Paying bills on time is something most people aim to do, yet many still struggle to stay consistent. Between busy schedules, multiple due dates, and unexpected expenses, it is easy for payments to slip through the cracks. Learning how to pay bills on time is not about perfection but about building simple systems that work in real life.

Late payments often come with more than just inconvenience. They can lead to extra fees, damaged credit, and even service interruptions that disrupt daily routines or business operations. Over time, these issues add stress and make financial planning harder than it needs to be.

The good news is that paying bills on time does not require complex financial knowledge. With better organization, smart use of automation, and the right tools, anyone can create a routine that keeps payments on track. This guide focuses on practical steps you can actually stick with.

Table of Contents

ToggleUnderstanding Your Bills

Before you can improve how you pay bills, you need a clear picture of what you are paying. Most people juggle a mix of utilities, loans, subscriptions, and recurring services. Each one comes with different rules, due dates, and consequences if missed.

Taking time to review your bills helps you understand billing cycles and grace periods. Some payments allow flexibility, while others penalize delays immediately. Knowing these differences helps you decide which bills need priority attention.

It also helps to separate fixed expenses from variable ones. Fixed bills stay consistent, while variable bills change based on usage or activity. This awareness makes budgeting and planning much easier over time.

Organizing Your Bills

One of the biggest reasons people miss payments is simple disorganization. When bills are scattered across emails, apps, and paper statements, it becomes harder to keep track. Creating one central place to list all bills instantly reduces confusion.

You can organize bills by due date, category, or importance depending on what works best for you. Essentials like rent, utilities, and loan payments should always be clearly marked. This makes it easier to focus on what truly needs attention.

Checking your bill list regularly keeps you ahead of upcoming deadlines. Even a quick weekly review can prevent late payments. Consistency, not complexity, is what makes bill organization effective.

Creating a Payment Schedule

A payment schedule turns bill paying into a routine rather than a reaction. When due dates are visible on a calendar, it is easier to plan ahead and avoid last minute stress. This approach also highlights weeks where multiple bills are due.

Prioritizing payments with higher penalties or stricter deadlines protects your finances. Some bills are more forgiving, while others are not. Understanding this difference helps you manage limited cash flow wisely.

Matching bill payments with your income schedule can also make a big difference. Paying bills shortly after payday reduces the temptation to spend money that is already committed. This habit supports long term financial stability.

Automating Bill Payments

Automation has become one of the most reliable ways to learn how to pay bills on time. Setting up recurring payments removes the need to remember every due date. Once in place, bills are paid automatically and consistently.

Automated payments save time and reduce human error. They are especially helpful for recurring expenses like subscriptions, utilities, and service contracts. Over time, automation builds a strong payment history with minimal effort.

That said, automation still requires occasional oversight. Checking accounts ensures payments are processed correctly and balances stay healthy. Automation works best when paired with regular reviews.

Budgeting to Ensure Timely Payments

A solid budget gives your bills a place before your money is spent elsewhere. When you allocate funds specifically for expenses, paying bills becomes a priority instead of an afterthought. This reduces the risk of scrambling at the last minute.

Including a small buffer in your budget helps absorb unexpected charges. Without this cushion, even minor surprises can throw off your payment schedule. Planning for the unexpected keeps you consistent.

Adjusting spending habits may also be necessary. Cutting unnecessary expenses frees up cash for essential payments. Over time, budgeting becomes less restrictive and more empowering.

Using Technology to Stay on Track

Modern technology makes bill management far easier than it used to be. Apps, reminders, and notifications provide gentle nudges before due dates arrive. These tools help keep payments top of mind without feeling overwhelming.

Online banking platforms offer instant visibility into balances and transactions. Being able to confirm payments quickly builds confidence and reduces stress. Transparency plays a big role in staying financially organized.

Digital confirmations and alerts also provide peace of mind. When paired with automation, technology creates a reliable system that supports timely payments. This makes managing bills feel manageable instead of stressful.

Tips and Best Practices

Regularly reviewing bills helps catch errors before they become problems. Incorrect charges or duplicate fees should be addressed as soon as they appear. Staying proactive prevents unnecessary payments.

Open communication with service providers can also help. If issues arise, reaching out early often leads to flexible solutions. Clear communication builds trust and avoids penalties.

Keeping organized records supports long term financial health. Well documented payments make it easier to track progress and resolve disputes. Good habits compound over time.

Common Mistakes to Avoid

Relying on memory alone is one of the most common mistakes people make. Even the most organized individuals forget things occasionally. Systems and reminders are far more reliable.

Another mistake is spending money without checking upcoming obligations. This can leave you short when bills are due. Awareness of cash flow is essential.

Failing to confirm completed payments can also cause trouble. Always verify that payments went through successfully. This final step closes the loop and prevents surprises.

How ReliaBills Helps With On Time Payments

ReliaBills helps businesses stay on top of payments by automating invoicing and reminders in one centralized platform. Instead of manually tracking who owes what and when, users get a clear view of invoices and payment statuses. This visibility reduces missed payments and improves overall cash flow.

Recurring billing is a key feature that makes ReliaBills especially effective for ongoing services. Businesses can set up recurring invoices that go out automatically on schedule. Built in reminders encourage customers to pay on time without awkward follow ups.

ReliaBills PLUS expands these capabilities for growing businesses. It offers advanced reporting, customization, and scalability for managing higher volumes of recurring billing. With ReliaBills PLUS, businesses gain deeper insights while maintaining consistent and professional billing processes.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

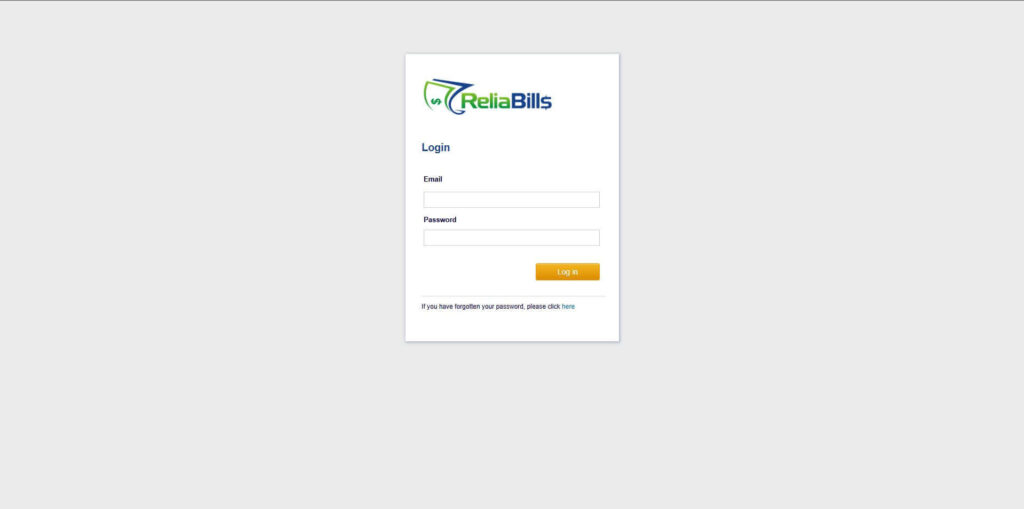

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

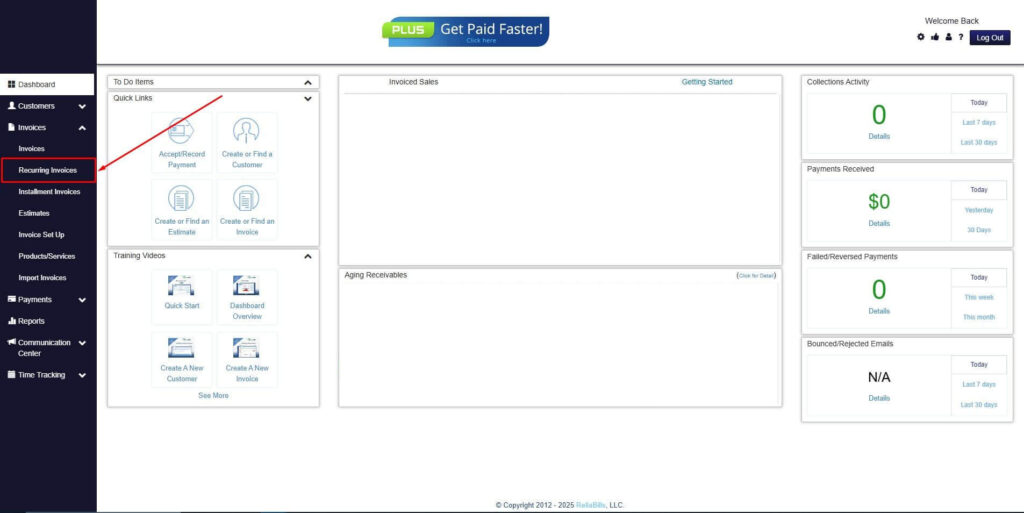

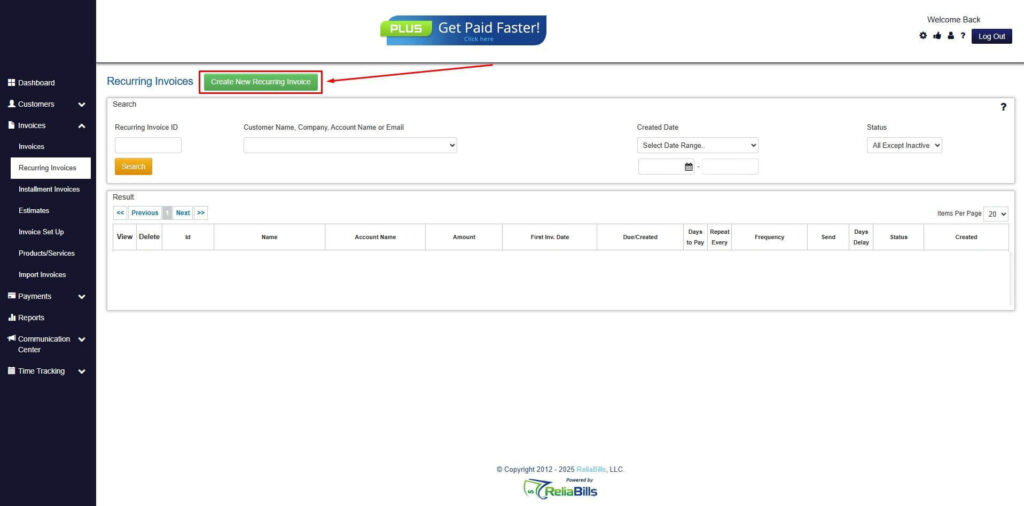

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

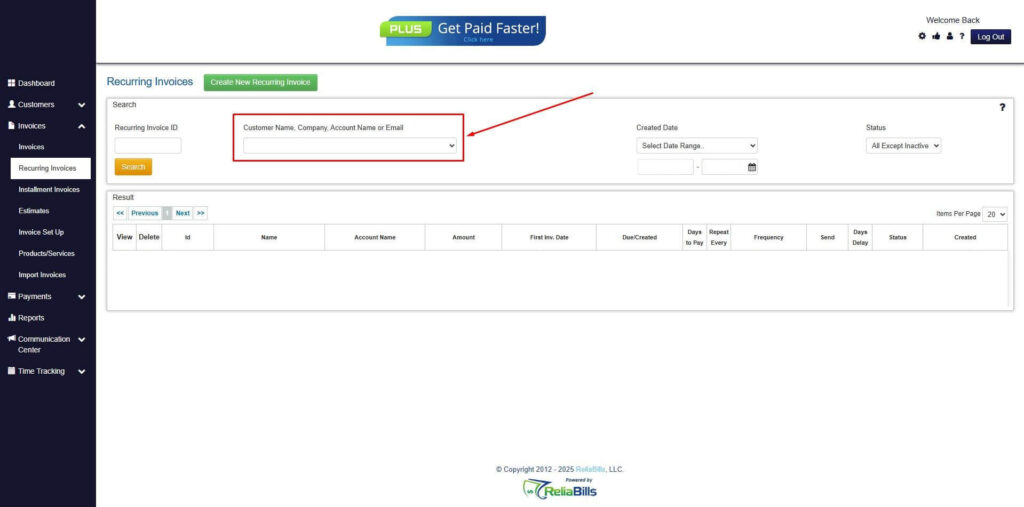

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

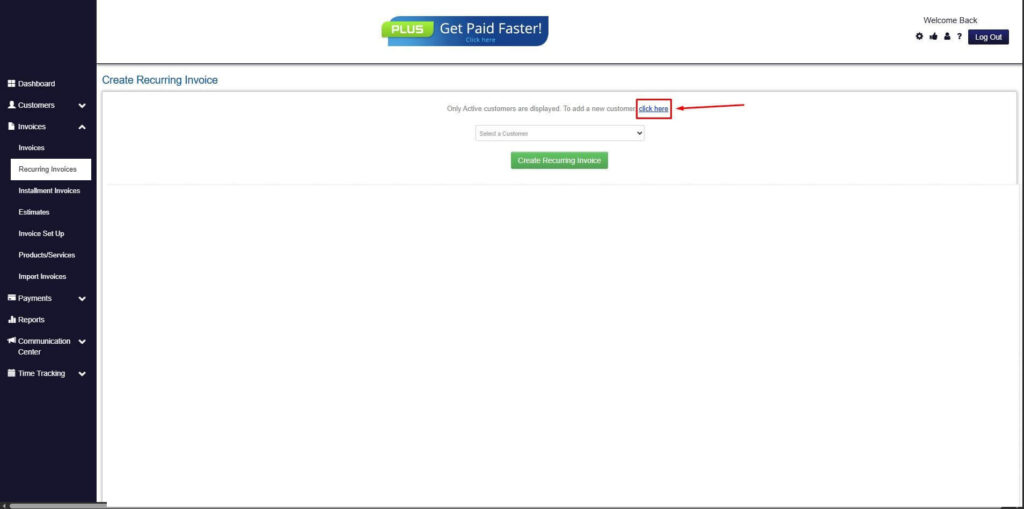

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

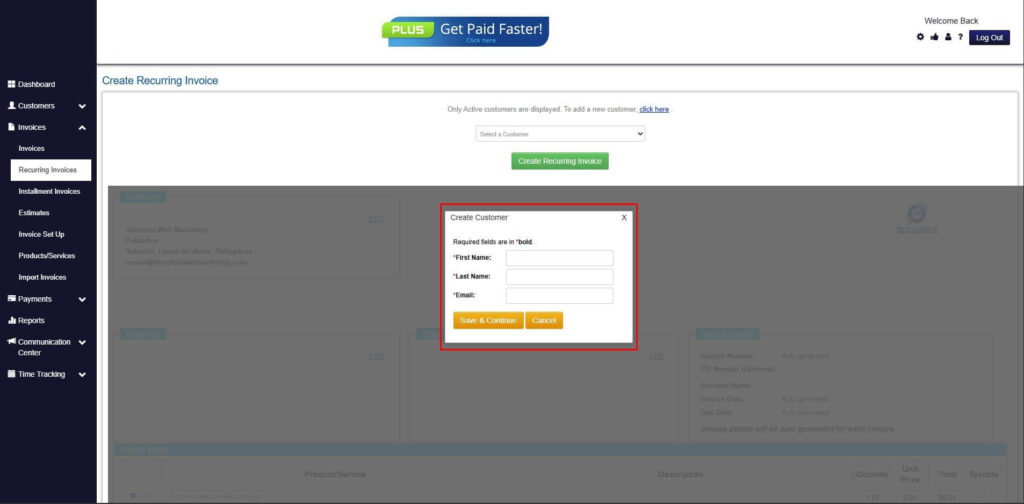

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

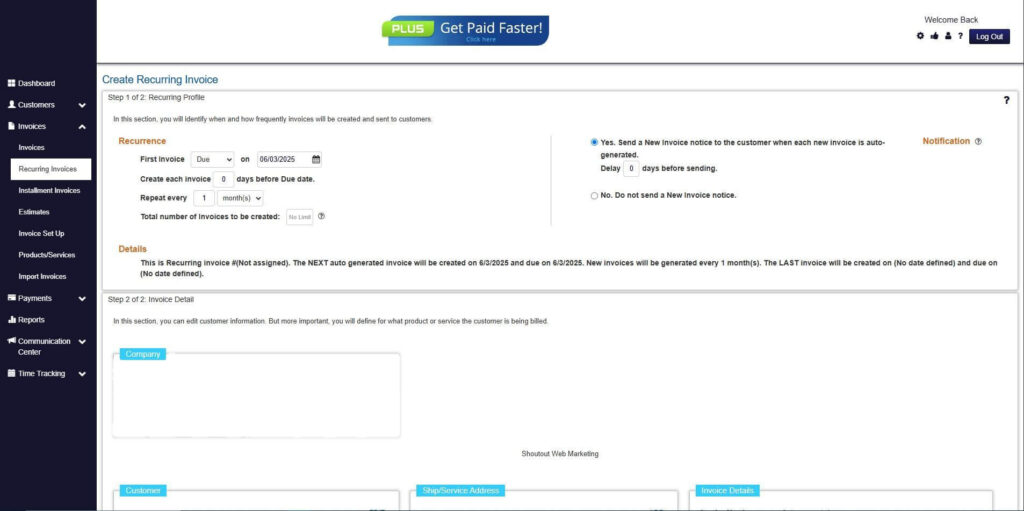

Step 7: Fill in the Create Recurring Invoice Form

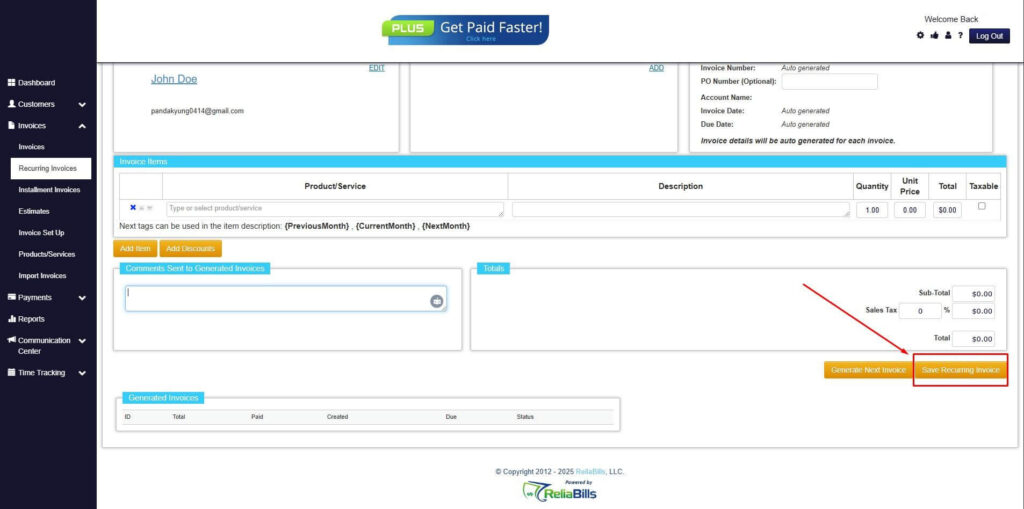

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

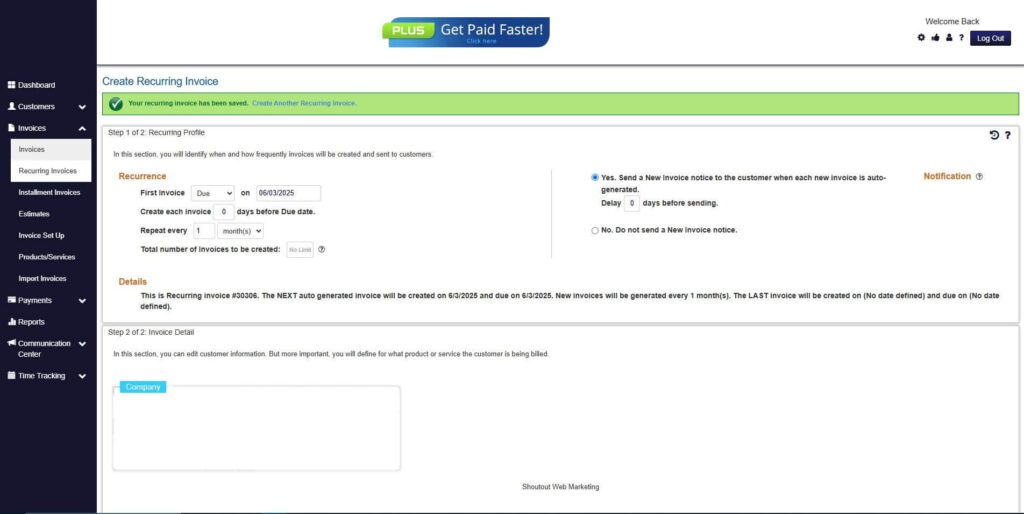

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What is the easiest way to manage multiple bills?

Using a centralized system with automation and reminders is the most effective approach.

2. Can automation cause overdrafts?

Yes, if balances are not monitored. Regular account reviews help prevent this.

3. How can I avoid missing manual payments?

Setting reminders and scheduling weekly reviews makes a big difference.

4. Are digital reminders reliable?

They are very reliable when paired with automation and periodic checks.

Conclusion

Learning how to pay bills on time is about creating habits that fit your lifestyle. Organization, automation, and budgeting all work together to reduce stress and improve consistency. Small changes can have a big impact.

Using digital tools and recurring billing systems simplifies the entire process. Over time, paying bills becomes routine rather than a source of anxiety. Confidence grows as systems do the heavy lifting.

By applying these strategies and using tools like ReliaBills, individuals and businesses can stay ahead of due dates. Timely payments lead to stronger financial health and fewer disruptions. Consistency is the real key to success.