Late payments and unpaid invoices are common challenges for many businesses, especially those that rely on invoicing to maintain steady cash flow. Even reliable clients can experience financial trouble, leaving businesses exposed to unexpected losses. Over time, these risks can disrupt operations and limit growth opportunities.

Invoice insurance exists to protect businesses from the financial impact of nonpayment. Instead of absorbing losses from unpaid invoices, businesses can transfer part of that risk to an insurer. This added layer of protection provides stability in uncertain payment environments.

As invoicing volumes grow and payment terms extend, invoice insurance becomes a practical tool rather than a luxury. It supports healthier cash flow while allowing businesses to confidently offer credit to customers. For companies focused on long-term stability, invoice insurance plays an important role in risk management.

Table of Contents

ToggleWhat Is Invoice Insurance?

Invoice insurance is a financial product designed to protect businesses against losses caused by unpaid customer invoices. It covers situations where customers fail to pay due to insolvency, extended delays, or other covered risks. Instead of writing off bad debt, businesses can recover a portion of the invoice value.

The process typically involves insuring eligible invoices under a policy with defined coverage limits. If a customer defaults on payment, the business files a claim with supporting documentation. Once approved, the insurer compensates the insured amount according to the policy terms.

Invoice insurance is commonly used by B2B companies, service providers, and businesses offering credit terms. It is especially valuable for companies issuing large invoices or working with new or international customers. By reducing exposure to nonpayment, businesses can operate with greater confidence.

How Invoice Insurance Works

Invoice insurance policies define which customers, invoices, and risks are covered. Coverage often includes nonpayment due to insolvency, prolonged default, or unexpected financial collapse. Businesses must meet eligibility requirements and follow policy guidelines to maintain coverage.

When an insured invoice remains unpaid beyond the agreed period, the business initiates the claims process. This typically involves submitting the original invoice, payment history, and evidence of collection attempts. Clear documentation helps ensure a smoother and faster claims review.

Once the claim is approved, the insurer pays out the insured portion of the invoice value. This allows the business to recover funds without prolonged uncertainty. Over time, this process stabilizes cash flow and reduces the financial impact of customer defaults.

Key Benefits of Invoice Insurance

One of the primary benefits of invoice insurance is protection against bad debt. Instead of absorbing losses from unpaid invoices, businesses receive financial compensation. This protection helps maintain profitability even when customers fail to pay.

Invoice insurance also improves cash flow stability by reducing financial uncertainty. Knowing that invoices are insured allows businesses to plan expenses and investments more confidently. Predictable cash flow supports smoother operations and long-term planning.

Additionally, invoice insurance enables businesses to extend credit more safely. Companies can pursue new customers or larger contracts without excessive fear of nonpayment. This confidence supports growth, expansion, and stronger client relationships.

Invoice Insurance vs Other Credit Protection Options

Invoice insurance is often compared to factoring, but the two serve different purposes. Factoring provides immediate cash by selling invoices, while invoice insurance focuses on protecting against nonpayment risk. Businesses using invoice insurance retain control over collections and customer relationships.

Compared to trade credit insurance, invoice insurance can be more flexible and targeted. Some policies allow businesses to insure specific customers or invoices rather than entire portfolios. This approach suits companies with selective risk exposure.

Credit checks and internal reserves offer some protection but lack financial recovery. While these methods help assess risk, they do not replace lost revenue. Invoice insurance provides direct financial compensation when payment failures occur.

When Should a Business Consider Invoice Insurance?

Businesses with large invoice amounts or extended payment terms are prime candidates for invoice insurance. A single unpaid invoice can significantly impact cash flow in these situations. Insurance helps reduce the financial risk tied to delayed payments.

Companies working with new, international, or higher-risk customers also benefit from coverage. Cross-border transactions and unfamiliar credit environments increase uncertainty. Invoice insurance offers reassurance when expanding into new markets.

High-volume B2B and recurring invoicing environments also gain value from invoice insurance. As invoice volumes grow, so does exposure to payment risk. Insurance provides consistency and protection across recurring billing cycles.

How Invoice Insurance Impacts Cash Flow and Risk Management

Invoice insurance supports predictable revenue planning by minimizing unexpected losses. Businesses can forecast income more accurately when insured invoices reduce downside risk. This reliability improves budgeting and financial control.

By lowering exposure to unpaid invoices, companies experience reduced financial stress. Resources can be allocated toward growth rather than damage control. Risk management becomes proactive instead of reactive.

Over time, invoice insurance strengthens overall financial resilience. Businesses gain confidence in their billing processes and customer relationships. This stability supports sustainable growth and long-term success.

Limitations and Considerations

Invoice insurance policies include exclusions and coverage limits that businesses must understand. Not all customers or invoices may qualify for coverage. Reviewing policy terms carefully helps avoid surprises during claims.

Premium costs are another important consideration. While invoice insurance adds an expense, it often offsets potential losses from bad debt. Evaluating cost versus risk exposure is key when selecting coverage.

Administrative requirements also apply, such as maintaining accurate records and timely reporting. Insurers may require regular updates on customer payment behavior. Businesses should ensure their invoicing processes support compliance.

Best Practices for Using Invoice Insurance Effectively

Choosing the right policy begins with assessing customer risk and invoice volume. Coverage levels should align with actual exposure rather than assumptions. A tailored approach ensures better protection and cost efficiency.

Accurate invoice records are essential for claims and compliance. Clear documentation supports faster claim resolution and reduces disputes. Organized invoicing processes strengthen insurance effectiveness.

Ongoing monitoring of customer credit risk also improves outcomes. Payment behavior can change over time, and policies should adapt accordingly. Regular reviews help maintain adequate protection.

Common Misconceptions About Invoice Insurance

A common misconception is that invoice insurance guarantees payment in all cases. In reality, coverage depends on policy terms and eligibility. Understanding limitations helps set realistic expectations.

Some believe invoice insurance is only for large enterprises. In practice, small and mid-sized businesses benefit just as much from payment protection. Flexible policies make coverage accessible to growing companies.

Others assume claims are difficult to file. With proper documentation and organized invoicing, claims can be straightforward. Efficient billing systems significantly reduce friction in the process.

How ReliaBills Supports Insured Invoicing

ReliaBills helps businesses maintain accurate and organized invoicing records that support invoice insurance requirements. Centralized invoice tracking makes it easier to reference original invoices, payment history, and supporting documentation. This clarity strengthens audit trails and simplifies claims preparation.

Recurring billing plays a key role in insured invoicing, especially for subscription and service-based businesses. ReliaBills automates recurring invoices, payment reminders, and customer communication. This consistency reduces errors, improves collection efforts, and aligns with insurer documentation standards.

For businesses needing advanced controls, ReliaBills PLUS, the paid pricing tier, provides enhanced automation and reporting features. These tools help manage higher invoice volumes and complex billing scenarios. With ReliaBills PLUS, insured invoicing becomes easier to track, verify, and scale.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

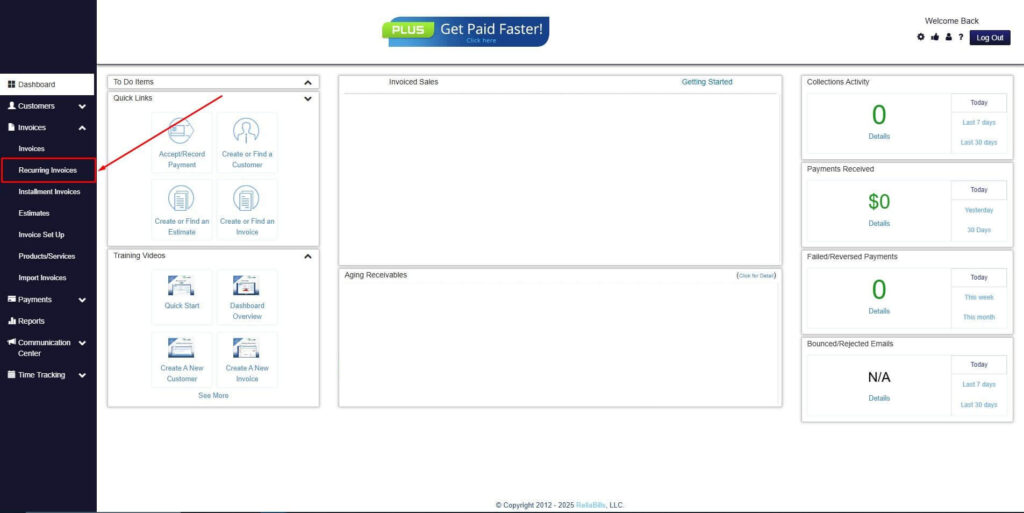

Step 2: Click on Recurring Invoices

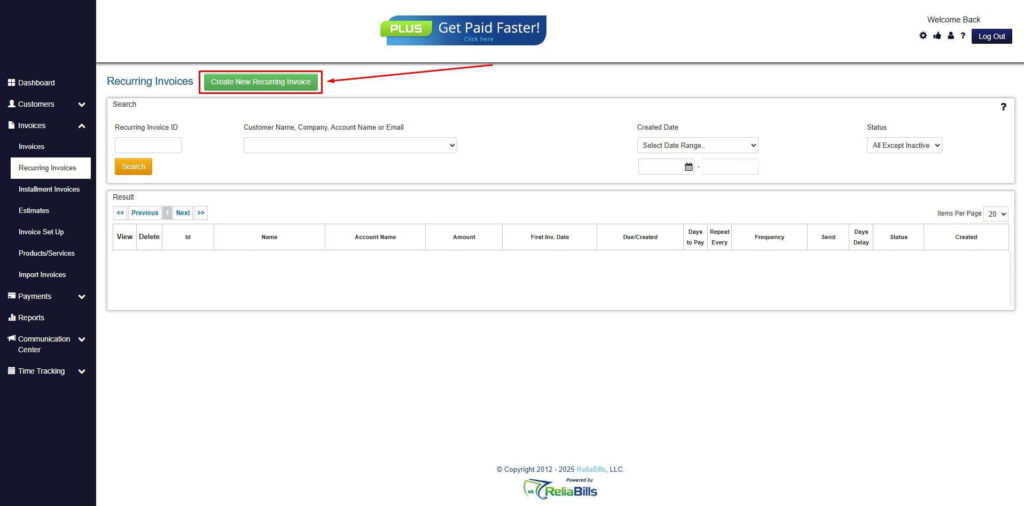

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

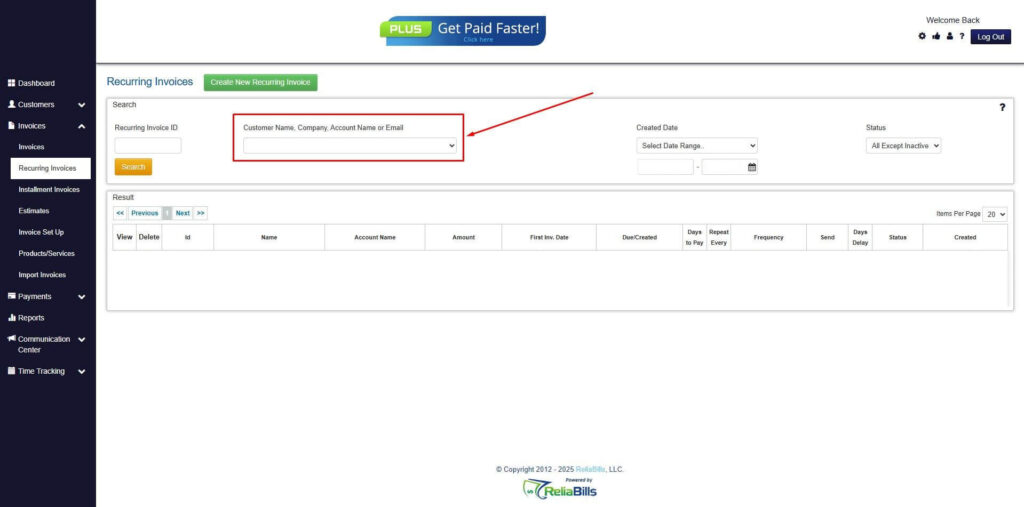

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

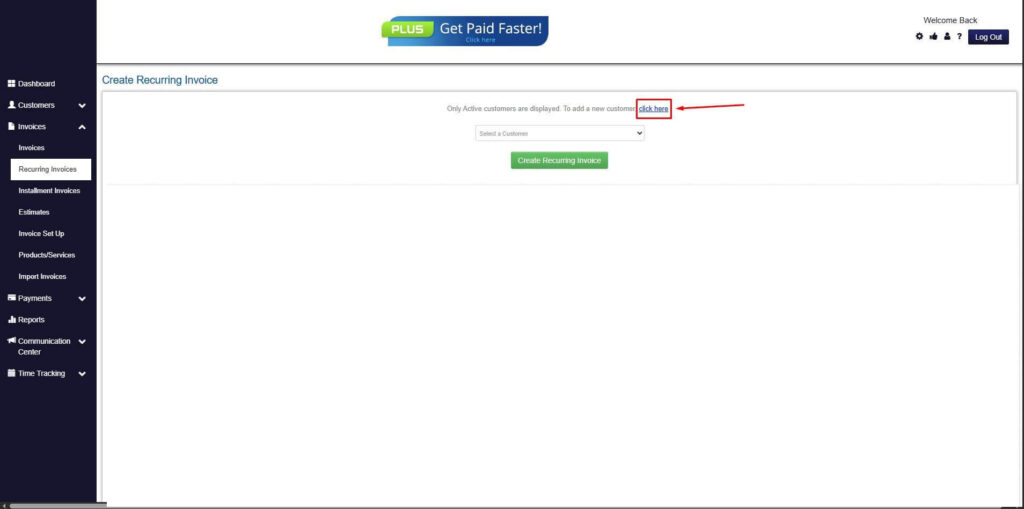

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

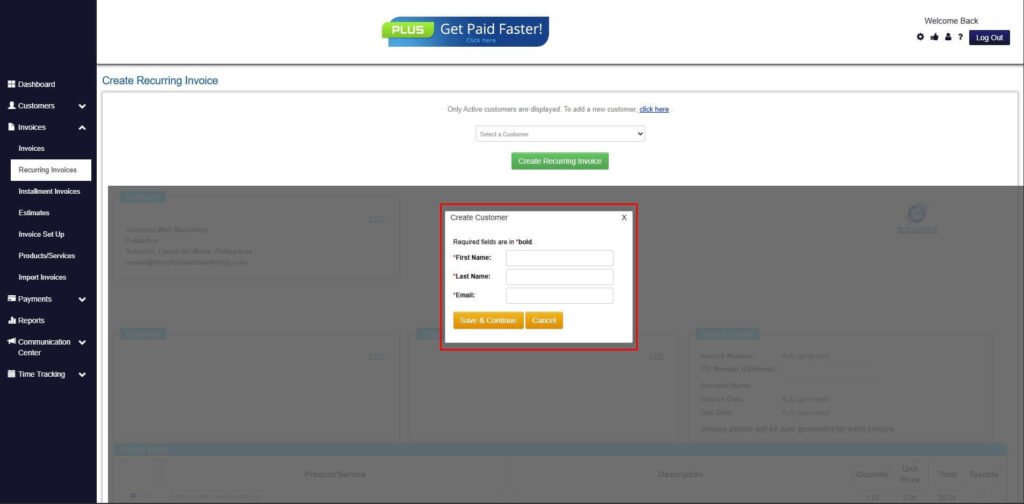

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

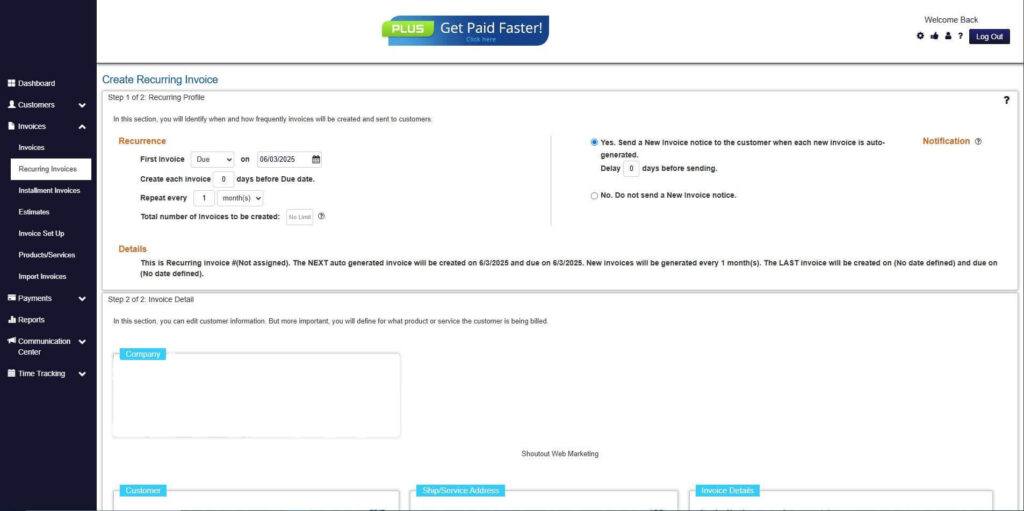

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

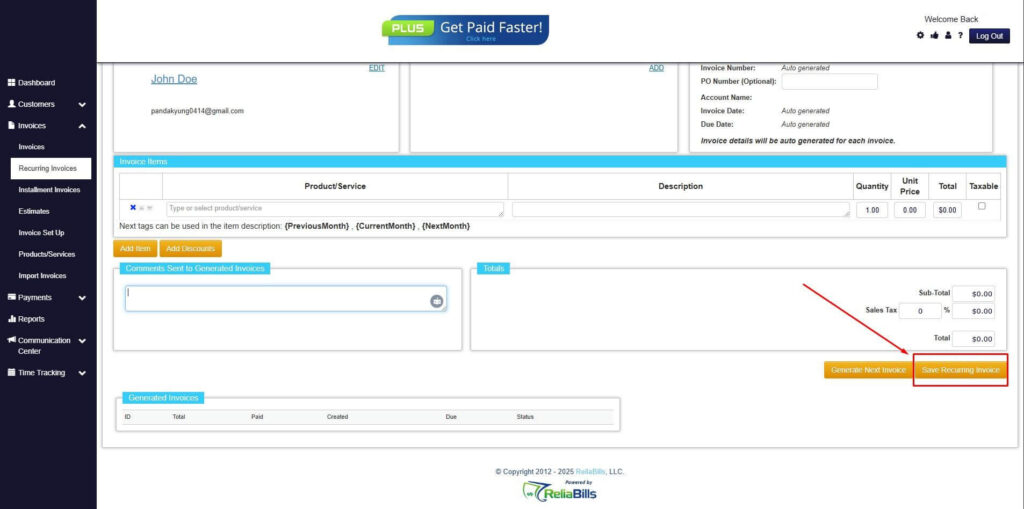

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

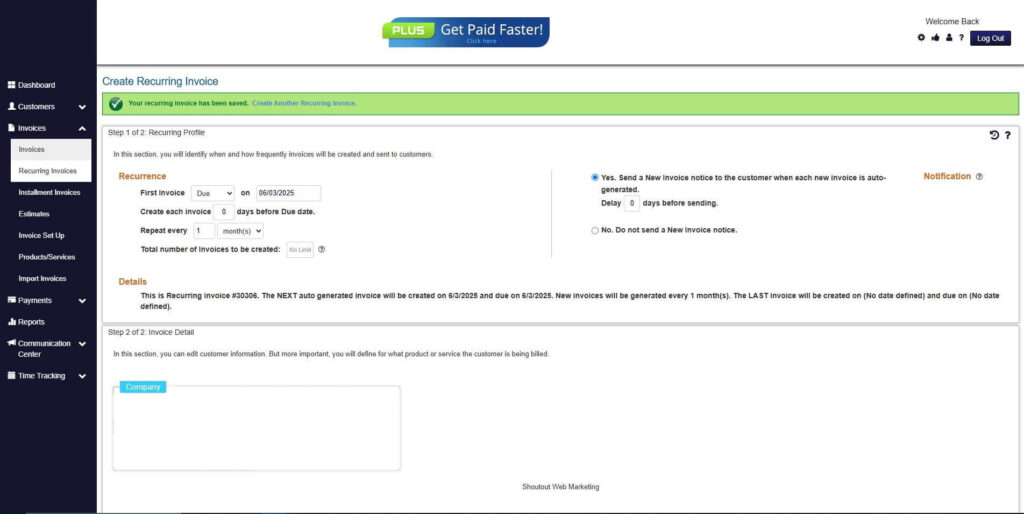

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is invoice insurance the same as trade credit insurance?

Invoice insurance focuses on protecting unpaid invoices, while trade credit insurance often covers broader customer credit risk.

2. Does invoice insurance cover partial payments?

Coverage depends on policy terms, but many insurers account for partial payments when calculating claims.

3. How long does it take to receive a payout?

Claim timelines vary by insurer, but clear documentation helps speed up the process.

4. Can insured invoices be automated?

Yes, automated invoicing systems support insured workflows by improving accuracy and record-keeping.

Conclusion

Invoice insurance provides valuable protection against unpaid invoices and financial uncertainty. By transferring payment risk, businesses gain greater control over cash flow and planning. This protection is especially important in credit-based invoicing environments.

When used effectively, invoice insurance supports confident growth and stronger client relationships. Combined with organized invoicing practices, it reduces financial stress and improves stability.

For businesses looking to safeguard revenue, invoice insurance is a practical solution. Paired with modern invoicing tools, it helps maintain consistent cash flow and long-term financial health.