Running a business means handling many financial documents such as quotes, receipts, and invoices. Among these, the credit invoice is one of the most important tools for maintaining accurate records and strong client relationships.

If you have ever needed to fix an overcharge, refund a customer, or adjust a previous invoice, you have probably used or needed a credit invoice.

In this article, we will explain what a credit invoice is, when to use it, how to create one, and why a platform like ReliaBills is perfect for managing your invoicing needs.

Table of Contents

ToggleWhen and Why Should You Use a Credit Invoice?

A credit invoice, also known as a credit memo, is issued when you need to reduce or cancel an amount that a customer owes from a previous invoice. It is a professional and transparent way to correct billing errors or process refunds.

You might issue a credit invoice in these situations:

- You accidentally overcharged a customer.

- A client returned a product or canceled a service.

- You offered a discount after sending the invoice.

- The original invoice contained incorrect amounts or items.

By issuing a credit invoice, your business acknowledges that an adjustment is needed. It keeps your records accurate and helps maintain good relationships with your clients.

For example, if you billed a client $1,000 for design work but realized the total should be $900, you can issue a credit invoice for $100 to correct the overpayment.

What Are the Benefits of Using a Credit Invoice?

Using a credit invoice offers several benefits that help both your business and your customers.

1. Improved Accuracy

A credit invoice keeps your financial records clean and consistent. Every adjustment is documented properly, which helps during audits or reviews.

2. Better Customer Relationships

Issuing a credit invoice shows honesty and professionalism. Customers appreciate transparency, which builds trust and loyalty.

3. Easier Refund Processing

Instead of returning cash immediately, you can issue a credit invoice as store credit or apply it to a future purchase.

4. Compliance with Accounting Standards

Credit invoices help ensure that your business stays compliant with financial and tax reporting standards.

5. Simplified Record-Keeping

With credit invoices, it becomes easier to track and reconcile your accounts because all adjustments are clearly documented.

How to Create a Credit Invoice

Creating a credit invoice is simple, especially if you already issue standard invoices. The main difference is that the credit invoice reflects a negative amount or adjustment rather than a new charge.

Here is how to create one:

1. Start with Business and Client Details

Include your business name, logo, and contact details, as well as your client’s information.

2. Add a Unique Credit Invoice Number

Assign a new invoice number and clearly label the document as “Credit Invoice” or “Credit Memo.”

3. Reference the Original Invoice

Mention the invoice number that you are adjusting or refunding to maintain clear records.

4. Describe the Reason for the Credit

Provide a short explanation, such as product return, billing error, or customer discount.

5. List the Adjusted Amounts

Include the specific products or services affected and show the credit amounts as negative values.

6. Include Payment or Credit Details

Indicate whether the customer will receive a refund, credit, or future service discount.

7. Save and Send to the Client

Once you finalize the credit invoice, send it to the customer and keep a copy for your records.

Using invoicing software like ReliaBills makes this process faster and more professional. You can create and send credit invoices automatically in just a few clicks.

What Should Be on a Credit Invoice?

A professional credit invoice should contain all key details to avoid confusion. Include the following:

- Business name, address, and contact information

- Customer’s name and contact details

- Credit invoice number and issue date

- Original invoice reference number

- Description of products or services being adjusted

- Quantity and unit price if applicable

- Total credit amount shown as a negative value

- Reason for the credit

- Signature or company authorization if needed

These details help both you and your customer understand the reason and value of the adjustment clearly.

What Is a Debit Invoice?

A debit invoice is the opposite of a credit invoice. While a credit invoice reduces the amount owed, a debit invoice increases it.

You might issue a debit invoice when you undercharged a customer or need to include an additional fee that was left out.

For example, if you charged $700 for a project but the correct amount should have been $800, you can issue a debit invoice for $100.

Both debit and credit invoices keep your billing accurate and transparent.

Accounting for Credit Invoices in Your Bookkeeping

Recording a credit invoice correctly is essential for accurate bookkeeping. When you issue a credit invoice, it reduces both your accounts receivable and your recorded revenue.

Here is a simple breakdown:

- When you issue a standard invoice, it increases your revenue and accounts receivable.

- When you issue a credit invoice, it decreases both.

If a refund is involved, your cash account also decreases.

Most accounting software automatically handles these adjustments, but knowing how it works helps you stay in control of your finances.

Why Choose ReliaBills for Your Invoicing Needs

If you regularly send invoices, managing credit invoices manually can be time-consuming and prone to errors. That is why many businesses use ReliaBills, a trusted invoicing and recurring billing platform that simplifies the entire billing process.

Here’s why ReliaBills is an excellent choice for managing your credit invoices:

1. Easy to Use

ReliaBills lets you create professional credit invoices with customizable templates that reflect your brand.

2. Automated Billing and Notifications

Automate your invoice creation, payment reminders, and tracking so you never miss a detail.

3. Recurring Billing Features

If you bill clients regularly, ReliaBills automates recurring invoices and payments to keep your cash flow steady.

4. Centralized Record Management

Keep all your invoices, credit memos, and transactions organized in one convenient dashboard.

5. Secure Online Payments

Clients can pay securely online through multiple payment options, improving efficiency and trust.

By using ReliaBills, you can handle your credit invoices more easily and make your billing process faster and more reliable.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

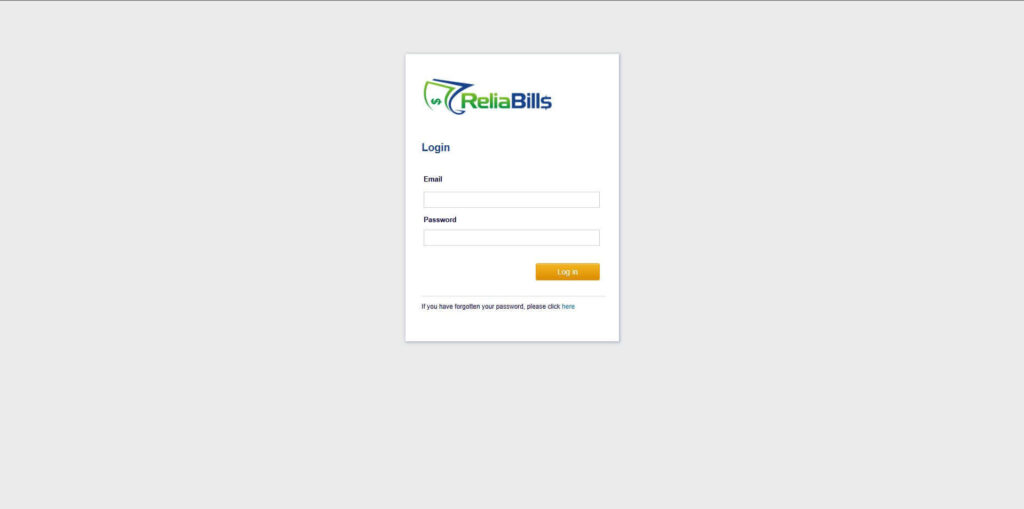

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

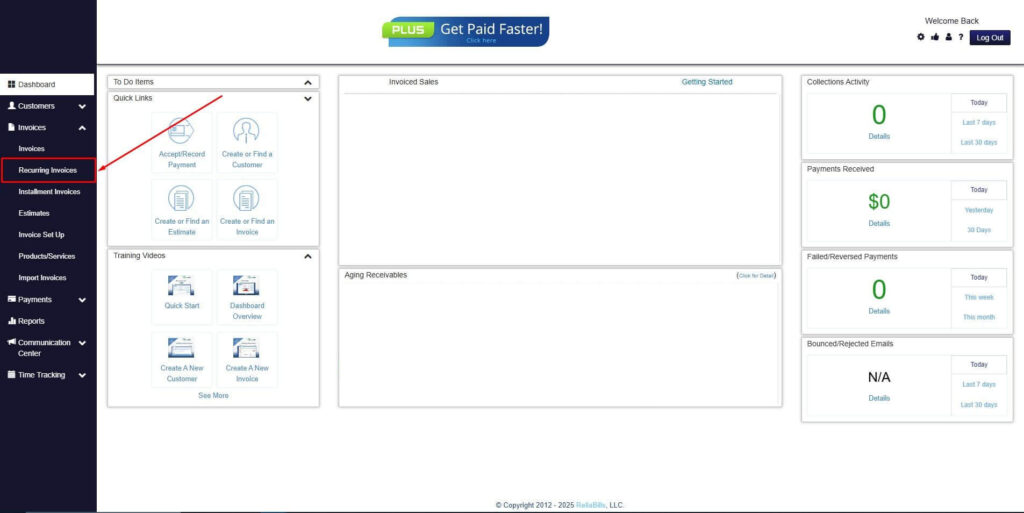

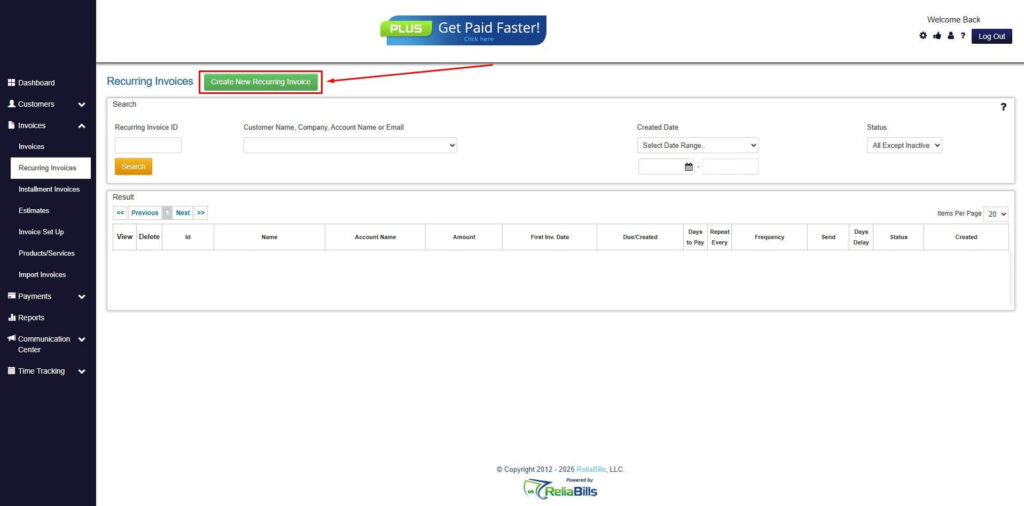

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

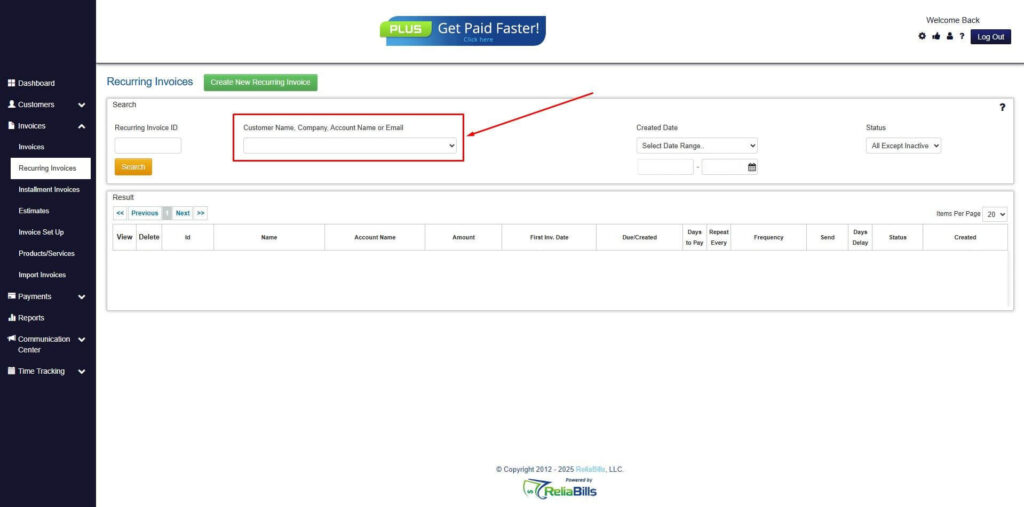

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

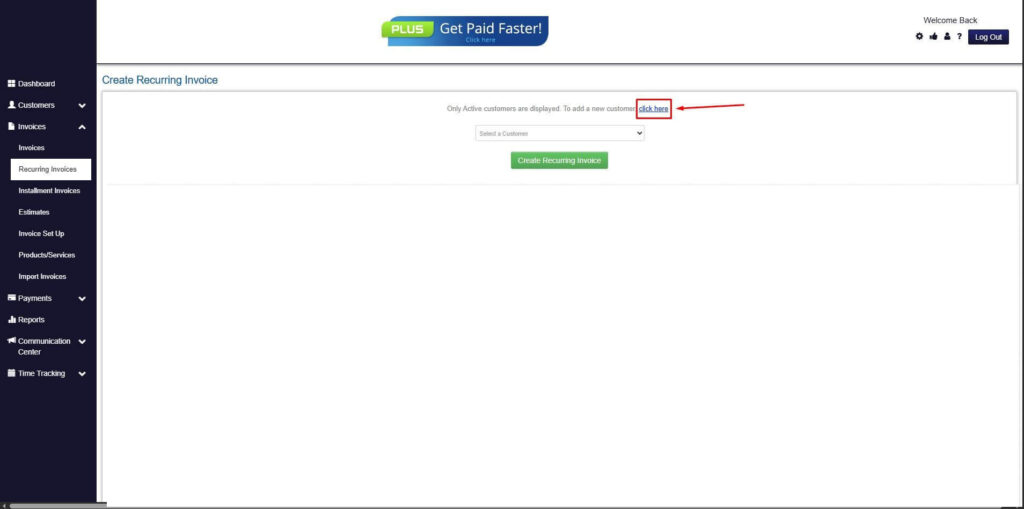

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

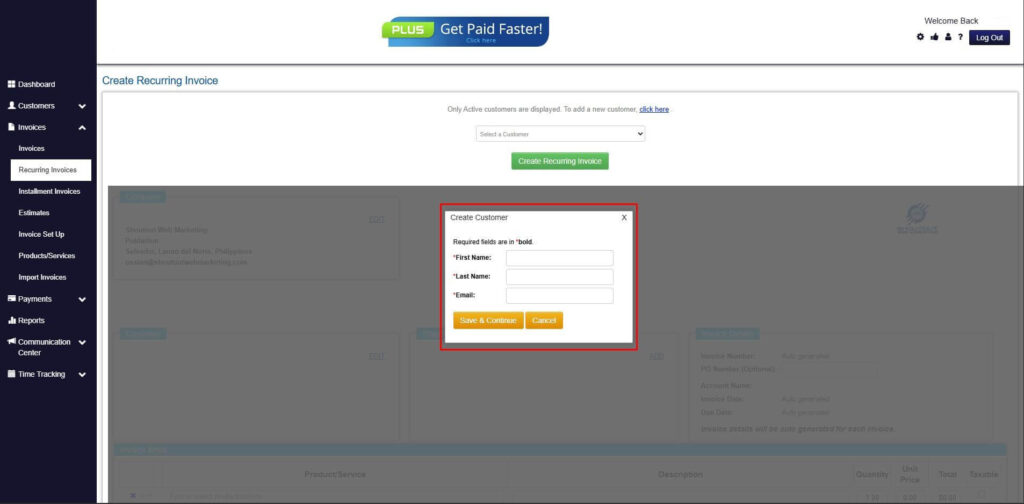

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

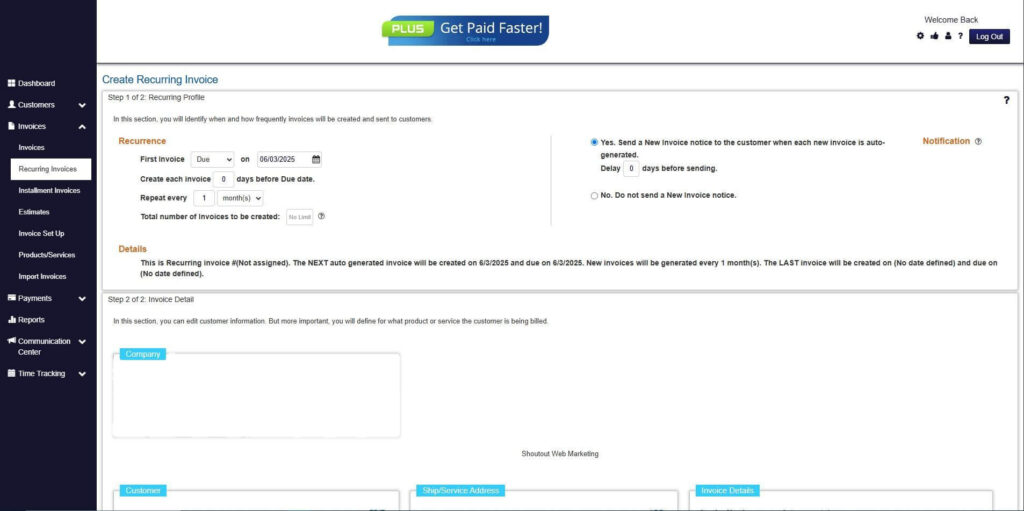

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

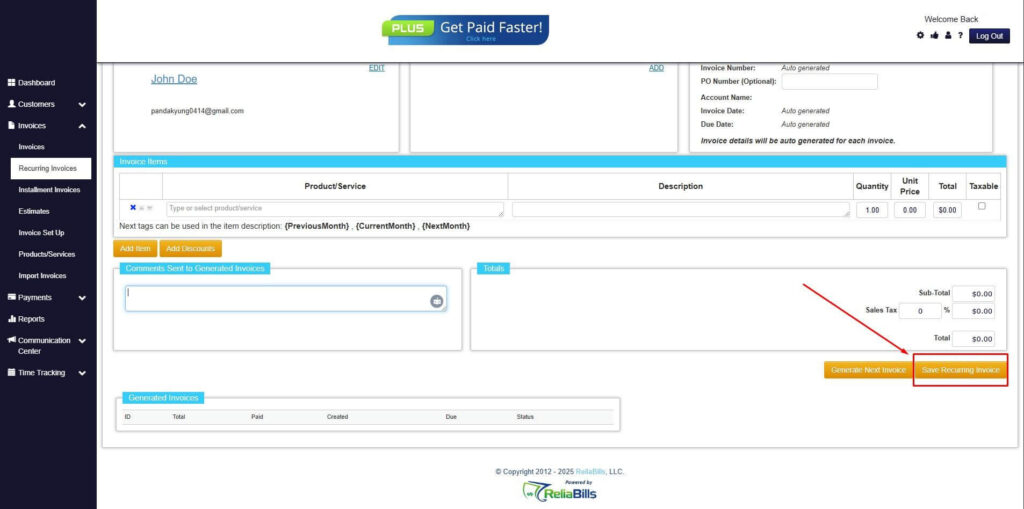

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

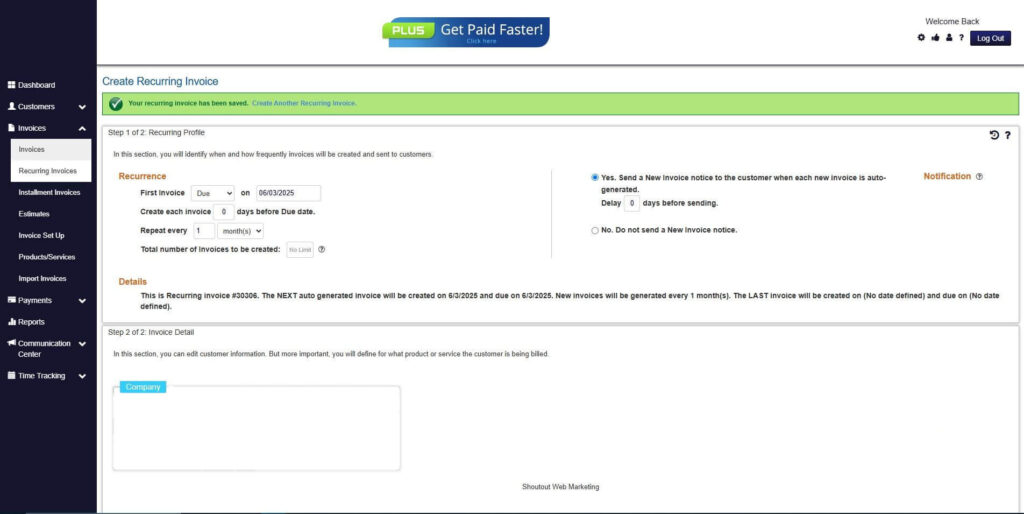

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What is the main purpose of a credit invoice?

A credit invoice reduces or cancels an amount that a customer owes, often due to billing errors, returns, or refunds.

2. How is a credit invoice different from a debit invoice?

A credit invoice decreases the amount owed, while a debit invoice increases it.

3. Can I issue a credit invoice for a partial refund?

Yes, you can issue a credit invoice for a specific portion of the original amount if only part of it needs adjustment.

4. Is a credit invoice the same as a refund?

Not exactly. A refund returns money to the customer, while a credit invoice records the credit that may be applied to future purchases or returned later.

5. Can I create credit invoices using ReliaBills?

Yes. ReliaBills allows you to create, send, and manage credit invoices automatically with ease.

Conclusion

A credit invoice is an essential tool for keeping your business finances accurate and transparent. Whether you are correcting a mistake, issuing a refund, or applying a discount, a credit invoice helps maintain professionalism and customer trust.

With ReliaBills, creating and managing credit invoices is easier than ever. You can automate your billing, track payments, and maintain organized records in one place.

Start simplifying your invoicing today. Sign up with ReliaBills and experience how effortless managing credit invoices can be.