Autopay has become an essential tool for managing recurring payments in both personal and business finance. Linking a debit card allows bills, subscriptions, and recurring invoices to be paid automatically, saving time and reducing the risk of missed payments. However, since funds are withdrawn directly from a bank account, there are legitimate concerns about debit card autopay safety.

This guide explores how autopay works, the advantages and risks of using debit cards, best practices to maintain financial control, and how automation platforms like ReliaBills can provide secure, reliable recurring payment solutions. By the end of this article, readers will understand how to leverage autopay safely while avoiding overdrafts, errors, or payment disputes.

Autopay is especially useful for small businesses, freelancers, and busy households that deal with multiple recurring transactions. Without careful management, however, the convenience of autopay can lead to overdraft fees, insufficient funds, and account errors. Understanding both the pros and potential pitfalls is critical to maintaining a smooth cash flow and protecting financial assets.

Table of Contents

ToggleHow Autopay Works

Autopay is a system that schedules recurring payments automatically, meaning that bills are paid without manual intervention. Debit cards can be linked to utilities, subscription services, loan payments, and vendor invoices, with the amount being deducted from the checking account at the scheduled time.

The process typically involves authorizing a service provider to withdraw payments on specific dates. Once the payment is processed, the transaction is reflected in the account immediately, unlike checks that take days to clear. This immediacy is convenient, but it also requires vigilance in tracking account balances to prevent overdrafts.

Automation platforms like ReliaBills enhance debit card autopay safety by tracking recurring payments in one centralized dashboard. These systems provide alerts for upcoming or failed transactions, reducing the chances of missed payments. Businesses can reconcile multiple accounts and track recurring invoices with more accuracy, while individuals can ensure their recurring expenses do not exceed available funds.

Pros of Using a Debit Card for Autopay

One of the main advantages of using a debit card for autopay is convenience. Payments are processed automatically, which eliminates the need to log in to multiple platforms or remember payment due dates. This method helps avoid late fees and ensures bills are paid on time, maintaining good credit and financial standing.

Immediate deduction from a checking account prevents unnecessary debt accumulation, which can happen with credit cards if balances are not managed carefully. Setting up autopay is straightforward and widely accepted across utilities, subscription platforms, and other service providers. For small businesses, linking debit cards to recurring billing allows consistent payment of suppliers and vendors without manual intervention.

Additionally, autopay can improve financial organization. By consolidating recurring payments and scheduling them automatically, both businesses and individuals gain better visibility into cash flow. Combining debit card autopay with automated billing tools strengthens control over outgoing funds and reduces administrative overhead.

Risks of Using a Debit Card for Autopay

While convenient, using a debit card for autopay carries inherent risks. Debit cards typically offer less fraud protection compared to credit cards, which means unauthorized transactions can directly impact available funds. Resolving these issues may take longer, potentially affecting cash flow for individuals and businesses.

Overdrafts are a common concern. If the account does not have enough funds at the time of payment, fees can accumulate quickly. For small businesses with variable revenue, this can create cash flow disruptions that affect payroll, supplier payments, and operational expenses.

Another risk is difficulty disputing charges. Unlike credit cards that allow chargebacks for fraud or service errors, debit card disputes often require more documentation and can take longer to resolve. Ensuring proper monitoring and having alerts for all transactions is essential for maintaining debit card autopay safety.

Best Practices for Debit Card Autopay

Monitor Account Balances Regularly

Always check your checking account before scheduled payments. This ensures sufficient funds are available and prevents overdraft fees. For businesses, monitoring cash flow helps avoid missed vendor payments or payroll delays.

Use Dedicated Accounts for Autopay

Consider linking autopay to a separate account specifically for recurring payments. This isolates these transactions from everyday expenses, providing better control and visibility over outgoing funds.

Set Up Alerts and Notifications

Enable alerts for upcoming payments, low balances, or failed transactions. Real-time notifications can prevent accidental overdrafts and help track payment schedules efficiently.

Verify and Review Autopay Agreements

Review terms, cancellation policies, and recurring amounts. Ensure that the payment frequency, amount, and start date match your budgeting plan. For subscription services, regularly confirm that no unauthorized charges have been added.

Link Accounts with Overdraft Protection

Connecting autopay to an account with overdraft protection adds a safety net in case of insufficient funds. This is especially important for small businesses with variable revenue streams.

Combine Automation Tools

Use recurring billing or invoicing platforms like ReliaBills to automate payment tracking, generate reminders, and reconcile accounts. Automation reduces human error and ensures timely payment execution.

Periodically Audit Your Autopay Transactions

Regularly review your autopay records to ensure all payments have been processed correctly. This helps catch any discrepancies and allows corrections before they impact cash flow or vendor relationships.

Debit Card vs Credit Card for Autopay

Credit cards generally provide stronger fraud protection, dispute resolution, and rewards programs, making them safer for high-value or critical payments. Debit cards, on the other hand, offer immediate deduction from checking accounts, which can prevent debt accumulation.

Choosing between debit and credit cards for autopay depends on the user’s financial priorities. Debit cards are ideal for those seeking real-time payments and direct account management, while credit cards may be better for those wanting added protection and rewards. For businesses, combining debit cards with recurring billing automation can ensure timely payments without the risk of carrying credit debt.

How Automation and Billing Tools Can Help

Recurring billing platforms like ReliaBills enhance debit card autopay safety by providing centralized control over all recurring transactions. Automation ensures payments are processed correctly and on schedule, reducing the chance of missed or duplicated payments.

By consolidating multiple autopay accounts, users can easily monitor transactions, track recurring invoices, and maintain accurate payment histories. Automation also simplifies reconciliation for accounting, helping businesses and individuals avoid errors that could disrupt cash flow.

Platforms with recurring billing features allow scheduled adjustments, partial payments, or subscription changes without manual intervention. This reduces administrative work, strengthens control, and provides consistent visibility over outgoing funds.

Common Mistakes to Avoid

Using Accounts With Insufficient Funds

Linking autopay to accounts with inconsistent balances can result in failed payments and overdraft fees. Businesses should ensure cash reserves align with scheduled withdrawals.

Neglecting to Monitor Automatic Payments

Assuming autopay is foolproof is risky. Failing to track payments can lead to unnoticed failed transactions or duplicate charges, affecting financial management and vendor relations.

Ignoring Notifications from Banks or Payment Platforms

Alerts about failed transactions, low balances, or suspicious activity are crucial. Ignoring these notifications may result in fees or unresolved disputes.

Mixing Personal and Business Autopay Accounts

Combining personal and business recurring payments in one account can make tracking difficult, increase errors, and reduce visibility into specific financial streams.

Failing to Update Expired Card Information

Expired or replaced debit cards linked to autopay can lead to payment failures. Updating card information promptly ensures uninterrupted recurring payments.

Over-Reliance on Autopay Without Reconciliation

Even with automation, it’s important to reconcile transactions against invoices, subscription agreements, and budgets. Skipping this step may result in unnoticed errors and financial discrepancies.

How ReliaBills Supports Secure Recurring Payments

ReliaBills makes debit card autopay safer and more reliable by centralizing recurring payment management in one secure platform. By automating recurring billing, the system reduces the risk of missed or duplicate payments and provides real-time tracking of all transactions. Businesses and individuals can see exactly when payments are scheduled, completed, or failed, helping prevent overdrafts and maintain accurate account balances.

The platform also supports customizable notifications and alerts, ensuring that users are informed of upcoming charges or potential issues before they occur. This proactive approach allows both small businesses and freelancers to manage cash flow more effectively, avoid late fees, and maintain positive relationships with clients and vendors. ReliaBills’ recurring billing system handles scheduled payments consistently, reducing human error and providing predictable, dependable payment cycles.

Additionally, ReliaBills offers robust reporting and audit-ready records, making it easy to reconcile autopay transactions with invoices or subscriptions. Users can link multiple debit cards or accounts for different payment streams, giving flexibility while maintaining centralized oversight. By combining automation, transparency, and security, ReliaBills ensures that debit card autopay is not only convenient but also safe, accurate, and reliable for both businesses and personal use.

How to Create a New Recurring Invoice Using ReliaBills

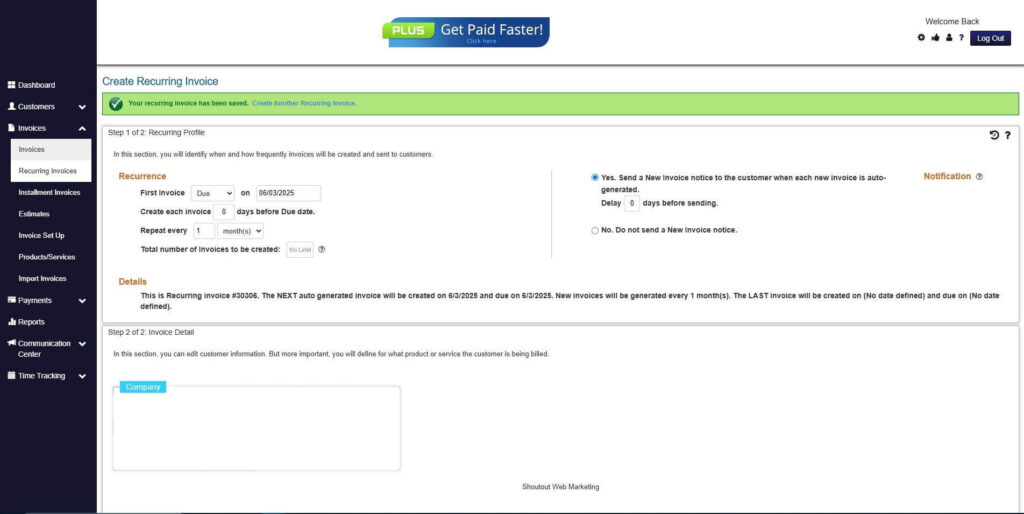

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

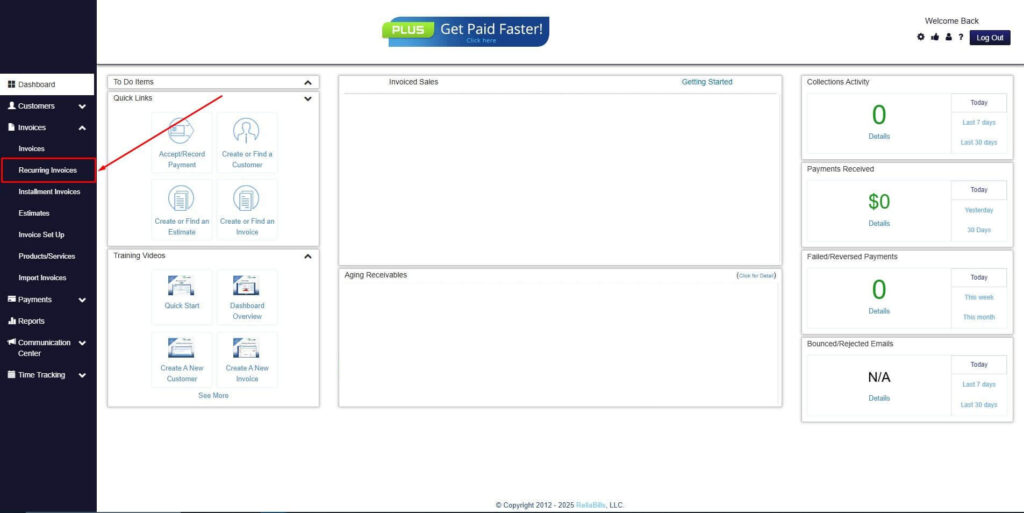

Step 2: Click on Recurring Invoices

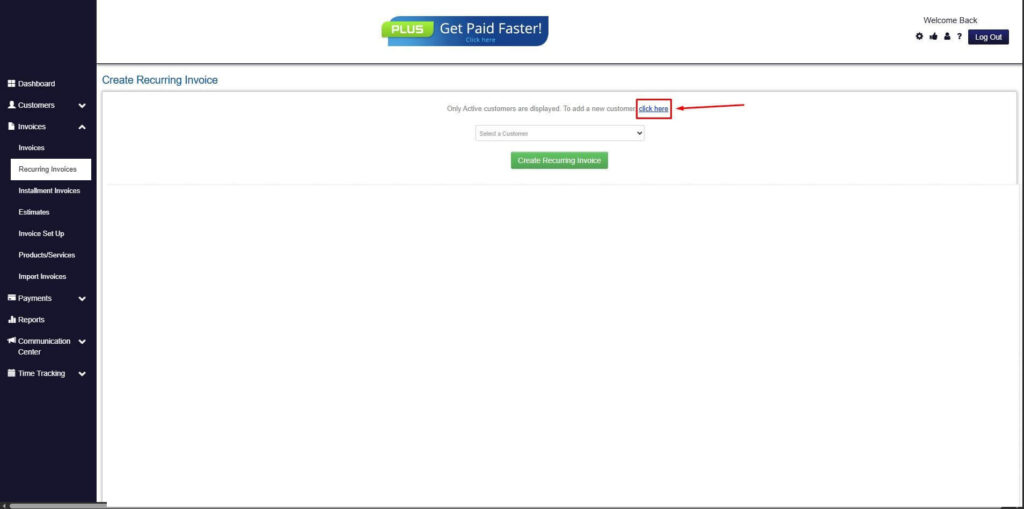

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

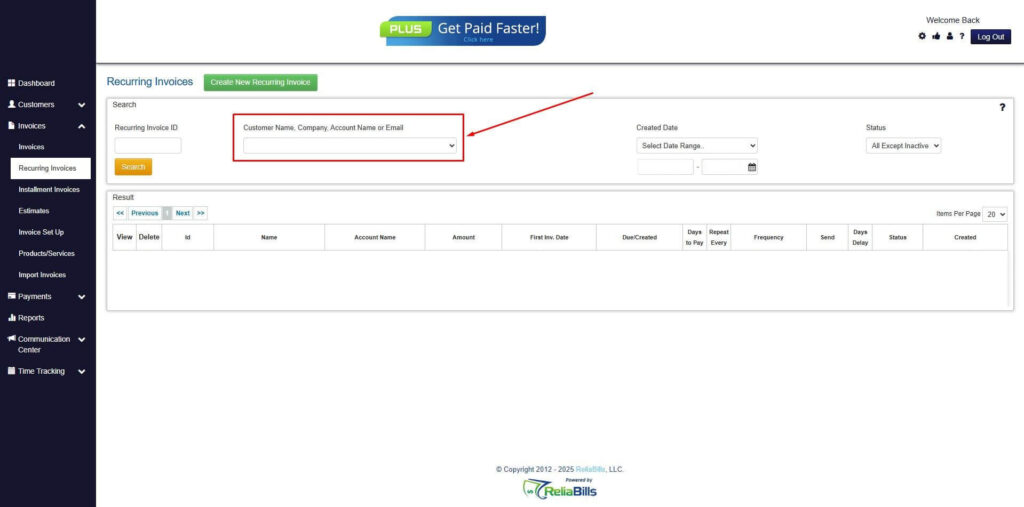

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

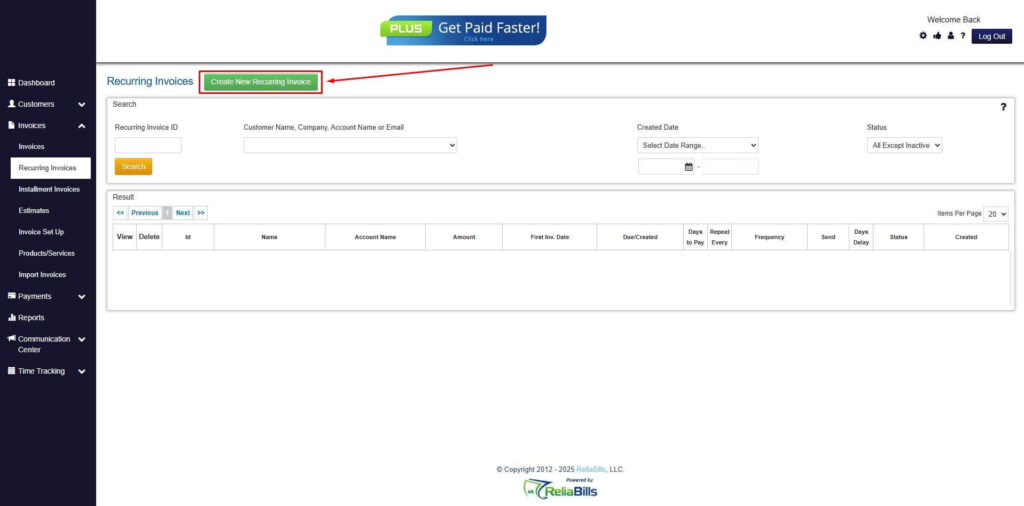

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

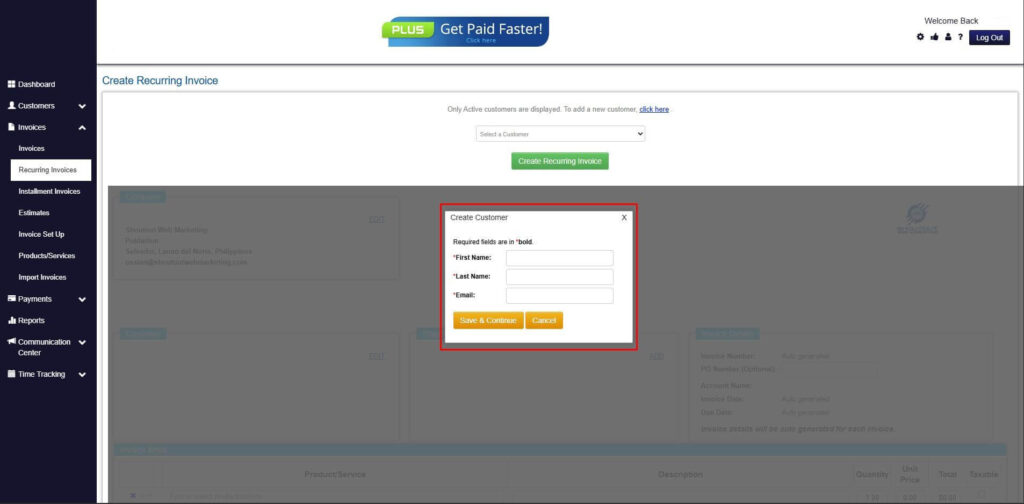

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

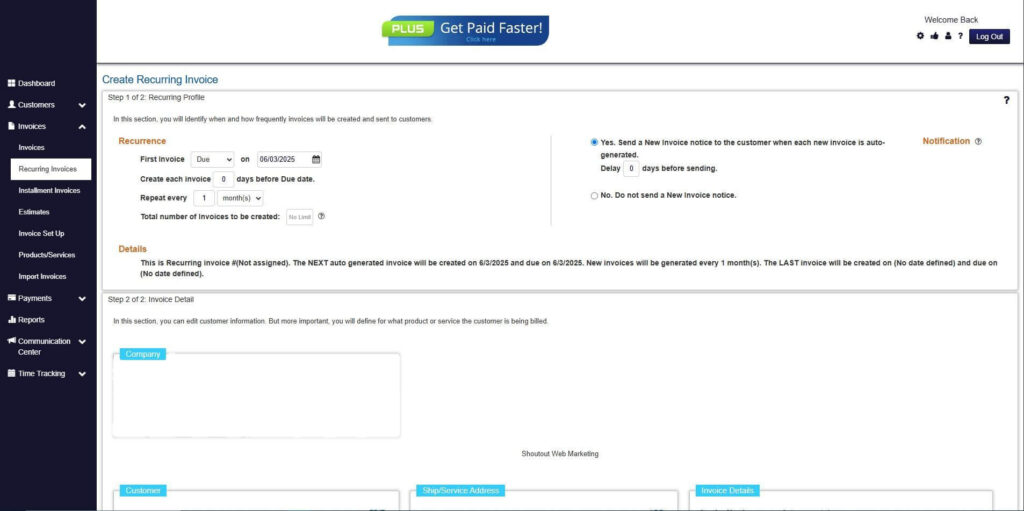

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

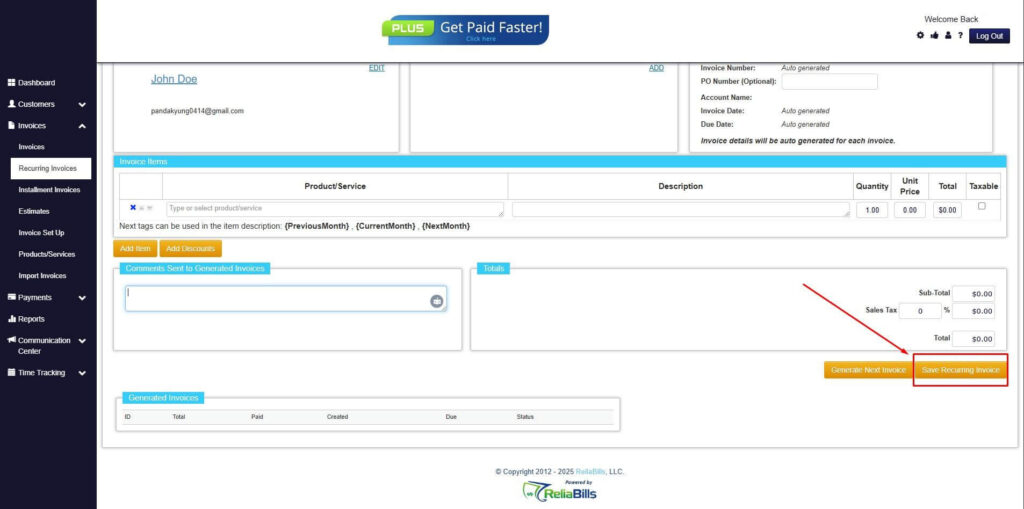

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Can debit card autopay protect against fraud?

Debit cards have limited protection compared to credit cards. Using alerts, monitoring balances, and platforms like ReliaBills for automated tracking improves security.

2. How do I stop or change a debit card autopay?

You can usually update card information or cancel autopay via the service provider’s dashboard or your billing automation platform. Always confirm the change to avoid missed payments.

3. Are there fees for debit card autopay?

Most services do not charge for autopay itself, but overdraft fees or insufficient fund penalties may apply if balances are not maintained.

4. Is autopay safe for business payments?

When combined with careful monitoring, automation, and recurring billing platforms, autopay is safe for businesses. It ensures timely payments, reduces human error, and simplifies cash flow management.

5. Can recurring billing platforms improve debit card autopay safety?

Yes, platforms like ReliaBills centralize recurring payments, provide alerts, and track all transactions, reducing errors and improving visibility into scheduled payments.

Conclusion

Debit card autopay offers convenience, simplicity, and immediate payments, but it requires careful monitoring to maintain safety. Risks such as overdrafts, reduced fraud protection, and potential account disputes can be mitigated with automation, recurring billing, and consistent tracking.

Platforms like ReliaBills enhance debit card autopay safety by providing recurring billing, real-time notifications, centralized tracking, and customizable automation. By combining careful oversight with automated solutions, individuals and businesses can efficiently manage recurring payments without compromising security or cash flow.