Recurring billing models are designed to create stable and predictable revenue, but they also introduce risk if billing processes are not carefully managed. One of the most common risks is overbilling, especially when subscription changes, usage adjustments, or billing errors occur mid-cycle. Even small mistakes can compound over time and damage customer trust.

Overbilling does not just affect revenue accuracy. It impacts customer relationships, brand reputation, and operational efficiency. Businesses that fail to correct billing errors quickly may face disputes, chargebacks, and even customer churn.

Automated return invoices provide a structured way to prevent overbilling with return invoices by correcting billing discrepancies immediately and transparently. When integrated into recurring billing systems, they ensure accurate adjustments while protecting both revenue and customer confidence.

Table of Contents

ToggleWhat Is Overbilling in Recurring Billing?

Overbilling in recurring billing occurs when a customer is charged more than agreed upon under a subscription or service contract. This can happen because of duplicate invoices, outdated pricing plans, incorrect billing cycles, or misapplied add-ons.

Common causes include system misalignment after subscription upgrades or downgrades. If plan changes are not reflected immediately, customers may continue to be charged under previous terms. Proration errors can also result in inflated charges.

In recurring environments, even minor miscalculations can repeat month after month. That is why businesses must actively prevent overbilling with return invoices and automated correction processes.

What Are Return Invoices?

Return invoices are formal billing documents that reverse or adjust previously issued invoices. They are issued when a correction is required, such as when an overcharge is identified in a recurring billing cycle.

Unlike refunds, which typically involve payment reversals, return invoices adjust the account balance through structured billing documentation. They differ from credit memos because they are directly tied to invoice-level corrections within the billing workflow.

In recurring billing systems, return invoices are issued when subscription adjustments, billing errors, or usage recalculations require documented corrections. They maintain financial clarity and ensure transparent records.

Why Manual Return Invoice Processes Fail

Manual return invoice management often leads to delays. By the time errors are discovered, multiple billing cycles may already be affected, increasing the complexity of corrections.

Calculation inconsistencies are another common issue. Human error during adjustments can create further discrepancies instead of resolving the original mistake.

Manual systems also lack visibility across billing cycles. Without centralized tracking, businesses struggle to identify patterns of recurring overbilling. This makes it harder to proactively prevent overbilling with return invoices.

How Overbilling Happens in Subscription and Recurring Models

Proration errors are a frequent cause of overbilling. When customers upgrade or downgrade mid-cycle, inaccurate proration calculations can result in higher-than-expected charges.

Failure to update billing plans in real time is another risk. If pricing adjustments are delayed in the system, customers may continue to be charged outdated rates.

Misapplied add-ons or usage-based charges can also inflate invoices. Without automated checks, these discrepancies can go unnoticed until customers raise concerns.

What Are Automated Return Invoices?

Automated return invoices are system-generated corrections triggered by predefined billing rules. Instead of relying on manual intervention, the billing platform identifies discrepancies and initiates adjustments automatically.

These systems use rule-based workflows to validate subscription changes, usage updates, and billing cycle modifications. When inconsistencies are detected, corrective invoices are created instantly.

Integrated within recurring billing platforms, automated return invoices ensure corrections happen in real time. This is a core strategy to prevent overbilling with return invoices while maintaining operational efficiency.

How to Prevent Duplicate and Incorrect Charges

Implement Automated Invoice Validation Rules

Configure your billing system to flag duplicate invoice numbers, overlapping billing periods, and repeated line items before invoices are finalized. Automated validation reduces reliance on manual reviews and prevents errors from reaching customers. Rule-based checks should apply to subscriptions, add-ons, usage charges, and proration adjustments.

Use Unique Invoice and Subscription Identifiers

Assign distinct invoice IDs and subscription references for every recurring customer. This prevents accidental duplication when processing renewals, upgrades, or manual adjustments. Unique identifiers also simplify reconciliation during audits.

Automate Proration Calculations

Incorrect proration during mid-cycle upgrades or downgrades is a major source of billing errors. Use predefined proration formulas within your recurring billing system to ensure charges reflect actual service usage. Automated calculations eliminate guesswork and reduce customer disputes.

Enable Real-Time Plan Synchronization

Ensure subscription plan changes update immediately across your billing platform. Delays between CRM updates and invoicing systems often result in outdated pricing being charged. Real-time synchronization prevents mismatched billing cycles.

Set Up Duplicate Charge Detection Alerts

Activate system alerts that notify billing teams when similar invoices are generated within a short timeframe. Monitoring tools can flag unusual billing activity, allowing teams to intervene before invoices are sent.

Review Add-Ons and Usage Charges Regularly

Recurring billing models frequently include add-ons, usage-based fees, or tiered pricing. Conduct periodic reviews to confirm that these charges are correctly applied and aligned with contract terms. Automated reporting dashboards can simplify this review process.

Maintain Clear Documentation of Billing Rules

Document pricing logic, discount structures, and billing cycle definitions. Clear internal documentation reduces human error during manual adjustments and ensures consistent application of billing policies.

Managing Plan Changes and Prorated Adjustments

Subscription models often involve mid-cycle plan changes. Automated systems recalculate charges instantly when upgrades or downgrades occur.

Proration is handled systematically using predefined formulas. This ensures customers are billed only for the portion of service they actually used.

Clear documentation of adjustments appears directly on return invoices. This transparency helps reduce confusion and reinforces trust in recurring billing systems.

Improving Transparency and Customer Trust

Customers expect clear explanations when billing changes occur. Automated return invoices provide structured, itemized documentation that explains each correction.

Digital records allow businesses to resolve disputes quickly. Instead of searching through spreadsheets or manual logs, teams can access time-stamped billing histories instantly.

Transparency is essential for long-term retention. Businesses that proactively prevent overbilling with return invoices demonstrate accountability and professionalism.

Protecting Revenue While Avoiding Overbilling

Preventing overbilling does not mean sacrificing revenue. In fact, accurate billing protects legitimate recurring revenue by ensuring customers remain confident in ongoing charges.

Automated adjustments help maintain correct revenue recognition. Financial reporting remains consistent because corrections are documented systematically.

By reducing unnecessary refunds and chargebacks, businesses stabilize cash flow while improving customer relationships.

Enhancing Audit Trails and Compliance

Every automated return invoice includes time-stamped records and detailed adjustment notes. This creates a reliable audit trail for internal reviews and regulatory compliance.

Centralized invoice history simplifies financial audits. All corrections are linked directly to original invoices and subscription records.

Accurate documentation supports stronger reporting and reduces compliance risks. Structured correction workflows strengthen overall financial governance.

Best Practices for Preventing Overbilling

Define Clear Subscription and Pricing Policies

Clearly outline billing frequencies, renewal terms, upgrade procedures, and cancellation policies. Ambiguity increases the risk of overbilling, especially in recurring models. Well-defined billing rules create a strong foundation for accurate invoicing.

Automate Return Invoice Workflows

Implement automated return invoices to correct discrepancies immediately when detected. Automated correction workflows reduce delays, minimize disputes, and maintain accurate account balances without interrupting recurring revenue.

Conduct Regular Billing Audits

Schedule monthly or quarterly audits of recurring billing data. Review duplicate charge rates, refund requests, and dispute trends. Proactive audits help identify systemic issues before they escalate.

Monitor Key Billing Performance Metrics

Track metrics such as invoice error rates, failed payments, chargeback frequency, and adjustment volumes. Monitoring these indicators supports continuous improvement in billing accuracy.

Standardize Invoice Templates and Line Items

Use consistent invoice formatting and standardized service descriptions. Clear and uniform invoices reduce misinterpretation and lower the risk of disputes related to billing confusion.

Integrate Billing with Payment Systems

Ensure seamless integration between invoicing and payment gateways. Automated reconciliation confirms that payments match issued invoices and highlights discrepancies early.

Train Billing and Finance Teams

Even automated systems require oversight. Train teams to understand billing workflows, subscription structures, and adjustment procedures. Skilled oversight reduces manual errors and strengthens internal controls.

Maintain Transparent Customer Communication

Inform customers about billing schedules, plan changes, and pricing updates in advance. Transparency reduces surprise charges and improves trust in recurring billing relationships.

How ReliaBills Automates Return Invoice Management

Managing corrections in recurring billing requires precision, visibility, and speed. ReliaBills streamlines return invoice management by automating how billing adjustments are created, tracked, and documented. Instead of relying on manual corrections or disconnected spreadsheets, businesses can generate return invoices directly within the billing workflow. This reduces delays, prevents calculation inconsistencies, and ensures customer account balances remain accurate.

Because ReliaBills is built with recurring billing at its core, return invoices integrate seamlessly into subscription cycles. When upgrades, downgrades, cancellations, or billing discrepancies occur, the system can automatically calculate adjustments and issue the appropriate return invoice. This protects predictable revenue while helping prevent overbilling with return invoices. Automated reminders, payment tracking, and real-time status updates further support transparency across every customer account.

For growing businesses, ReliaBills PLUS provides enhanced visibility and control over billing adjustments and recurring revenue performance. Centralized dashboards make it easy to review invoice histories, monitor corrections, and maintain audit-ready documentation. With automation, standardized workflows, and recurring billing intelligence, ReliaBills helps businesses maintain billing accuracy, strengthen customer trust, and reduce operational risk.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

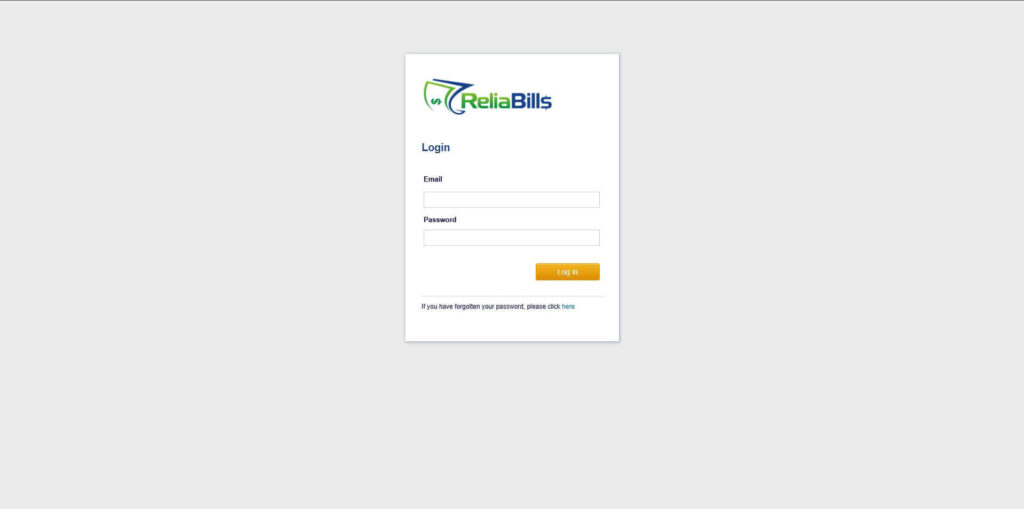

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

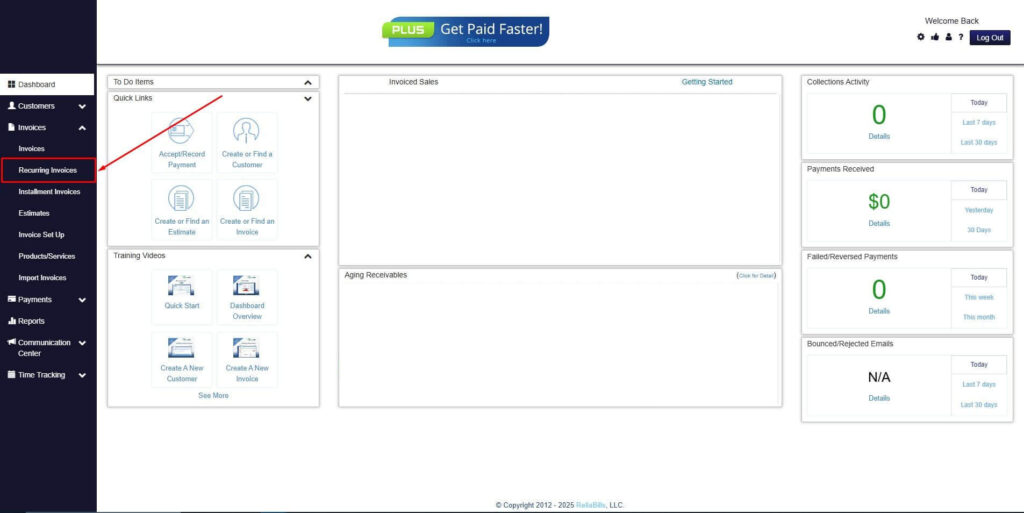

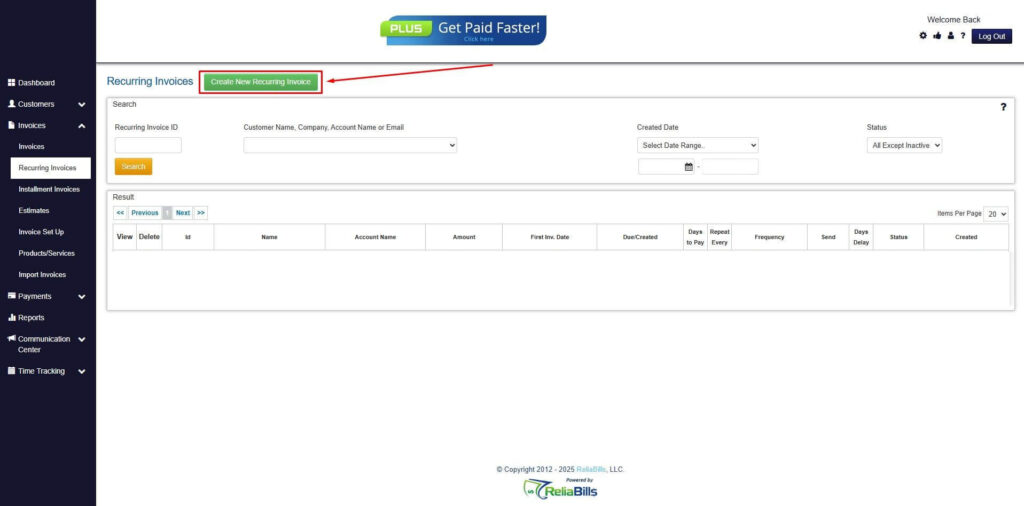

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

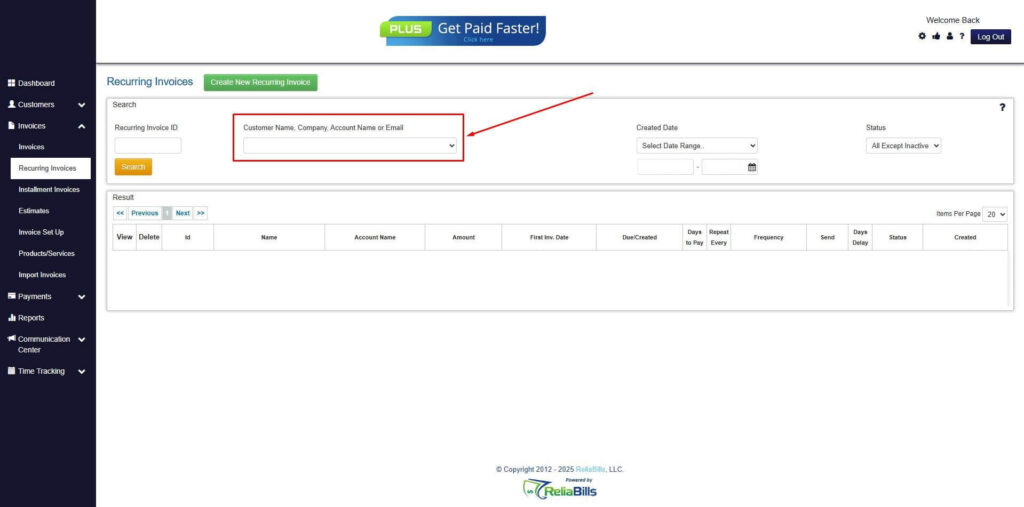

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

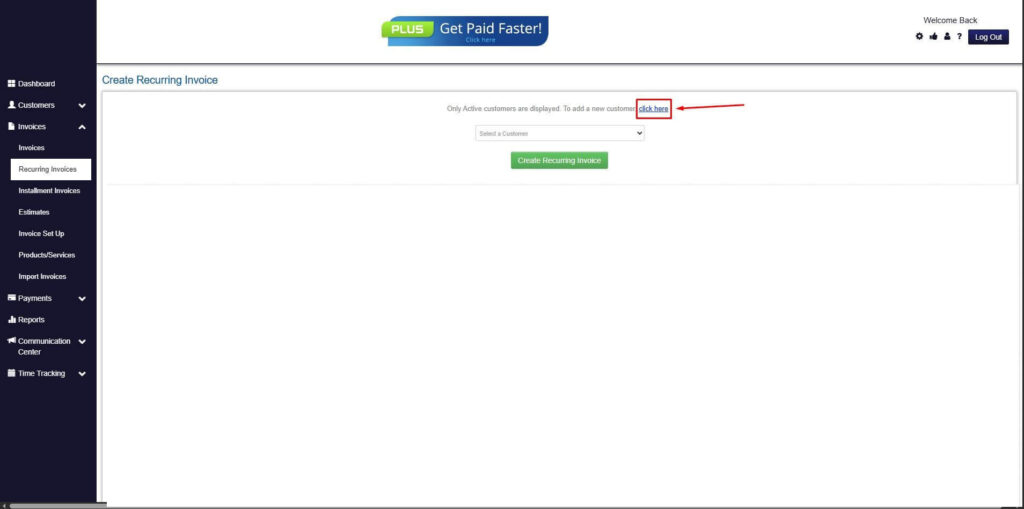

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

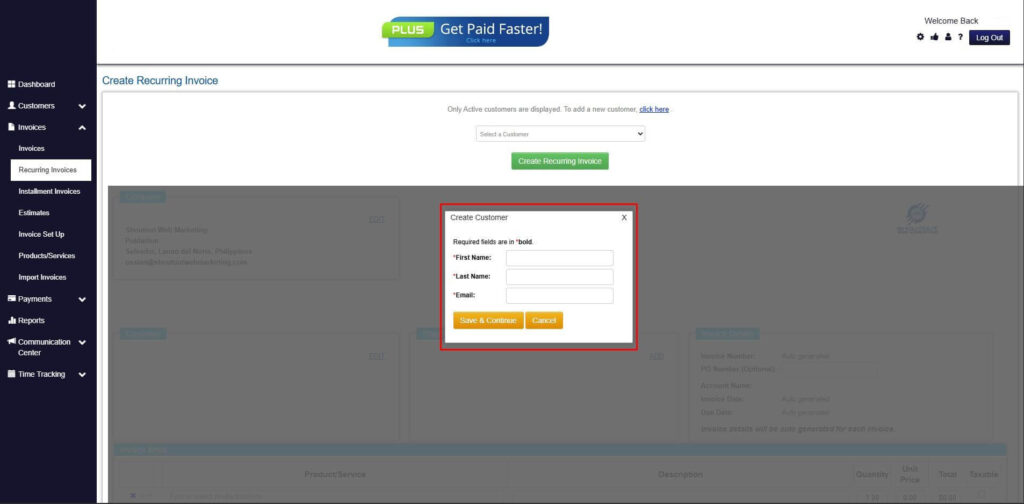

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

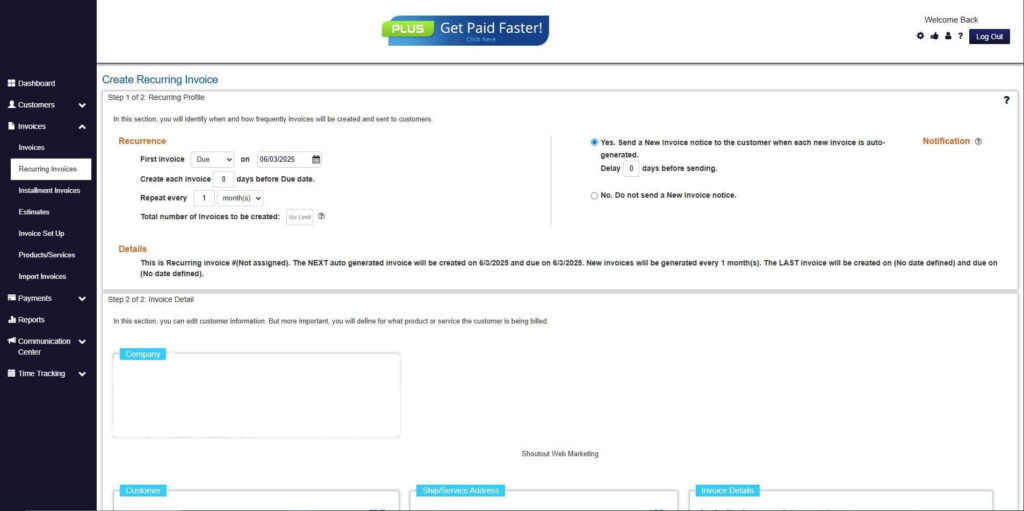

Step 7: Fill in the Create Recurring Invoice Form

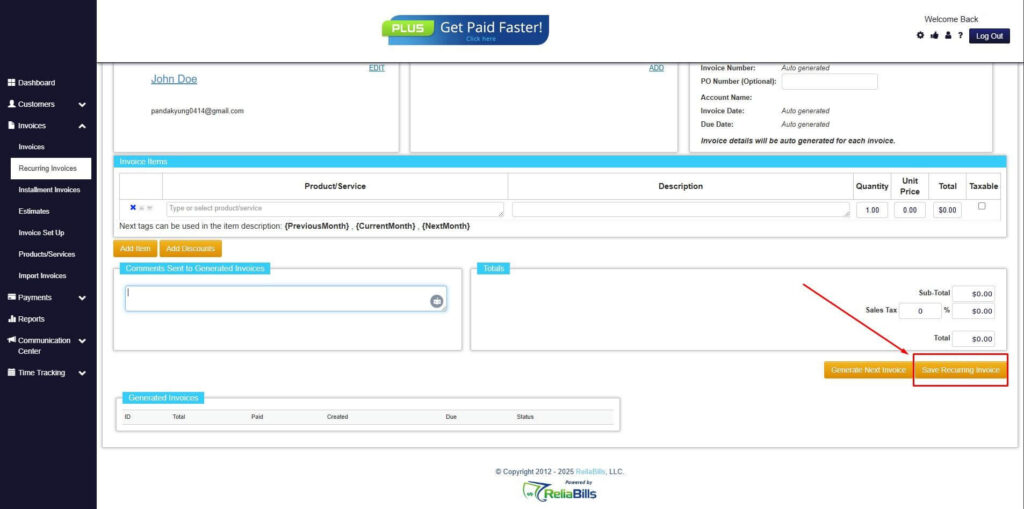

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

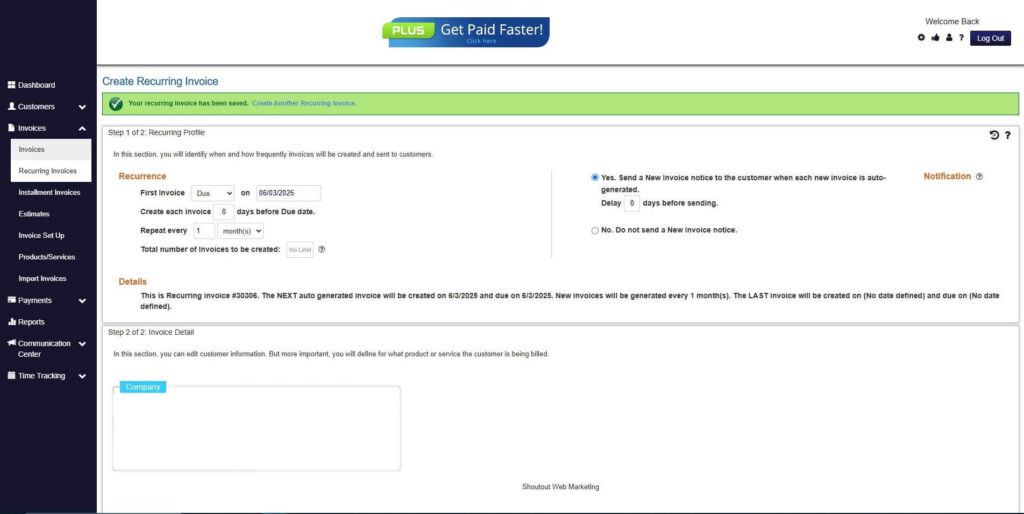

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What causes duplicate charges in recurring billing?

Duplicate charges often result from system synchronization errors, manual invoice creation overlapping with automated billing, or subscription changes not updating correctly.

2. How can businesses detect overbilling early?

Automated validation checks, billing dashboards, and regular audits help identify discrepancies before invoices are finalized or payments are processed.

3. Are automated return invoices better than manual corrections?

Yes. Automated return invoices provide real-time adjustments, consistent calculations, and detailed documentation, reducing delays and minimizing human error.

4. How often should billing audits be conducted?

Most recurring billing businesses benefit from monthly reviews, with more comprehensive quarterly audits to assess systemic risks and process improvements.

5. Can preventing overbilling improve customer retention?

Absolutely. Accurate billing builds trust, reduces disputes, and enhances long-term customer relationships, particularly in subscription-based models.

6. Does preventing overbilling affect revenue?

Preventing overbilling protects legitimate revenue by ensuring customers are charged correctly. Accurate billing reduces refunds, chargebacks, and churn.

Conclusion

Overbilling poses a serious risk in recurring billing models, affecting revenue accuracy and customer trust. Manual correction processes are often slow and inconsistent, increasing operational strain.

Automated return invoices provide structured, real-time solutions that correct discrepancies before they escalate. They help businesses prevent overbilling with return invoices while maintaining predictable recurring revenue.

For organizations seeking scalable and accurate recurring billing systems, automation is no longer optional. It is a critical component of sustainable growth and customer retention.