Electronic payments have become a standard part of how modern businesses operate, regardless of size or industry. From online purchases to recurring invoices, companies now rely on digital payment methods to move money faster and more securely. As customer expectations continue to evolve, offering electronic payments is no longer optional for businesses that want to stay competitive.

Businesses that adopt electronic payments often see improvements in efficiency, customer satisfaction, and cash flow. Manual processes like paper checks and cash handling slow down operations and increase the risk of errors. Electronic payments help streamline transactions while providing better visibility into incoming revenue.

This guide explains what electronic payments are, the different types available, and how businesses can use them effectively. It also covers costs, security considerations, and best practices, along with how platforms like ReliaBills support electronic payments and recurring billing.

Table of Contents

ToggleWhat Are Electronic Payments?

Electronic payments refer to any transaction where money is transferred digitally rather than through physical cash or paper checks. These payments are processed through electronic systems that securely move funds between customers and businesses. They are widely used for both one time and recurring transactions.

In most cases, electronic payments work by connecting a customer’s payment method to a payment processor or gateway. The processor verifies the transaction, authorizes the payment, and transfers the funds to the business account. This entire process typically happens within seconds or days, depending on the method used.

Compared to traditional payment methods, electronic payments are faster, easier to track, and more scalable. They reduce manual work and make it easier for businesses to manage billing, reporting, and customer payments in one place.

Types of Electronic Payment Methods

Electronic payments come in many forms, allowing businesses to choose options that fit their operations and customer preferences. Common electronic payment methods include:

- Credit and debit card payments, which are widely accepted and convenient for customers

- Bank transfers and ACH payments, often used for B2B and recurring billing

- Digital wallets and mobile payments, such as app based payment solutions

- Online payment gateways, which process payments through websites and apps

- Invoice based electronic payments, where customers pay directly from a digital invoice

Offering multiple electronic payment methods gives customers flexibility while helping businesses collect payments faster.

How Electronic Payments Benefit Businesses

One of the biggest advantages of electronic payments is faster payment processing. Businesses no longer need to wait for checks to arrive or clear, which helps improve cash flow and reduce delays. Faster access to funds allows companies to cover expenses and reinvest in growth more confidently.

Electronic payments also reduce administrative workload. Automated payment processing minimizes manual data entry, lowers the risk of errors, and simplifies reconciliation. This saves time for finance teams and business owners.

From a customer perspective, electronic payments improve convenience. Customers can pay invoices online, set up recurring payments, and choose their preferred method. This convenience often leads to higher on time payment rates and better long term relationships.

Electronic Payments for Different Business Models

Retail and point of sale businesses

These businesses rely on fast electronic payments such as card and mobile payments to keep checkout lines moving and reduce cash handling.

Service based and professional businesses

Consultants, agencies, and service providers often use invoice based electronic payments to collect fees after services are delivered.

Subscription and recurring billing models

Businesses offering memberships or ongoing services benefit from automated recurring electronic payments that reduce missed invoices and stabilize revenue.

B2B and high volume transaction businesses

Companies handling large invoices or frequent transactions often prefer ACH and bank transfers for lower fees and easier reconciliation.

Security and Compliance in Electronic Payments

Security is a critical consideration when accepting electronic payments. Businesses must ensure that customer data is protected through encryption and secure processing systems. Using reputable payment providers helps reduce the risk of data breaches and fraud.

PCI compliance is another important requirement for businesses that accept card payments. Compliance standards are designed to protect sensitive payment information and reduce fraud. Secure authentication methods also help verify customer identity and prevent unauthorized transactions.

By prioritizing security and compliance, businesses can build trust with customers and protect their revenue.

Costs and Fees Associated With Electronic Payments

Electronic payments often come with processing fees, which vary depending on the payment method and provider. Credit card payments typically have higher transaction fees, while ACH and bank transfers are often more cost effective for larger or recurring payments.

Some providers also charge setup fees, monthly service fees, or additional costs for advanced features. Comparing pricing models helps businesses balance convenience with profitability.

Understanding all associated fees allows businesses to choose electronic payment options that align with their budget and growth goals.

How to Implement Electronic Payments in Your Business

Implementing electronic payments starts with choosing the right payment provider. Businesses should look for providers that support multiple payment methods and integrate smoothly with existing invoicing systems. Integration reduces manual work and improves accuracy.

Training staff and onboarding customers is also important. Clear instructions and communication help ensure a smooth transition to electronic payments. Businesses should also test payment workflows before full implementation.

A well planned rollout helps maximize the benefits of electronic payments while minimizing disruptions.

Best Practices for Managing Electronic Payments

Monitor transactions and settlements regularly

Reviewing payment activity helps catch errors early and ensures funds are deposited correctly.

Handle disputes and chargebacks promptly

Quick responses reduce financial losses and maintain strong customer relationships.

Maintain accurate and organized payment records

Clear records support accounting, reporting, and compliance requirements.

Use automation where possible

Automated reminders, recurring payments, and reporting tools reduce manual work and improve consistency.

How Electronic Payments Improve Cash Flow

Electronic payments play a major role in improving cash flow by reducing payment delays. Faster settlement times mean businesses receive funds sooner and can plan expenses more confidently. This is especially important for small businesses with tight margins.

Automated reminders and online payment options reduce late payments. Customers are more likely to pay on time when the process is simple and accessible. Recurring electronic payments provide even greater predictability by ensuring consistent revenue each billing cycle.

Together, these benefits create a more stable financial foundation for businesses.

Common Mistakes to Avoid

Overlooking security and compliance requirements

Failing to follow data protection and PCI standards can expose businesses to fraud and penalties.

Not reviewing fees and provider contracts

Hidden or misunderstood fees can erode profitability over time.

Offering limited electronic payment options

Restricting payment choices may lead to delayed payments or lost customers.

Poor transaction monitoring and reconciliation

Ignoring payment data can result in missed issues and inaccurate financial reporting.

How ReliaBills Supports Electronic Payments

ReliaBills helps businesses accept electronic payments directly through their invoices, making it easier for customers to pay quickly and securely. Multiple payment options can be embedded into invoices, reducing friction and encouraging on time payments. Automated reminders ensure customers never miss a due date.

For businesses that rely on recurring billing, ReliaBills simplifies subscription and ongoing service payments. Recurring electronic payments are processed automatically, helping businesses maintain predictable cash flow without manual follow ups. Real time visibility into payment status allows business owners to track receivables with confidence.

ReliaBills PLUS adds advanced tools such as centralized payment tracking, detailed reporting, and branded communication. These features reduce administrative work, improve accuracy, and support long term growth by keeping electronic payments organized and reliable.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

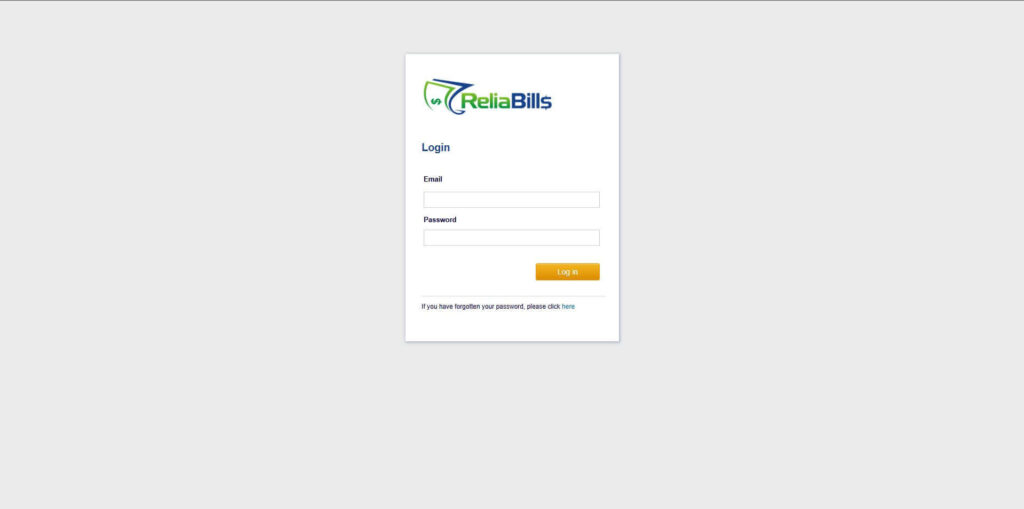

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

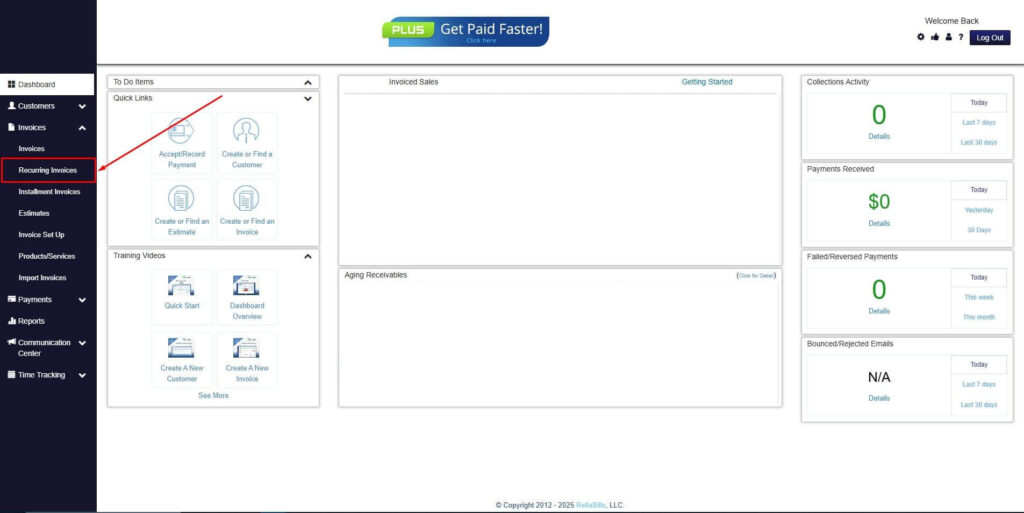

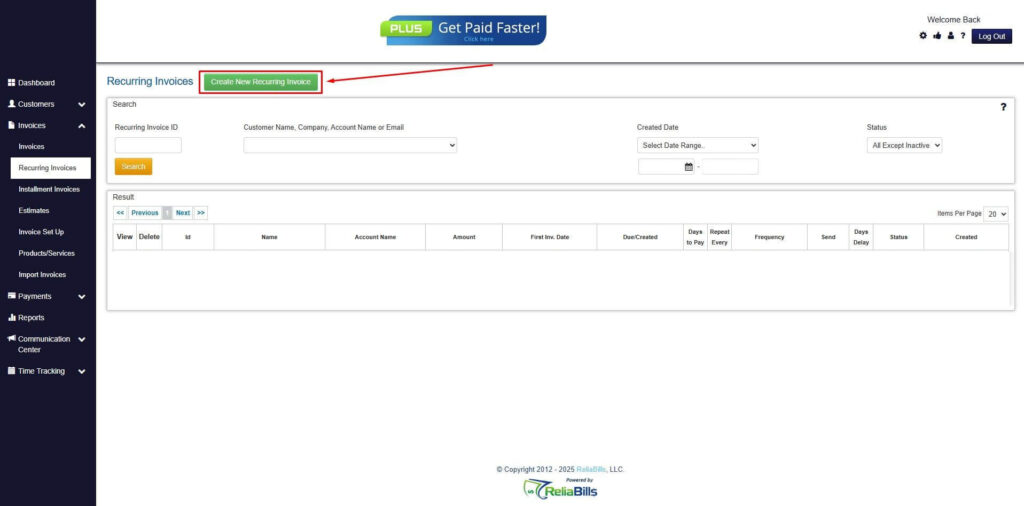

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

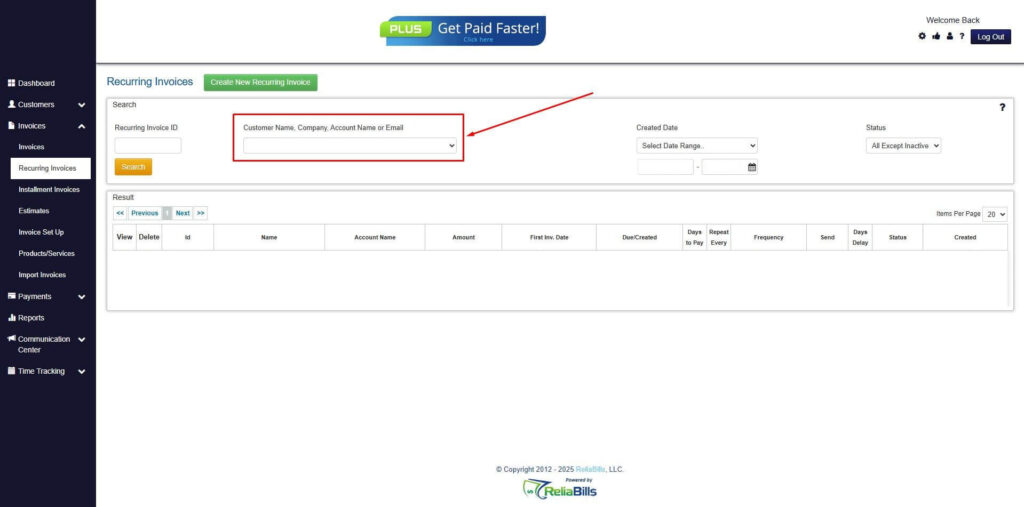

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

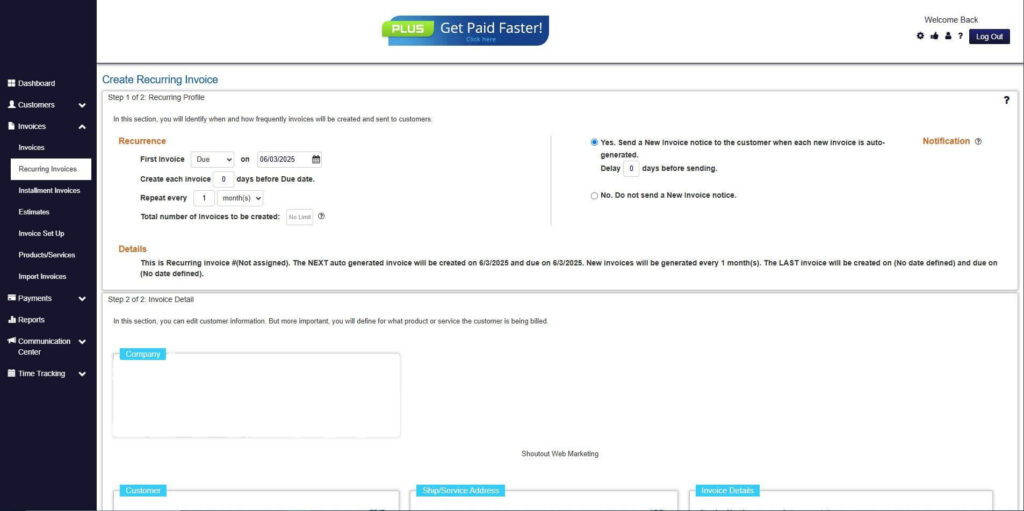

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

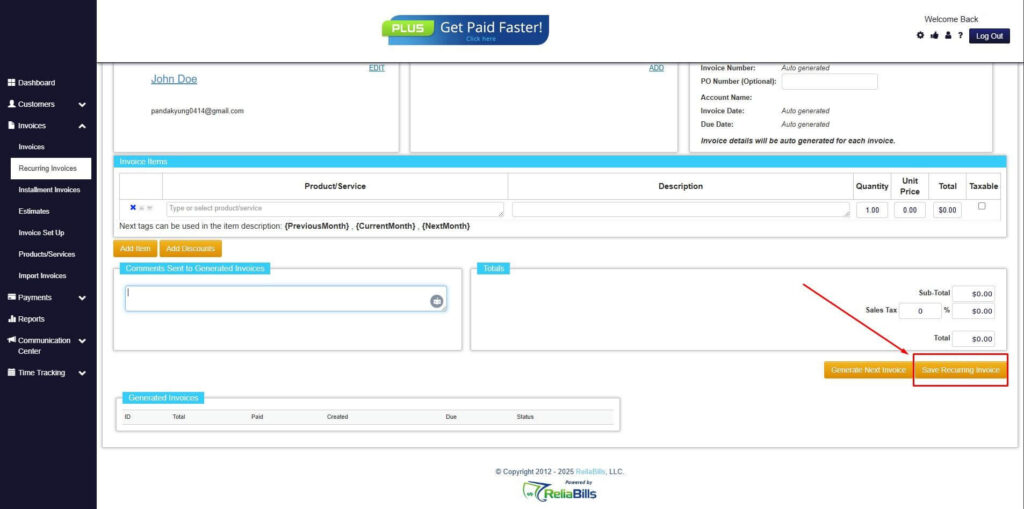

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Are electronic payments safe for businesses?

Yes, when processed through secure and compliant providers that follow industry standards.

2. What electronic payment methods are best for small businesses?

A mix of card payments, ACH transfers, and invoice based payments works well for most small businesses.

3. How quickly are electronic payments processed?

Processing times vary, but many electronic payments settle faster than checks or cash deposits.

4. Can electronic payments be automated?

Yes, automation is common, especially for recurring billing and subscription based services.

Conclusion

Electronic payments have become essential for businesses looking to improve efficiency, customer experience, and cash flow. By understanding the available payment methods, costs, and security considerations, businesses can make informed decisions that support growth.

With the right tools and best practices, electronic payments simplify billing and reduce administrative effort. Platforms like ReliaBills make it easier to manage electronic payments and recurring billing, helping businesses stay organized and financially stable.