Many businesses rely on early payments to secure project costs, purchase materials, or reserve time in their schedule. This is where a down payment invoice becomes essential. It allows companies to request a portion of the total cost upfront, ensuring both sides are committed before the work begins.

Using a clear and well-structured invoice for down payment helps avoid misunderstandings and supports better financial planning. Whether you run a service business, handle custom orders, or manage large projects, requesting an initial payment through a professional invoice keeps everything transparent from day one.

Table of Contents

ToggleWhat Is a Down Payment Invoice?

A down payment invoice is a document businesses send to request a percentage of the total project cost before starting work. It is similar to a deposit request, but it is more formal and includes detailed billing information. Unlike a standard invoice, this one doesn’t cover the entire amount. Instead, it reflects only the portion a client must pay upfront.

This type of invoice is often issued after a proposal is accepted but before resources are allocated. It keeps both the business and client aligned on expectations and financial obligations.

When Do Businesses Use a Down Payment Invoice?

Down payment invoices are common in industries where costs are incurred before the project starts. Businesses use them for project-based work, custom manufacturing, construction, event planning, consulting services, and large service agreements.

They are also helpful when materials need to be purchased early or when reserving time on a busy schedule. The invoice serves as proof that a client is committed and ready to move forward.

Why Down Payment Invoices Matter

A down payment invoice supports healthy cash flow by providing funds before costs start piling up. It also encourages client commitment, since people are more likely to follow through once they’ve made a partial payment.

These invoices also make project scheduling easier. When a client pays upfront, businesses can confidently block off time, order materials, and prepare resources. This reduces financial risk and protects the business from cancellations or last-minute changes.

How a Down Payment Invoice Works (Step-by-Step)

Here’s how the process typically works:

- Agreement is reached. The business and client finalize terms, pricing, and project details.

- Down payment invoice is issued. The document lists the percentage or amount needed upfront.

- Client submits payment. Funds are received before any major work begins.

- Project starts. Once the down payment clears, the business begins the work or orders materials.

- Final invoice is issued. The down payment is applied as a credit toward the remaining balance.

This simple process helps both parties stay organized and financially secure.

Examples of Down Payment Invoices

A typical invoice for down payment includes:

- Business name and contact details

- Client information

- Project or order description

- Total estimated amount

- Down payment percentage or flat amount

- Amount due now

- Payment methods

- Notes or terms

For example:

Total Project Cost: $5,000

Down Payment (30%): $1,500

Balance Due Later: $3,500

This format keeps everything clear and easy to understand.

Common Mistakes to Avoid

Businesses often run into issues when requesting down payments. Avoid these mistakes:

- Not stating whether the down payment is refundable

- Leaving out the total project cost

- Failing to list terms or deadlines

- Using vague descriptions

- Forgetting to credit the down payment on the final invoice

Clear communication helps prevent misunderstandings and makes billing smoother for everyone.

How ReliaBills Can Help With Down Payment Invoicing

ReliaBills makes it easy for businesses to create a polished and professional invoice for down payment. You can customize the invoice to show the total project cost, the required upfront amount, and the remaining balance. This keeps everything clear for your clients and helps you avoid misunderstandings about how payments are applied.

One of the major advantages of ReliaBills is its built-in ability to track partial payments and automatically apply them to the final invoice. This removes the need for manual updating and reduces billing errors. If your project requires multiple follow-up payments after the initial down payment, ReliaBills also supports recurring billing, allowing you to schedule ongoing charges at set intervals. This is extremely helpful for longer projects, maintenance plans, or staged payment agreements.

For contractors, service providers, and project-based businesses, ReliaBills streamlines every step of the billing process. From requesting deposits to managing recurring billing and issuing the final invoice, the platform helps you stay organized and get paid on time without extra effort.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

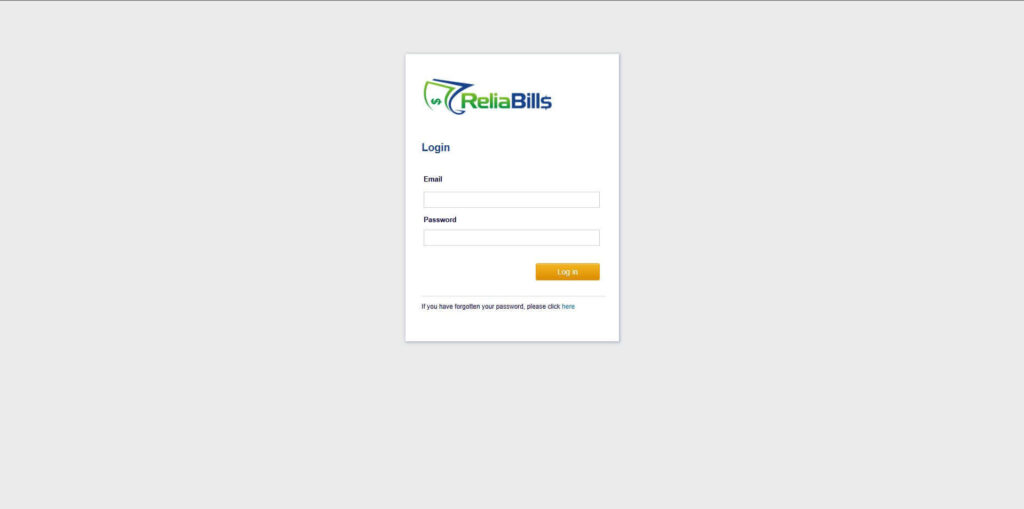

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

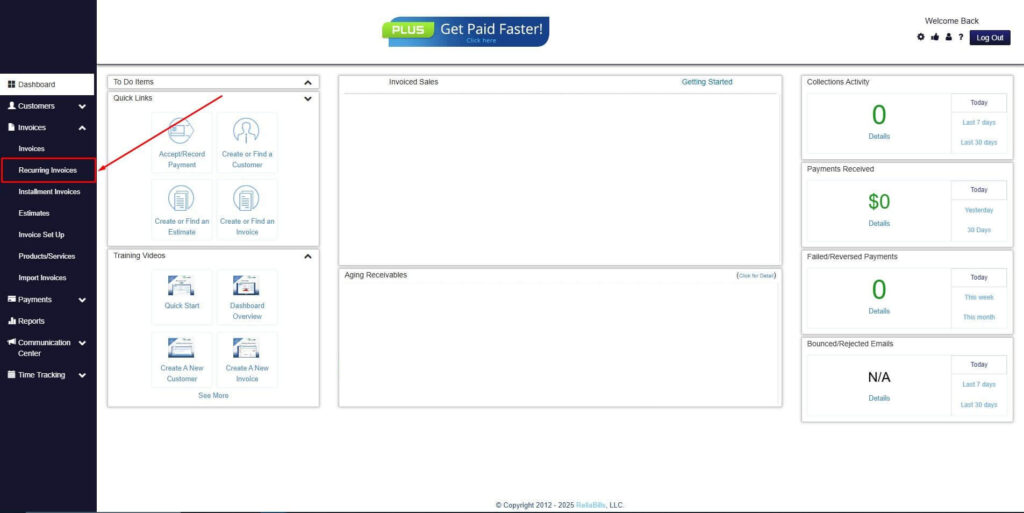

Step 2: Click on Recurring Invoices

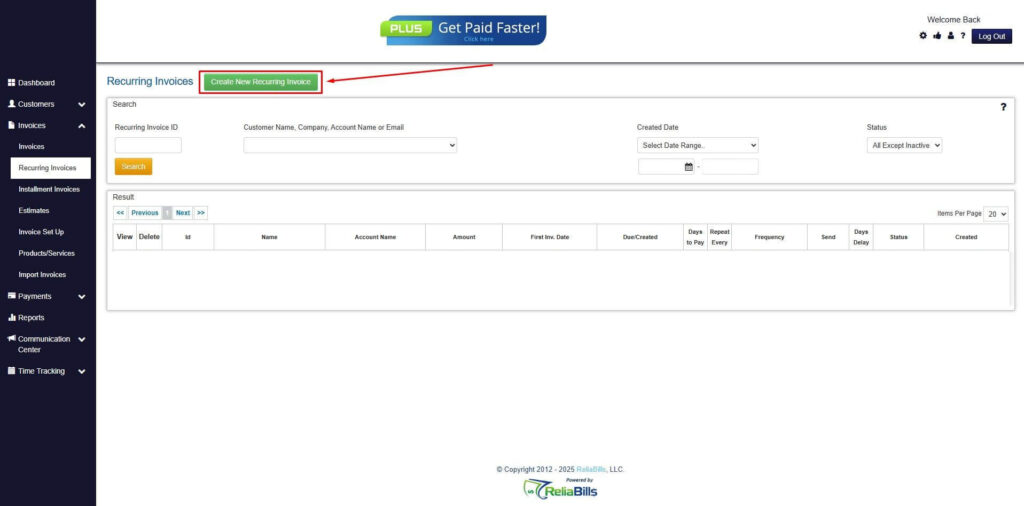

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

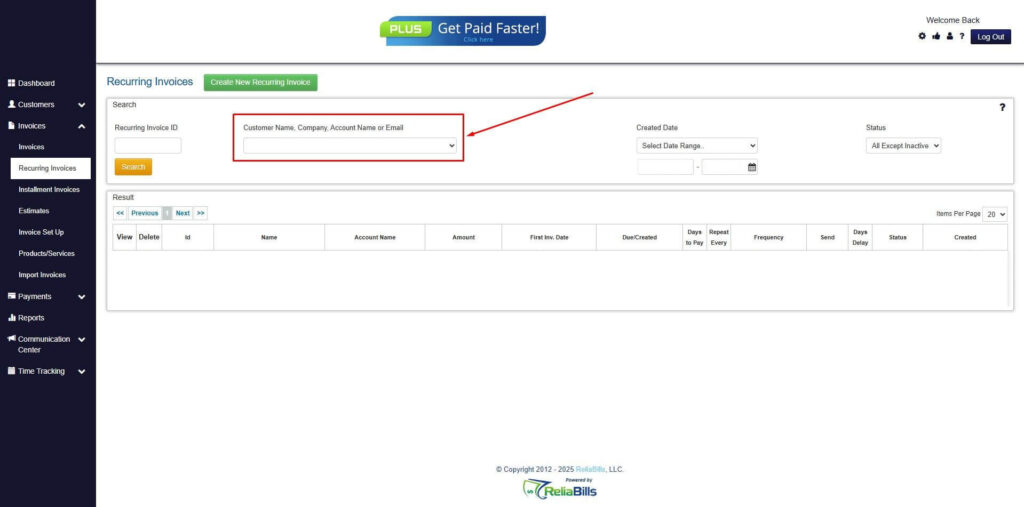

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

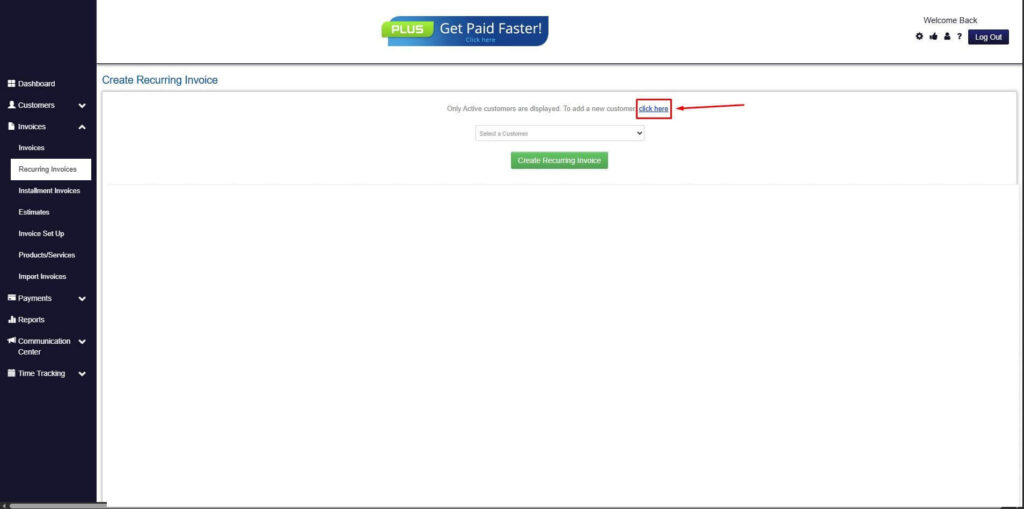

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

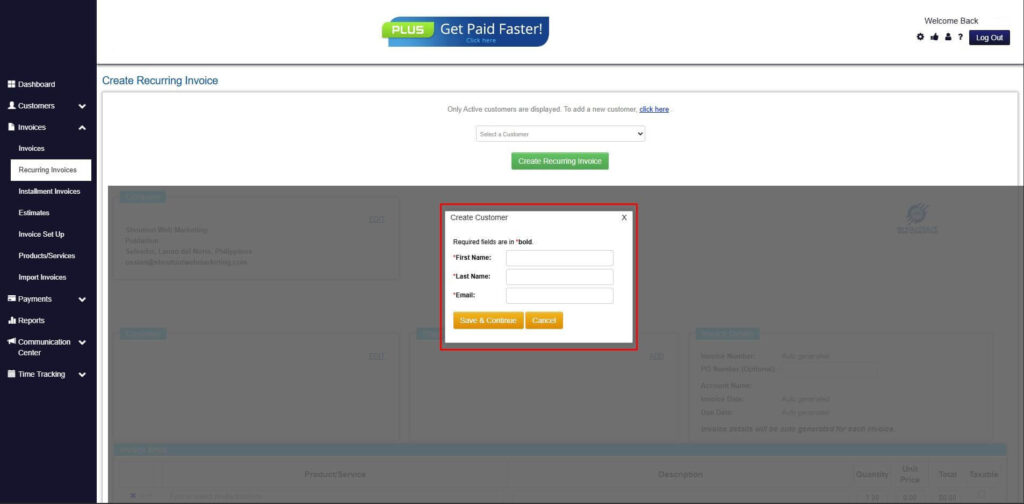

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

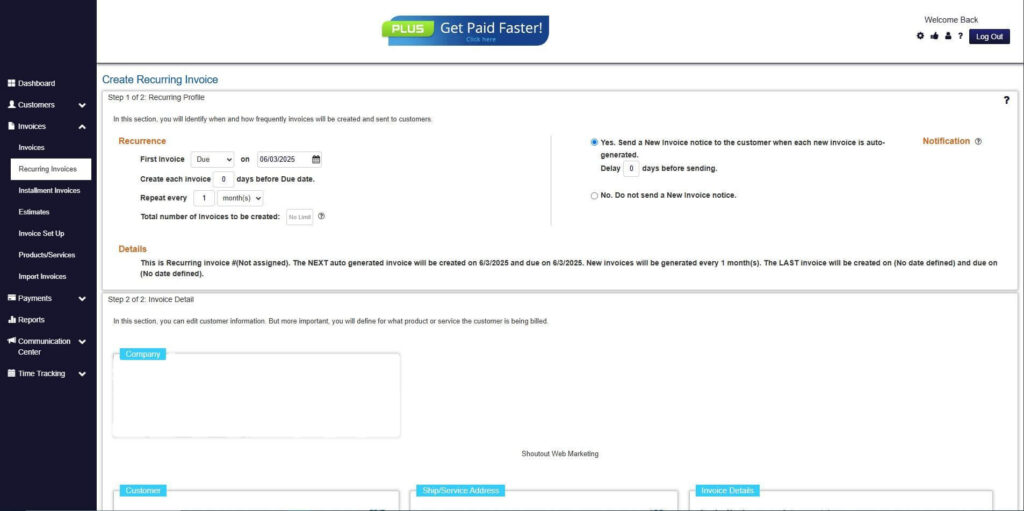

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

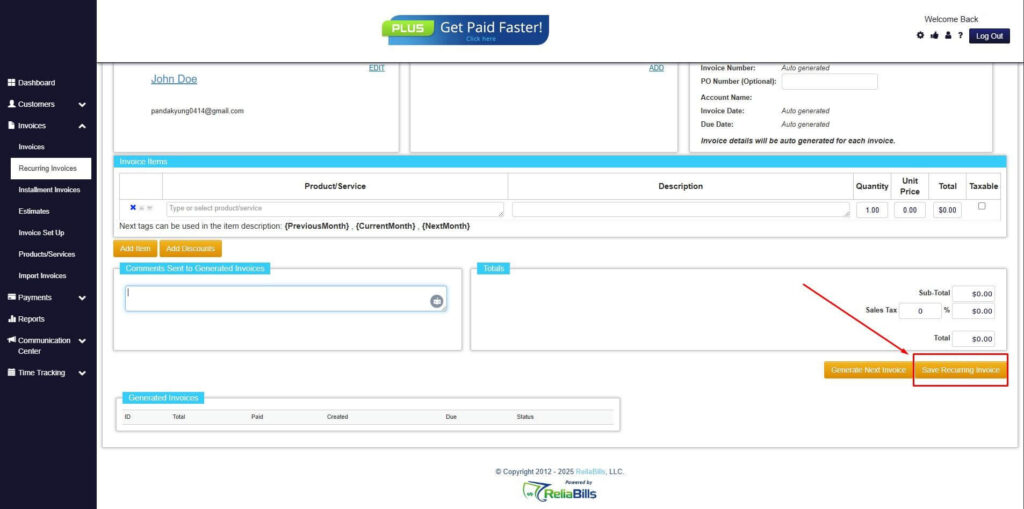

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

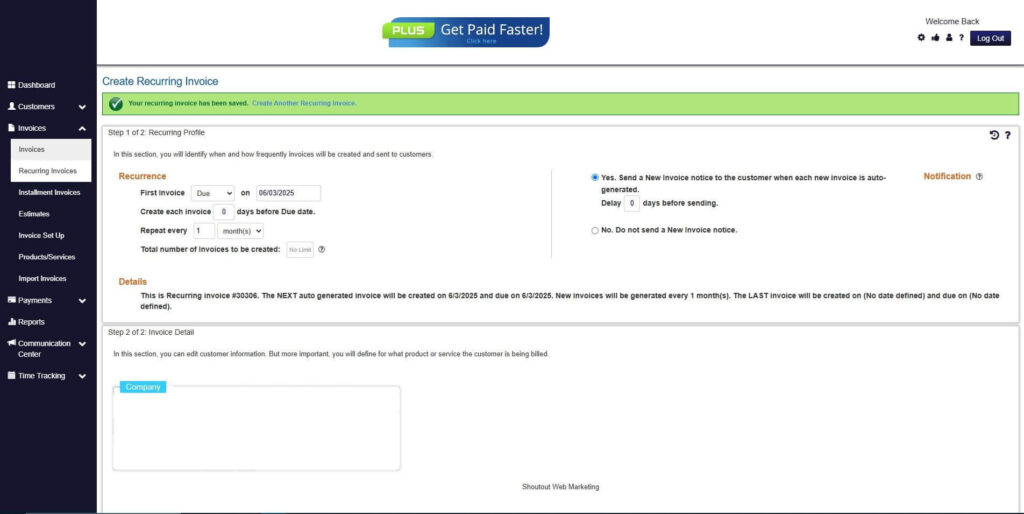

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is a down payment invoice legally required?

Not always, but it provides clear documentation and protects both the business and the client.

2. How much should a business request as a down payment?

Common ranges are 20 to 50 percent, depending on project size and industry.

3. Are down payments refundable?

It depends on your policy. Make refunds or non-refund rules clear on the invoice.

4. Can down payments be applied to the final bill?

Yes. The amount paid upfront should be credited toward the remaining balance.

5. Can I automate down payment invoices?

Yes, platforms like ReliaBills allow you to automate invoicing, reminders, and partial payment tracking.

Conclusion

Down payment invoices help businesses secure commitment, protect their time, and manage cash flow before starting work. A clear and professional invoice sets expectations from the beginning and helps avoid payment issues later.

With tools like ReliaBills, businesses can streamline the entire process, from requesting upfront payments to tracking balances and issuing final invoices. This ensures smoother communication, better organization, and faster payments.