Late payments can interrupt your cash flow and create unnecessary financial strain. One of the most effective ways to encourage clients to pay on time is by charging interest on late payment. Knowing how much to charge and when to apply it keeps your business protected while maintaining a fair and professional relationship with customers. This guide explains how late payment interest works, how to calculate it, and how to manage overdue invoices with clarity and confidence.

Table of Contents

ToggleWhat is Late Invoice Payment Interest?

Interest on late payment is a fee added to an overdue invoice when a client fails to pay by the agreed deadline. It compensates your business for the time and resources lost due to delayed payment. You can charge a percentage rate or a flat fee depending on what works best for your business model. The key is transparency. When clients understand your late payment terms from the start, there is less confusion and fewer disputes when invoices become overdue.

How to Calculate a Late Payment Interest Rate

Calculating interest on late payment is simple once you set a standard rate. Many businesses charge between 1 percent and 2 percent per month, equivalent to 12 percent to 24 percent annually. To calculate the interest owed, multiply your monthly rate by the overdue amount and the number of months the invoice remains unpaid.

For example, if your rate is 1.5 percent and a client owes 1,000 dollars, the interest for one month would be 15 dollars. The longer the balance remains overdue, the more interest accumulates. Using consistent calculations helps avoid misunderstandings and keeps your process fair for all clients.

How to Create a Late Payment Policy

A late payment policy ensures clients know what to expect when payments are delayed. Your policy should include your chosen interest rate, the invoice due date, how many days after the due date interest begins to accrue, and whether you offer a grace period. Make sure the policy aligns with local laws, which may limit how much interest you can charge.

Place your late payment terms in proposals, contracts, invoices, and onboarding materials. Clients are more likely to pay on time when they understand your expectations early in the relationship.

How to Deal With Late Payments and Unpaid Invoices

Even with a strong policy, late payments can still occur. When they do, start by sending a friendly reminder shortly after the due date. Many late payments are unintentional and can be resolved with a simple nudge. If the invoice remains unpaid, send follow-up messages that outline the overdue balance and the interest that is now being added.

Stay professional in your communication and offer payment plan options if necessary. If an invoice becomes severely overdue and the client stops responding, you may need to involve a collections agency or consider legal action. A clear, documented process ensures you remain consistent and protected throughout every step.

How ReliaBills Can Help You With Invoices

Managing overdue invoices is much easier when you have the right tools. ReliaBills automates invoicing, reminders, and late payment follow-ups so you spend less time chasing unpaid balances. You can set your own interest on late payment terms, and the system automatically applies them when invoices pass the due date.

With automated recurring billing, scheduled invoicing, and built-in payment reminders, ReliaBills helps reduce late payments before they happen. The platform also gives clients multiple payment options, making it easier for them to settle what they owe. Real-time reporting shows which invoices are paid, outstanding, or overdue, giving you full visibility into your cash flow. By automating the process from end to end, ReliaBills helps you stay organized, save time, and get paid faster.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

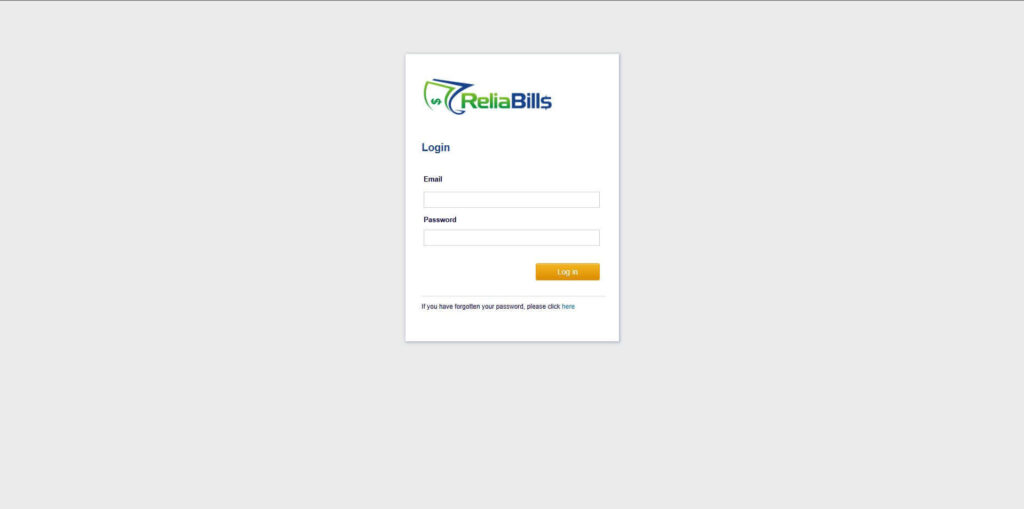

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

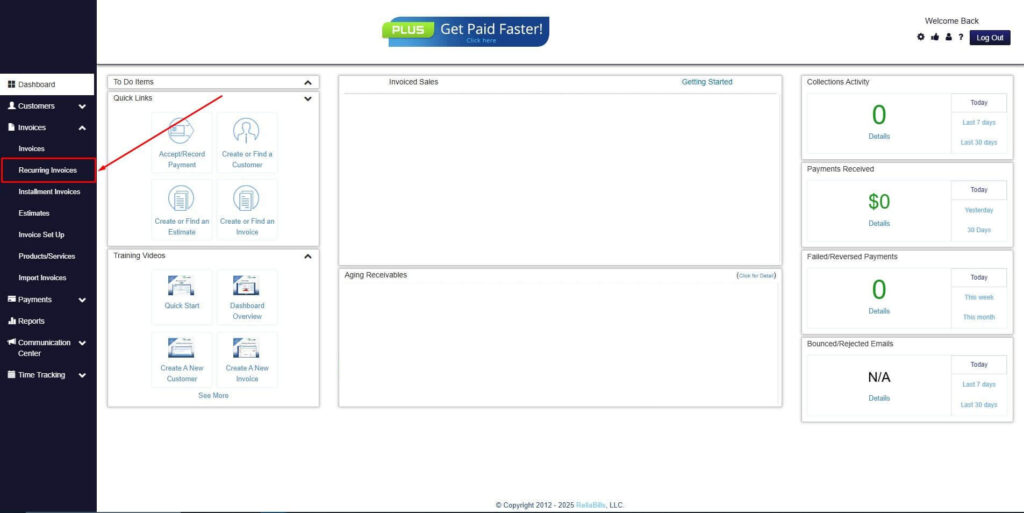

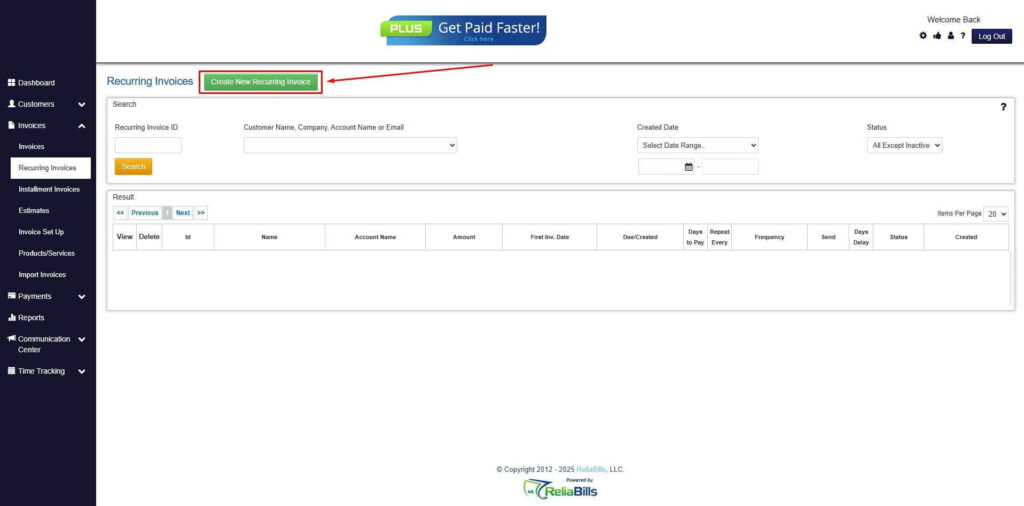

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

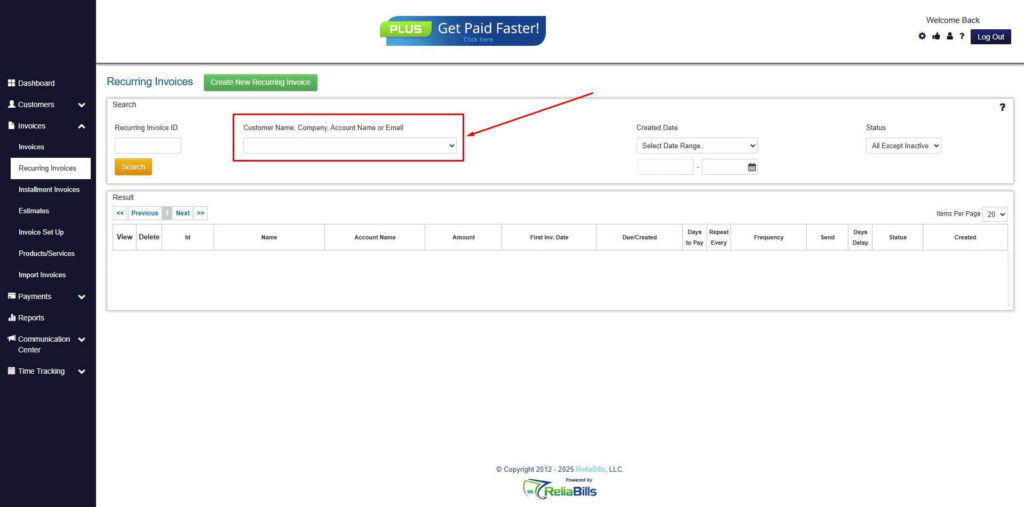

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

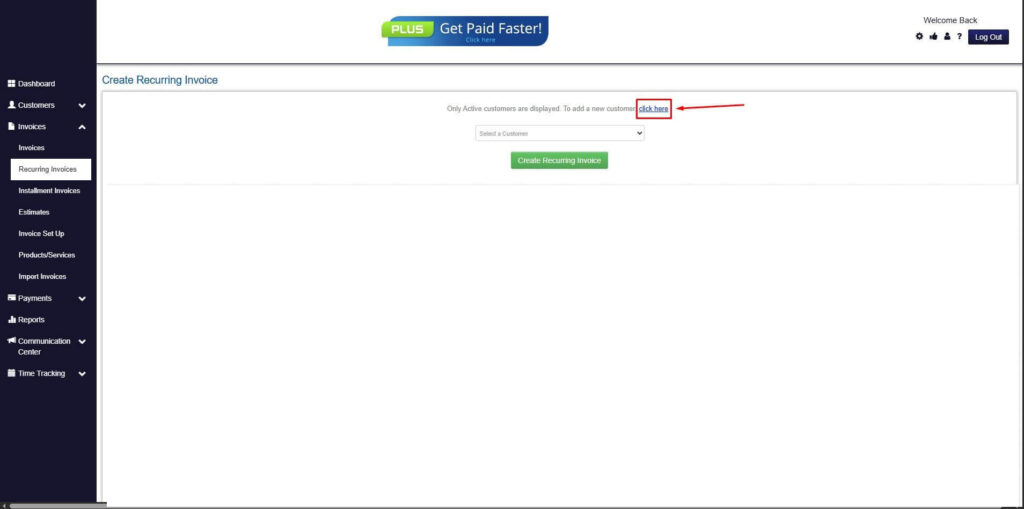

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

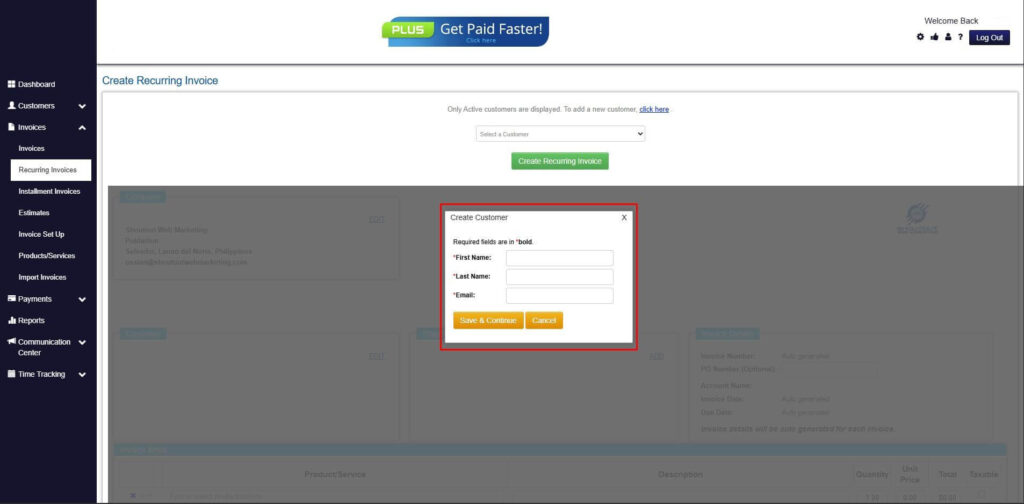

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

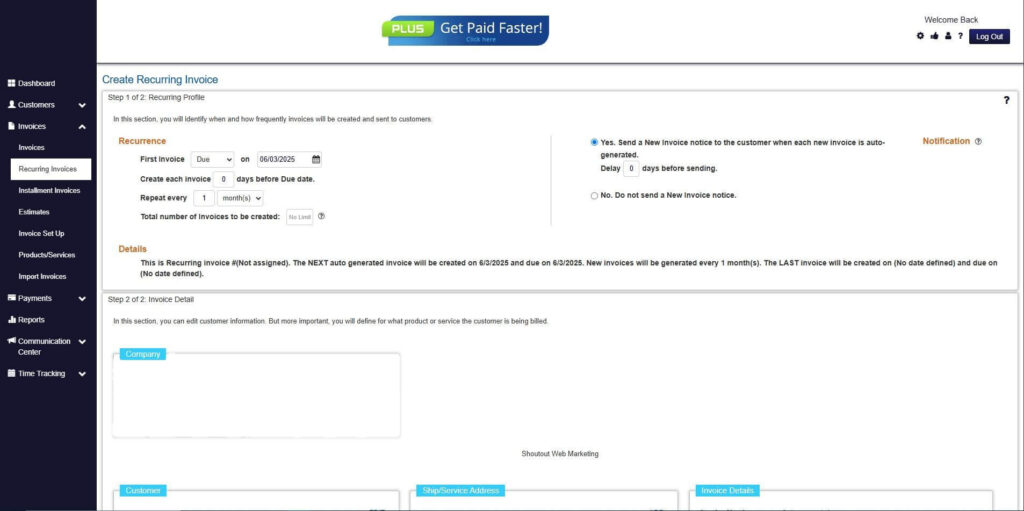

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

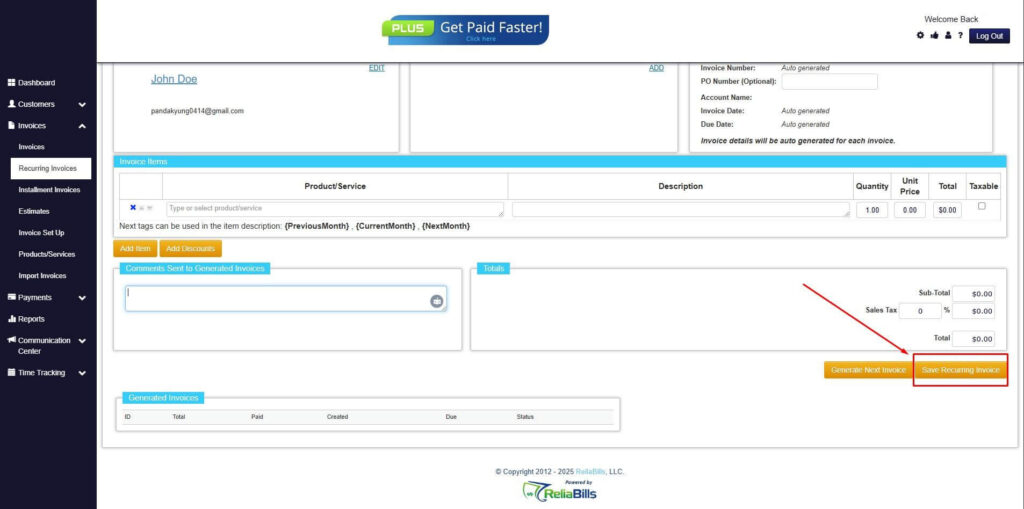

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

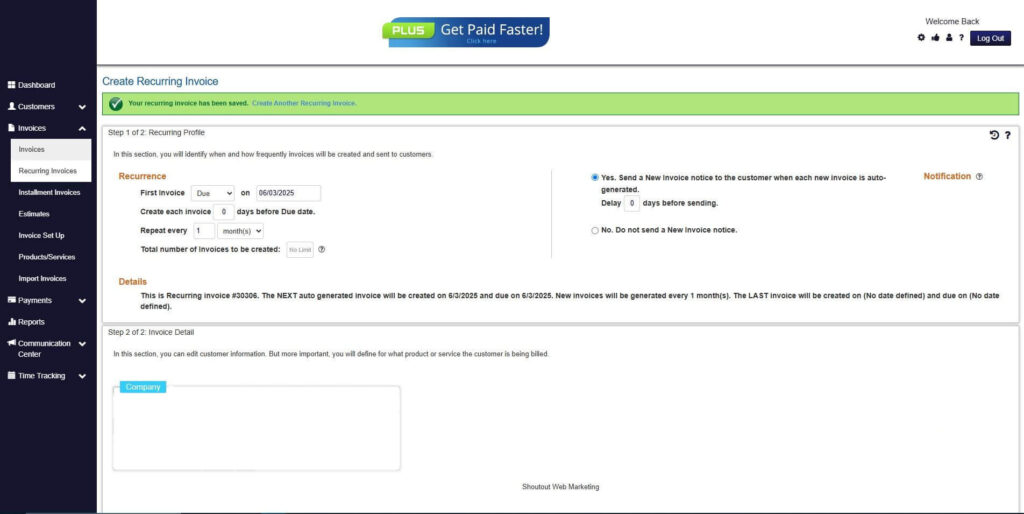

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Takeaways

Charging interest on late payment is a practical way to discourage delays and protect your revenue. Set a clear rate, include it in your policies, and communicate with customers early and professionally. With the support of automation tools like ReliaBills, handling invoicing and overdue accounts becomes far more efficient and less stressful.

Frequently Asked Questions

1. Can I legally charge interest on all overdue invoices?

Yes, as long as your rate follows local regulations and the customer was informed upfront.

2. What is a typical late payment interest rate?

Most businesses charge between 1 and 2 percent per month.

3. Can I waive interest for certain clients?

Yes. Many businesses waive late fees for long-term partners or in cases of genuine hardship.

4. How should I communicate late payment interest?

Always place your terms in contracts, invoices, and email reminders to ensure complete transparency.

Conclusion

Charging interest on late payment is an important step in protecting your business and maintaining consistent cash flow. When supported by a clear policy and reliable invoicing tools, you can manage overdue invoices with confidence and professionalism. ReliaBills makes this process smoother by automating invoices, reminders, and interest calculations so you can focus on running and growing your business.