B2B payments continue to evolve as businesses demand faster, more reliable ways to move money. In 2026, payment expectations are shaped by digital transformation, tighter cash flow management, and growing automation across finance teams. Companies that modernize their B2B payment processes are better positioned to reduce delays and improve financial visibility.

Traditional B2B payment workflows often involve long approval cycles and manual reconciliation. These processes create friction that slows operations and strains supplier relationships. As competition increases, businesses can no longer afford inefficient payment systems.

This guide explains how B2B payments work today, what is changing in 2026, and how businesses can choose the right B2B payment method to stay competitive. It also highlights emerging trends, common challenges, and practical strategies for improvement.

Table of Contents

ToggleWhat Are B2B Payments?

B2B payments refer to financial transactions made between businesses for goods or services. These payments typically involve higher values, longer payment terms, and more complex approval workflows than consumer transactions. Accuracy, documentation, and traceability are critical in B2B environments.

Unlike B2C payments, B2B transactions often rely on invoicing rather than instant point-of-sale payments. Payment terms such as net 30 or net 60 are common, which affects cash flow timing. Many businesses also require detailed records for accounting and compliance purposes.

Common B2B payment scenarios include vendor payments, subscription services, wholesale purchases, and professional services. Choosing the right B2B payment method depends on transaction volume, payment frequency, and operational needs.

B2B Payment Trends in 2026

Wider Adoption of Digital and Electronic Payments

More businesses are replacing paper checks with digital B2B payment methods such as ACH, card payments, and invoice-based electronic payments. These options reduce processing delays and improve payment traceability. Digital payments also make reconciliation faster and more accurate for finance teams.

Increased Use of Automation and AI

Automation is becoming a standard expectation in B2B payments. Businesses are using automated invoicing, payment reminders, and reconciliation to reduce manual work and errors. AI-driven tools are also helping identify payment delays, disputes, and cash flow risks earlier.

Demand for Faster Settlement Times

B2B buyers and suppliers now expect quicker access to funds. Same-day or near-real-time settlement options are gaining traction as businesses look to improve liquidity. Faster payments help reduce days sales outstanding and strengthen supplier relationships.

Stronger Focus on Security and Compliance

As digital transactions increase, businesses are investing more in fraud prevention and data protection. Compliance with financial regulations and security standards is a top priority. Secure authentication and encrypted payment workflows are now essential components of any B2B payment method.

Common B2B Payment Methods

Bank Transfers and ACH Payments

ACH remains one of the most common B2B payment methods due to its reliability and low transaction costs. It is widely used for vendor payments, payroll, and recurring invoices. While settlement times may vary, ACH is a trusted option for high-volume transactions.

Wire Transfers

Wire transfers are often used for urgent or high-value payments, especially in international transactions. They provide speed but typically come with higher fees. Businesses use wires selectively when timing is critical.

Credit Cards and Virtual Cards

Card-based payments are increasingly used in B2B, particularly for smaller transactions or recurring expenses. Virtual cards add an extra layer of security and control. They also simplify expense tracking and reconciliation.

Digital Wallets and Payment Platforms

Digital wallets and online payment platforms are becoming more accepted in B2B environments. These tools offer convenience and faster processing. They are especially useful for cross-border payments and online services.

Invoice-Based and Recurring Payments

Invoice-based payments remain central to B2B transactions. When combined with recurring billing, they create predictable revenue streams and reduce late payments. Automated invoice payments improve cash flow and reduce administrative effort.

Challenges in B2B Payments

Long Payment Cycles and Delayed Settlements

Extended payment terms are common in B2B, which can strain cash flow. Even when invoices are accurate, internal approval delays can slow payments. Businesses often struggle with inconsistent payment timing.

Manual Invoicing and Reconciliation

Manual processes increase the risk of errors and missed payments. Finance teams spend significant time matching payments to invoices. This lack of automation limits efficiency and scalability.

High Transaction and Processing Costs

Certain B2B payment methods, such as wire transfers, carry high fees. Without proper oversight, costs can accumulate quickly. Businesses need visibility into fees to manage expenses effectively.

Disputes, Errors, and Limited Visibility

Incomplete or unclear invoice data often leads to disputes. Without centralized tracking, resolving issues becomes time-consuming. Limited visibility makes it difficult to monitor payment performance.

The Role of Invoicing in B2B Payments

Accurate invoicing plays a central role in every B2B payment method. Clear invoices with correct details reduce disputes and speed up approvals. Even small errors can delay payment for weeks.

Standardized invoice formats help customers process payments faster. Including clear payment terms, due dates, and references improves consistency across transactions. Well-structured invoices also support automation and reporting.

When invoicing is integrated with payment systems, businesses gain better control over cash flow. Faster invoice delivery and easier payment options directly impact how quickly payments are received.

Automating B2B Payments

Automation simplifies complex B2B payment workflows. Automated invoicing, reminders, and reconciliation reduce manual work and administrative costs. This allows finance teams to focus on higher-value tasks.

Integrating invoicing and payment systems improves data accuracy. Payments can be matched to invoices automatically, reducing errors and disputes. Automation also supports real-time visibility into outstanding balances.

Businesses that automate B2B payments experience faster processing and improved customer satisfaction. Consistency and reliability become easier to maintain at scale.

Recurring and Subscription-Based B2B Payments

Recurring billing is becoming more common in B2B environments. Businesses use it for subscriptions, retainers, service contracts, and ongoing supply agreements. This model simplifies billing for both parties.

Predictable recurring payments improve revenue stability and forecasting. Automated renewals reduce missed payments and administrative follow-ups. Customers also benefit from consistent billing schedules.

Managing adjustments, upgrades, and disputes is easier when recurring billing is system-driven. Clear records help businesses maintain transparency and trust in long-term relationships.

Security, Compliance, and Risk Management

Security is a top priority for B2B payments in 2026. Businesses must protect sensitive financial data and prevent fraud. Strong authentication and encryption are essential across payment systems.

Compliance requirements vary by industry and region. Businesses must ensure payment processes align with financial regulations and data protection standards. Failure to comply can result in penalties and reputational damage.

Effective risk management includes monitoring transactions and resolving disputes efficiently. Centralized payment data helps identify issues before they escalate.

How B2B Payments Impact Cash Flow

The choice of B2B payment method directly affects cash flow timing. Faster payment options reduce days sales outstanding and improve liquidity. This allows businesses to reinvest revenue more quickly.

Predictable payment schedules support better financial planning. Recurring payments and automated reminders reduce uncertainty. Businesses gain clearer insight into expected revenue.

Improved cash flow visibility enhances forecasting and decision-making. Finance teams can plan payroll, expenses, and growth initiatives with greater confidence.

Best Practices for B2B Payment Management in 2026

Standardize Payment Terms and Invoicing

Consistent payment terms help customers understand expectations. Standardized invoices reduce confusion and speed up approvals. Clear documentation supports faster and more reliable payments.

Offer Flexible B2B Payment Options

Providing multiple payment methods improves customer experience. Flexibility allows clients to choose the option that best fits their workflow. Businesses that adapt are more likely to get paid on time.

Leverage Automation and Recurring Billing

Automation reduces manual work and errors. Recurring billing is especially effective for long-term B2B relationships. These tools create predictable revenue and improve cash flow forecasting.

Monitor Performance With Reporting and Analytics

Tracking payment data helps identify trends and issues early. Analytics provide insight into late payments, disputes, and customer behavior. Informed decisions lead to better financial outcomes.

Common Mistakes to Avoid

Relying on Manual Payment Processes

Manual workflows slow operations and increase error rates. They make it harder to scale and manage growing transaction volumes. Automation is essential for modern B2B payments.

Ignoring Recurring Payment Opportunities

Many B2B services are well suited for recurring billing. Failing to implement recurring payments leads to inconsistent revenue and unnecessary follow-ups. Predictability is lost without automation.

Offering Limited Payment Methods

Restricting payment options creates friction for customers. Businesses risk delayed payments when clients cannot pay conveniently. Flexibility is key to improving payment speed.

Poor Dispute and Exception Handling

Lack of visibility and documentation makes disputes harder to resolve. Delayed resolutions damage relationships and cash flow. Clear records and centralized systems are critical.

How ReliaBills Supports Modern B2B Payments

ReliaBills helps businesses navigate the complexity of modern B2B payments by combining invoicing and payment collection into a unified platform. Instead of managing multiple tools for billing, reminders, and reconciliation, finance teams can generate professional invoices and monitor payment status in one place. Built-in automation reduces manual tasks, minimizes errors, and ensures payment details are accurate and accessible when needed. Centralized payment tracking also gives business owners clear visibility into receivables and outstanding balances.

Recurring billing is a core capability of ReliaBills that directly addresses the needs of many B2B relationships. Whether a business bills monthly retainers, subscription services, or phased contracts, automated recurring invoices help maintain consistent cash flow without repetitive manual intervention. Payment reminders, online payment links, and scheduled billing cycles work together to encourage on-time payments and reduce the time spent chasing outstanding invoices. These features help finance teams free up time for higher-value work.

For businesses that require more advanced tools, ReliaBills PLUS offers enhanced automation, customizable reporting, and detailed analytics. This tier provides deeper insights into payment trends, aging accounts, and revenue performance across multiple clients or business units. With these capabilities, companies can scale their B2B billing operations while improving accuracy, reducing disputes, and strengthening client relationships. ReliaBills PLUS supports a more efficient, data-driven approach to B2B payment management.

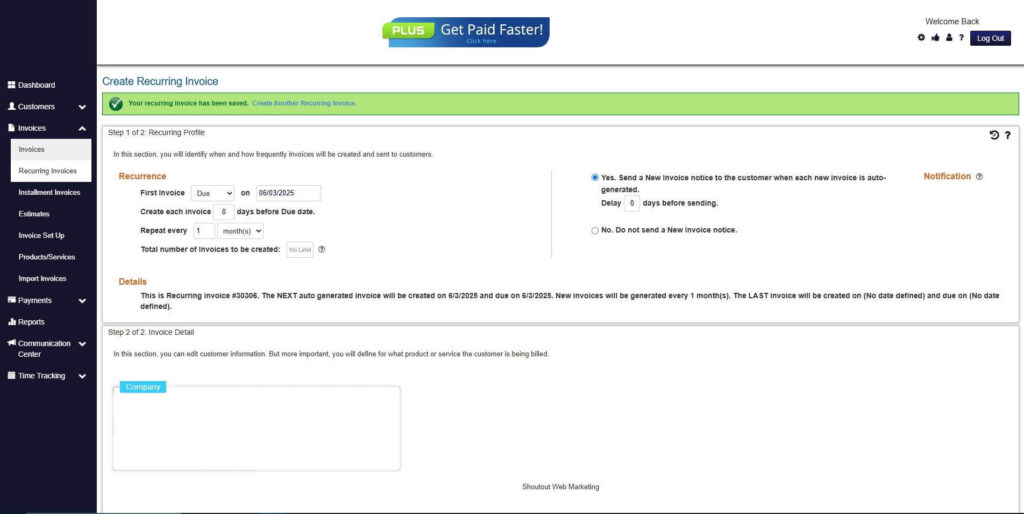

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

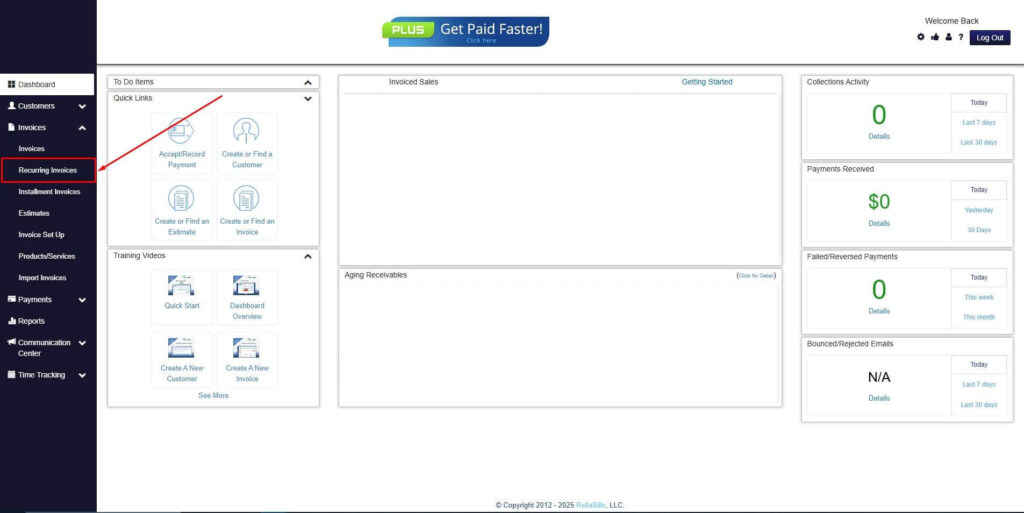

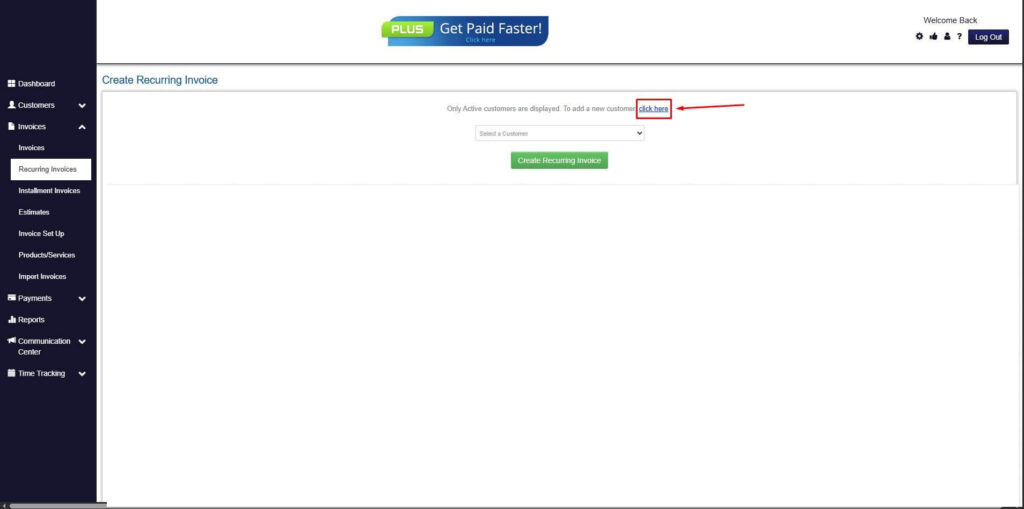

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

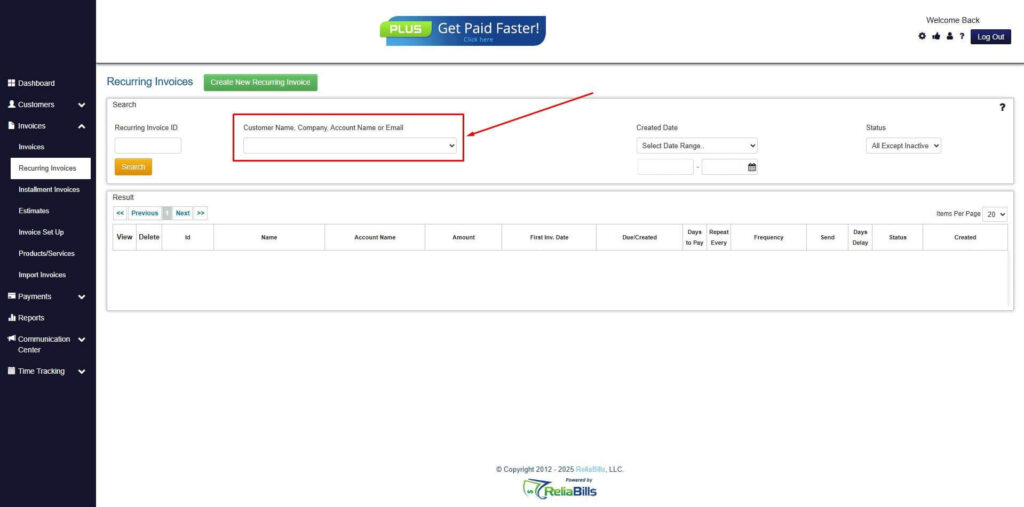

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

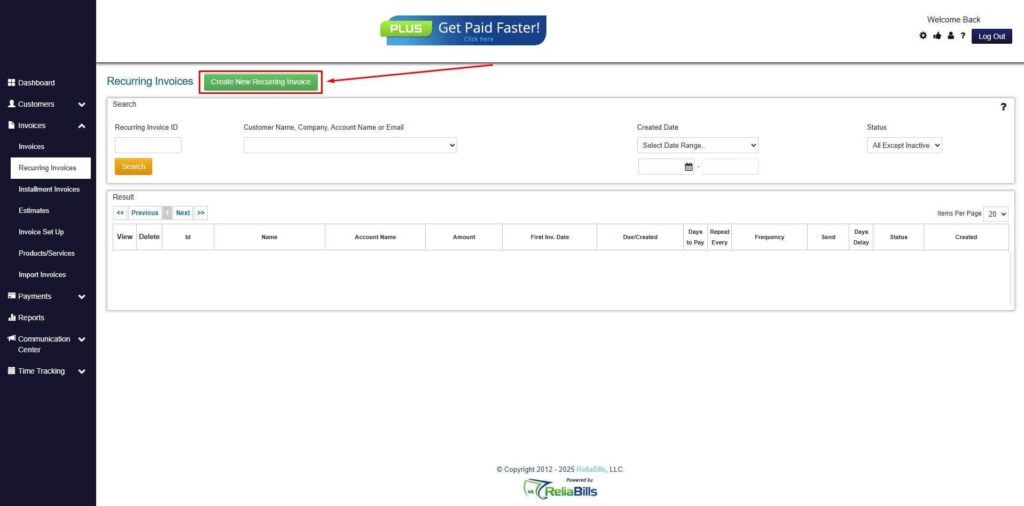

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

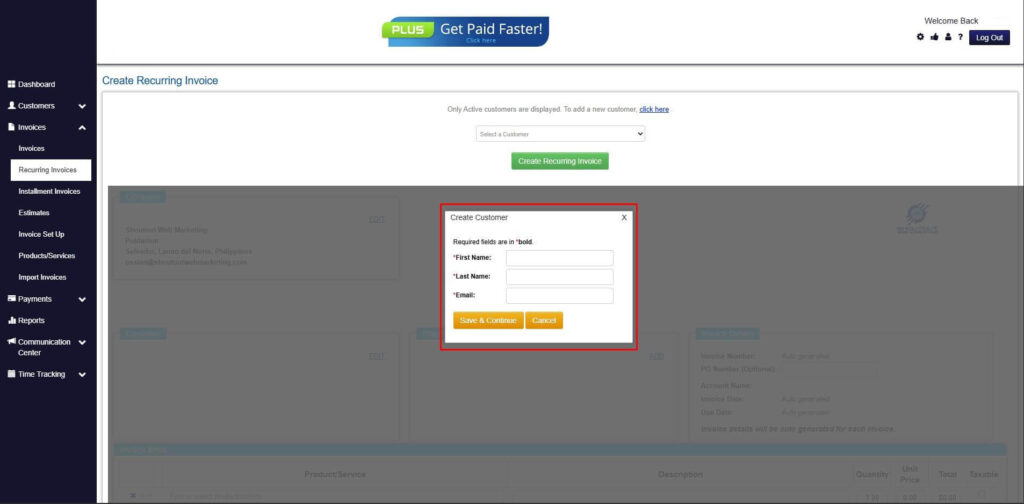

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

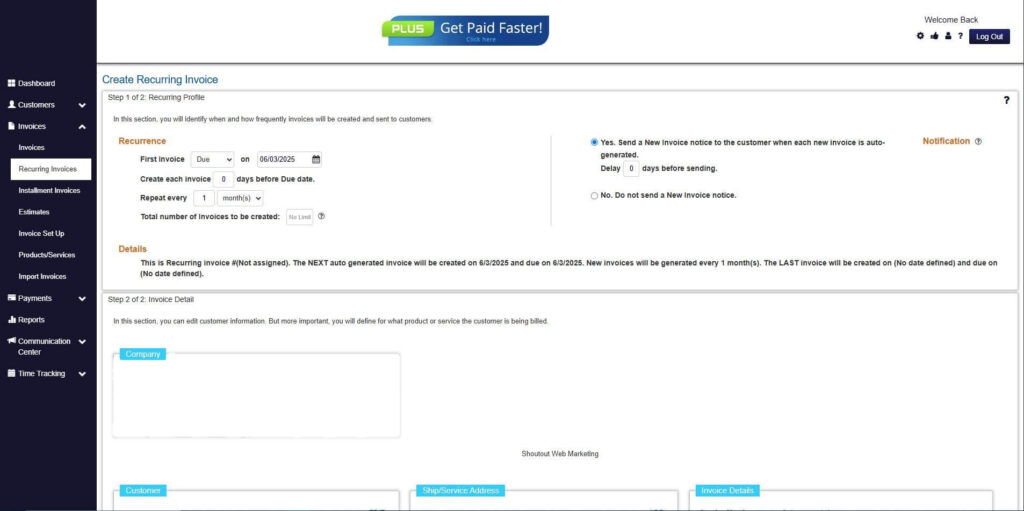

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

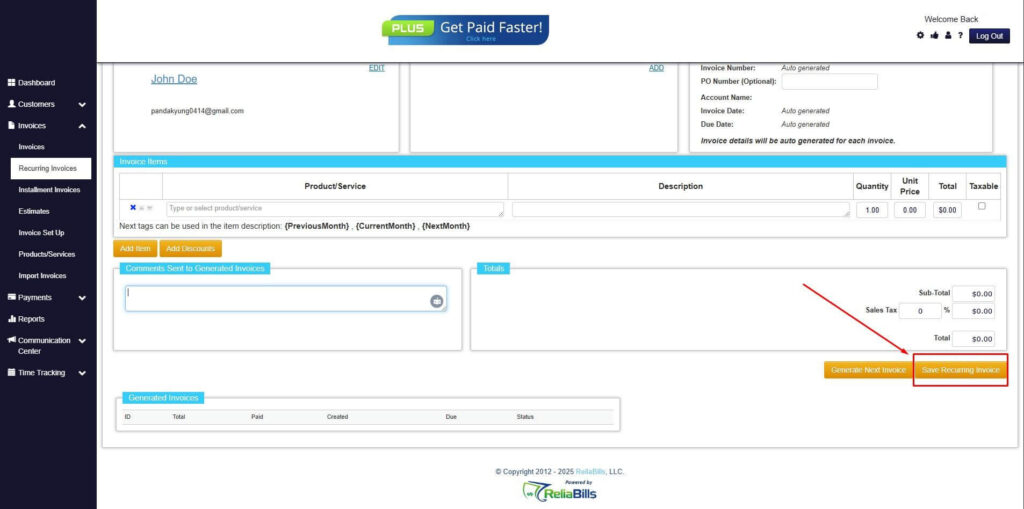

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What is the fastest B2B payment method?

ACH and card-based payments with automation are among the fastest for most businesses.

2. How can businesses reduce late B2B payments?

Clear invoicing, automated reminders, and recurring billing significantly reduce delays.

3. Are recurring B2B payments secure?

Yes, when managed through secure platforms with proper controls and compliance.

4. What technologies will shape B2B payments beyond 2026?

Automation, AI, and real-time payment systems will continue to drive change.

Conclusion

B2B payments in 2026 are defined by speed, automation, and flexibility. Businesses that modernize their payment processes gain stronger cash flow and operational efficiency. Choosing the right B2B payment method is a strategic decision.

Digital invoicing, recurring billing, and secure payment systems are no longer optional. They are essential tools for maintaining competitiveness and customer trust.

By adopting modern B2B payment strategies and platforms like ReliaBills, businesses can reduce friction, improve visibility, and build healthier financial operations for the future.