An interim invoice is a billing document used to request partial payment before a project is fully completed. It is especially useful for long term or high value projects where waiting until the end to invoice is not practical. Many businesses rely on interim invoices to maintain steady cash flow throughout a project.

Interim invoicing is commonly used in industries where work is delivered over time rather than all at once. Construction, consulting, creative services, and professional projects often benefit from this approach. It allows both parties to track progress and payments more clearly.

Using an interim invoice supports better project management and financial planning. Businesses receive payments earlier, while clients avoid large lump sum bills at the end. This creates a more balanced and transparent billing relationship.

Table of Contents

ToggleWhat Is an Interim Invoice?

An interim invoice is issued for work completed up to a specific point in a project. It reflects partial progress rather than the final outcome. The purpose is to bill incrementally while the project is still ongoing.

Unlike final invoices, interim invoices do not close out the full project balance. They also differ from milestone invoices, which are tied to specific deliverables, and progress invoices, which may follow different measurement methods. Interim invoices focus on billed amounts to date.

Many industries use interim invoicing as part of their standard billing process. Construction firms, consultants, engineers, and service providers rely on interim invoices for ongoing engagements. This method supports transparency and predictable payments.

When Should You Use an Interim Invoice?

Interim invoices are ideal for long term or ongoing projects that span weeks or months. Billing in stages helps avoid financial strain caused by delayed payments. It also aligns payments with actual work completed.

They are also useful when projects are delivered in phases or partial segments. Each interim invoice reflects progress made during a specific period. This keeps clients informed and engaged throughout the project.

High value projects often require interim invoicing to manage risk. Client agreements that allow staged billing make this approach easier to implement. Clear contract terms are essential before issuing interim invoices.

Key Elements of an Interim Invoice

Every interim invoice should include complete business and client information. This ensures proper identification and smooth processing. Consistency across invoices is important.

Referencing the original contract or agreement is critical. This connects the interim invoice to approved billing terms. It also helps prevent disputes later.

The invoice should clearly show the work completed to date, the amount billed so far, and previous payments received. Including the remaining balance improves transparency. Accurate details build client trust.

How to Make an Interim Invoice Step by Step

Step 1: Review the contract or billing agreement

Start by checking the original contract to confirm that interim invoicing is allowed and agreed upon. Review billing intervals, percentages, or payment schedules outlined in the agreement. This ensures your interim invoice aligns with what the client expects and prevents disputes later.

Step 2: Track completed work or project progress

Document the work completed up to the billing point, whether it is based on time, deliverables, or project progress. Accurate tracking is essential to justify the interim amount being billed. Clear records also make it easier to answer client questions if they arise.

Step 3: Calculate the interim amount accurately

Determine the portion of the total project cost that should be billed at this stage. Apply agreed rates, percentages, or milestones carefully to avoid overbilling or underbilling. Always double-check calculations before moving forward.

Step 4: Clearly label the invoice as an interim invoice

Make sure the invoice is clearly marked as an interim invoice to avoid confusion with final or milestone invoices. Include references to previous invoices and show the remaining balance. This helps clients understand where the project stands financially.

Step 5: Add payment terms and due dates

Include clear payment terms, accepted payment methods, and the due date on the invoice. Transparent terms reduce delays and improve payment turnaround. Consistency here supports smoother cash flow.

Step 6: Send the invoice and record it properly

Send the interim invoice promptly through your preferred billing method, whether digital or manual. Record the invoice in your accounting system to keep financial records accurate. Proper tracking ensures the final invoice reflects all interim payments correctly.

Best Practices for Interim Invoicing

Clearly defining billing stages upfront is one of the most important practices. Clients should understand when and why interim invoices will be issued. This avoids surprises.

Maintaining detailed progress documentation supports transparency. Clients are more comfortable paying when progress is clearly documented. Good records also protect your business.

Consistency is key when issuing interim invoices. Billing on a predictable schedule improves cash flow. Reliable invoicing builds professional credibility.

Interim Invoice vs Milestone Invoice vs Final Invoice

Interim invoices focus on partial payment during ongoing work. Milestone invoices are issued when specific deliverables are completed. Final invoices close out the full project balance.

Choosing the right invoice type depends on how the project is structured. Some projects use a combination of interim and milestone invoices. Clear planning ensures smooth billing.

Each invoice type impacts cash flow differently. Interim invoices provide steady income, while final invoices often involve larger payments. Understanding these differences helps manage expectations.

Common Mistakes to Avoid

Failing to reference previous invoices is a common issue. Each interim invoice should clearly connect to prior billing. This maintains continuity.

Overbilling or underbilling can damage trust. Accurate calculations are essential. Clients expect fairness and clarity.

Unclear descriptions of progress often lead to questions or disputes. Inconsistent labeling also causes confusion. Attention to detail prevents these problems.

How ReliaBills Simplifies Interim Invoicing

ReliaBills is built to make billing easier for businesses that need flexible invoicing options, including interim invoices. Instead of manually compiling partial billing data and creating a separate document each time, you can quickly generate clear interim invoices that reflect the work completed to date. This eliminates much of the repetitive work that slows down billing and helps ensure your cash flow stays consistent.

The platform supports both recurring and staged billing workflows, so interim invoices can be issued alongside regular project invoices without extra effort. Once you set up your billing schedule and payment terms, ReliaBills can automatically prepare and send invoices based on progress or predefined intervals. With automated reminders and an intuitive dashboard showing issued and outstanding invoices, staying on top of partial payments becomes much easier and less stressful.

ReliaBills PLUS adds even more functionality for businesses that require advanced control and reporting. With this paid tier, you get enhanced customization and deeper visibility into interim invoice performance, including consolidated payment histories and improved reconciliation tools. The combination of automated interim billing, real-time tracking, and recurring billing support makes ReliaBills a powerful solution for businesses managing long-term or phased projects.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

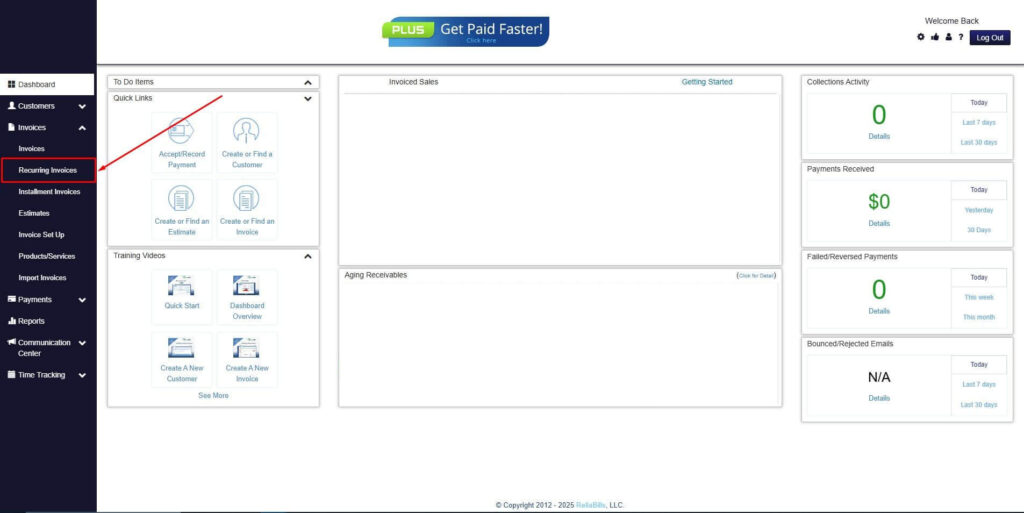

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

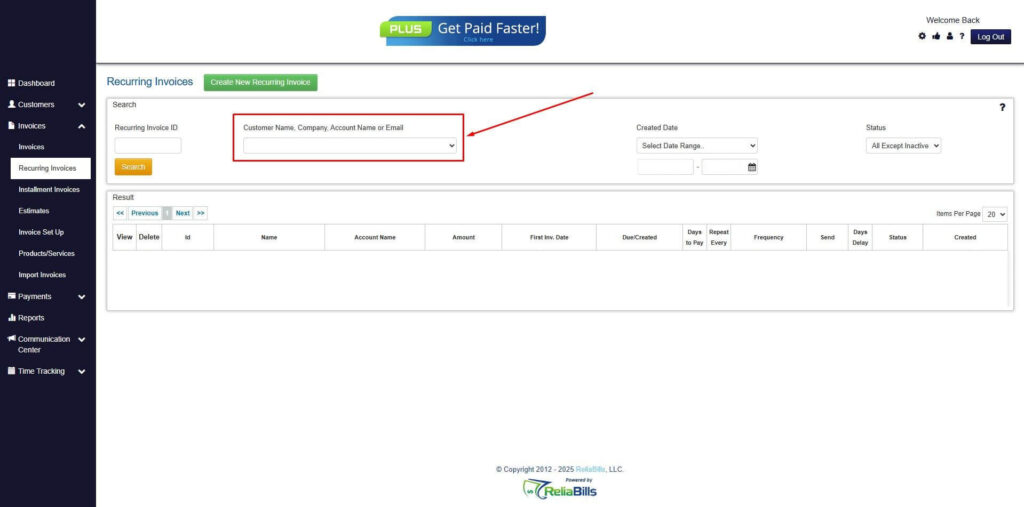

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

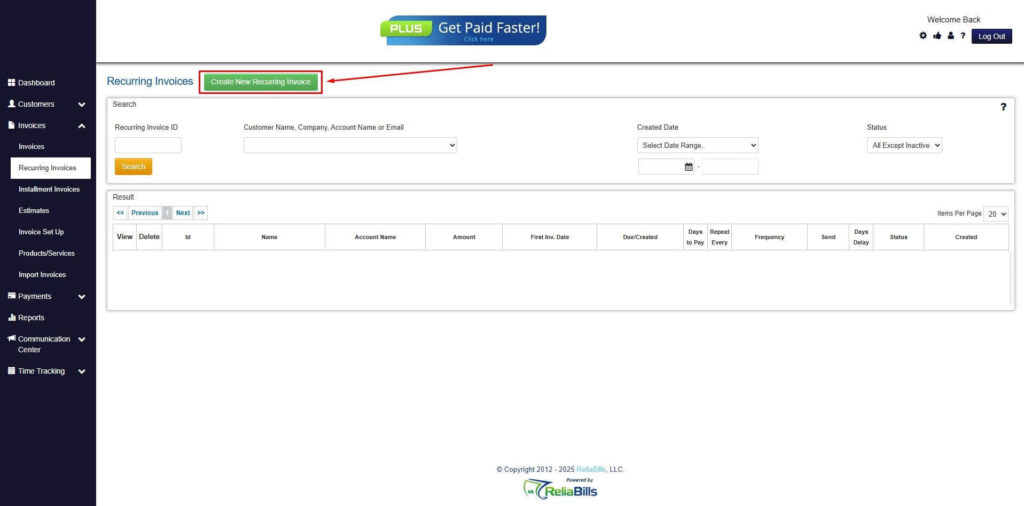

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

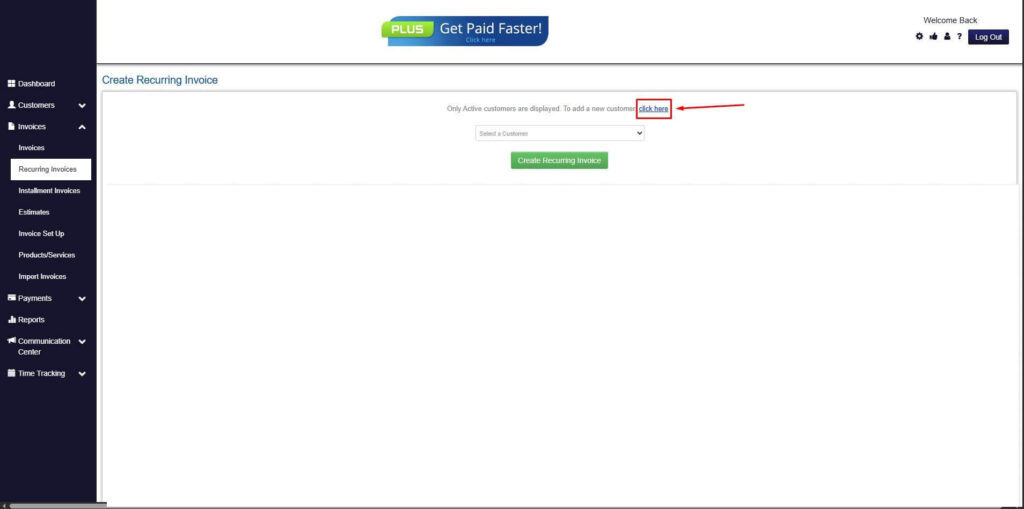

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

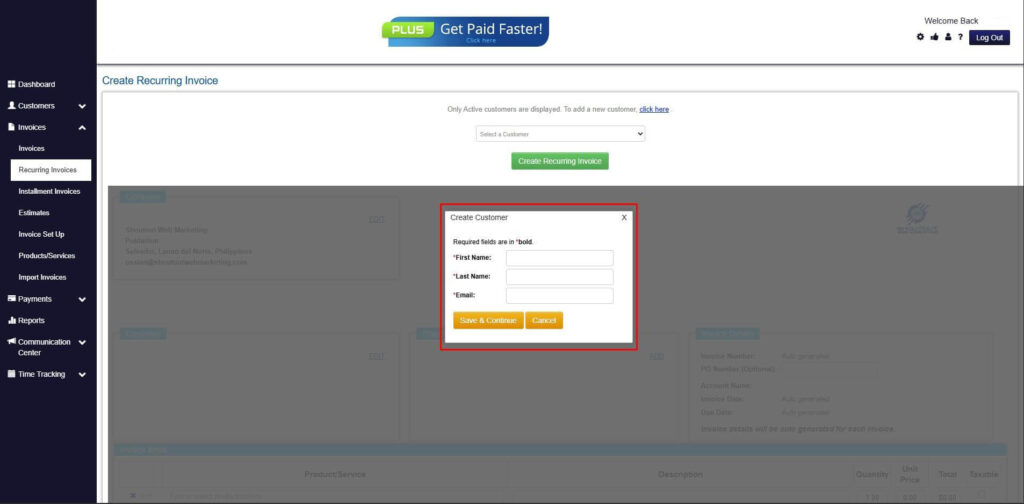

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

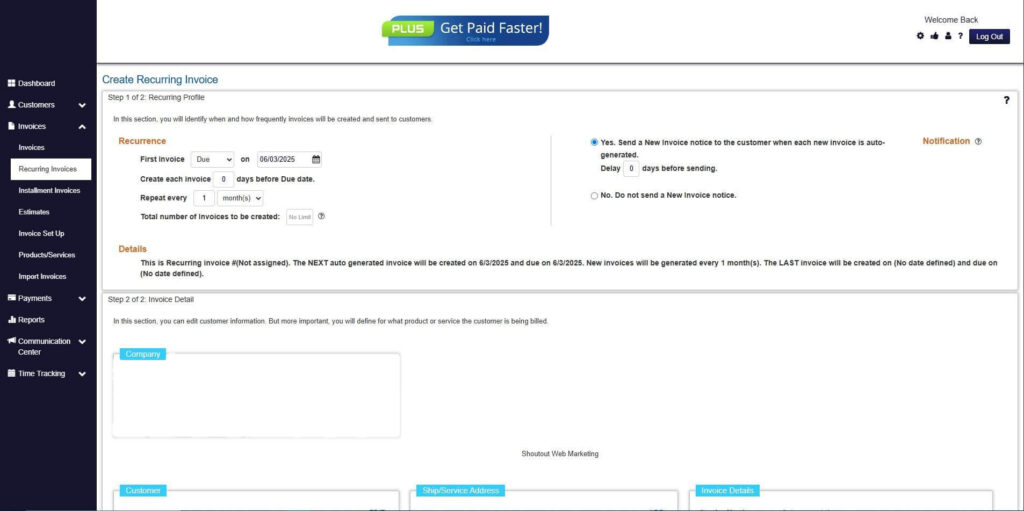

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

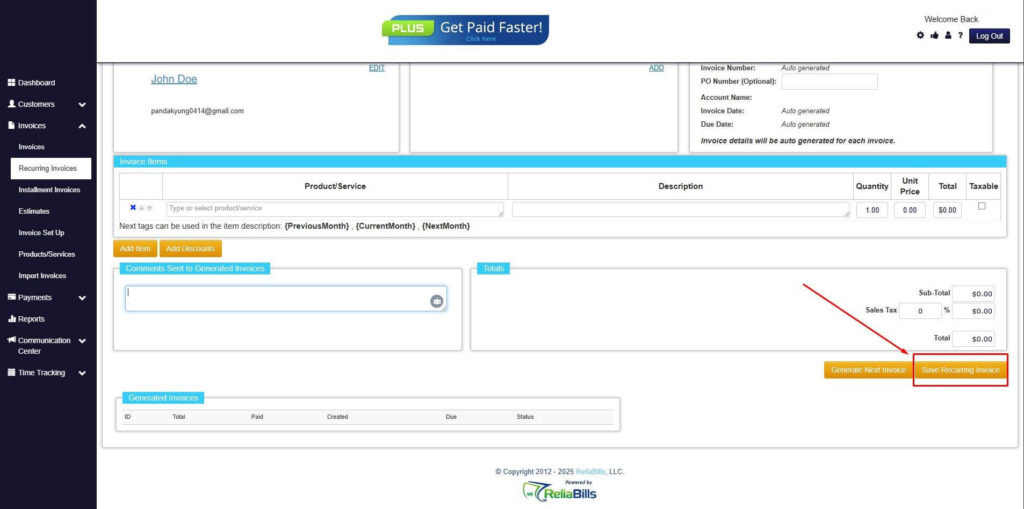

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

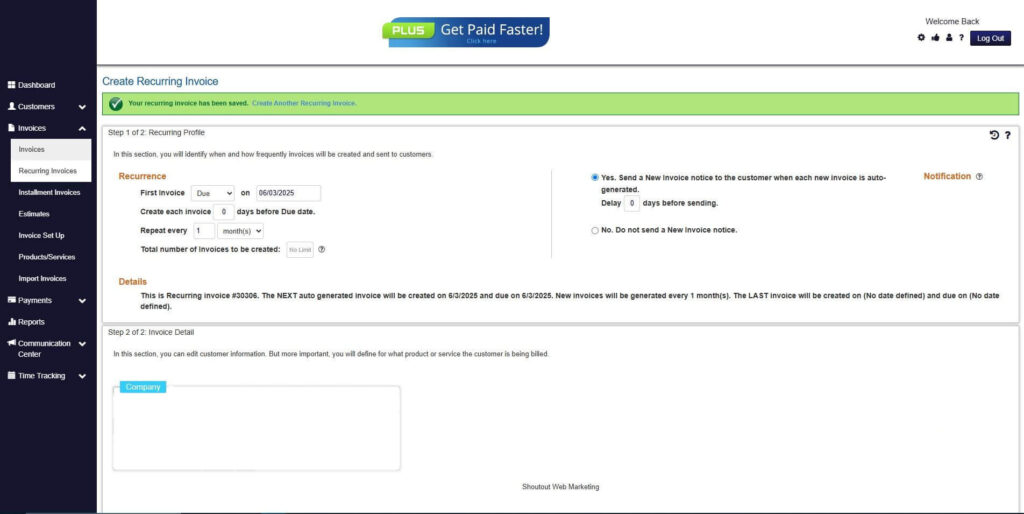

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Are interim invoices legally binding?

Yes, interim invoices are legally binding when issued under a valid contract.

2. How many interim invoices can be issued per project?

The number depends on the agreement and project duration.

3. Do interim invoices affect final billing?

Yes, all interim payments are deducted from the final invoice total.

4. Can interim invoicing be automated?

Yes, modern billing platforms can automate interim invoices.

Conclusion

An interim invoice is a powerful tool for managing long term projects and maintaining healthy cash flow. When used correctly, it benefits both businesses and clients. Clear communication is essential.

Following structured steps and best practices ensures accuracy and transparency. Interim invoicing reduces financial risk and improves planning. It also strengthens client relationships.

By using automation and reliable invoicing tools, businesses can simplify interim billing. Over time, this leads to fewer disputes and faster payments. A well managed interim invoice process supports sustainable growth.