Close the BIG deals with Installment Invoicing.

Don’t confuse installment billing with recurring billing. Installment billing is designed

to help you close the big deals by giving your customers payment flexibility. Below are

6 KEY differences between Recurring billing and Installment billing.

Recurring

Installment

Large purchases: vehicles, website design/builds, landscape projects, etc.

Yes. Specifically defined at start of billing. May include finance fees or charges.

May be fixed or variable based on usage or services.

Fixed. Although first and last payment may vary based on down payments or finance fees and charges.

Applied to the final or last open invoice.

Typically undefined. Ongoing until service is terminated.

Fixed and pre-defined.

5. Invoice Generation

Invoices are automatically generated one at a time according to schedule and services.

Invoices are pre-generated. Allows customer to see remaining peayments and balance due.

Unspecified. Billing continues as long as service is rendered.

Specifically defined based on number of invoices or billings.

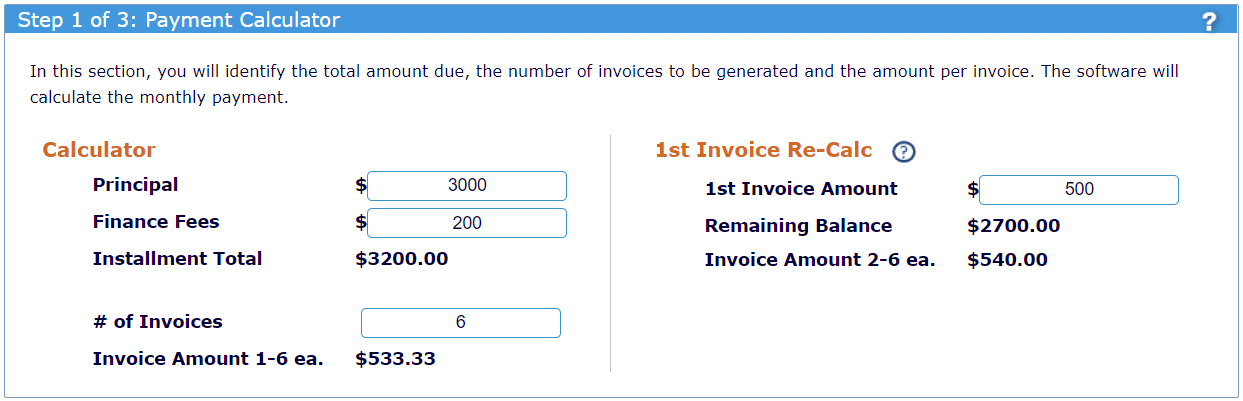

Payment Calculator

Easily calculate and create each payment amount based on principle, fees, number of payments and amount of down payment.

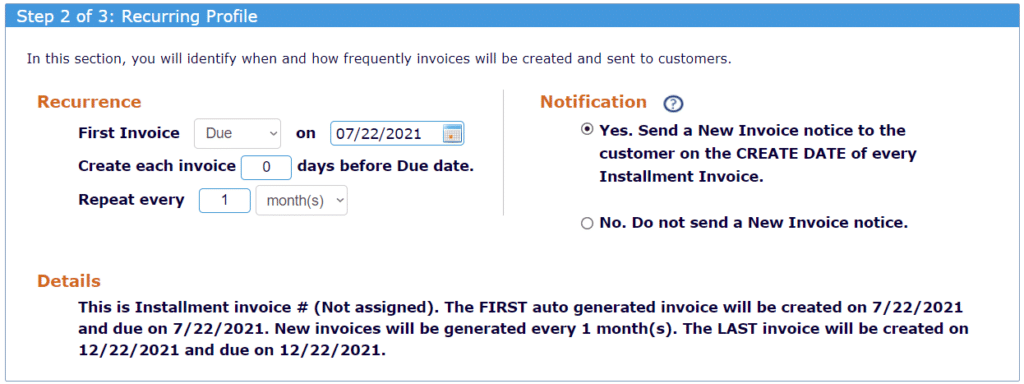

Recurring Profile

Define how frequently invoices will be auto-generated and how they will be sent.

Side by Side

To see a side by side comparison of Recurring versus installment set up, just click to watch a short video.