Proper invoicing is essential for consultants who want to maintain steady cash flow and professional credibility. A well prepared consultant invoice ensures clients understand what they are paying for and when payment is expected. This clarity helps reduce delays and unnecessary back and forth.

Many consultants struggle with invoicing due to inconsistent billing terms or unclear service descriptions. Late invoicing and missing details often lead to delayed payments or disputes. These challenges can disrupt income and strain client relationships.

Clear invoicing supports stronger financial stability and long term client trust. When invoices are accurate and easy to understand, clients are more likely to pay on time. Effective invoicing is just as important as delivering quality consulting work.

Table of Contents

ToggleUnderstanding Consultant Invoicing

Consultant invoicing differs from standard product or service invoices in several ways. Consulting work is often intangible and requires clear explanations of value delivered. This makes detailed descriptions especially important.

Consultants commonly use multiple billing models depending on the engagement. These include hourly billing, fixed fee projects, retainers, and recurring arrangements. Each model affects how the consultant invoice is structured.

Legal and tax considerations also play a role in consultant invoicing. Taxes, compliance requirements, and proper documentation vary by location. Consultants should ensure invoices meet regulatory and contractual obligations.

Key Elements of a Consultant Invoice

Every consultant invoice should include complete business details and branding. This includes the consultant’s name, business address, and contact information. Professional branding reinforces credibility.

Client information is equally important for proper identification. Include the client’s name, billing address, and reference details. This prevents confusion and speeds up internal approvals.

Invoices should also clearly show the invoice number, dates, service descriptions, rates, and totals. Itemized consulting services improve transparency. Accurate totals reduce the risk of disputes.

Choosing the Right Billing Method

Hourly billing works well for flexible or short term consulting projects. It requires accurate time tracking and clear hourly rates. Transparency is critical to maintain client trust.

Fixed fee or project based billing is ideal for well defined scopes. Clients appreciate predictable costs, while consultants benefit from simplified invoicing. Clear deliverables should always be documented.

Retainer and recurring billing arrangements suit ongoing advisory services. Milestone billing is effective for long term projects with defined phases. Choosing the right method improves consistency and cash flow.

How to Create a Consultant Invoice Step by Step

Step 1: Gather service and time tracking data.

Collect records of hours worked, tasks completed, or milestones achieved. Accurate data ensures correct billing.

Step 2: Use a professional invoice template.

A standardized template keeps invoices consistent and easy to read. This saves time and reduces errors.

Step 3: Clearly describe services and outcomes.

Explain what was delivered and how it aligns with the agreement. Clear descriptions build confidence.

Step 4: Apply correct rates, taxes, and totals.

Double check calculations before sending the invoice. Accuracy prevents disputes.

Step 5: Add payment terms and notes.

Include due dates, accepted payment methods, and late fee policies. Clear terms set expectations.

Step 6: Send the invoice promptly.

Timely invoicing improves payment speed. Delays often lead to delayed payments.

Best Practices for Consultant Invoicing

Sending invoices on a consistent schedule helps clients plan payments. Whether weekly or monthly, consistency matters. Predictability improves payment behavior.

Transparency with clients builds trust and reduces questions. Always align invoices with agreed terms. Clear communication prevents misunderstandings.

Tracking invoices and keeping organized records is essential. Follow up on unpaid invoices promptly. Organized systems support long term success.

Common Invoicing Mistakes Consultants Should Avoid

Vague service descriptions are a common issue in consultant invoices. Clients may question charges they do not understand. Clear explanations prevent this.

Inconsistent rates or billing terms create confusion. Every invoice should match the agreement. Changes should always be communicated in advance.

Delayed invoicing and missing payment instructions also cause problems. Late invoices often result in late payments. Clear instructions make payment easier.

Handling Late Payments and Disputes

Setting clear payment expectations from the start reduces late payments. Payment terms should be discussed before work begins. This creates accountability.

When payments are late, polite reminders are usually effective. Follow ups should be professional and documented. Consistent communication matters.

Disputes should be handled calmly and professionally. Refer back to contracts and invoices. In some cases, pausing work or renegotiating terms may be necessary.

Recurring Billing for Consultants

Recurring billing makes sense for ongoing consulting relationships. Retainers and advisory services benefit from predictable invoicing. This model reduces administrative work.

Invoices for recurring services should be consistent and automated. Clients appreciate knowing what to expect each billing cycle. This improves satisfaction and retention.

Recurring billing provides more predictable income for consultants. It stabilizes cash flow and reduces the need for constant follow ups. This allows consultants to focus on delivering value.

How ReliaBills Helps Consultants Invoice Efficiently

ReliaBills makes consultant invoice creation simple and professional. Customizable templates ensure clarity and consistency. Consultants can invoice confidently.

Recurring billing is fully supported for retainers and ongoing services. Automated reminders help reduce late payments. This improves cash flow without manual effort.

ReliaBills also provides centralized tracking of clients and payments. Consultants can monitor invoice status in one place. This improves visibility and control.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

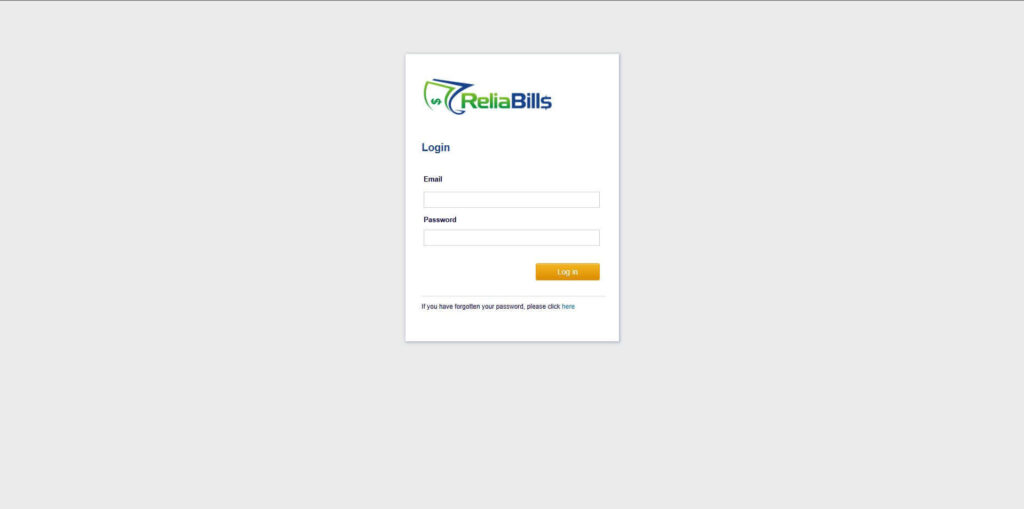

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

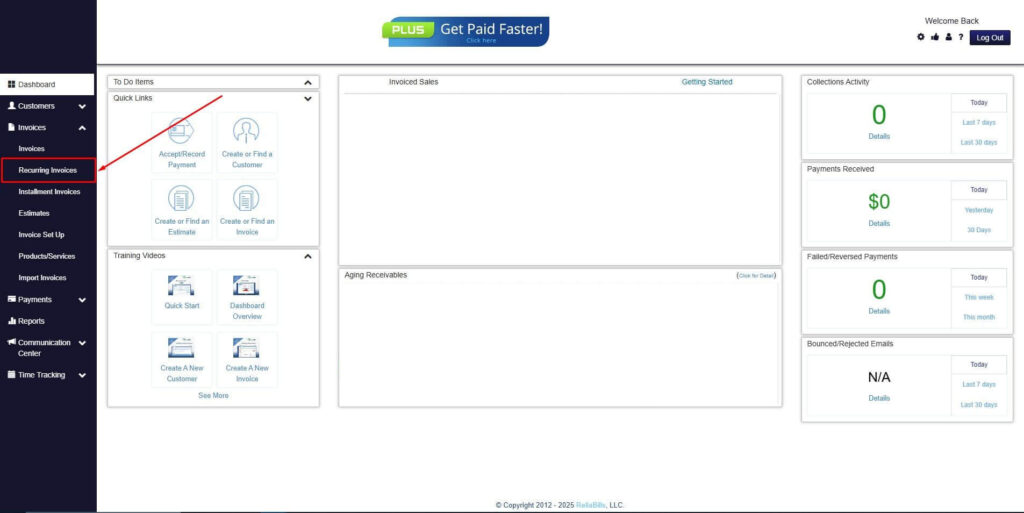

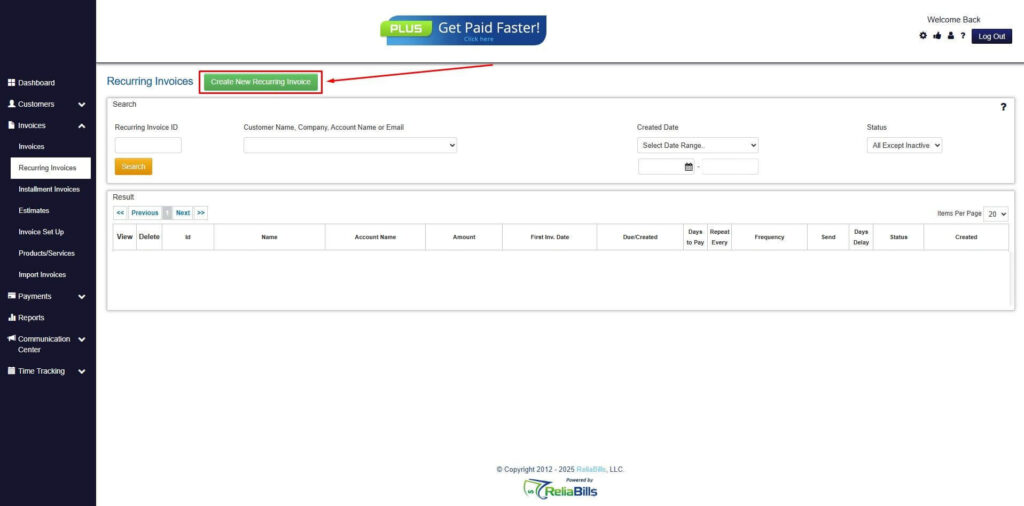

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

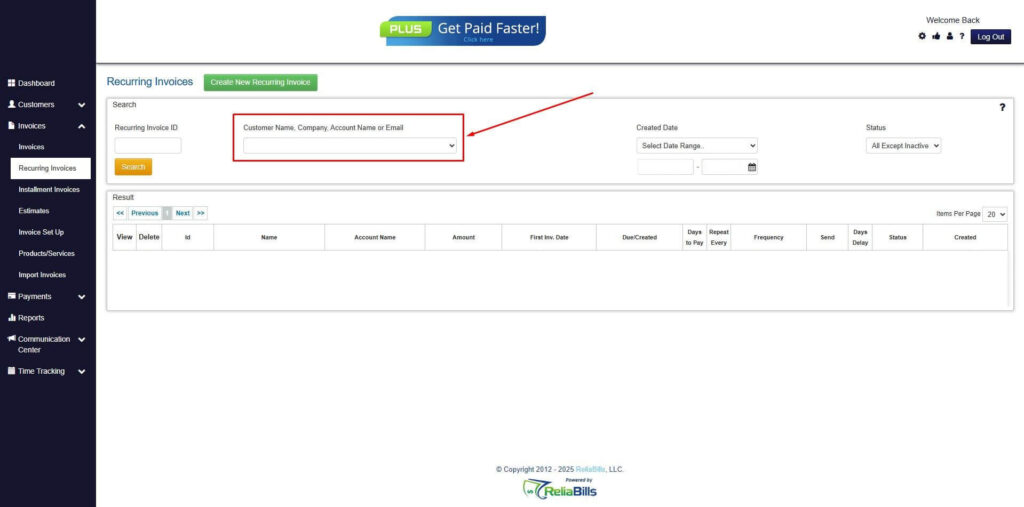

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

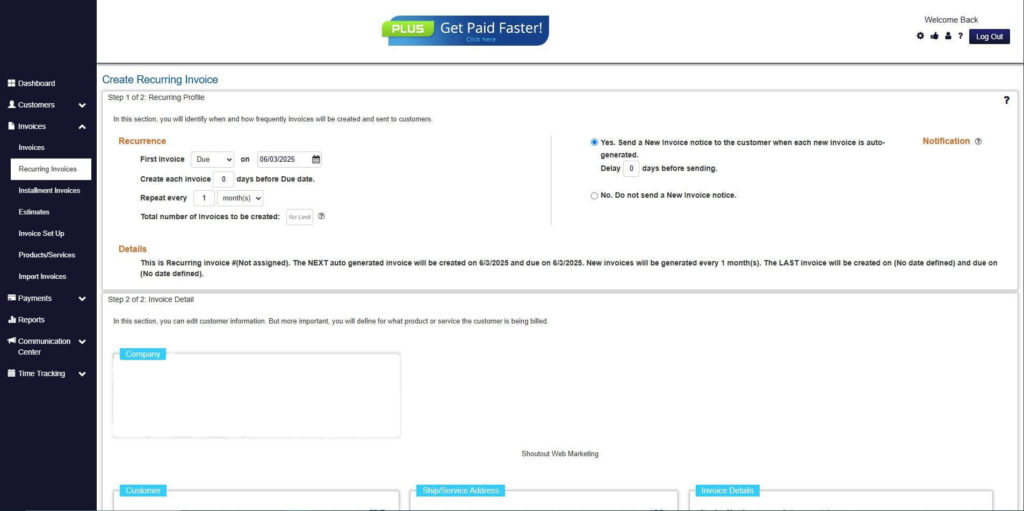

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

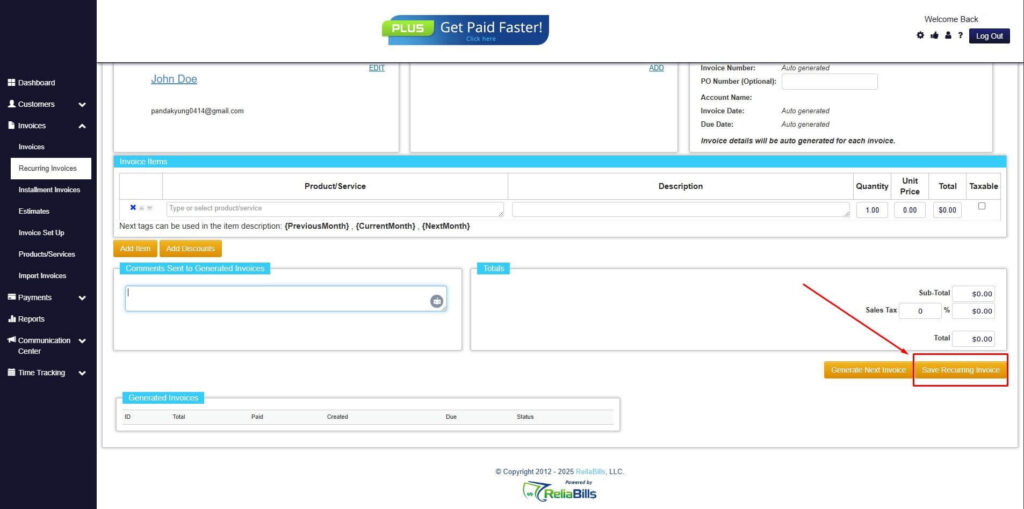

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How often should consultants invoice clients?

Most consultants invoice monthly or at project milestones, depending on the agreement.

2. Should consultants require upfront payments?

Upfront payments or deposits are common and help reduce payment risk.

3. What payment methods should be accepted?

Offering multiple digital payment options improves payment speed.

4. How can consultants speed up payments?

Clear invoices, automation, and timely follow ups help significantly.

Conclusion

Creating an effective consultant invoice is essential for financial stability and professionalism. Clear structure, accurate details, and consistent billing practices make a real difference. Good invoicing supports strong client relationships.

Choosing the right billing method and following best practices reduces stress and delays. Consultants who invoice promptly and clearly get paid faster. This supports sustainable growth.

By using modern tools and automation, consultants can simplify invoicing. Over time, this leads to better cash flow and fewer disputes. Strong invoicing supports long term success.