Billing and payment processing are the backbone of any modern business, whether you are a small startup or an established company. They ensure that products or services are accurately invoiced and that payments are collected efficiently. Understanding how these processes work together is critical for maintaining cash flow, avoiding accounting errors, and keeping customers satisfied.

In this guide, we’ll explain what billing and payment processing are, highlight common challenges businesses face, and provide practical insights on how automation and best practices can streamline these essential operations. By the end, you’ll have a clear understanding of how to optimize your business’s financial workflow for efficiency and accuracy.

Table of Contents

ToggleWhat Is Billing?

Billing is the process of creating and sending invoices or bills to customers for goods or services provided. It can take various forms, such as one-time payments for a single purchase, recurring billing for subscription services, or ongoing invoicing for long-term contracts.

Key elements of an invoice include the total amount due, payment terms, due date, a description of goods or services, applicable taxes, and customer information. Accurate billing ensures that clients clearly understand what they owe and helps businesses maintain timely revenue collection. Properly structured bills also serve as essential documentation for accounting, auditing, and legal compliance.

Billing is not just about sending an invoice; it is the first step in the payment collection process. A well-designed billing system reduces confusion, minimizes disputes, and sets clear expectations for clients, which is especially important for small businesses looking to maintain trust and professional relationships.

What Is Payment Processing?

Payment processing is the execution stage of billing. It involves accepting and handling customer payments through various methods, including credit and debit cards, ACH transfers, digital wallets, checks, or even direct bank transfers. Payment processors, gateways, and banks work together to ensure funds move securely from the customer to the business.

Effective payment processing requires accuracy, speed, and security. Errors in processing, delays, or failed transactions can negatively affect cash flow and customer satisfaction. Modern solutions integrate multiple payment methods, allowing businesses to meet customer preferences while maintaining secure handling of sensitive financial data.

In essence, while billing generates the request for payment, payment processing ensures the transaction is completed and recorded properly. Seamless integration between these two functions prevents discrepancies and simplifies reconciliation.

The Relationship Between Billing and Payment Processing

Billing and payment processing are two sides of the same coin. Billing triggers the payment request, while payment processing executes that request. When these systems are integrated, businesses benefit from faster payment collection, fewer errors, and a smoother overall workflow.

For example, recurring billing can automatically generate invoices on scheduled dates, and integrated payment processing can immediately collect the funds. This seamless cycle reduces the risk of late payments, simplifies accounting, and provides real-time visibility into outstanding balances. Businesses that treat these functions as separate often face reconciliation issues, delays, and administrative bottlenecks.

Integration also improves customer experience. Clients receive clear, accurate invoices and multiple convenient payment options, which increases trust and encourages timely payments.

Common Challenges Businesses Face

Manual Invoicing and Payment Tracking

Relying on spreadsheets or disconnected systems often leads to errors such as duplicate invoices, missing payments, or unrecorded transactions. Small mistakes can escalate into larger cash flow problems over time.

Late or Missed Payments

Without automated reminders or clear billing cycles, customers may delay payments. This affects working capital, disrupts financial planning, and creates unnecessary follow-up tasks for staff.

Reconciliation and Accounting Errors

When billing and payment records are kept separately, reconciling accounts becomes time-consuming and error-prone. Mistakes in payment allocation can result in inaccurate financial reports.

Security and Compliance Risks

Handling sensitive customer information manually increases the risk of fraud or data breaches. Businesses must comply with regulations such as PCI DSS for card payments and maintain proper documentation for audits.

Customer Confusion and Disputes

Poorly formatted or inconsistent invoices can confuse clients, leading to disputes, delayed payments, or damaged business relationships.

Benefits of Streamlining Billing and Payment Processing

Faster Payment Collection

Automated invoicing and integrated payment processing reduce delays, helping businesses receive funds quickly and maintain steady cash flow.

Reduced Administrative Workload

Automation eliminates repetitive tasks like manual invoice creation, payment tracking, and reconciliation, allowing teams to focus on higher-value activities.

Improved Accuracy and Fewer Errors

Standardized processes reduce human mistakes, such as incorrect totals, missing taxes, or misapplied payments, improving financial reliability.

Enhanced Customer Experience

Clear, accurate invoices and convenient payment options increase client satisfaction and encourage on-time payments.

Better Reporting and Compliance

Integrated systems provide real-time financial reports and audit-ready records, making tax filing and regulatory compliance easier.

Predictable Revenue Through Recurring Billing

For subscription or repeat services, recurring billing ensures consistent income, reduces manual follow-ups, and minimizes late payments.

How Automation Bridges Billing and Payment

Automation plays a critical role in connecting billing with payment processing. Invoice generation can be automated to match payment cycles, reducing manual data entry and eliminating human errors.

Recurring billing enables businesses to schedule repeated invoices and payments, which is especially useful for subscription services or long-term contracts. Automated integration with accounting systems ensures that every payment is properly recorded, and reconciliations happen in real time.

Overall, automation reduces delays, improves accuracy, and allows teams to focus on higher-value tasks like customer service or business growth.

Best Practices for Small Businesses

- Implement Clear Billing Policies – Set expectations for payment terms, due dates, and follow-up procedures. Share policies upfront with customers to avoid confusion.

- Use Secure and Reliable Payment Solutions – Choose platforms that support multiple payment methods and integrate seamlessly with billing, ensuring security and speed.

- Align Billing and Payment Cycles – Synchronize invoice issuance with payment processing to maintain cash flow, especially when managing recurring services or subscriptions.

- Regularly Reconcile Transactions – Perform frequent audits of invoices and payments to catch discrepancies early and maintain accurate financial records.

- Leverage Automation for Repeating Tasks – Automate recurring billing and invoice generation to reduce human error and ensure timely payments.

- Provide Clear and Professional Invoices – Include all essential details such as item descriptions, taxes, due dates, and contact information to prevent disputes.

Common Mistakes to Avoid

- Using Separate or Unintegrated Systems – Managing billing and payments independently can create gaps, errors, and reconciliation challenges.

- Ignoring Late Payment Follow-Ups – Not sending reminders or communicating overdue invoices slows cash flow and can strain client relationships.

- Overcomplicating Invoices – Complex or inconsistent invoice formats confuse clients and increase the chance of errors or disputes.

- Neglecting Security and Compliance – Mishandling sensitive payment data can lead to breaches, penalties, or compliance violations.

- Relying Solely on Manual Processes – Manual tracking, calculations, and entry increase errors and waste time, particularly for recurring transactions.

How ReliaBills Supports Integrated Billing and Payment Processing

ReliaBills provides a unified platform that brings both billing and payment processing together so businesses can manage invoices and payments in one place. With automated invoice generation, users can quickly create and send professional bills without manual effort, reducing the risk of human errors and saving valuable administrative time. This approach ensures that invoices are issued promptly, which lays the foundation for faster payment processing and stronger cash flow.

One of the key strengths of ReliaBills is its recurring billing capability, which allows businesses to set up scheduled invoices for ongoing or subscription-based services. Once configured, the system automatically generates and delivers these invoices according to the defined schedule, and payment processing tools linked within the platform give customers a straightforward way to complete transactions online. These integrated features eliminate the need to juggle separate systems for billing and payments, streamlining operations and reducing reconciliation challenges.

ReliaBills also offers detailed reporting and centralized tracking of accounts receivable, giving business owners real-time visibility into which invoices have been issued, paid, or are overdue. Customizable invoices, branded communications, and options for online payment methods such as credit/debit cards or ACH make it easier for customers to pay, improving the overall payment experience. With these tools, businesses can monitor revenue trends, stay on top of outstanding balances, and make more informed financial decisions without the friction of disjointed workflows.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

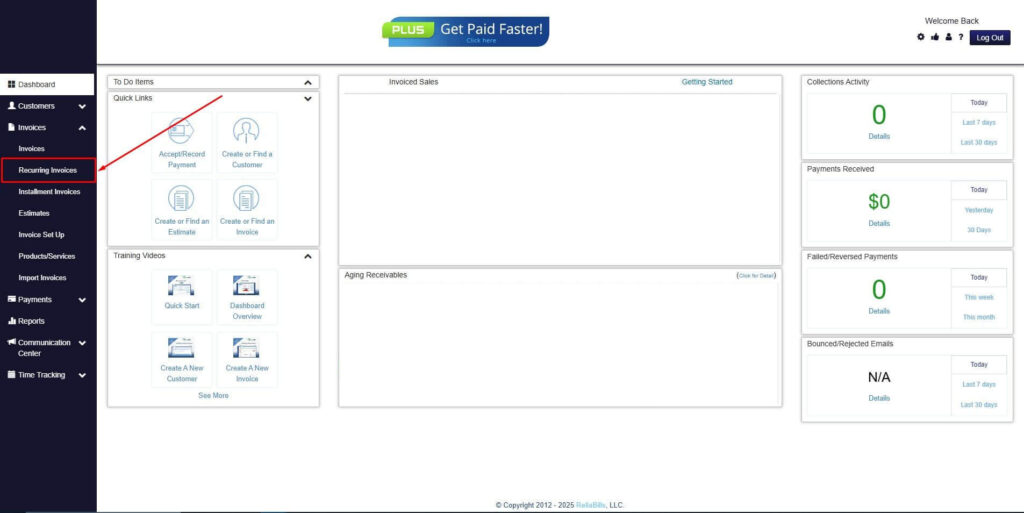

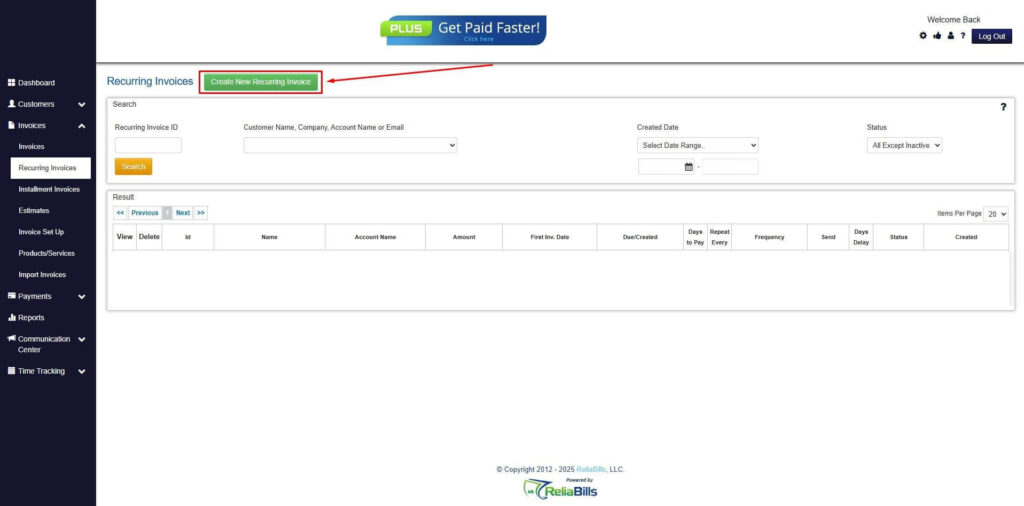

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

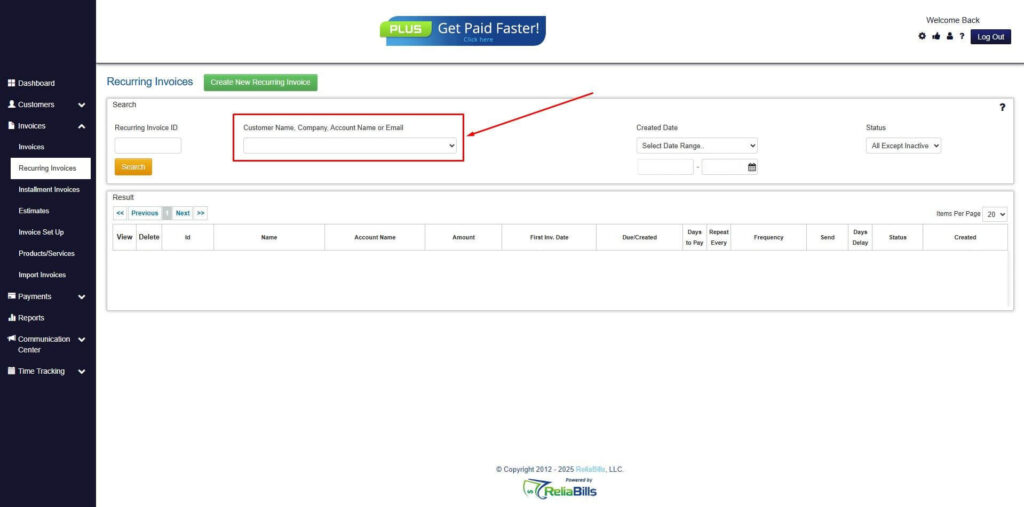

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

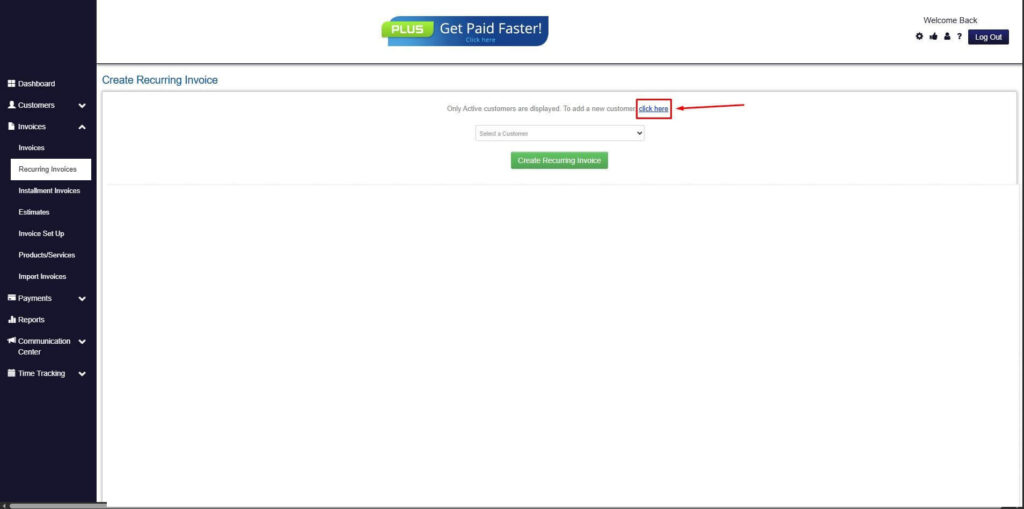

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

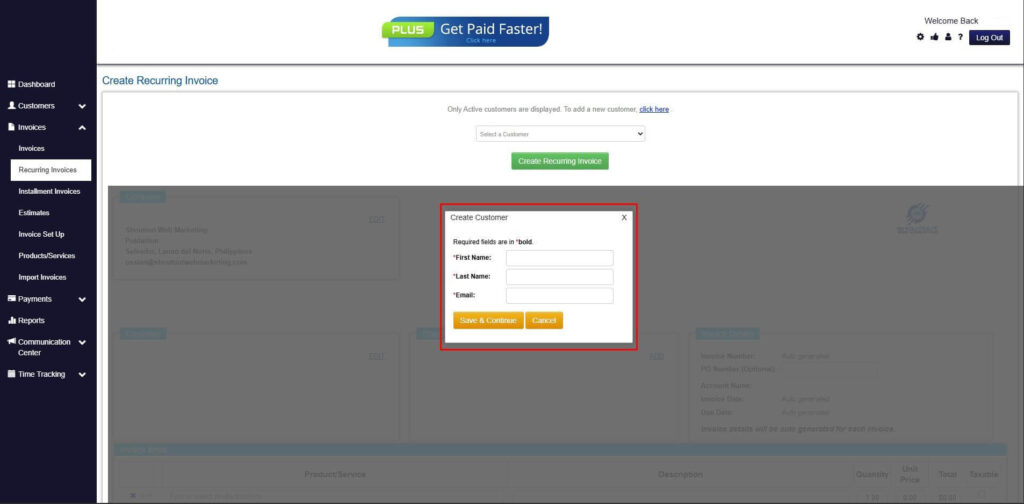

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

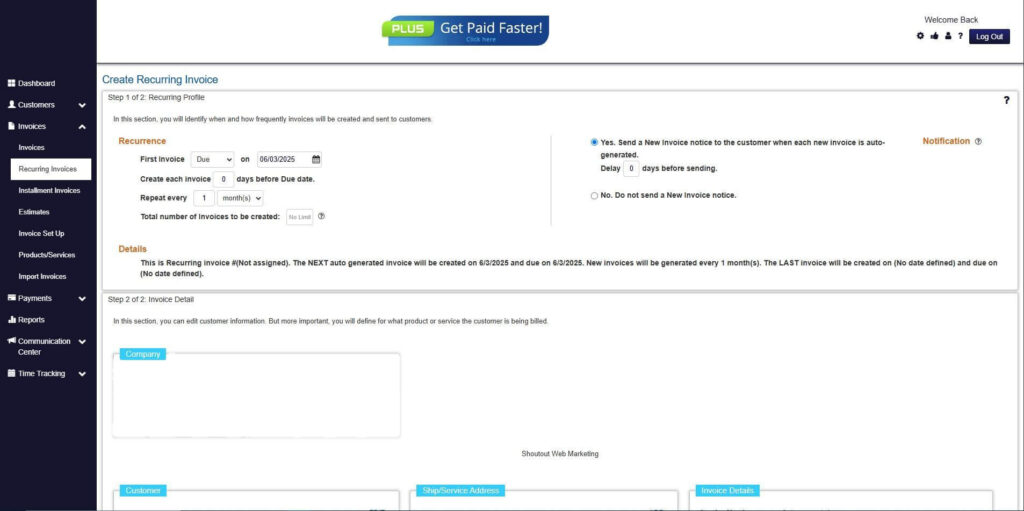

Step 7: Fill in the Create Recurring Invoice Form

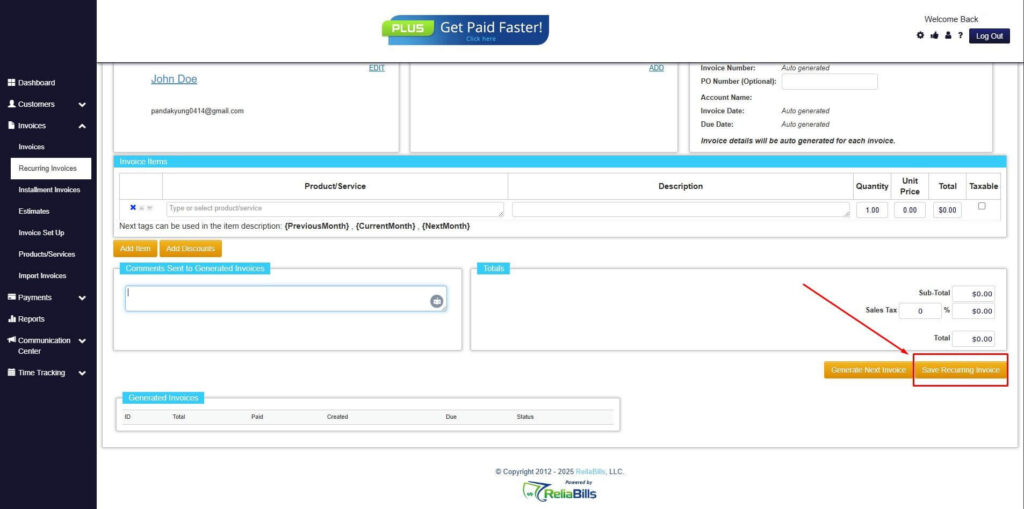

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

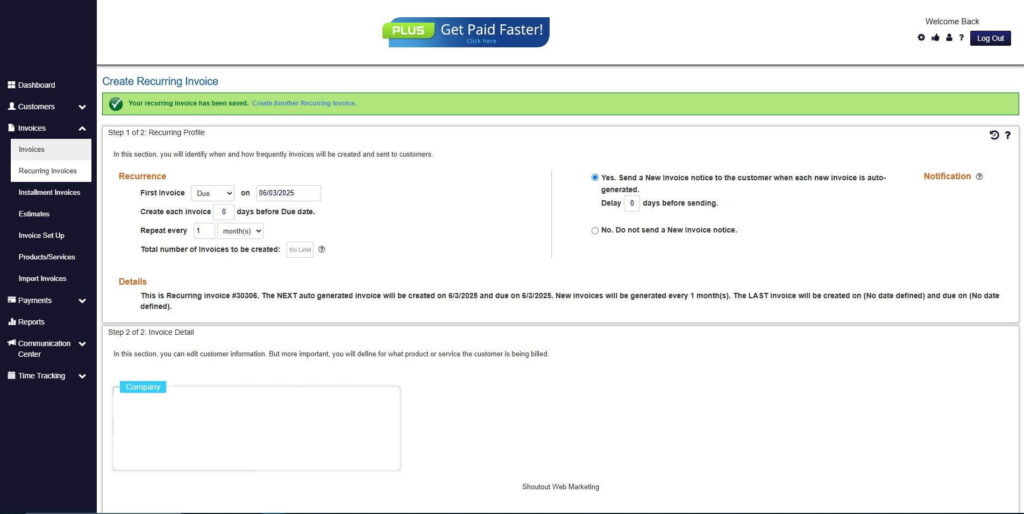

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Can billing and payment processing be fully automated?

Yes. Platforms like ReliaBills automate invoice generation, recurring billing, and payment collection, reducing manual effort and errors.

2. What payment methods should small businesses accept?

A combination of credit/debit cards, ACH transfers, and digital wallets offers convenience for clients and ensures faster payments.

3. How does recurring billing improve cash flow?

By automatically generating invoices and collecting payments on schedule, recurring billing creates predictable revenue and reduces late payments.

4. Is integration with accounting software necessary?

Yes. Integration ensures accurate recordkeeping, real-time reconciliation, and simplified reporting for audits and tax compliance.

5. How can automation reduce errors in billing and payment processing?

Automation eliminates repetitive data entry, standardizes invoices, applies taxes and calculations correctly, and tracks payment status in real time.

Conclusion

Billing and payment processing are essential functions that must work hand-in-hand for business efficiency. When integrated, they reduce errors, accelerate revenue collection, and improve customer experience. Small businesses benefit greatly from automation and recurring billing, which provide predictable income and simplify financial management.

By adopting best practices and leveraging platforms like ReliaBills, businesses can streamline operations, maintain compliance, and focus on growth, all while ensuring accurate and timely payments.