Clear invoices play a major role in getting paid on time. When invoices are easy to read and understand, clients can process them faster without asking follow up questions. This directly reduces delays and improves cash flow for businesses.

Unclear or poorly structured invoices often lead to confusion, disputes, and late payments. Missing details, vague descriptions, or inconsistent formatting can frustrate clients. These issues slow down approvals and damage professional relationships.

This guide shares practical tips for writing invoices that are clear, accurate, and easy to act on. You will learn how to structure invoices properly, avoid common mistakes, and improve payment speed. These tips for writing invoices are useful for businesses of all sizes.

Table of Contents

ToggleWhat Makes an Invoice Clear and Effective

A clear and effective invoice is well structured and easy to scan. Important details such as totals, due dates, and payment instructions should stand out immediately. Clients should not have to search for critical information.

Transparency and accuracy are equally important in invoice creation. Every charge should be explained clearly and match agreed pricing or contracts. Accurate invoices build confidence and reduce the chance of disputes.

Clarity also impacts customer trust and how quickly payments are made. When clients understand exactly what they are paying for, they are more likely to pay promptly. Clear invoices signal professionalism and reliability.

Tip 1: Use a Simple and Consistent Invoice Layout

A simple layout helps clients process invoices quickly. Information should follow a logical order, starting with business details and ending with payment instructions. White space improves readability and reduces visual clutter.

Consistency across invoices is just as important as simplicity. Using the same layout, fonts, and branding makes invoices familiar and easy to recognize. This reduces confusion for repeat clients.

Invoices that are easy to scan are more likely to be approved quickly. Clear headings and aligned sections guide the reader naturally. This is one of the most effective tips for writing invoices that get paid faster.

Tip 2: Include Complete Business and Client Information

Every invoice should clearly display your business name, logo, and contact details. This reassures clients that the invoice is legitimate and professional. It also makes it easy for them to reach you with questions.

Client information should be equally complete and accurate. Include the client’s name, billing address, and any account or reference numbers. Proper identification prevents misdirected or delayed payments.

Accurate business and client details reduce processing errors. Many accounting teams rely on these details for internal approvals. Missing information can cause unnecessary delays.

Tip 3: Clearly Label Invoice Numbers and Dates

Invoice numbers help both parties track and reference payments. Each invoice should have a unique number that follows a consistent sequence. This simplifies communication and record keeping.

Dates are just as important as invoice numbers. Always include the issue date and the due date in a visible location. Clear payment terms remove guesswork for clients.

Avoid confusion by aligning invoice dates with billing cycles. This is especially important for recurring or subscription based services. Clear labeling supports faster approvals and payments.

Tip 4: Provide Clear Descriptions of Products or Services

Every charge on an invoice should be itemized and described clearly. Vague labels can cause confusion and lead to disputes. Clients should understand exactly what each line item represents.

Avoid generic descriptions whenever possible. Specific service names, quantities, or time periods improve transparency. This makes invoices easier to review and approve.

When applicable, link charges to contracts or agreements. Reference project names or service periods clearly. This reinforces trust and reduces questions.

Tip 5: Break Down Costs and Totals Transparently

Transparent cost breakdowns help clients understand how totals are calculated. Subtotals, taxes, discounts, and fees should be shown separately. This improves clarity and reduces misunderstandings.

The total amount due should stand out visually. Clients should not have to calculate totals themselves. Clear presentation speeds up payment processing.

Transparency also helps prevent disputes. When clients see exactly how charges add up, they are less likely to question the invoice. This is a key principle in effective invoice writing.

Tip 6: Clearly State Payment Terms and Accepted Methods

Payment terms should be written clearly and placed where clients can easily find them. This includes due dates, late fees, and any penalties. Clear terms set expectations from the start.

Accepted payment methods should also be listed. Let clients know if you accept bank transfers, cards, or digital payments. This removes friction from the payment process.

Providing simple payment instructions further improves clarity. The easier it is to pay, the faster payments are received. This is one of the most practical tips for writing invoices.

Tip 7: Highlight Important Notes and Policies

Important notes and policies should be clearly highlighted on the invoice. This may include late fees, refund terms, or return policies. Clients should not have to search for this information.

Dispute resolution guidelines are also helpful to include. Clear instructions reduce frustration if questions arise. This shows professionalism and preparedness.

Always include contact information for billing support. Clients appreciate knowing who to reach out to. Clear communication reduces delays and builds trust.

Tip 8: Use Digital Tools to Improve Invoice Clarity

Digital invoicing tools help standardize invoice formats. Pre built templates ensure consistency and reduce manual errors. This improves clarity across all invoices.

Automation also reduces the risk of missing information. Invoice numbers, dates, and totals are generated automatically. This improves accuracy and efficiency.

Using digital tools is one of the smartest tips for writing invoices at scale. As businesses grow, automation becomes essential for maintaining quality. Clear invoices support long term growth.

Common Mistakes to Avoid When Writing Invoices

Overcrowded invoice layouts make information hard to read. Too much text or poorly organized sections overwhelm clients. Simplicity is always more effective.

Missing or unclear payment instructions are another common issue. If clients do not know how or when to pay, delays are inevitable. Clear guidance prevents this problem.

Inconsistent formatting across invoices also causes confusion. Each invoice should follow the same structure and branding. Consistency builds trust and speeds up approvals.

How ReliaBills Helps Create Clear Invoices

ReliaBills provides pre built invoice templates designed for clarity and readability. These templates ensure all essential details are included and properly formatted. Businesses can send professional invoices with confidence.

Recurring billing is seamlessly supported within ReliaBills. Invoices are generated consistently for ongoing services, reducing manual work and errors. Automated reminders help ensure clients pay on time.

ReliaBills PLUS offers enhanced customization and advanced tracking features. It supports growing businesses that need more control and visibility over invoicing. With ReliaBills PLUS, clear invoicing scales effortlessly.

How to Create a New Invoice Using ReliaBills

Creating an invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

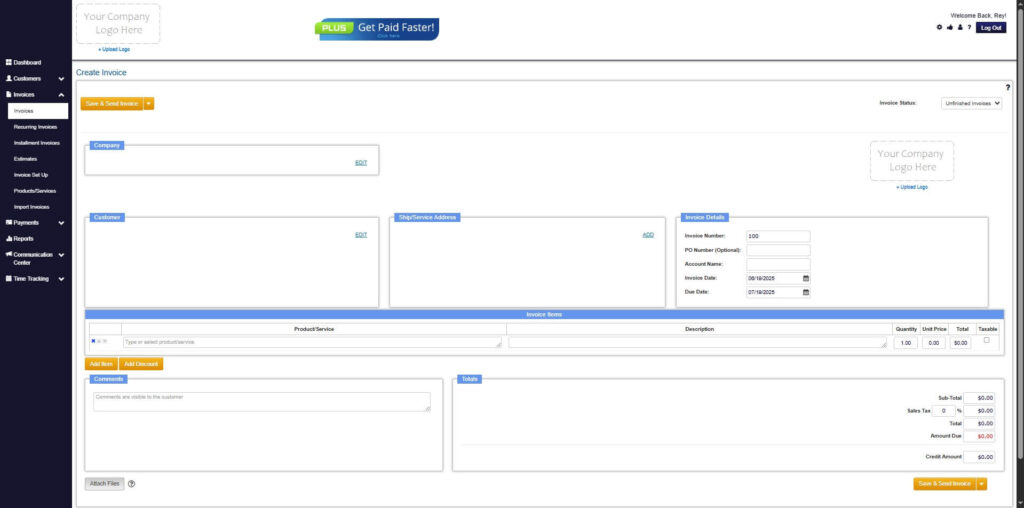

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

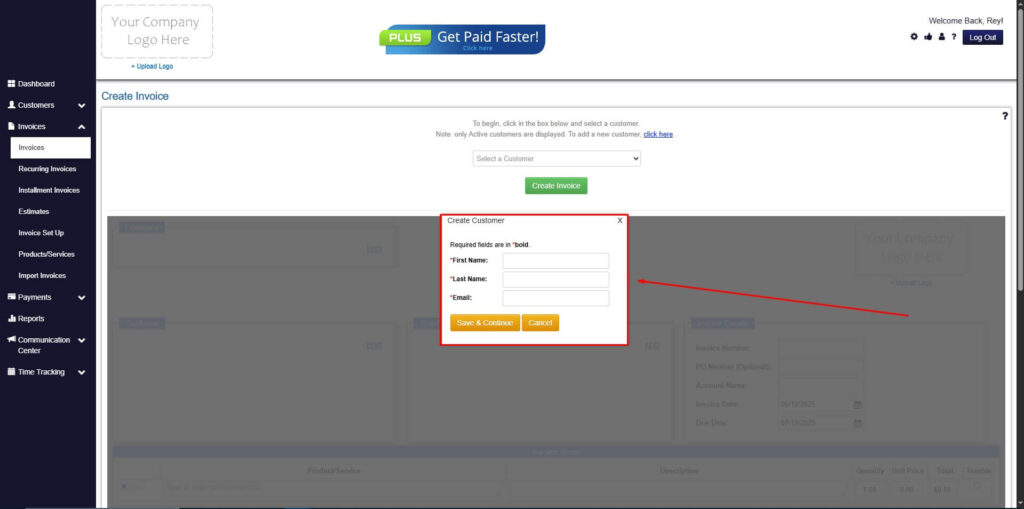

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

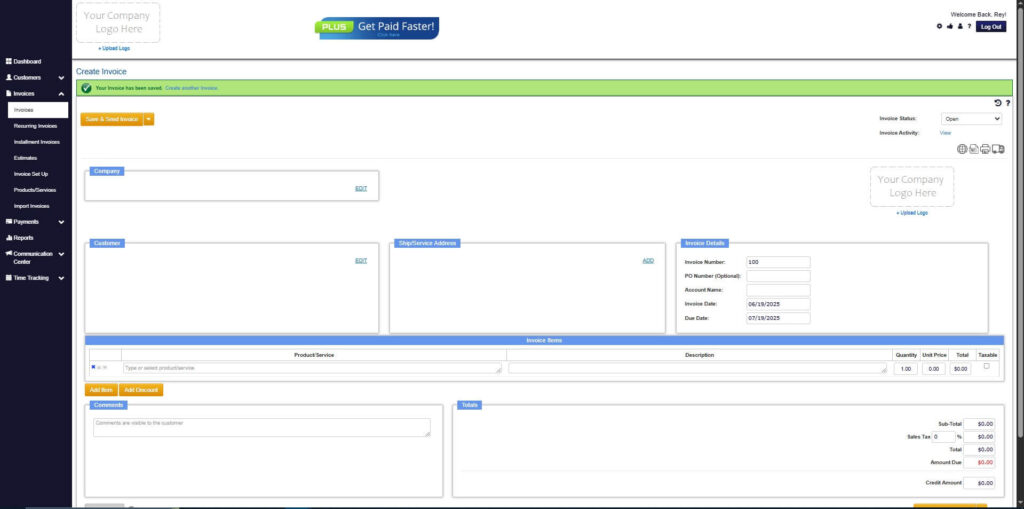

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

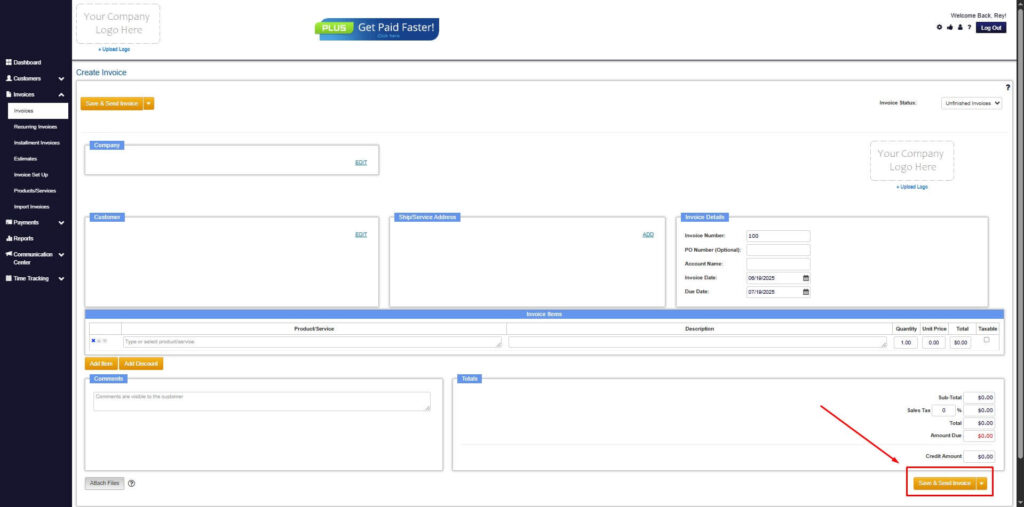

Step 7: Save Invoice

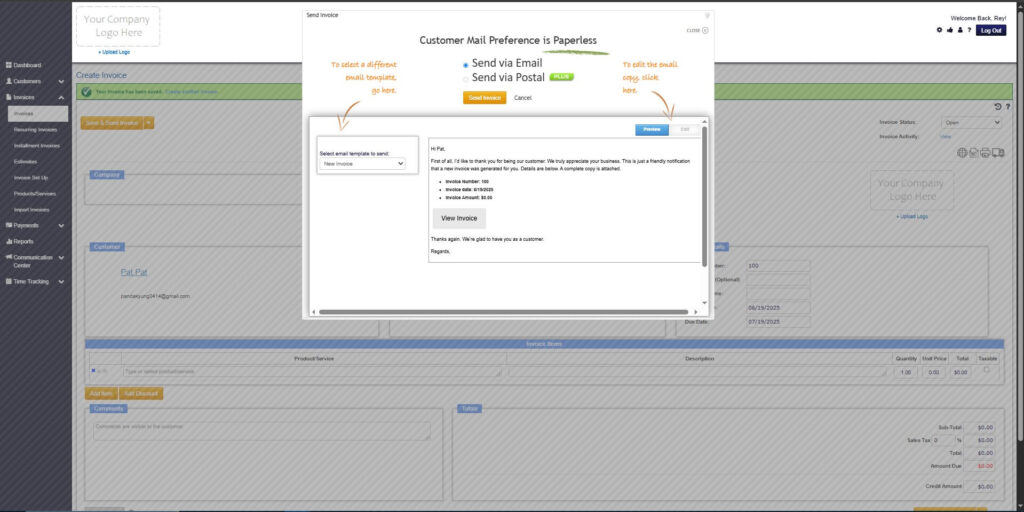

- After filling out the form, click “Save & Send Invoice” to continue.

Step 8: Invoice Created

- Your Invoice has been created.

Frequently Asked Questions

1. How detailed should an invoice be?

An invoice should be detailed enough to explain all charges clearly without overwhelming the reader.

2. Can clear invoices really improve payment speed?

Yes, clear invoices reduce questions and approvals, leading to faster payments.

3. Should invoices be customized per client?

Customization can help, especially for complex billing, as long as clarity is maintained.

Conclusion

Writing clear invoices is essential for getting paid on time and maintaining strong client relationships. Small improvements in layout, wording, and structure can make a big difference. These tips for writing invoices help reduce confusion and delays.

Consistency, transparency, and accuracy are the foundations of effective invoicing. When invoices are easy to understand, clients are more likely to pay promptly. Clear invoicing reflects professionalism and reliability.

By applying these tips and using the right tools, businesses can streamline their billing process. Over time, this leads to better cash flow and fewer disputes. Clear invoices support sustainable business growth.