Recurring billing has become a common part of how businesses charge for services today, especially as more companies move toward subscription and ongoing service models. Instead of sending invoices manually every billing period, businesses now rely on automated systems to handle repeat payments. This shift helps reduce errors and creates a more consistent billing experience.

Many organizations initially rely on manual invoicing because it feels straightforward at a small scale. Over time, this approach becomes inefficient as customer numbers grow and billing cycles multiply. Delays, missed invoices, and follow-ups start to consume valuable time and resources.

Speed and simplicity are now essential expectations in billing. Customers want predictable charges, and businesses need reliable cash flow. Recurring billing for any business offers a way to meet both needs while supporting long-term growth.

Table of Contents

ToggleWhat Is Recurring Billing?

Recurring billing is a payment structure where customers are charged automatically at set intervals based on an agreement. These intervals may be monthly, quarterly, or annually depending on the service provided. Once established, billing continues without the need for repeated manual actions.

The process typically includes automatic invoice generation and scheduled payment collection. Customers know when charges will occur, which reduces confusion and disputes. Businesses benefit from reduced administrative effort and improved consistency.

Recurring billing for any business works across many industries. It is used by software companies, service providers, consultants, and maintenance businesses. The flexibility of the model allows it to adapt to different pricing and service structures.

Common Challenges with Traditional Billing Methods

Manual billing often requires staff to prepare, send, and track each invoice individually. This creates opportunities for mistakes such as incorrect amounts or missed billing dates. Even small errors can delay payments and strain customer relationships.

Traditional billing also lacks consistency when schedules are not standardized. Customers may receive invoices at irregular times or with varying formats. This inconsistency can lead to questions, disputes, and slower collections.

As transaction volumes increase, manual systems struggle to keep up. Tracking payments across multiple customers becomes more complex and time-consuming. Without automation, scaling billing operations becomes difficult.

Benefits of Recurring Billing for Any Business

- Predictable revenue that allows businesses to plan expenses and investments more confidently

- Faster and more consistent payments that improve overall cash flow

- Reduced administrative work by eliminating repetitive invoicing tasks

- Better customer experience through reliable and transparent billing

How Recurring Billing Simplifies Payment Collection

Recurring billing simplifies payment collection by automating invoice creation and delivery. Invoices are generated and sent on time without manual intervention. This consistency reduces missed billing cycles and late payments.

Payments are scheduled according to agreed terms, removing the need for customers to take action each time. This convenience lowers friction and encourages timely payment behavior. Businesses experience fewer payment delays as a result.

Automated reminders and retry processes help recover failed payments. Instead of relying on manual follow-ups, the system handles retries automatically. This improves collection rates while saving staff time.

Key Features of an Effective Recurring Billing System

An effective system offers flexible billing schedules that align with different business models. Businesses can adjust billing frequency, pricing, and duration as needed. This flexibility supports both fixed and variable charges.

Support for multiple payment methods is also essential. Customers expect options, including cards and digital payments. Automated notifications keep customers informed about upcoming and completed charges.

Reporting tools provide visibility into billing performance. Businesses can monitor payment success, revenue trends, and customer behavior. These insights help improve decision-making and financial planning.

Recurring Billing Use Cases Across Industries

- Service-based businesses offering ongoing support or maintenance

- Subscription and membership-based companies charging recurring fees

- Consultants and professional service firms using monthly retainers

- Maintenance, utilities, and long-term service contract providers

Best Practices for Making Recurring Billing Quick and Easy

Clear billing terms should be established before recurring charges begin. Customers need to understand pricing, frequency, and payment methods upfront. Transparency reduces confusion and disputes.

Standardizing pricing and billing cycles simplifies internal management. Fewer variations make billing easier to track and audit. Consistency also helps customers know what to expect.

Regularly reviewing billing performance is equally important. Monitoring failed payments and churn rates helps identify issues early. Adjustments can be made before problems grow.

Common Mistakes to Avoid

Overly complex billing schedules often confuse customers and staff. Simple and consistent structures are easier to manage and explain. Predictability leads to better payment outcomes.

Poor communication about charges can damage trust. Customers should always understand what they are paying for and why. Clear invoices help prevent disputes.

Failing to monitor failed payments results in lost revenue. Manual follow-ups are unreliable and inefficient. Automated tracking helps ensure issues are addressed promptly.

How ReliaBills Makes Recurring Billing Simple

ReliaBills helps businesses manage billing by centralizing invoices, payments, and customer data in one platform. This eliminates the need for separate tools and manual tracking. The result is improved accuracy and efficiency.

Recurring billing is a core capability within ReliaBills, allowing businesses to automate invoice creation, payment collection, and reminders. These features work together to reduce late payments and billing disputes. Businesses gain more predictable revenue with less effort.

ReliaBills PLUS is designed for growing businesses that need additional automation and reporting. It supports advanced recurring billing workflows and scalable billing operations. This makes recurring billing for any business easier to manage as demand increases.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

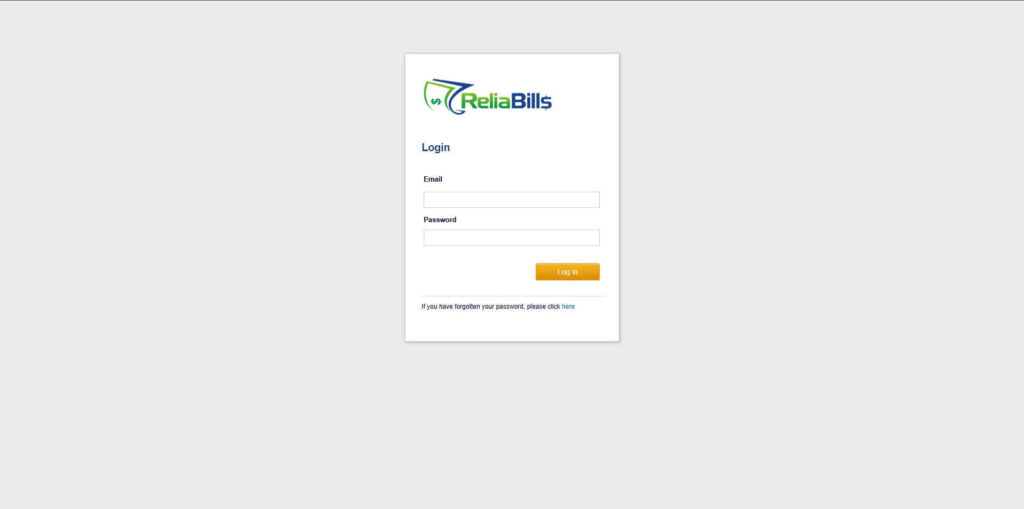

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

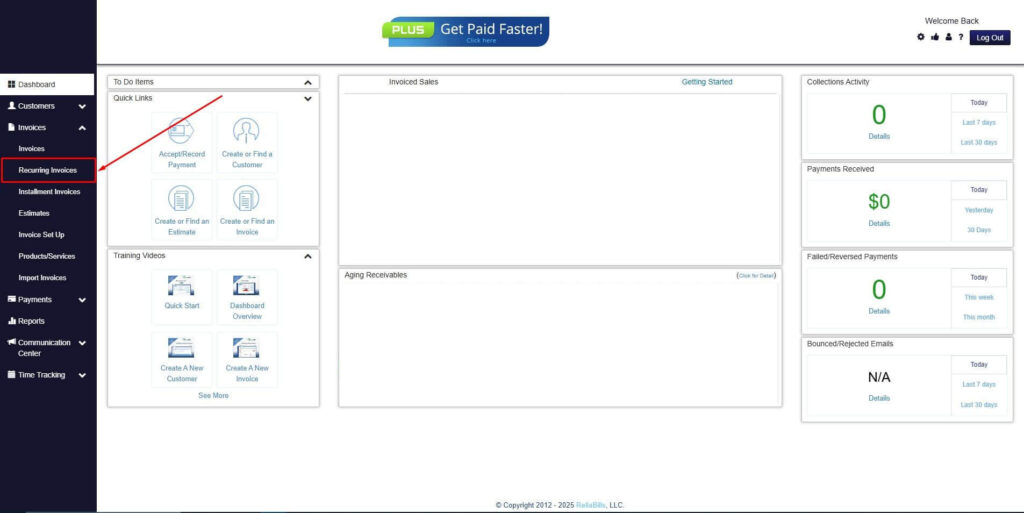

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

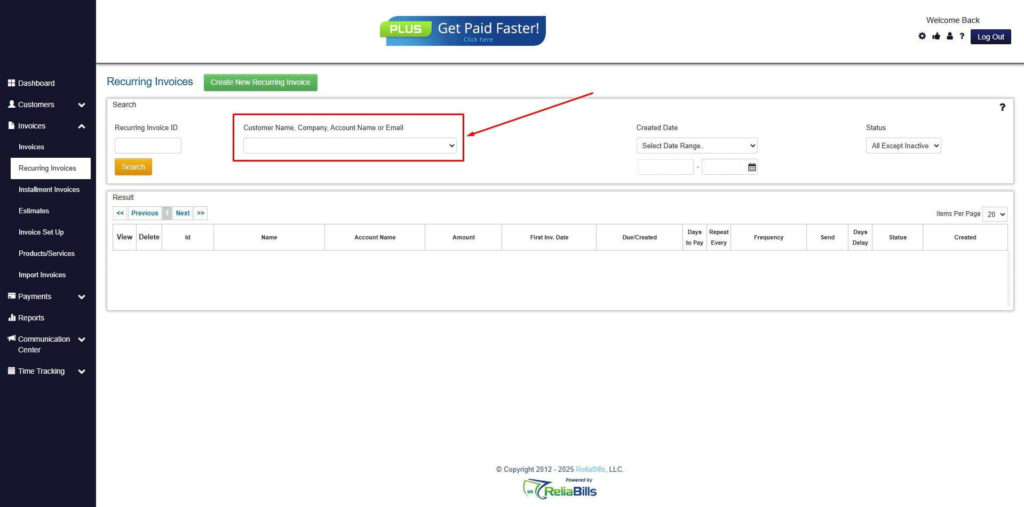

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

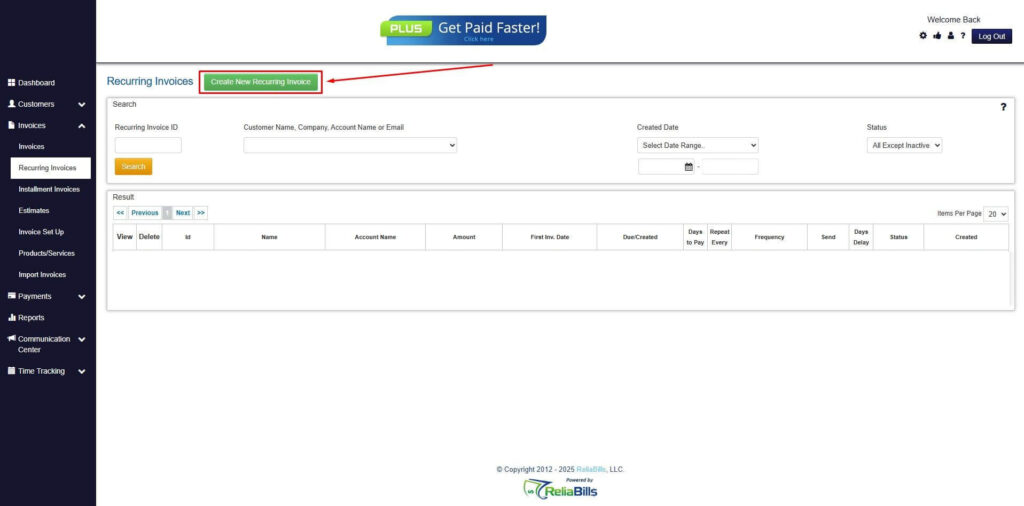

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

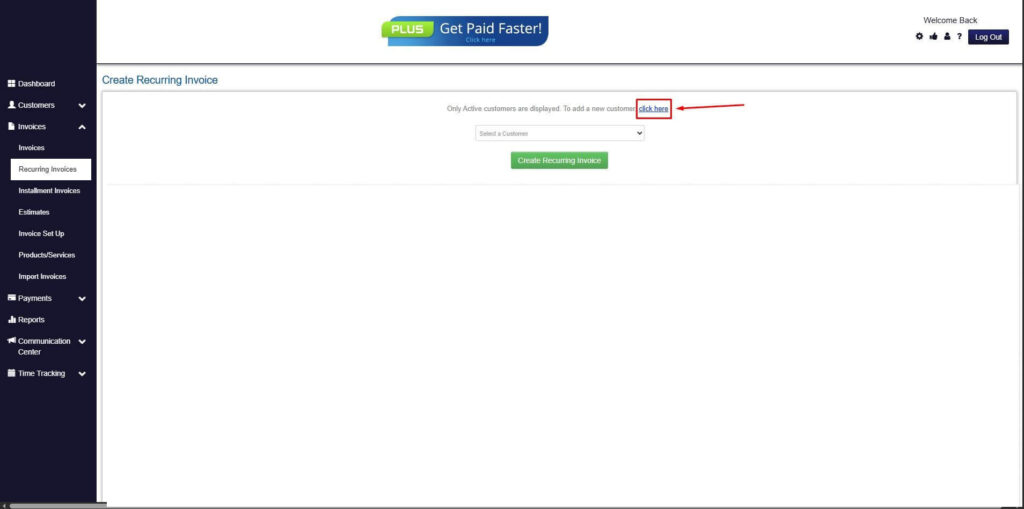

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

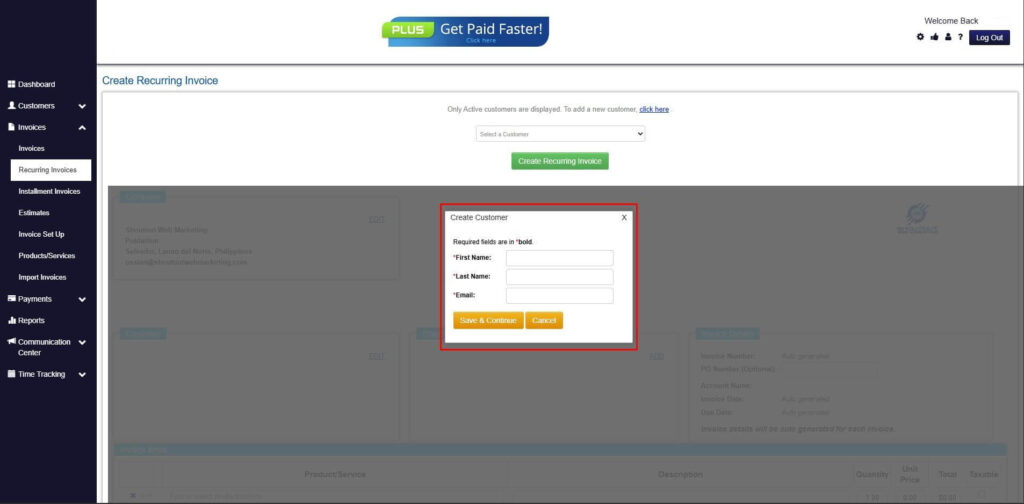

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

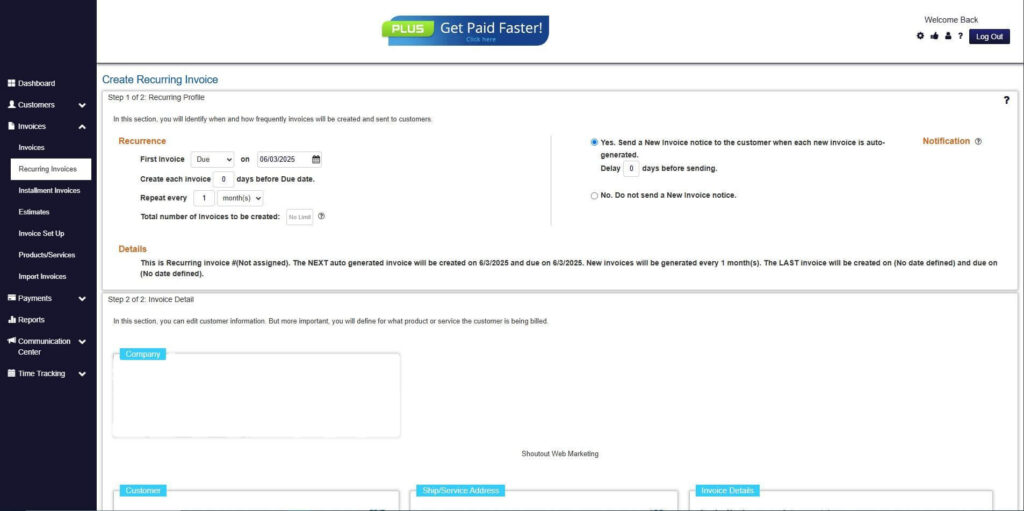

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

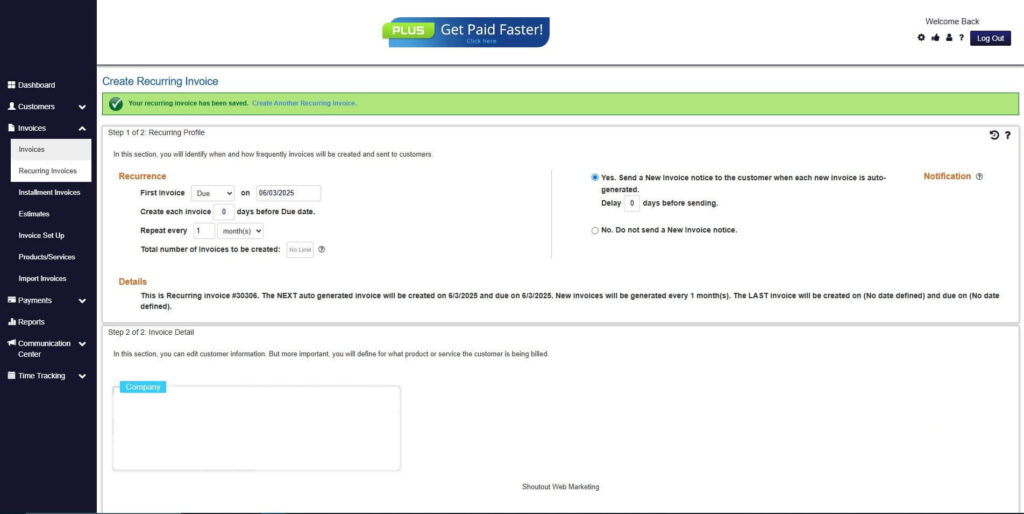

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is recurring billing suitable for small businesses?

Yes, recurring billing for any business works well for small and growing companies.

2. Can recurring billing support variable pricing?

Many systems allow flexible charges based on usage or service level.

3. How secure are recurring billing platforms?

Reputable platforms use encryption and compliance standards to protect data.

4. How long does setup usually take?

Most businesses can get started quickly with minimal configuration.

Conclusion

Recurring billing provides a reliable way to manage payments while reducing administrative effort. It improves consistency, accuracy, and customer satisfaction. These advantages make it a practical solution for modern businesses.

Automation is the key factor that makes recurring billing effective. Manual processes struggle to support growth and volume. Automated systems offer scalability and control.

Recurring billing for any business supports predictable revenue and long-term stability. With the right approach and tools, billing becomes a streamlined process rather than a challenge. Businesses can focus more on delivering value and less on chasing payments.