A supplier invoice is one of the most important documents in business finance. It keeps your expenses organized, ensures vendors are paid correctly, and creates a record of every transaction. However, managing supplier invoices manually can be slow and error prone. As your business grows, automation becomes a valuable way to improve accuracy and reduce workload. Understanding how supplier invoices function and why automation matters helps small businesses stay financially healthy and efficient.

Table of Contents

ToggleWhat Is a Supplier Invoice?

A supplier invoice is a formal request for payment that a vendor sends after delivering goods or providing services. It includes essential details such as the supplier’s name, a description of what you purchased, quantities, prices, payment terms, and the total amount due. This document acts as an official record of your business expenses and plays a key role in managing accounts payable. Without accurate supplier invoices, it becomes difficult to track spending, organize financial data, or maintain proper documentation for reporting and tax purposes.

How Supplier Invoices Work

Supplier invoices follow a straightforward process. After receiving goods or completing a service, the supplier sends the invoice to your business. Your team then reviews the document to verify accuracy, compares it with purchase orders or delivery receipts, and approves it for payment. Once approved, the invoice is scheduled for payment based on the agreed-upon terms and recorded in your accounting system. When handled manually, this workflow often involves multiple emails, printed documents, and repeated data entry, which increases the risk of mistakes and delays.

Why Supplier Invoices Are Important

Supplier invoices are essential because they help maintain transparency and accuracy in business spending. They document exactly what was purchased, how much was owed, and when payments are due. This prevents overbilling, duplicate payments, and miscommunication with vendors. Supplier invoices are also important for budgeting, cash flow planning, and tax compliance. By keeping clear and accurate records, businesses can make better financial decisions, maintain trust with suppliers, and avoid costly accounting errors.

What Is Supplier Invoice Automation?

Supplier invoice automation uses technology to streamline the way invoices are received, processed, approved, and recorded. Instead of manually keying in data or tracking approvals through email, automation tools capture invoice details, route them to the right people, and update financial records automatically. This reduces human error and speeds up the accounts payable process, making it easier for businesses to stay organized and on schedule.

How to Automate Supplier Invoices

Automating supplier invoices typically involves using a digital invoicing platform or accounts payable system. The automation process often includes:

- Invoice Capture – Uploading or scanning invoices so the system can extract key information.

- Approval Routing – Automatically sending invoices to the correct team members for review.

- Payment Scheduling – Setting payment dates based on vendor terms.

- Data Syncing – Updating your accounting or bookkeeping software without manual entry.

- Alerts and Reminders – Notifying your team about pending approvals or upcoming deadlines.

This approach keeps your workflow consistent and reduces the need for repetitive manual tasks.

Benefits of Automating Supplier Invoices for Small Businesses

Supplier invoice automation offers several important benefits:

- Faster processing and fewer delays

- Less manual data entry

- Reduced risk of duplicate or incorrect payments

- More accurate financial records

- Better visibility into cash flow and due dates

- Stronger communication and relationships with suppliers

- More time for teams to focus on core business tasks

Automation provides small businesses with the structure and reliability they need to keep operations running smoothly.

How ReliaBills Can Help You Automate Invoices

ReliaBills helps small businesses simplify supplier invoice management by automating many of the steps that typically slow down accounts payable. With automated workflows, scheduled payments, and organized invoice tracking, you can ensure suppliers are paid on time while maintaining accurate financial records. ReliaBills also provides useful tools such as recurring billing, automated reminders, and approval routing, helping you stay on top of due dates and avoid missed payments.

The platform gives businesses clear visibility through real-time dashboards that show outstanding invoices, completed payments, and pending approvals. By reducing errors and eliminating manual processes, ReliaBills helps businesses maintain strong vendor relationships, improve efficiency, and keep cash flow steady. Using ReliaBills for supplier invoice automation allows small businesses to stay organized without spending hours managing paperwork.

How to Create a New Invoice Using ReliaBills

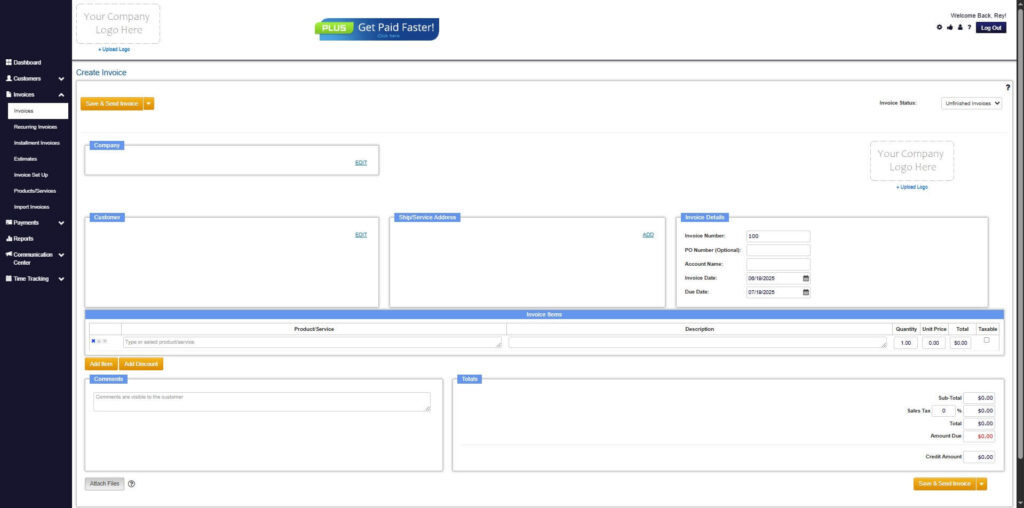

Creating an invoice using ReliaBills involves the following steps:

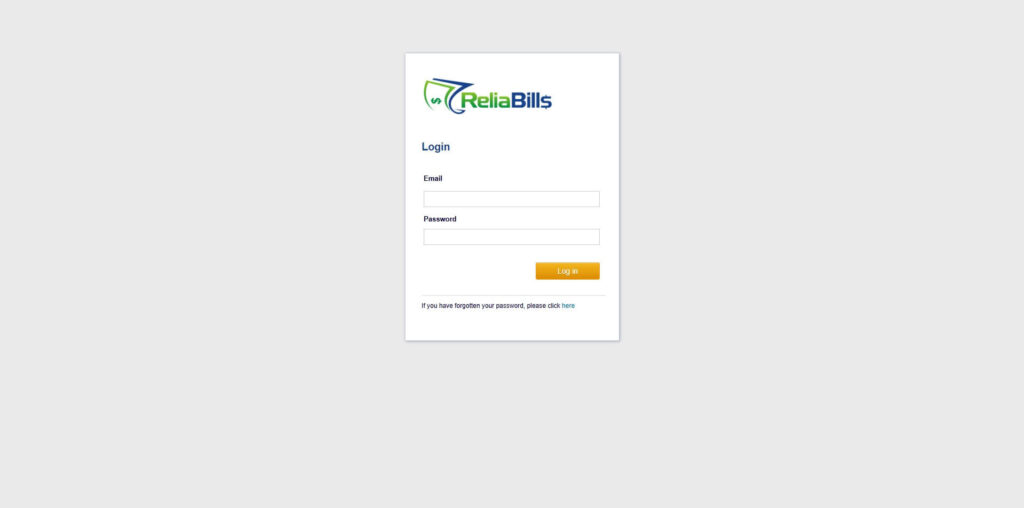

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

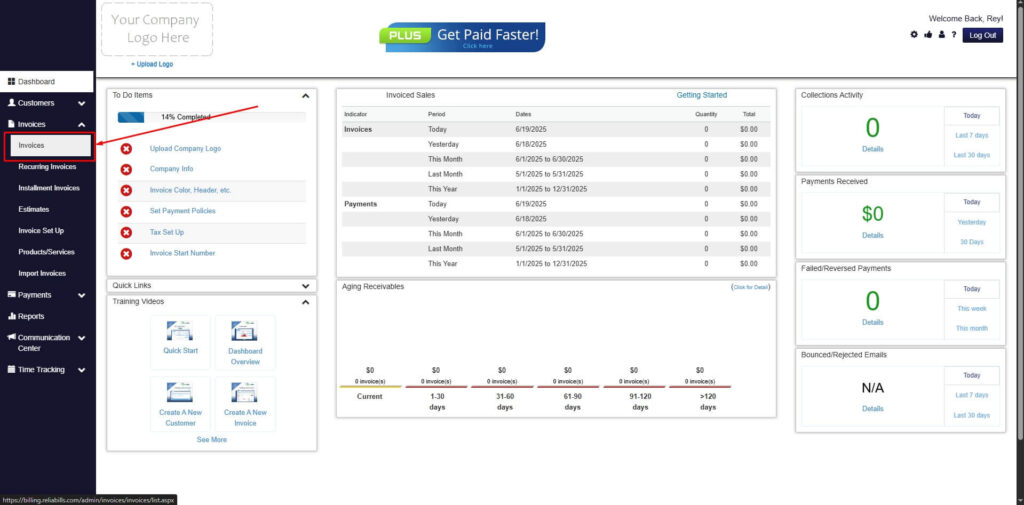

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

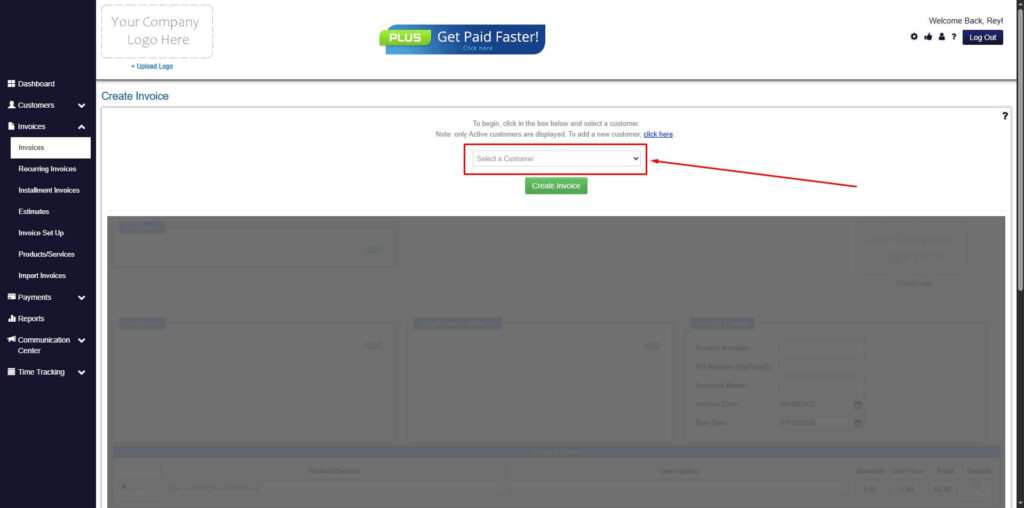

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

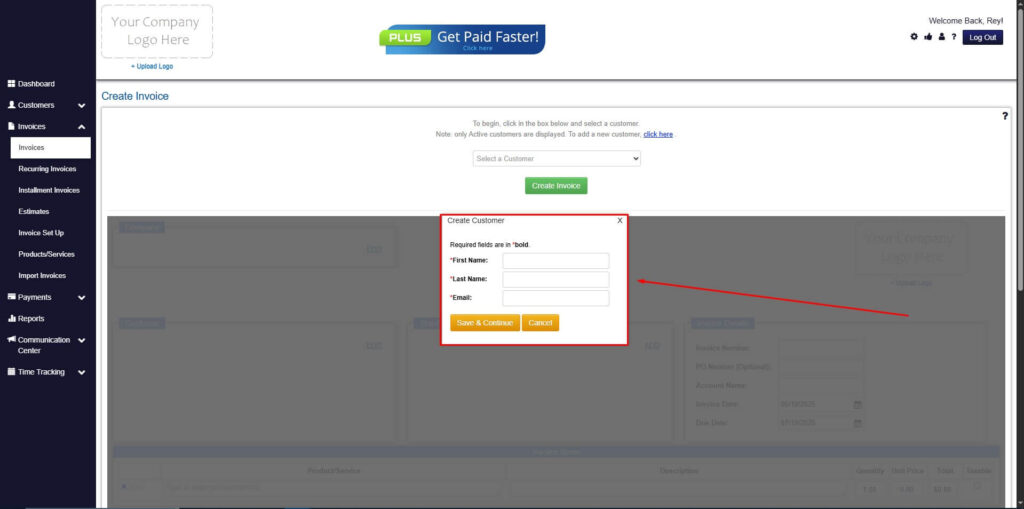

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

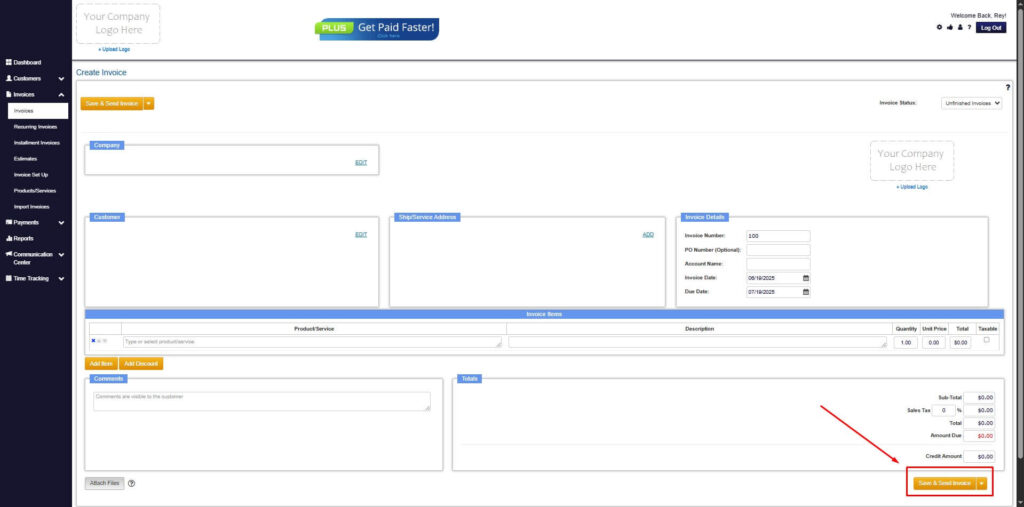

Step 7: Save Invoice

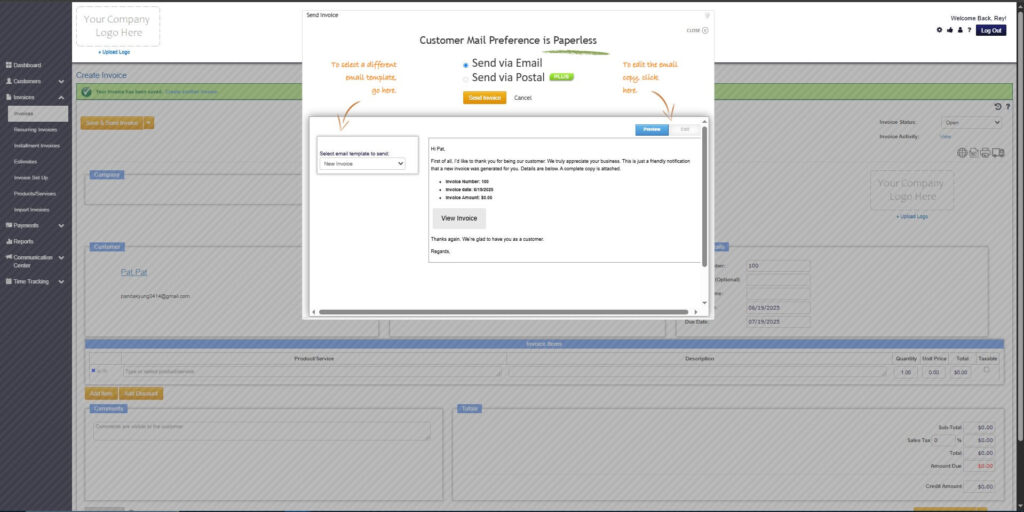

- After filling out the form, click “Save & Send Invoice” to continue.

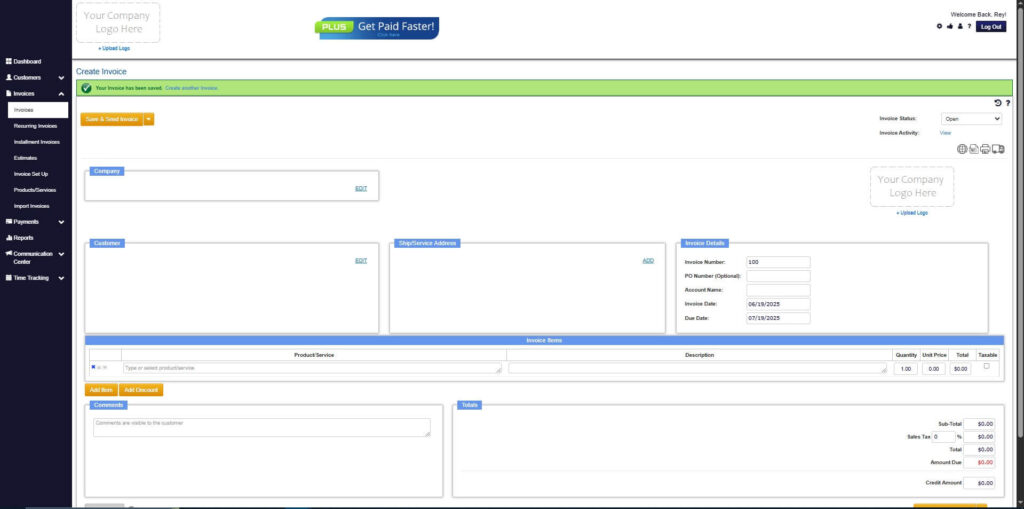

Step 8: Invoice Created

- Your Invoice has been created.

Frequently Asked Questions

1. What types of invoices can be automated?

Most supplier invoices can be automated, including service fees, product purchases, monthly contracts, and recurring vendor bills.

2. Does automation work with existing accounting tools?

Yes. Many automation platforms integrate with widely used accounting software.

3. Does automating supplier invoices reduce errors?

Yes. Automated data capture minimizes mistakes caused by manual entry.

4. Is it expensive to automate invoices?

No. Many platforms, including ReliaBills, offer affordable options geared toward small businesses.

Conclusion

Supplier invoices are essential for tracking expenses, managing payments, and maintaining organized financial records. However, manual invoice processing can lead to delays, errors, and inefficiencies. Automating your supplier invoice workflow makes it easier to process invoices accurately, pay vendors on time, and focus on growing your business. With tools like ReliaBills, small businesses can streamline their accounts payable systems, reduce errors, and improve financial control with ease.