A non commercial invoice for customs is an important document used to explain shipments that are not being sold. Customs authorities rely on this invoice to understand the nature of the goods, their value for declaration purposes, and the reason for cross-border movement. Without it, shipments can be delayed, questioned, or even rejected.

Non-commercial invoices are commonly required for samples, gifts, returns, and internal transfers. Preparing this document correctly helps ensure smooth customs clearance and avoids unnecessary fees or inspections.

Table of Contents

ToggleWhat Is a Non-Commercial Invoice?

A non-commercial invoice is a document used to declare goods that have no commercial transaction attached to them. It outlines what is being shipped, why it is being shipped, and its value strictly for customs assessment, not for sale or payment.

Unlike a commercial invoice, it does not request payment or show sales terms. Customs authorities typically request a non-commercial invoice when goods cross borders without a purchase involved, but still require documentation for regulatory and tax purposes.

When Do You Need a Non-Commercial Invoice for Customs?

You need a non commercial invoice for customs in several situations. These include shipping samples with no commercial value, sending personal items or gifts, and returning goods for warranty replacement or repair.

It is also required for internal company transfers between international offices, as well as temporary exports or imports such as trade show materials. In each case, customs needs documentation even though no sale occurs.

Required Information on a Non-Commercial Invoice

A complete non-commercial invoice should include shipper and receiver details, including addresses and contact information. The description of goods must be clear and accurate, avoiding vague language.

You should also list quantities, weights, and a realistic customs value. The reason for export or import must be stated clearly, along with the country of origin and destination. HS codes may be required depending on the shipment, and shipping reference numbers should be included for tracking.

How to Prepare a Non-Commercial Invoice Step by Step

Step 1: Identify the purpose of the shipment

Clearly determine why the goods are being shipped, such as samples, gifts, returns, or internal transfers. This purpose must align with non-commercial customs requirements.

Step 2: Describe the goods accurately and clearly

Provide detailed descriptions of each item, including what the product is and how it will be used. Avoid vague terms that could confuse customs officials.

Step 3: Assign a realistic customs value

Even though the goods are not for sale, you must declare a reasonable value for customs assessment. This value should reflect production or replacement cost, not zero unless justified.

Step 4: Add required declarations and notes

Include statements such as “no commercial value,” “returned goods,” or “temporary export” when applicable. These notes help customs quickly understand the shipment context.

Step 5: Review compliance and attach to shipping documents

Double-check all details for accuracy, ensure consistency with packing lists and labels, then attach the invoice to your shipment documentation.

Common Customs Declarations and Statements

Many non-commercial invoices include a declaration stating that the goods have no commercial value. Others explain that the shipment is a return, replacement, or temporary export.

Some customs authorities also require a signature and date to confirm the accuracy of the information provided. Including these statements helps reduce questions during inspection.

Best Practices for Non-Commercial Invoices

Using clear and standardized descriptions improves processing speed. Avoid undervaluing goods or using zero values incorrectly, as this can raise red flags with customs.

Consistency across invoices, packing lists, and shipping labels is essential. Keeping copies of all documentation ensures you can respond quickly if customs requests clarification.

Common Mistakes to Avoid

One common mistake is assigning a zero value without explanation. Missing the shipment purpose can also delay clearance. Incomplete shipper or consignee information often results in customs holds.

Incorrect or missing HS codes may trigger inspections or fines. Reviewing the invoice before shipment helps avoid these issues.

Non-Commercial Invoice Template Example

Shipper Information

Name

Address

Contact details

Receiver Information

Name

Address

Contact details

Invoice Details

Invoice number

Invoice date

Description of Goods

Item description

Quantity

Weight

Declared value

Shipment Purpose

Sample shipment

Gift

Return or replacement

Internal transfer

Additional Information

Country of origin

Country of destination

HS code (if applicable)

Declaration

Statement of non-commercial value

Signature and date

How ReliaBills Can Help With Invoice Documentation

ReliaBills helps businesses create standardized invoice templates that can be adapted for non-commercial use. By keeping all invoice documentation digital and organized, businesses can quickly retrieve records when customs authorities request verification.

For companies that manage frequent shipments, recurring billing workflows help maintain consistent documentation practices across departments. Even when invoices are non-commercial, recurring structures ensure that reference numbers, shipment details, and records are aligned and easy to track.

For businesses with more complex operations, ReliaBills Plus, the paid tier of ReliaBills, offers advanced template customization, reporting, and centralized document management. ReliaBills Plus helps growing companies maintain accuracy and consistency across international invoicing and customs documentation.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

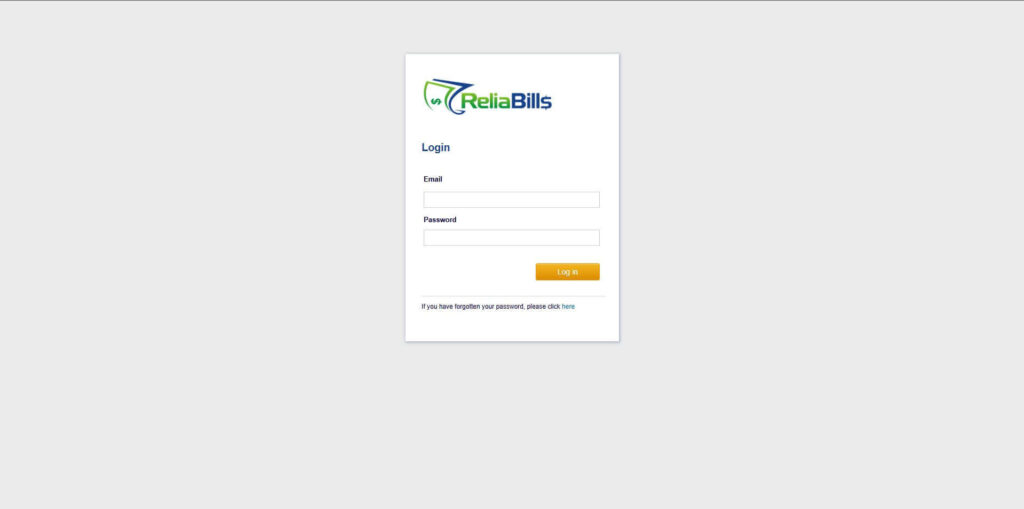

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

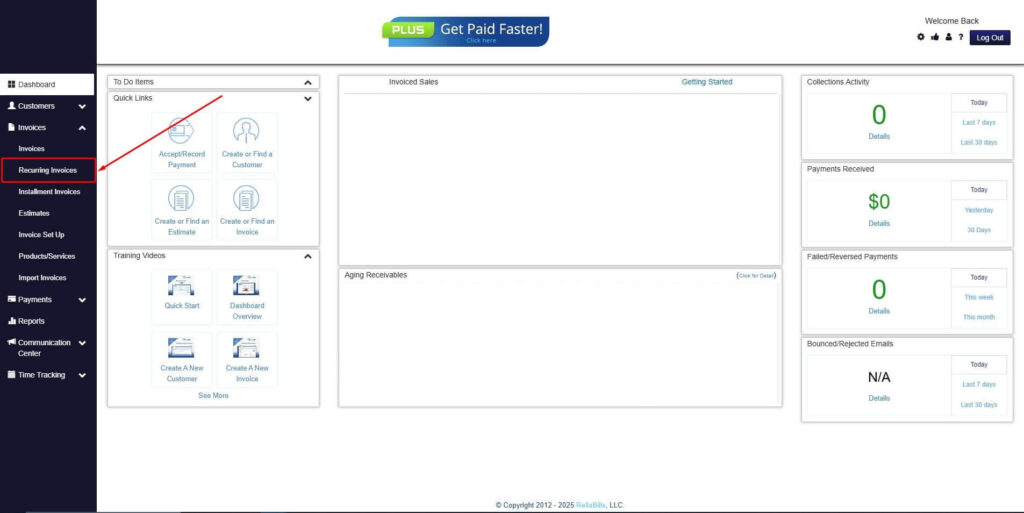

Step 2: Click on Recurring Invoices

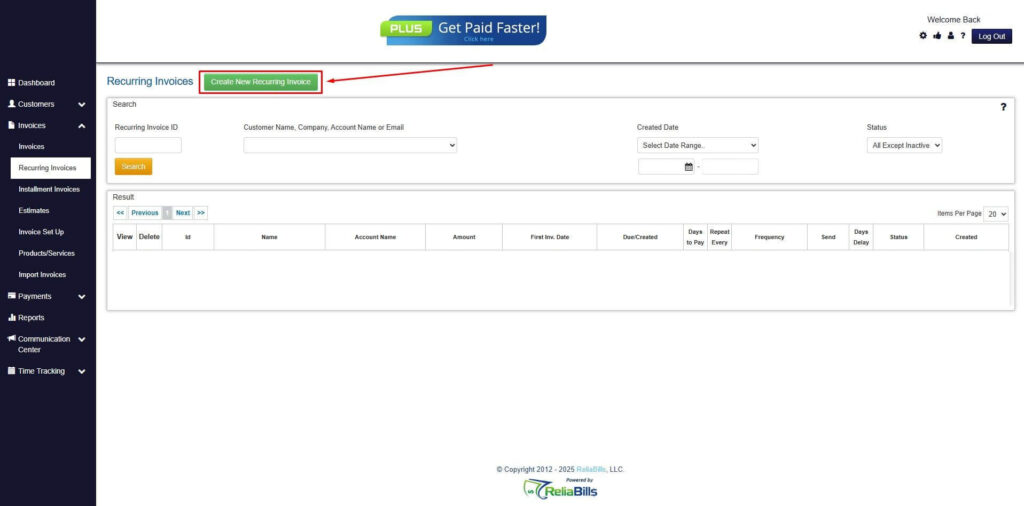

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

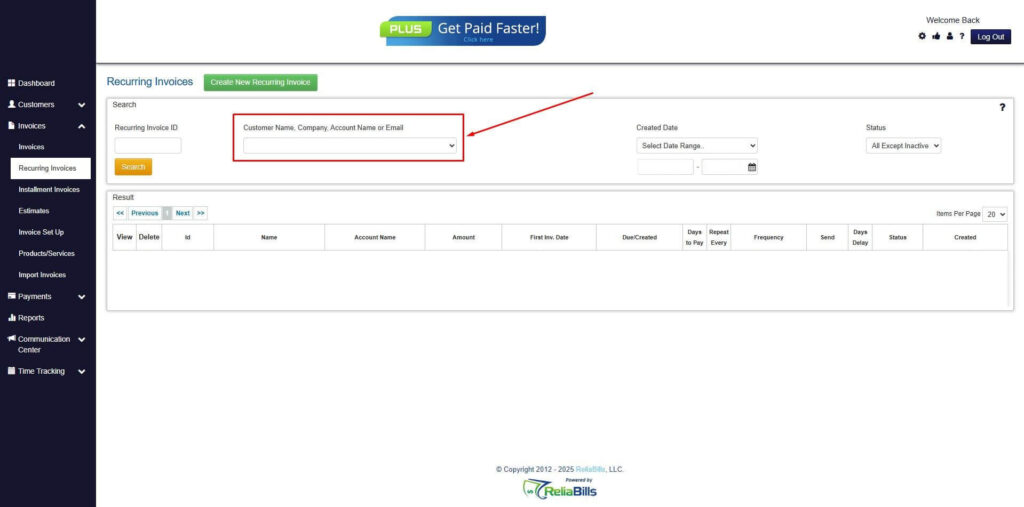

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

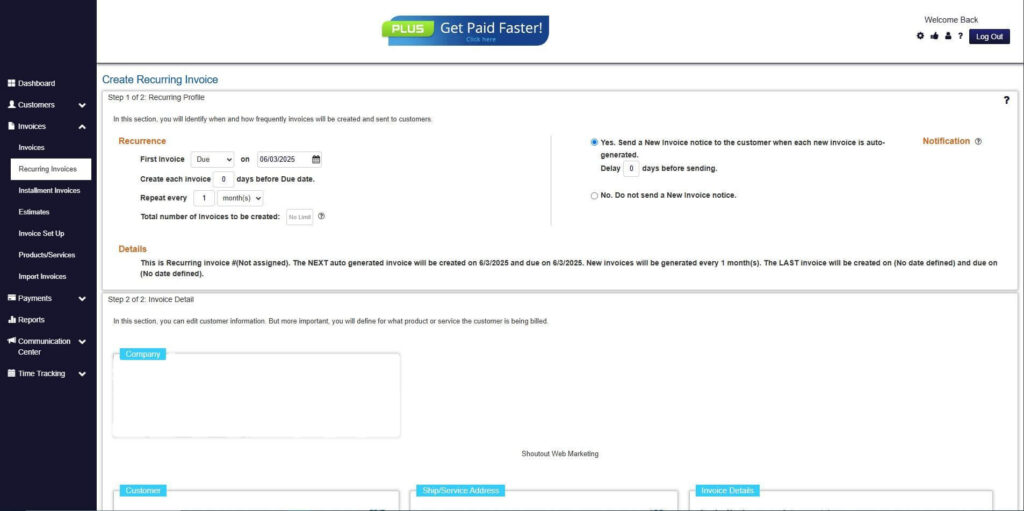

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

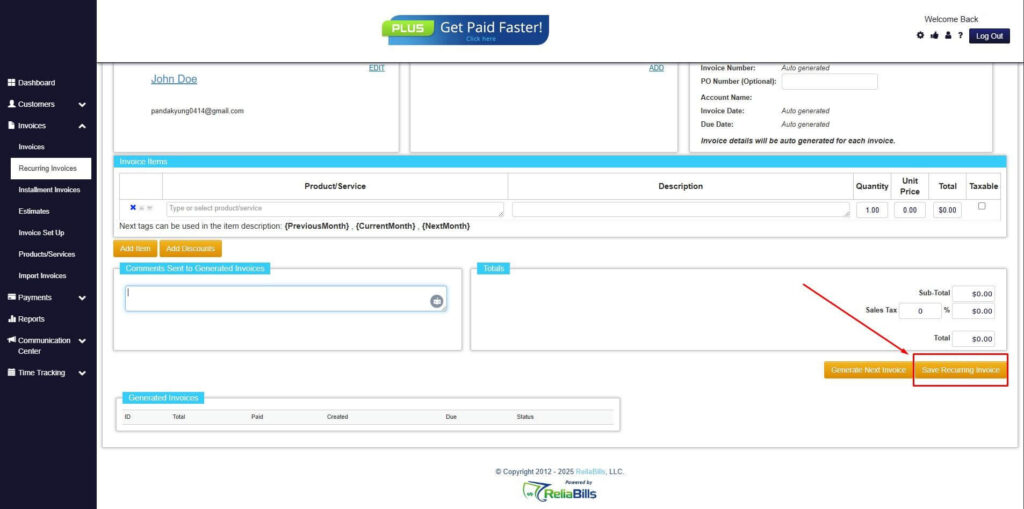

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is a non-commercial invoice legally required for all shipments?

Not always, but customs authorities often require it for shipments with no sale involved, depending on the country and shipment type.

2. Can a pro-forma invoice replace a non-commercial invoice?

In some cases, yes, but many customs offices specifically request a non-commercial invoice for non-sale transactions.

3. How do customs authorities assess value?

Customs reviews the declared value based on the description, purpose of shipment, and supporting documents provided.

4. Do non-commercial invoices need to be signed?

Many customs authorities require a signature and date to confirm the accuracy of the information on the invoice.

Conclusion

Preparing a correct non commercial invoice for customs is essential for avoiding delays and ensuring compliance. Clear descriptions, accurate values, and proper declarations help customs process shipments efficiently.

By following best practices and using organized invoicing tools, businesses can streamline customs clearance and reduce the risk of costly shipping issues.