Payroll is one of the most fundamental responsibilities of running a small business. It directly affects employees, government compliance, and overall financial health. When payroll is handled correctly, employees feel secure, operations run smoothly, and the business maintains a professional reputation. When payroll goes wrong, the consequences can be immediate and costly.

For small business owners, payroll often competes for attention with sales, customer service, and daily operations. Many owners manage payroll themselves, which increases the risk of errors due to time constraints or lack of specialized knowledge. Even small inconsistencies can lead to employee dissatisfaction or regulatory penalties.

This guide explains what payroll is, how small business payroll works, and why it matters more than many owners realize. It also covers common challenges, compliance requirements, and how predictable cash flow through automated invoicing and recurring billing can support reliable payroll management.

Table of Contents

ToggleWhat Is Payroll?

Payroll is the process of calculating, distributing, and recording employee compensation for work performed during a specific pay period. This includes determining gross wages, applying deductions, withholding taxes, and delivering net pay to employees accurately and on time.

In small business payroll, the process often includes wages or salaries, payroll taxes, benefits contributions, reimbursements, and legally required deductions. Each of these components must be calculated correctly and documented properly to avoid errors or compliance issues.

Payroll is sometimes confused with compensation, but the two are not the same. Compensation refers to the overall value of what an employee earns, including salary, bonuses, and benefits. Payroll focuses on the operational process of paying employees and managing related financial and tax obligations.

How Payroll Works in a Small Business

Payroll in a small business follows a recurring cycle, typically weekly, biweekly, or monthly. The cycle begins with tracking employee work hours or confirming salaried pay. Accurate time tracking is especially important for hourly employees, as even small errors can impact paychecks and create disputes.

Once time and wages are confirmed, payroll taxes and deductions are calculated. These may include federal income tax, Social Security, Medicare, state taxes, and benefit contributions. Small business payroll requires attention to detail, as tax rates and requirements can change.

The final step is distributing payments to employees through direct deposit, checks, or digital payment platforms. Each payroll run must also be recorded for accounting, reporting, and compliance purposes. Proper documentation ensures transparency and supports audits or employee inquiries.

Why Payroll Matters for Small Businesses

Payroll plays a critical role in employee trust and satisfaction. Employees depend on consistent and accurate pay to manage their personal finances. When payroll is late or incorrect, it quickly damages morale and can increase turnover.

Payroll accuracy is also essential for legal and regulatory compliance. Small business payroll must meet labor laws and tax requirements at the federal, state, and sometimes local level. Noncompliance can lead to fines, penalties, and legal disputes that small businesses are often unprepared to handle.

In addition, payroll affects financial planning and cash flow. Payroll is usually one of the largest recurring expenses for small businesses. Without proper planning and predictable income, meeting payroll obligations can become stressful and disruptive to operations.

Key Payroll Components

Payroll is made up of several interconnected components that must work together to ensure employees are paid correctly and on time. Understanding each element helps small businesses avoid errors and maintain compliance.

Employee Classification

Employees are typically classified as hourly, salaried, or contract workers. Correct classification affects overtime eligibility, tax withholding, benefits, and legal obligations. Misclassification can lead to penalties and back pay issues.

Gross Wages and Salary Calculations

This includes base pay, overtime, commissions, bonuses, and shift differentials. Accurate time tracking and rate calculations are essential to prevent underpayment or disputes.

Payroll Taxes and Deductions

Payroll includes withholding federal, state, and local taxes, as well as Social Security and Medicare contributions. Other deductions may include retirement contributions, health insurance premiums, and wage garnishments.

Benefits and Reimbursements

Benefits such as paid time off, health insurance, and retirement plans are often tied to payroll. Reimbursements for travel or work expenses must also be recorded properly to maintain accurate payroll records.

Recordkeeping and Reporting

Payroll records must be stored securely and retained for required time periods. These records support audits, tax filings, and employee inquiries.

Payroll Compliance Requirements

Payroll compliance ensures that a small business follows all labor and tax laws related to employee compensation. Noncompliance can result in fines, penalties, and legal exposure.

Federal Payroll Tax Obligations

Businesses must withhold and remit federal income tax, Social Security, and Medicare taxes. Employers are also responsible for paying their portion of payroll taxes and filing required forms such as Form 941 and Form W-2.

State and Local Payroll Requirements

Many states and municipalities have additional tax withholding rules, wage laws, and reporting requirements. These may include state income tax, disability insurance, or local payroll taxes.

Minimum Wage and Overtime Laws

Payroll must comply with minimum wage standards and overtime regulations under labor laws. These rules can vary by location and employee classification.

Filing Deadlines and Reporting Forms

Payroll taxes and reports must be submitted on time to avoid penalties. Missing deadlines can quickly add interest charges and compliance risks.

Employee Pay Transparency and Documentation

Pay stubs, wage statements, and earnings breakdowns must be accurate and accessible to employees, supporting trust and legal compliance.

Common Payroll Challenges for Small Businesses

Manual payroll processing is one of the most common challenges. Spreadsheets and manual calculations increase the risk of errors, especially as the business grows.

Missed tax deadlines are another frequent issue, particularly for businesses without dedicated payroll staff. Employee classification problems also arise when roles change or the business expands.

As small businesses grow, payroll becomes more complex. More employees, benefits, and compliance rules require better systems and processes to maintain accuracy and efficiency.

Payroll Solutions for Small Businesses

Manual payroll processing may work in very small operations, but it becomes inefficient and risky over time. Errors are harder to catch and correct.

Payroll software offers automation, tax calculations, and reporting tools that reduce errors and save time. These systems improve accuracy but still require proper setup and oversight.

Outsourcing payroll services is another option. While it reduces internal workload, it can be costly and may limit flexibility for small business owners.

Managing Payroll Cash Flow

Cash flow plays a major role in small business payroll. Even profitable businesses can struggle if revenue timing does not align with payroll schedules.

Aligning payroll with incoming revenue helps reduce financial strain. Predictable income allows business owners to plan payroll confidently and avoid last-minute funding gaps.

Automated invoicing and recurring billing support payroll stability by creating consistent payment schedules. When revenue is reliable, payroll becomes easier to manage and less stressful.

Best Practices for Small Business Payroll

Following payroll best practices helps small businesses reduce errors, stay compliant, and improve employee satisfaction.

Establish Clear Payroll Schedules

Set consistent pay periods and communicate them clearly to employees. Predictable payroll schedules support financial planning for both the business and its staff.

Maintain Accurate And Up-to-Date Records

Keep employee information, tax forms, and payroll data current. Regular reviews reduce the risk of outdated or incorrect payroll processing.

Separate Payroll Duties When Possible

Assigning different payroll tasks to different roles helps reduce errors and fraud, even in small teams.

Conduct Regular Compliance Reviews

Laws and tax rates change frequently. Periodic reviews ensure payroll practices remain aligned with current regulations.

Leverage Automation and Financial Tools

Automation reduces manual calculations and improves accuracy. Predictable revenue from automated invoicing and recurring billing can also help ensure payroll obligations are consistently funded.

How ReliaBills Helps Small Businesses Stay Payroll-Ready

ReliaBills helps small businesses build stronger payroll readiness by improving visibility into their incoming revenue. By automating invoice creation and sending, the platform ensures that invoices go out promptly and consistently, reducing the risk of delayed payments that can disrupt payroll cycles. Automated reminders and notifications further encourage timely client payments, which strengthens cash flow planning and makes it easier to predict when funds will be available for payroll and other recurring expenses.

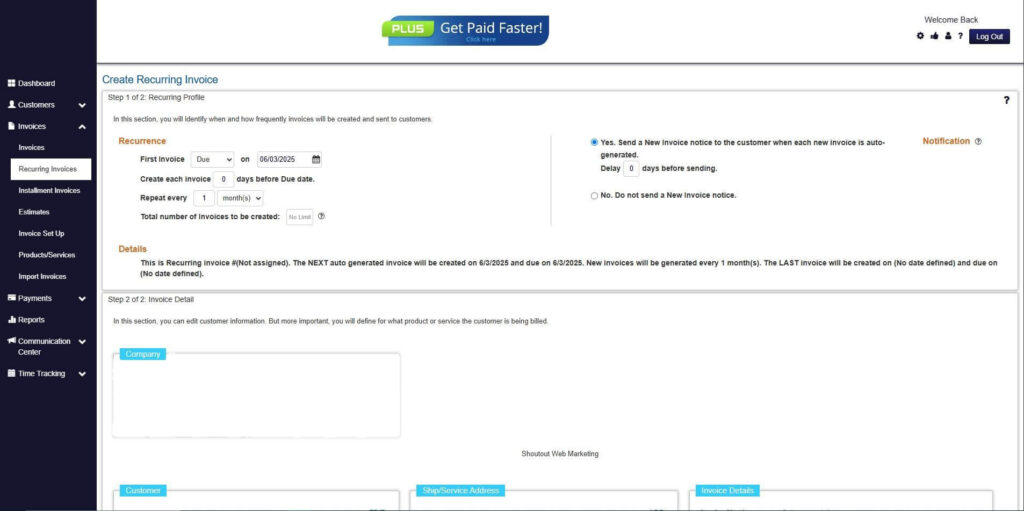

A core feature that supports payroll stability is ReliaBills’ recurring billing system. Instead of generating invoices manually each period, businesses can set up recurring invoices once and allow the system to handle them automatically. This recurring billing automation ensures that ongoing services, memberships, or subscription fees are charged on schedule, helping create a predictable income stream. With consistent revenue coming in, small business owners avoid cash shortfalls when it’s time to run payroll, providing greater confidence in meeting employee compensation commitments.

ReliaBills also provides detailed financial tracking and reporting tools that offer insight into accounts receivable, outstanding invoices, and payment history. These reports help business owners forecast cash flow and align payroll schedules with expected income. For small businesses managing fluctuating revenue, this visibility is critical for making informed decisions about hiring, pay cycles, and budget allocation. Together with automated invoicing and recurring billing, ReliaBills supports payroll readiness by helping businesses maintain reliable revenue flow and financial clarity.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

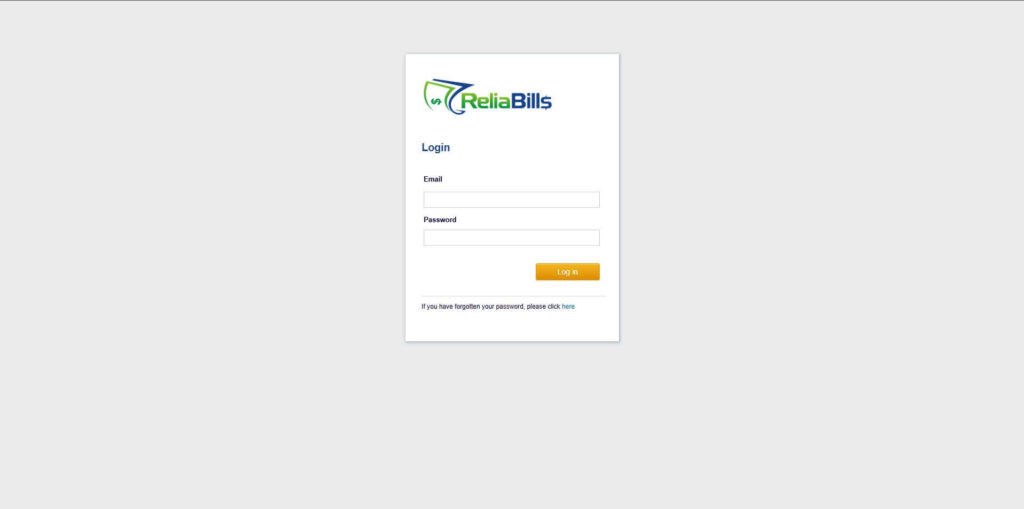

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

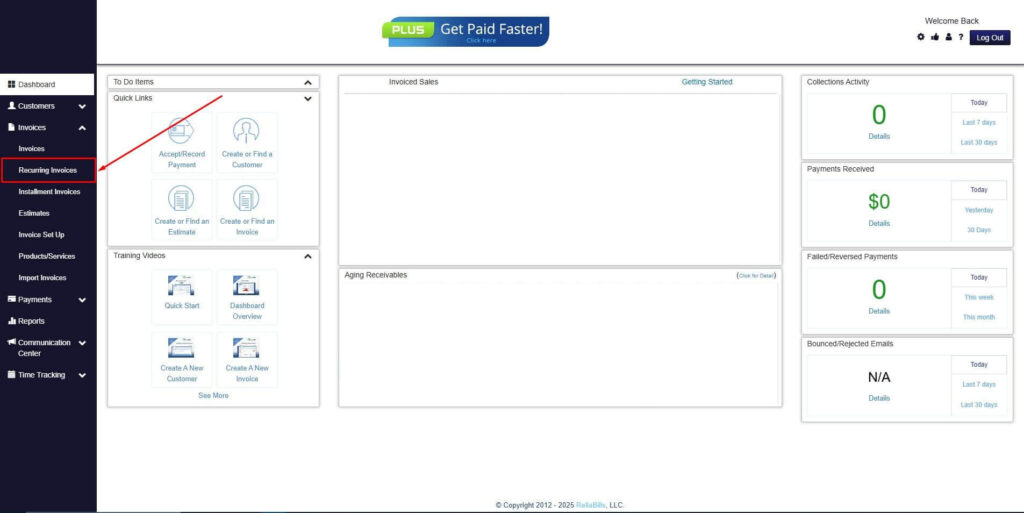

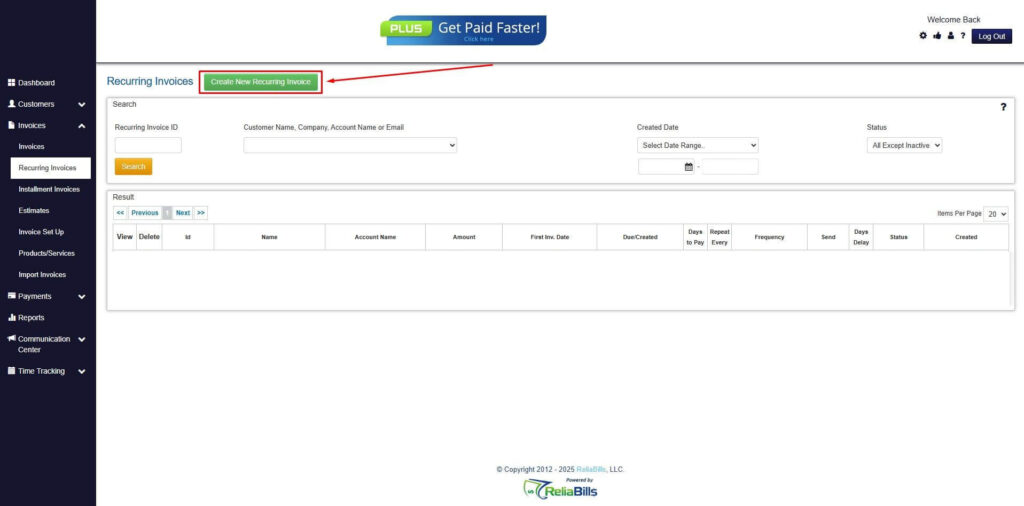

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

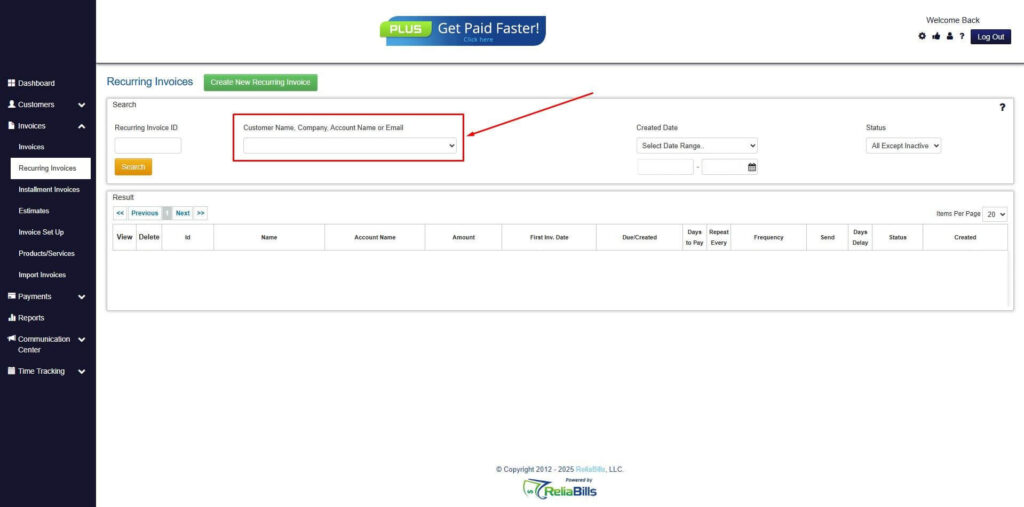

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

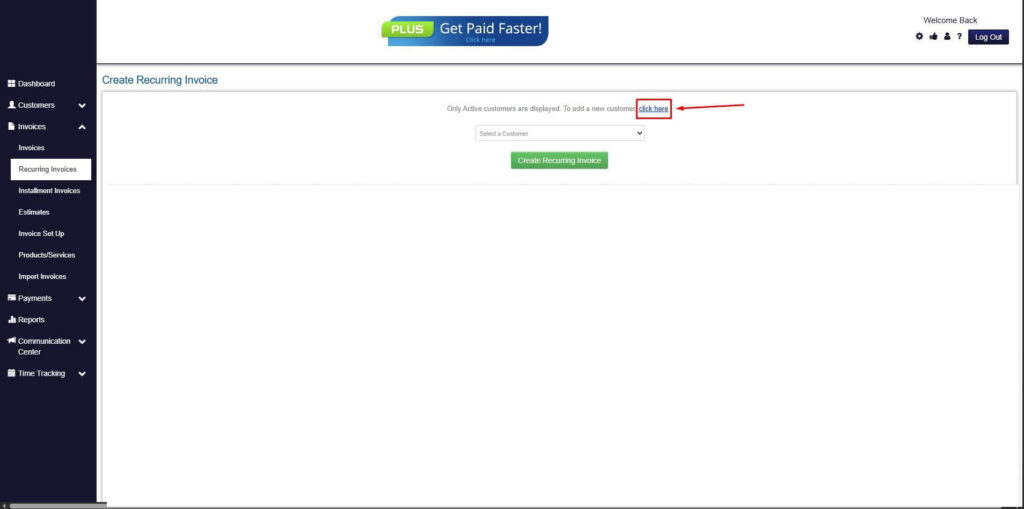

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

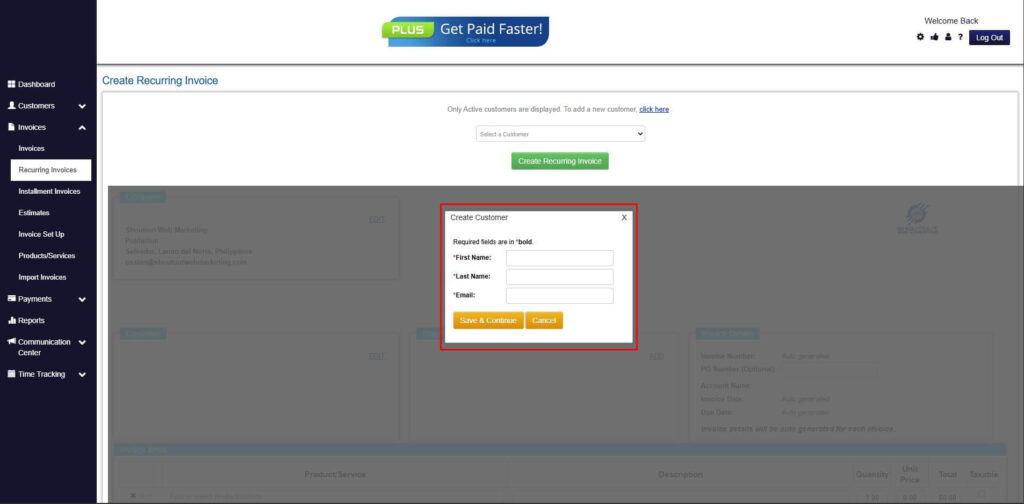

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

Step 7: Fill in the Create Recurring Invoice Form

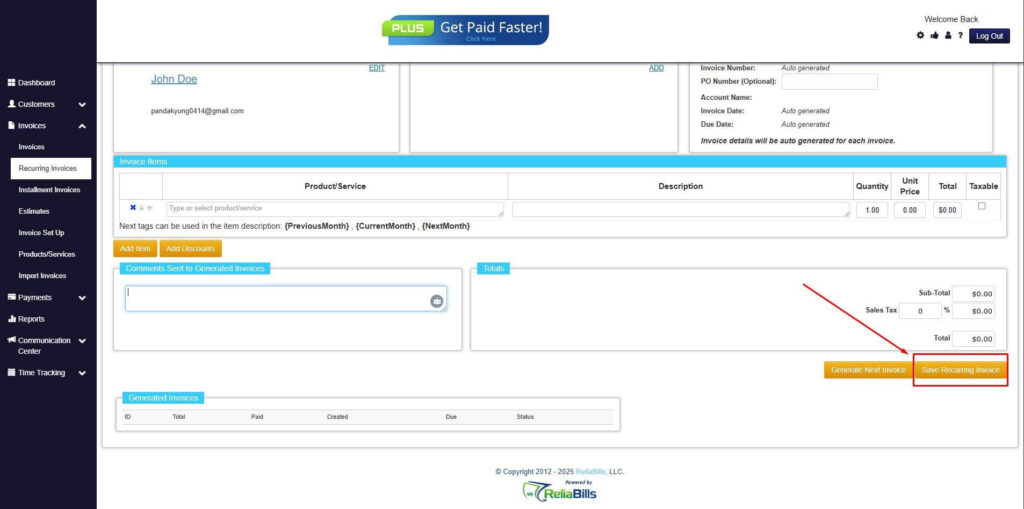

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

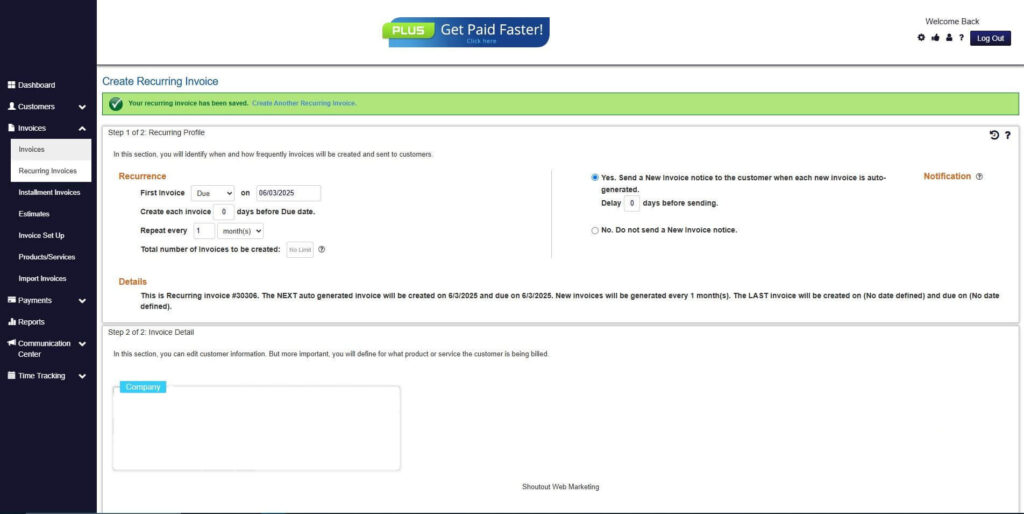

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

These common payroll questions help small business owners better understand their responsibilities and options.

1. How often should payroll be processed?

Payroll frequency depends on business needs and local regulations. Common schedules include weekly, biweekly, semi-monthly, or monthly payroll.

2. What happens if payroll taxes are paid late?

Late payroll tax payments can result in penalties, interest charges, and increased scrutiny from tax authorities. Timely payment is critical.

3. Can payroll be automated?

Yes, many payroll tasks can be automated, including wage calculations, tax withholding, and reporting. Automation reduces errors and saves time.

4. When should a small business outsource payroll?

Outsourcing may be beneficial when payroll becomes complex, the business grows, or compliance risks increase. It allows owners to focus on operations rather than administrative tasks.

5. How does cash flow affect payroll reliability?

Payroll depends on having sufficient funds available. Predictable income, supported by automated invoicing and recurring billing, helps ensure payroll can be processed without delays.

Conclusion

Small business payroll is a critical operational function that affects employees, compliance, and financial stability. Accurate and consistent payroll builds trust, protects the business from penalties, and supports long-term growth.

By understanding payroll fundamentals and ensuring predictable cash flow through automated invoicing and recurring billing, small businesses can reduce risk and operate with greater confidence. Strong payroll practices are not just an administrative task but a foundation for sustainable business success.