Payroll cost is one of the largest and most consistent expenses for small businesses, often accounting for a significant portion of monthly operating budgets. As businesses head into 2026, payroll planning is becoming more complex due to changing labor expectations, economic pressure, and evolving regulations. Understanding payroll cost early helps business owners avoid surprises and maintain financial stability.

For many small businesses, payroll is not just about paying employees on time but also about balancing cash flow, compliance, and long-term growth. Rising wages, benefits expectations, and administrative requirements are forcing business owners to look more closely at how payroll costs are structured. Poor planning in this area can quickly lead to cash shortages and operational stress.

In 2026, small businesses that actively manage payroll cost tend to be more resilient and better prepared for change. Having visibility into payroll expenses allows owners to make smarter hiring decisions and adjust staffing levels as needed. With the right systems and planning, payroll cost can be controlled without sacrificing employee satisfaction.

Table of Contents

ToggleWhat Are Payroll Costs?

Payroll costs refer to the total expenses a business incurs to compensate its workforce. This includes not only wages and salaries but also taxes, benefits, and employer contributions. Many small business owners underestimate payroll cost by focusing only on take-home pay.

Direct payroll costs include wages, overtime, commissions, and bonuses paid directly to employees. Indirect payroll costs cover items such as payroll taxes, insurance contributions, and benefits administration. Together, these costs represent the true financial commitment of employing staff.

Payroll costs can also be divided into fixed and variable components. Fixed costs, such as salaries, remain consistent each pay period, while variable costs fluctuate based on hours worked, overtime, or performance incentives. Understanding these categories makes payroll forecasting more accurate.

Key Components of Payroll Costs

Employee wages and salaries form the foundation of payroll cost for any small business. These payments are usually determined by role, experience, and market demand. As labor markets remain competitive in 2026, wage pressure continues to rise.

Overtime, bonuses, and incentive pay add another layer to payroll expenses. While these costs can motivate employees and boost productivity, they also require careful tracking. Without oversight, variable compensation can quickly inflate payroll cost.

Payroll taxes, benefits, and employer-paid insurance significantly increase total payroll cost beyond base pay. Contributions for social security, health insurance, and retirement plans must be factored into every payroll budget. These components are often overlooked but have a major impact on cash flow.

Payroll Cost Trends for Small Businesses in 2026

Wage Growth and Labor Market Changes

Rising wages and increased competition for skilled employees are affecting payroll budgets. Businesses may need to adjust pay scales to attract and retain talent while balancing overall costs.

Regulatory and Tax Considerations

Updates to payroll taxes, minimum wage laws, and compliance requirements can impact total payroll expenses. Staying informed ensures businesses avoid penalties and plan budgets accurately.

Remote and Hybrid Workforce Impact

With more teams working remotely or in hybrid models, payroll planning now includes stipends, remote work allowances, and adjustments for location-based wage differences.

Technology and Automation Trends

Adoption of payroll software, automated invoicing, and workforce management tools can streamline payroll processing. Investing in technology reduces errors and helps forecast payroll costs more reliably.

How to Calculate Payroll Costs

Calculating payroll cost starts with determining gross pay for each employee. Gross pay includes wages, overtime, and bonuses before deductions. This figure forms the base of all payroll calculations.

Next, employers must account for payroll taxes, insurance contributions, and benefits. These costs are added on top of gross pay to calculate the true employer cost per employee. Many businesses use payroll software or spreadsheets to track these figures accurately.

Understanding the difference between gross pay, net pay, and total employer cost is essential. Net pay reflects what employees receive, while payroll cost reflects what the business actually pays. Accurate calculations support better budgeting and planning.

Hidden Payroll Costs Small Businesses Often Overlook

Recruitment and onboarding expenses are often hidden payroll costs. Advertising roles, interviewing candidates, and training new hires all require time and money. These costs increase significantly when turnover is high.

Training and professional development also contribute to payroll cost. While these investments improve employee performance, they still impact budgets. Businesses should include them in long-term payroll planning.

Compliance penalties and administrative labor are additional hidden costs. Errors in payroll processing or missed filings can result in fines. Manual payroll processes increase the risk of these costly mistakes.

Payroll Costs for Different Business Types

Service-Based Businesses:

- High variability in overtime and performance-based compensation.

- Payroll fluctuates based on project workload and client demand.

Retail and Hospitality:

- Seasonal staffing increases payroll during peak periods.

- Variable shifts and part-time employees affect total costs.

Manufacturing and Trades:

- Skilled labor commands higher wages.

- Union agreements and safety compliance can raise payroll expenses.

Remote and Freelance Teams:

- Contractor fees add flexibility but must be budgeted.

- Technology or platform costs for managing remote workers contribute to payroll.

How Payroll Costs Affect Cash Flow

Payroll payments are time-sensitive and non-negotiable expenses. Missing payroll can damage employee trust and expose businesses to legal risk. This makes payroll one of the most critical cash flow obligations.

Pay periods must be aligned with revenue cycles to avoid cash shortages. Businesses with delayed customer payments often struggle to meet payroll on time. This mismatch highlights the importance of predictable income.

Strong cash flow planning ensures payroll obligations are met even during slow periods. Businesses that track receivables closely are better positioned to manage payroll cost without stress.

Strategies to Manage and Reduce Payroll Costs

Optimize Staffing Levels:

- Avoid overstaffing during slow periods and understaffing during peaks.

- Balance employee hours to align with workload demands.

Leverage Automation and Payroll Software:

- Reduce manual calculations and errors.

- Save time on payroll processing and reporting.

Consider Outsourcing or Hybrid Payroll Solutions:

- Outsourcing can lower administrative costs.

- Hybrid approaches allow control over critical payroll functions while offloading routine tasks.

Improve Scheduling and Productivity:

- Efficient scheduling reduces overtime and idle time.

- Align labor allocation with revenue generation for better cash flow management.

The Role of Billing and Revenue in Payroll Planning

Predictable revenue plays a major role in managing payroll cost effectively. When income is inconsistent, meeting payroll obligations becomes stressful. Reliable billing systems help stabilize cash flow.

Recurring income streams allow businesses to plan payroll with confidence. When revenue arrives on a predictable schedule, payroll forecasting becomes more accurate. This alignment reduces reliance on credit or emergency funding.

Consistent invoicing and payment tracking support payroll stability. Businesses that monitor receivables closely can anticipate cash gaps before they become problems.

Common Payroll Cost Mistakes to Avoid

One common mistake is underestimating total employer payroll cost. Many businesses budget for wages but forget taxes, benefits, and insurance. This leads to inaccurate forecasts.

Poor cash flow planning is another frequent issue. Relying on expected payments instead of confirmed revenue can result in payroll shortfalls. Manual processes increase this risk.

Failing to review payroll costs regularly can also cause problems. Payroll should be evaluated alongside revenue and growth plans. Regular reviews help businesses stay financially healthy.

How ReliaBills Supports Payroll Cost Management

ReliaBills helps small businesses gain clearer visibility into their revenue so payroll planning becomes more predictable and less stressful. By managing all invoices and payments in one centralized platform, ReliaBills gives owners and finance teams a real‑time view of what is owed and what has already been collected. This clarity is particularly useful when aligning incoming funds against regular payroll obligations, helping avoid cash shortages when payroll costs are due.

Automation is a cornerstone of ReliaBills, and this plays directly into managing payroll cost effectively. With features like recurring billing, businesses can set up and collect predictable revenue from subscription services or ongoing contracts, minimizing gaps between pay periods and supporting consistent cash flow. Automatic payment reminders and secure online payment options further reduce the likelihood of late payments, which in turn makes it easier to plan and meet payroll commitments without constant manual follow‑ups.

For organizations seeking more advanced control and insight, ReliaBills PLUS offers enhanced reporting, detailed receivables tracking, and automation tools that scale with business growth. These advanced features help businesses not only forecast future revenue but also monitor trends and customer payment behavior, giving deeper context around payroll funding. By reducing administrative workload and providing actionable financial visibility, ReliaBills PLUS helps small businesses stay on top of payroll expenses while allocating resources more strategically.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

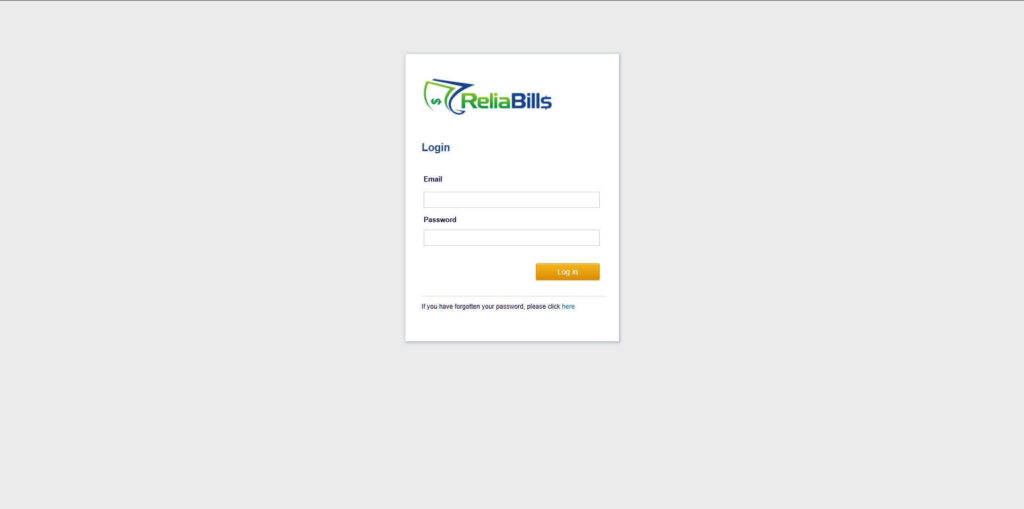

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

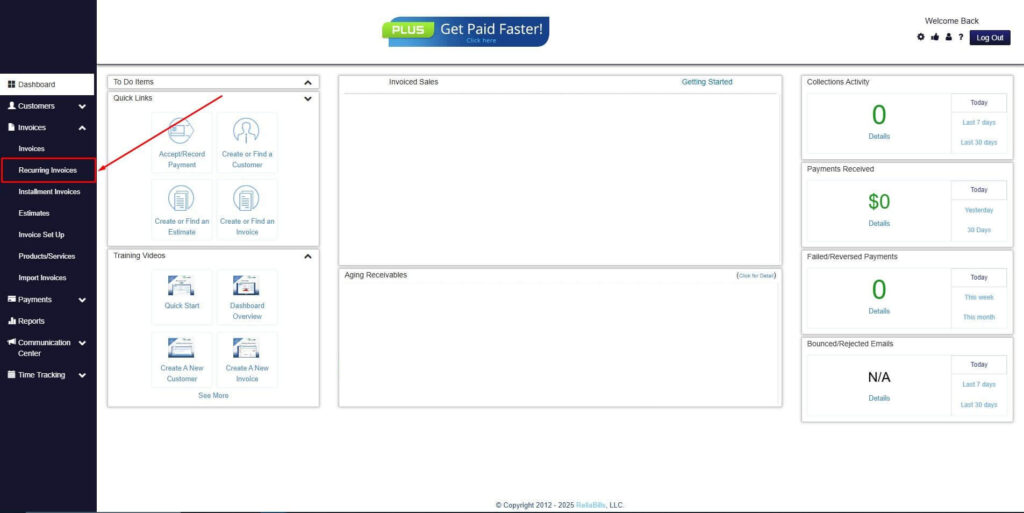

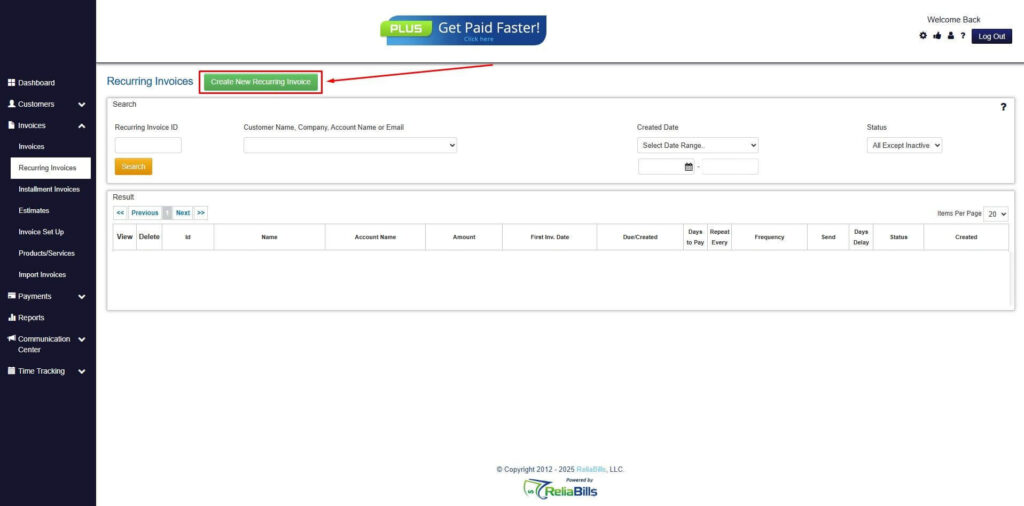

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

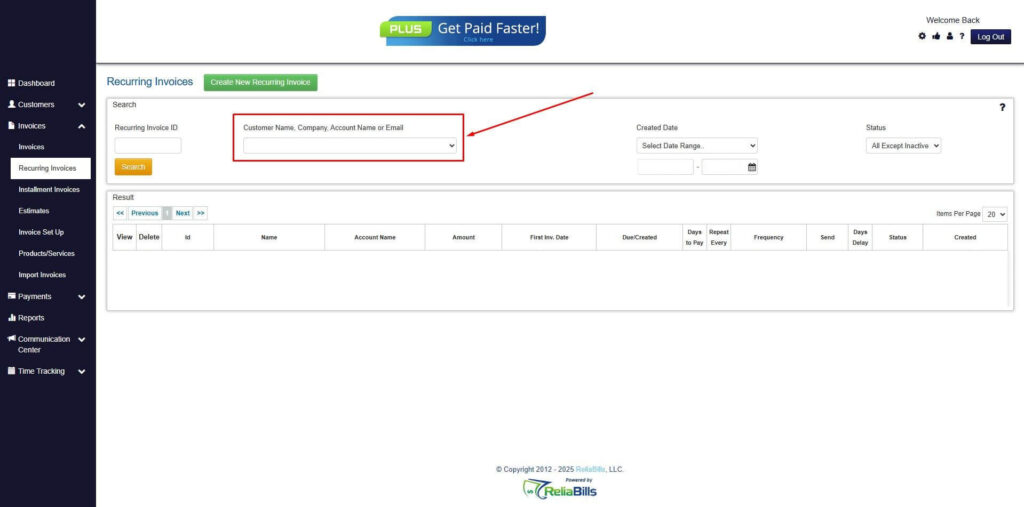

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

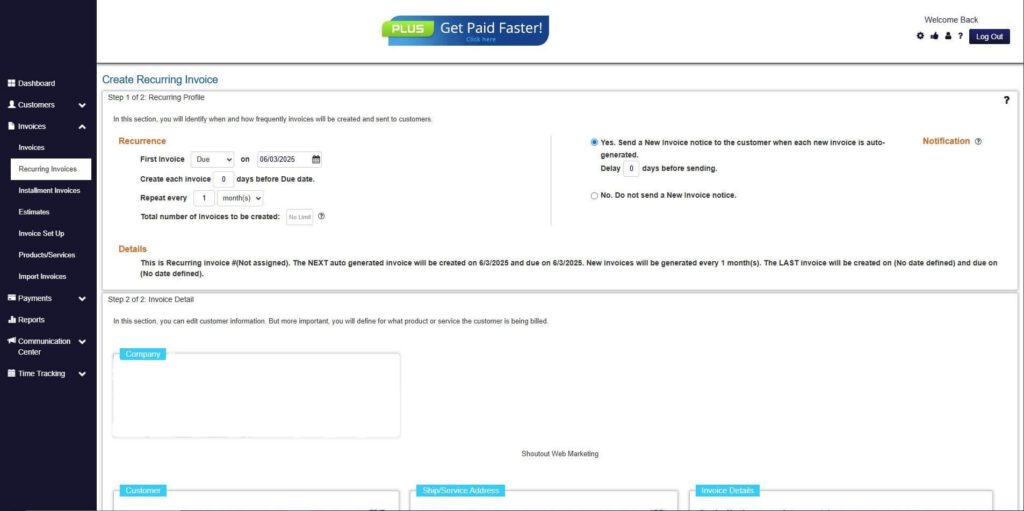

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

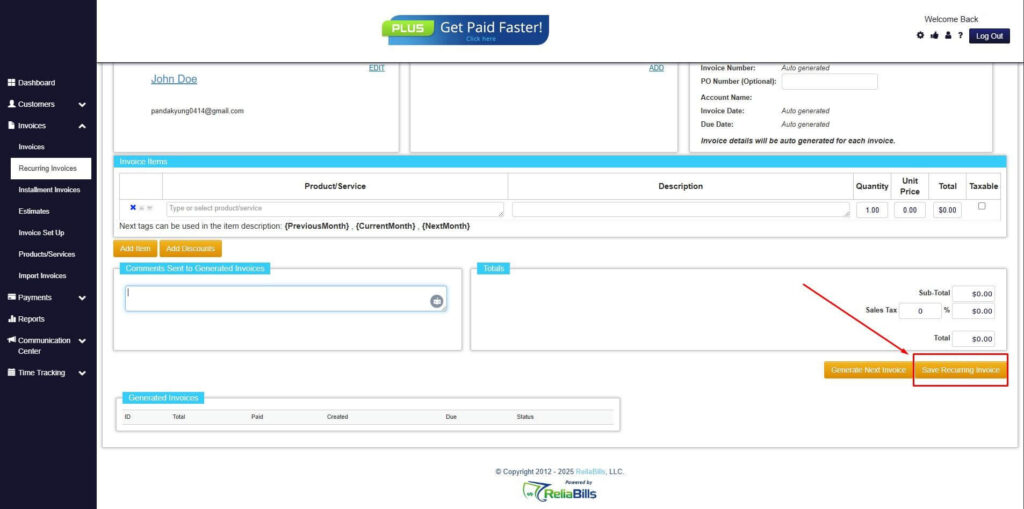

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How much of the revenue should go to payroll?

It depends on the industry, but most businesses review payroll monthly or quarterly.

2. Can payroll costs be reduced without layoffs?

Yes. Better scheduling, automation, and productivity improvements often reduce costs before workforce reductions are necessary.

3. Does automation save money?

Over time, yes. It reduces errors and administrative work while improving accuracy and cost control.

4. What is the best way to track payroll costs?

Using payroll software or detailed spreadsheets helps monitor both direct and indirect costs accurately. Regular tracking makes budgeting easier.

5. How often should payroll be reviewed?

Payroll should be reviewed at least monthly, and more often if there are changes in staffing, regulations, or business revenue. Frequent reviews prevent surprises and help maintain financial stability.

Conclusion

Payroll cost management is a critical priority for small businesses heading into 2026. Understanding all components of payroll expenses allows for better budgeting and decision-making. Clear visibility reduces financial stress.

Businesses that align payroll planning with predictable revenue are better positioned to grow. Strong systems, automation, and recurring income all contribute to payroll stability. These strategies protect both employees and the business.

By taking a proactive approach, small businesses can manage payroll cost sustainably. Planning ahead, reviewing regularly, and using the right tools creates long-term financial confidence.