A consolidated invoice brings multiple charges or transactions into a single, easy to read document. Instead of sending separate invoices for each transaction, businesses can group them together under one billing statement. This approach is especially helpful for companies that bill clients frequently or manage ongoing services.

For businesses handling multiple transactions with the same client, invoicing can quickly become time consuming and confusing. Sending many individual invoices increases administrative work and raises the risk of missed or delayed payments. A consolidated invoice helps streamline billing while improving clarity for both parties.

By simplifying how charges are presented and paid, consolidated invoicing improves efficiency and cash flow. Clients appreciate receiving fewer invoices, while businesses benefit from better tracking and faster payments. Over time, this method creates a more organized billing process.

Table of Contents

ToggleWhat Is a Consolidated Invoice?

A consolidated invoice combines multiple individual charges into one invoice issued over a specific period. Unlike a standard invoice that covers a single transaction, a consolidated invoice summarizes several related transactions. Each charge is still listed clearly, but payment is made once.

This type of invoice is commonly used in B2B relationships, recurring services, and multi location operations. Businesses that provide frequent services or deliver products regularly often rely on consolidated invoices to reduce billing complexity. It is also popular among subscription based and contract driven businesses.

By grouping transactions together, consolidated invoices make accounting and record keeping easier. Finance teams spend less time reconciling multiple invoices and payments. Clients also gain a clearer overview of what they are paying for in one document.

Benefits of Consolidated Invoicing

One of the biggest advantages of using a consolidated invoice is the reduction in administrative workload. Fewer invoices mean less time spent creating, sending, and tracking individual bills. This allows teams to focus on more strategic tasks instead of repetitive billing work.

Consolidated invoicing also simplifies payment processing for clients. Instead of approving and paying multiple invoices, clients can make one payment for all charges. This convenience often leads to faster payments and fewer disputes.

Another key benefit is improved cash flow visibility. With all charges grouped together, businesses can see outstanding balances more clearly. This reduces errors, duplicate payments, and confusion during reconciliation and reporting.

Key Components of a Consolidated Invoice

A well structured consolidated invoice starts with clear business and client information. This includes company details, client name, billing address, and contact information. Accurate identification ensures invoices are processed smoothly.

The core of the invoice is a detailed list of included transactions. Each line should show dates, descriptions, reference numbers, and individual amounts. Transparency is essential so clients understand exactly what they are being charged for.

The invoice should also display the total amount due, payment terms, and accepted payment methods. Supporting documentation or references to original invoices may be included for clarity. These elements help prevent questions and payment delays.

Types of Consolidated Invoices

Consolidated invoices can be issued on a daily, weekly, or monthly basis depending on transaction volume. Businesses with frequent activity often choose weekly or monthly consolidation to reduce invoice volume. This structure keeps billing predictable and organized.

Project based consolidation is common for long term or multi phase projects. Charges related to milestones, materials, and labor can be grouped into one invoice. This helps clients track progress and costs more easily.

Some businesses use customer account or multi location consolidation. This approach is ideal for franchises or enterprises with multiple service locations. All charges roll up into a single consolidated invoice for the parent account.

How to Create a Consolidated Invoice

Step 1: Identify the transactions that should be included in the consolidated invoice. These may be tied to a specific period, project, or customer account. Consistency is important when defining inclusion criteria.

Step 2: Gather invoice details and supporting documents for each transaction. This includes dates, descriptions, amounts, and reference numbers. Accurate data prevents disputes and corrections later.

Step 3: Calculate totals, taxes, and adjustments before finalizing the invoice. Add clear payment terms and client notes, then deliver the consolidated invoice digitally or physically. Always review the invoice for accuracy before sending.

Best Practices for Consolidated Invoicing

Maintaining clear and consistent transaction records is essential for effective consolidated invoicing. Every charge should be documented and traceable to its source. This supports transparency and audit readiness.

Standardizing invoice formats across teams or locations helps reduce confusion. When invoices follow the same structure, clients know what to expect. Consistency also speeds up internal processing.

Automating invoice generation for recurring transactions improves accuracy and efficiency. Automated systems reduce manual errors and ensure invoices are sent on time. Payment tracking and reconciliation become much easier as a result.

Common Mistakes to Avoid

One common mistake is omitting transaction details from the consolidated invoice. Without proper descriptions, clients may question charges or delay payment. Clarity is always better than brevity.

Another issue is sending invoices with incorrect totals due to calculation errors. These mistakes damage trust and require additional follow up. Reviewing invoices before sending helps prevent this problem.

Failing to update records after payments are received can also cause confusion. Inaccurate balances lead to unnecessary reminders or disputes. Keeping records current is critical for reliable billing.

How ReliaBills Simplifies Consolidated Invoicing

ReliaBills simplifies consolidated invoicing by automating the process of grouping multiple transactions into a single invoice. Its centralized dashboard allows businesses to manage and review invoices efficiently. This reduces manual work and improves billing accuracy.

Recurring billing is a major advantage of ReliaBills for businesses with ongoing services. Transactions are automatically consolidated based on predefined billing cycles. Automated reminders encourage timely client payments and reduce follow up efforts.

ReliaBills PLUS expands these capabilities with advanced reporting and customization options. It supports growing businesses that manage higher transaction volumes and complex billing structures. With ReliaBills PLUS, businesses gain deeper insights while maintaining clean and professional consolidated invoices.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

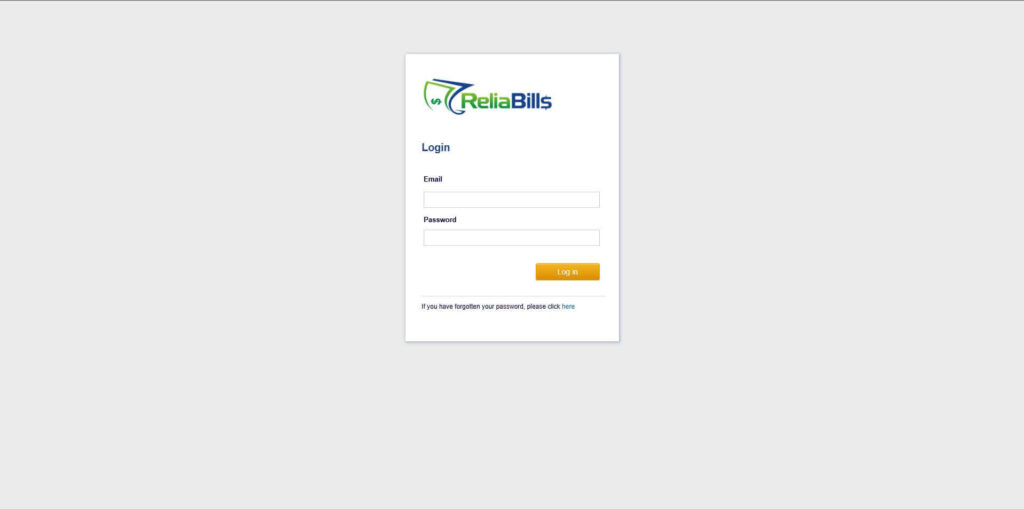

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

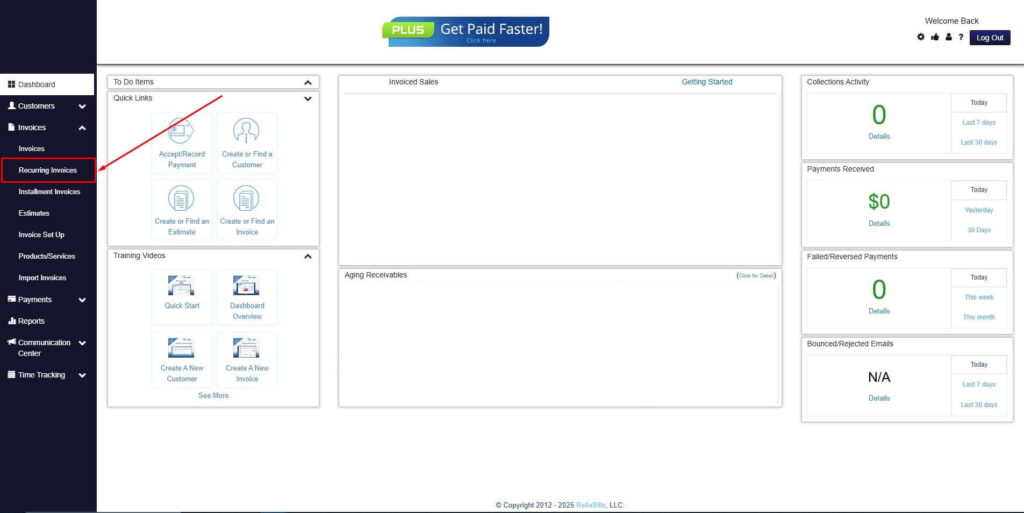

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

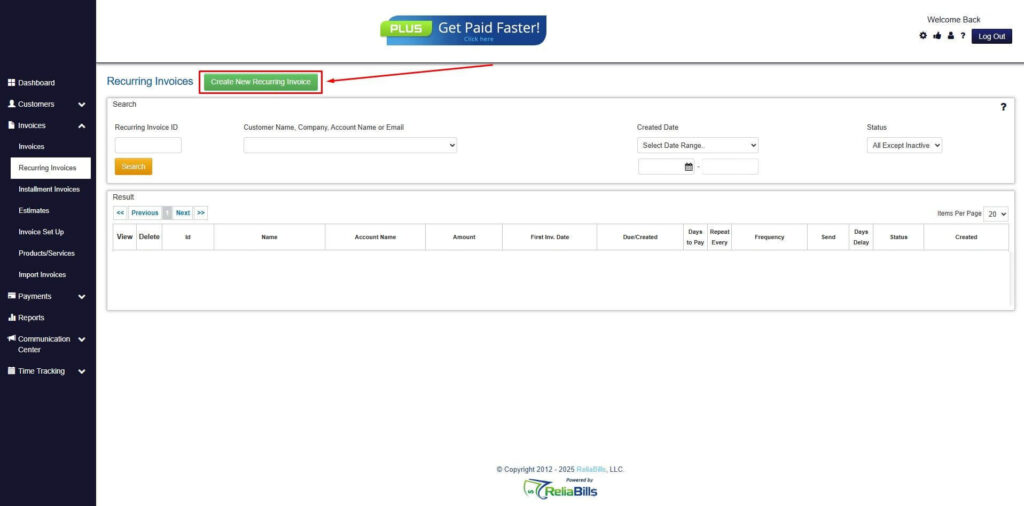

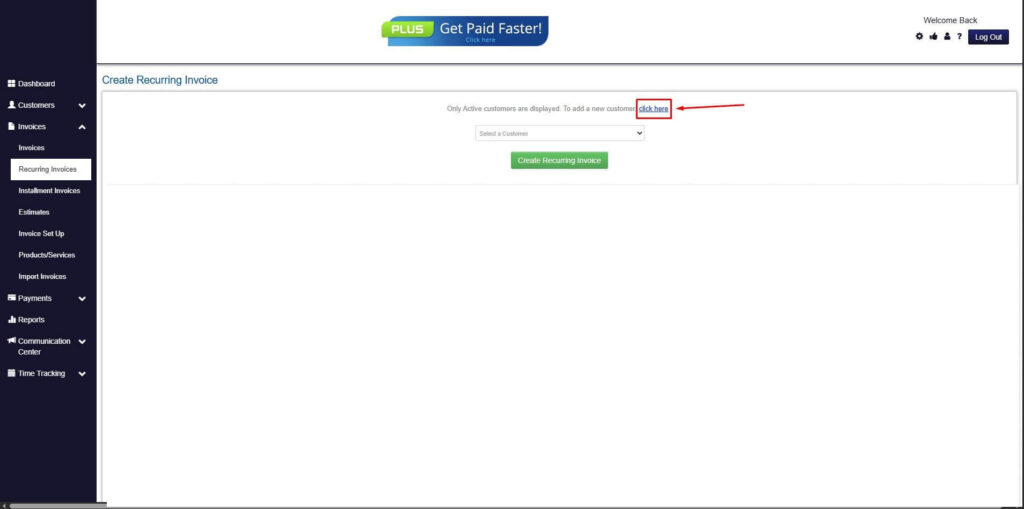

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

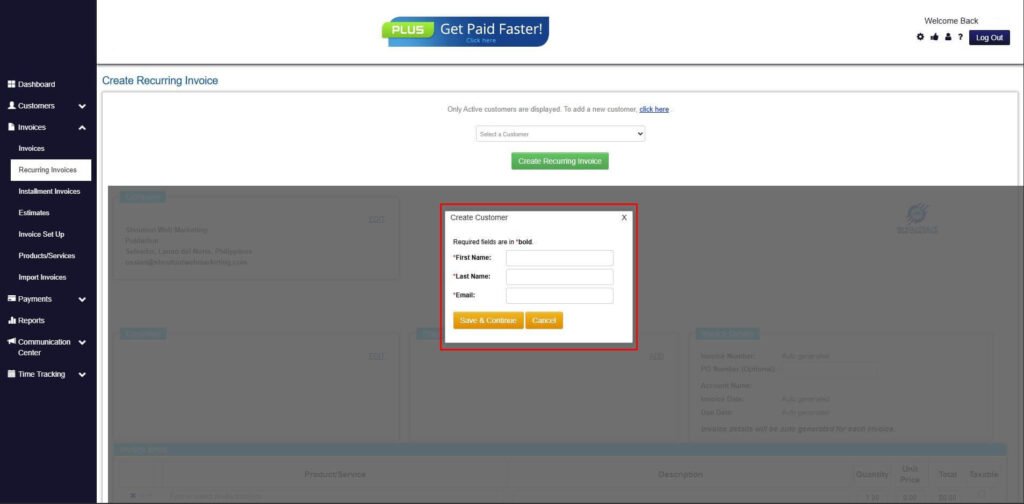

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

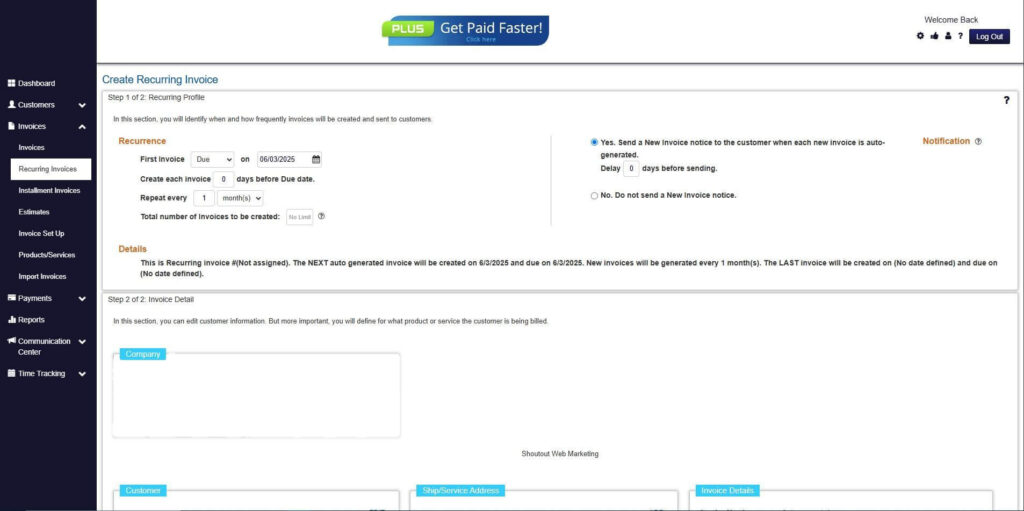

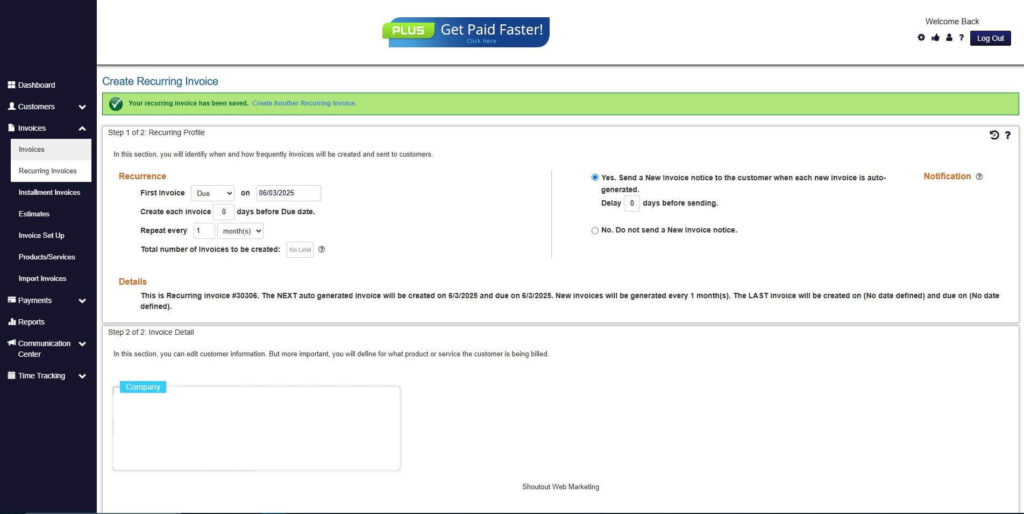

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

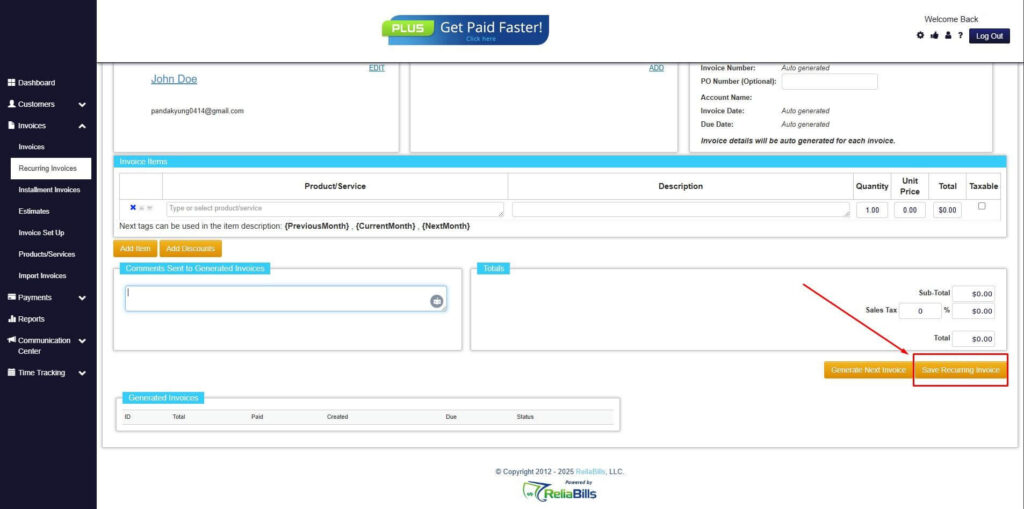

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Can consolidated invoices include partial payments?

Yes, consolidated invoices can reflect partial payments as long as balances are updated accurately.

2. How often should businesses issue a consolidated invoice?

The frequency depends on transaction volume, client preference, and internal billing policies.

3. Are consolidated invoices legally accepted in all industries?

Most industries accept consolidated invoices, but businesses should confirm compliance requirements.

4. How can disputes be handled with consolidated invoices?

Clear transaction references and documentation make dispute resolution faster and easier.

Conclusion

A consolidated invoice is a powerful tool for businesses that manage multiple transactions with the same client. It reduces administrative effort while improving clarity and efficiency. Both businesses and clients benefit from a simpler billing experience.

By following best practices and avoiding common mistakes, consolidated invoicing becomes a reliable part of financial operations. Automation further strengthens accuracy and consistency. Over time, billing becomes more predictable and manageable.

With solutions like ReliaBills, businesses can adopt consolidated invoicing with confidence. Streamlined billing supports better cash flow, stronger client relationships, and long term growth. Consolidated invoicing is a smart step toward modern financial management.