Choosing the right payment options is a critical decision for small businesses that want to get paid faster and keep customers satisfied. Payment methods directly affect how easily customers can complete transactions and how quickly revenue reaches your bank account. When payment options are limited or inconvenient, businesses often experience delayed payments and strained cash flow.

Today’s customers expect flexibility, whether they are paying online, in person, or through invoices. Small businesses that offer multiple, reliable payment options are better positioned to reduce friction and improve the overall customer experience. At the same time, business owners must balance convenience with costs, security, and operational efficiency.

This guide explains how to evaluate small business payment options, compare different methods, and choose solutions that support steady cash flow and long-term growth.

Table of Contents

ToggleUnderstanding Payment Options for Small Businesses

Payment options refer to the various ways customers can pay for products or services. These include traditional methods like cash and checks, as well as digital options such as cards, bank transfers, and online invoice payments. Each option comes with different costs, processing times, and customer expectations.

Traditional payment methods still play a role for certain industries, but digital payments have become the standard for many small businesses. Customers increasingly prefer fast, electronic payment experiences that require minimal effort. Businesses that rely only on manual or outdated payment methods may struggle to keep up with these expectations.

Offering flexible payment options allows small businesses to meet customers where they are. It also helps reduce missed or late payments by making it easier for customers to pay on time.

Common Payment Options Available to Small Businesses

Small businesses typically choose from several core payment methods, depending on their industry and customer base.

Cash and Checks

These methods are simple but often slow and difficult to track. Checks can delay cash flow and increase administrative work.

Credit and Debit Cards

Card payments are widely accepted and convenient for customers, though they involve processing fees and chargeback risk.

Bank Transfers and ACH Payments

ACH payments are cost-effective and commonly used for B2B transactions and invoicing, especially for larger amounts.

Digital Wallets and Mobile Payments

Options like Apple Pay and Google Pay offer speed and convenience, particularly for online and mobile customers.

Online and Invoice-based Payments

These allow customers to pay directly from an invoice using secure payment links, improving payment speed and accuracy.

Key Factors to Consider When Choosing Payment Options

Selecting the best small business payment options requires more than following trends. Businesses should evaluate each option based on practical considerations.

Customer preferences play a major role, since payment friction often leads to delays or abandoned transactions. Processing fees and transaction costs should also be reviewed carefully, as they can impact profitability over time. Payment speed matters as well, especially for businesses that rely on consistent cash flow.

Security is another critical factor. Payment methods should protect both customer data and business revenue while complying with industry standards. Finally, integration with existing invoicing and accounting systems helps reduce manual work and errors.

Payment Options for Different Business Types

Different business models benefit from different payment setups.

- Retail and point-of-sale businesses often rely on card payments and digital wallets for fast, in-person transactions.

- Service-based and professional businesses typically use invoice-based payments and ACH transfers for accuracy and documentation.

- Subscription and recurring billing models depend on automated payments to ensure predictable revenue.

- B2B and high-value transactions usually favor bank transfers and invoice payments for lower fees and better tracking.

Understanding how payment options align with your business type helps prevent unnecessary costs and payment delays.

Online and Invoice-Based Payment Methods

Invoice-based payments are especially valuable for small businesses that bill after services are delivered. By allowing customers to pay directly from an invoice, businesses remove extra steps that often cause delays. Payment links and QR codes further simplify the process, making it easier for customers to act immediately.

For businesses offering ongoing services, automating payments for recurring invoices reduces administrative effort and improves consistency. Automated invoice payments also help businesses better predict incoming revenue and plan expenses accordingly.

Security and Compliance Considerations

Security should never be an afterthought when choosing payment options. Businesses must ensure that payment methods comply with PCI standards and protect sensitive customer data. Secure payment experiences help build trust and reduce the risk of fraud or chargebacks.

Using reliable payment platforms also simplifies compliance responsibilities. Customers are more likely to pay promptly when they feel confident that their information is handled securely.

Cost Management and Fee Optimization

Payment convenience often comes with fees, which can add up over time. Small businesses should compare providers and pricing models to understand the true cost of each payment method. Lower fees may be available for bank transfers or ACH payments, especially for high-value invoices.

Balancing convenience with profitability is key. Offering too many costly payment options can reduce margins, while offering too few may slow down payments.

How Payment Options Impact Cash Flow

Payment speed has a direct impact on cash flow. Faster settlement methods improve liquidity, while slower options can create gaps between revenue and expenses. Late payments often occur when customers find the payment process confusing or inconvenient.

Recurring payment options help stabilize cash flow by creating predictable revenue streams. When payments are automated and tracked, businesses spend less time chasing invoices and more time focusing on growth.

Common Mistakes to Avoid

Offering too few or too many payment options – Limiting choices can frustrate customers, while too many options can create confusion and slow down payment processing.

Ignoring customer preferences – Failing to understand how your customers prefer to pay can lead to late payments or abandoned transactions.

Overlooking hidden fees – Not accounting for processing costs and transaction fees can reduce profitability and cause unexpected expenses.

Failing to monitor payment performance – Without tracking which payment methods are most effective, businesses may miss opportunities to optimize cash flow.

Not reviewing payment options regularly – Payment needs evolve over time; outdated methods can slow down collections and hurt customer satisfaction.

How ReliaBills Helps Small Businesses Offer Flexible Payments

ReliaBills makes it simple for small businesses to provide customers with multiple payment options, all from a single platform. Businesses can embed credit cards, bank transfers, digital wallets, and online payment links directly into invoices, giving customers the freedom to pay in the way that’s most convenient for them. Automated reminders and notifications help reduce missed payments while keeping customers informed throughout the payment process.

For businesses that rely on recurring billing, ReliaBills ensures predictable cash flow by automatically processing subscription and service payments. This eliminates the need for manual follow-ups, minimizes late payments, and keeps recurring revenue consistent. The platform also provides detailed reporting so business owners can quickly see which payment methods perform best and identify trends to optimize collections.

ReliaBills PLUS offers advanced features like centralized payment tracking across multiple clients, customizable invoicing, and detailed audit trails. This allows small business owners to maintain control over their revenue, reduce administrative workload, and focus on growth. By combining automation with flexible payment options, ReliaBills helps businesses streamline operations, improve cash flow, and deliver a better payment experience to their customers.

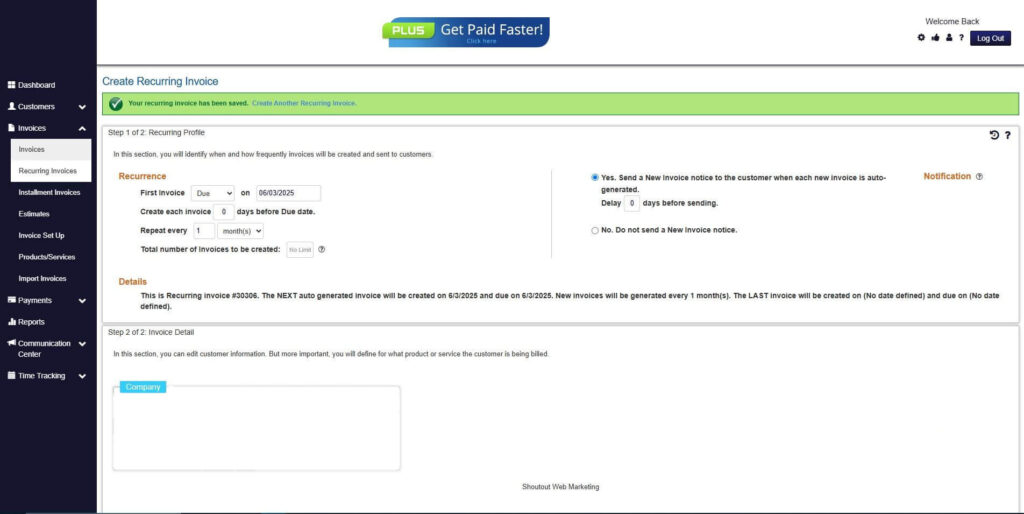

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

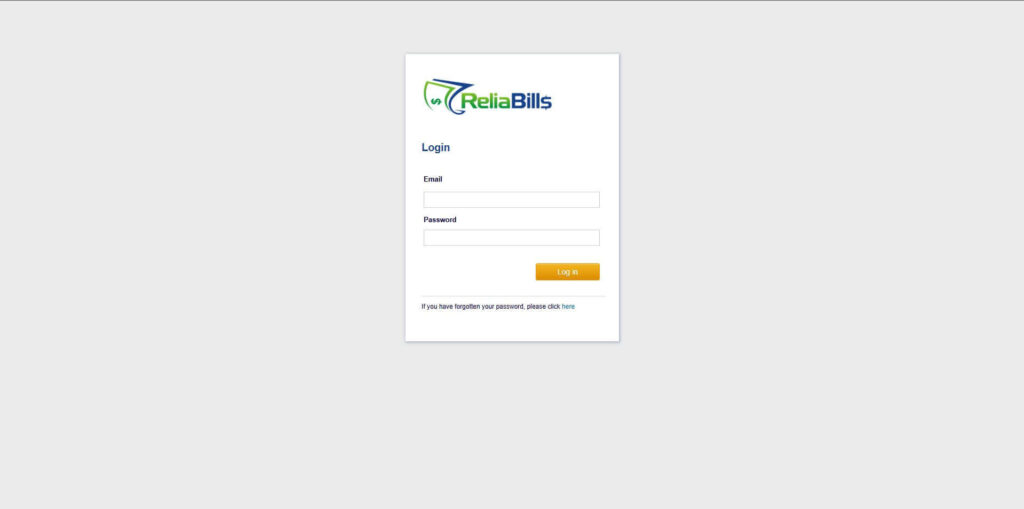

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

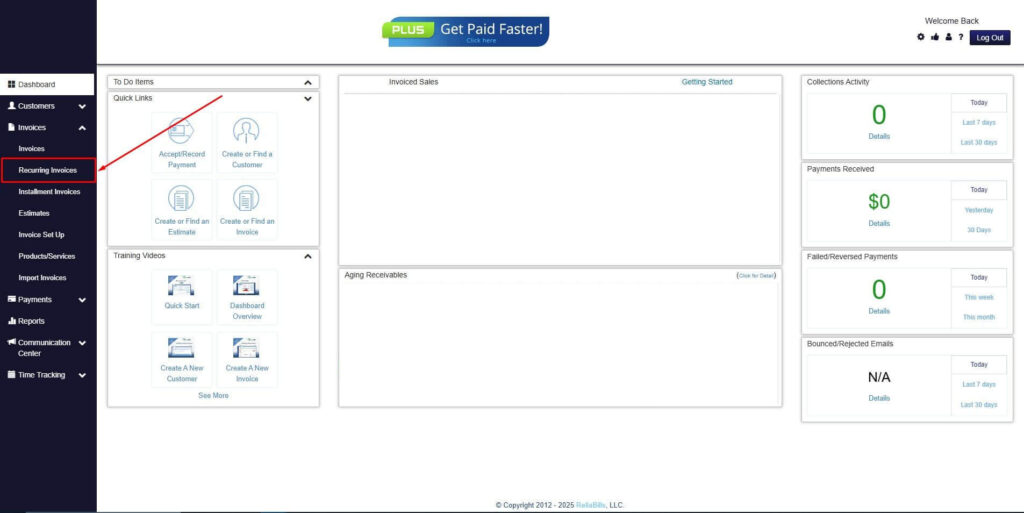

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

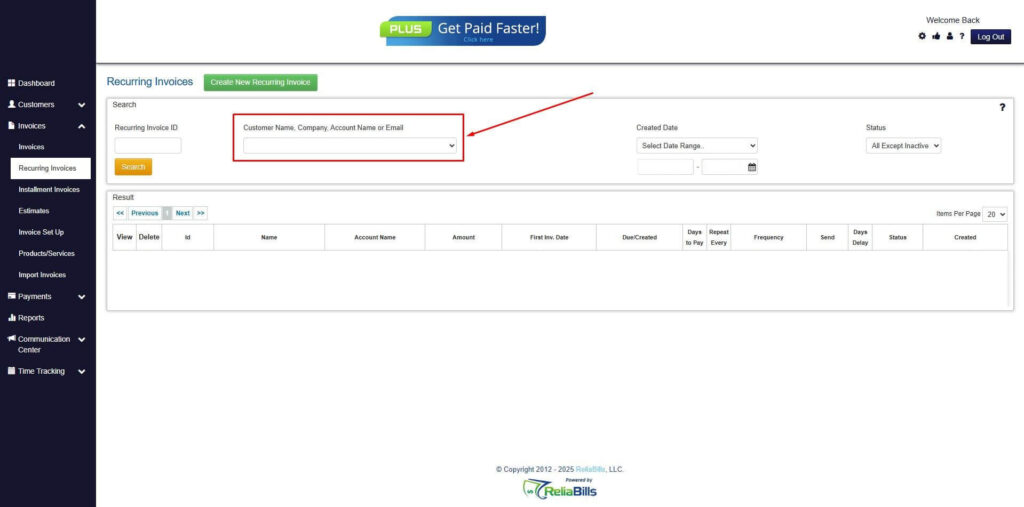

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

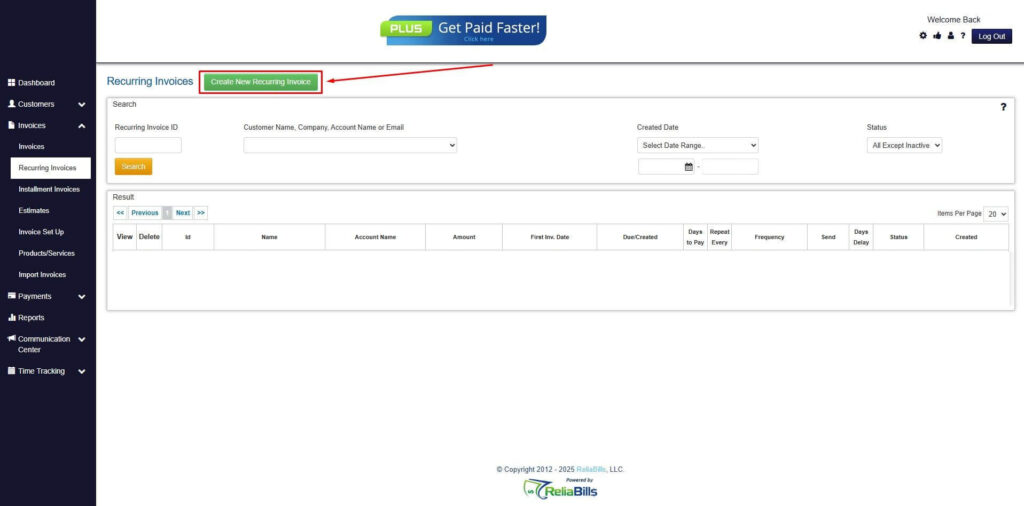

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

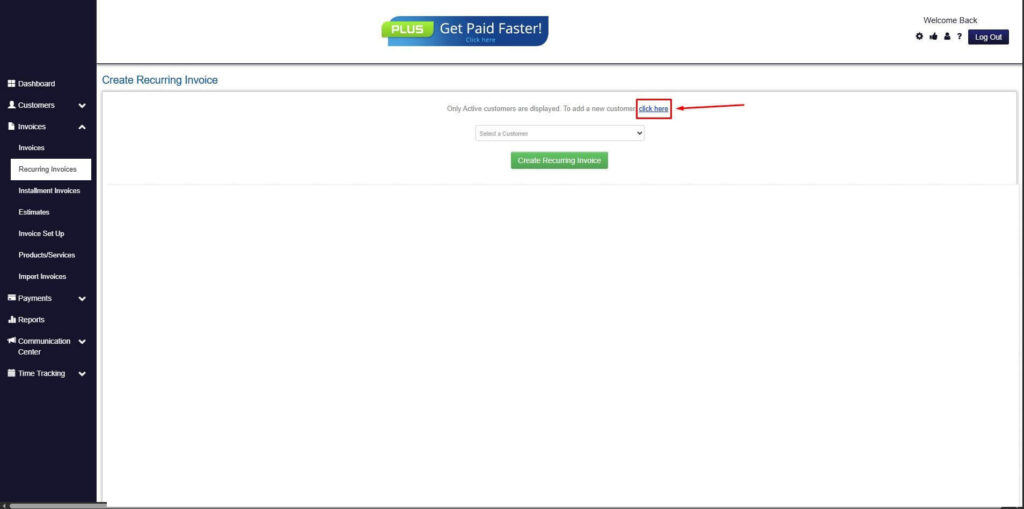

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

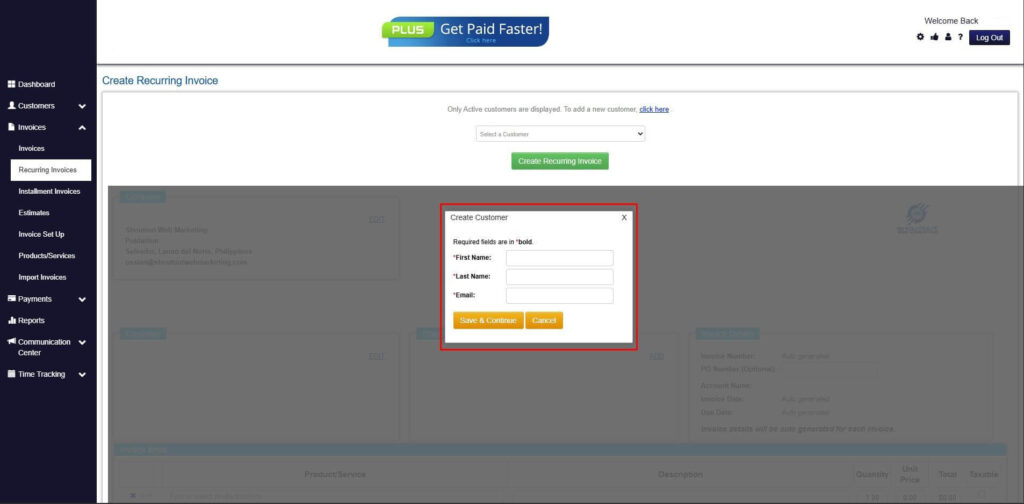

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

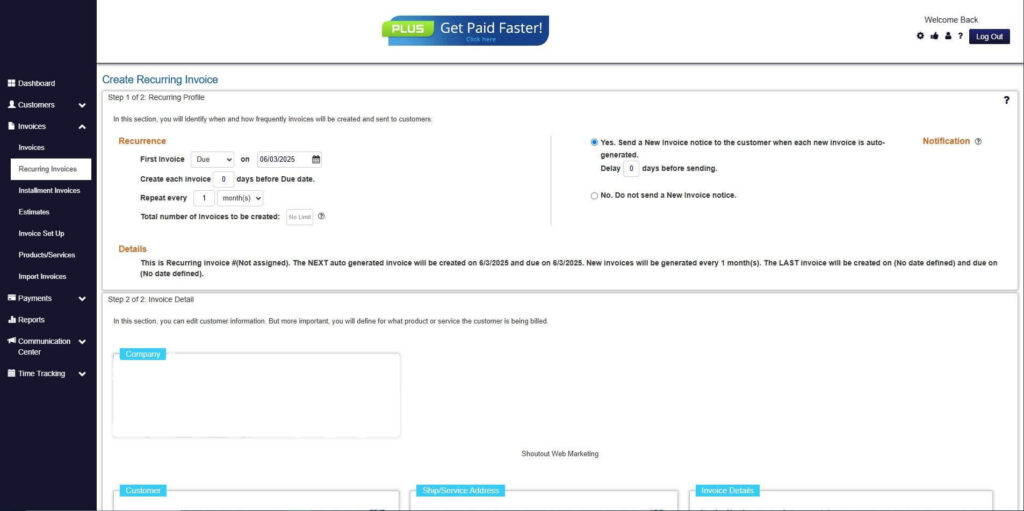

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

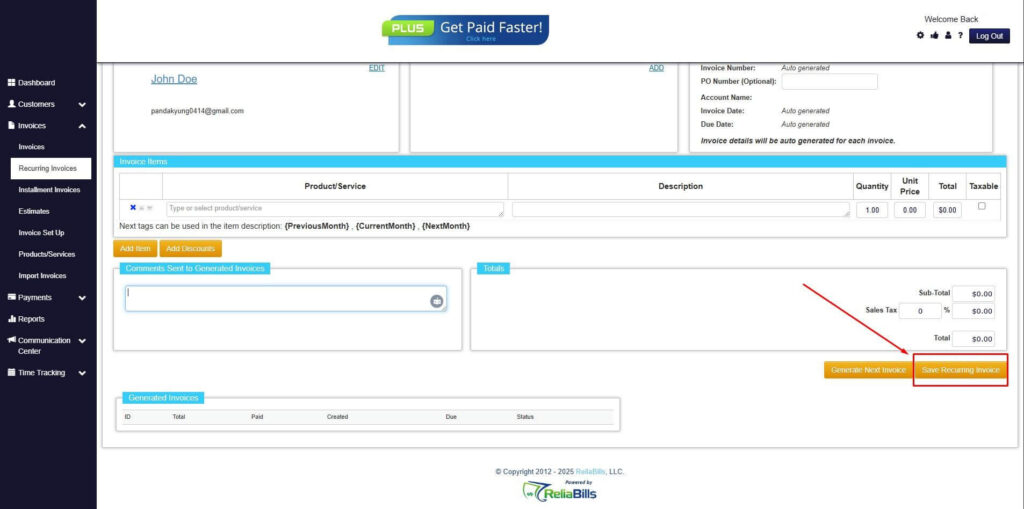

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How many payment options should a small business offer?

Most businesses benefit from offering three to five options that cover customer preferences without adding complexity.

2. Are digital payments safe for small businesses?

Yes, when using compliant and secure platforms that protect customer data.

3. What payment methods are best for recurring billing?

Automated card payments and ACH transfers work best for recurring invoices.

4. How quickly can businesses start accepting payments?

With modern invoicing platforms, businesses can often start within days.

Conclusion

Choosing the right small business payment options is essential for improving cash flow, customer satisfaction, and operational efficiency. The best approach balances convenience, cost, security, and integration with existing systems. Businesses that adapt their payment strategies are better positioned to reduce delays and grow sustainably.

By combining flexible payment methods with automated invoicing and recurring billing, small businesses can create a smoother payment experience for customers. Platforms like ReliaBills help simplify this process, allowing business owners to focus on delivering value while maintaining steady and predictable revenue.