Cash flow is the lifeblood of any real estate business. Whether managing residential apartments, commercial spaces, or mixed-use properties, maintaining steady income is essential for covering mortgages, taxes, maintenance, and operational expenses. Without predictable cash flow, property managers may struggle to fund repairs, pay staff, or meet financial obligations on time.

Real estate operations often face challenges with inconsistent payments. Late rent, missing HOA dues, or delayed service fees can create gaps in revenue that affect day-to-day operations. Seasonal fluctuations in occupancy or temporary vacancies can further complicate income stability, making forecasting and budgeting more difficult.

Recurring invoices real estate solutions offer a way to create consistency in revenue streams. By automating invoice delivery for rent and associated fees, property managers can ensure timely payment reminders and reduce the likelihood of late or missed payments. This approach not only stabilizes cash flow but also minimizes administrative burden and strengthens tenant accountability.

Table of Contents

ToggleWhat Are Recurring Invoices in Real Estate?

Definition and how they function

Recurring invoices are scheduled billing statements that automatically generate at regular intervals, typically monthly. They are used to collect rent, service fees, or other charges without requiring manual invoice creation for each billing cycle.

By setting up recurring invoices, property managers establish a predictable revenue system that mirrors the terms of a lease agreement. Tenants receive consistent billing notifications, and accounting systems can automatically track payment statuses.

Difference between one-time invoices and scheduled recurring billing

Unlike one-time invoices, which require manual generation for each transaction, recurring invoices function on a pre-set schedule. This eliminates delays caused by human error and ensures timely payment collection. Scheduled billing also allows businesses to enforce late fees automatically, maintain clear financial records, and streamline reporting.

How automation fits into property management

Automation integrates seamlessly with property management workflows. Recurring invoices real estate solutions can send reminders, process online payments, and update tenant records automatically. This reduces manual oversight while providing transparency for both property managers and tenants.

Common Real Estate Payments That Use Recurring Invoices

Monthly Rent

Monthly rent is the most common recurring payment in real estate. Automating these invoices ensures tenants are billed on the same date each month, reducing late payments and improving cash flow predictability. For multi-unit properties, recurring invoices allow property managers to track individual units separately while consolidating reporting for the overall portfolio.

HOA or Association Dues

Homeowners associations and condo boards often charge monthly or quarterly dues for community maintenance, landscaping, and shared amenities. Recurring invoices simplify collection by automatically generating statements and sending reminders, helping avoid missed or late payments that could affect community services.

Property Management Fees

Third-party property managers often charge monthly or quarterly management fees. Using recurring invoices ensures consistent billing for management services, streamlines payment tracking, and maintains transparency between property owners and management firms.

Maintenance Retainers and Service Contracts

Properties frequently require ongoing maintenance services, such as landscaping, pest control, or janitorial work. Recurring invoices allow managers to charge for retainers or service contracts automatically, ensuring vendors are paid on time and maintenance budgets remain predictable.

Utilities and Shared Expenses

In multi-tenant buildings, shared utilities or common area expenses can be billed regularly. Recurring invoices help allocate costs fairly, reduce disputes, and keep tenants informed about their financial responsibilities.

Lease-Based Add-Ons

Additional recurring charges, such as parking, storage, or pet fees, can be added to recurring invoices. Automating these ensures accuracy and consistency while preventing overlooked charges.

Late Fees and Penalties

Recurring invoicing systems can also automatically calculate and add late fees to tenant accounts, reducing manual follow-ups and improving overall collection efficiency.

The Cash Flow Challenges in Real Estate

Managing cash flow in real estate can be complicated by several factors. Late payments and delinquent tenants create unpredictability, requiring extra time and resources for follow-up. Manual tracking errors, such as misentered amounts or missed invoices, can further disrupt financial stability.

Seasonal vacancies also affect revenue streams, especially in markets with high turnover or short-term rentals. Administrative bottlenecks, such as manually generating invoices or reconciling payments, can create delays that compound cash flow challenges. These factors highlight the importance of recurring invoices in stabilizing income and reducing errors.

How Recurring Invoices Create Predictable Revenue

Recurring invoices improve financial predictability by establishing fixed billing cycles aligned with lease agreements. Rent invoices are generated automatically each month, eliminating the need for repetitive manual processes. Consistent reminders ensure that tenants are aware of upcoming payments, reducing the chances of missed income.

By standardizing invoicing practices, property managers can close revenue gaps caused by human error or oversight. Predictable revenue makes it easier to plan for ongoing expenses, maintenance projects, and long-term investments.

Accelerating Rent Collection with Automation

Automation is a key advantage of recurring invoices real estate systems. Scheduled invoice delivery ensures tenants receive timely billing notifications, reducing delays. Integrated online payment options allow tenants to pay instantly, further accelerating cash flow.

Automatic late fee calculations provide an incentive for timely payments without manual follow-up, freeing property managers from constant reminders. The combination of automated delivery, easy payment processing, and late fee enforcement significantly enhances revenue collection efficiency.

Minimizing Billing Errors and Disputes

Recurring invoices help minimize errors by standardizing templates and accurately configuring lease-based charges. Transparent breakdowns of rent, fees, and other charges clarify the invoicing process for tenants, reducing confusion and disputes.

Audit-ready documentation ensures that every payment and adjustment is traceable. This level of detail is particularly important for property managers overseeing multiple tenants or complex fee structures.

Improving Financial Forecasting

With recurring invoices, property managers gain visibility into expected monthly income. Automated reporting tools allow analysis of cash flow trends and enable informed decision-making. Accurate forecasting simplifies budgeting for maintenance, capital improvements, and operational expenses.

The predictability of recurring payments provides confidence to lenders and investors, helping support growth and investment strategies.

Supporting Multi-Property and Portfolio Management

For property managers overseeing multiple units, recurring invoices provide centralized billing for all properties. Consolidated reporting allows a clear overview of total income, outstanding payments, and tenant activity across the portfolio.

Scalable recurring billing systems enable managers to add new properties or adjust fees without disrupting existing workflows, enhancing operational efficiency and enabling business growth.

Enhancing Tenant Experience

Recurring invoices improve tenant satisfaction by providing clear, professional invoices and easy-to-access billing history. Flexible payment methods, including online portals, direct debit, or card payments, reduce friction in the payment process.

Transparent billing reduces confusion about charges and fosters trust between tenants and property managers, supporting long-term occupancy and reducing disputes.

Reducing Administrative Work for Property Managers

Manual invoice creation, follow-up emails, and payment tracking are time-consuming tasks. Recurring invoices eliminate much of this work, freeing managers to focus on other operational priorities.

Automated reminders and real-time payment tracking lower administrative overhead, allowing managers to maintain accurate records without extensive manual input. The result is a more efficient property management workflow with fewer errors.

Best Practices for Implementing Recurring Invoices

Align Billing Cycles with Lease Agreements

Ensure recurring invoices match the terms of the lease. Monthly, quarterly, or annual billing should coincide with rent due dates or service contract schedules. This alignment reduces tenant confusion and improves on-time payments.

Set Clear Late Fee Policies

Establish transparent late fee rules and communicate them clearly in lease agreements. Recurring invoicing systems can automatically apply late fees, making enforcement consistent and fair while reducing manual follow-up.

Regular Reconciliation and Reporting

Regularly reconcile invoices with payments received to identify missed or partial payments. Reporting dashboards allow property managers to spot trends, monitor tenant behavior, and maintain accurate financial records.

Monitor Tenant Payment Behavior

Track payment patterns over time to identify tenants who consistently pay late. Proactive communication, reminders, or adjustments to billing methods can help prevent recurring issues and protect cash flow.

Use Clear, Professional Invoice Templates

Standardized templates reduce errors and improve tenant understanding. Each invoice should include a clear breakdown of rent, fees, and any additional charges to maintain transparency.

Automate Reminders and Follow-Ups

Automated reminders for upcoming invoices and overdue payments minimize administrative effort and improve on-time payment rates.

Maintain Audit-Ready Documentation

Keep all invoices, payment records, and adjustments easily accessible for audits. Audit-ready documentation improves compliance, ensures accurate reporting, and strengthens tenant trust.

How ReliaBills Supports Recurring Invoicing in Real Estate

Managing multiple properties and recurring payments can quickly become overwhelming without the right tools. ReliaBills simplifies recurring invoicing for real estate by automating the entire billing workflow. Property managers can schedule recurring rent, HOA dues, maintenance fees, and other lease-based charges, ensuring invoices are delivered on time every month without manual effort.

Beyond automation, ReliaBills supports online payment collection, making it easy for tenants to pay securely and on schedule. Automatic payment tracking, late fee calculations, and real-time account updates reduce missed payments and streamline accounting. This ensures that property managers maintain consistent cash flow while saving hours of administrative work each month.

For larger portfolios, ReliaBills offers centralized reporting dashboards that give property managers visibility into expected income, tenant payment history, and overall cash flow trends. Branded communications keep tenants informed and engaged, enhancing the tenant experience while preserving professionalism. By combining recurring billing, automation, and reporting in one platform, ReliaBills ensures real estate businesses can scale operations efficiently and reliably.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

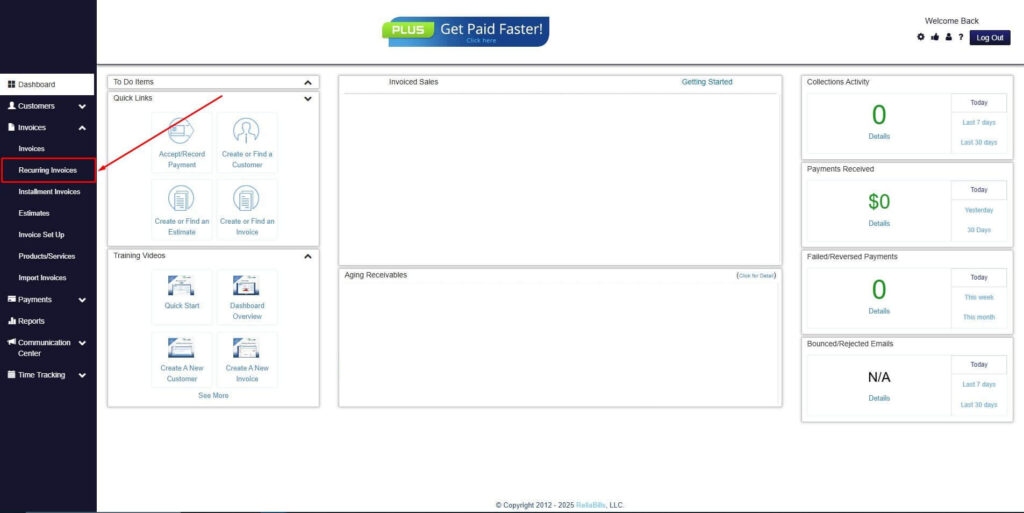

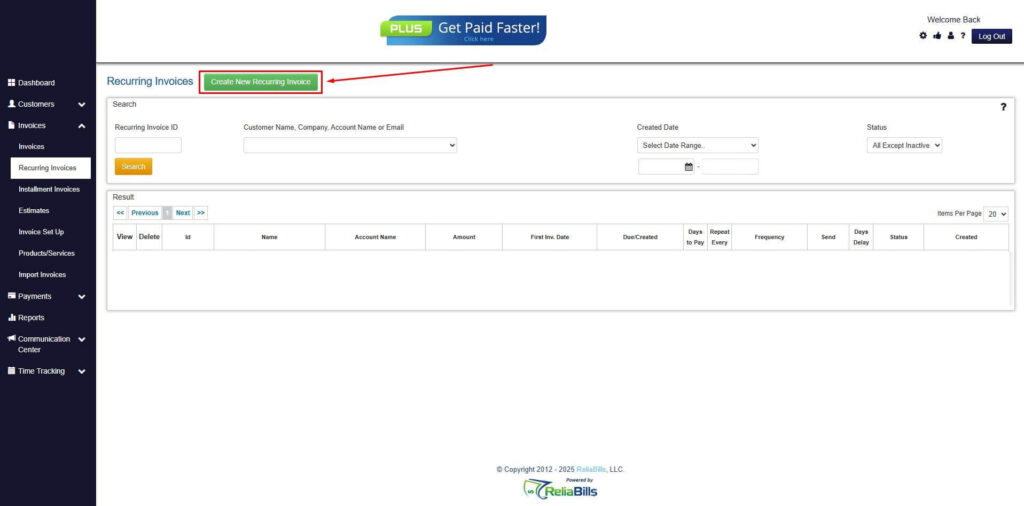

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

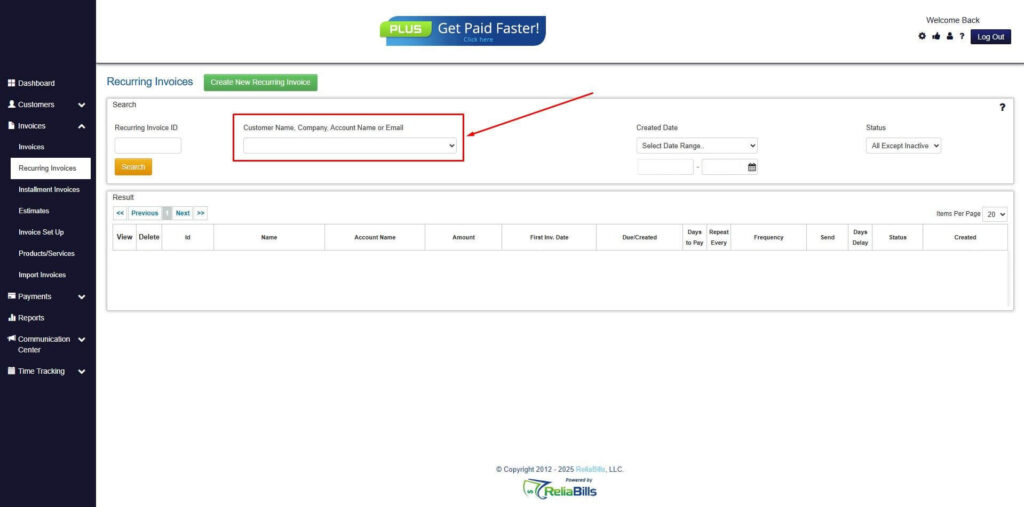

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

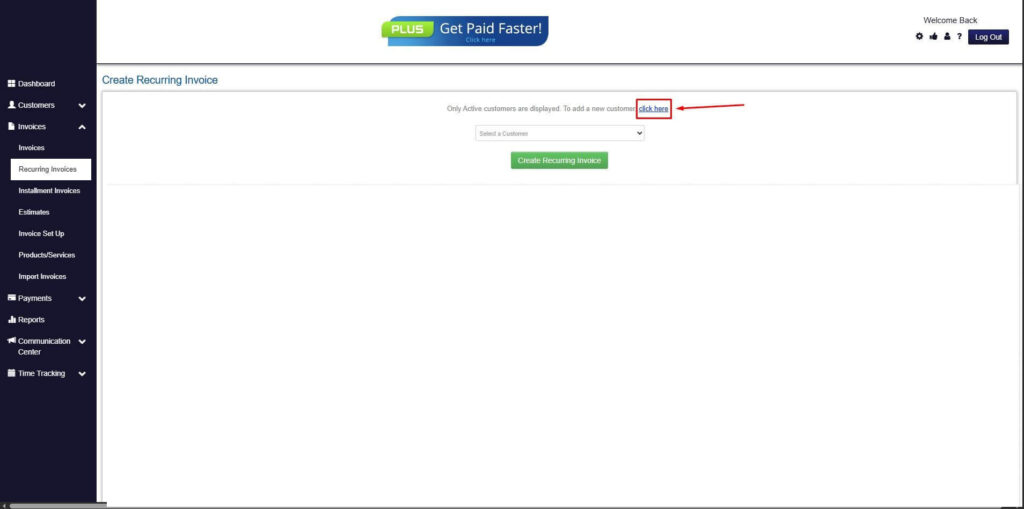

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

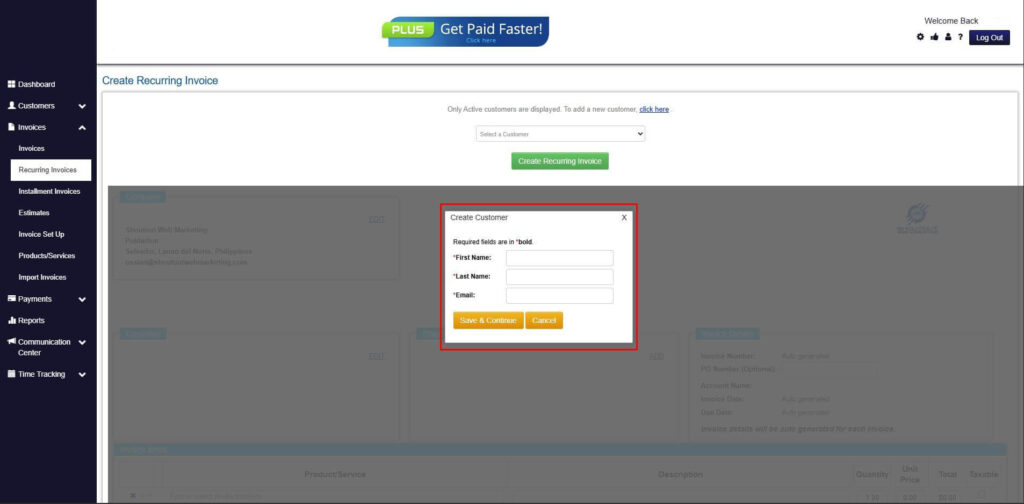

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

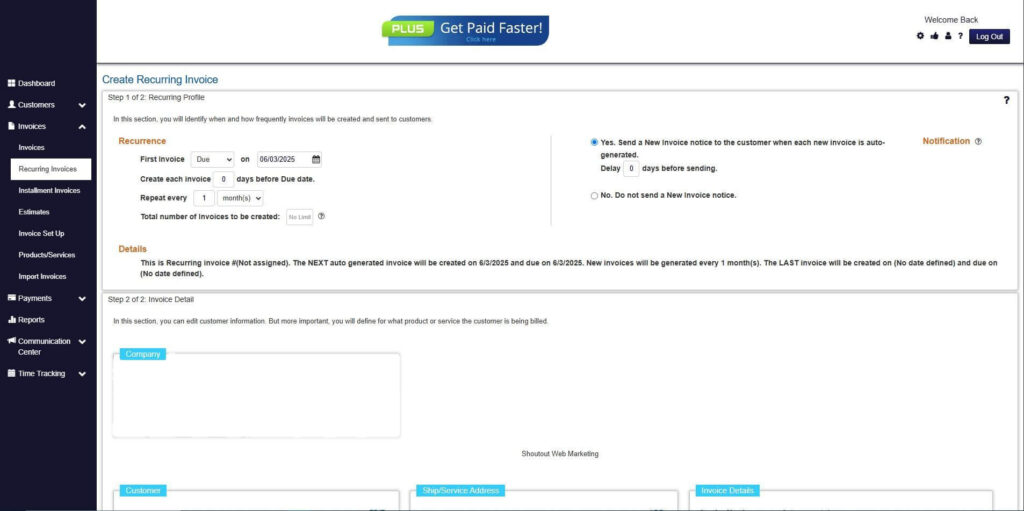

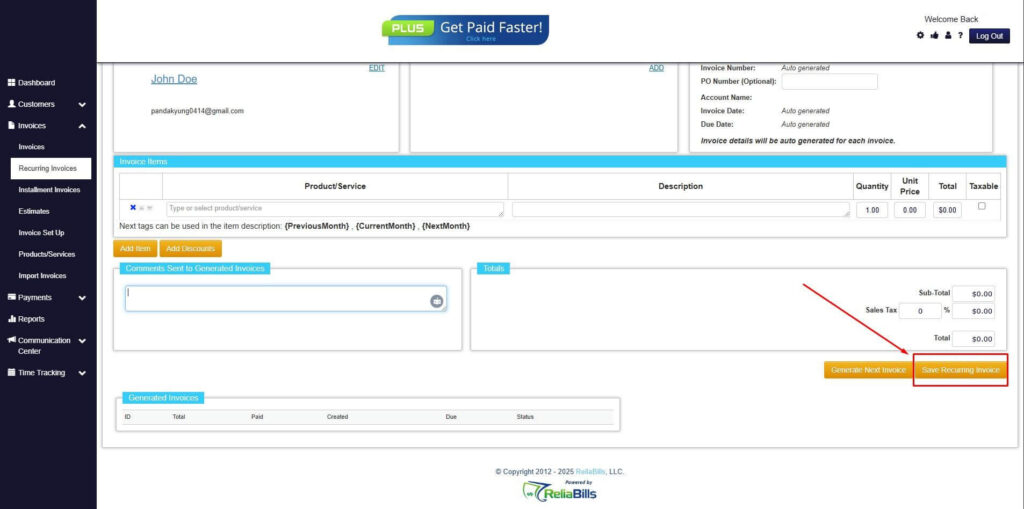

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

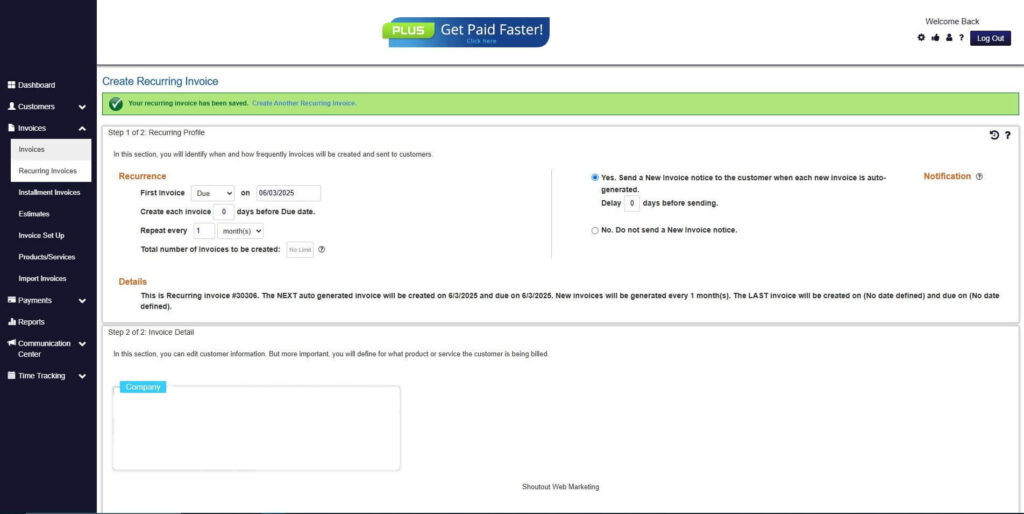

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What are recurring invoices in real estate?

Recurring invoices are scheduled bills generated automatically at regular intervals, such as monthly rent, HOA dues, or maintenance fees. They simplify collections and create predictable cash flow.

2. How do recurring invoices improve cash flow for property managers?

They create a consistent revenue stream by automating billing and reminders, reducing late payments, and minimizing gaps caused by manual processes.

3. Can recurring invoices be used for additional fees like parking or utilities?

Yes. Any recurring charge tied to a lease or service contract, including parking, storage, or shared utility costs, can be added to automated invoices.

4. Do recurring invoices reduce administrative workload?

Absolutely. Automation eliminates repetitive tasks such as creating invoices, sending reminders, and tracking payments, allowing property managers to focus on operations and tenant relations.

5. How does automation help with late fees?

Systems can automatically calculate late fees and apply them to tenant accounts, ensuring consistency and reducing manual follow-up.

6. Are recurring invoices suitable for multi-property portfolios?

Yes. Centralized recurring invoicing allows property managers to handle multiple properties efficiently, consolidate reports, and maintain visibility across the portfolio.

7. How does recurring invoicing improve tenant experience?

Professional, consistent invoices with clear breakdowns and online payment options make it easier for tenants to understand their obligations, pay on time, and avoid disputes.

Conclusion

Recurring invoices are essential for improving cash flow in real estate. They stabilize income, reduce administrative work, minimize errors, and provide clear documentation for both tenants and property managers.

For real estate businesses, predictable revenue from automated recurring invoices supports budgeting, financial forecasting, and long-term growth. When combined with a system like ReliaBills, recurring invoicing becomes a scalable, reliable solution that enhances operational efficiency and strengthens tenant relationships.