Predictable revenue is essential for businesses that want to grow without constantly worrying about cash flow gaps. When income is consistent and forecastable, teams can plan investments, staffing, and operations with greater confidence. This stability is especially important for companies that rely on subscriptions, retainers, or recurring services.

Many businesses struggle with inconsistent billing cycles, delayed invoices, and missed payments, which disrupt cash flow and create uncertainty. These issues often stem from manual invoicing processes or unclear billing structures. Without a reliable system, even strong customer relationships can lead to unpredictable revenue.

Invoices play a critical role in recurring billing models by formalizing charges and setting clear expectations. When invoices are generated consistently and accurately, they become the foundation for predictable revenue. They ensure customers know what they are paying, when they are paying, and why the charge exists.

Table of Contents

ToggleWhat Is Predictable Revenue?

Predictable revenue refers to income that a business can reasonably expect to receive on a regular schedule. In recurring billing environments, this usually means monthly, quarterly, or annual payments tied to ongoing services or subscriptions. The more consistent these payments are, the easier it is to forecast financial performance.

Predictability supports better planning and long-term growth. Businesses with steady revenue can budget more accurately, reduce reliance on short-term financing, and make informed decisions about expansion. It also helps leadership focus on strategy instead of chasing overdue payments.

Industries such as SaaS, professional services, membership organizations, and property management rely heavily on predictable revenue. In these models, recurring invoices act as a financial anchor. They translate ongoing value into reliable income streams.

Understanding Recurring Billing

Recurring billing is a payment model where customers are charged automatically at regular intervals. These charges are usually tied to subscriptions, retainers, memberships, or ongoing services. Instead of creating a new invoice for every transaction manually, billing happens on a predefined schedule.

Common billing cycles include monthly, quarterly, and annual intervals. The chosen cycle often depends on the service type, contract terms, and customer preferences. Consistency in these cycles helps businesses and customers stay aligned.

Unlike one-time billing, recurring billing prioritizes continuity and automation. One-time invoices are reactive and often manual, while recurring billing is proactive and structured. Invoices within recurring billing systems reinforce this structure by documenting each cycle clearly.

The Role of Invoices in Recurring Billing Systems

Formalizing recurring charges

Invoices act as the official record of each recurring charge, even when payments are automated. They clearly show the billing period, amount due, and services covered, helping customers understand exactly what they are paying for each cycle.

Setting clear customer expectations

Consistent invoices reinforce billing schedules and pricing terms. When customers receive invoices at the same time each cycle, it reduces confusion and lowers the risk of payment disputes or delayed approvals.

Creating a reliable billing history

Invoices provide a documented trail of recurring transactions. This history supports audits, financial reporting, and customer inquiries, while also helping businesses track long-term billing performance.

Supporting automated payment workflows

In recurring billing systems, invoices trigger payment collection, reminders, and follow-ups. This connection ensures billing and payments stay synchronized without manual intervention.

How Invoices Create Billing Consistency

Standardized invoice templates help businesses present information the same way every billing cycle. Customers quickly learn how to read and understand their invoices, which reduces questions and delays. Consistency also minimizes internal errors caused by manual formatting.

Automated invoice generation ensures invoices are sent on fixed schedules. This eliminates the risk of missed billing cycles or late invoice delivery. When invoices arrive on time, payments are more likely to follow on time as well.

By removing manual steps, businesses avoid duplicate invoices or skipped charges. These issues often cause disputes or revenue loss. Reliable invoice consistency directly supports predictable revenue recurring billing.

Improving Cash Flow Visibility Through Invoices

Invoices help businesses see expected revenue before it is collected. By reviewing issued invoices, finance teams can compare projected income with actual payments received. This visibility is critical for accurate cash flow forecasting.

Invoice statuses such as sent, paid, or overdue provide real-time insight into revenue health. Instead of guessing when money will arrive, businesses can monitor progress throughout the billing cycle. This reduces financial surprises.

Clear invoice records also support better decision-making. When leaders understand cash flow patterns, they can plan expenses and investments more confidently. Invoices become a key tool for financial clarity.

Reducing Revenue Disruptions with Automated Invoicing

Manual invoicing increases the risk of late or missed invoices. Even small delays can disrupt recurring revenue streams. Automated invoicing ensures billing continues even when staff are busy or unavailable.

Automation also reduces human error in calculations and data entry. Incorrect amounts or missing details often lead to payment delays. Accurate invoices help maintain uninterrupted billing cycles.

By keeping invoices consistent and timely, automated systems protect revenue continuity. This reliability is essential for businesses that depend on predictable revenue recurring billing.

Supporting Subscription Renewals and Long-Term Customers

Invoices reinforce contract terms and subscription details over time. Each invoice reminds customers of their agreement and ongoing value received. This reinforcement supports smoother renewals.

Automated renewals paired with recurring invoices reduce friction at renewal points. Customers are less likely to lapse when billing feels routine and transparent. Invoices play a subtle but powerful role in retention.

Consistency in invoicing builds trust. Customers who understand their bills are more likely to stay long term. This trust directly contributes to predictable revenue.

Handling Plan Changes Without Revenue Loss

Managing upgrades and downgrades smoothly

Invoices clearly reflect changes in subscription tiers or service levels. This ensures customers are billed correctly when they move to higher or lower plans, preventing underbilling or overcharging.

Applying proration accurately

When plan changes occur mid-cycle, invoices calculate prorated charges or credits automatically. Transparent proration helps customers understand adjustments and reduces disputes that can delay payments.

Documenting changes for future reference

Updated invoices serve as proof of when plan changes took effect. This documentation protects both the business and the customer if questions arise later.

Maintaining consistent revenue records

By reflecting changes immediately on invoices, businesses keep recurring revenue data accurate. This accuracy is critical for forecasting and predictable revenue recurring billing.

Invoices as a Tool for Financial Reporting

Invoices support revenue tracking and recognition by providing detailed billing records. These records help finance teams align income with accounting standards. This is especially important for recurring revenue models.

Audit readiness improves when invoices are organized and accessible. Businesses can quickly demonstrate billing history and payment activity. This reduces compliance risks.

With reliable invoice data, leaders gain better insight into business performance. Invoices become more than billing documents; they become financial intelligence tools.

Predictable Revenue for Service-Based and SaaS Businesses

Service businesses rely on retainers, memberships, and subscriptions to stabilize income. Invoices ensure these recurring charges are consistently documented. This reduces revenue volatility.

SaaS companies depend on recurring invoices to support monthly recurring revenue tracking. Clear billing cycles help align financial metrics with growth goals.

Across industries, invoices help translate ongoing value into steady income. This consistency strengthens budgeting and forecasting accuracy.

Best Practices for Using Invoices in Recurring Billing

Align invoices with contracts and pricing models

Every invoice should match the agreed billing terms. Clear alignment reduces confusion and reinforces trust with recurring customers.

Standardize invoice templates

Using consistent formats makes invoices easier to understand and faster to process. Customers recognize key details quickly, which encourages timely payments.

Automate invoice generation and delivery

Automation ensures invoices are sent on time every cycle. This eliminates missed billing periods and supports predictable revenue.

Communicate billing schedules clearly

Let customers know when invoices will be issued and when payments are due. Invoices should reinforce these expectations rather than introduce surprises.

Review invoice performance regularly

Monitoring late payments, failed charges, or disputes helps businesses refine their recurring billing process and protect revenue stability.

How ReliaBills Supports Predictable Revenue Through Invoicing

ReliaBills helps businesses establish predictable revenue by automating invoice creation and delivery within structured recurring billing workflows. Instead of relying on manual billing or inconsistent invoicing schedules, ReliaBills ensures invoices are generated on time and aligned with defined billing cycles. This consistency allows businesses to bill customers reliably while reducing missed or delayed invoices that disrupt cash flow.

Recurring billing is central to how ReliaBills supports revenue predictability. Businesses can configure recurring invoices for subscriptions, memberships, retainers, or ongoing services, ensuring charges repeat accurately each cycle. Automated payment reminders and follow-ups work alongside recurring invoices to reduce late payments and failed transactions, helping maintain steady and reliable incoming revenue.

ReliaBills also provides centralized tracking and reporting that improves visibility into expected and collected revenue. Businesses can monitor invoice statuses, outstanding balances, and payment trends in one place, making forecasting more accurate and informed. By combining automated invoicing, recurring billing, and real-time reporting, ReliaBills gives businesses greater control over billing operations and long-term revenue stability.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

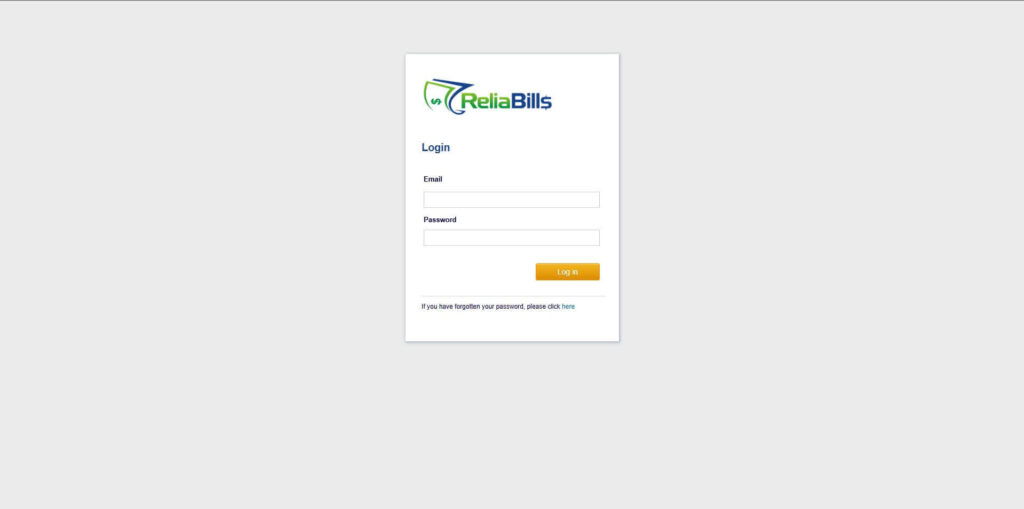

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

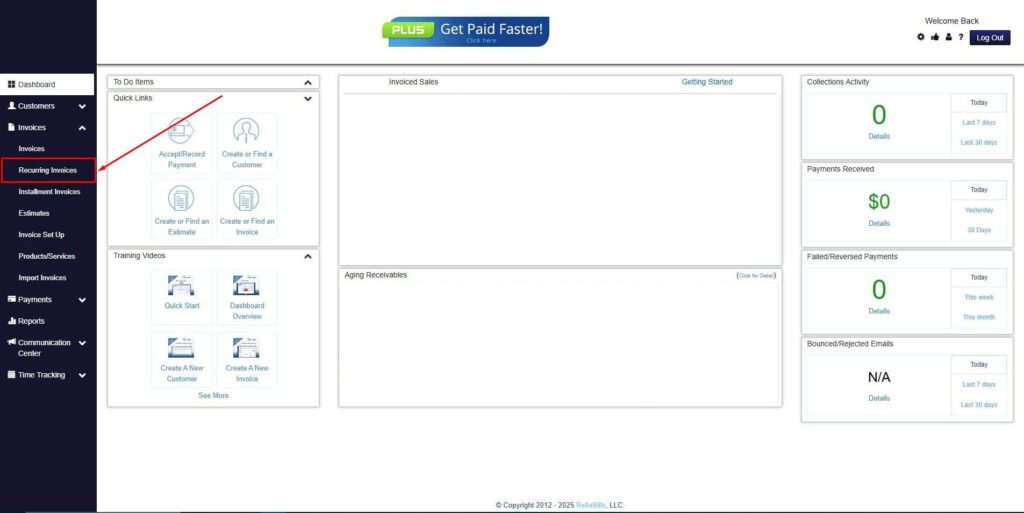

Step 2: Click on Recurring Invoices

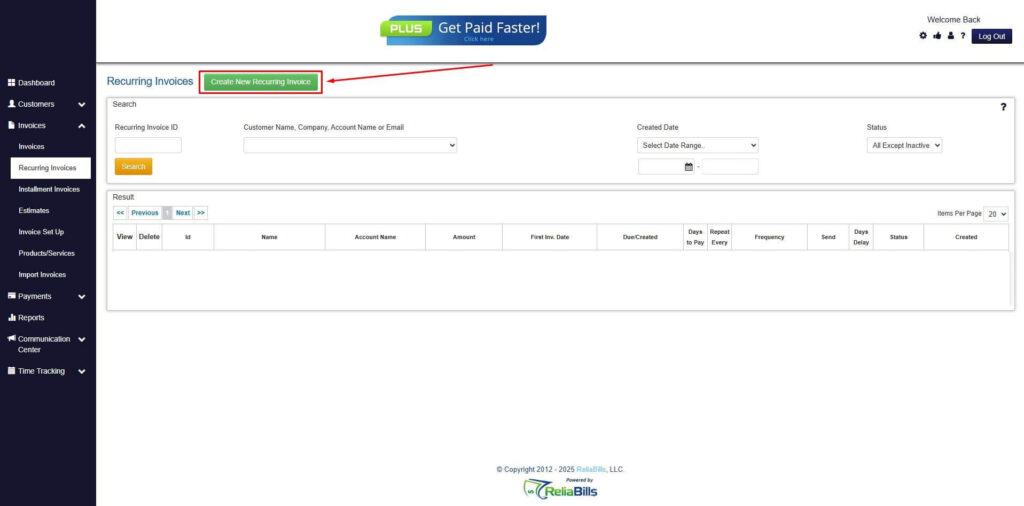

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

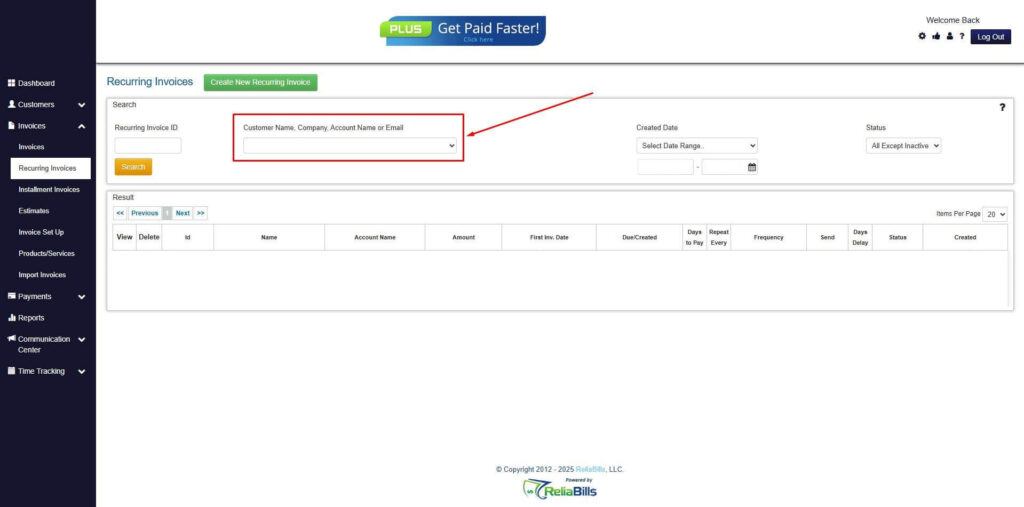

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

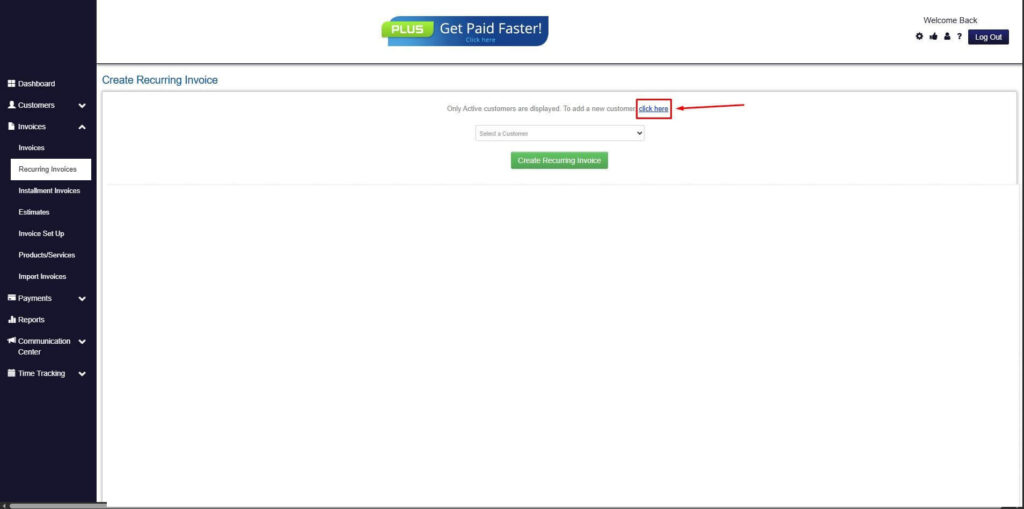

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

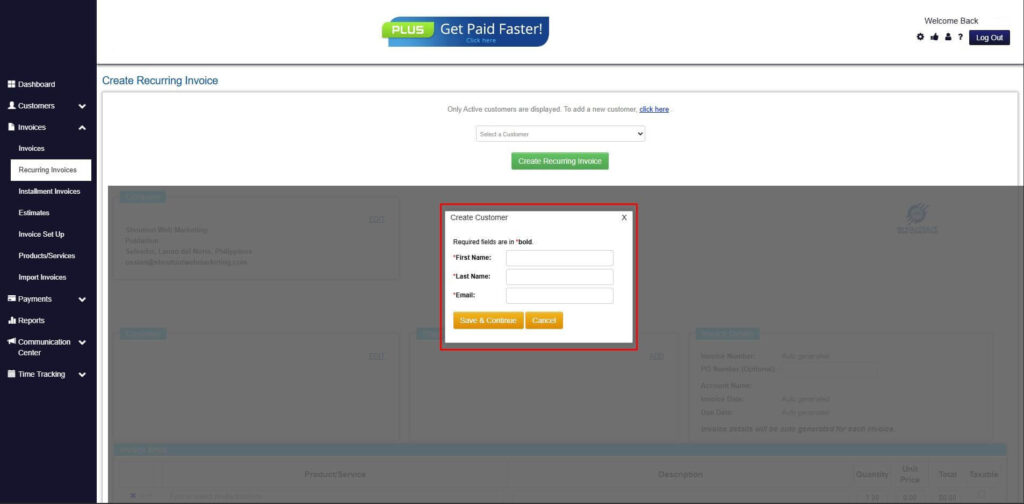

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

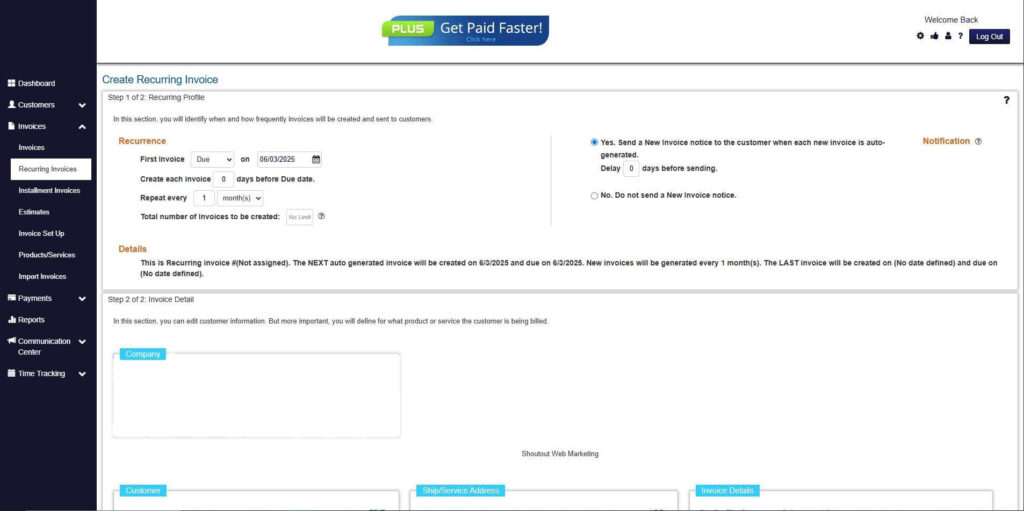

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

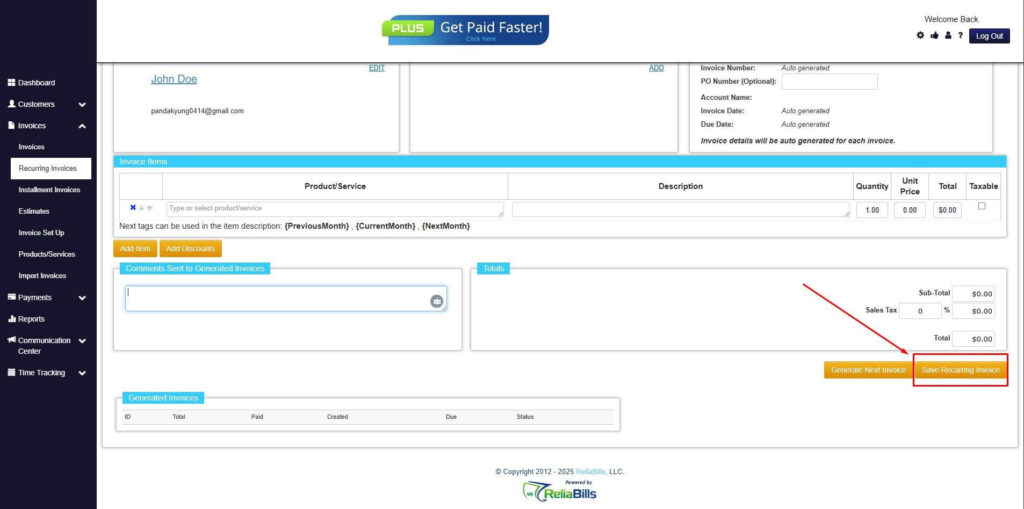

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

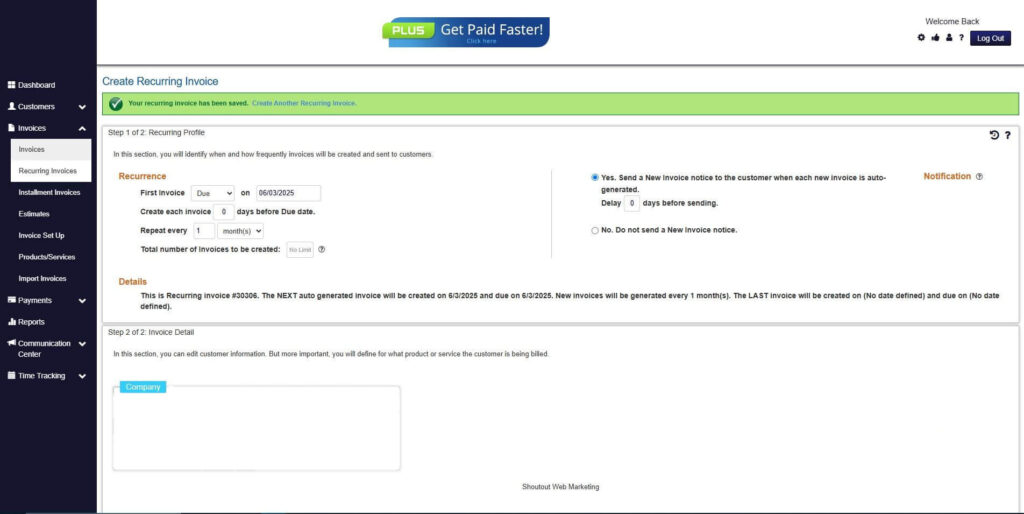

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Do recurring billing systems still need invoices?

Yes. Invoices provide transparency, documentation, and customer clarity, even when payments are automated.

2. How do invoices support predictable revenue?

Consistent invoices ensure billing happens on schedule, reduce errors, and improve visibility into expected revenue.

3. Can invoices handle changes in recurring plans?

Modern invoicing systems can reflect upgrades, downgrades, and prorated charges accurately without disrupting billing cycles.

4. How long should recurring invoices be stored?

Invoices should be retained according to accounting and regulatory requirements. Long-term storage also supports audits and financial analysis.

Conclusion

Invoices are a foundational element of predictable revenue recurring billing. They create consistency, improve visibility, and reduce revenue disruptions across billing cycles. Without reliable invoicing, recurring billing systems struggle to deliver stable income.

By combining standardized invoices with automation, businesses can support long-term customer relationships and financial planning. Invoices turn recurring services into dependable revenue streams.

For businesses focused on growth and stability, investing in strong invoicing practices is essential. Predictable revenue starts with predictable invoices.