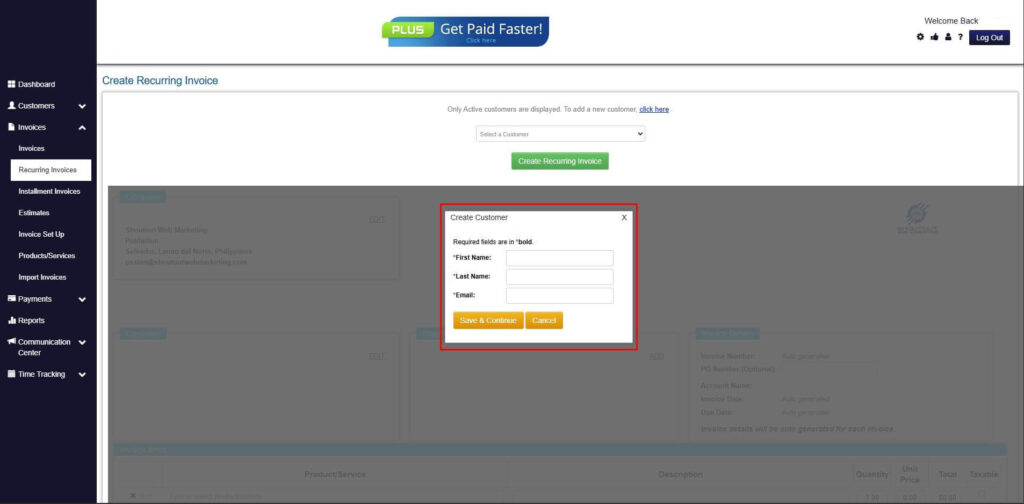

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

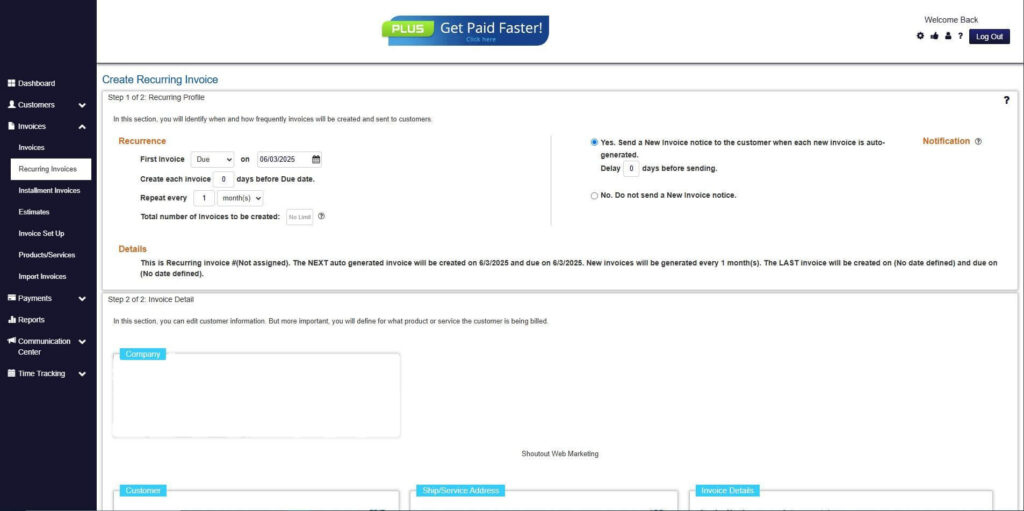

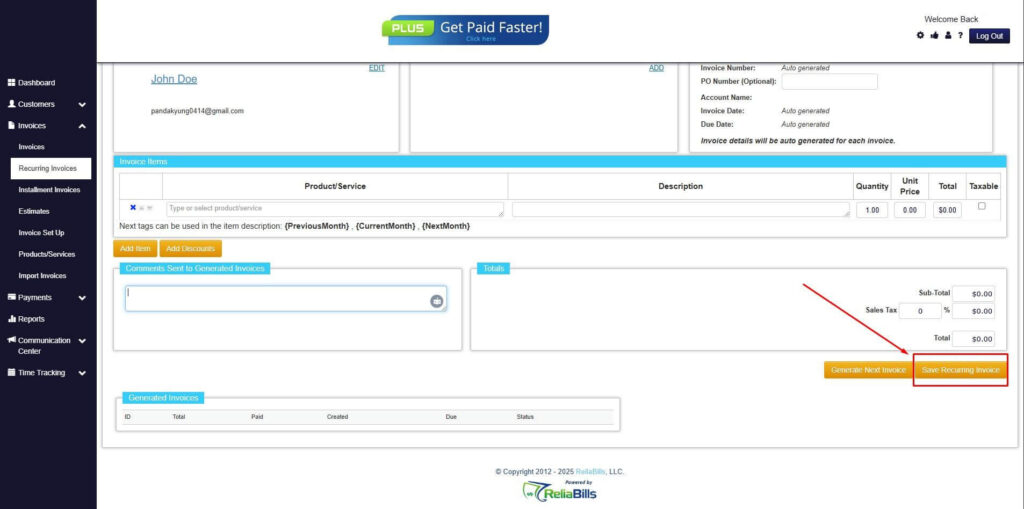

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

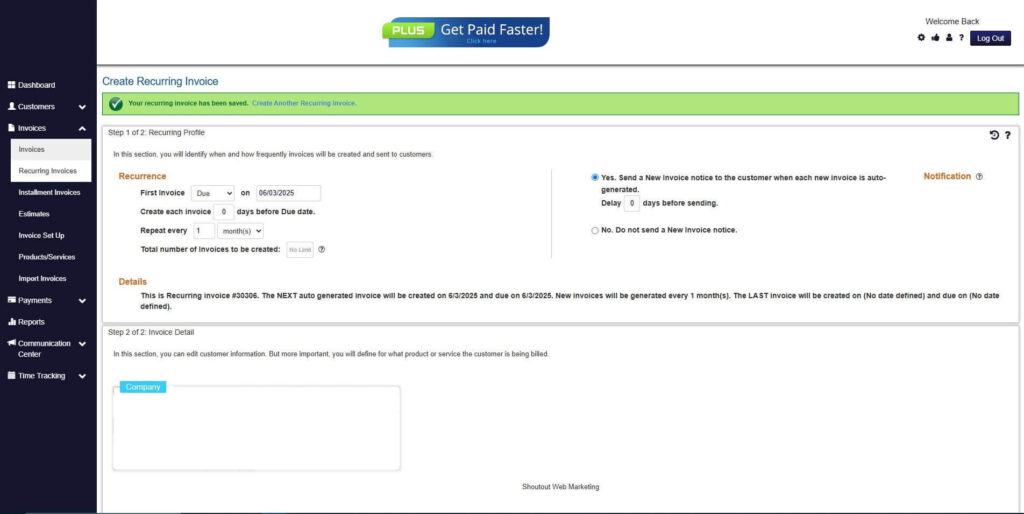

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Conclusion

Understanding what is a tax invoice is crucial for every business that sells taxable products or services. It’s not just a document but a vital record that ensures compliance, professionalism, and accuracy in your financial operations.

With automated invoicing platforms like ReliaBills, you can simplify the process of creating tax invoices, reduce manual work, and maintain compliance effortlessly.

Start issuing professional, accurate, and automated tax invoices today with ReliaBills and experience the benefits of a smarter billing system for your business.