When shopping for a vehicle, you will come across two important price terms: MSRP and invoice price. Many buyers assume these numbers are confusing, but understanding the difference can completely change how much you pay for a car. Knowing how MSRP compares to invoice price helps you negotiate confidently, avoid overpaying, and recognize when a deal is genuinely fair.

Table of Contents

ToggleWhat Is MSRP?

MSRP stands for Manufacturer’s Suggested Retail Price. It is the price that car manufacturers recommend dealers should sell a vehicle for. The MSRP is based on factors such as production cost, market demand, features, and brand positioning. Although the MSRP is printed on the window sticker, it is not always the final selling price. Dealers have the freedom to set their own prices, and you are free to negotiate below the MSRP.

What Is an Invoice Price?

The invoice price is what the dealer pays the manufacturer for the vehicle. This amount typically includes the base vehicle price, destination charges, and sometimes small advertising or regional fees. While many buyers assume the invoice price represents the dealer’s true cost, most dealerships receive incentives and manufacturer rebates that lower their actual expenses. Even so, the invoice price still gives buyers a valuable baseline when negotiating.

MSRP vs Invoice Price: Key Differences

The main difference between MSRP and invoice price lies in their purpose. The MSRP is a public-facing price designed for consumers, while the invoice price is the internal cost between the manufacturer and the dealer. MSRP is almost always higher than the invoice price, leaving room for profit and negotiation. Understanding both numbers gives you a realistic picture of how much you can negotiate and what kind of discount is reasonable.

Why the Difference Between MSRP and Invoice Matters

The gap between MSRP and invoice price directly affects how much you can save during negotiations. If you know the invoice price, you have more leverage when making an offer. You can avoid deals that sound good on the surface but are actually overpriced. This knowledge helps you identify fair offers, push for better pricing, and understand when a dealership is being transparent.

How Car Dealers Use MSRP and Invoice Price

Car dealerships rely on both MSRP and invoice pricing when setting their sales strategy. Many start at MSRP to create room for negotiation. They may also use price psychology, such as offering small discounts off the MSRP to make buyers feel they are getting a deal. Dealers can earn extra profit through incentives, financing plans, add-ons, and extended warranties. Some specials allow them to temporarily sell below the invoice price while still making money from manufacturer rebates.

How to Use MSRP and Invoice Price When Negotiating a Car

When negotiating, use the MSRP as your starting point and the invoice price as your target. Good deals often fall somewhere between the two. Follow these tips:

- Research the invoice price before visiting the dealership.

- Ask for a breakdown of charges to catch any unnecessary fees.

- Aim for a price close to the invoice, especially for models with lower demand.

- Be willing to walk away if the dealer will not negotiate.

- Compare multiple dealers to see who offers the most competitive pricing.

This balanced approach helps you negotiate confidently and avoid paying more than necessary.

MSRP vs Invoice: Which Should You Rely On?

If you must focus on one price, rely on the invoice price. It provides better insight into the real value of the vehicle and gives you an anchor point for your negotiation strategy. The MSRP is still helpful because it shows what the manufacturer believes the car should be sold for, but the invoice price offers a more realistic picture of what the dealer paid.

How ReliaBills Can Help With Your Invoicing Needs

While MSRP and invoice pricing apply to the auto world, accurate invoicing is important for every industry. ReliaBills helps businesses create professional invoices, automate billing, and ensure clients pay on time. The platform is designed to remove manual work by generating branded invoices, tracking payments, and sending automatic reminders.

One of the biggest advantages of ReliaBills is its recurring billing feature. If your business provides ongoing services, maintenance, or subscription-style offerings, recurring billing helps you get paid consistently without sending the same invoice over and over. Once you set up your billing schedule, ReliaBills handles the rest. This improves cash flow, reduces missed payments, and saves hours each month.

With built-in automation, real-time tracking, and easy payment processing, ReliaBills helps business owners stay organized and deliver transparent invoicing that clients can understand. Whether you manage service fees, product invoices, or monthly retainers, ReliaBills gives you a dependable system that supports your growth.

How to Create a New Invoice Using ReliaBills

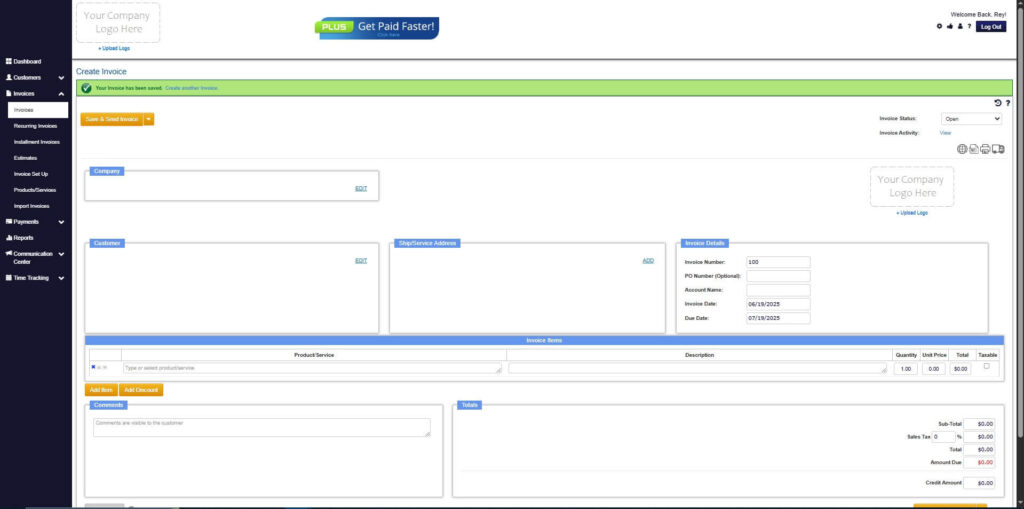

Creating an invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

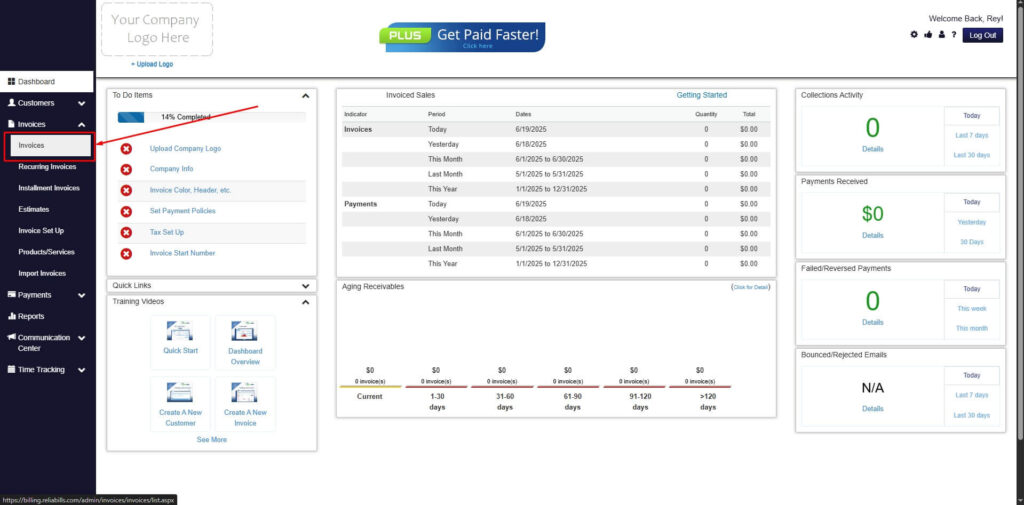

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

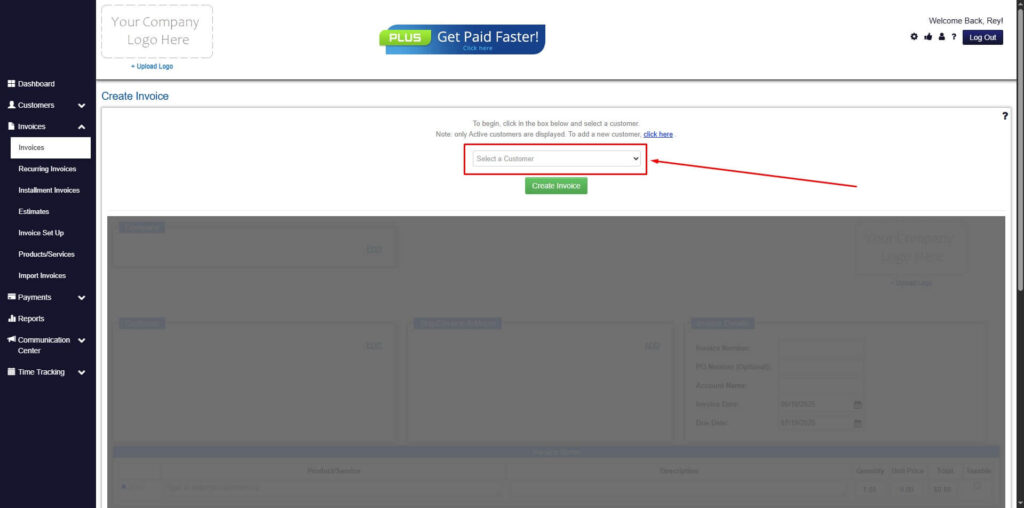

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

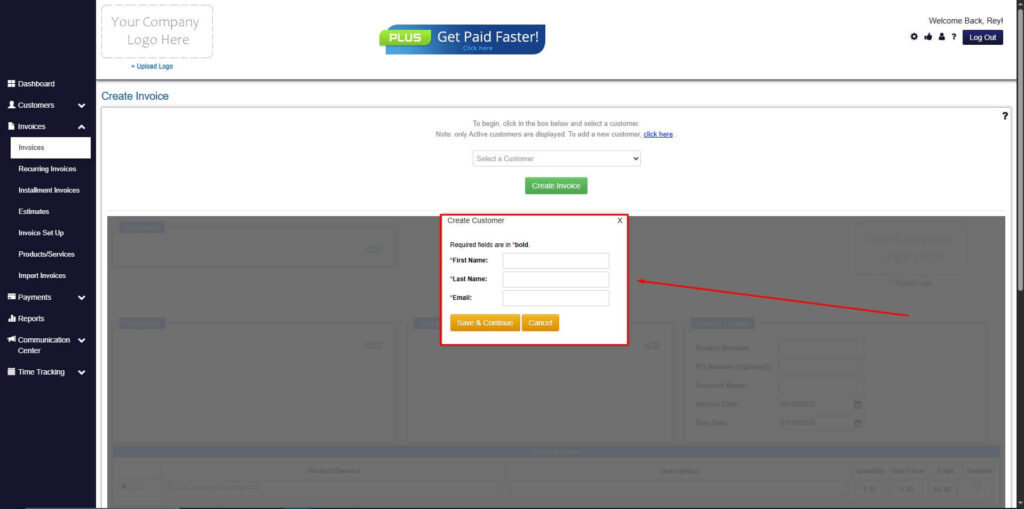

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

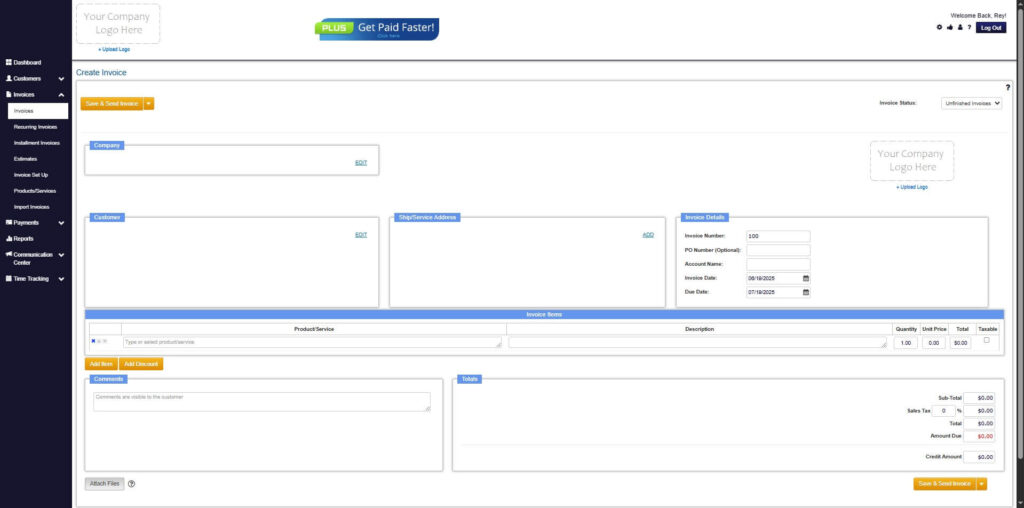

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

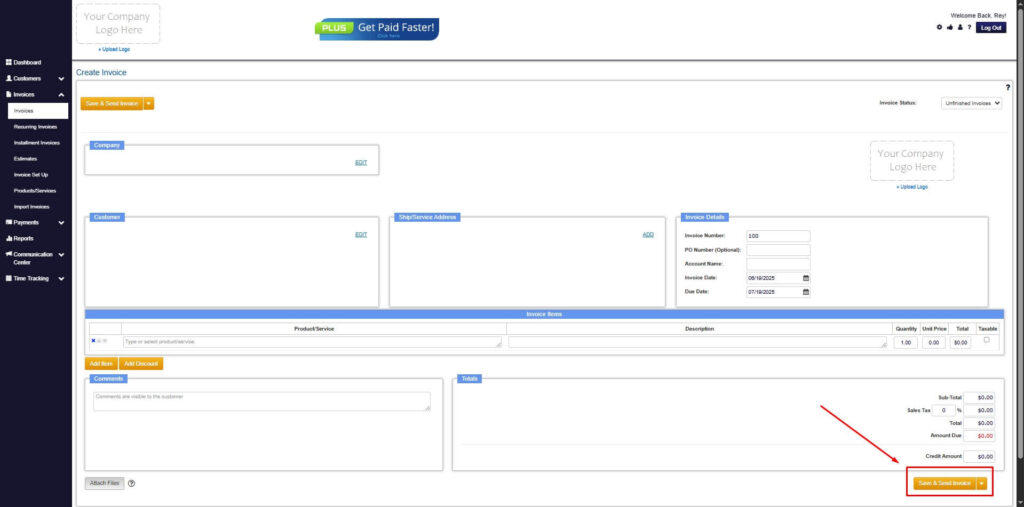

Step 7: Save Invoice

- After filling out the form, click “Save & Send Invoice” to continue.

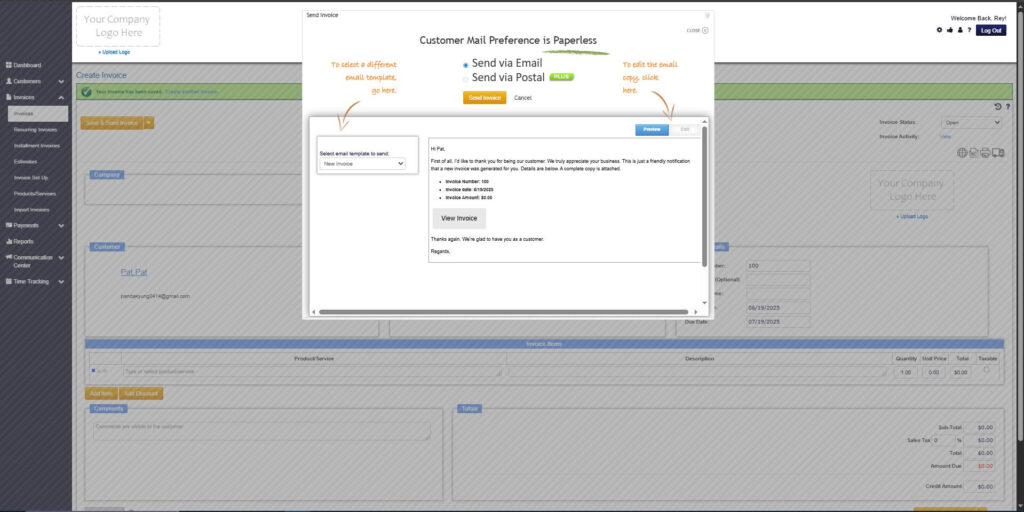

Step 8: Invoice Created

- Your Invoice has been created.

Frequently Asked Questions

1. Is the invoice price always lower than the MSRP?

Yes, the invoice price is typically lower because it represents the dealer’s cost before incentives.

2. Can you negotiate below the invoice price?

Sometimes. Dealer incentives may allow them to sell below the invoice price without losing money.

3. Does the MSRP ever change?

MSRP is set by the manufacturer and usually stays the same for that model year.

Conclusion

Understanding the difference between MSRP and invoice price gives you the power to negotiate better and make informed decisions when buying a car. MSRP provides a starting point, while the invoice price helps you understand what the dealer truly paid. By using both numbers smartly, you can secure a fair deal and feel confident throughout the buying process. And for business owners who want accurate, automated invoicing, tools like ReliaBills make financial management easier than ever.