If you own a business, you understand that getting paid is essential to survive. This is especially true for small businesses that rely on prompt payments to maintain adequate cash flow. If you haven’t already deal with a late-paying customer, chances are you will at some point in the future. Better understanding your customer and the reasons behind their late payments can help your business develop effective payment solutions and prevent late payments in the first place. In this first of three articles, we will highlight the reasons why your invoice isn’t getting paid.

Table of Contents

ToggleWhy Do Customers Pay Their Invoices Late?

There are a number of different reasons why a customer might pay an invoice late. To begin, it’s helpful to understand that there are significant differences between a B2B customer and a B2C customer. These areas of difference are often the same drivers of late payments. For example, reasons for a late payment from a B2B customer tend to be process-related, whereas B2C customer reasons tend to be personal matters.

B2B Reasons for Late Payments

Rigid Payables System

Most common with large corporations, these businesses may operate on a payment schedule that doesn’t line up with your own. For example, while your business might expect payment within a month, it’s possible that the corporation doesn’t send payments until the 60th day.

Multiple Approvals Required

While your business may have a simple structure with a streamlined approval process, it’s possible that your customer has a more complex structure. Sometimes a business requires multiple people or departments signing off before payment is sent out.

Different Data Requirements

Some companies have certain invoice data requirements that must be satisfied. These requirements may consist of a W-9 form, purchase order number (PO number), and more.

In-House Payable Terms

In some cases, it may not matter to a customer what terms you provide in your contract. They plan to pay on their own terms, a certain amount of days after receipt, regardless.

B2C Reasons for Late Payments

Cash Flow

It’s possible that your customer is having business issues of their own that are holding up the payment. They may have every intention of paying your invoice but are struggling to do so because of cash flow issues.

Invoice Accuracy Questions

Ensuring that you send an accurate and timely invoice will help you get paid sooner. Inaccuracies can lead to questions and disputes, which will draw out the payment process.

Low Priority

While ensuring quick receipt of payment might be a top priority to your business, making that payment may be low on the priority list of your customer.

Questions Regarding Work Performed

From time to time, a customer may find your work unsatisfactory and withhold payment as a result. In this scenario, it is best to try and work out a solution with the customer.

Misplaced or Never Received Invoice

In some cases, a customer may have misplaced your invoice or never received it in the first place. Whether a one-time slip or recurring problem, mishandling and mistakes can set you back.

Simple Deadbeat

No beating around the bush here. Sometimes you simply run into a deadbeat customer that never had any intention of paying. This customer may be difficult to identify early on.

Apart from impacting your company’s current bottom line, late payments hurt your efficiency and ability to grow in the future. Tracking down payments from customers is a hassle that eats away at your time, attention, and resources, all of which would be better served focusing on bigger matters. In the next article of this series, we will cover late payment solutions for your B2C customers.

Utilizing recurring billing software can save you time, simplify your process, and avoid many late payment problems altogether. If you are interested in learning more about how recurring billing software can address late payments for your business, contact ReliaBills at 1.877.93BILLS (877.932.4557) or sales@reliabills.com.

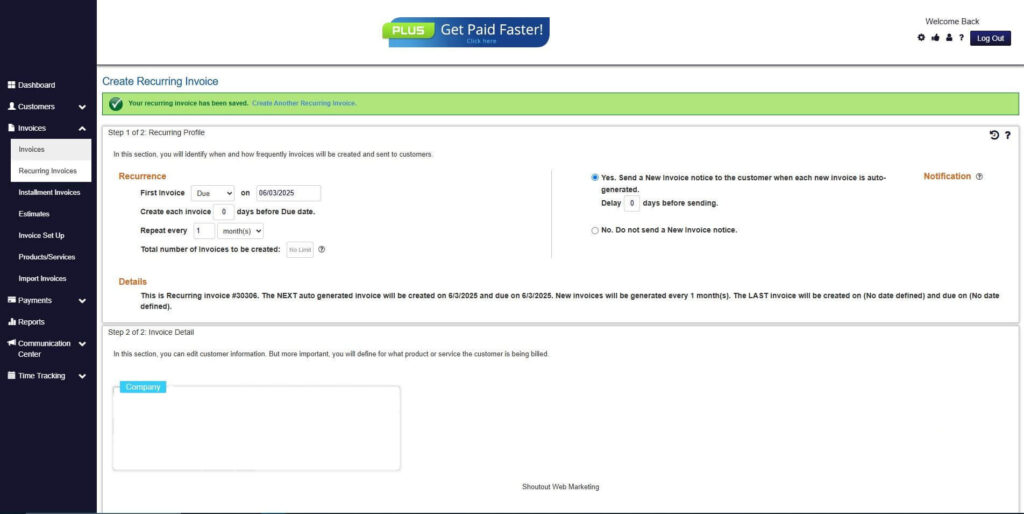

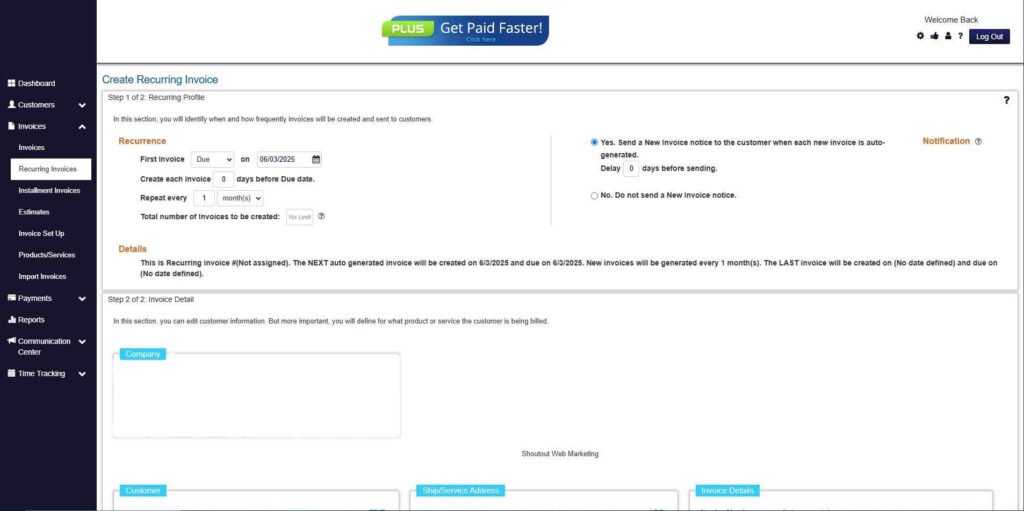

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

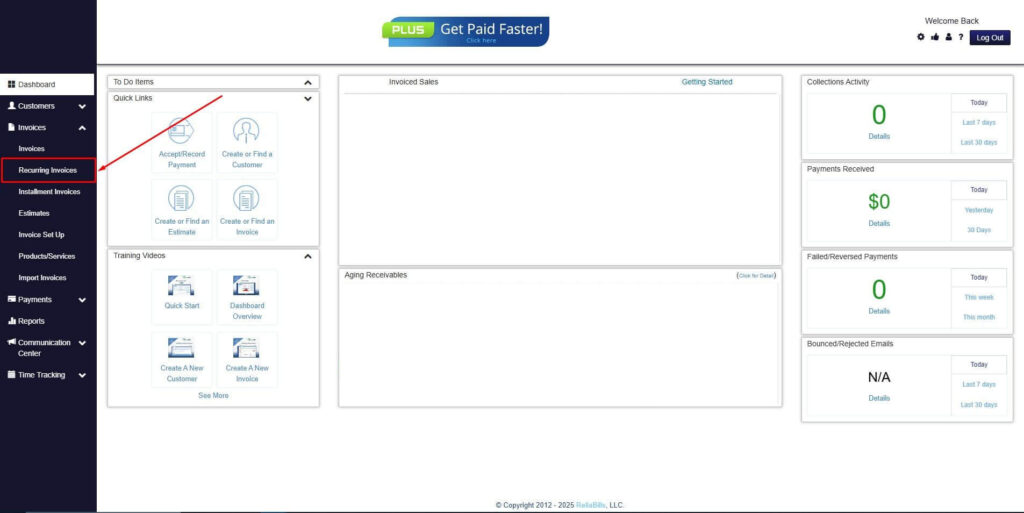

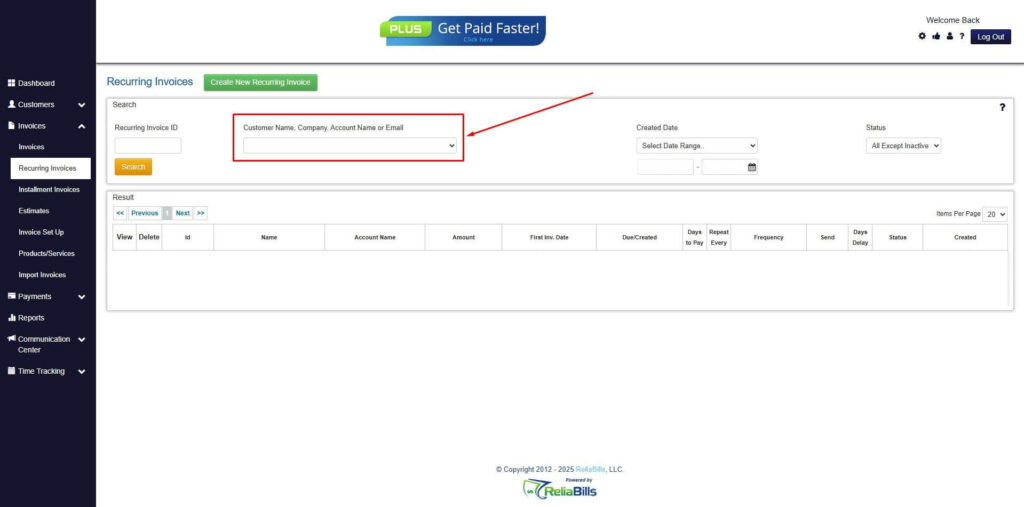

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

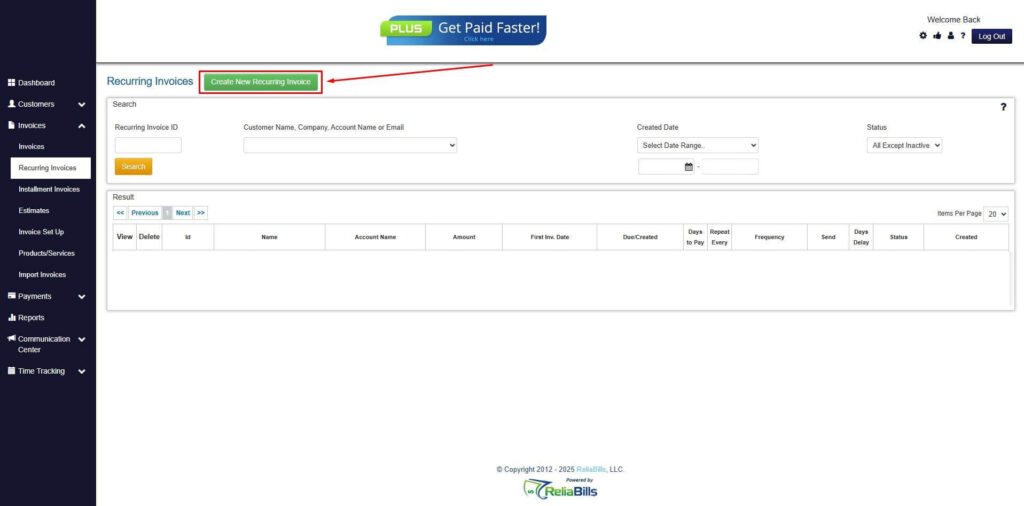

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

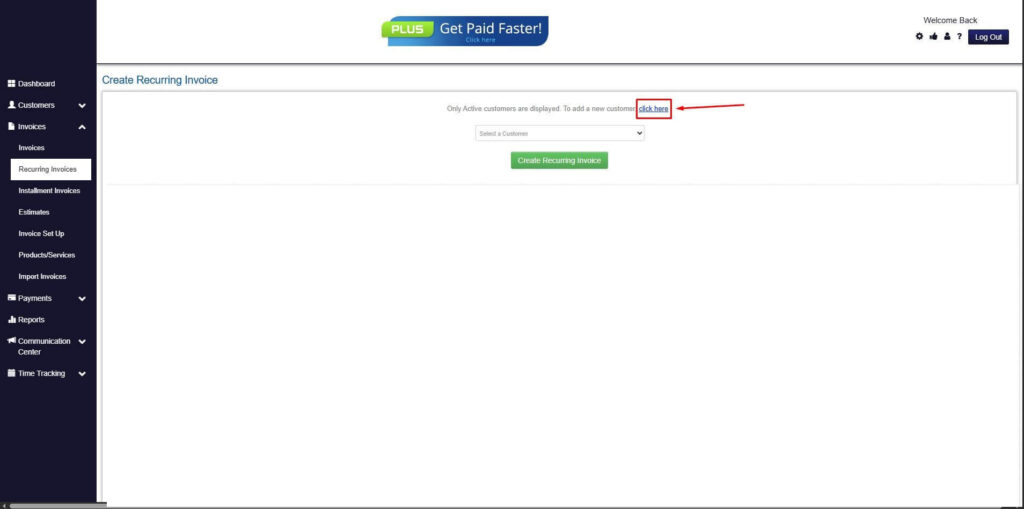

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

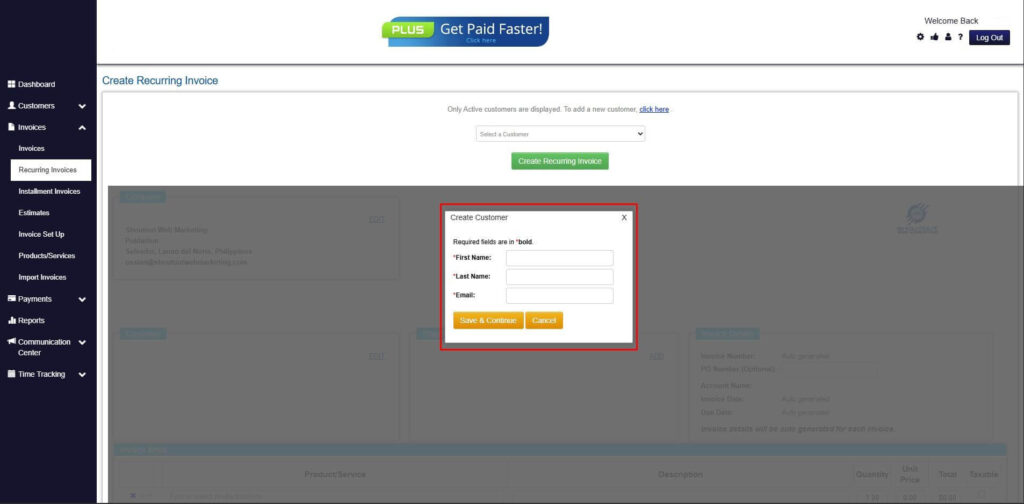

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

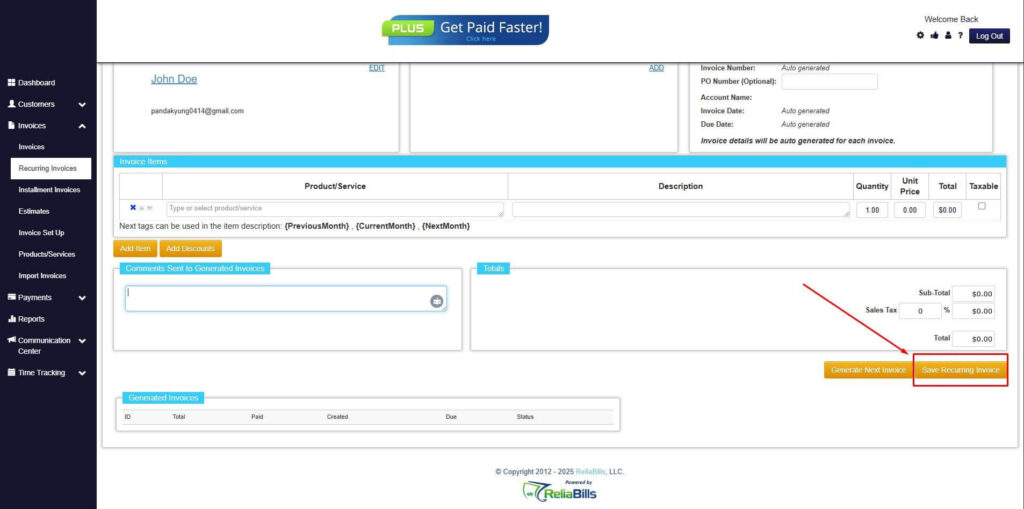

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

Your Recurring Invoice has been created.