Payroll is often viewed as a routine administrative function, but it holds far more strategic value than many business owners realize. When properly analyzed, payroll data reveals patterns in labor costs, workforce efficiency, and financial stability. Understanding the true payroll reporting benefits can transform payroll from a compliance task into a powerful growth tool.

Payroll reporting does more than track compensation. It provides visibility into overtime trends, department spending, tax liabilities, and benefit allocations. This level of insight allows leadership teams to connect workforce spending directly to revenue performance and profitability goals.

Structured payroll reporting supports smarter decisions because it delivers measurable, actionable data. Instead of reacting to financial pressure, businesses can proactively manage labor expenses and align workforce strategy with growth plans. Companies that leverage payroll reporting benefits effectively often experience stronger cost control and improved scalability.

Table of Contents

ToggleWhat Is Payroll Reporting?

Payroll reporting refers to the systematic collection, organization, and analysis of employee compensation data. These reports provide detailed insights into wages, taxes, benefits, deductions, and employer contributions. The primary purpose is to ensure accuracy, compliance, and financial clarity.

There are several types of payroll reports that businesses rely on regularly. Wage reports summarize gross and net pay, tax reports detail withholdings and liabilities, overtime reports track extra labor costs, and department-level reports break down spending by team or project. Each type provides a unique perspective on workforce expenses.

Payroll reporting differs from basic payroll processing. Processing ensures employees are paid correctly and on time, while reporting analyzes the financial impact of those payments. This analytical layer is where payroll reporting benefits truly emerge, allowing leaders to make informed operational and strategic decisions.

Key Metrics Found in Payroll Reports

Total Payroll Costs

This includes gross wages, salaries, bonuses, commissions, employer-paid taxes, and benefit contributions. Tracking total payroll costs over time helps businesses measure labor spending against revenue growth. One of the most important payroll reporting benefits is understanding whether workforce expenses are scaling sustainably.

Overtime Trends

Overtime reports highlight how often employees exceed standard working hours and how much that additional labor costs. Persistent overtime may indicate understaffing, inefficient scheduling, or workflow bottlenecks. Monitoring this metric allows businesses to reduce unnecessary expenses and protect profit margins.

Payroll Tax Liabilities

These reports outline federal, state, and local tax withholdings along with employer contributions. Reviewing tax liabilities regularly helps prevent underpayment, penalties, and compliance risks. Accurate tax tracking is a core payroll reporting benefit that safeguards financial stability.

Employee Benefit Expenses

This metric includes health insurance contributions, retirement plan matches, paid leave accruals, and other benefits. Understanding the full cost of compensation beyond base salary provides a clearer view of workforce investment. It also supports more accurate budgeting and long-term planning.

Net vs. Gross Pay Analysis

Comparing gross earnings to net pay helps businesses understand deduction patterns and employee cost structures. This visibility ensures accurate payroll processing and transparent reporting. It also assists in identifying irregular deductions or errors.

Labor Cost per Department

Breaking payroll down by department reveals where labor expenses are concentrated. This allows leadership to evaluate departmental efficiency and profitability. It is especially valuable for businesses managing multiple teams or locations.

Labor Cost per Project

For project-based businesses, payroll reports can allocate labor expenses to specific jobs or contracts. This enables accurate profitability analysis at the project level. One of the strongest payroll reporting benefits here is improved pricing and resource allocation decisions.

Payroll-to-Revenue Ratio

This ratio measures how much of total revenue is spent on payroll. A rising ratio without revenue growth may signal inefficiency. Monitoring this metric helps maintain financial balance and sustainable expansion.

Employee Turnover Costs

Some payroll reports track termination payouts, unused leave settlements, and rehiring expenses. High turnover impacts payroll stability and increases recruitment costs. Identifying patterns helps businesses address retention issues early.

Improving Cost Control Through Payroll Insights

One of the most immediate payroll reporting benefits is improved cost control. By identifying patterns in overtime or irregular wage spikes, businesses can correct inefficiencies before they escalate. This proactive approach reduces financial waste.

Payroll insights also help monitor labor cost fluctuations across seasons or business cycles. When leadership understands these patterns, they can adjust staffing models accordingly. This flexibility supports budget stability and long-term planning.

Reducing payroll waste often comes down to data visibility. Detailed reporting highlights redundant roles, excessive overtime, or inconsistent scheduling practices. With accurate insights, businesses can optimize budgets without compromising productivity.

Enhancing Cash Flow Management

Payroll represents one of the largest recurring expenses for most organizations. Forecasting payroll obligations allows businesses to prepare for upcoming disbursements with confidence. This reduces the risk of short-term cash shortages.

Aligning payroll schedules with revenue cycles improves financial balance. For example, businesses with subscription or recurring income can structure payroll timing to match predictable revenue inflows. This synchronization strengthens liquidity management.

Preventing cash flow disruptions is essential for sustainable growth. Payroll reporting benefits include the ability to anticipate high-expense periods and plan reserves accordingly. This forward-thinking approach stabilizes operations and supports expansion initiatives.

Supporting Strategic Hiring Decisions

Hiring decisions should be guided by financial data, not guesswork. Payroll reports reveal labor cost ratios, helping businesses determine whether staffing levels align with revenue performance. This ensures that workforce growth is sustainable.

Identifying staffing gaps becomes easier when payroll data is segmented by department or project. Leaders can see where labor costs are high but output is low, or where productivity demands additional personnel. This clarity supports smarter workforce planning.

Planning expansion responsibly requires financial discipline. Payroll reporting benefits allow businesses to model the impact of new hires before committing to additional salaries. This reduces risk while enabling strategic scaling.

Increasing Operational Efficiency

Payroll data can be compared directly against productivity metrics. When labor costs increase without corresponding performance gains, it signals inefficiency. These comparisons help leadership address operational bottlenecks quickly.

Department-level analysis uncovers disparities in spending and output. Some teams may operate efficiently within budget, while others exceed cost expectations. Targeted adjustments can improve overall business performance.

Aligning payroll expenses with performance metrics ensures resources are allocated effectively. Businesses that use payroll reporting benefits strategically often experience stronger profitability and streamlined operations.

Strengthening Compliance and Risk Management

Accurate payroll reporting plays a critical role in regulatory compliance. Monitoring tax withholdings and filing schedules reduces the risk of penalties or audits. Clear documentation protects the business from legal exposure.

Maintaining audit-ready payroll records simplifies internal and external reviews. Organized reports provide transparency and accountability. This builds trust with regulators, stakeholders, and financial partners.

Reducing compliance risk also preserves financial stability. Unexpected penalties can disrupt growth plans. Payroll reporting benefits include minimizing these risks through structured, consistent oversight.

Identifying Growth Opportunities

Payroll-to-revenue ratios reveal whether labor spending supports profitability. If payroll grows faster than revenue, corrective action may be necessary. Balanced ratios indicate sustainable growth.

Assessing profitability by team or project allows businesses to identify high-performing segments. Investments can then be directed toward the most profitable operations. This data-driven approach strengthens competitive positioning.

Strategic expansion should always be supported by measurable insights. Payroll reporting benefits empower leadership to pursue growth opportunities confidently, backed by accurate workforce data.

Integrating Payroll Data with Billing and Revenue Systems

Connecting payroll data with billing systems creates a comprehensive financial view. Businesses can compare labor expenses directly against income streams. This alignment enhances overall financial visibility.

For companies operating on subscription or service models, aligning payroll expenses with recurring revenue is especially valuable. Measuring profitability per recurring client or contract helps ensure margins remain healthy. This integration supports predictable financial planning.

Improved financial visibility strengthens decision-making across departments. When payroll and revenue systems communicate effectively, leadership gains a unified perspective on performance and sustainability.

Automating Payroll Reporting for Better Accuracy

Manual payroll calculations increase the likelihood of errors. Automated payroll reporting reduces miscalculations and ensures consistency. Real-time tracking enhances accuracy across reporting periods.

Automation also saves administrative time. Instead of compiling spreadsheets manually, finance teams can access up-to-date dashboards instantly. This efficiency improves responsiveness to financial changes.

Customizable reporting tools allow businesses to focus on metrics that matter most. Automation amplifies payroll reporting benefits by combining accuracy, speed, and strategic insight.

Best Practices for Leveraging Payroll Reports

Review Payroll Reports Consistently

Monthly reviews allow businesses to identify cost trends before they escalate. Quarterly strategic reviews provide deeper insight into workforce efficiency. Regular analysis maximizes payroll reporting benefits.

Set Clear Labor Cost Benchmarks

Establish acceptable payroll-to-revenue ratios and overtime thresholds. Benchmarks create measurable performance standards for departments. This ensures payroll spending aligns with profitability goals.

Monitor Overtime Closely

Investigate departments with recurring overtime spikes. Determine whether the cause is seasonal demand, staffing shortages, or workflow inefficiencies. Addressing root causes improves operational efficiency.

Integrate Payroll Data with Revenue Reporting

Align payroll reports with billing and income statements to gain a complete financial picture. This integration is particularly important for recurring revenue businesses. It strengthens forecasting and financial planning accuracy.

Use Payroll Data for Hiring Decisions

Evaluate labor cost ratios before expanding the workforce. Model the financial impact of new hires using historical payroll data. This reduces risk and supports responsible scaling.

Automate Reporting Where Possible

Automation reduces manual calculation errors and saves administrative time. Real-time dashboards improve responsiveness to financial changes. Automation enhances both accuracy and strategic visibility.

Share Insights with Leadership Teams

Payroll reporting should not remain siloed within HR or accounting. Sharing insights with executives encourages data-driven decision-making. Cross-functional visibility increases the strategic value of payroll reporting benefits.

Prepare for Compliance Reviews

Maintain organized and audit-ready payroll documentation. Regular internal reviews help prevent regulatory penalties. Compliance readiness protects long-term growth.

How ReliaBills Supports Financial Visibility and Recurring Revenue Tracking

ReliaBills helps businesses gain a complete view of their financial performance by centralizing billing data and recurring revenue insights in one platform. Instead of juggling spreadsheets or fragmented systems, users can see invoicing activity, payment status, and outstanding balances in organized dashboards. This gives leadership a clearer picture of where money is coming in and where attention is needed, improving decision-making and reducing surprises at month end.

For companies that depend on predictable income, such as subscription services or long-term client agreements, ReliaBills’ recurring invoicing and revenue tracking tools are especially valuable. Users can schedule recurring invoices, automate reminders for due and overdue payments, and measure actual revenue against expected cash flow. By making revenue streams more reliable, businesses can better align financial planning with payroll or other operational commitments, ensuring stability as they grow.

ReliaBills also delivers comprehensive reporting that supports deeper financial analysis. Customizable reports and dashboards surface trends, highlight late payments, and show historical performance so companies can spot opportunities or challenges early. This level of visibility enhances cash flow forecasting, strengthens financial planning, and helps teams stay focused on strategic growth rather than manual billing tasks.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

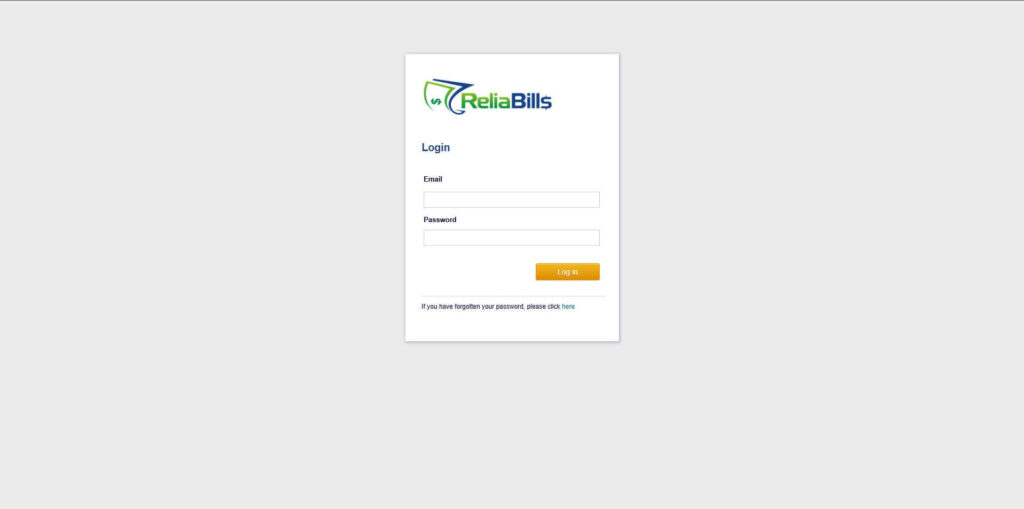

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

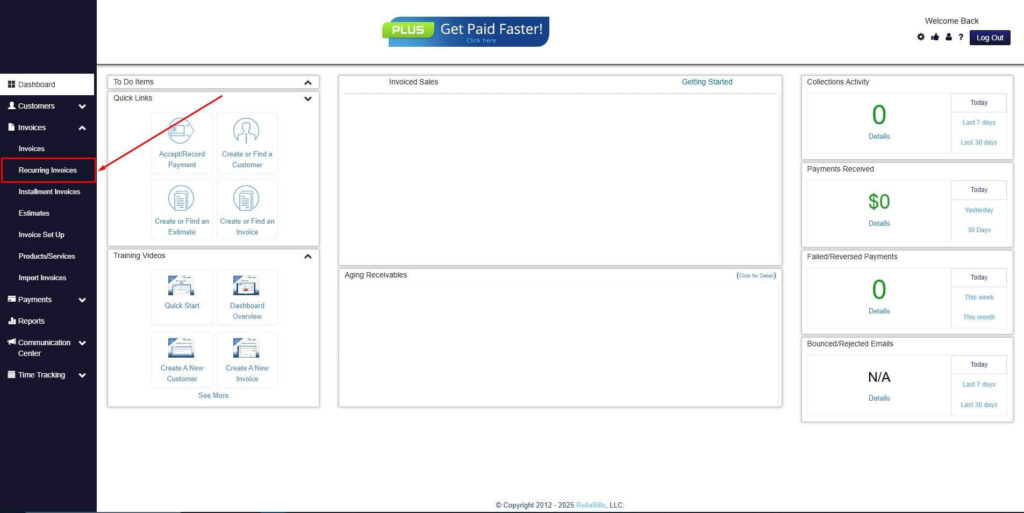

Step 2: Click on Recurring Invoices

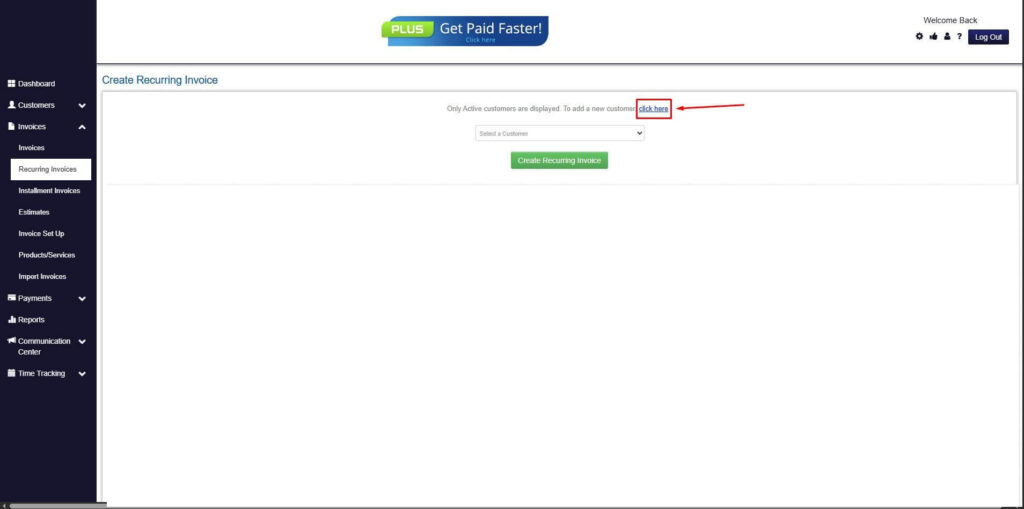

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

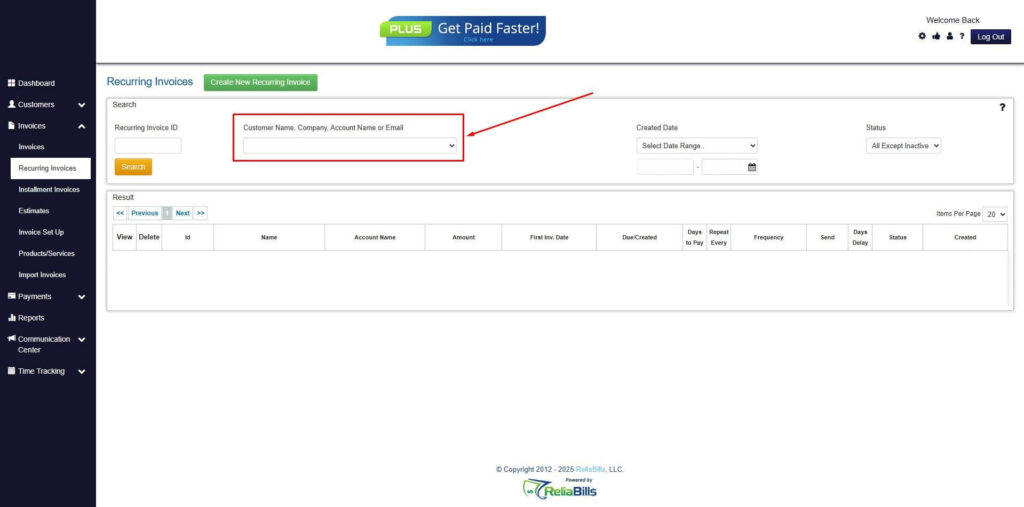

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

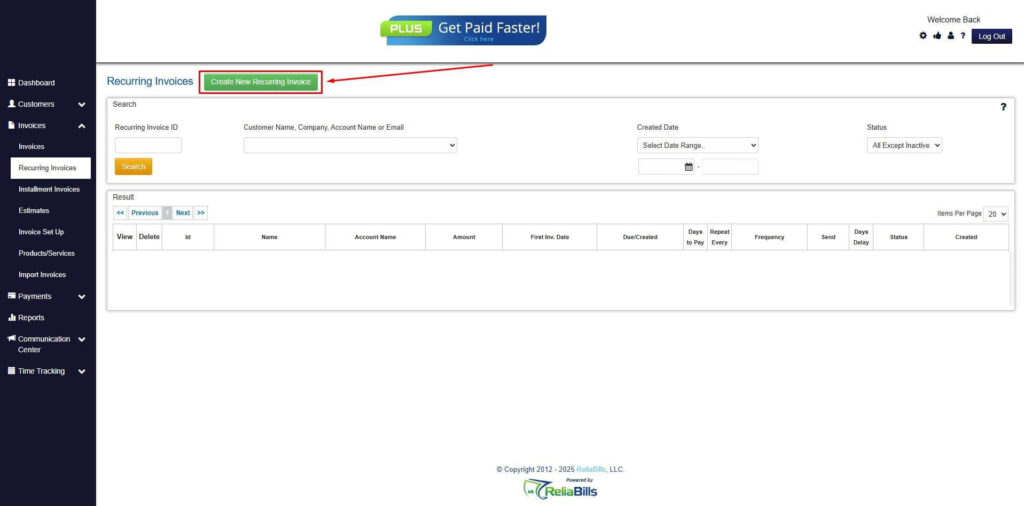

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

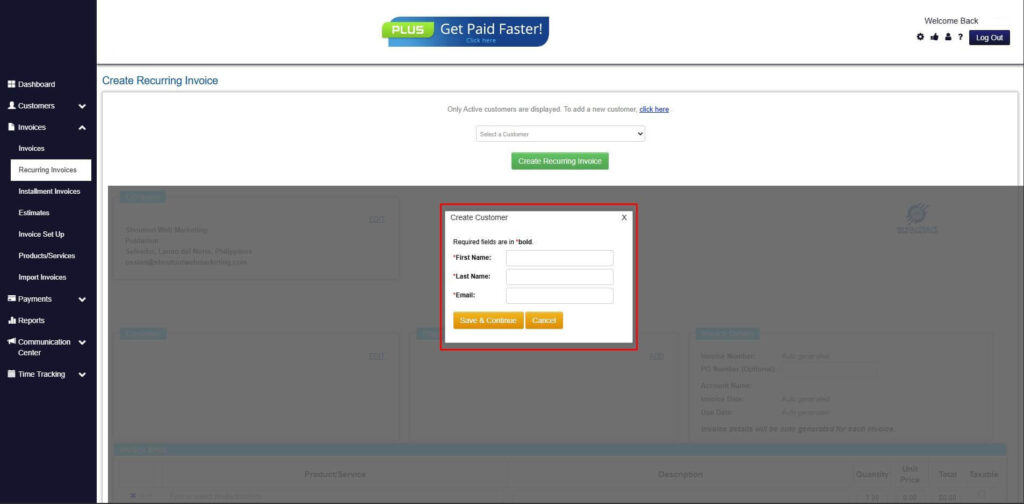

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

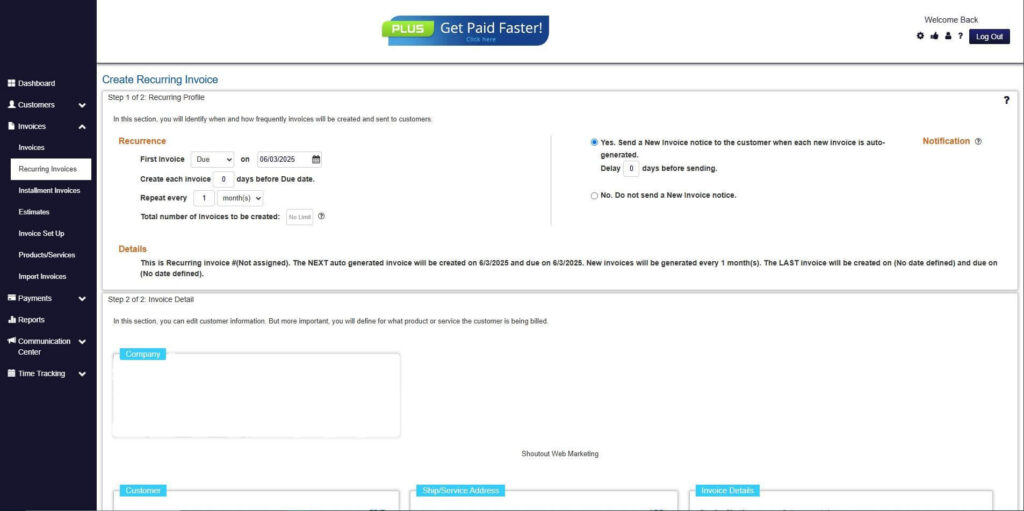

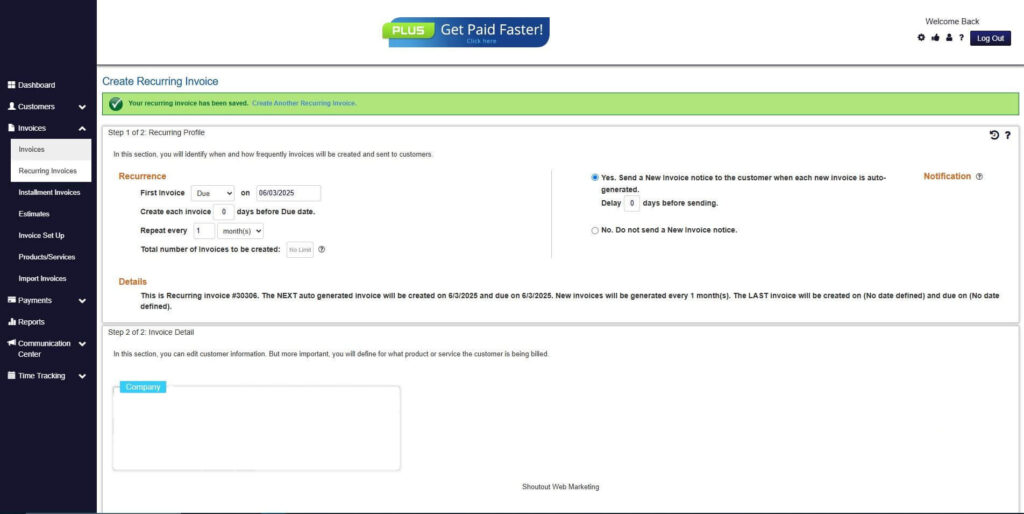

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

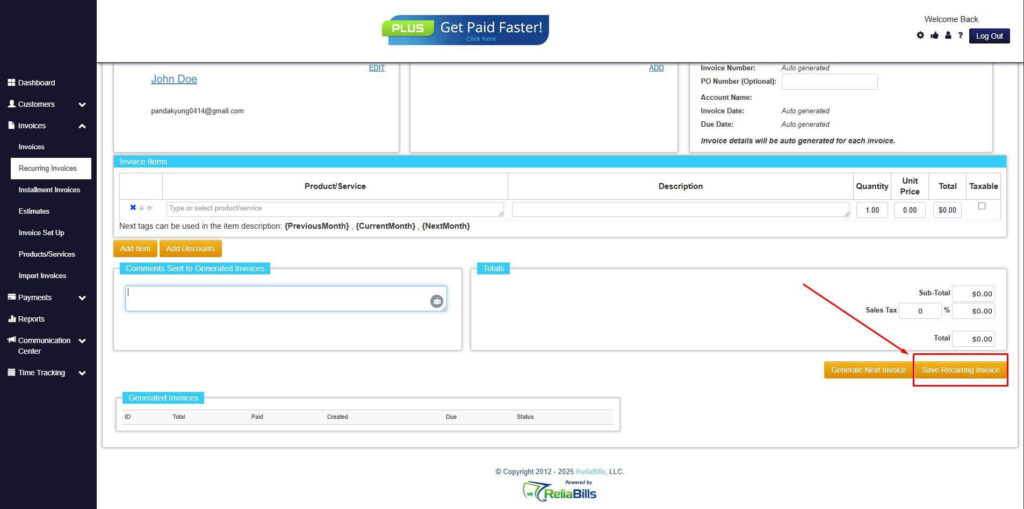

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What are the primary payroll reporting benefits?

Payroll reporting benefits include improved cost control, stronger cash flow forecasting, compliance protection, better hiring decisions, and enhanced operational efficiency.

2. How often should payroll reports be analyzed?

Most businesses review payroll reports monthly for trend monitoring and quarterly for strategic planning. High-growth companies may analyze them more frequently.

3. Can payroll reporting improve profitability?

Yes. By identifying unnecessary overtime, labor inefficiencies, and excessive payroll growth, businesses can reduce expenses and protect margins.

4. Is payroll reporting useful for small businesses?

Absolutely. Smaller businesses often benefit the most because tight budgets require precise cost monitoring and disciplined financial management.

5. How does payroll reporting support business expansion?

It provides accurate labor cost projections, helping businesses determine when they can afford to hire, expand operations, or invest in new markets.

6. What is the difference between payroll processing and payroll reporting?

Payroll processing focuses on paying employees accurately and on time. Payroll reporting analyzes compensation data to support strategic financial decisions.

Conclusion

Payroll reporting is far more than an administrative necessity. When used strategically, it delivers measurable payroll reporting benefits that improve cost control, cash flow management, and hiring decisions. Businesses that leverage payroll insights position themselves for smarter, more sustainable growth.

Data visibility is essential for scaling operations responsibly. Without structured reporting, leadership lacks the clarity needed to make informed financial decisions. Payroll reporting bridges that gap by transforming raw compensation data into actionable intelligence.

For businesses seeking long-term success, integrating payroll insights with billing and recurring revenue tracking creates a strong financial foundation. With accurate reporting and strategic oversight, growth becomes intentional rather than reactive.