Jewelry businesses operate in a market built on trust, craftsmanship, and transparency. Whether you sell custom engagement rings, diamond earrings, or handcrafted bracelets, each transaction needs a clear and professional jewelry invoice. A well-structured invoice protects your business, reassures customers, and ensures that payments are processed on time. It also helps with recordkeeping, inventory management, and long-term customer service.

This guide explains what a jewelry invoice is, when it should be issued, and how to create one that supports accuracy, professionalism, and efficient business operations.

Table of Contents

ToggleWhat Is a Jewelry Invoice?

A jewelry invoice is a formal document that records the sale of a jewelry item or service. It outlines the materials used, item specifics, pricing details, and payment terms. Unlike general invoices, a jewelry invoice often includes gemstone characteristics, metal purity, weight, and design notes. These details help maintain transparency, support appraisals, and strengthen customer trust.

When Jewelry Businesses Need to Issue an Invoice

Jewelry businesses need to issue an invoice at the point of sale, whether in-store, online, or through special orders. Invoices are required for custom jewelry commissions, repair services, wholesale orders, luxury piece purchases, consignment transactions, and e-commerce checkouts. Providing a proper invoice ensures that your customer has proof of purchase while your business maintains accurate financial and inventory records.

Essential Elements of a Jewelry Invoice

A complete jewelry invoice includes several important components such as business information, customer details, invoice number, invoice date, due date, detailed item descriptions, pricing, materials used, labor or design fees, taxes, and total amount due. Many jewelry buyers also appreciate warranty notes or service guarantees. Each of these details helps create clarity and improves customer confidence.

How to Write a Jewelry Invoice Step-by-Step

- Start with your business details. Include your business name, logo, and contact information.

- Add customer information. Use accurate names and contact details.

- Create a unique invoice number. This helps with tracking and bookkeeping.

- Write a detailed description of the jewelry. Include metal purity, gemstone characteristics, weight, and craftsmanship details.

- Present a clear pricing breakdown. Show material cost, labor fees, taxes, and the total amount due.

- Specify payment terms. State deadlines, accepted payment methods, and any service notes.

- Include warranty or repair notes if applicable.

- Review the invoice before sending. Accuracy matters in jewelry transactions.

Best Practices for Jewelry Invoice Accuracy

Accuracy is crucial in the jewelry industry because buyers rely on precise information to validate the value of their purchase. Always describe materials using proper jewelry terminology and ensure all values, weights, and gemstone details are correct. Consistency in formatting strengthens your brand and reduces confusion. Many businesses also attach photos of custom pieces to support documentation and avoid disputes.

Common Mistakes to Avoid

Some jewelry businesses make mistakes such as providing vague item descriptions, omitting invoice numbers, listing inaccurate gemstone details, or failing to set clear payment terms. Leaving out taxes or fees can also cause confusion. Every jewelry invoice should be clear, accurate, and professionally presented to maintain trust and prevent misunderstandings.

How ReliaBills Helps Jewelry Businesses Invoice More Efficiently

ReliaBills provides jewelry businesses with a streamlined invoicing system that improves accuracy and reduces the administrative burden that comes with manual billing. It allows jewelry sellers to create polished invoices that include detailed descriptions, transparent pricing, and consistent formatting. This ensures customers receive documentation that supports authenticity and long-term valuation.

One of the biggest benefits for jewelry businesses is ReliaBills’ recurring billing feature. Many jewelry stores offer subscription-based cleaning plans, maintenance programs, or layaway arrangements. Recurring billing automates these scheduled payments so invoices are sent automatically at the right time. This reduces missed payments, eliminates repetitive manual work, and creates a more predictable revenue stream.

ReliaBills also includes automated reminders, multiple payment options, and a dashboard that tracks every invoice and customer interaction. It helps eliminate errors that often come with handwritten or manually prepared invoices. For jewelry sellers who want to work efficiently and maintain a professional reputation, ReliaBills offers a complete invoicing solution that supports long-term growth and customer loyalty.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

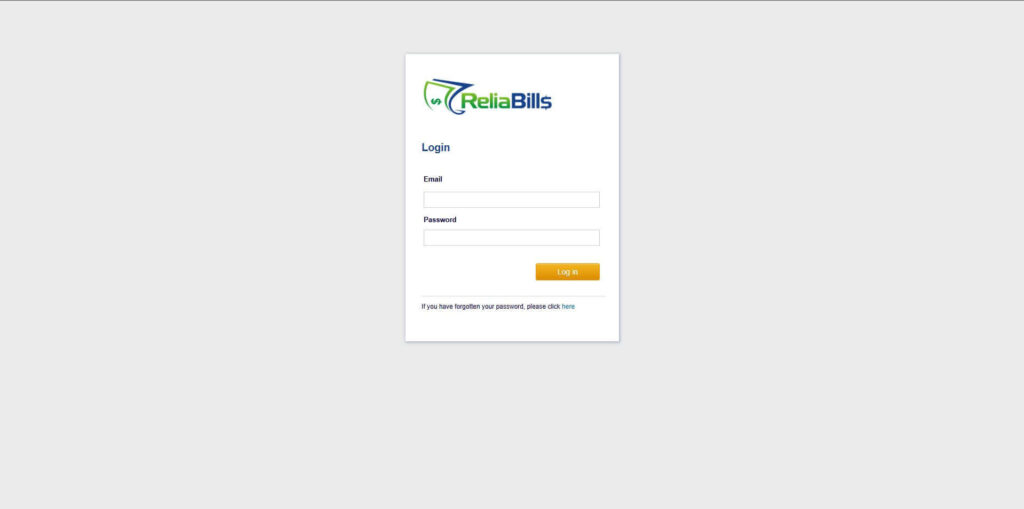

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

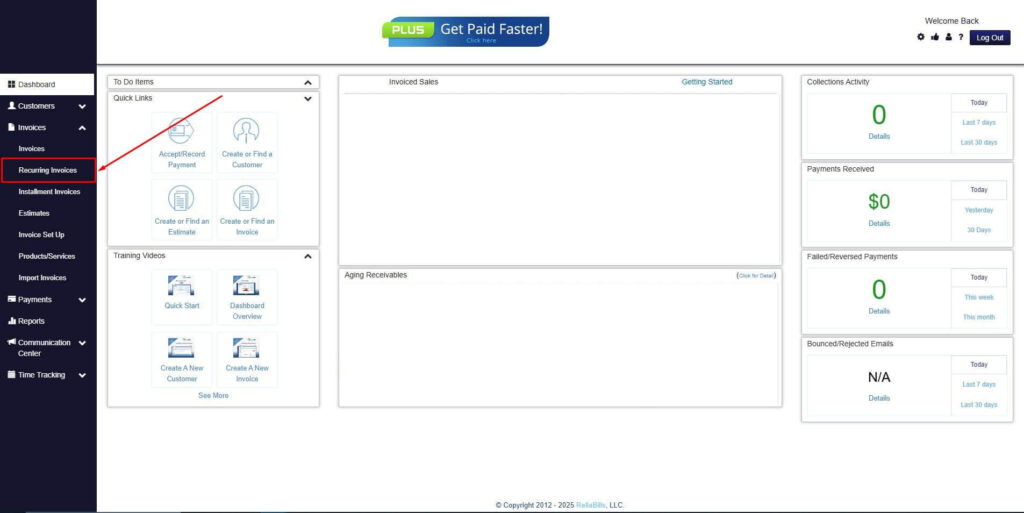

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

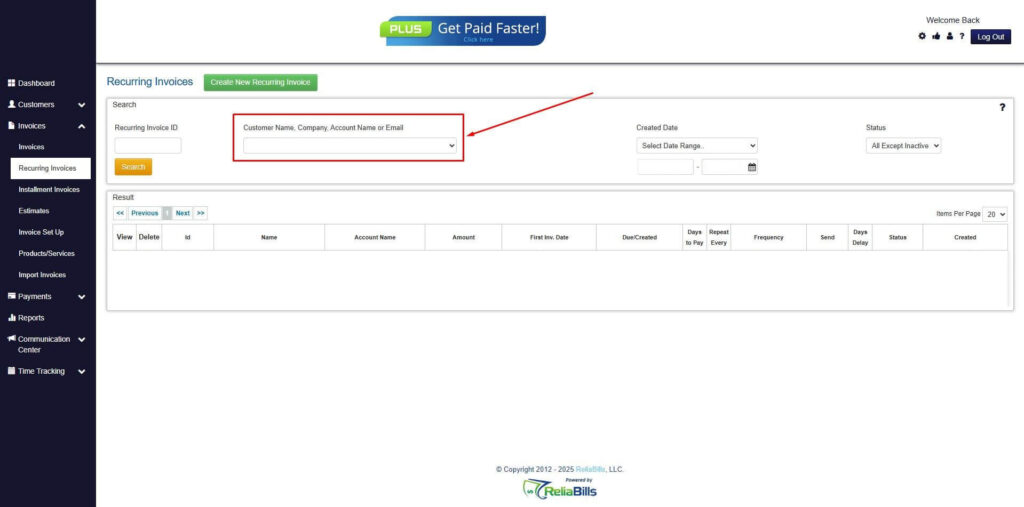

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

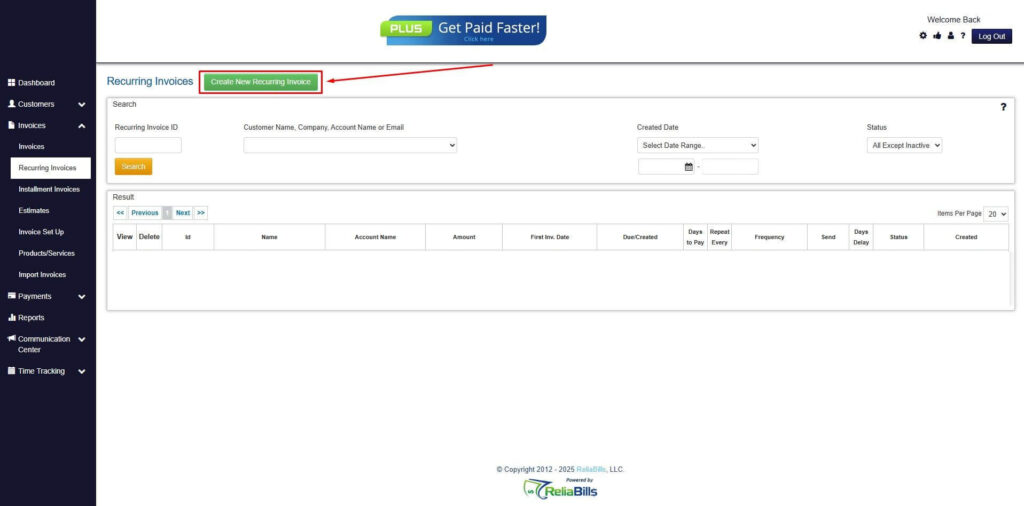

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

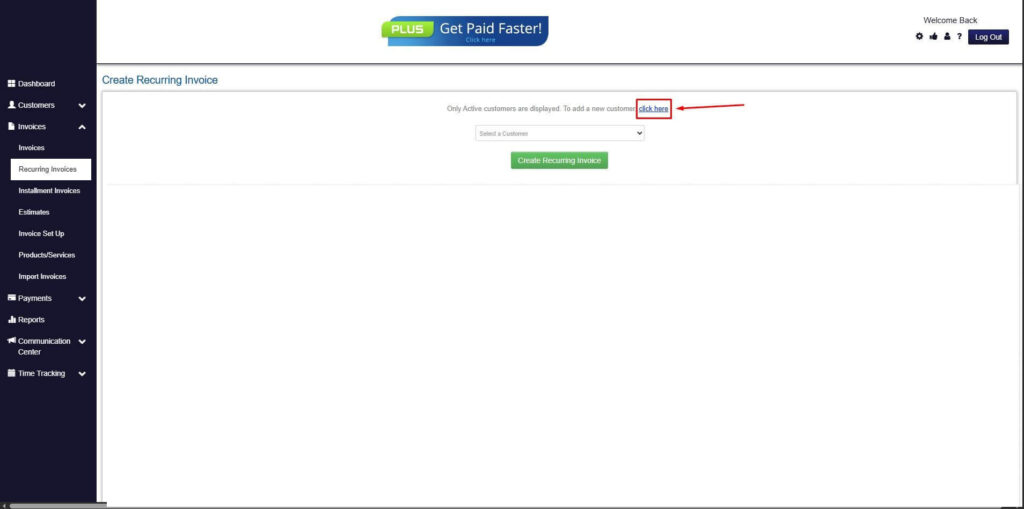

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

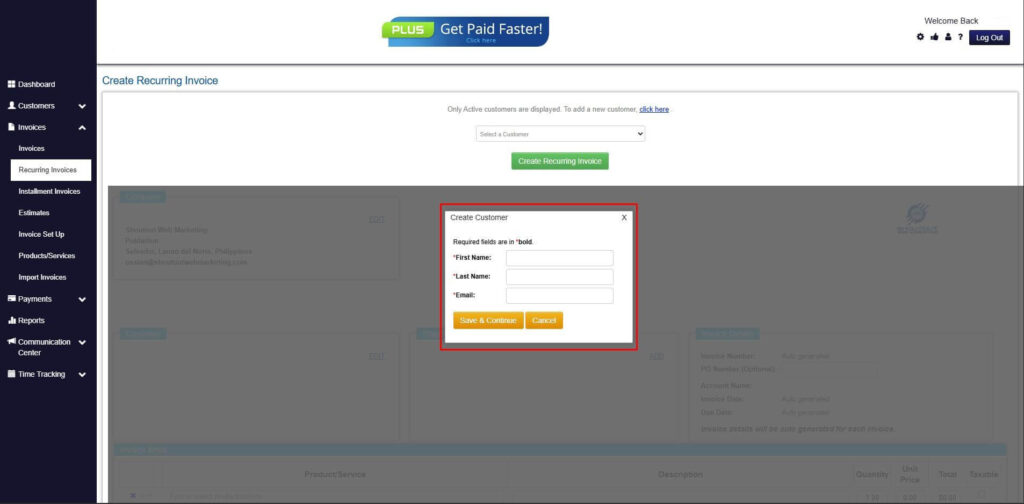

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

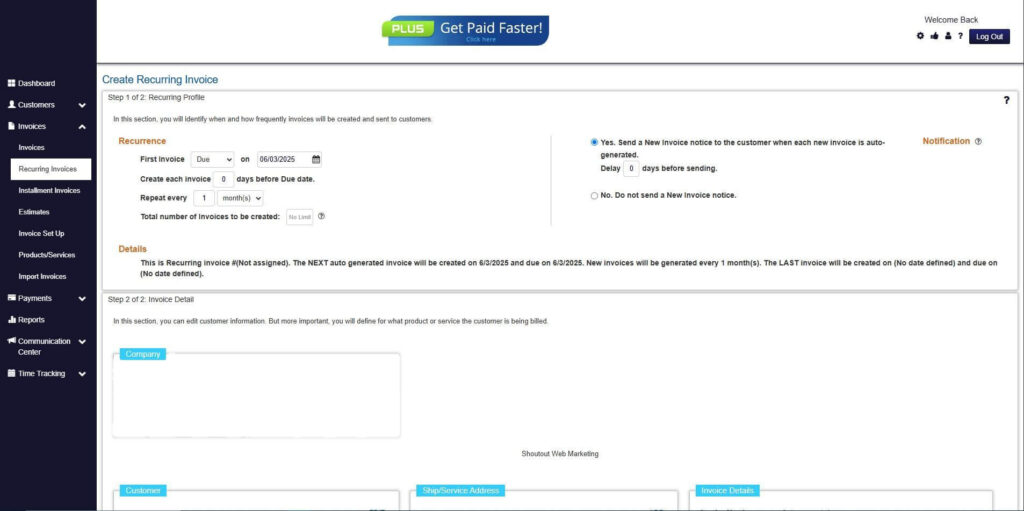

Step 7: Fill in the Create Recurring Invoice Form

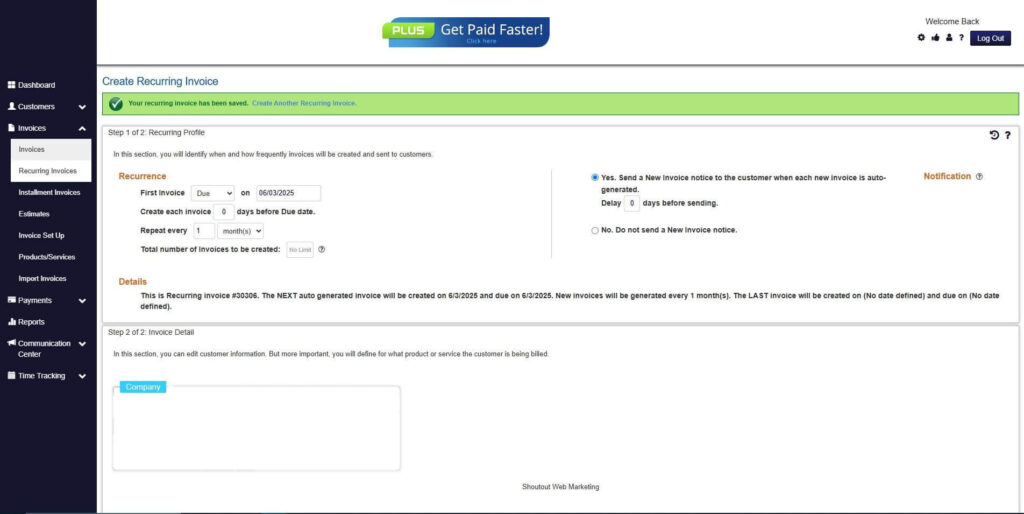

- Fill in all the necessary fields.

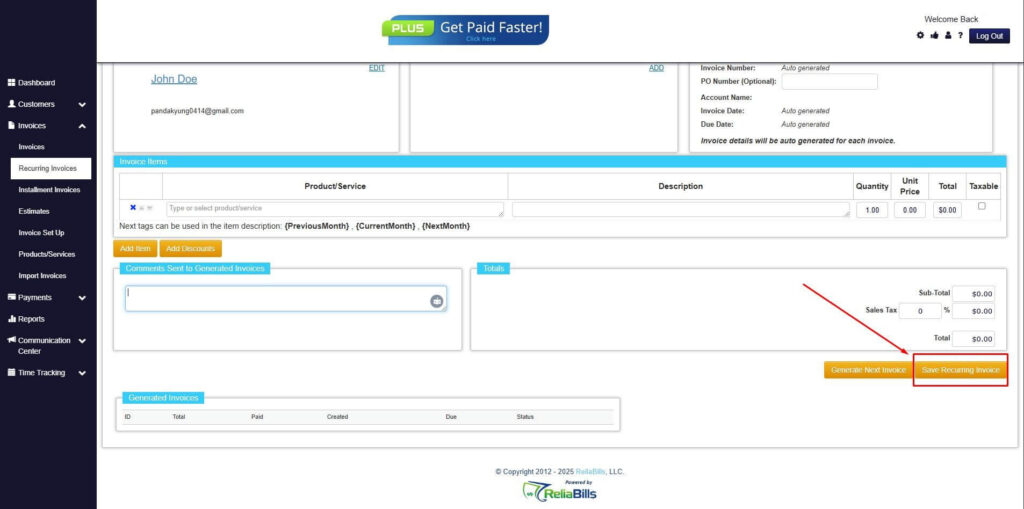

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Do I need a jewelry invoice for every sale?

Yes. An invoice protects both your business and the customer, and it documents the specifics of the purchase.

2. What details should be included in a jewelry invoice?

Descriptions, gemstone details, pricing, payment terms, invoice numbers, dates, and taxes.

3. Can jewelry invoices be digital?

Yes. Digital invoices are easier to track, store, and share.

4. Why do jewelry invoices require detailed item descriptions?

They help with appraisals, prevent disputes, and build customer trust.

Conclusion

A jewelry invoice is an essential document for every jewelry business. It protects your transactions, builds trust, and ensures accuracy in every sale. By following best practices and using tools like ReliaBills to automate and streamline the process, jewelry businesses can focus on quality craftsmanship while maintaining a professional and efficient billing workflow. A well-structured jewelry invoice supports your brand, improves customer satisfaction, and strengthens your business operations.