Clear invoice wording is essential for getting paid on time. The words you choose help clients understand what they are being charged for, when payment is due, and how to submit it. Strong invoice wording reduces misunderstandings, prevents delays, and strengthens your professional image. Whether you work with long term clients or new customers, well written invoices help build trust and support smooth transactions.

Table of Contents

ToggleWhat Is Invoice Wording?

Invoice wording refers to the language used throughout an invoice, including descriptions, notes, instructions, and payment terms. It covers everything from line item details to due dates and reminder messages. Effective invoice wording is simple, direct, and easy for clients to understand at a glance.

Essential Elements to Include in Every Invoice

Business Information

Each invoice should begin with complete business information so clients know exactly who it is from. Include your business name, logo, address, email, phone number, and website.

Client Information

List the client’s name, company, and contact details. Accurate client information ensures proper delivery and avoids confusion.

Invoice Number and Date

Assign a unique invoice number for tracking and reference. Include the invoice date and, if needed, the date the service was completed or the product was delivered.

Clear Description of Goods or Services

Use simple, straightforward descriptions. Explain what was provided without vague or overly technical wording. Clear descriptions help clients understand the value of your work.

Pricing, Taxes, and Total Amount Due

Itemize costs clearly. Show the price for each service or product, any taxes applied, and the final amount due. Make the total easy to find.

How to Word an Invoice Professionally

Using Clear and Simple Language

Professional invoice wording avoids unnecessary complexity. Use direct phrases like “Total due,” “Service provided,” and “Payment instructions.” Simple language speeds up approvals and reduces questions.

Structuring Line Items Effectively

Organize line items in a clean format. Include the name of the service or product, quantity, rate, and individual cost. A clear layout makes invoices easier to review and pay.

Setting Expectations with Payment Terms

State your payment terms clearly, including due dates, late fees, and accepted payment methods. Clients should know exactly what to expect and how to comply.

Best Practices for Payment Terms Wording

Due Dates

Choose a clear, direct format such as:

- “Payment is due on April 15.”

- “Payment is due within 15 days.”

Late Fee Language

If you charge late fees, state them plainly:

- “A late fee of 3 percent applies to unpaid balances after the due date.”

- “A 25 dollar fee applies to overdue invoices.”

Early Payment Discounts

Encourage fast payment with positive wording:

- “A 5 percent discount applies to payments made within 7 days.”

- “Save 20 dollars when payment is received before the due date.”

Invoice Wording Examples for Different Businesses

Service-Based Businesses

“Service provided on March 1 which includes software setup and configuration. Payment is due within 15 days. Thank you for your business.”

Freelancers and Consultants

“Freelance writing services provided for three blog articles delivered on February 20. Please submit payment within 10 days.”

Product-Based Businesses

“Delivery of 50 units of custom printed packaging including materials and production. Payment due on receipt.”

Construction and Trade Services

“Labor and materials for plumbing repair completed on March 5. Charges include inspection, parts, and installation. Payment due within 30 days.”

Creative Industries

“Graphic design services for brand package. Includes logo design and final file delivery. Payment is due upon receipt.”

Polite and Effective Payment Reminder Wording

Friendly reminders help maintain positive relationships while keeping payments on track. Examples include:

- “This is a friendly reminder that invoice 1245 is now due. Please let us know if you have any questions.”

- “We hope you are well. Our records show invoice 878 is unpaid. Please submit payment at your earliest convenience.”

Professional reminders maintain goodwill while encouraging timely action.

Common Invoice Wording Mistakes to Avoid

Avoid the following issues to prevent delays and misunderstandings:

- Using unclear or vague descriptions

- Leaving out payment terms

- Using emotional or unprofessional language

- Creating long, confusing sentences

- Forgetting taxes, totals, or important details

- Simple, direct wording keeps everything clear.

Why Professionals Rely on ReliaBills for Invoicing

Professionals choose ReliaBills because it makes invoicing easier, clearer, and more reliable. The platform provides customizable templates that help users create invoices with clean and consistent invoice wording, clear line items, and professional formatting. This helps businesses communicate charges accurately and present a polished, trustworthy brand image.

ReliaBills also boosts cash flow through automation. Users can send recurring invoices, automatic reminders, and apply late fees without manual follow-up. With built-in online payment options, clients can pay instantly through credit card or ACH, which reduces delays and improves overall payment speed. These features help businesses stay organized, save time, and get paid faster.

In addition, ReliaBills supports secure payment processing and works across many industries. Whether you run a service business, freelance practice, construction company, or creative studio, the platform provides a complete invoicing system that helps you maintain clarity, professionalism, and strong customer relationships.

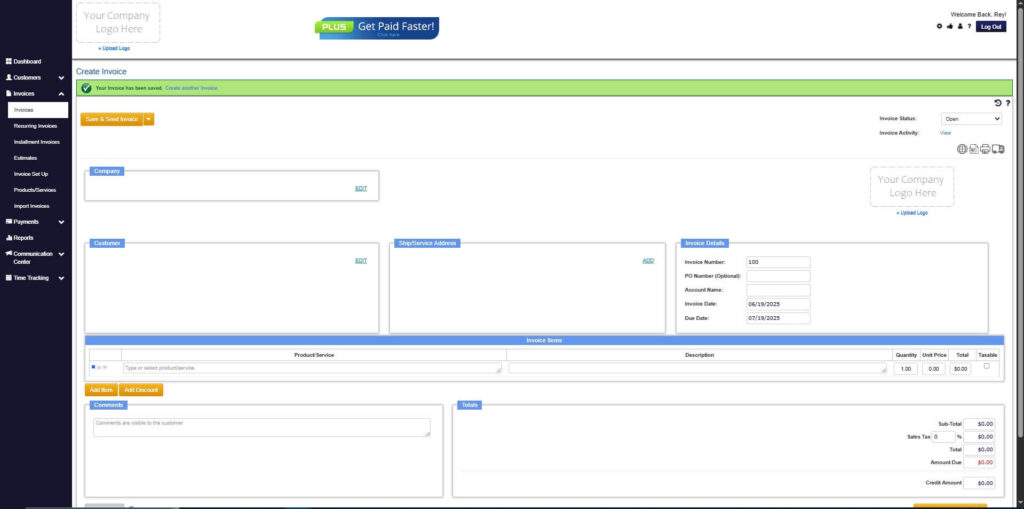

How to Create a New Invoice Using ReliaBills

Creating an invoice using ReliaBills involves the following steps:

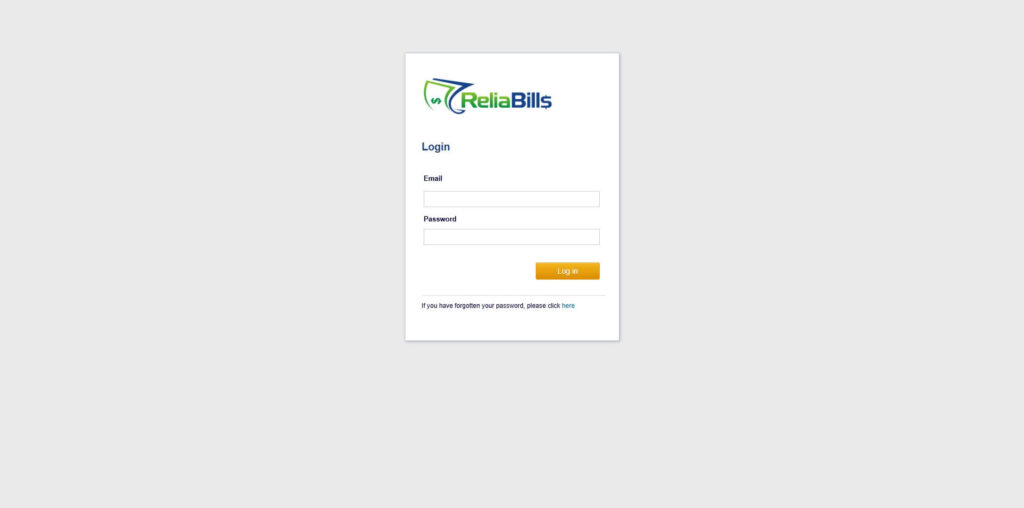

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

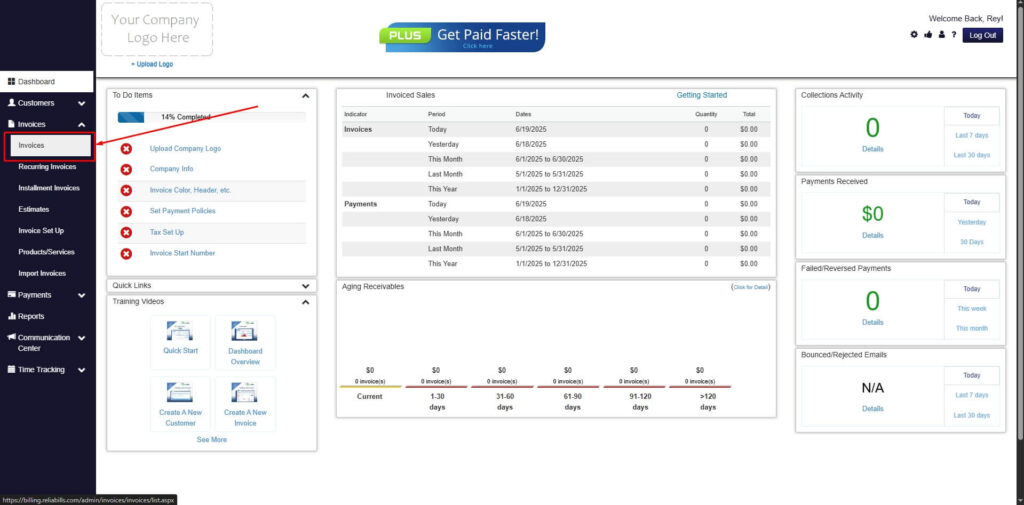

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

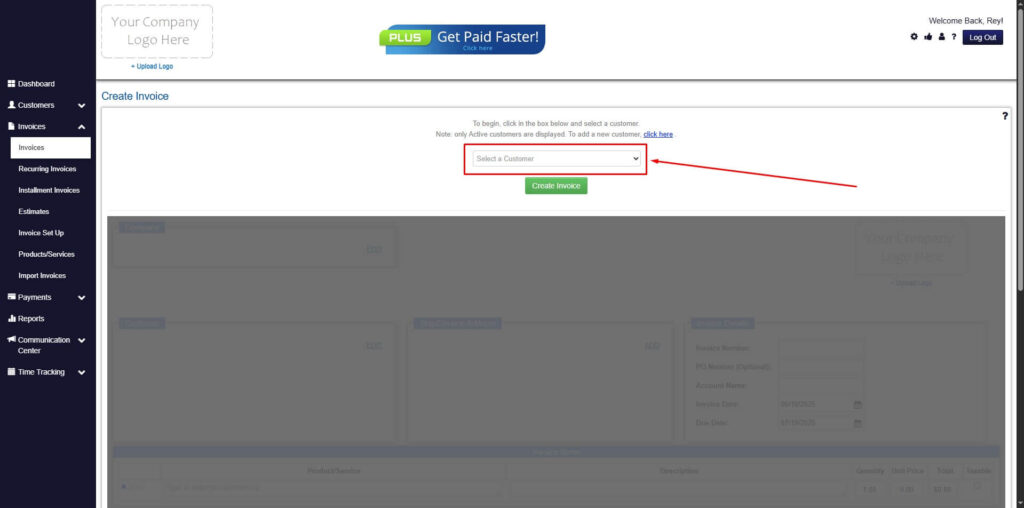

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

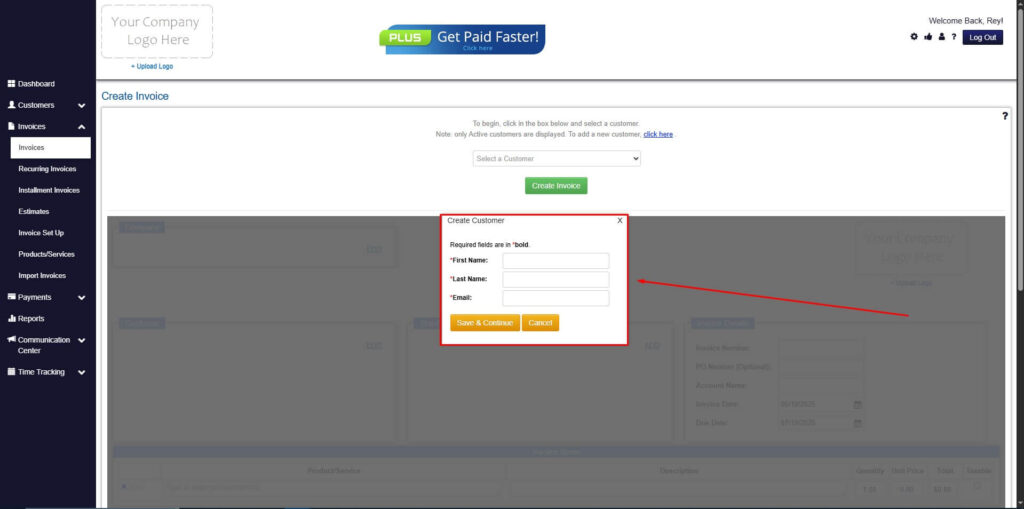

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

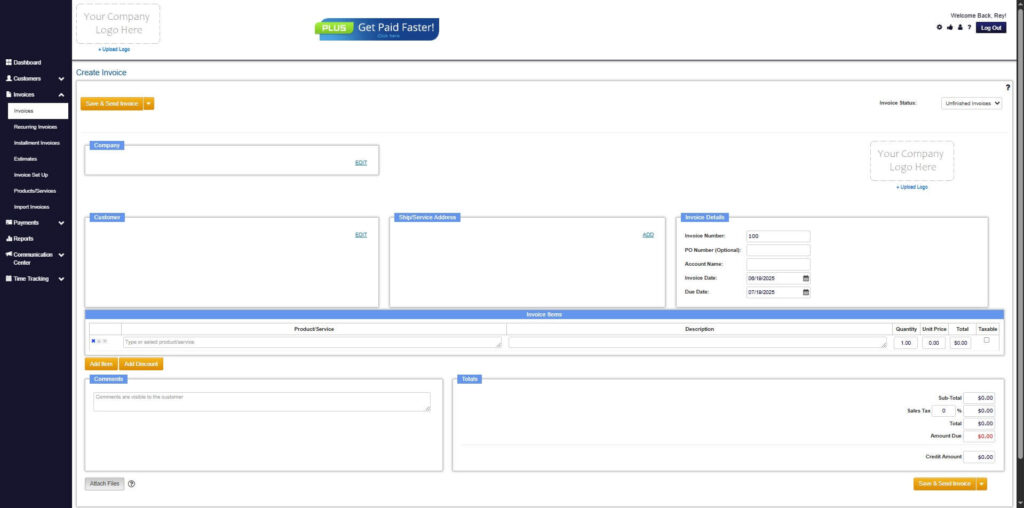

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

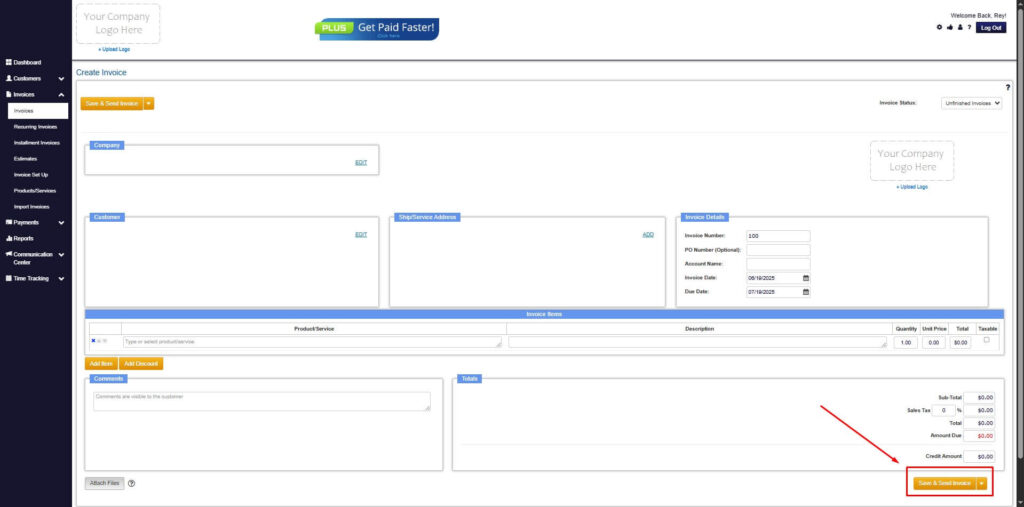

Step 7: Save Invoice

- After filling out the form, click “Save & Send Invoice” to continue.

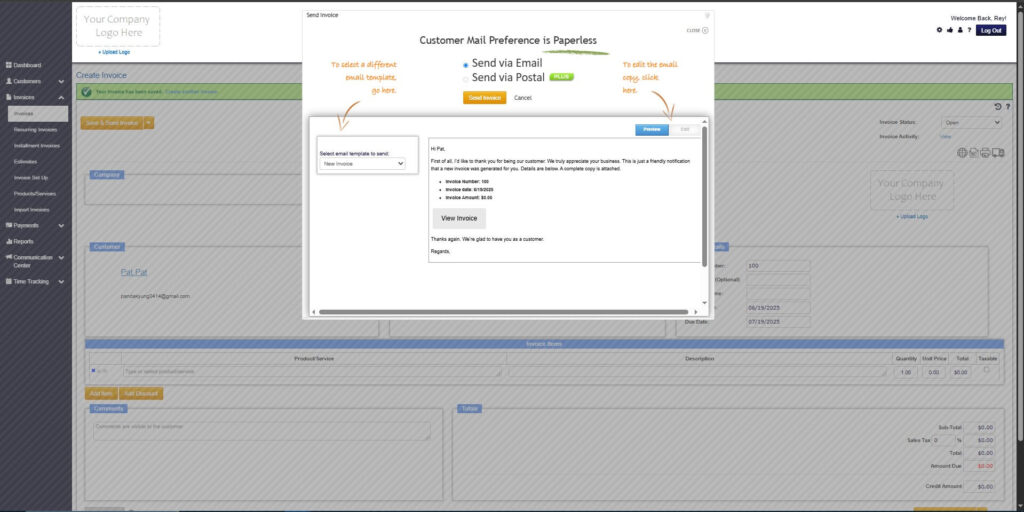

Step 8: Invoice Created

- Your Invoice has been created.

Frequently Asked Questions

1. Why is invoice wording important?

Clear wording helps clients understand charges, expectations, and payment instructions, which leads to faster payments.

2. Can invoice wording affect cash flow?

Yes. Well written invoices reduce disputes and delays, which improves cash flow.

3. Should invoice wording be customized for each client?

You can adjust wording if needed, especially for long term clients or large projects.

4. Do all businesses need consistent invoice wording?

Yes. Every business benefits from clear, professional invoice communication.

Conclusion

Strong invoice wording plays a major role in creating smooth, professional client interactions. By using clear descriptions, well-structured line items, and direct payment terms, you make it easier for clients to understand what they owe and when payment is due. With tools like ReliaBills, you can create invoices that are organized, accurate, and ready to be paid quickly. Clear communication leads to better relationships and a healthier cash flow for your business.