Project-based billing is a common approach for businesses that handle client work with defined deliverables. Choosing the right billing method can significantly impact cash flow, client trust, and administrative efficiency. Two widely used models are milestone billing and project billing, each suited for different project types and client expectations.

Milestone billing divides a project into phases, with payments triggered at the completion of each milestone. Project billing, in contrast, generally involves a single invoice for the entire project or periodic billing based on project progress. Understanding the differences between these methods is crucial for accurate planning and smooth client relationships.

For businesses and freelancers alike, selecting the right approach ensures both timely revenue collection and transparent communication with clients. This guide explains the nuances of each method, highlights their advantages, and shows how to apply them effectively in real-world scenarios.

Table of Contents

ToggleUnderstanding Project Billing

Project billing is a payment structure where a client is billed for the project as a whole or in large segments based on progress. Businesses often use this model for short-term projects or when the scope is well-defined. Payment may be collected upfront, upon completion, or at regular intervals until the project is finished.

Industries such as web development, graphic design, and construction frequently use project billing. It works best when deliverables are clear and the project timeline is relatively short. The simplicity of a single, comprehensive invoice reduces administrative effort for smaller engagements.

However, project billing has limitations. Unexpected changes or scope creep can complicate collections, and clients may feel less engaged without incremental checkpoints. Cash flow can also be less predictable, especially for larger projects without phased payments.

Understanding Milestone Billing

Milestone billing divides a project into defined phases, each associated with a specific deliverable and payment. This approach ensures both the client and the service provider stay aligned throughout the project lifecycle. Payments are released as each milestone is completed and approved.

Common industries using milestone billing include software development, marketing campaigns, and long-term consulting projects. The phased approach allows for clear progress tracking, reducing the risk of disputes and improving client transparency. Milestone billing also provides flexibility in managing partial payments and adjustments along the way.

While milestone billing promotes clarity and reduces risk, it can increase administrative work. Businesses must track each milestone, verify deliverables, and issue invoices accordingly. Proper planning and communication are essential to make this approach effective.

Milestone Billing vs Project Billing: Key Differences

The main difference lies in billing structure and timing. Milestone billing involves multiple smaller invoices tied to project phases, whereas project billing may rely on one invoice or a few large payments. This difference affects how cash flow is managed and forecasted.

Client transparency and trust also vary. Milestone billing provides clear checkpoints and progress visibility, making clients more comfortable with ongoing payments. Project billing is simpler but can create uncertainty if deliverables are delayed or misaligned.

Administrative effort and risk management are additional considerations. Milestone billing requires careful tracking and documentation, but it reduces the risk of nonpayment. Project billing is easier to manage but may leave businesses exposed to delays or client disputes.

When to Use Project Billing

Project billing works well for small or short-term projects where the scope is clearly defined. Clients understand exactly what they are paying for and when, which simplifies invoicing and collections.

It is suitable for fixed-price agreements that have minimal likelihood of change orders. Since the scope is unlikely to shift, the business can confidently bill the full amount upon completion or at prearranged intervals.

This method is particularly effective for low-risk projects where a single invoice or consolidated payment plan makes administrative sense. It streamlines the billing process and reduces tracking requirements.

When to Use Milestone Billing

Milestone billing is ideal for larger or longer projects where work is completed in phases. By linking payment to tangible deliverables, both parties are motivated to meet deadlines and maintain quality.

This model is especially useful when projects involve multiple stakeholders or complex deliverables. Milestone billing ensures accountability and minimizes disputes, as progress is measured and payments are released incrementally.

Businesses can also use milestone billing to maintain better cash flow over the duration of the project. It spreads revenue recognition evenly and allows adjustments if changes occur during the project.

Impact on Cash Flow and Revenue Management

Billing timing significantly affects cash flow. Project billing may lead to lump-sum payments at the end, which can create temporary cash flow gaps. Milestone billing provides smaller, consistent payments that improve predictability.

Handling partial payments and delays becomes easier with milestone billing, as each phase is individually documented. Project billing requires careful planning to avoid revenue shortfalls when payment is tied to a single invoice.

Financial forecasting benefits from milestone billing because businesses can anticipate incoming payments at each project stage. Project billing requires tracking progress and estimating revenue recognition more cautiously.

Best Practices for Choosing the Right Billing Model

- Assess project size, duration, and complexity to determine the suitable approach

- Evaluate client expectations and willingness to pay in phases

- Align billing with internal workflows and administrative capabilities

- Clearly document all billing terms, deadlines, and approval processes

Common Mistakes to Avoid

Selecting a billing model without client agreement can lead to disputes and payment delays. Always ensure expectations are documented and approved upfront.

Poorly defined milestones or deliverables create confusion. This can slow project progress and complicate invoicing. Clear scope definitions are essential.

Inconsistent invoicing practices and lack of payment tracking are common pitfalls. Businesses should standardize invoice formats, schedules, and follow-up processes to prevent errors.

How ReliaBills Supports Milestone and Project Billing

ReliaBills provides a comprehensive solution for businesses managing both milestone and project billing. Its platform allows you to create highly customizable invoices tailored to specific project stages or full-project payments. You can assign invoices to individual milestones, track completion progress, and automatically send reminders to clients, reducing delays in payment collection. This ensures each phase is properly documented and linked to the agreed-upon deliverables, providing clarity for both your team and your clients.

For businesses handling recurring or subscription-based services alongside milestone projects, ReliaBills offers robust recurring billing support. This feature is especially useful when projects span several months or involve multiple phased deliverables. Payments can be scheduled to automatically align with milestone completion or subscription cycles, minimizing manual work while maintaining predictable cash flow. The system also centralizes client payment histories, making it easy to resolve disputes, generate reports, and monitor revenue for all ongoing projects.

ReliaBills PLUS further enhances these capabilities, providing advanced tools for scaling businesses. It offers detailed analytics on payment trends, performance tracking by project or milestone, and the ability to customize invoice templates to reflect your brand consistently. Additionally, ReliaBills PLUS supports complex recurring billing scenarios, helping businesses manage phased payments across multiple clients or locations with ease. This combination of automation, flexibility, and centralized management makes it easier to streamline your billing workflow while improving cash flow and client satisfaction.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

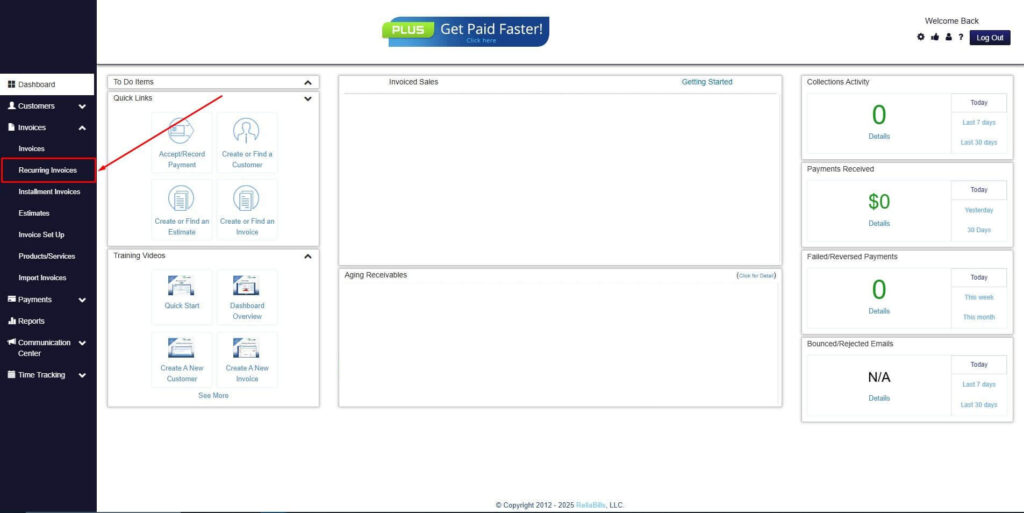

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

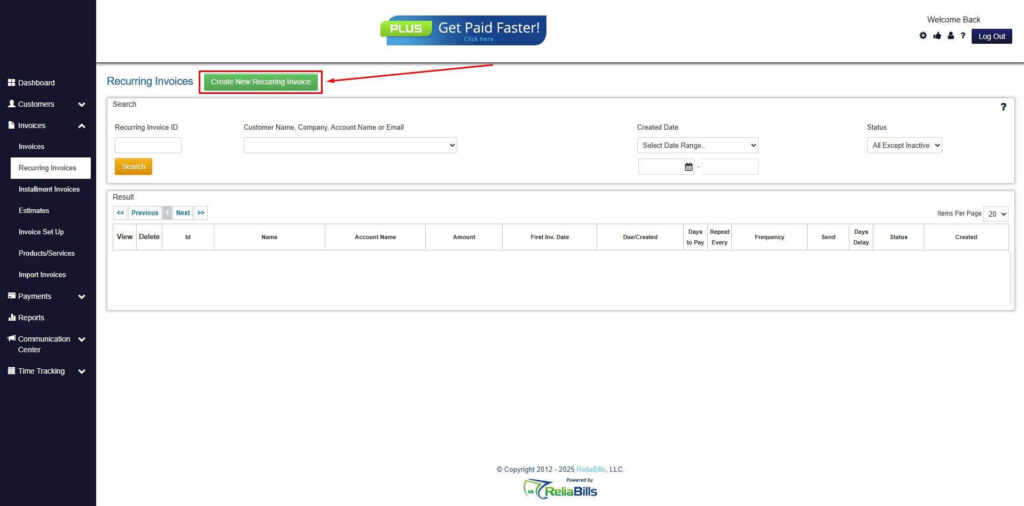

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

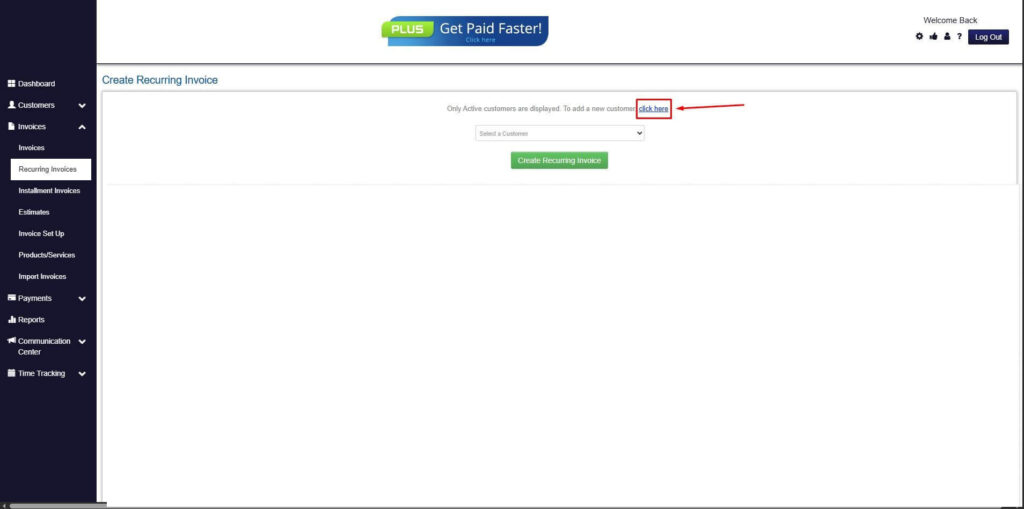

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

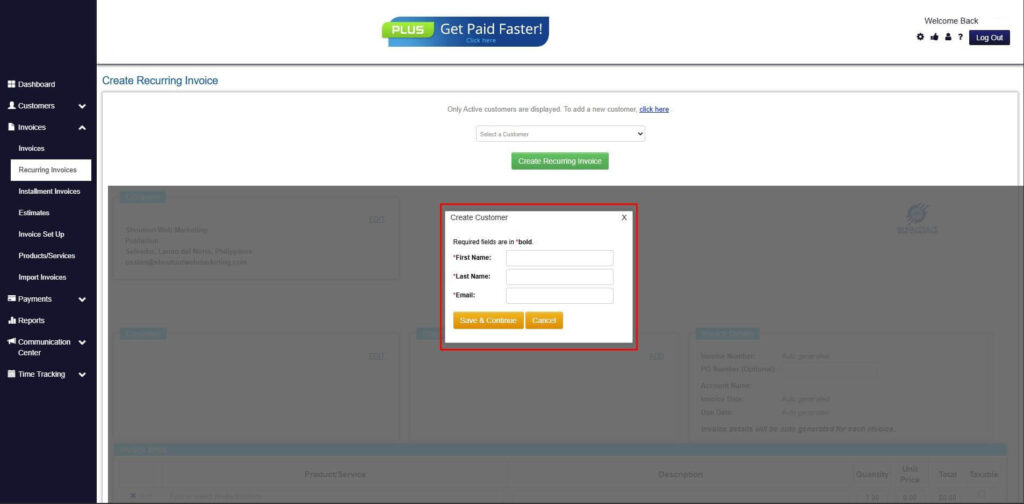

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

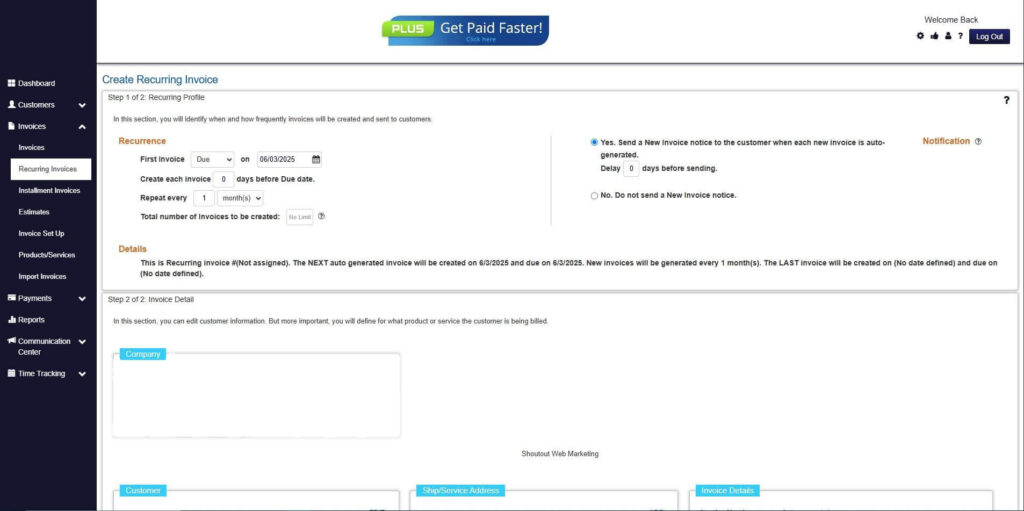

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

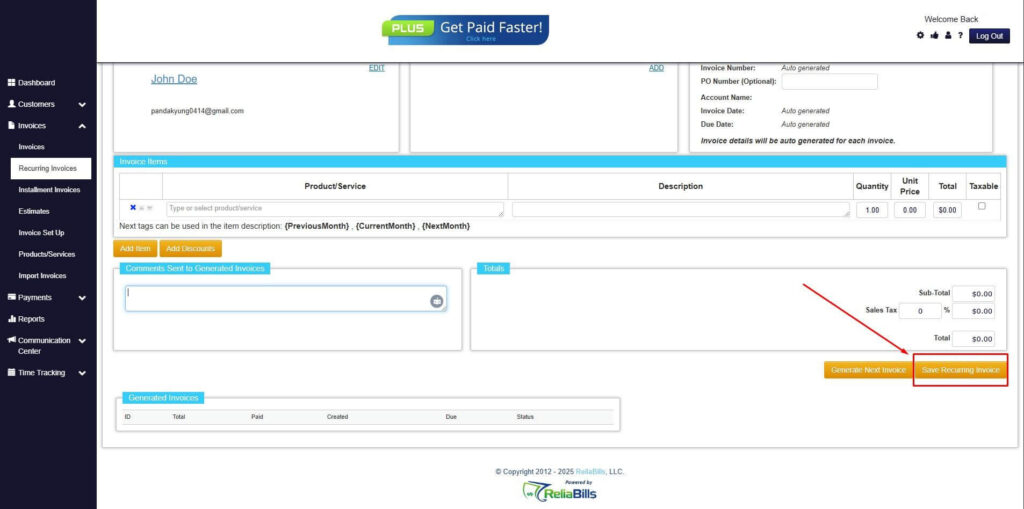

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

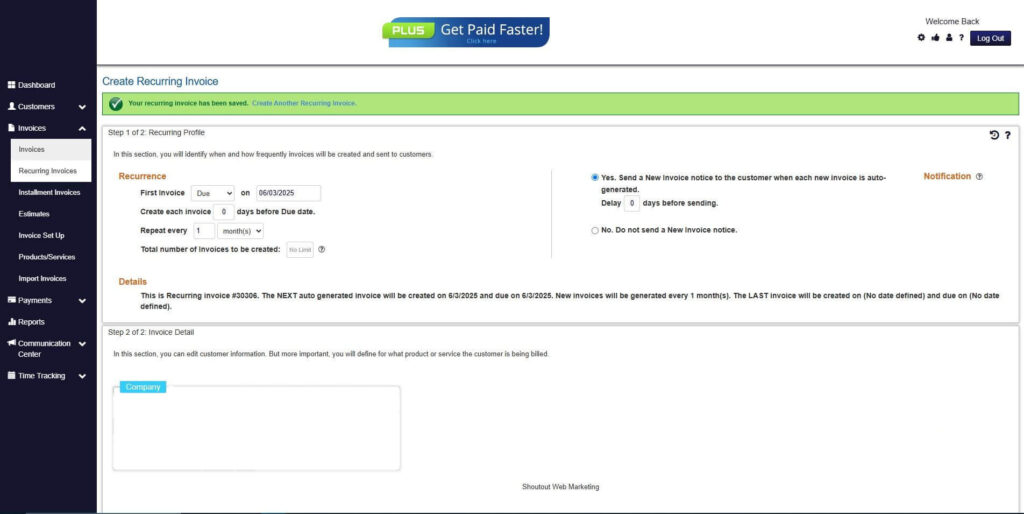

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Can milestone and project billing be combined?

Yes, businesses can blend the two methods for complex projects, using milestones for key phases and a final project invoice for overall completion.

2. Which model is better for cash flow?

Milestone billing generally provides more predictable cash flow through phased payments, while project billing may concentrate revenue at the end.

3. How should disputes be handled under each model?

For milestone billing, disputes are easier to resolve per phase. Project billing disputes usually require negotiation over the full invoice.

4. Can billing be automated for both methods?

Yes, software like ReliaBills can automate milestone invoicing, project billing, and reminders for recurring payments.

Conclusion

Choosing between milestone billing and project billing depends on project size, complexity, and client expectations. Milestone billing offers better visibility and reduces risk, while project billing is simpler and faster for smaller projects.

Both models require careful documentation, clear communication, and proper tracking to ensure smooth invoicing and payment collection. Understanding the differences allows businesses to align billing with operations and client needs.

Tools like ReliaBills and ReliaBills PLUS make managing either billing approach easier. With automation, recurring billing options, and milestone tracking, businesses can maintain predictable cash flow while delivering professional and transparent invoicing.