Recurring service agreements often require precise billing documentation to maintain accurate records and avoid confusion. While most invoices track revenue, certain transactions like free trials, replacements, or goodwill adjustments do not generate income but still need to be formally recorded. These non-commercial invoices are essential for maintaining transparency and ensuring compliance.

Using non-commercial invoices helps businesses differentiate between revenue-generating and non-revenue transactions. Clear documentation prevents errors, reduces disputes, and supports proper auditing. With recurring billing, consistent tracking is particularly important, as repeated or ongoing services can otherwise create accounting discrepancies.

This guide explains when non-commercial invoices are needed, how to handle them in recurring service agreements, and best practices for implementation. Businesses can leverage automation to streamline the process while maintaining accuracy and compliance.

Table of Contents

ToggleWhat Is a Non-Commercial Invoice?

A non-commercial invoice documents the delivery of services or goods without generating revenue. It includes essential details such as the recipient, service description, date, and invoice number but reflects a zero-dollar amount. These invoices are not intended for payment collection but serve as official records.

Non-commercial invoices differ from commercial invoices, which track revenue transactions. They are commonly used for samples, internal transfers, replacements, donations, or complimentary services. While the amount billed is zero, these invoices are vital for bookkeeping, audit trails, and regulatory compliance.

Using non-commercial invoices ensures that all service delivery events are documented, maintaining consistency in recurring service agreements. They provide a clear distinction between transactions that impact revenue and those that are non-revenue, reducing potential errors in financial reporting.

Understanding Recurring Service Agreements

Recurring service agreements involve ongoing provision of services, often with retainer arrangements, subscription models, or maintenance contracts. Billing occurs on standardized cycles monthly, quarterly, or annually ensuring predictable revenue and service continuity.

Recurring billing systems help manage these agreements by automating invoice generation and delivery. Non-commercial invoices fit naturally into these systems, allowing businesses to document non-revenue activities without disrupting automated billing workflows.

With recurring agreements, proper invoice management supports both operational efficiency and financial integrity. Businesses can maintain accurate customer histories while ensuring that non-revenue transactions are clearly separated from revenue-generating activities.

Why Non-Commercial Invoices May Be Needed in Recurring Models

Non-commercial invoices are particularly useful for documenting services provided at no charge. For instance, replacement services under warranty or contract obligations require formal documentation to confirm service delivery. Even though no revenue is collected, the transaction must be recorded.

Goodwill adjustments or complimentary services also necessitate non-commercial invoices. Offering a free upgrade or correcting a service error without billing helps maintain strong customer relationships while keeping accurate records.

Internal transfers or no-cost documentation is another scenario. When services or products are shifted between departments or divisions without generating revenue, non-commercial invoices ensure the transaction is traceable and auditable.

Common Scenarios for Using Non-Commercial Invoices

Free Trial Extensions

Businesses often provide extended trials for ongoing services or subscription offerings. Non-commercial invoices formally document these extensions, ensuring accounting records reflect the service delivery without impacting revenue. They also help reconcile recurring billing cycles, preventing confusion in customer accounts.

Replacement Services Under Contract

When a service needs to be replaced due to warranty obligations or contract terms, non-commercial invoices record the delivery without generating revenue. This documentation is essential for both internal tracking and customer transparency, proving that the replacement occurred within the agreement terms.

No-Cost Upgrades or Corrections

Companies may provide complimentary upgrades, adjustments, or billing corrections as goodwill gestures. Using non-commercial invoices for these ensures every service event is documented, supporting accurate histories for future billing or audits while maintaining strong client relationships.

Internal Cost Allocations

Sometimes, services or items are moved between departments or cost centers without charging revenue. Non-commercial invoices track these internal transactions, preserving a clear audit trail and helping with internal accounting reconciliation.

Common Mistakes in Manual Non-Commercial Invoicing

Incorrect Labeling or Classification

A frequent error is misclassifying a non-commercial invoice as a revenue-generating invoice. This can distort revenue reports and complicate audits. Clear templates and automated rules help prevent such mistakes.

Missing Required Details

Even though the invoice is non-revenue, essential information such as invoice number, date, service description, and customer or department reference must be included. Omitting these details leads to incomplete records and confusion during reviews.

Inconsistent Formatting

Manual invoices often vary in layout or content across teams, which can make tracking and auditing cumbersome. Standardized templates ensure every non-commercial invoice is uniform, reducing errors and improving visibility.

Delayed Processing

Manual handling can lead to late or missing invoices, which breaks the continuity of recurring billing records. Automated systems help ensure non-commercial invoices are generated promptly and consistently.

How to Prevent Duplicate and Incorrect Charges

Proper systems and workflows are critical for preventing errors. Automated invoicing helps ensure that non-commercial transactions are flagged correctly, separate from revenue invoices. Rule-based triggers in recurring billing systems prevent accidental payment requests or duplication.

Clear documentation of every adjustment or service delivered without charge helps maintain audit trails. Integrating non-commercial invoices into the recurring billing cycle ensures consistent tracking while eliminating the manual oversight that can lead to errors.

Regular reviews of invoice records help identify discrepancies early. Businesses should verify that non-commercial invoices are properly classified and that they do not inadvertently affect revenue reporting or customer billing.

Best Practices for Using Non-Commercial Invoices

Establish Clear Internal Policies

Define when non-commercial invoices should be issued, including scenarios like free trials, replacements, or goodwill adjustments. Policies ensure all teams follow a consistent approach, reducing errors.

Align Invoices With Contract Terms

Non-commercial invoices should reference the related service agreement, warranty clause, or internal cost allocation. This alignment supports transparency, audit readiness, and accurate account histories.

Standardize Templates and Workflows

Use predefined templates with clear labels, zero-dollar amounts, and structured fields. Consistent layouts simplify audits and reduce confusion for teams handling recurring service agreements.

Regularly Review and Audit

Periodic checks help verify that non-commercial invoices are correctly classified, complete, and compliant with internal and regulatory requirements. Automation can simplify this by providing reporting dashboards and audit trails.

How ReliaBills Supports Non-Commercial Invoices in Recurring Agreements

ReliaBills makes managing non-commercial invoices in recurring service agreements effortless. Its platform allows businesses to automate the creation of zero-value or adjusted-value invoices without affecting revenue reporting. By using flexible templates, each invoice clearly indicates that the service or item is non-revenue, preventing confusion for both internal teams and clients. This ensures all service deliveries, replacements, or goodwill adjustments are properly documented and traceable.

Integration with recurring billing workflows means non-commercial invoices are generated automatically based on predefined triggers, such as free trial extensions, warranty replacements, or internal transfers. This reduces the risk of errors from manual processing and ensures timely invoice delivery to maintain accurate account histories. Teams can easily manage exceptions, avoiding accidental charges or duplicate billing while keeping customer relationships transparent and professional.

Centralized reporting and dashboards provide a complete view of all non-commercial and revenue invoices in one place. Businesses can track historical data, audit activity, and generate reports for internal review or regulatory compliance. With ReliaBills, companies save time, reduce administrative workload, and maintain full visibility and control over their recurring service agreements, all while supporting scalable, compliant billing practices.

How to Create a New Recurring Invoice Using ReliaBills

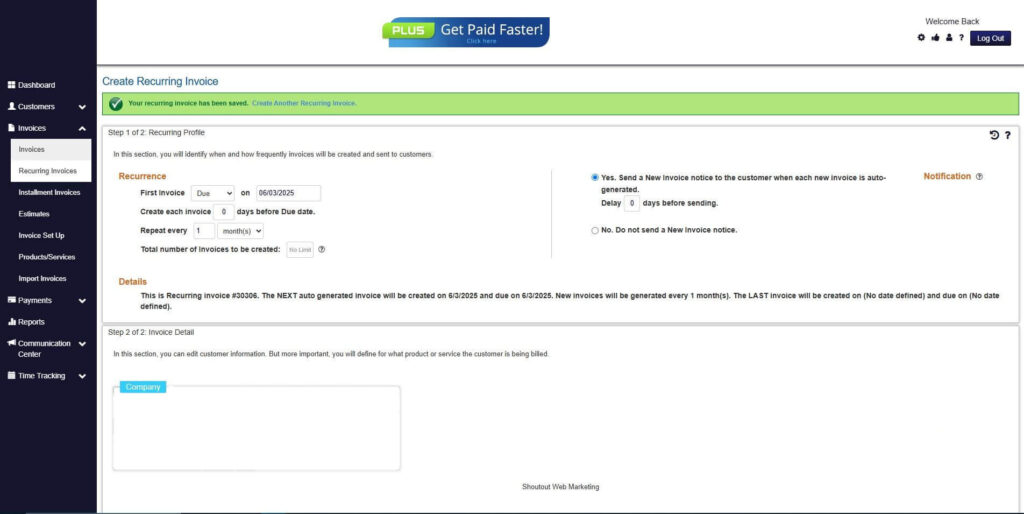

Creating a New Recurring Invoice using ReliaBills involves the following steps:

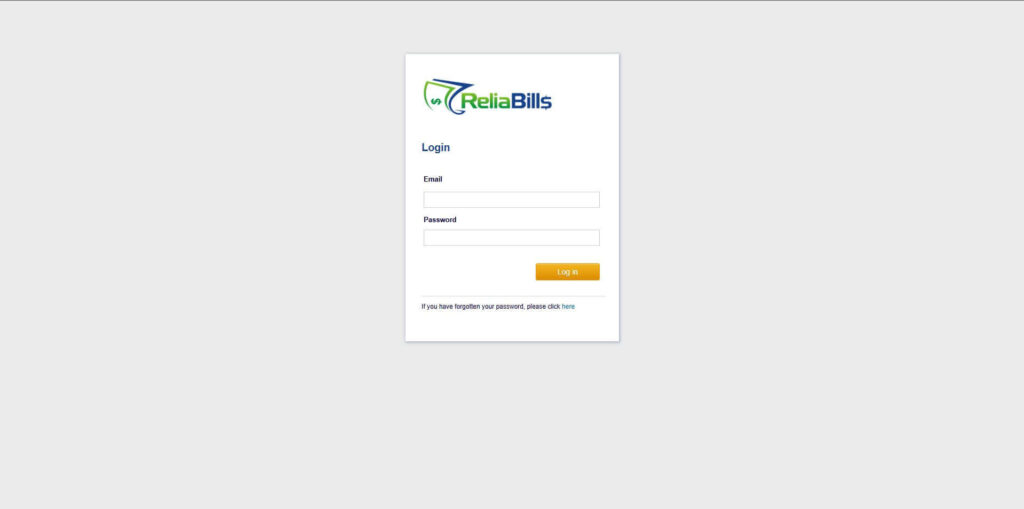

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

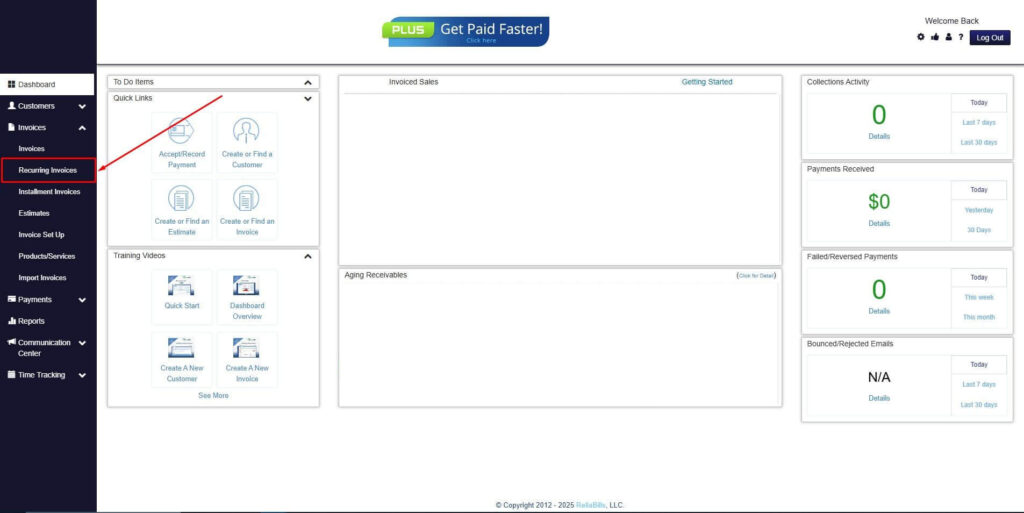

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

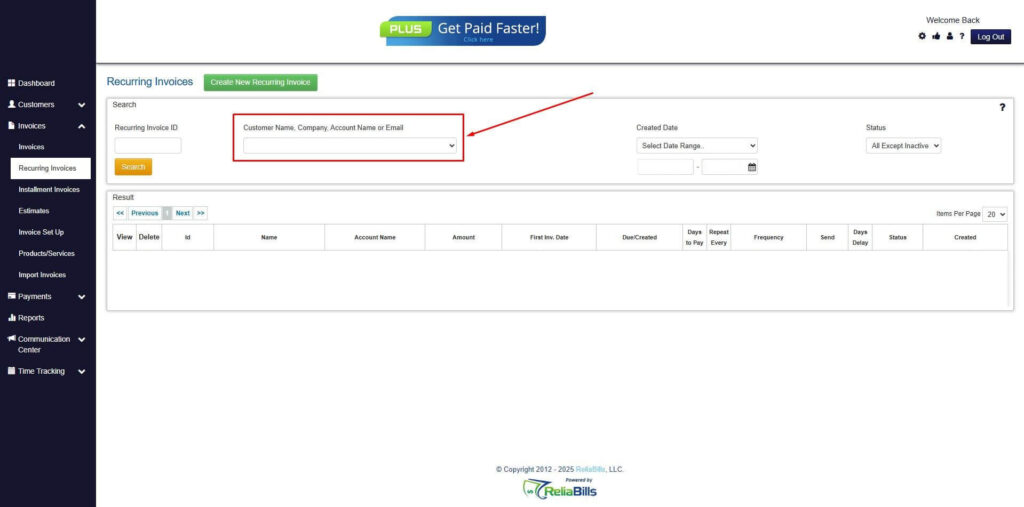

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

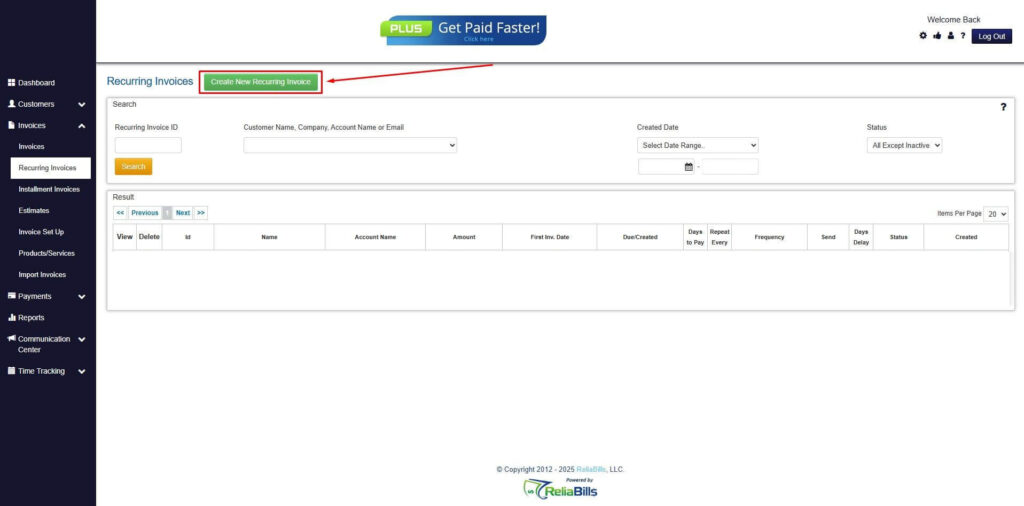

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

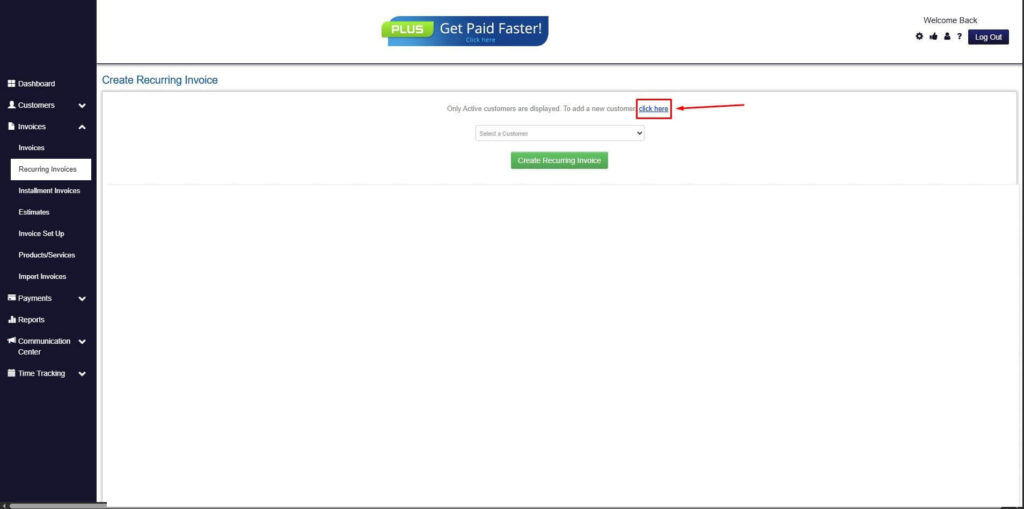

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

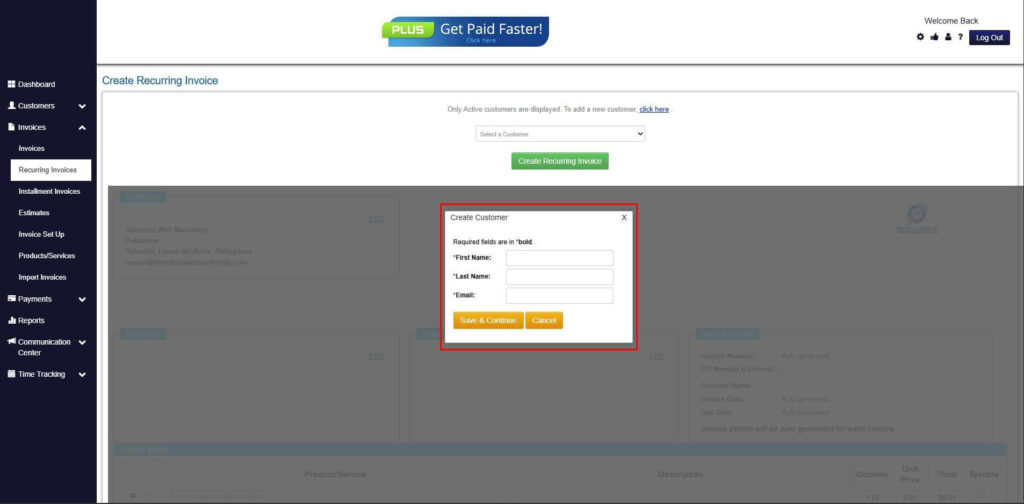

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

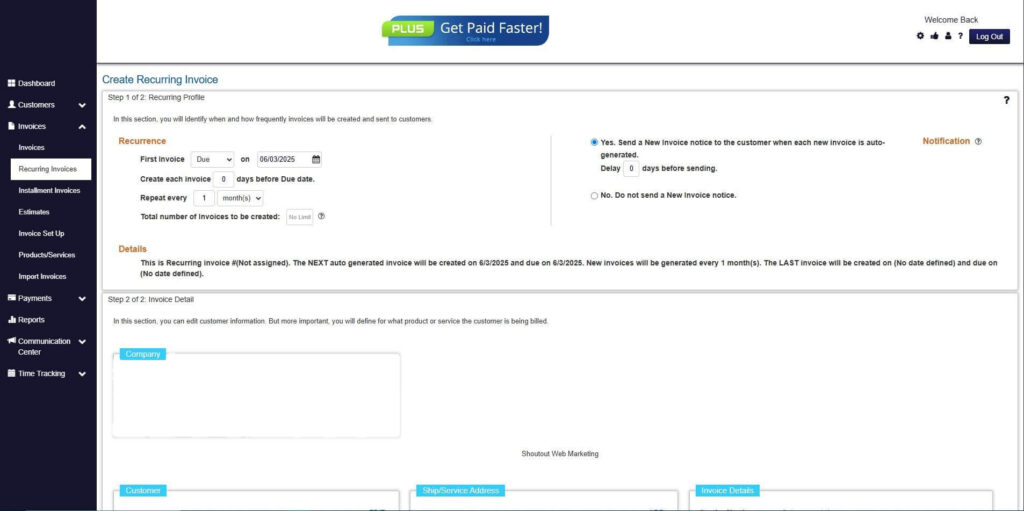

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

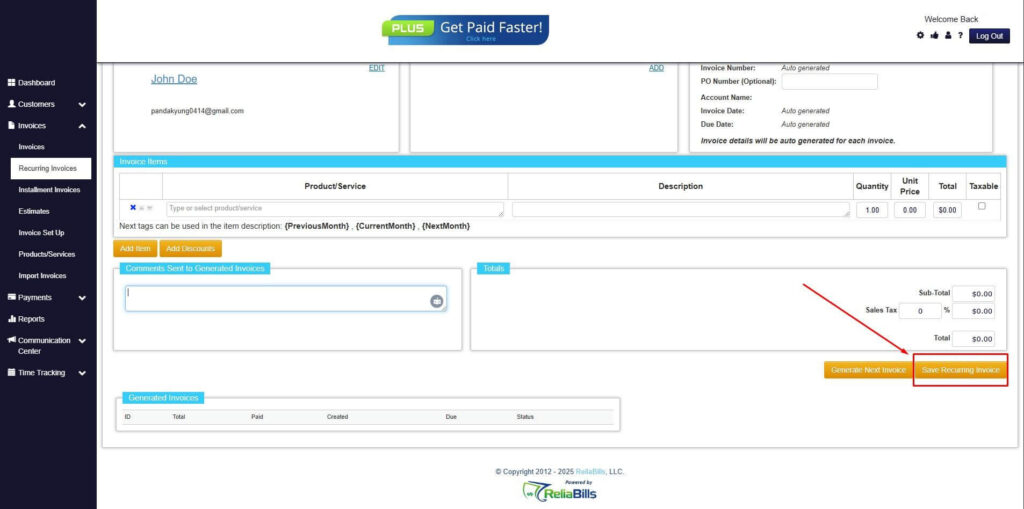

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. When should non-commercial invoices be used?

Non-commercial invoices should be issued for services delivered without charge, such as free trials, replacements, complimentary upgrades, or internal transfers.

2. Do non-commercial invoices affect revenue reporting?

No. When properly classified, non-commercial invoices do not impact revenue but provide a complete record of service delivery for accurate accounting and audit purposes.

3. Can non-commercial invoices be automated in recurring billing systems?

Yes. Platforms like ReliaBills allow non-commercial invoices to be generated automatically based on predefined triggers, preventing accidental payment requests and maintaining accurate customer histories.

4. Why are non-commercial invoices important for compliance?

They create a traceable audit trail, ensure transparent service documentation, and reduce the risk of misreporting, which is crucial for regulatory and tax compliance.

5. How can businesses avoid mistakes with non-commercial invoices?

Using standardized templates, automated workflows, and regular internal reviews minimizes errors, ensures proper classification, and keeps recurring billing operations efficient.

Conclusion

Non-commercial invoice service agreements provide clarity and control in recurring billing systems. Proper use ensures that services delivered without revenue are documented accurately, reducing disputes, improving audit readiness, and maintaining predictable billing operations.

Automation through platforms like ReliaBills streamlines the process, saving time, improving accuracy, and giving businesses visibility into all transactions, whether revenue-generating or non-revenue. By implementing structured workflows, organizations can manage non-commercial invoices efficiently while protecting customer relationships and maintaining compliance.