If you run a business that provides professional services, one of the most important tasks you’ll handle is invoicing your clients. Knowing how to create service invoices properly can make a huge difference in how quickly you get paid, how organized your finances are, and how professional you appear to your customers.

Whether you’re a freelancer, contractor, or business owner, understanding what a service invoice is and how to create one efficiently is essential. This guide will walk you through everything you need to know, from what a service invoice includes to how you can simplify the process with automation tools like ReliaBills.

Table of Contents

ToggleWhat Is a Service Invoice?

A service invoice is a professional document that a business or individual issues to clients after providing services. It outlines the details of the services rendered, their respective costs, and the total amount due.

Unlike product-based invoices, service invoices don’t include physical goods. Instead, they itemize labor, time, and expertise. For example, if you’re a consultant, your service invoice may detail hours spent advising a client and the hourly rate charged.

A proper service invoice typically includes:

- The business name and contact information

- Client details

- A description of each service provided

- The rate per hour, project, or milestone

- The total amount due (including taxes if applicable)

- Payment terms and accepted payment methods

- An invoice number and issue date

Creating clear and well-structured service invoices not only ensures timely payments but also builds trust and professionalism between you and your clients.

What’s a Service-Based Business?

Before diving deeper, it’s important to understand what a service-based business is. Unlike product-based businesses that sell tangible items, service-based businesses sell skills, time, or expertise.

These can include:

- Professional services such as consulting, marketing, or graphic design

- Home services like cleaning, landscaping, or repair work

- Creative services like photography, videography, and content creation

- Technical services such as IT support, web development, or accounting

For these types of businesses, service invoices play a vital role in getting paid. Since there’s no physical product to deliver, the invoice serves as the formal record of what was provided and how much it costs.

How to Invoice for Services

Creating and sending service invoices can be simple if you follow a structured process. Here’s how to do it effectively:

- Add Your Business Details

Start by including your business name, address, phone number, email, and logo to make your invoice look professional. - Include Client Information

Clearly list your client’s name, company name (if applicable), and contact details to ensure accuracy and record-keeping. - Describe the Services Rendered

List each service you provided with a brief description, the number of hours worked (if applicable), and the corresponding rate. The goal is to be clear and transparent about what the client is paying for. - Add Costs and Total Amount

Include each service’s cost, any additional fees, taxes, and the total amount due. - Include Payment Terms

Clearly state the payment due date and acceptable payment methods (such as credit card, bank transfer, or PayPal). You can also include late payment fees if applicable. - Assign an Invoice Number

A unique invoice number helps you organize records and track payments more efficiently. - Review and Send

Double-check all details before sending your invoice to ensure accuracy. Send it as a PDF for professionalism and record-keeping.

Using these steps, you can ensure your service invoices are professional, accurate, and effective in communicating what your clients owe.

Factors to Consider When Invoicing

When creating service invoices, several factors can affect how quickly you get paid and how smoothly your billing process runs.

Clarity and Transparency

Always make sure your invoices are easy to read and understand. Avoid jargon or vague descriptions that can confuse your clients.

Timeliness

Send your invoices as soon as possible after completing the service. The sooner you send them, the faster you’ll receive payment.

Consistency

Use a consistent invoicing format for all clients to maintain professionalism and brand identity.

Payment Options

Offering multiple payment methods can make it easier for clients to pay you. Include online payment links if possible.

Automation

Consider automating your invoicing process with software like ReliaBills. Automation helps reduce errors, saves time, and ensures you never miss a billing cycle.

Features to Consider When Choosing Invoicing Software

With so many invoicing platforms available, choosing the right one for creating and managing service invoices is crucial. Here are the most important features to look for:

Customization

Your invoicing software should allow you to add your logo, adjust layouts, and include your brand colors to maintain a professional look.

Automation and Recurring Billing

If your business offers ongoing services, recurring billing is a must-have feature. It automatically generates and sends invoices on a schedule, so you don’t have to manually bill the same clients every cycle.

Payment Tracking

Good invoicing software tracks payments, sends reminders for overdue invoices, and updates payment statuses automatically.

Multiple Payment Options

Providing clients with flexible payment methods such as credit cards, ACH transfers, or online payments increases the likelihood of timely payments.

Secure and Reliable

Your invoicing system should protect sensitive client information with secure encryption and reliable backup features.

Why Choose ReliaBills

If you’re looking for a powerful and user-friendly platform to manage your service invoices, ReliaBills is an excellent choice. It’s designed specifically for small businesses and freelancers who want to simplify their billing process and improve cash flow.

ReliaBills makes creating and managing invoices simple and efficient. You can generate professional service invoices, automate payment reminders, and track all your transactions in one place. The platform’s intuitive interface ensures that you can create invoices in just minutes, without any technical expertise.

One of the standout features of ReliaBills is its automated recurring billing system. This is especially useful for businesses that provide ongoing services, such as monthly maintenance, consulting, or subscription-based work. With recurring billing, your invoices are automatically generated and sent to clients on a schedule, ensuring timely payments and reduced administrative workload.

ReliaBills also supports online payments, making it easier for clients to pay through secure channels. You can even customize your invoices to match your brand, giving your business a professional and trustworthy image.

By choosing ReliaBills, you’ll save time, reduce errors, and maintain better financial control while ensuring your service invoices are handled with accuracy and consistency.

Improve Your Invoicing With Recurring Billing Software

Automated recurring billing is one of the best ways to take your service invoices to the next level. It ensures you get paid on time, reduces manual work, and keeps your cash flow steady. Clients love the convenience of auto-pay options, and you’ll appreciate how much administrative time you save.

Recurring billing also minimizes the risk of missed payments and improves customer relationships through consistent and predictable billing cycles. Whether you’re a freelancer, contractor, or small business owner, automating your invoicing can transform how you manage your business finances.

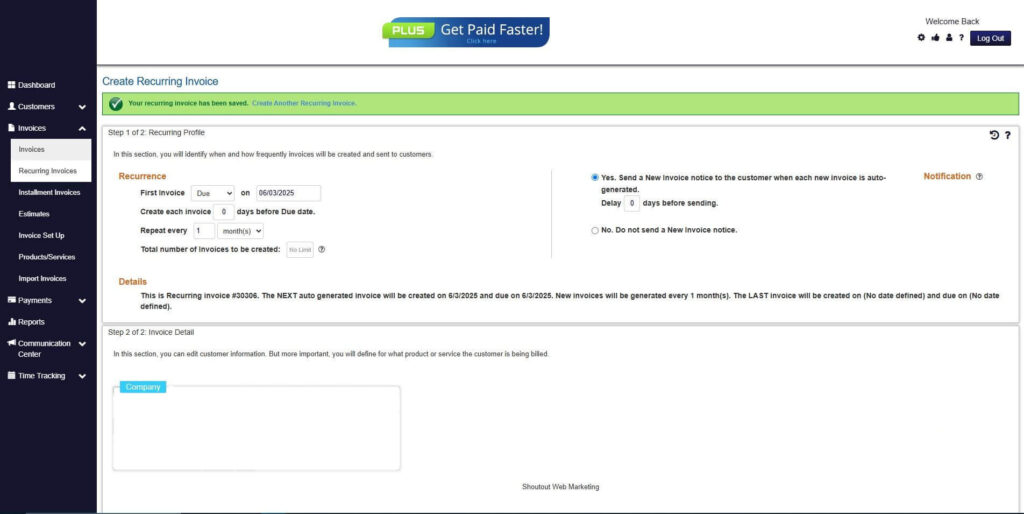

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

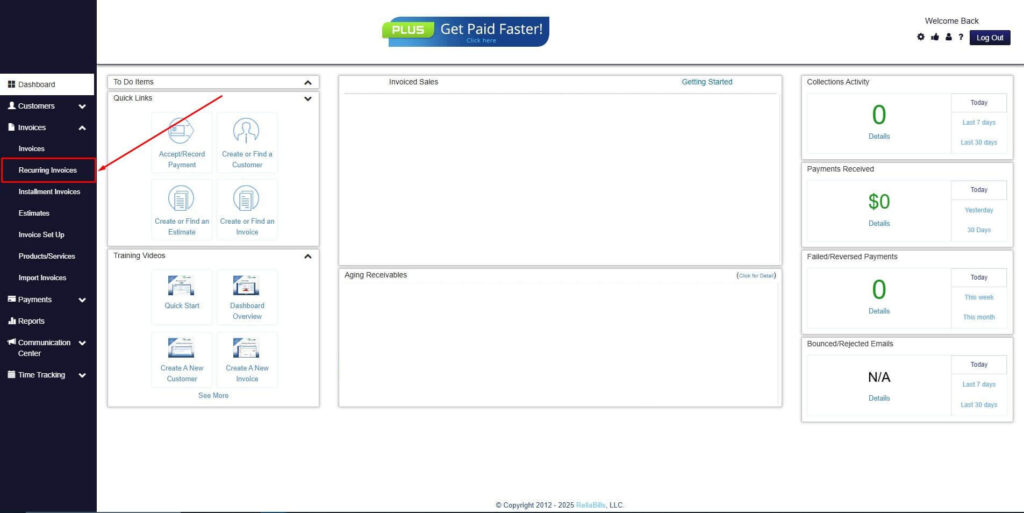

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

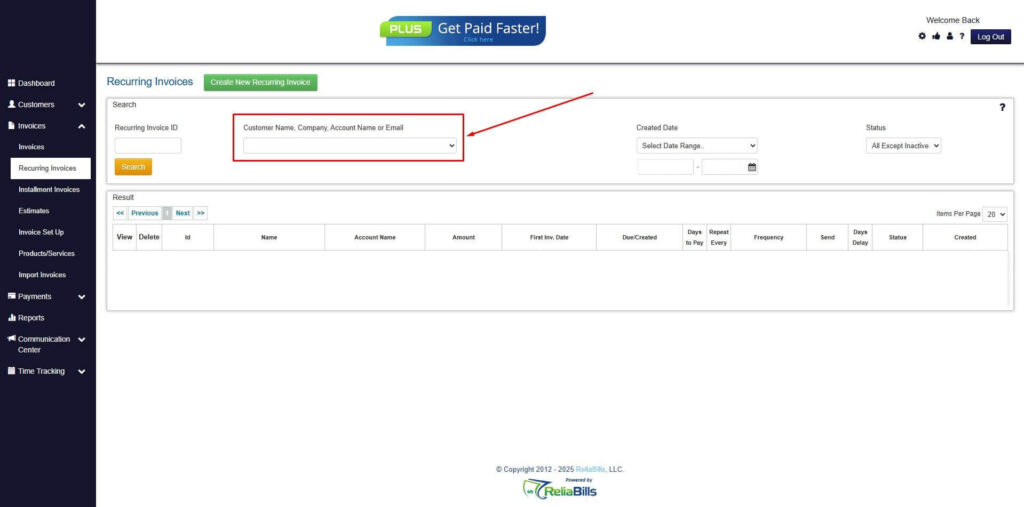

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

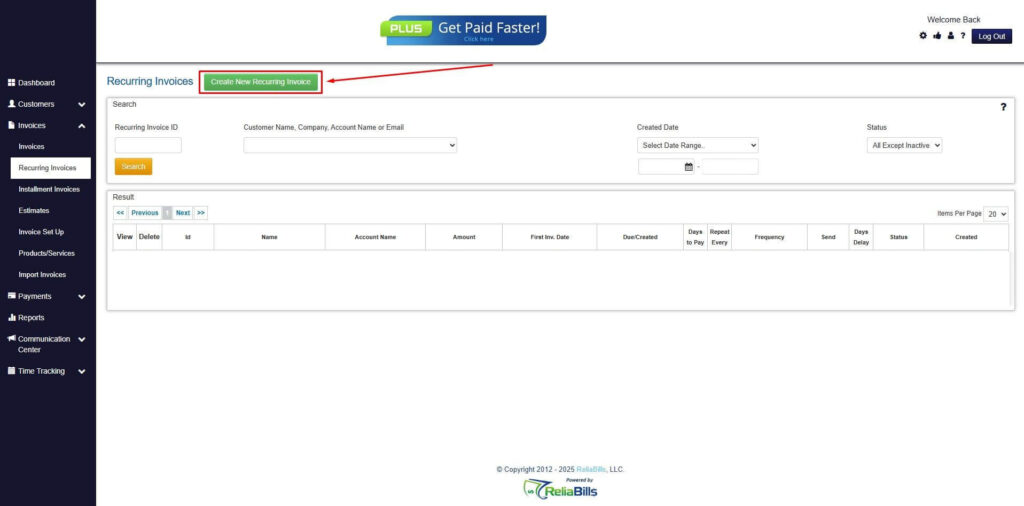

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

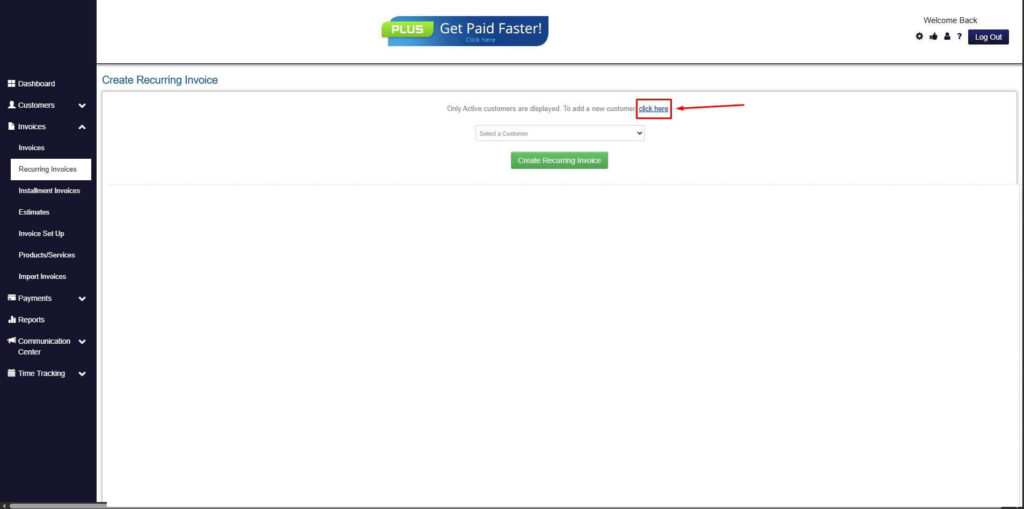

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

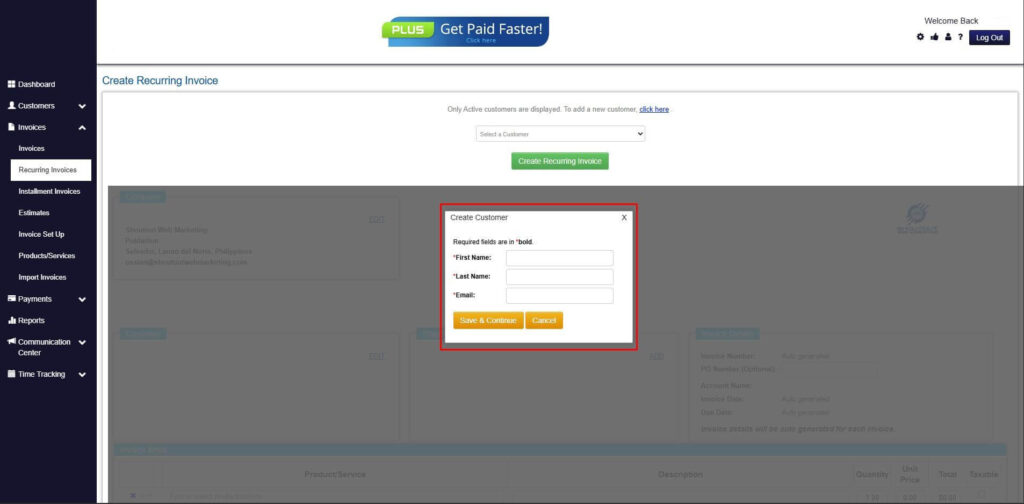

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

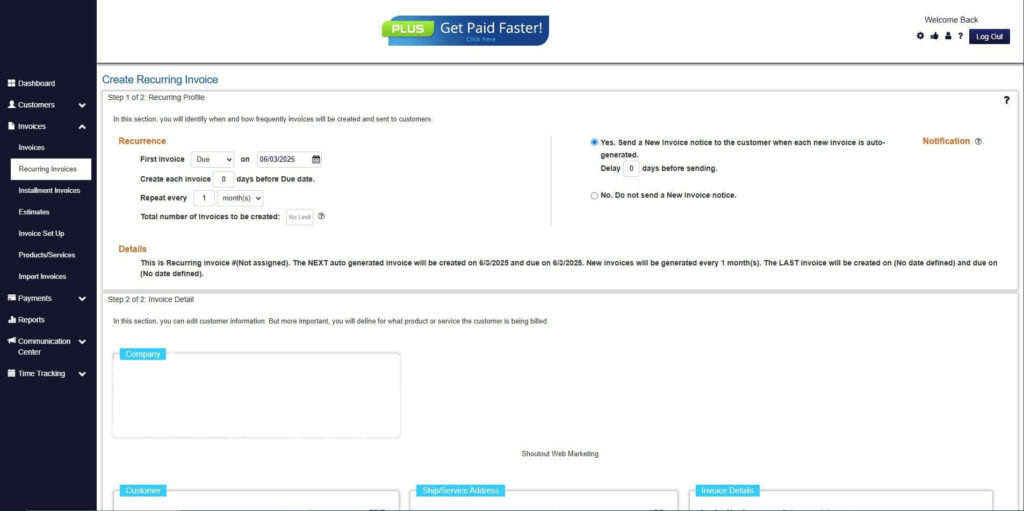

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

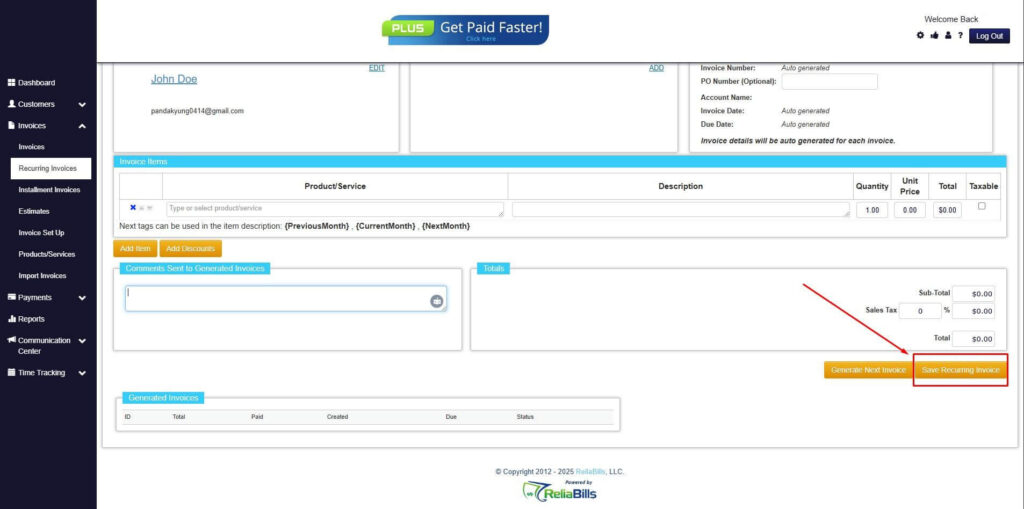

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Conclusion

Learning how to create service invoices for different services rendered is essential for every service-based business. It’s not just about billing, it’s about maintaining professionalism, transparency, and efficiency.

By using automation tools like ReliaBills, you can simplify the invoicing process, save time, and ensure you always get paid on time. ReliaBills combines professional invoicing, recurring billing, and payment automation in one easy-to-use platform.Start creating professional service invoices today with ReliaBills, and experience a smarter, faster, and more reliable way to manage your business billing.