Consistent revenue is the foundation of every successful membership organization. Whether the organization operates a professional association, nonprofit group, online community, or subscription-based club, predictable income allows leaders to plan programs, retain staff, and invest in long-term growth. Without reliable billing, even strong membership engagement can be undermined by cash flow instability.

Many membership organizations struggle because their billing systems were not designed for recurring relationships. Manual invoicing, spreadsheet tracking, and ad hoc reminders often lead to late payments, missed renewals, and frustrated members. As membership numbers increase, these issues become harder to manage and more costly to fix.

Recurring invoices offer a sustainable solution by automating ongoing billing while maintaining clear communication with members. By creating predictable billing cycles, membership organizations can reduce administrative burden, improve financial visibility, and build stronger relationships with their members over time.

Table of Contents

ToggleWhat Are Recurring Invoices?

Recurring invoices are invoices that are automatically generated and sent on a predefined schedule. For membership organizations, these invoices typically cover recurring dues, subscriptions, or contributions tied to active memberships. Once configured, recurring invoices continue to run without the need for manual intervention.

Billing frequencies vary depending on the organization’s structure and member preferences. Monthly billing is often used for affordability and steady revenue, while quarterly or annual billing simplifies renewals and reduces transaction volume. Recurring invoices can be customized to match these schedules precisely.

Unlike one-time membership billing, recurring invoices eliminate the need to recreate invoices at each renewal period. They ensure consistent formatting, accurate amounts, and timely delivery, which helps reduce confusion and missed payments.

How Membership Organizations Generate Revenue

Membership dues are the most common and reliable source of revenue for membership organizations. These dues may grant access to resources, professional networks, or exclusive content. Recurring invoices ensure dues are collected consistently without relying on manual reminders or follow-ups.

Many organizations also offer tiered membership plans with varying benefits and pricing levels. Premium tiers, add-on services, and special access programs can all be billed on a recurring basis. Automated invoicing makes it easy to manage multiple pricing structures without increasing complexity.

Events, donations, and recurring contributions often supplement membership revenue. Workshops, conferences, and fundraising initiatives benefit from recurring billing when participation is ongoing. Automation ensures these payments are tracked accurately and aligned with member records.

Common Billing Challenges for Membership Organizations

Missed or Late Membership Payments

Many membership organizations rely on manual billing or email reminders, which increases the risk of members forgetting to pay on time. Late payments can disrupt cash flow and force staff to spend extra time on follow-ups. Over time, inconsistent collections make it difficult to plan programs, staffing, and events with confidence.

Manual Renewal Tracking

Tracking renewals manually becomes increasingly difficult as membership numbers grow. Staff often rely on spreadsheets or calendar reminders, which can easily lead to missed renewals or duplicated charges. This lack of automation creates confusion for members and increases the risk of churn.

Inconsistent Billing Communication

Members may receive invoices, reminders, and renewal notices through different channels or at irregular intervals. Inconsistent communication can lead to misunderstandings about due dates, pricing changes, or membership terms. When billing messages are unclear, members are more likely to question charges or delay payment.

Billing Errors Across Membership Tiers

Organizations offering multiple membership levels or add-ons often struggle with pricing accuracy. Manual invoicing increases the likelihood of incorrect charges, missing discounts, or outdated pricing. Even small billing mistakes can erode trust and increase support requests.

Limited Visibility Into Payment Status

Without centralized billing tools, staff may not have a real-time view of who has paid, who is overdue, and which memberships are nearing renewal. This lack of visibility makes proactive outreach difficult and slows financial reporting. It also prevents leadership from making informed decisions based on accurate revenue data.

Why Recurring Invoices Are Essential for Membership Models

Recurring invoices create predictable billing cycles that benefit both organizations and members. Members know when and how much they will be charged, while organizations can rely on steady income. This predictability supports long-term planning and operational stability.

Automation significantly reduces administrative workload. Staff no longer need to manually generate invoices, track renewals, or chase late payments. This allows teams to focus on member engagement, program development, and strategic initiatives.

Financial stability improves when revenue is consistent. Recurring invoices reduce revenue gaps caused by delayed renewals or forgotten payments. This stability is especially important for organizations that rely heavily on membership income.

Improving Member Retention Through Predictable Billing

Predictable billing eliminates surprises that can frustrate members. When invoices arrive on a consistent schedule with clear descriptions, members feel more confident and informed. This transparency strengthens trust over time.

Seamless renewals also play a key role in retention. Recurring invoices ensure memberships renew automatically without requiring action from the member. This reduces lapses and keeps engagement uninterrupted.

When billing feels smooth and professional, members are more likely to stay long term. Reliable invoicing reinforces the organization’s credibility and commitment to member experience.

Recurring Invoices and Cash Flow Predictability

Consistent revenue streams are essential for financial planning. Recurring invoices allow membership organizations to anticipate income and allocate resources more effectively. This predictability reduces financial stress.

Better budgeting and forecasting become possible when billing patterns are stable. Organizations can plan events, marketing efforts, and staffing needs with confidence. Automated billing removes uncertainty from revenue projections.

Reduced reliance on manual follow-ups also improves cash flow health. Automated reminders and scheduled invoices ensure payments are collected on time without constant staff involvement.

Supporting Membership Renewals and Plan Changes

Automatic renewals simplify the membership lifecycle. Recurring invoices ensure renewals happen on time and align with membership terms. This minimizes disruptions and administrative overhead.

Handling plan upgrades, downgrades, or pauses becomes more manageable with automation. Billing adjustments can be reflected in future invoices without confusion or manual recalculation. Members appreciate flexibility when their needs change.

Accurate member records are maintained when billing updates occur automatically. This ensures billing history, membership status, and payment details remain consistent and reliable.

Reducing Billing Errors and Member Disputes

Standardized invoices with clear line items reduce misunderstandings. Members can easily see what they are paying for and how charges are calculated. Transparency prevents disputes before they arise.

Automated calculations further reduce errors. Taxes, discounts, and prorated charges are applied consistently across all members. This accuracy builds confidence in the billing process.

Fewer billing-related inquiries mean staff spend less time resolving disputes. This improves operational efficiency and member satisfaction simultaneously.

Enhancing the Member Experience

Easy access to invoices and payment history empowers members. Digital records allow members to review past charges without contacting support. Convenience improves overall satisfaction.

Multiple payment options make it easier for members to pay on time. Flexible methods reduce friction and accommodate different preferences. Faster payments benefit both parties.

Transparent communication throughout the billing process strengthens relationships. Timely invoices, reminders, and confirmations help members feel informed and respected.

Scaling Membership Organizations with Recurring Billing

Recurring billing supports growth without increasing administrative workload. Automated systems handle higher invoice volumes effortlessly. This scalability is essential for expanding organizations.

Managing multiple membership tiers becomes simpler with structured billing rules. Each tier can have its own pricing, schedule, and benefits. Automation ensures consistency across all levels.

Large member bases are easier to manage when billing is centralized. Recurring invoices provide visibility and control even as organizations grow across regions or programs.

Best Practices for Membership Organizations Using Recurring Invoices

Set Clear Billing Terms From the Start

Membership agreements should clearly define billing frequency, renewal timing, and payment expectations. When members understand exactly when and how they will be billed, disputes and confusion are significantly reduced. Transparent terms also improve long-term trust and retention.

Standardize Membership Invoice Templates

Using consistent invoice formats helps members quickly recognize charges and understand what they are paying for. Standardized templates reduce errors and make invoices easier to review for both members and staff. Clear line items also support better record-keeping and compliance.

Automate Renewals and Payment Reminders

Recurring invoices combined with automated reminders ensure members are notified before payments are due. This reduces the need for manual follow-ups and improves on-time payment rates. Automation also makes renewals feel seamless rather than disruptive.

Offer Flexible Billing Options

Providing monthly, quarterly, or annual billing options allows members to choose what works best for their budget. Flexible payment methods such as cards and bank transfers reduce friction at checkout. Convenience plays a major role in keeping members enrolled long term.

Monitor Billing Performance Regularly

Regularly reviewing billing reports helps organizations identify trends such as late payments or high churn periods. These insights allow teams to adjust billing strategies and communication before issues escalate. Continuous monitoring supports healthier, more predictable revenue.

How ReliaBills Supports Membership Recurring Invoices

ReliaBills helps membership organizations simplify invoicing by centralizing all billing activities in one easy-to-manage platform. Membership dues, add-ons, and event-related charges can be invoiced consistently using standardized templates that reduce errors and confusion. This creates a more professional billing experience for members while reducing manual work for staff.

Recurring billing is a core strength of ReliaBills, making it easier to automate membership renewals and scheduled dues. Organizations can set billing frequencies that align with their membership models, whether monthly, quarterly, or annual. Automated reminders and scheduled invoices help ensure payments are collected on time, improving cash flow and reducing missed renewals.

ReliaBills also provides clear visibility into member payment status through centralized tracking and reporting. Teams can quickly see active memberships, overdue accounts, and upcoming renewals without relying on spreadsheets or manual checks. With better insight and automation, membership organizations can focus more on engagement and growth while maintaining predictable, recurring revenue.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

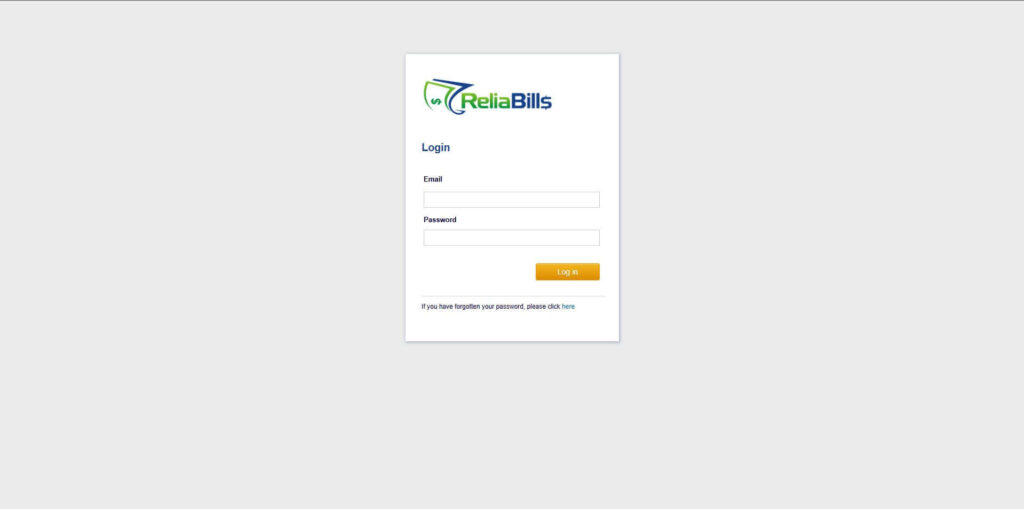

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

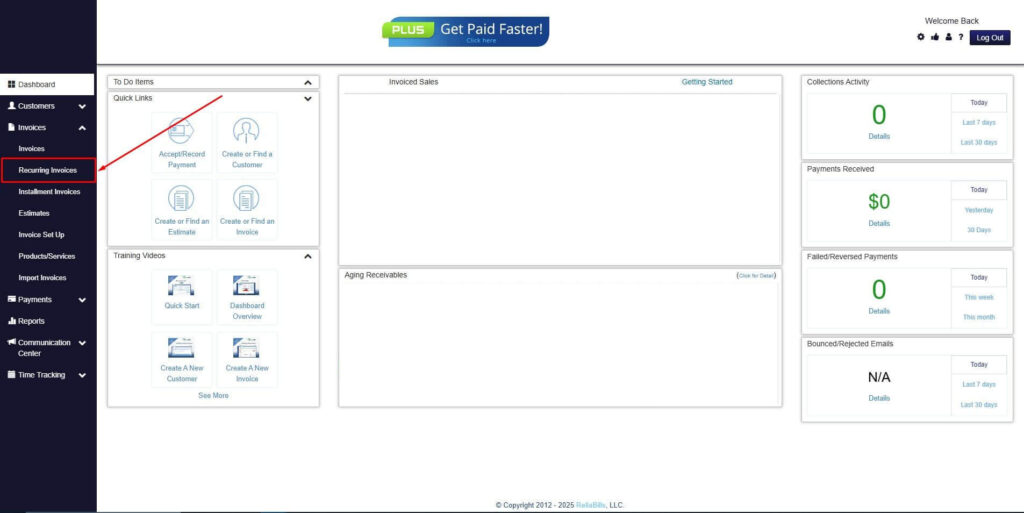

Step 2: Click on Recurring Invoices

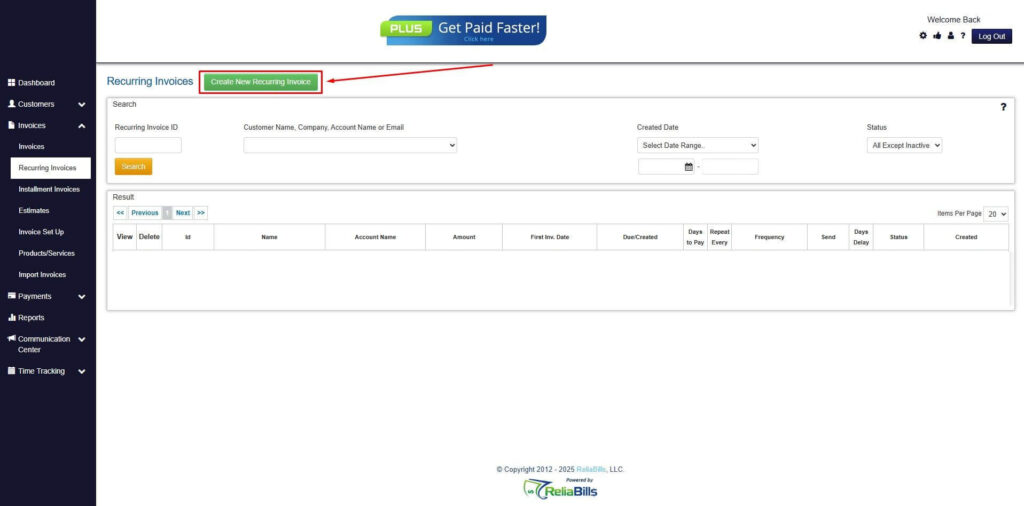

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

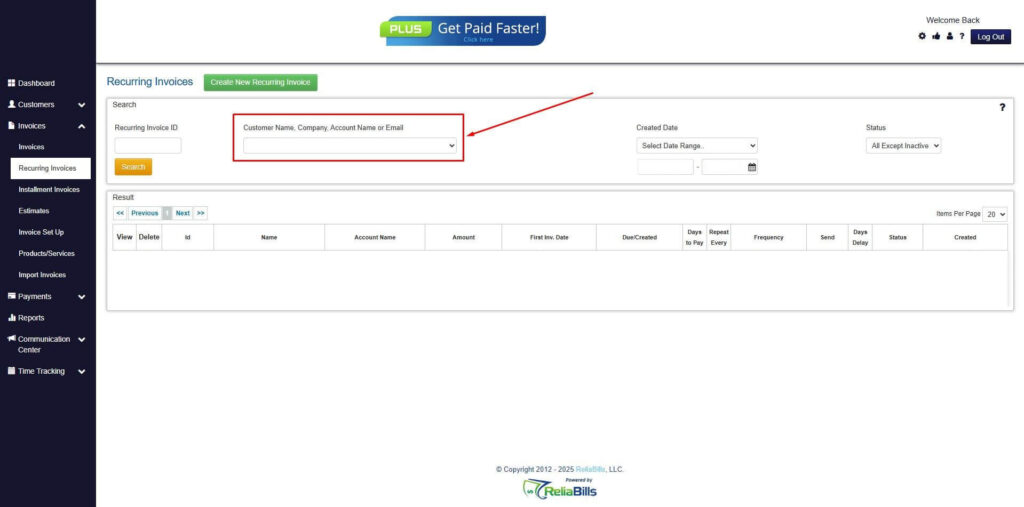

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

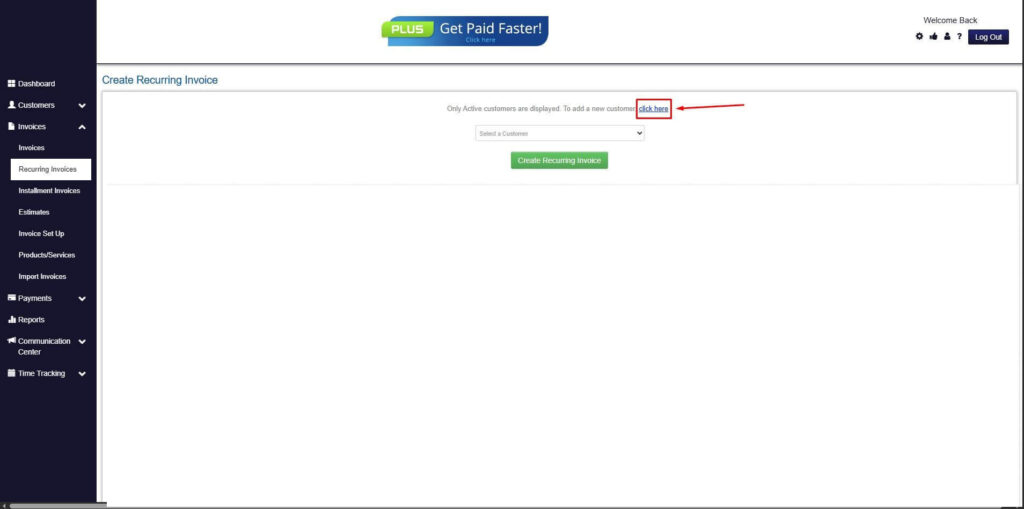

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

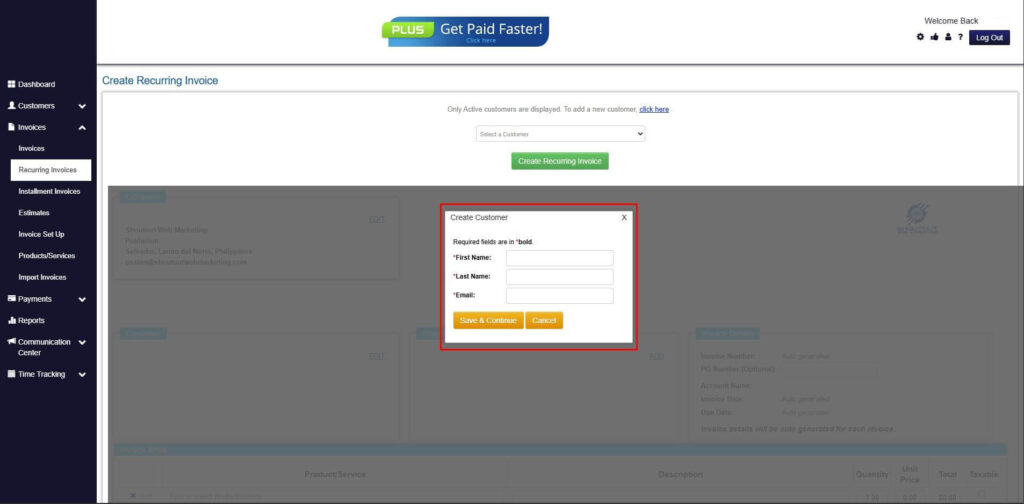

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

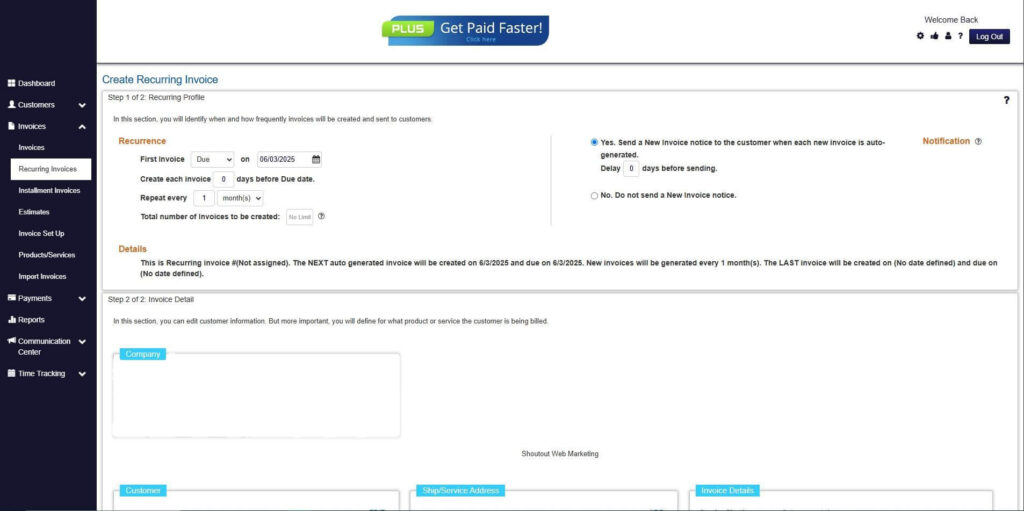

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

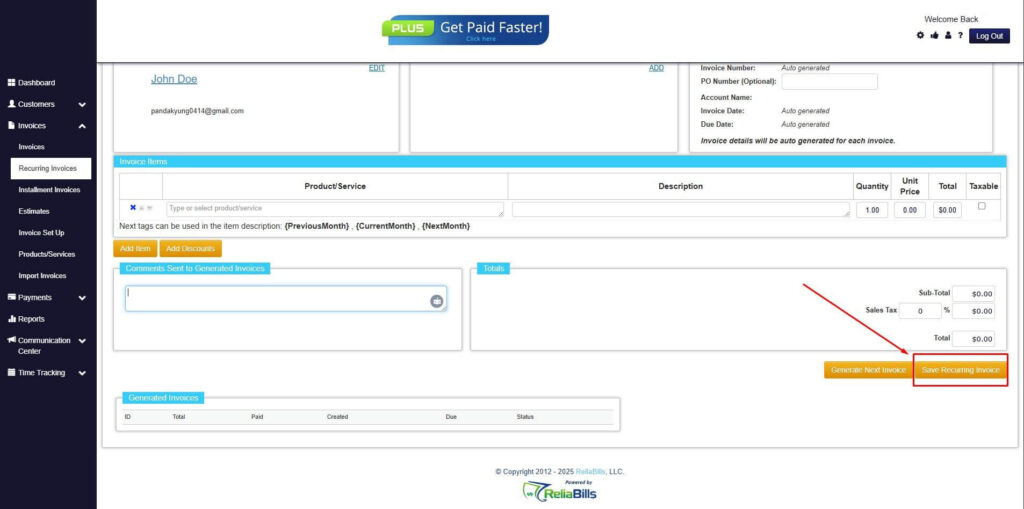

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

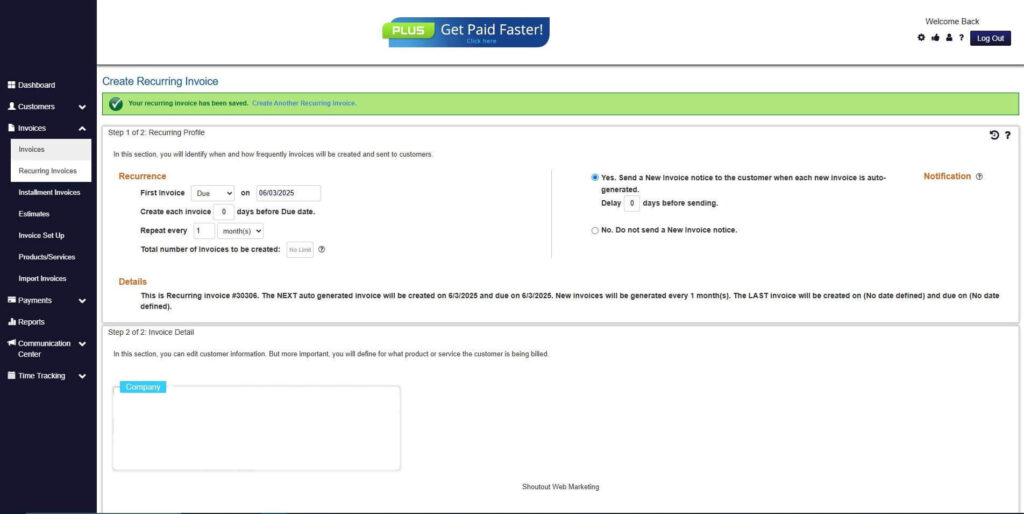

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Are recurring invoices suitable for small membership organizations?

Yes, recurring invoices are highly beneficial for organizations of all sizes. Even small membership groups save time and reduce errors by automating billing. As the organization grows, recurring invoicing scales without adding administrative burden.

2. Can recurring invoices handle multiple membership tiers?

Most modern billing systems support tiered pricing and add-ons. Each member can be assigned to the correct plan with automated pricing and billing schedules. This ensures accurate invoicing regardless of membership complexity.

3. How do recurring invoices help with member retention?

Predictable billing eliminates surprises and makes renewals effortless. Members are more likely to stay enrolled when payments are automatic and communication is clear. A smooth billing experience directly supports long-term engagement.

4. What happens if a member’s payment fails?

Automated systems can trigger reminders and retry payments without manual intervention. Members are notified quickly, allowing issues to be resolved before access is interrupted. This reduces involuntary churn caused by simple payment failures.

5. Do recurring invoices replace the need for receipts or records?

Recurring invoices actually improve record-keeping by maintaining a complete billing history. Members and staff can access past invoices and payments at any time. This is especially helpful for audits, reporting, and member inquiries.

Conclusion

Recurring invoices are essential for membership organizations seeking consistent revenue, improved retention, and operational efficiency. They reduce administrative effort, minimize errors, and create predictable cash flow that supports long-term sustainability.

By adopting recurring invoices for membership, organizations can strengthen member trust, improve financial stability, and scale with confidence. With the right recurring billing tools in place, invoicing becomes a strategic advantage rather than a recurring challenge.