Payroll is one of the most critical and sensitive responsibilities for any business. Employees rely on timely wages, and even short disruptions can create legal, financial, and operational problems. Unexpected events such as revenue interruptions, disasters, or operational shutdowns can make meeting payroll obligations difficult. Because payroll expenses are fixed and recurring, they continue even when income slows down. Without protection, businesses may face cash flow gaps that put employee trust and compliance at risk. This is where payroll insurance becomes an important safeguard.

Payroll insurance coverage helps businesses protect their ability to pay employees during unexpected disruptions. It supports continuity, reduces financial stress, and ensures businesses remain compliant with employment obligations during challenging periods.

Table of Contents

ToggleWhat Is Payroll Insurance Coverage

Payroll insurance coverage is designed to help businesses manage payroll-related financial risks. It provides financial support to cover wages, salaries, and related payroll expenses when normal business operations are disrupted. The primary purpose is to ensure employees continue to be paid even when revenue is temporarily affected.

Unlike general business insurance, payroll insurance focuses specifically on payroll obligations. While standard policies may cover property damage or liability, payroll insurance addresses the cost of maintaining payroll continuity. This distinction is critical for businesses with consistent wage commitments.

Payroll insurance is commonly used by small and mid-sized businesses, service providers, and companies with regular payroll cycles. Businesses with limited cash reserves or high payroll expenses often find this coverage especially valuable.

Why Is Payroll Insurance Important

One of the most important reasons for payroll insurance is protecting employee wages. Employees depend on predictable income, and payroll disruptions can quickly damage morale and retention. Payroll insurance helps maintain trust and stability within the workforce.

Payroll insurance also supports business continuity during unexpected disruptions. When operations are interrupted, businesses still need to meet payroll obligations. Insurance coverage helps bridge the gap until normal operations resume.

In addition, payroll insurance reduces legal and financial exposure. Missed or delayed payroll can lead to penalties, lawsuits, and compliance issues. Coverage helps employers meet regulatory obligations while managing financial risk responsibly.

How Payroll Insurance Coverage Works

Payroll insurance policies are typically structured with defined coverage triggers. These triggers may include business interruptions, natural disasters, or other insured events that impact revenue. When a triggering event occurs, payroll coverage becomes active.

Claims are initiated by submitting documentation related to payroll expenses and the qualifying event. Insurers review payroll records, policy terms, and supporting information before approving claims. Clear and accurate documentation plays a major role in the speed of claim processing.

Employers, insurers, and payroll providers all play a role in this process. Employers maintain payroll records, insurers assess coverage eligibility, and payroll systems help provide accurate reporting. Coordination between these parties ensures smoother claim resolution.

What Payroll Insurance Typically Covers

Payroll insurance commonly covers employee wages and salaries during covered disruptions. This ensures employees continue to be paid even when business income is temporarily reduced. Maintaining consistent payroll protects both staff and business reputation.

Many policies also include payroll taxes and mandatory contributions. These obligations do not stop during disruptions, so coverage helps businesses remain compliant. This reduces the risk of penalties or missed filings.

In some cases, payroll insurance may cover temporary staffing or replacement labor costs. This can be useful when businesses need short-term support to maintain operations. Coverage details vary by policy, so careful review is essential.

What Payroll Insurance Does Not Cover

Payroll insurance does not cover every payroll-related situation. Intentional non-payment, fraud, or mismanagement is typically excluded. Policies are designed to protect against unforeseen events, not deliberate actions.

Pre-existing payroll issues are also commonly excluded. If payroll problems existed before coverage began, insurers are unlikely to provide compensation. Maintaining compliant payroll practices is a prerequisite for coverage.

Policy-specific limitations may apply depending on coverage terms. Some events or expenses may fall outside the policy scope. Understanding exclusions helps businesses avoid misunderstandings during claims.

Types of Payroll Insurance Coverage

Payroll protection is often included as part of business interruption insurance. In these cases, payroll expenses are covered when operations are interrupted by insured events. This is one of the most common ways payroll insurance is structured.

Employment practices liability insurance, or EPLI, addresses legal risks related to employment practices. While not direct payroll insurance, it supports broader payroll-related risk management. These policies help protect employers from wage-related disputes.

Some businesses also use supplemental payroll protection policies. These are designed to address specific payroll risks not covered by standard insurance. Combining coverage types provides more comprehensive protection.

Who Should Consider Payroll Insurance Coverage

Small and mid-sized businesses are strong candidates for payroll insurance. These businesses often have limited cash reserves and less flexibility during disruptions. Payroll insurance provides added financial security.

Companies with large or fixed payroll obligations also benefit from coverage. High payroll expenses increase financial exposure when income fluctuates. Insurance helps manage this risk more effectively.

Businesses operating in high-risk industries or volatile markets should also consider payroll insurance. Organizations with seasonal revenue or unpredictable cash flow can use coverage to maintain payroll stability.

How Payroll Insurance Impacts Financial Planning

Payroll insurance helps stabilize cash flow during unexpected disruptions. By covering payroll expenses, businesses can preserve working capital. This stability supports smoother financial operations.

With payroll risks managed, budgeting and forecasting become more reliable. Businesses can plan expenses without overestimating contingency reserves. This leads to more efficient financial planning.

Payroll insurance also works best when coordinated with other insurance policies. Aligning coverage ensures gaps are minimized and financial protection is consistent across operations.

Best Practices for Managing Payroll Risk

Maintaining accurate payroll records is essential for payroll insurance effectiveness. Clear documentation supports compliance and simplifies claims. Well-organized records also reduce administrative stress.

Regularly reviewing coverage limits ensures payroll insurance remains aligned with current payroll expenses. As businesses grow, coverage may need adjustment. Periodic reviews help maintain adequate protection.

Coordination between HR, finance, and insurance teams strengthens payroll risk management. Using digital systems for payroll and billing documentation improves accuracy and accessibility.

Common Misconceptions About Payroll Insurance

One common misconception is that payroll insurance replaces payroll systems. In reality, insurance complements payroll systems by providing financial protection. Payroll processing tools are still required.

Another misconception is that only large companies need payroll insurance. Small businesses often face greater payroll risk due to limited reserves. Coverage can be even more valuable for growing organizations.

Some assume all payroll risks are automatically covered. Coverage depends on policy terms and exclusions. Understanding the details is essential for effective protection.

How ReliaBills and Modern Billing Systems Support Payroll Insurance

ReliaBills plays an important role in helping businesses maintain the steady cash flow required to support payroll obligations and payroll insurance planning. By centralizing invoicing, payments, and customer records in one platform, ReliaBills gives businesses better visibility into incoming revenue and outstanding balances. This level of organization is essential when payroll continuity depends on predictable income and accurate financial documentation.

Through automated invoicing and recurring billing, ReliaBills helps businesses reduce delays that can impact payroll readiness. Recurring billing ensures consistent revenue for subscription-based or ongoing services, while automated payment reminders encourage customers to pay on time without manual follow-ups. These features help stabilize cash flow, making it easier to meet payroll commitments and support payroll insurance requirements during periods of disruption or uncertainty.

ReliaBills PLUS further strengthens payroll and insurance support by offering advanced reporting, enhanced automation, and deeper insight into billing performance. With improved tracking and analytics, businesses can better align billing activity with payroll planning and insurance documentation needs. This added visibility supports stronger financial forecasting, simplifies record-keeping for insurance claims, and helps businesses maintain payroll stability as they grow.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

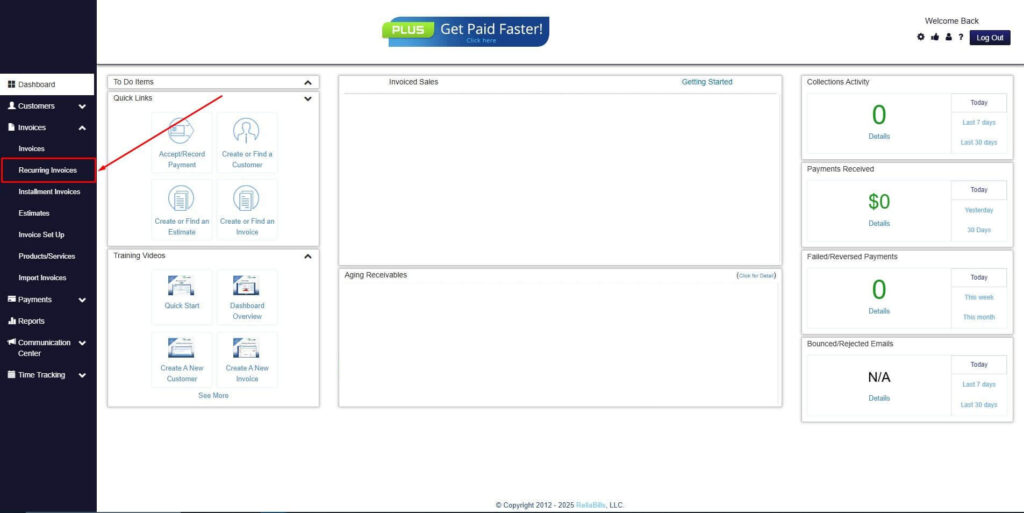

Step 2: Click on Recurring Invoices

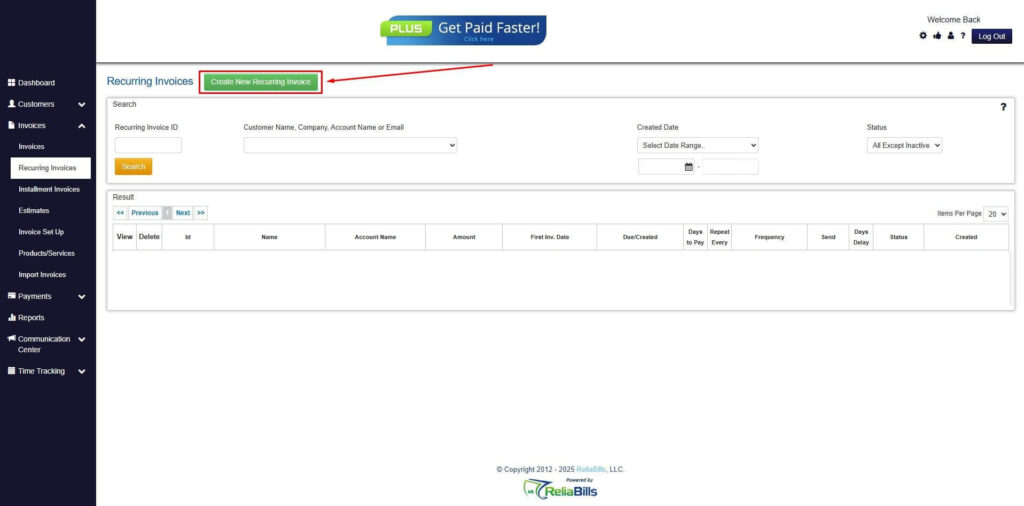

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

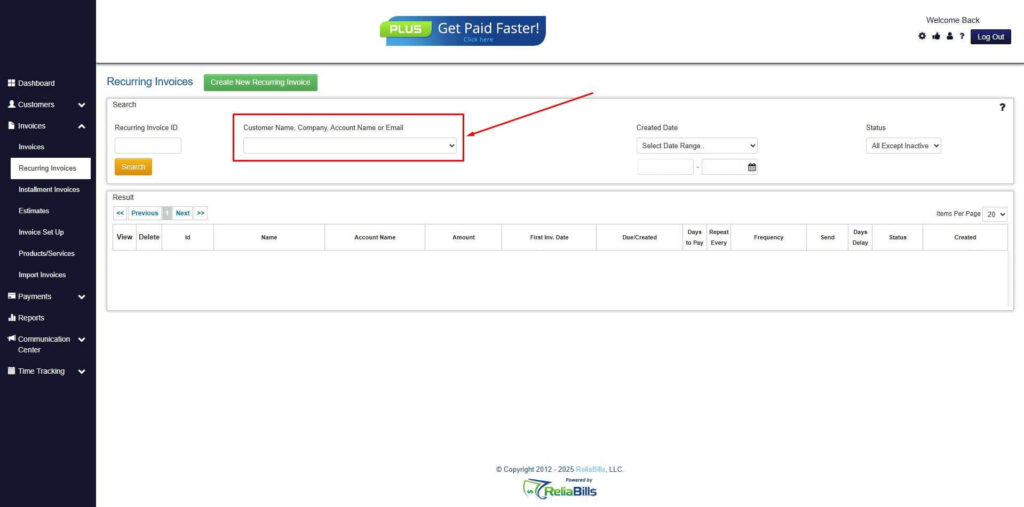

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

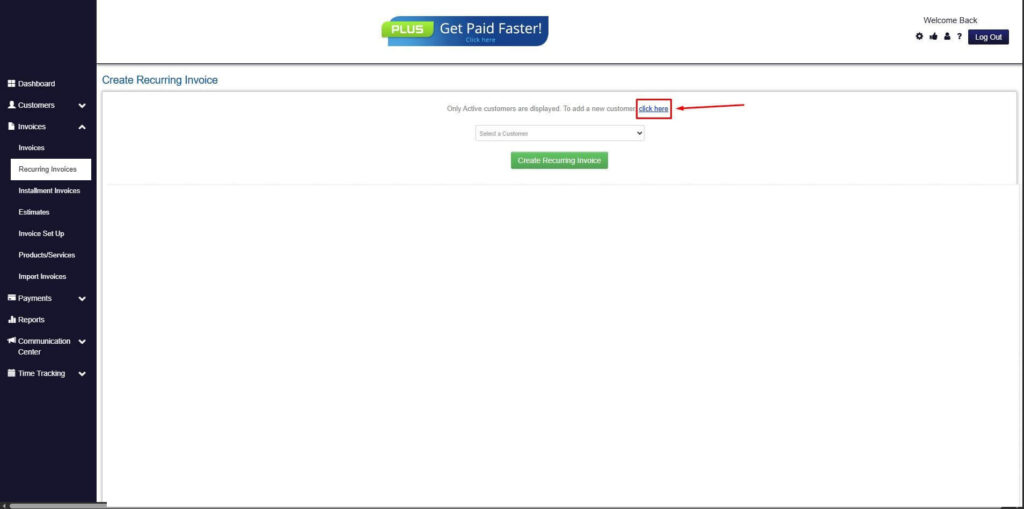

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

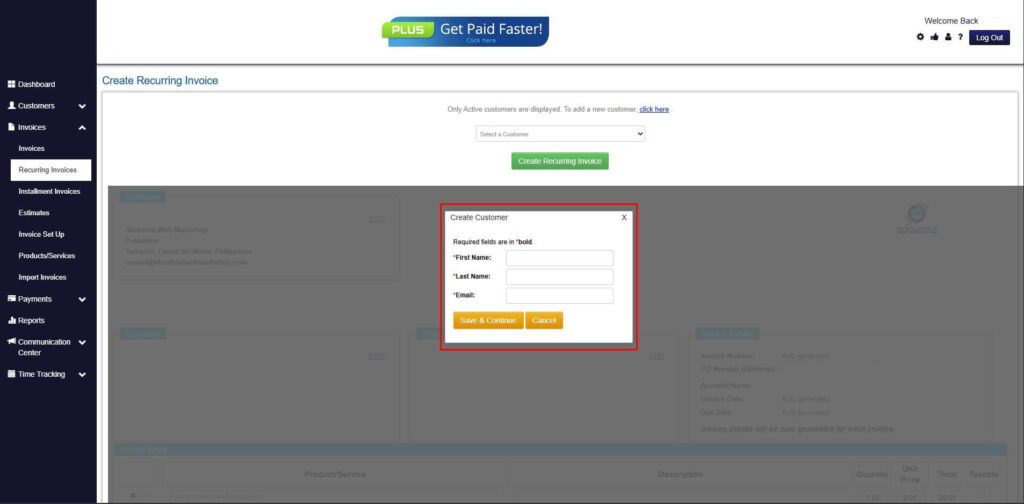

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

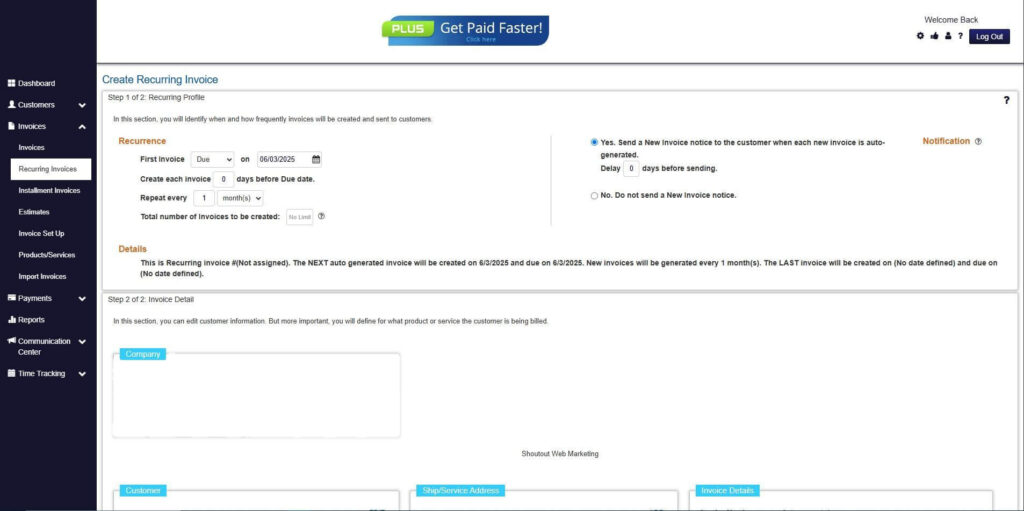

Step 7: Fill in the Create Recurring Invoice Form

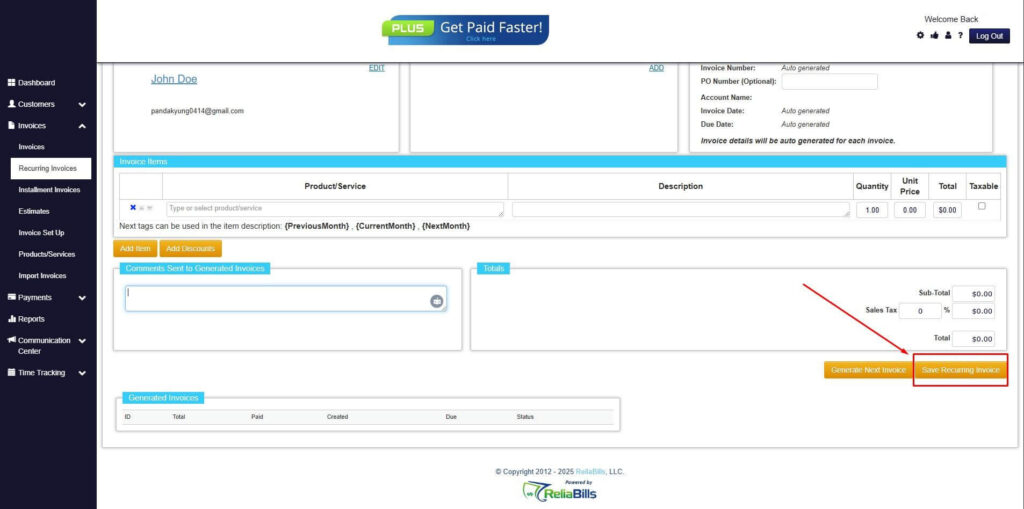

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

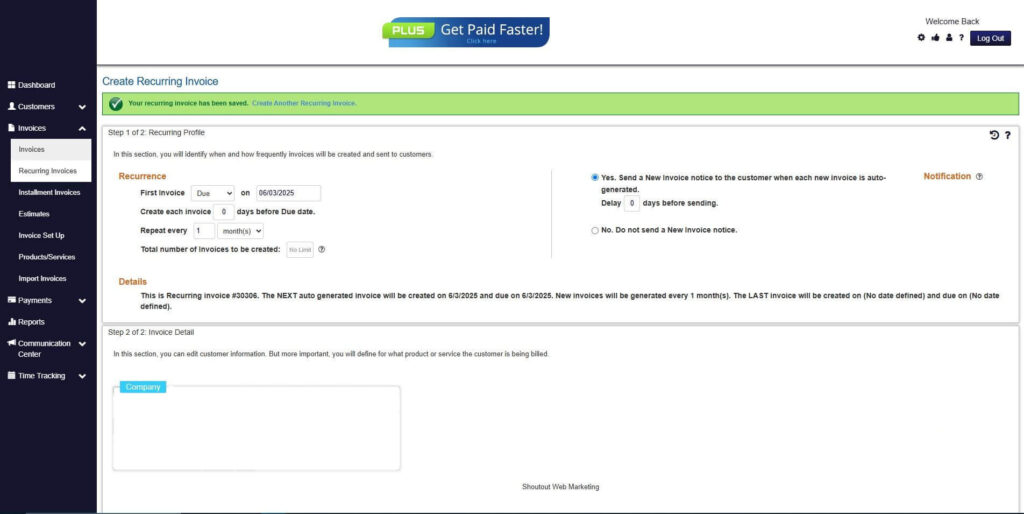

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is payroll insurance mandatory?

Payroll insurance is generally optional, but it is highly recommended for risk management.

2. How much payroll insurance coverage is needed?

Coverage should align with total payroll expenses and risk exposure.

3. Does payroll insurance cover contractors?

Coverage depends on policy terms and worker classification.

4. How long does coverage last during a disruption?

Duration varies by policy and triggering event.

Conclusion

Payroll insurance coverage helps businesses protect one of their most important obligations. By ensuring payroll continuity, it supports employee trust and operational stability. This protection becomes especially valuable during unexpected disruptions.

When paired with accurate payroll records and organized billing systems, payroll insurance strengthens financial resilience. Businesses gain confidence knowing payroll obligations can be met even during challenging periods.

For companies focused on long-term stability, payroll insurance is a practical risk management tool. Combined with reliable invoicing and recurring billing systems, it helps maintain business continuity and financial health.