If you are running your business as a sole trader, you already know how important it is to stay organized and manage your finances properly. One of the biggest responsibilities you must handle is creating sole trader invoices that are clear, accurate, and easy for your clients to understand. A professional invoice helps you get paid quickly, protects your business, and builds trust with your customers.

This beginner-friendly guide covers everything you need to know about creating sole trader invoices, what to include, and how to simplify the entire process using ReliaBills.

Table of Contents

ToggleWhat Do I Need to Include on a Sole Trader Invoice?

A professional sole trader invoice must include all essential details that help you bill clients correctly and get paid without delays. Every item on the invoice provides clarity and ensures both you and your client are on the same page.

Here are the details you should always include on sole trader invoices:

- Your name or business name

- Your business address, phone number, and email

- Your client’s name and contact details

- A unique invoice number for record keeping

- The invoice date and the payment due date

- A clear description of the goods or services provided

- The cost for each item or task completed

- The total amount due

- Applicable tax information, if required

- Your preferred payment methods

Adding complete information builds trust and reduces the possibility of disputes or late payments.

How Do I Write a Sole Trader Invoice?

Writing sole trader invoices is simple once you know what structure to follow. A clear and well-organized invoice helps clients understand what they are paying for and ensures you establish a professional impression.

Here is how to write a good sole trader invoice:

- Begin by adding your business name and branding at the top of the invoice. This creates a polished and consistent look.

- List your client’s name and their contact information.

- Insert a unique invoice number, along with the invoice issue date and due date.

- Provide a detailed list of the products or services you delivered. Describe each item clearly so the client understands the value of the work performed.

- Include the price of each item and calculate the total amount owed.

- Specify all accepted payment options.

- Add any important notes, such as policy reminders or thank-you messages.

If possible, use invoicing software like ReliaBills to simplify the process and make your sole trader invoices look clean and professional.

What Bank Details Are Needed on an Invoice?

If you want clients to pay directly to your bank account, your sole trader invoices should provide complete and accurate bank details. Missing or incorrect information may result in delayed payments.

Here are the bank details you should include:

- Your account name

- Your account number

- Your bank name

- Your branch information if necessary

- Your IBAN or SWIFT code for international payments

By including these details in every invoice, your clients can pay you quickly and securely.

Why Should You Use ReliaBills

As a sole trader, your time should be focused on running your business, not manually creating invoices or tracking payments. ReliaBills makes invoicing easier, faster, and more reliable.

Here is why ReliaBills is ideal for creating sole trader invoices:

- It allows you to create professional invoices that reflect your business identity.

- It provides automatic invoice reminders so you do not have to follow up manually.

- It supports multiple payment methods that help clients pay conveniently.

- It offers recurring billing features that save time for ongoing or repeat services.

- It keeps all your invoices organized in one place for easier financial tracking.

ReliaBills gives sole traders the tools they need to manage billing efficiently and avoid common payment issues.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

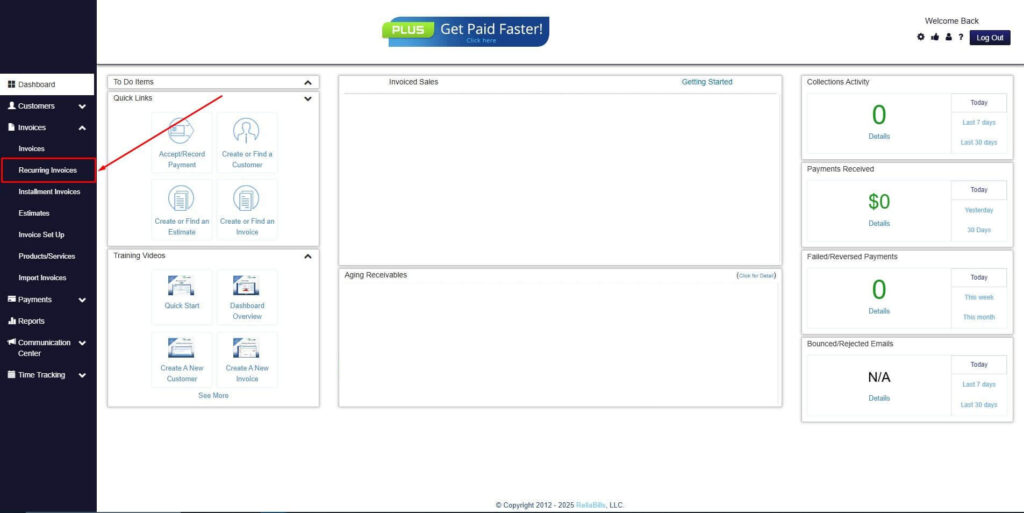

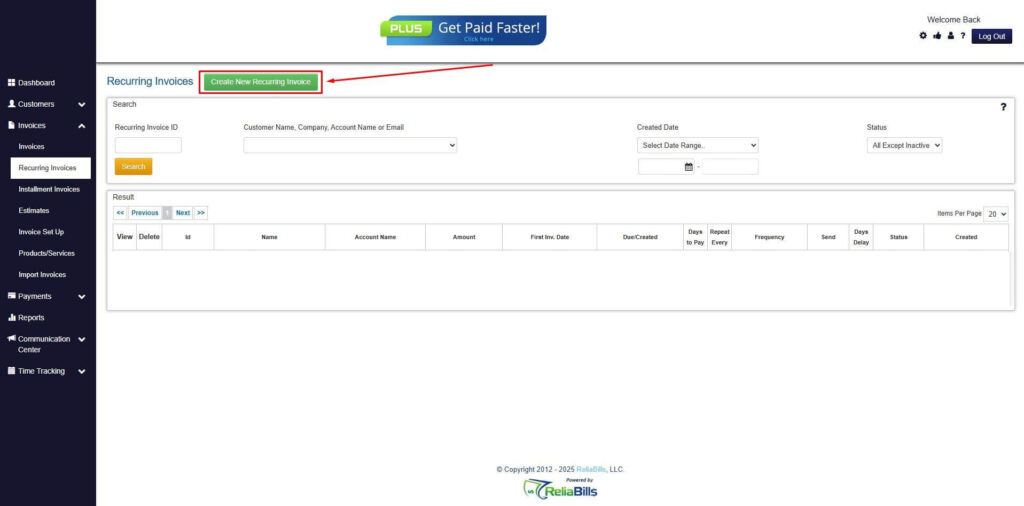

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

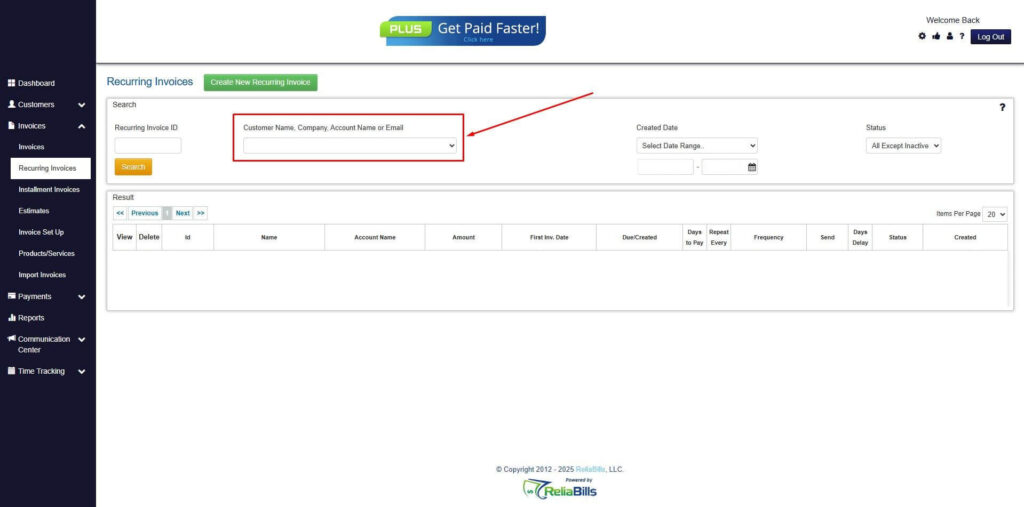

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

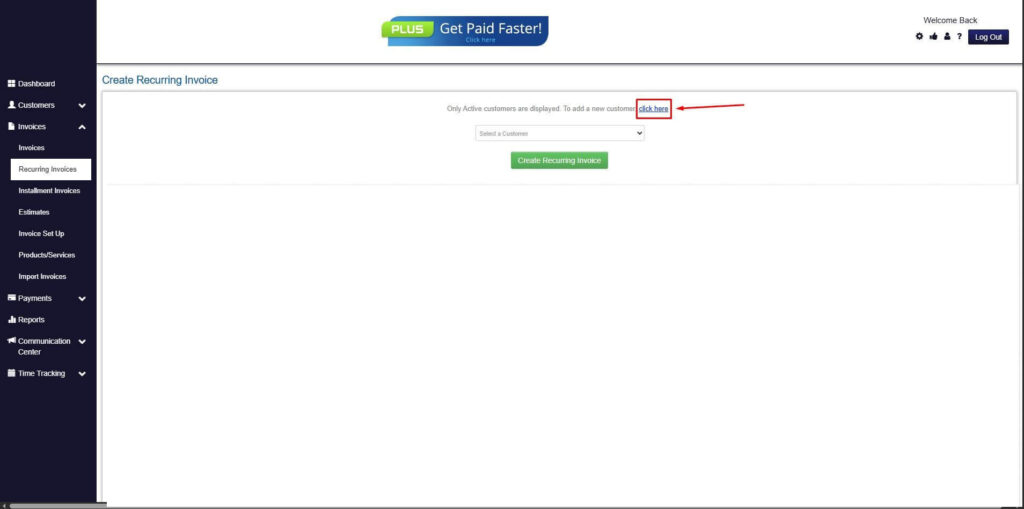

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

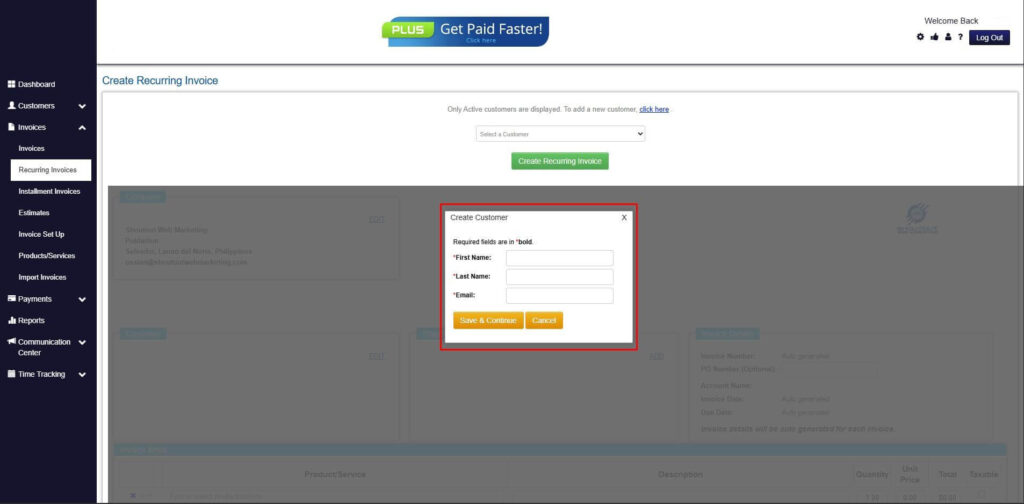

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

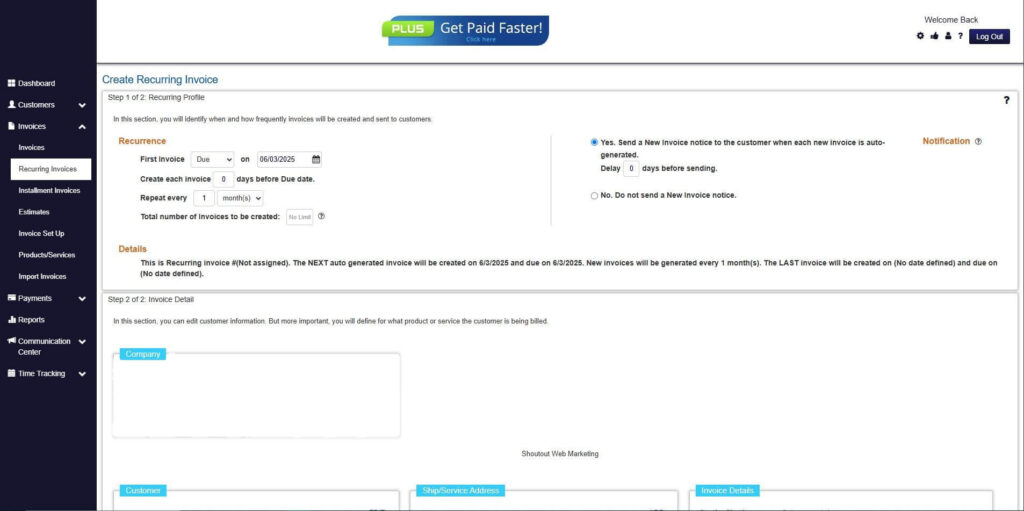

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

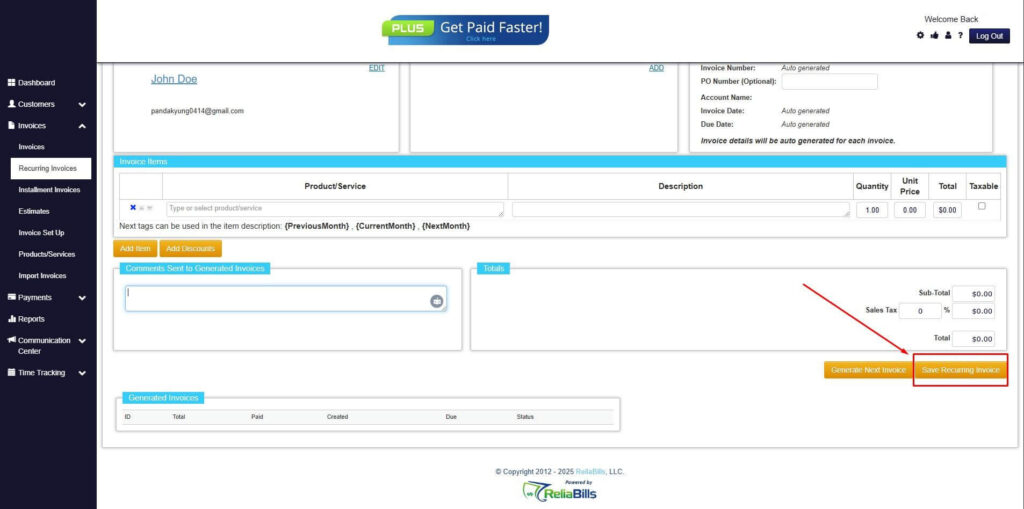

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

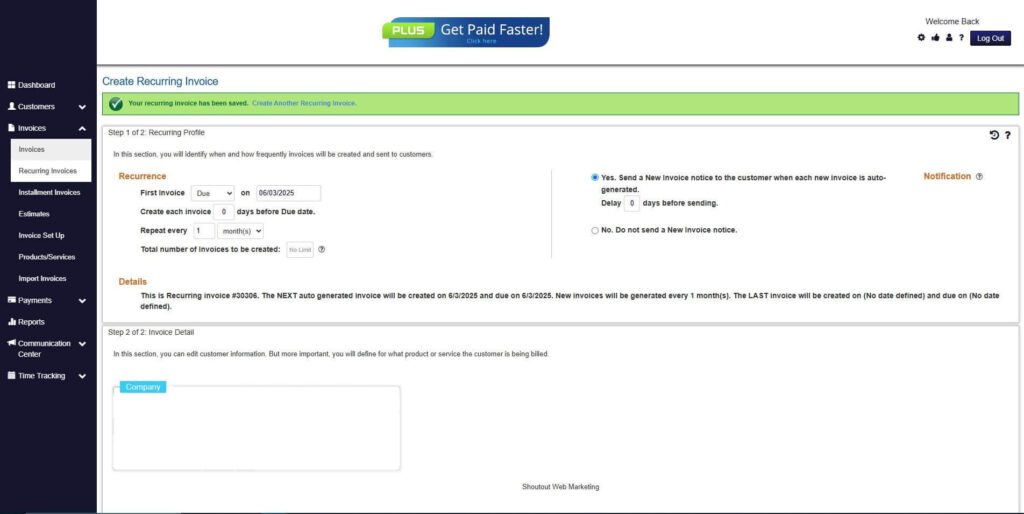

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Do sole traders need to include tax information on invoices?

Yes, if you are required to collect tax in your region. Always check your local tax rules to ensure accuracy.

2. Can I send sole trader invoices electronically?

Absolutely. Sending invoices online is faster and more efficient, especially when using ReliaBills.

3. Do I need a business name to issue an invoice?

No. Sole traders can invoice under their personal name, although using a business name adds professionalism.

4. Is invoicing software necessary?

While not required, it saves time and reduces errors. It also makes your invoices look more professional.

5. What happens if a client does not pay my invoice?

You may send reminders, apply late fees if stated in your terms, or escalate the matter based on your business policies.

Conclusion

Creating clear and complete sole trader invoices is essential for maintaining smooth cash flow and presenting yourself as a reliable professional. By knowing what information to include and how to structure your invoices, you increase the likelihood of being paid on time.

Using ReliaBills can make this process even easier. With automated reminders, recurring billing, and professionally designed templates, ReliaBills helps sole traders save time and improve payment efficiency. Start simplifying your invoicing today and focus more on growing your business.