Invoice accrual plays an important role in modern business accounting, especially for companies that want accurate and timely financial reporting. As businesses grow, relying only on cash-based tracking often creates gaps between when costs occur and when they are recorded. Accrual accounting helps close those gaps by recognizing expenses and revenue when they are earned or incurred.

Invoice accrual is especially useful for businesses that manage ongoing services, subscriptions, or delayed invoicing cycles. It allows finance teams to reflect true business performance even when invoices have not yet been issued or received. This approach supports better decision-making and clearer financial insights.

Understanding invoice accrual is essential for business owners, finance professionals, and operations teams alike. When used correctly, it improves reporting accuracy and helps businesses stay compliant with accounting standards.

Table of Contents

ToggleWhat Is Invoice Accrual?

Invoice accrual refers to recording an expense or revenue in the accounting system before the actual invoice is received or sent. This ensures that financial statements reflect activity from the correct accounting period. It is a core principle of accrual accounting.

In practice, invoice accrual works by estimating the cost or revenue and recording it as an accrued entry. Once the actual invoice is issued or received, the accrual is reversed and replaced with the real transaction. This keeps records accurate without double counting.

Unlike cash-based accounting, invoice accrual focuses on timing rather than payment. It recognizes financial activity when it happens, not when money changes hands, which leads to more reliable reporting.

Why Businesses Use Invoice Accrual

One of the main reasons businesses use invoice accrual is to match expenses and revenue accurately. This matching principle ensures costs are recorded in the same period as the revenue they support. It provides a clearer picture of profitability.

Invoice accrual also improves financial visibility throughout the month. Businesses can monitor performance without waiting for invoices to arrive, which helps leadership make informed decisions sooner.

Additionally, invoice accrual supports compliance with accounting standards such as GAAP and IFRS. Many businesses are required to use accrual methods once they reach a certain size or complexity.

How Invoice Accrual Works

Invoice accrual begins when a service is performed or a cost is incurred, even if no invoice exists yet. At that point, the business records an estimated accrual in its accounting system. This ensures the transaction is reflected in the correct period.

Accruals can apply to both expenses and revenue. For example, a business may accrue monthly software fees or recognize earned revenue before billing the client. These entries are temporary placeholders.

Once the invoice is received or issued, the accrual is reversed and replaced with the actual invoice entry. This process keeps financial records clean and accurate.

Invoice Accrual vs Accounts Payable

Invoice accrual and accounts payable are closely related but not the same. Accruals represent estimated amounts recorded before an invoice exists, while accounts payable represent confirmed obligations backed by invoices. Understanding the difference is essential for proper reporting.

An accrued invoice becomes an accounts payable entry once the actual invoice is received. At that point, the estimate is removed and replaced with the real payable amount. This transition ensures financial statements remain accurate.

Both accruals and payables affect balance sheets and income statements differently. Proper tracking prevents misstatements and duplicate entries.

Common Examples of Invoice Accrual

Utilities And Rent

Monthly utilities and rent are often accrued when the service period ends before the bill arrives. This ensures expenses reflect actual usage for the reporting period. It is especially common during month-end close.

Professional Services

Legal, consulting, or accounting services are frequently completed before invoices are issued. Businesses accrue these costs to avoid understating expenses. This is common for hourly or project-based engagements.

Subscription And Recurring Services

Software licenses, maintenance plans, and recurring service agreements are often accrued monthly. Even when billed quarterly or annually, accruals keep expenses consistent. This supports accurate budgeting and forecasting.

Project-based Work

Long-term projects may require accruals as milestones are completed. Costs are recorded as work progresses rather than waiting for final invoices. This provides better visibility into project profitability.

How to Record Invoice Accruals

The invoice accrual process starts with identifying expenses or revenue that belong to the current period. Finance teams estimate the amount based on contracts, usage, or historical data. This estimate is then recorded as an accrual entry.

A typical journal entry records the expense or revenue and an offsetting accrued liability or asset. These entries are clearly labeled to ensure they are tracked properly. Documentation is essential for accuracy.

Once the invoice is issued or received, the accrual entry is reversed. The actual invoice is then recorded, ensuring the books reflect real transaction values.

Best Practices for Managing Invoice Accruals

Use consistent accrual schedules

Applying accruals at the same time each period improves accuracy and reliability. Consistency makes financial reporting easier to review and audit. It also reduces confusion across teams.

Maintain proper documentation and approvals

Accrual estimates should be supported by contracts, usage data, or historical invoices. Clear documentation strengthens internal controls. Approval workflows help prevent errors.

Reconcile accruals regularly

Monthly reviews ensure accruals are reversed correctly when invoices arrive. This prevents duplicate entries and misstated expenses. Regular reconciliation keeps records clean.

Improve communication between teams

Finance, operations, and billing teams should stay aligned. Clear communication ensures accruals reflect real business activity. This reduces last-minute adjustments.

Common Mistakes to Avoid

Over-accruing or under-accruing expenses

Poor estimates can distort financial results. Over-accruing inflates expenses, while under-accruing hides true costs. Using historical data helps improve accuracy.

Forgetting to reverse accrual entries

Failure to reverse accruals leads to double counting once invoices are recorded. This is one of the most common accrual errors. Clear tracking prevents this issue.

Inconsistent accrual timing

Applying accruals irregularly creates confusion and unreliable reporting. Standardized timing supports better comparisons between periods. Consistency is key.

Poor documentation and tracking

Missing records make accruals difficult to validate. This increases audit risk and internal confusion. Organized systems reduce manual errors.

How Invoice Accrual Affects Cash Flow and Reporting

Invoice accrual does not change actual cash movement, but it improves reporting accuracy. Accruals ensure profit and loss statements reflect real business activity. This helps leadership understand performance more clearly.

Accrual accounting separates cash flow from profitability. A business may show strong profits even if cash has not yet been received. Understanding this difference is critical for planning.

Invoice accrual also plays a key role in monthly and year-end close processes. It ensures reports are complete and compliant before finalization.

How ReliaBills Supports Accurate Invoice Accrual

ReliaBills helps businesses maintain accurate and organized invoicing records that make accrual accounting more reliable and less time consuming. By centralizing all invoices, payment statuses, and customer interactions, the platform creates a single source of truth for financial data. This centralized view makes it easier to identify outstanding invoices that should be reflected as accruals in financial reports, reducing the risk of missing or inaccurate entries.

Recurring billing is a core strength of ReliaBills that supports accrual accuracy, especially for subscription-based and service-driven businesses. With automated recurring invoices, businesses can predict revenue timing and recognize it in the appropriate reporting periods, aligning billing cycles with accounting needs. Automated payment reminders and real-time tracking further help reduce delays and ensure that revenue is collected and recorded correctly.

ReliaBills PLUS, the advanced pricing tier, adds enhanced reporting and deeper analytics that further streamline accrual practices. With detailed receivables visibility and customizable dashboards, businesses can spot trends in billing and outstanding income that should be accrued. These tools help finance teams reduce manual work, improve audit readiness, and maintain accurate financial statements as the business scales.

How to Create a New Invoice Using ReliaBills

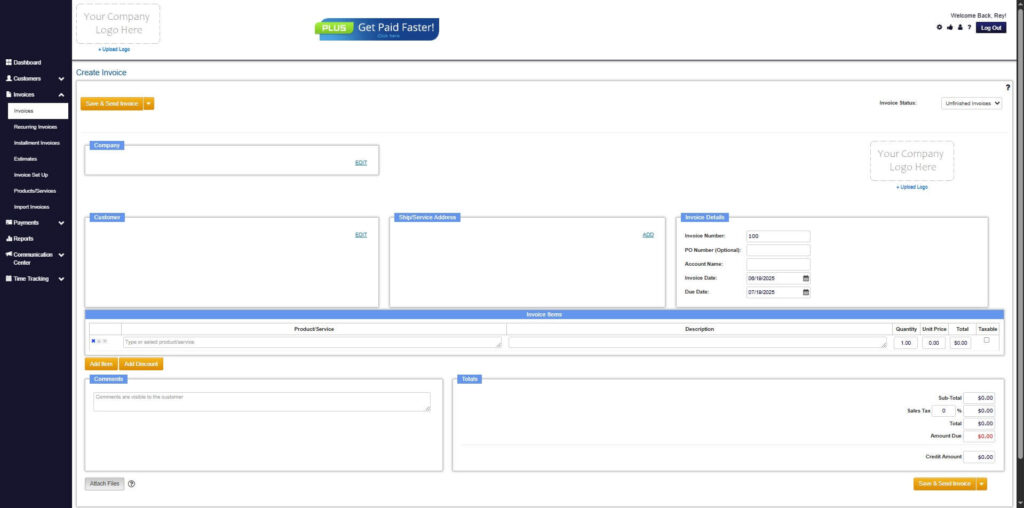

Creating an invoice using ReliaBills involves the following steps:

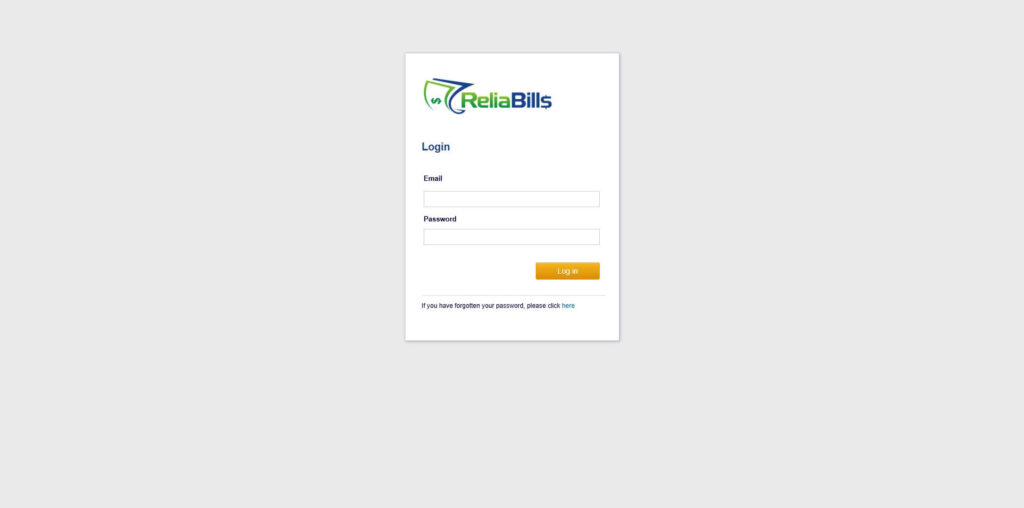

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

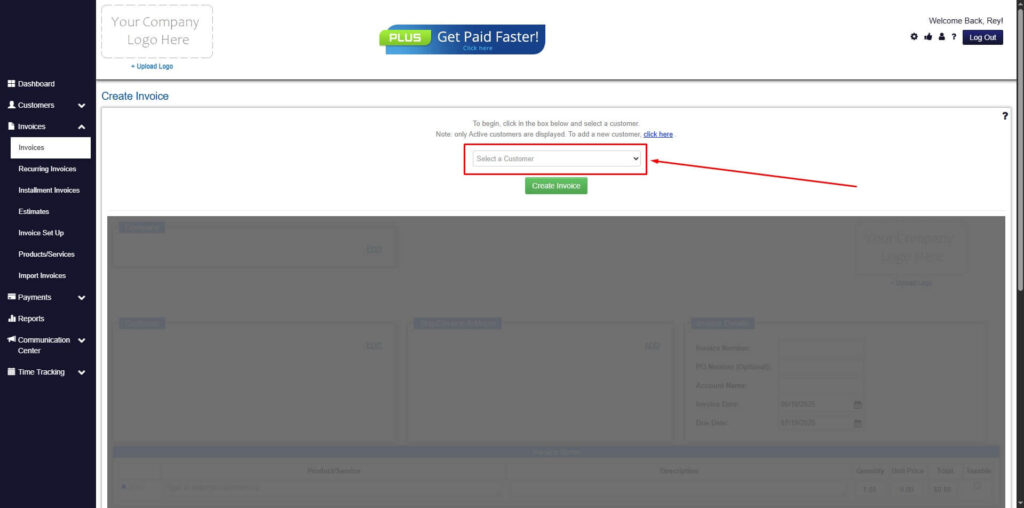

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

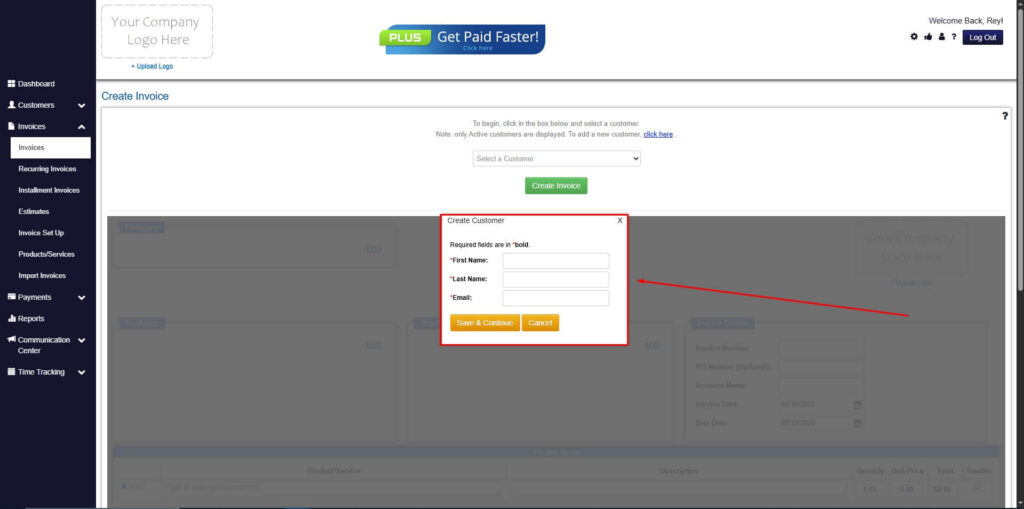

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

Step 7: Save Invoice

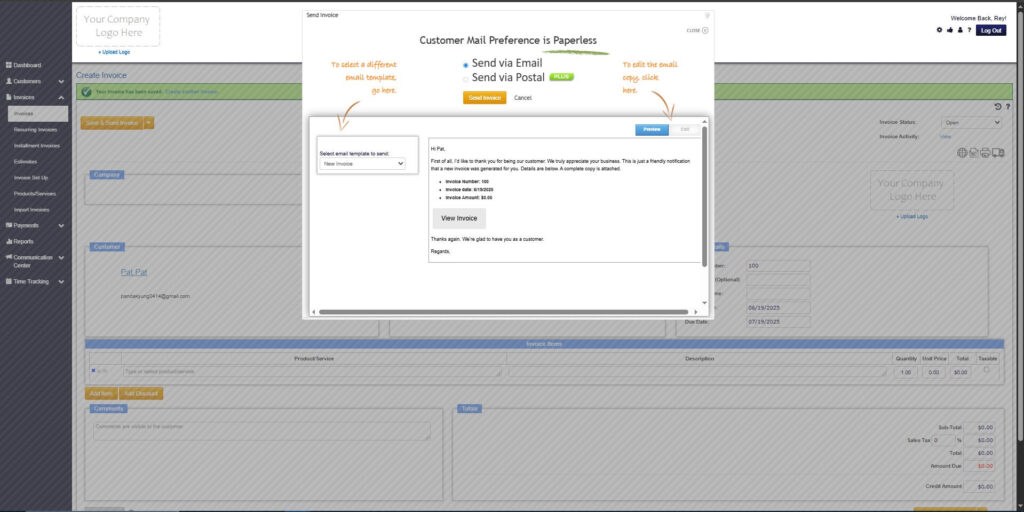

- After filling out the form, click “Save & Send Invoice” to continue.

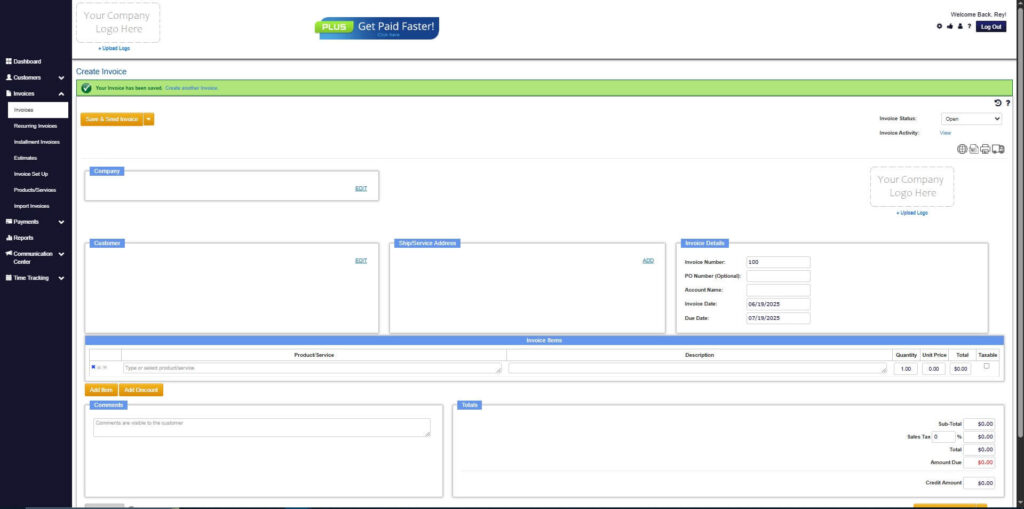

Step 8: Invoice Created

- Your Invoice has been created.

Frequently Asked Questions

1. When should an invoice be accrued?

Invoices should be accrued when the expense or revenue belongs to the current period but the invoice has not yet been issued or received.

2. Is invoice accrual mandatory for all businesses?

Not all businesses are required to use accrual accounting, but many must adopt it as they grow or for compliance reasons.

3. How often should accruals be reviewed?

Accruals should be reviewed monthly and during period-end closings to ensure accuracy.

4. Can invoice accrual be automated?

Yes, billing and accounting systems can automate accrual tracking, especially for recurring services.

Conclusion

Invoice accrual is a critical accounting practice that improves financial accuracy and transparency. It ensures expenses and revenue are recorded in the correct period, even when invoices are delayed.

By understanding how invoice accrual works and applying best practices, businesses can improve reporting and decision-making. Avoiding common mistakes helps maintain clean and reliable records.

With the right systems in place, invoice accrual becomes easier to manage. Combining structured processes with tools like ReliaBills supports long-term financial clarity and growth.